North America Medical Cannabis Market Size, Share, Trends & Growth Forecast Report By Species, Derivatives, Application, Route of Administration & Country (U.S, Canada & Rest of North America) – Industry Analysis From (2025 to 2033).

North America Medical Cannabis Market Size

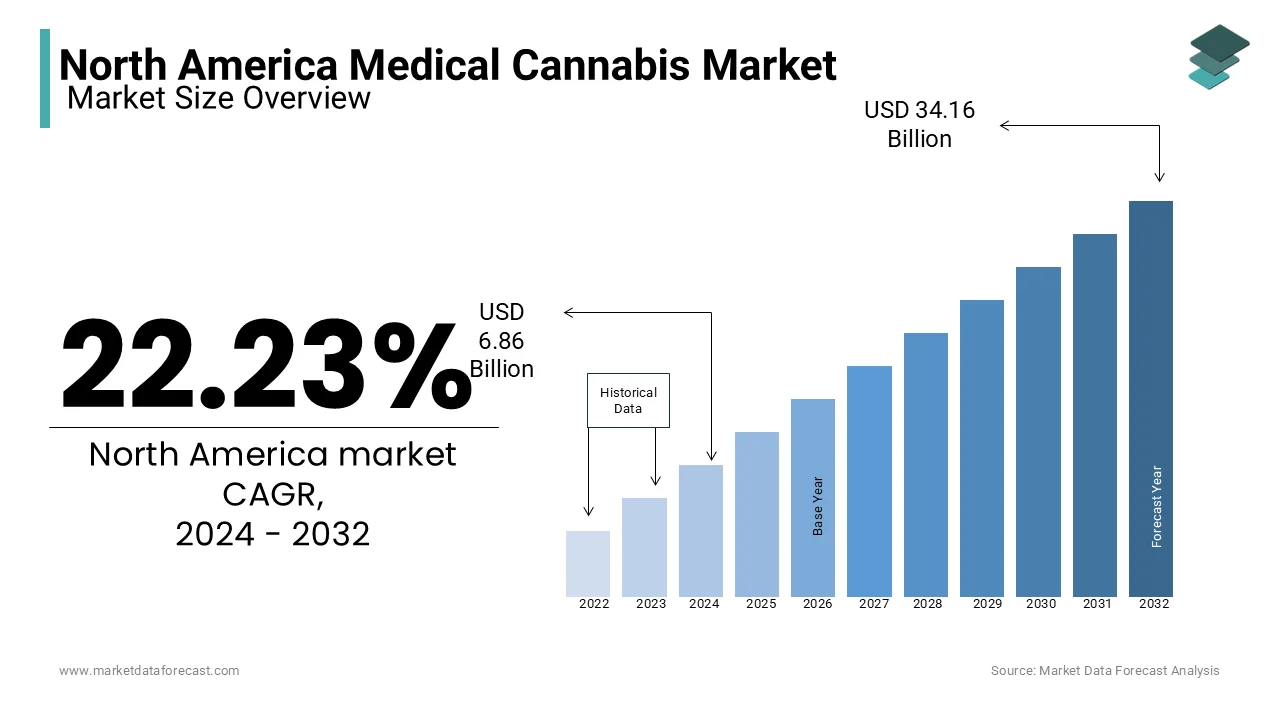

The size of the North America medical cannabis market was valued at USD 6.86 billion in 2024. This market is expected to grow at a CAGR of 22.23% from 2025 to 2033 and be worth USD 41.75 billion by 2033 from USD 8.38 billion in 2025.

MARKET DRIVERS

Public perception and acceptance of medical cannabis have played an important role in the north american medical cannabis market.

This has resulted in rising awareness among both patients and healthcare professionals. This evolves the perception of medical cannabis from a stigmatized substance to a therapeutic option, which has significantly expanded the patient seeking its benefits. Many patients who were hesitant about considering it as a viable treatment option have become more open to exploring its potential benefits, particularly for conditions like chronic pain, epilepsy, and anxiety. This change in patient attitudes reflects a growing awareness of the potential therapeutic properties of medical cannabis. Also, it's not just patients who are changing their perspectives; healthcare professionals are also increasingly embracing the idea of incorporating medical cannabis into their treatment options. They've come to recognize that medical cannabis can be an effective tool in alleviating symptoms and enhancing the quality of life for their patients.

The gradual legalization has influenced the North American medical cannabis market.

This shift has emerged as an important driver of the market expansion. As governments relax regulations and establish clear legal frameworks for medical cannabis, accessibility for patients significantly improves. Legalization has not only licensed the use of medical cannabis but has also fostered a more transparent and regulated marketplace. Patients now have the option to obtain cannabis-based therapies with confidence, knowing that they are compliant with the law and safety standards. This has raised a surge in patient enrolment in medical cannabis programs. Therefore, as provinces continue to refine their regulatory structures, it has covered the way for an expansion in industry with new businesses, innovations, and job opportunities. The process has raised market growth by providing patients with alternative therapeutic options and boosting economic growth.

MARKET RESTRAINTS

High Costs in Strictly Regulated Areas

The North American medical cannabis market has a significant restraint from the disparities in pricing that patients encounter based on their geographic location. These price variations are primarily rooted in the diverse regulatory frameworks and tax structures established by individual states and provinces. In some regions, notably those with more stringent regulations or higher taxation on medical cannabis products, patients often find themselves facing significantly elevated costs. These price disparities can have several implications. Also, they create accessibility where patients in higher-cost regions may struggle to afford their necessary medical cannabis treatments. This not only affects the well-being of patients but can also hinder the overall growth and acceptance of medical cannabis as a viable medical option.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Species, Derivatives, Application, End-user, Route of Administration, and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, and the Rest of North America. |

|

Market Leader Profiled |

BOL Pharma, Tilray, Medreleaf Corporation, Aurora Cannabis, Inc., Canopy Growth Corporation, Insys Therapeutics, Inc., Aphria, Inc., MGC Pharmaceuticals Limited, GW Pharmaceuticals, plc., and Others. |

SEGMENTAL ANALYSIS

By Species Insights

REGIONAL ANALYSIS

North America is more by its large patient base, product innovation, and increasing acceptance. However, the regulatory landscape can vary significantly between states and provinces.

The United States holds the largest position in the North America Medical Cannabis Market due to federal restrictions, various states have legalized medical cannabis, contributing to a rapidly growing industry. The U.S. medical cannabis market has benefited from a large patient base and a diverse range of medical conditions eligible for treatment. As legalization efforts gain patients, acceptance is on the rise and is also encouraging medical professionals to explore cannabis-based treatments.

Canada's medical cannabis market is anticipated to show a potential growth rate during the forecast period.

The country implemented a federal framework for medical cannabis use by allowing patients with various qualifying conditions to access products through licensed producers. Canada's well-regulated system has raised the confidence of both patients and healthcare providers, and medical cannabis is often covered by insurance plans.

KEY MARKET PLAYERS

BOL Pharma, Tilray, Medreleaf Corporation, Aurora Cannabis, Inc., Canopy Growth Corporation, Insys Therapeutics, Inc., Aphria, Inc., MGC Pharmaceuticals Limited and GW Pharmaceuticals, plc. are some of the major players in the North American medical cannabis market.

MARKET SEGMENTATION

This research report on the North America medical cannabis market has been segmented and sub-segmented based on species, derivatives, application, end-user, route of administration, and region.

By Species

- Indica

- Sativa

- Hybrid

By Derivatives

- Cannabidiol (CBD)

- Tetrahydrocannabinol (THC)

- Others

By Application

- Cancer

- Arthritis

- Epilepsy

- Migraine

By End User

- Pharmaceutical Industry

- Research and Development Centers

- Others

By Route of Administration

- Oral Solutions and Capsules

- Smoking

- Vaporizers

- Topicals

- Others

By Country

- The U.S.

- Canada

- Rest of North America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]