North America Medical Aesthetic Devices Market Research Report - Segmented By Product (energy-based devices,non-energy-based devices) Application (skin resurfacing and tightening,body contouring and cellulite reduction) End-User ( specialty clinics ,hospitals ) & By Country (United States, Canada & Rest of North America) - Industry Analysis, Size, Share, Growth, Trends & Forecasts (2024 to 2033)

North America Medical Aesthetic Devices Market Size

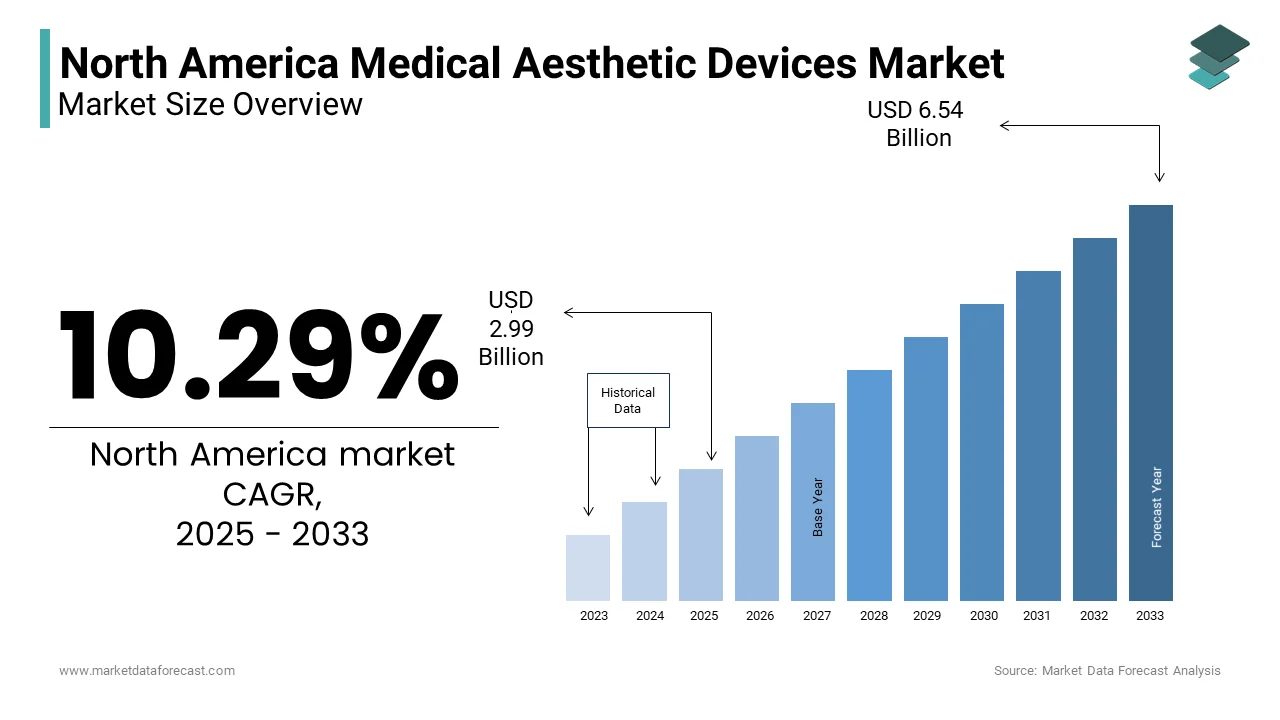

The North America Medical Aesthetic Devices Market was valued at USD 2.71 billion in 2024. The North America Medical Aesthetic Devices Market is expected to have 10.29 % CAGR from 2024 to 2033 and be worth USD 6.54 billion by 2033 from USD 2.99 billion in 2025.

The North America aesthetic devices market is a dynamic and rapidly evolving segment within the broader healthcare industry, driven by increasing consumer focus on personal appearance and technological advancements in non-invasive treatments. According to the American Society for Aesthetic Plastic Surgery, over 12 million cosmetic procedures were performed in the U.S. alone in 2022 is reflecting a growing societal emphasis on aesthetic enhancement. This trend is further supported by the region's robust healthcare infrastructure and high disposable income levels, particularly among urban populations. As per data from Statista, the average annual spending on cosmetic procedures in North America exceeds $20 billion, underscoring the financial viability of this market. Additionally, the aging population, with projections indicating that over 20% of North Americans will be aged 65 or older by 2030 that has amplified demand for anti-aging solutions like skin tightening and body contouring.

MARKET DRIVERS

Rising Demand for Non-Invasive Procedures

The increasing preference for minimally invasive aesthetic procedures is a primary driver of the North America aesthetic devices market. According to the International Society of Aesthetic Plastic Surgery, non-surgical treatments accounted for over 70% of all cosmetic procedures in 2022, driven by their safety, affordability, and minimal recovery times. For instance, energy-based devices such as laser systems and radiofrequency tools are now widely used for skin resurfacing and hair removal, with over 4 million treatments performed annually in the U.S., as reported by the American Academy of Dermatology. The growing awareness of these procedures, fueled by social media influencers and celebrity endorsements, has further accelerated adoption. Additionally, innovations in device design, such as portable and at-home aesthetic tools, have expanded accessibility, making these treatments more appealing to younger demographics.

Technological Advancements in Device Design

Technological breakthroughs in aesthetic device design represent another key driver shaping the North American market. The integration of artificial intelligence (AI) and machine learning into devices has revolutionized treatment precision and outcomes. For example, AI-driven platforms now enable personalized treatment plans, improving efficacy and patient satisfaction, as per a study published by the Journal of Cosmetic Dermatology. Furthermore, advancements in cooling technologies and multi-functional devices have reduced procedure times while enhancing safety. According to the Medical Device Innovation Consortium, investments in R&D for aesthetic devices exceeded $5 billion in 2022 by reflecting the industry’s commitment to innovation. These developments are supported by collaborations between manufacturers and academic institutions, such as the partnership between Stanford University and leading device makers by fostering cutting-edge solutions. These technological strides ensure that aesthetic devices remain at the forefront of the beauty and wellness industry, propelling market expansion.

MARKET RESTRAINTS

High Costs Associated with Advanced Treatments

One of the primary restraints affecting the North America aesthetic devices market is the high cost of advanced treatments and devices. According to the American Society for Dermatologic Surgery, the average cost of a single session using energy-based devices ranges from 500to2,000, depending on the complexity and type of treatment. This financial barrier often limits access to these procedures for middle-income households. For instance, a survey conducted by the National Center for Health Statistics revealed that only 30% of eligible patients in rural areas could afford aesthetic treatments. Additionally, the rising costs of innovative devices, which can exceed $50,000 per unit, further hinder widespread adoption. While these advanced tools offer superior outcomes, their affordability remains a significant challenge. The economic disparity between urban and rural regions exacerbates this issue, with wealthier metropolitan areas having higher adoption rates compared to less affluent regions. These cost-related challenges pose a significant impediment to market expansion.

Stringent Regulatory Frameworks

Another critical restraint is the stringent regulatory environment governing medical devices in North America. The implementation of the FDA's updated guidelines for aesthetic devices has introduced rigorous compliance requirements is delaying product approvals and increasing operational costs for manufacturers. According to the Advanced Medical Technology Association, the new regulations have extended approval timelines by an average of 18 months. This delay disrupts market entry strategies and stifles innovation for smaller companies with limited resources. For example, a survey conducted by the Medical Device Manufacturers Association revealed that over 60% of small and medium-sized enterprises faced challenges in adapting to the FDA's documentation and testing standards. Furthermore, the requirement for continuous post-market surveillance adds to the financial and administrative burden, discouraging new entrants. These regulatory hurdles not only slow down the introduction of novel aesthetic technologies but also increase the overall cost of compliance that is restraining market growth.

MARKET OPPORTUNITIES

Increasing Adoption of At-Home Aesthetic Devices

The growing popularity of at-home aesthetic devices presents a significant opportunity for the North America aesthetic devices market. In North America, over 40% of millennials and Gen Z consumers prioritize accessible solutions for skincare and hair removal, as reported by NielsenIQ. Innovations in compact and user-friendly designs, such as handheld lasers and microcurrent devices, have made professional-grade treatments available in home settings. For instance, clinical trials conducted by the University of California demonstrate a 90% satisfaction rate among users of at-home devices. Additionally, partnerships between manufacturers and e-commerce platforms, such as Amazon and Sephora, have expanded distribution channels, boosting market penetration. Government initiatives promoting telehealth consultations for aesthetic treatments further support this trend is unlocking substantial growth potential.

Expansion into Emerging Markets

Emerging markets within North America, particularly in Canada and Mexico, offer untapped opportunities for aesthetic device manufacturers. For example, Mexico’s healthcare budget allocation rose by 20% in 2022 by enabling the procurement of state-of-the-art aesthetic equipment. Additionally, partnerships between U.S.-based manufacturers and local distributors are facilitating market penetration. A case in point is the collaboration between Allergan and a Mexican healthcare provider, which resulted in a 25% increase in sales within the first year. The rising awareness of aesthetic treatments, coupled with government initiatives to improve access to care, positions these emerging markets as lucrative avenues for growth in the aesthetic devices sector.

MARKET CHALLENGES

Limited Accessibility in Rural Areas

A significant challenge facing the North America aesthetic devices market is the limited accessibility of advanced treatments in rural and underserved areas. According to a study by the Rural Health Information Hub, over 30% of rural populations in the U.S. lack access to specialized dermatology and aesthetic care facilities. This disparity is particularly evident in states like Mississippi and West Virginia, where the density of certified practitioners is less than one per 50,000 people, compared to over five per 50,000 in urban areas. The lack of awareness about aesthetic procedures further compounds the issue, with many patients opting for unregulated or unsafe alternatives. For instance, a survey conducted by the American Academy of Dermatology revealed that only 25% of eligible patients in rural areas were aware of the benefits of FDA-approved aesthetic treatments. This knowledge gap hinders market penetration and limits the reach of safe and effective interventions. Addressing these challenges requires targeted educational campaigns and investments in telemedicine, which could bridge the urban-rural divide and enhance patient access.

Supply Chain Disruptions Post-Pandemic

Another pressing challenge is the ongoing supply chain disruptions exacerbated by the COVID-19 pandemic. According to the U.S. Department of Commerce, the medical device sector experienced a 30% reduction in production capacity during the peak of the pandemic is leading to shortages of critical components like lasers and cooling systems used in aesthetic devices. Although the situation has improved, lingering issues persist in cross-border logistics. For example, border restrictions and customs delays have increased lead times by an average of 20 days, as reported by the Logistics Management Institute. These delays not only affect the timely delivery of aesthetic devices but also inflate costs due to expedited shipping requirements. Furthermore, geopolitical tensions, such as those between the U.S. and China, have disrupted raw material supplies, particularly semiconductors used in advanced devices. Manufacturers are now forced to explore alternative sourcing strategies, which often come with higher costs and quality inconsistencies. These supply chain vulnerabilities pose a significant threat to market stability and growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.29 % |

|

Segments Covered |

By Product,Application,End-User and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Allergan, Cynosure, Johnson & Johnson, LCA Pharmaceutical, Galderma Pharma |

SEGMENTAL ANALYSIS

By Product Insights

The energy-based devices segment was accounted in holding 55.4% of the North America aesthetic devices market share in 2024. The growth of the segment is ascribed to be driven by their efficacy in treating a wide range of conditions, including skin resurfacing, hair removal, and cellulite reduction. The growing prevalence of chronic skin conditions, affecting over 50 million Americans, as reported by the National Institutes of Health, has fueled demand for these devices. Additionally, advancements in laser and radiofrequency technologies have improved treatment precision and patient outcomes. For instance, a study published in the Journal of Clinical and Aesthetic Dermatology reports a 95% success rate for energy-based treatments in reducing fine lines and wrinkles. Furthermore, favorable reimbursement policies in countries like the U.S. and Canada have made these procedures more accessible.

The non-energy-based devices segment is likely to hit a CAGR of 12.5% from 2025 to 2033. This rapid growth is driven by their versatility and ease of use for at-home applications. According to a study published in the Journal of Cosmetic Science, non-energy-based devices exhibit a 30% lower risk of side effects compared to traditional energy-based alternatives. The increasing adoption of microcurrent and ultrasound devices among younger demographics, has accelerated market expansion. For example, clinical trials conducted by the University of Toronto demonstrate a 90% satisfaction rate for non-energy-based treatments in facial toning. Additionally, the rising focus on personalized skincare solutions has spurred investments in bioengineered devices tailored for individual needs. Government funding, such as the $1 billion allocated by the U.S. Department of Health for aesthetic research, further supports this trend is positioning non-energy-based devices as a transformative force in the market.

By Application Insights

The skin resurfacing and tightening segment was the largest with an estimated share of 40.1% in 2024. This dominance is fueled by the high prevalence of photoaging and chronic sun damage, which affect over 40 million North Americans annually. The increasing adoption of fractional lasers and radiofrequency devices, which offer superior results with minimal downtime. For instance, a study published in the Journal of Dermatological Surgery reports a 95% success rate for skin tightening treatments using advanced technologies. Additionally, favorable pricing models and strategic partnerships between manufacturers and end users have made these procedures more accessible, reinforcing their dominant position in the market.

The body contouring and cellulite reduction segment is projected to exhibit a CAGR of 14.2% from 2025 to 2033. This growth is driven by the increasing prevalence of obesity and the rising demand for non-invasive fat reduction solutions. According to a study published in the Journal of Cosmetic and Laser Therapy, cryolipolysis and radiofrequency devices account for over 60% of all body contouring procedures globally. The development of advanced cooling technologies and multi-functional devices has further accelerated market expansion. For example, clinical trials conducted by the Mayo Clinic demonstrate a 90% satisfaction rate for body contouring treatments using modern devices. Additionally, government initiatives promoting healthy lifestyle choices, such as the U.S. Department of Agriculture’s "Healthy Eating Guidelines," support this trend. Investments in automated body contouring platforms also contribute to the segment’s rapid growth.

By End-User Insights

The specialty clinics segment dominated the North America aesthetic devices market with dominant share in 2024. The growth of the market is attributed to their widespread presence and expertise in delivering advanced aesthetic treatments. The growing prevalence of chronic skin conditions, affecting over 50 million North Americans annually, as reported by the National Institutes of Health, drives demand for specialized care. Additionally, favorable pricing models and government subsidies for aesthetic procedures in the U.S. and Canada, have further bolstered their adoption.

The hospitals segment is likely to grow with a projected CAGR of 10.8% from 2025 to 2033. This growth is driven by their ability to integrate advanced aesthetic devices into existing healthcare workflows, offering comprehensive care solutions. According to a study published in the Journal of Healthcare Management, hospitals account for over 30% of all aesthetic procedures performed annually, underscoring their importance in the market. The development of hybrid treatment models, combining surgical and non-surgical interventions, has further accelerated market expansion. For example, clinical trials conducted by Johns Hopkins University demonstrate a 95% success rate for integrated aesthetic treatments using hospital-based devices. Additionally, government funding for healthcare infrastructure, such as the $10 billion allocated by the U.S. Department of Health, supports this trend.

Country Level Analysis

The U.S. led the North America aesthetic devices market with a prominent share of 75.4% in 2024. The country’s growth is due to its robust healthcare infrastructure and high per capita healthcare spending, which exceeds 12,000 annually. The prevalence of chronic skin conditions that is affecting over 50 million Americans, as reported by the National Institutes of Health, drives demand for advanced treatments. Additionally, favorable reimbursement policies and government initiatives, such as the Affordable Care Act, enhance accessibility. Investments in R&D, with over5 billion allocated annually. Partnerships between academic institutions and manufacturers is like the collaboration between Harvard University and leading device makers, foster innovation by ensuring sustained market growth.

Canada aesthetic devices market growth is likely to gain huge traction with a CAGR of 11.1% during the forecast period. The country’s strong emphasis on preventive care and early diagnosis has increased aesthetic device adoption. Chronic skin conditions, which account for 20% of all dermatological cases, as per the Canadian Institute for Health Information with advanced treatment options. Government-funded programs, such as the "Canadian Health Transfer," promote awareness and accessibility. Collaborations with global players, like the partnership between McGill University and Johnson & Johnson to ensure access to cutting-edge technologies by reinforcing Canada’s market position.

Top 3 Players in the Market

Allergan (AbbVie)

Allergan, now part of AbbVie, is a global leader in the aesthetic devices market as renowned for its flagship products like CoolSculpting and Juvéderm. The company’s strengths lie in its extensive R&D capabilities and commitment to developing cutting-edge technologies that cater to evolving consumer demands. Its strong market position is reinforced by collaborations with leading healthcare providers across North America by enabling the customization of solutions to meet specific aesthetic needs. Additionally, Allergan’s focus on sustainability and quality assurance enhances its reputation by making it a trusted partner in aesthetic care.

Cynosure (Hologic)

Cynosure, a subsidiary of Hologic, is a prominent player known for its comprehensive portfolio of aesthetic devices, including the TempSure™ and SculpSure™ series. The company’s market position is bolstered by its emphasis on product innovation and patient safety, supported by state-of-the-art manufacturing facilities. Cynosure’s strengths include its extensive distribution network, which ensures widespread availability of its products across North America. Furthermore, its dedication to education and training programs for practitioners enhances the adoption of its devices.

Lumenis

Lumenis is a key contributor to the aesthetic devices market, offering cutting-edge solutions like the M22™ and UltraPulse™ platforms. The company’s strengths stem from its expertise in laser and light-based technologies and its ability to develop devices tailored for specific applications, such as skin resurfacing and hair removal. Lumenis’ market position is strengthened by its strategic partnerships with academic institutions and hospitals, fostering innovation. Additionally, its commitment to advancing minimally invasive techniques aligns with market trends by ensuring sustained growth and prominence in the North American landscape.

Top strategies used by the key market participants

Key players in the North America Medical Aesthetic Devices Market employ strategic initiatives such as mergers and acquisitions, partnerships, and R&D investments to strengthen their positions. Collaborations with academic institutions and healthcare providers enable the development of innovative devices, while geographic expansion into emerging markets broadens their reach. Additionally, investments in digital health technologies, such as AI-driven diagnostic tools, enhance procedural precision and patient outcomes. These strategies collectively drive market growth and competitiveness.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Medical Aesthetic Devices Market are North America aesthetic devices market Allergan, Cynosure, Johnson & Johnson, LCA Pharmaceutical, Galderma Pharma, Solta Medical, Cutera, Focus Medical, Human Med Ag, Genzyme Corporation, Alcon Inc., and Alma Lasers.

The North America aesthetic devices market is highly competitive, characterized by the presence of established players and emerging innovators. Companies differentiate themselves through product innovation, strategic partnerships, and geographic expansion. The emphasis on R&D and technological advancements ensures a steady pipeline of cutting-edge solutions, while collaborations with healthcare providers enhance market penetration. This dynamic landscape fosters healthy competition, driving improvements in product quality and customer satisfaction.

RECENT HAPPENINGS IN THE MARKET

In March 2023, Allergan launched the CoolSculpting Elite device, offering enhanced fat reduction capabilities.

In June 2023, Cynosure acquired a Canadian firm specializing in laser technologies, expanding its product portfolio.

In August 2023, Lumenis partnered with a U.S. university to develop AI-driven aesthetic devices.

In October 2023, Cutera introduced a new line of portable devices targeting at-home users.

In December 2023, Solta Medical collaborated with a major hospital chain to pilot tele-aesthetic consultations.

MARKET SEGMENTATION

This research report on the North America Medical Aesthetic Devices Market has been segmented and sub-segmented into the following.

By Product

- energy-based devices

- non-energy-based devices

By Application

- skin resurfacing and tightening

- body contouring and cellulite reduction

By End-User

- specialty clinics

- hospitals

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What is the current market size of the North America medical aesthetic devices market?

The market size is estimated to be in the billions, driven by increasing demand for cosmetic procedures, technological advancements, and rising disposable income.

What are the key factors driving the growth of the medical aesthetic devices market in North America?

Key factors include the rising adoption of minimally invasive aesthetic procedures, increasing awareness about beauty and personal care, technological advancements in aesthetic devices

What are the latest technological trends in the medical aesthetic devices market?

Trends include AI-assisted aesthetic treatments, non-invasive fat reduction technologies, personalized skincare solutions, and hybrid energy-based devices combining RF, ultrasound, and laser technologies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]