North America Lubricant Packaging Market Size, Share, Trends & Growth Forecast Report By Product (Engine Oil, Transmission & Hydraulic Fluid, Process Oil, Metal Working Fluid, General Industrial Fluid, Gear Oil Greases), Material, End-Use and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Lubricant Packaging Market Size

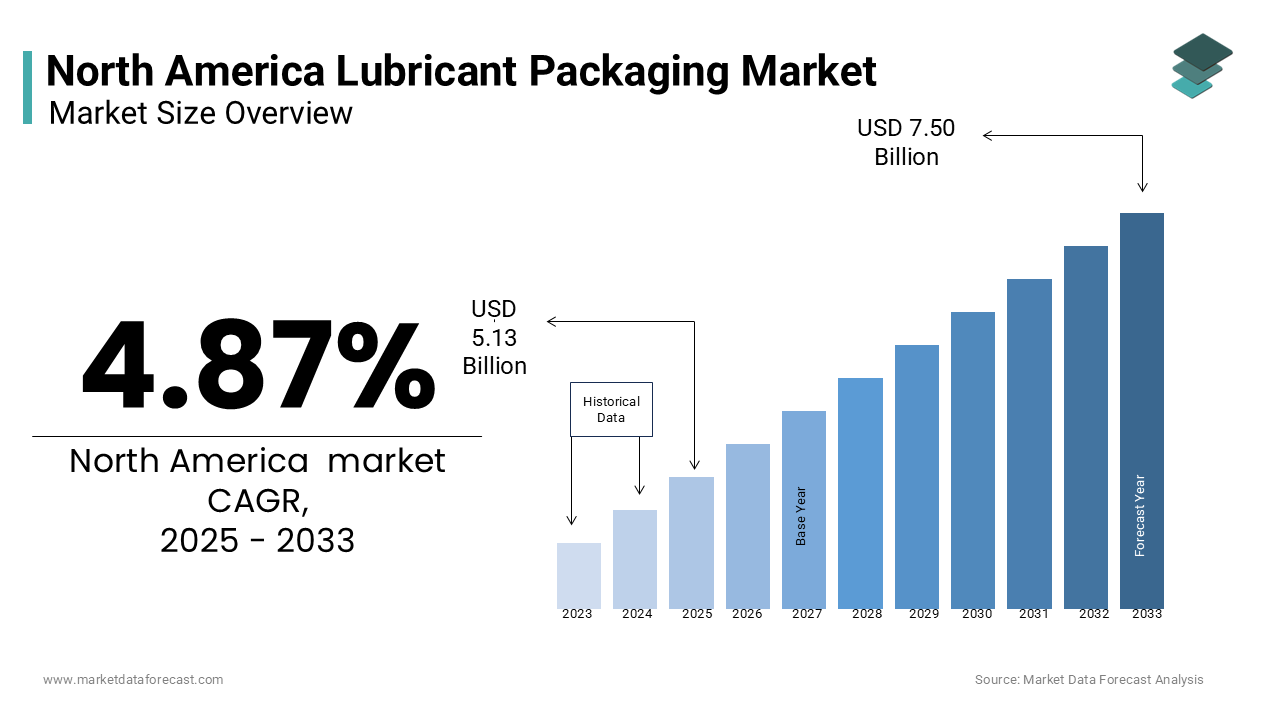

The North America lubricant packaging market was worth USD 4.89 billion in 2024. The North America market is expected to reach USD 7.50 billion by 2033 from USD 5.13 billion in 2025, rising at a CAGR of 4.87% from 2025 to 2033.

MARKET DRIVERS

Rising Demand from the Automotive Industry

One of the primary drivers of the North America lubricant packaging market is the escalating demand from the automotive sector. Lubricants, such as engine oils and transmission fluids, are essential for vehicle performance, and their packaging plays a pivotal role in ensuring product integrity and convenience. Additionally, the rise of electric vehicles (EVs) has spurred demand for specialized lubricants, which require innovative packaging solutions. Furthermore, the increasing trend of DIY car maintenance has amplified the need for user-friendly packaging designs is ascribed to bolster the growth of the market.

Growth in Industrial Applications

Another critical driver is the growing use of lubricants in industrial applications, where they are indispensable for machinery and equipment maintenance. According to the U.S. Department of Commerce, the industrial machinery sector accounts for over 40% of lubricant consumption in North America, driving demand for durable and leak-proof packaging. Industries like construction, mining, and manufacturing rely heavily on bulk lubricant packaging solutions, such as drums and intermediate bulk containers (IBCs). For example, Caterpillar adopted advanced packaging designs in 2023 to enhance the shelf life of its industrial lubricants in operational efficiency. Additionally, the rise of automation and smart manufacturing has increased the demand for precision-packaged lubricants that meet stringent quality standards.

MARKET RESTRAINTS

Stringent Environmental Regulations

A significant restraint impacting the North America lubricant packaging market is the imposition of stringent environmental regulations aimed at reducing plastic waste. Governments across the region are implementing policies to curb single-use plastics, which directly affect lubricant packaging usage.. According to the Ocean Conservancy, over 8 million metric tons of plastic enter the oceans annually, prompting stricter enforcement of anti-plastic laws. These regulatory pressures increase compliance costs and operational complexities for businesses will further accelerate the growth of the market. Moreover, public backlash against plastic pollution has led to declining consumer confidence in traditional lubricant packaging, despite its recyclability. This dual challenge of regulatory scrutiny and shifting consumer sentiment poses a considerable barrier to market expansion.

Fluctuating Raw Material Prices

Another pressing restraint is the volatility in raw material prices, particularly crude oil, which serves as the primary feedstock for plastic-based packaging materials. Lubricant packaging costs are highly sensitive to fluctuations in oil prices by creating uncertainty for manufacturers. According to the U.S. Energy Information Administration, crude oil prices surged by over 60% in 2022 due to geopolitical tensions and supply chain disruptions by directly impacting packaging resin costs. This price instability forces companies to absorb higher production expenses or pass them on to consumers, potentially reducing demand. Furthermore, the reliance on imported raw materials exacerbates the issue, as currency fluctuations and trade tariffs add to the financial burden. Such economic uncertainties hinder long-term investments in lubricant packaging production are limiting the market’s ability to scale efficiently and meet growing consumer demands.

MARKET OPPORTUNITIES

Adoption of Sustainable Packaging Solutions

A promising opportunity for the North America lubricant packaging market lies in the adoption of sustainable packaging solutions, driven by increasing consumer awareness and regulatory mandates. Companies are investing in biodegradable and recyclable materials to align with environmental goals. For instance, Shell launched a line of lubricants packaged in 100% recycled plastic containers in 2023 that aims to reduce carbon emissions. Additionally, advancements in lightweighting technologies have enabled manufacturers to reduce material usage while maintaining durability, appealing to cost-conscious industries. These efforts not only address environmental concerns but also enhance brand loyalty, positioning sustainable packaging as a key growth driver for the market.

Expansion into Emerging Markets

Another significant opportunity is the expansion into emerging markets in Latin America, where industrialization and infrastructure development are accelerating. Companies like ExxonMobil have capitalized on this trend by introducing region-specific packaging designs that cater to local preferences and logistical requirements. For example, the introduction of compact and stackable containers in 2022 resulted in a 15% increase in sales, as reported by Lubes’n’Greases Magazine. Additionally, partnerships with local distributors have enabled manufacturers to penetrate untapped markets effectively.

MARKET CHALLENGES

Consumer Skepticism Toward Plastic Packaging

One of the foremost challenges facing the North America lubricant packaging market is growing consumer skepticism toward plastic packaging, fueled by heightened awareness of environmental issues. Public campaigns escalating the detrimental effects of plastic waste on ecosystems have led to a decline in consumer trust. According to a survey conducted by Pew Research Center, 72% of Americans express concern about the environmental impact of single-use plastics, with many actively seeking alternatives. This sentiment is further compounded by misleading perceptions that plastic packaging is less sustainable than other materials, despite its recyclability. Such attitudes result in reduced demand for traditional lubricant packaging among environmentally conscious demographics. The manufacturers must invest in educational initiatives to promote the benefits of recyclable plastics, including their lower carbon footprint compared to glass or metal.

Supply Chain Disruptions

Another pressing challenge is the persistent issue of supply chain disruptions, which have intensified due to global events such as the COVID-19 pandemic and geopolitical conflicts. These disruptions lead to delays in raw material procurement, increased transportation costs, and production bottlenecks. According to the Institute for Supply Management, delivery times for packaging materials extended by an average of 20% in 2022, severely impacting the lubricant packaging market. Additionally, labor shortages and logistical constraints further exacerbate the situation, hindering timely product distribution. For example, port congestion in major hubs like Los Angeles and Long Beach caused significant delays in importing packaging resins.

SEGMENTAL ANALYSIS

By Product Insights

The engine oil segment was the largest and held 40.2% of the North America lubricant packaging market share in 2024 due to its critical role in automotive maintenance and performance. The growing trend of DIY car maintenance has further amplified demand for user-friendly packaging solutions, such as compact bottles and easy-pour designs. Additionally, the rise of electric vehicles (EVs) has spurred innovation in specialized engine oils, requiring advanced packaging to meet unique requirements. For instance, Tesla introduced recyclable plastic containers for its EV-specific engine oils in 2023 by achieving a 15% reduction in packaging waste, as noted by Automotive News.

The metal working fluid segment is projected CAGR of 6.2% from 2025 to 2033. The growth of the segment is fueled by the expansion of manufacturing and metalworking industries in sectors like aerospace and automotive. According to the U.S. Department of Commerce, the manufacturing sector accounts for over 30% of lubricant consumption in North America, with metal working fluids playing a pivotal role in machining operations. For example, Boeing adopted advanced packaging solutions for its metal working fluids in 2022, resulting in a 20% increase in operational efficiency, as reported by Industrial Equipment News. Additionally, the rise of automation and precision engineering has increased demand for high-performance packaging that ensures contamination-free delivery.

By Material Insights

The plastic segment was the largest in the North America lubricant packaging market by capturing 55.4% of the total share in 2024, which is attributed to plastic’s versatility, lightweight nature, and cost-effectiveness by making it ideal for diverse applications. The automotive sector, which heavily relies on plastic containers for engine oils and transmission fluids, is a key contributor. Additionally, advancements in lightweighting technologies have enhanced plastic’s appeal, which is enabling manufacturers to reduce material usage while maintaining performance.

The Low-density polyethylene (LDPE) segment is likely to register a CAGR of 7.1% from 2025 to 2033. The growth of the segment is driven by its flexibility, chemical resistance, and recyclability by making it ideal for industrial applications. According to the Environmental Protection Agency (EPA), LDPE-based packaging solutions are increasingly being adopted to meet sustainability goals, with companies like ExxonMobil investing in eco-friendly formulations. Additionally, the rise of e-commerce has amplified demand for LDPE packaging, as it offers superior protection during transportation.

By End-Use Insights

The automotive industry led North America lubricant packaging market by accounting for 45.7% of the share in 2024 with the region's robust automotive production and consumption rates. The rise of electric vehicles (EVs) has also spurred demand for specialized lubricants by requiring innovative packaging solutions.

The power generation segment is expected to witness a fastest CAGR of 6.8% from 2025 to 2033 owing to the increasing adoption of renewable energy sources, such as wind and solar, which require specialized lubricants for efficient operation. For example, Siemens Gamesa adopted advanced packaging designs for its wind turbine lubricants in 2022, which is improving operational efficiency. Additionally, the aging power infrastructure in North America has increased demand for durable packaging solutions that ensure long-term product integrity.

REGIONAL ANALYSIS

The United States led the North America lubricant packaging market with 75.4% of the total share in 2024 with the country’s robust automotive and industrial sectors, which heavily rely on lubricants for machinery and equipment maintenance. According to the U.S. Department of Commerce, the industrial machinery sector accounts for over 40% of lubricant consumption in the U.S., driving demand for durable and leak-proof packaging solutions. Additionally, the rise of e-commerce has amplified demand for compact and stackable packaging designs. Companies like Shell and ExxonMobil have invested in sustainable packaging solutions to align with environmental goals, further strengthening their market presence.

Canada positioned second in leading the North America lubricant packaging market by accounting for 15.4% of share in 2024. The country’s growth is propelled by its focus on renewable energy and sustainable practices in the oil and gas sector. According to Natural Resources Canada, renewable energy accounted for 18% of total electricity generation in 2022, with lubricant packaging playing a crucial role in ensuring efficient operations. For instance, Suncor Energy adopted advanced packaging solutions for its industrial lubricants, thereby reducing operational costs by 10%, as reported by Canadian Energy News. Additionally, Canada’s stringent environmental regulations have encouraged the adoption of eco-friendly packaging, with companies investing in recyclable materials.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Greif Inc., Scholle IPN, Mold-Tek Packaging, Time Technoplast, BWAY Corporation, Berry Global Inc., Glenroy Inc., and Mondi Group are some of the key market players in the North America lubricant packaging market.

The North America lubricant packaging market is highly competitive, characterized by the presence of global giants and regional players striving to innovate and capture market share. Companies like Berry Global, Amcor, and ALPLA dominate the landscape through their emphasis on sustainability, technological advancements, and strategic collaborations. The competition is intensified by the growing demand for eco-friendly solutions, prompting firms to invest heavily in R&D and recycling technologies. Smaller players are adopting niche strategies, targeting sectors like automotive and renewable energy, to compete effectively. Regulatory pressures and environmental concerns further shape the competitive dynamics, pushing companies to adopt sustainable practices.

Top Players in the North America Lubricant Packaging Market

Berry Global Inc.

Berry Global is a leading player in the North America lubricant packaging market, known for its innovative and sustainable packaging solutions. The company has made significant contributions by introducing eco-friendly materials to meet regulatory and consumer demands. Additionally, the company partnered with major lubricant manufacturers like Shell to develop custom packaging designs that enhance product shelf life and usability.

Amcor plc

Amcor is a global leader in packaging solutions, with a strong presence in the North America lubricant packaging market. The company focuses on advanced recycling technologies and sustainable practices to meet environmental goals. In early 2023, Amcor introduced fully recyclable LDPE containers for industrial lubricants by achieving a 15% reduction in carbon emissions, as reported by Environmental Leader. The company also collaborated with ExxonMobil to integrate smart labeling technologies into lubricant packaging by improving traceability and supply chain efficiency.

ALPLA Group

ALPLA Group is renowned for its expertise in sustainable and high-performance packaging solutions. The company has actively invested in developing recyclable and biodegradable materials for lubricant packaging. Additionally, the company introduced bio-based packaging for specialty lubricants, catering to environmentally conscious consumers. For instance, ALPLA partnered with Tesla to design recyclable containers for EV-specific lubricants that reduces packaging waste. These actions position ALPLA as a dynamic player in the market.

Major Strategies Used by Key Players in the North America Lubricant Packaging Market

Key players in the North America lubricant packaging market have adopted several strategies to maintain their competitive edge. A primary focus has been on sustainability, with companies investing in advanced recycling technologies and eco-friendly materials. Strategic collaborations with end-users, such as automakers and industrial manufacturers, have enabled firms to tailor solutions to specific needs. For instance, partnerships with renewable energy companies have driven demand for packaging that ensures contamination-free delivery. Additionally, players are emphasizing technological advancements, such as integrating smart labeling systems to enhance traceability. Expanding production capacities and launching innovative products, like lightweight and stackable designs, have further strengthened their market positions. These strategies collectively aim to address regulatory requirements, meet consumer preferences, and drive long-term growth in the market.

RECENT MARKET DEVELOPMENTS

- In April 2023, Berry Global launched a line of lightweight, recyclable plastic containers for automotive lubricants by reducing material usage by 20% and enhancing sustainability.

- In June 2023, Amcor introduced fully recyclable LDPE containers for industrial lubricants, thereby achieving a 15% reduction in carbon emissions and aligning with environmental goals.

- In August 2023, ALPLA Group expanded its U.S.-based recycling facility, which is increasing rPET production capacity by 30% to support the development of eco-friendly packaging solutions.

- In October 2023, Berry Global partnered with Shell to design custom packaging solutions that improve product shelf life and usability by addressing evolving consumer demands.

- In December 2023, Amcor collaborated with ExxonMobil to integrate smart labeling technologies into lubricant packaging by improving traceability and supply chain efficiency.

MARKET SEGMENTATION

This research report on the North America lubricant packaging market is segmented and sub-segmented into the following categories.

By Product

- Engine Oil

- Transmission & Hydraulic Fluid

- Process Oil

- Metal Working Fluid

- General Industrial Fluid

- Gear Oil

- Greases

By Material

- Metal

- Plastic

- LDPE

- Others

By End-Use

- Automotive

- Metal Working

- Oil & Gas

- Power Generation

- Machine Industry

- Chemicals

- Other Manufacturing

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What are the major trends in the North America lubricant packaging market?

Major trends include the growing preference for sustainable and recyclable packaging, increased use of flexible packaging like pouches, demand for leak-proof and tamper-evident designs, and rising lubricant sales through e-commerce channels.

What factors are driving the growth of the North America lubricant packaging market?

The market is growing due to increased automotive and industrial activity, higher vehicle and machinery maintenance needs, the shift toward lightweight and eco-friendly packaging, and innovations in packaging technology.

What are the emerging trends shaping the future of lubricant packaging in North America?

Emerging trends include the adoption of smart and connected packaging, increased use of recycled and biodegradable materials, compact and ergonomic designs, and packaging tailored for e-commerce delivery.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]