North America lip care products market Size, Share, Trends & Growth Forecast Report By Product (Lip Balm, Lip Scrub), Distribution Channel, And Country (Us, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Lip Care Products Market Size

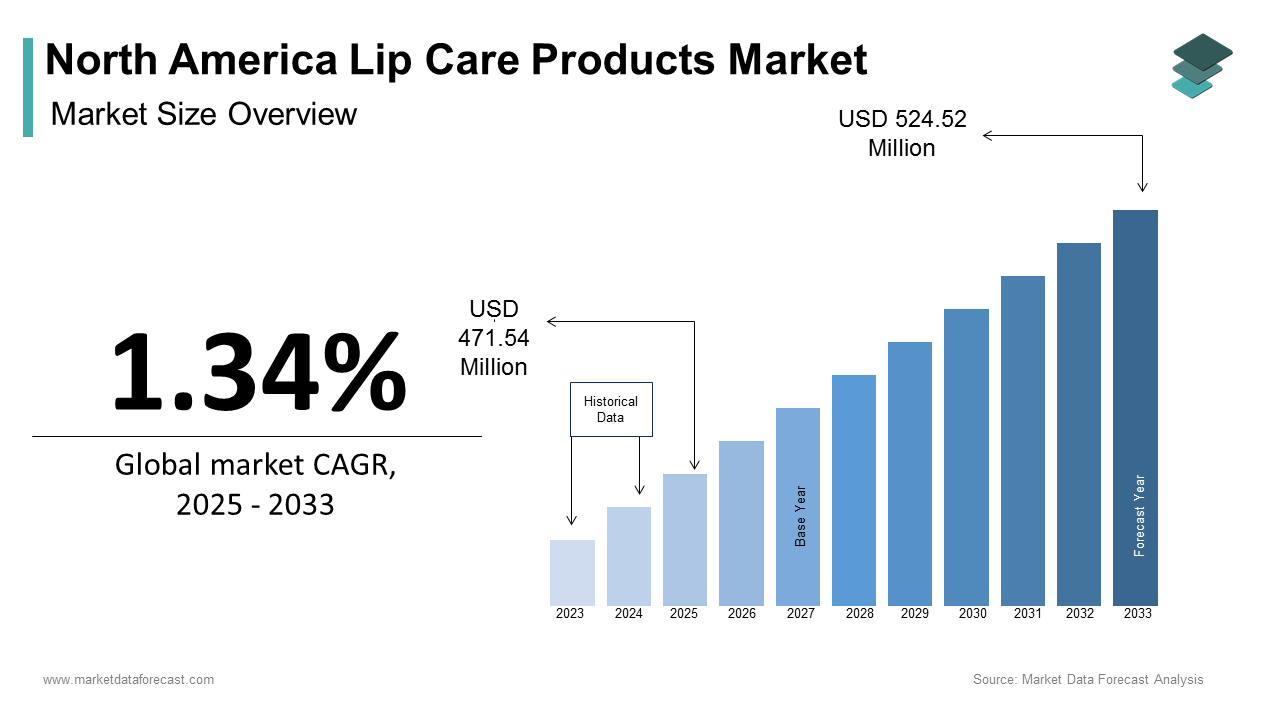

The North America lip care products market Size was calculated to be USD 465.30 million in 2024 and is anticipated to be worth USD 524.52 million by 2033, from USD 471.54 million in 2025, growing at a CAGR of 1.34% during the forecast period.

The North American lip care products market has established itself as a dynamic segment within the broader personal care industry, driven by evolving consumer preferences and an increasing focus on self-care. Moreover, the United States dominates the regional landscape. A key factor influencing this growth is the rising demand for organic and natural formulations, which appeal to health-conscious consumers. Additionally, the proliferation of social media influencers promoting lip care routines has amplified awareness and adoption. Despite these positive trends, regulatory challenges and fluctuating raw material costs remain concerns.

MARKET DRIVERS

Rising Demand for Organic and Natural Formulations

The increasing preference for organic and natural lip care products represents a significant driver for the North American market. For example, brands like Burt’s Bees and EOS have capitalized on this trend, offering products made from beeswax, shea butter, and plant-based oils. A study by the Organic Trade Association notes that over 70% of millennials in the U.S. are willing to pay a premium for organic personal care products, further fueling demand. Additionally, certifications such as USDA Organic and Ecocert have bolstered consumer trust, encouraging wider adoption. This shift toward natural ingredients underscores how health-consciousness and sustainability are reshaping purchasing behaviors and driving market growth.

Growing Influence of Social Media and Influencer Marketing

The growing influence of social media platforms and influencer marketing has significantly propelled the lip care market forward. According to a report by Influencer Marketing Hub, over 75% of beauty brands in North America leverage Instagram and TikTok to promote their products, reaching millions of potential customers. For instance, viral trends like “lip scrubs” and “overnight lip masks” have gained traction, with influencers showcasing DIY routines and product reviews. Additionally, collaborations between brands and influencers. These factors collectively reinforce the importance of digital engagement in driving market expansion.

MARKET RESTRAINTS

High Costs of Premium and Organic Products

A significant restraint impacting the North American lip care market is the high cost associated with premium and organic products, which often price out budget-conscious consumers. This financial barrier limits adoption, particularly among first-time users or those seeking affordable solutions. Additionally, the perception of limited value for money discourages repeat purchases. While technological advancements have reduced production costs over time, the premium pricing remains prohibitive for many, slowing market penetration.

Regulatory Challenges and Ingredient Restrictions

Another critical restraint is the regulatory scrutiny surrounding certain ingredients used in lip care products, creating uncertainty for manufacturers. This challenge is compounded by varying regulations across regions, complicating product standardization. For example, a report by the Environmental Working Group (EWG) states that 25% of lip care products contain potentially harmful substances, leading to increased consumer skepticism. These regulatory hurdles necessitate significant investments in compliance and reformulation, posing a significant barrier to market growth.

MARKET OPPORTUNITIES

Expansion in Men’s Grooming Segment

The men’s grooming segment presents a significant opportunity for the North American lip care market, driven by shifting societal norms and increased focus on male self-care. For instance, brands like Jack Black and Bulldog Skincare have introduced gender-neutral lip balms tailored for men, gaining popularity among urban professionals. Additionally, the rise of unisex packaging and marketing campaigns has expanded the appeal of lip care products beyond traditional demographics. A study reveals that over 60% of millennial men in North America now prioritize skincare and grooming routines, showcasing the immense growth potential in this untapped segment.

Adoption of Multi-Functional Lip Care Solutions

The growing demand for multi-functional lip care products represents another promising avenue for growth, fueled by consumer desire for convenience and versatility. For example, brands like Laneige and Fresh have launched overnight lip masks infused with SPF and collagen-boosting ingredients, appealing to busy urban consumers. Also, the integration of innovative textures, such as gel-based formulas and tinted balms, has expanded applications in both skincare and makeup routines. These innovations are accelerating adoption, positioning multi-functional lip care solutions as a key growth driver.

MARKET CHALLENGES

Intense Competition from Low-Cost Alternatives

One of the foremost challenges facing the North American lip care market is the intense competition posed by low-cost alternatives, particularly private-label and generic brands. These alternatives often undercut established brands on price, intensifying pricing pressure. This trend has forced premium brands to either lower their profit margins or invest heavily in differentiation strategies, such as unique formulations or eco-friendly packaging.

Limited Awareness of Product Benefits

Another significant challenge is the limited awareness of the specific benefits offered by advanced lip care products, particularly among older demographics and rural populations. This lack of awareness creates hesitation among potential buyers, who may perceive premium products as unnecessary or overly complex. Furthermore, misconceptions about the efficacy of natural versus synthetic ingredients deter adoption. Bridging this knowledge gap requires concerted efforts from manufacturers and retailers to educate consumers and demonstrate the tangible benefits of modern lip care solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

1.34% |

|

Segments Covered |

By Product, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, And Rest Of North America |

|

Market Leaders Profiled |

Procter & Gamble, Unilever, L'Oréal S.A., Beiersdorf AG, Burt’s Bees, EOS Products LLC, Johnson & Johnson, The Estée Lauder Companies Inc., Revlon Inc., Blistex Inc. |

SEGMENTAL ANALYSIS

By Product Insights

The lip balm segment dominated the North American market by holding a substantial share in 2024. This dominance is attributed to its affordability, versatility, and widespread availability across retail channels. For instance, brands like ChapStick and Carmex are household names, widely used for everyday hydration and sun protection. Additionally, innovations in formulation, such as SPF-infused and tinted variants, have expanded their appeal. For example, EOS launched a new line of vegan lip balms in 2022, which gained popularity for their eco-friendly design and vibrant colors. These factors collectively reinforce the segment's leadership position.

The lip scrubs segment is the fastest-growing category, with a projected CAGR of 22.1%. This growth is fueled by their ability to exfoliate and rejuvenate lips, appealing to consumers seeking premium self-care experiences. Additionally, the rise of DIY beauty trends on social media has amplified awareness and adoption. These innovations are accelerating adoption, positioning lip scrubs as a key growth driver.

By Distribution Channel Insights

The segment of hypermarkets and supermarkets dominate the North American lip care market by capturing 60.7% of the total share in 2024. This pre-eminence is credited to their extensive reach and ability to offer a wide range of products at competitive prices. Besides, promotional campaigns and discounts during holiday seasons have boosted sales. For instance, Walmart’s Black Friday deals on lip care products resulted in a increase in sales, exhibiting the channel’s prominence.

Specialty stores segment is the quickest one to expand, with a projcalculatedected CAGR of 20.6%. This growth is driven by their focus on premium and niche products, appealing to affluent consumers seeking high-quality formulations. For instance, Sephora and Ulta Beauty have introduced exclusive lines of organic and luxury lip care products, gaining traction among urban professionals. Additionally, personalized shopping experiences and expert consultations enhance customer satisfaction.

REGIONAL ANALYSIS

The United States commanded the North American lip care market with a 85.7% share in 2024. This control over the market is driven by its robust cosmetics industry and strong emphasis on personal grooming. A significant portion of U.S. consumers prioritize lip care as part of their daily routine, creating a fertile ground for innovation. Moreover, federal incentives promoting sustainable practices have bolstered adoption of eco-friendly products. For instance, brands attributed to their commitment to sustainability.

Canada holds a notable share of the regional market. The growth is fueled by investments in wellness and green living initiatives. For example, Canadian pharmacies like Shoppers Drug Mart have expanded their offerings of cruelty-free lip balms, gaining popularity among health-conscious consumers. These trends underscore Canada’s commitment to innovation and sustainability.

Mexican growth is primarily driven by the expanding middle class and rising disposable incomes, supported by economic reforms. Urban centers like Mexico City have seen a surge in demand for affordable yet effective lip care products, particularly during extreme weather conditions. Government-led health campaigns promoting sun protection have also accelerated adoption. For instance, local brands like Natura reported a key increase in sales during summer months, noting the segment’s potential.

The Rest of North America collectively holds a smaller portion of the market. This region’s growth is driven by tourism and hospitality industries, which rely on lip care products for guest comfort and well-being. Besides, agricultural modernization has expanded applications in controlled-environment farming. Costa Rica’s vertical farms, for instance, employ eco-friendly lip care products to align with sustainability goals. These developments show the region’s niche but vital role in the North American market.

LEADING PLAYERS IN THE NORTH AMERICAN LIP CARE PRODUCTS MARKET

Burt’s Bees Inc.

Burt’s Bees leads the North American lip care market. Its commitment to organic and natural formulations has positioned it as a trusted brand among health-conscious consumers. For instance, its beeswax-based lip balms are widely used for their hydrating and soothing properties. The company’s focus on sustainability and eco-friendly packaging has strengthened its global presence derived from environmentally responsible products.

The Body Shop International PLC

The Body Shop ranks second. Known for its cruelty-free and ethically sourced products, the company serves diverse demographics, from urban professionals to eco-conscious millennials. Its emphasis on ethical practices and community engagement has positioned it as a leader in socially responsible beauty solutions.

EOS Products LLC

EOS holds the third spot. Specializing in visually appealing and innovative lip care products, EOS serves younger demographics seeking trendy and functional solutions. Its spherical lip balm designs gained popularity for their unique aesthetics and organic formulations. EOS’s partnerships with retailers like Target and Walmart have expanded its footprint, solidifying its reputation for creativity and reliability.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North American lip care market employ diverse strategies to maintain their competitive edge. Innovation remains central, with companies investing heavily in R&D to develop unique formulations and packaging designs. Strategic partnerships with retailers, such as Sephora and Ulta Beauty, ensure wide distribution and accessibility. For instance, Burt’s Bees collaborates with eco-conscious organizations to promote sustainability and transparency. Expanding geographic reach through online channels and targeting emerging markets like men’s grooming further strengthens market presence. Finally, sustainability initiatives, such as biodegradable packaging and carbon-neutral operations, align with global trends, appealing to environmentally conscious consumers.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the North America lip care products market include Procter & Gamble, Unilever, L'Oréal S.A., Beiersdorf AG, Burt’s Bees, EOS Products LLC, Johnson & Johnson, The Estée Lauder Companies Inc., Revlon Inc., and Blistex Inc.

The North American lip care products market is characterized by fierce competition, driven by rapid innovation and diverse consumer preferences. Leading players like Burt’s Bees, The Body Shop, and EOS dominate the landscape, leveraging their expertise in organic formulations, ethical sourcing, and creative branding to differentiate offerings. Smaller firms, however, face challenges due to high R&D costs and the dominance of established brands. The market is also witnessing increased competition from low-cost private-label alternatives, which remain more affordable and accessible. Regulatory pressures and the need for compliance with safety standards further complicate the competitive environment. Despite these challenges, opportunities abound in emerging segments like men’s grooming and multi-functional products. Companies that balance innovation with affordability while addressing regional needs are likely to thrive. The dynamic nature of the market ensures continuous evolution, with players vying for leadership through strategic investments and cutting-edge solutions.

RECENT HAPPENINGS IN THE MARKET

- In February 2023, Burt’s Bees launched a new line of SPF-infused lip balms featuring recyclable packaging. This move strengthened its position in the eco-friendly segment.

- In April 2023, The Body Shop acquired a natural skincare startup specializing in antioxidant-rich formulations. This acquisition enhanced its capabilities in anti-aging lip care solutions.

- In July 2023, EOS partnered with Sephora to offer exclusive discounts on its vitamin-enriched lip balms. This collaboration expanded its customer base and boosted sales.

- In October 2023, Burt’s Bees introduced a limited-edition holiday collection featuring festive scents and packaging, targeting gift shoppers. This launch boosted its brand appeal during the peak season.

- In December 2023, The Body Shop unveiled a next-generation lip scrub with biodegradable microbeads, positioning itself as a leader in sustainable beauty solutions.

MARKET SEGMENTATION

This research report on the North American lip care products market has been segmented and sub-segmented based on product, distribution channel, and region.

By Product

- Lip Balm

- Lip Scrub

By Distribution Channel

- Hypermarket & Supermarket

- Specialty Stores

By Region

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What are the key factors driving the growth of this market?

The market growth is driven by increasing consumer awareness of personal care, a rising preference for natural and organic products, the popularity of multifunctional lip care items (e.g., those offering hydration and sun protection), and the influence of social media trends promoting lip care routines.

2. Which product types are most popular among consumers?

Lip balms remain the most popular product type, holding the largest market share. Other favored products include lip butter, lip scrubs, and lip oils, with consumers showing a growing interest in products that combine cosmetic appeal with therapeutic benefits.

3. How are distribution channels evolving in the North American market?

While hypermarkets and supermarkets continue to be significant distribution channels, online retail is experiencing the fastest growth. The convenience of e-commerce platforms and the ability to access a wide range of products are contributing to this trend.

4. Who are the major players in the North America lip care products market?

Key market players include L'Oréal, Unilever, Procter & Gamble, Beiersdorf AG, Johnson & Johnson, The Estée Lauder Companies Inc., Burt’s Bees, EOS Products LLC, Colgate-Palmolive Company, and Revlon Inc.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]