North America LED Lighting Market Research Report – Segmented Product (lamps segment, luminaires segment ) Application ( indoor segment , out door segment ) End-Use ( commercial segment, residential segment ), By Country (US, Canada and Rest of North America) – Industry Analysis on Size, Share, Trends, Growth, Forecast ( 2025 to 2033 ).

North America LED Lighting Market Size

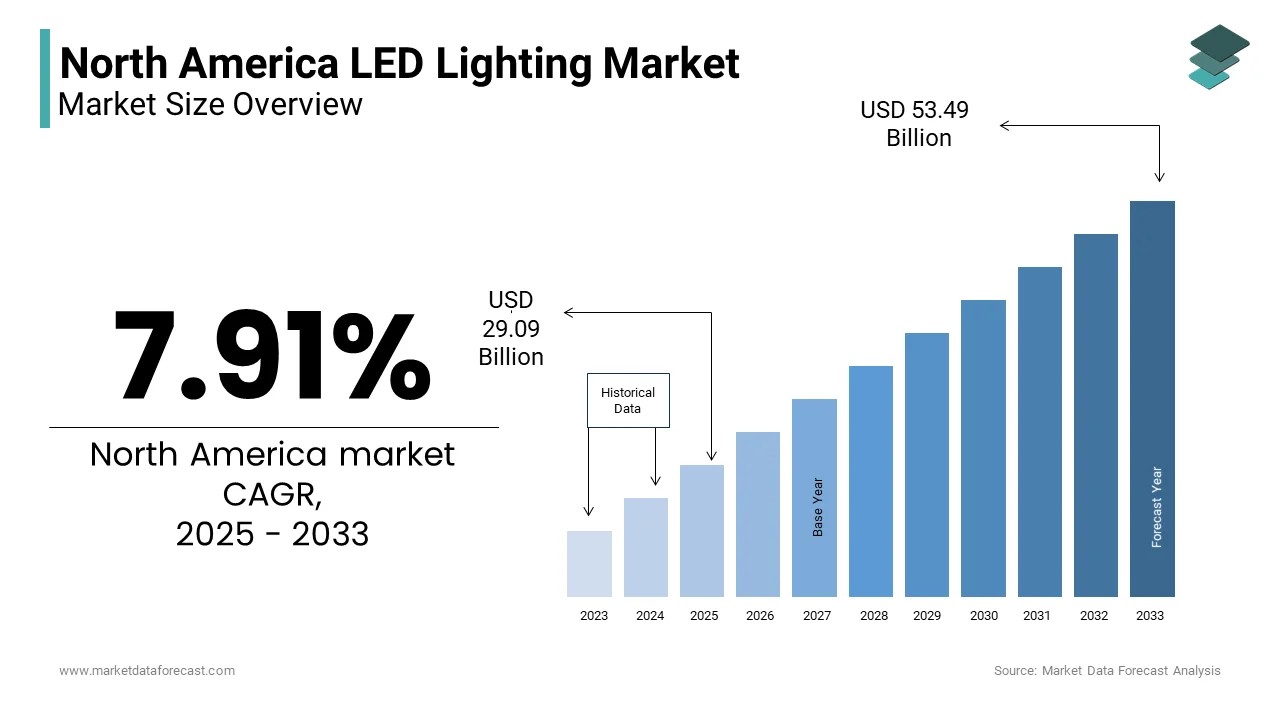

The size of the North America LED lighting market was worth USD 26.96 billion in 2024. The North America market is anticipated to grow at a CAGR of 7.91% from 2024 to 2033 and be worth USD 53.49 billion by 2033 from USD 29.09 billion in 2025.

The LED lighting is renowned for its energy efficiency, longevity, and reduced environmental impact compared to traditional incandescent and fluorescent lighting solutions. This growth is driven by several factors, including increasing energy costs, stringent energy efficiency regulations, and a growing emphasis on sustainability. Additionally, advancements in LED technology, such as improved color rendering and smart lighting capabilities, are further propelling market expansion. The transition to LED lighting is not only beneficial for reducing energy consumption but also contributes to lower greenhouse gas emissions, aligning with broader environmental goals. As consumers and businesses increasingly prioritize energy-efficient solutions, the North American LED lighting market is poised for significant growth, driven by innovation and the need for sustainable lighting solutions.

MARKET DRIVERS

Energy Efficiency and Cost Savings

The increasing focus on energy efficiency is a primary driver of the North American LED lighting market. LED technology is significantly more energy-efficient than traditional lighting solutions, consuming up to 80% less energy while providing the same level of brightness. According to the U.S. Department of Energy, widespread adoption of LED lighting could save the United States approximately $30 billion in energy costs by 2027. This substantial potential for cost savings is prompting both consumers and businesses to transition to LED lighting solutions. Additionally, many states and municipalities are implementing energy efficiency programs that incentivize the adoption of LED technology. The long lifespan of LED bulbs, which can last up to 25,000 hours or more, also contributes to reduced maintenance and replacement costs, making them an economically attractive option. The demand for energy-efficient LED lighting is expected to grow as energy prices continue to rise and the need for sustainable solutions becomes more pressing.

Government Regulations and Incentives

Government regulations and incentives play a crucial role in driving the growth of the North American LED lighting market. Various federal, state, and local governments have established stringent energy efficiency standards aimed at reducing energy consumption and promoting the use of sustainable lighting solutions. For instance, the Energy Independence and Security Act (EISA) of 2007 set efficiency standards for light bulbs, effectively phasing out traditional incandescent bulbs in favor of more efficient alternatives, including LEDs. According to the U.S. Environmental Protection Agency, the ENERGY STAR program has helped consumers save over $5 billion in energy costs since its inception by promoting the adoption of energy-efficient products, including LED lighting. Additionally, many states offer rebates and tax incentives for consumers and businesses that invest in energy-efficient lighting solutions. These regulatory frameworks and financial incentives are encouraging the transition to LED technology is driving market growth. The North American LED lighting market is expected to benefit from ongoing support and initiatives aimed at promoting the adoption of LED lighting solutions.

MARKET RESTRAINTS

High Initial Costs

Despite the promising growth prospects, the North American LED lighting market faces notable restraints, particularly concerning the high initial costs associated with LED lighting solutions. While LED technology offers significant long-term savings through reduced energy consumption and maintenance, the upfront investment can be substantial compared to traditional lighting options. According to industry estimates, the cost of LED bulbs can be two to three times higher than that of incandescent or fluorescent bulbs. This financial barrier can deter some consumers and businesses from making the switch to LED lighting in price-sensitive markets. Additionally, the costs associated with retrofitting existing lighting systems to accommodate LED technology can further complicate the decision-making process for potential adopters. As a result, the high initial investment required for LED lighting solutions represents a significant restraint that could hinder market growth, particularly among smaller businesses and low-income households that may prioritize immediate cost savings over long-term benefits.

Market Competition and Price Pressure

Another significant restraint impacting the North American LED lighting market is the intense competition and price pressure among manufacturers. The market is characterized by a diverse range of players, including established brands and emerging startups, all vying for market share. According to industry reports, the proliferation of low-cost LED products from overseas manufacturers has led to increased price competition, which can erode profit margins for established companies. This competitive environment can make it challenging for manufacturers to invest in research and development, potentially stifling innovation in the sector. Additionally, the rapid pace of technological advancements necessitates continuous improvement in product offerings to remain competitive, placing further pressure on companies to allocate resources effectively. The challenge of maintaining profitability while navigating a competitive market landscape becomes increasingly complex as manufacturers strive to differentiate their products and capture consumer attention.

MARKET OPPORTUNITIES

Technological Advancements in LED Lighting

The North American LED lighting market is poised to capitalize on several emerging opportunities, particularly advancements in LED technology. Innovations in lighting design, such as smart lighting systems and tunable white lighting are enhancing the functionality and appeal of LED solutions. These advancements enable users to control lighting remotely, adjust brightness and color temperature, and integrate lighting systems with other smart home technologies. The demand for advanced LED products is expected to rise significantly as consumers and businesses increasingly seek energy-efficient and customizable lighting solutions. This trend presents a substantial opportunity for manufacturers to innovate and develop cutting-edge LED lighting solutions that meet the evolving needs of the market.

Growing Demand for Sustainable Solutions

Another promising opportunity for the North American LED lighting market lies in the growing demand for sustainable and environmentally friendly lighting solutions. Consumers and businesses are prioritizing products that minimize energy consumption and reduce carbon footprints as awareness of environmental issues increases. According to a survey conducted by the National Retail Federation, approximately 70% of consumers are willing to pay more for sustainable products, indicating a strong market preference for eco-friendly solutions. LED lighting, with its energy efficiency and long lifespan is aligned perfectly with these sustainability goals. Additionally, the increasing focus on green building practices and energy-efficient certifications, such as LEED (Leadership in Energy and Environmental Design), is driving the adoption of LED lighting in commercial and residential projects. The North American LED lighting industry is well-positioned to capitalize on this opportunity by offering environmentally friendly products that meet consumer expectations as the market shifts towards sustainability. This growing emphasis on sustainability is expected to drive significant growth in the LED lighting market as consumers prioritize eco-conscious choices in their purchasing decisions.

MARKET CHALLENGES

Regulatory Compliance and Standards

The North American LED lighting market faces significant challenges stemming from the need to comply with stringent regulatory standards and certifications. Government agencies, such as the U.S. Department of Energy and the American National Standards Institute to impose rigorous testing and certification requirements for LED lighting products to ensure safety, performance, and energy efficiency. Compliance with these regulations can impose substantial costs on manufacturers for those that may need to invest in new technologies or processes to meet evolving standards. Additionally, the potential for regulatory changes can create uncertainty in the market by making it challenging for companies to plan long-term investments. As a result, the regulatory landscape presents a significant challenge for the North American LED lighting market by requiring manufacturers to remain agile and responsive to changing requirements to ensure the successful deployment of LED lighting solutions.

Supply Chain Disruptions

Another formidable challenge facing the North American LED lighting market is the ongoing supply chain disruptions that have emerged in recent years. The COVID-19 pandemic has exposed vulnerabilities in global supply chains by leading to delays in the procurement of critical components for LED lighting manufacturing. Many manufacturers have experienced significant lead time increases for essential materials, such as semiconductors and phosphors, which are vital for LED production. These disruptions not only affect production schedules but also escalate costs, as manufacturers may need to source materials from alternative suppliers at higher prices. Additionally, the semiconductor shortage has further complicated the supply chain for LED lighting for smart lighting solutions that rely on advanced electronic components. The ongoing supply chain challenges pose a significant hurdle for the North American LED lighting market with strategic planning and risk management to mitigate their impact.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.91 % |

|

Segments Covered |

By Product,Application,End-Use and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Osram GmbH, Digital Lumens Inc., Signify Holding, General Electric, Cree, Inc. |

SEGMENTAL ANALYSIS

By Product Insights

The lamps segment was accounted in holding 55.4% of the North America LED lighting market share in 2024. This dominance can be attributed to the widespread adoption of LED lamps in residential, commercial, and industrial applications, driven by their energy efficiency and long lifespan. The versatility of LED lamps, which can be used in various fixtures and settings, contributes to their continued dominance in the market. Additionally, the increasing focus on sustainability and reducing energy consumption is further propelling the demand for LED lamps by making them a preferred choice among consumers and businesses alike.

The luminaires segment is anticipated to register a CAGR of 15.6% during the forecast period in the LED lighting market. This growth can be attributed to the increasing demand for integrated LED lighting solutions in commercial and industrial settings, where energy efficiency and design flexibility are paramount. The growing emphasis on smart lighting solutions and the integration of LED technology into architectural designs further position the luminaires segment for significant growth in the coming years.

By Application Insights

The indoor segment dominated the market and held significant share of the North America LED lighting market in 2024. This dominance is driven by the extensive use of LED lighting in residential and commercial indoor applications, including offices, retail spaces, and homes. The increasing focus on improving indoor air quality and enhancing the overall ambiance of spaces further contributes to the continued dominance of the indoor segment in the North American LED lighting market.

The outdoor segment is expected to register a CAGR of 12.4% during the forecast period. This growth can be attributed to the increasing demand for LED lighting in outdoor applications, such as street lighting, parking lots, and landscape lighting. The adoption of LED lighting solutions is expected to rise significantly as municipalities and businesses prioritize energy efficiency and safety in outdoor environments. The outdoor LED lighting segment is anticipated to capture a larger share of the market as more cities and organizations seek to implement sustainable and cost-effective lighting solutions. The growing emphasis on smart city initiatives and the integration of LED technology into public infrastructure further position the outdoor segment for significant growth in the coming years.

By End-Use Insights

The commercial segment was the largest by occupying 50.1% of the North America LED lighting market share in 2024. This dominance is driven by the extensive adoption of LED lighting solutions in commercial settings, including offices, retail spaces, and hospitality venues. The ongoing demand for energy-efficient and aesthetically pleasing lighting solutions is ascribed to boost the growth of the market. The increasing focus on sustainability and reducing operational costs in commercial buildings further contributes to the continued dominance of the commercial segment in the North American LED lighting market.

The residential segment is expected to register a CAGR of 14.3% during the forecast period. This growth can be attributed to the increasing adoption of LED lighting solutions in homes that is driven by consumer awareness of energy efficiency and the long lifespan of LED products. The residential LED lighting segment is expected to capture a larger share of the market as more homeowners seek to upgrade their lighting systems to more sustainable options. The growing emphasis on smart home technology and the integration of LED lighting into home automation systems further position the residential segment for significant growth in the coming years.

Country Level Analysis

The United States was the dominant country in the North American LED lighting market with significant share of 75.3% in 2024. The U.S. market is characterized by a robust demand for LED lighting driven by advancements in technology and increasing energy efficiency regulations. According to the U.S. Department of Energy, the adoption of LED lighting has the potential to save the country over $30 billion in energy costs annually by 2027. Major manufacturers and retailers are investing heavily in LED technology, enhancing the availability and accessibility of energy-efficient lighting solutions.

Canada LED lighting market is ascribed to exhibit a CAGR of 15.4% during the forecast period. The Canadian market is driven by similar factors as the U.S., including increasing government support for energy efficiency and sustainability. According to Natural Resources Canada, the adoption of LED lighting in Canada has been steadily increasing, with various initiatives aimed at promoting energy-efficient products. The Canadian government has implemented programs to encourage the transition to LED lighting that is eventually to leverage the growth of the market.

The demand for LED lighting solutions is expected to rise as Canada continues to prioritize sustainability and innovation in its lighting sector by reflecting the country's commitment to reduce energy consumption and greenhouse gas emissions. The growing awareness among consumers regarding the benefits of LED technology, combined with government incentives, positions Canada as a significant player in the North American LED lighting market.

KEY MARKET PLAYERS

Key players in the North American LED lighting market are Osram GmbH, Digital Lumens Inc., Signify Holding, General Electric, Cree, Inc., Dialight, Eaton, and others.

MARKET SEGMENTATION

This research report on the North America LED Lighting Market has been segmented and sub-segmented into the following categories

By Product

- lamps segment

- luminaires segment

By Application

- indoor segment

- out door segment

By End-Use

- commercial segment

- residential segment

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

Which country leads the North America LED lighting market?

The United States is the largest market for LED lighting in North America.

What are the key applications for LED lighting?

Key applications include residential, commercial, industrial, and government sectors, with notable subsegments in smart lighting and street lighting.

What challenges does the market face?

Challenges include high initial costs, regulatory hurdles, and supply chain disruptions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]