North America IT Services Market Size, Share, Trends & Growth Forecast Report By Service Type (Professional Services - System Integration and Consulting, Managed Services), Enterprise Size (Small and Medium-sized Enterprises, Large Enterprises), Deployment Mode (On-premises, Cloud-based), End Use Industry (BFSI, Telecommunication, Healthcare, Retail, Manufacturing, Government) and Country (United States, Canada, Mexico) Industry Analysis From 2025 to 2033.

North America IT Services Market Size

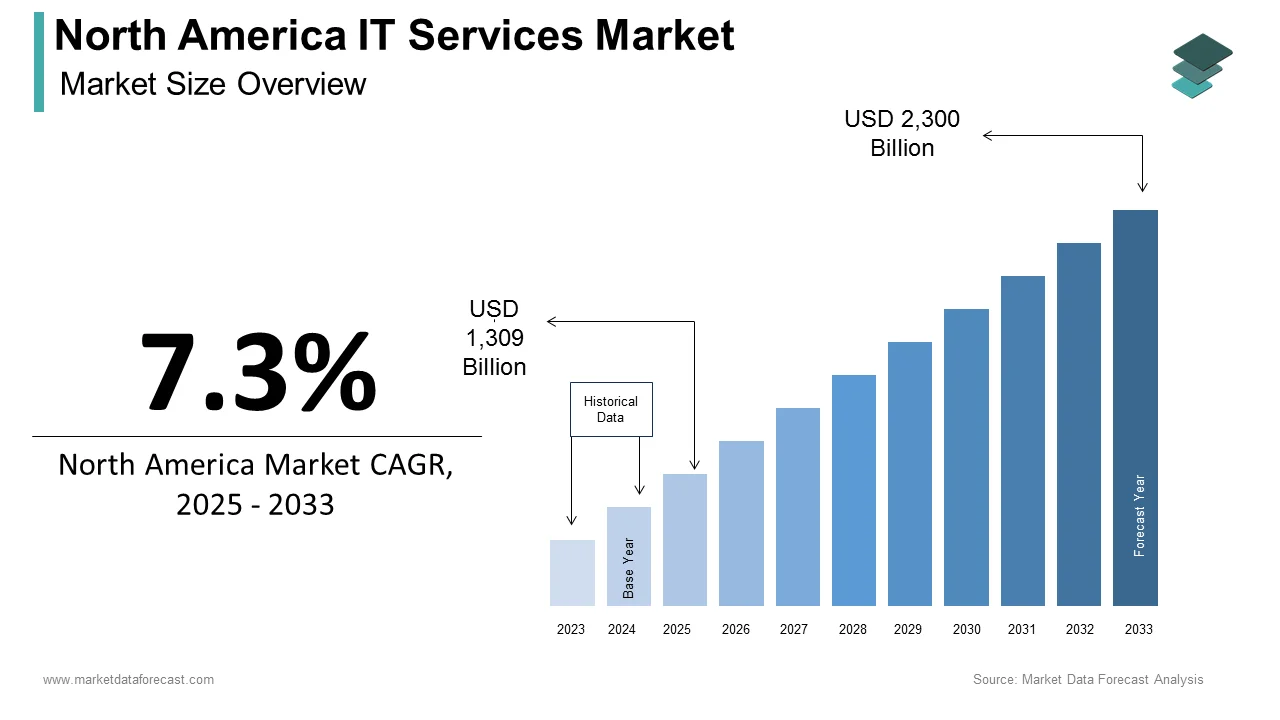

The size of the North America IT services market was valued at USD 1,220 billion in 2024. This market is expected to grow at a CAGR of 7.3% from 2025 to 2033 and be worth USD 2,300 billion by 2033 from USD 1,309 billion in 2025.

The North America IT services market encompasses a broad spectrum of services designed to support the information technology needs of organizations across various sectors. This market includes services such as consulting, system integration, application development, managed services, and technical support. As businesses increasingly rely on technology to drive operations, enhance productivity, and improve customer experiences, the demand for IT services has surged. This growth is driven by the rising adoption of cloud computing, the increasing need for cybersecurity solutions, and the ongoing digital transformation initiatives undertaken by organizations. As companies seek to leverage technology to gain a competitive edge, the IT services market in North America is poised for significant expansion, offering innovative solutions to meet the evolving demands of the digital landscape.

MARKET DRIVERS

Increasing Adoption of Cloud Computing

The increasing adoption of cloud computing is a significant driver of the North America IT services market. As organizations seek to enhance operational efficiency and reduce IT costs, they are increasingly migrating their infrastructure and applications to the cloud. As per a report by Gartner, the public cloud services landscape globally is expected to reach $397 billion by 2022, with North America accounting for a substantial portion of this growth. Cloud computing offers numerous advantages, including scalability, flexibility, and cost-effectiveness, allowing businesses to pay only for the resources they use. Additionally, the COVID-19 pandemic has accelerated the shift to remote work, further emphasizing the need for cloud-based solutions that enable collaboration and data access from anywhere.

Growing Cybersecurity Concerns

The rising concerns surrounding cybersecurity are another key driver propelling the North America IT services market. As cyber threats become increasingly sophisticated and prevalent, organizations are investing heavily in cybersecurity solutions to protect their sensitive data and maintain compliance with regulatory requirements. According to a report by Cybersecurity Ventures, global cybercrime costs are projected to reach $10.5 trillion annually by 2025 is spotlighting the urgent need for robust cybersecurity measures. Businesses are increasingly turning to IT service providers for expertise in implementing security protocols, conducting risk assessments, and managing incident response. The rise of remote work and the increasing reliance on digital platforms have further heightened the need for comprehensive cybersecurity strategies.

MARKET RESTRAINTS

High Implementation Costs

High implementation costs associated with IT solutions forms the primary restraint affecting the North America IT services market. Organizations often face significant expenses related to software licenses, hardware, and consulting services, which can deter them from adopting advanced IT services. As outlined in a report by the Deloitte, the average cost of implementing a comprehensive IT solution can range from $100,000 to $500,000 is depending on the size and complexity of the organization. Additionally, ongoing costs related to maintenance, upgrades, and training can further strain budgets. This financial barrier can lead to a slower rate of technology adoption among small and medium-sized enterprises (SMEs), limiting their ability to compete effectively in the market. IT service providers must focus on offering more affordable solutions and flexible pricing models that cater to the needs of smaller organizations.

Skill Shortages in IT Workforce

The shortage of skilled professionals in the IT workforce is another significant restraint impacting the North America IT services market. As organizations increasingly adopt advanced technologies, the demand for qualified IT personnel with expertise in areas such as cloud computing, cybersecurity, and data analytics continues to rise. According to a study by the U.S. Bureau of Labor Statistics, the demand for information security analysts is expected to grow by 31% from 2019 to 2029 is significantly faster than the average for all occupations. This skills gap can hinder organizations' ability to fully leverage IT services, limiting their effectiveness and potential benefits. Additionally, the rapid pace of technological change can make it challenging for existing IT staff to keep their skills up to date.

MARKET OPPORTUNITIES

Expansion of Artificial Intelligence and Machine Learning

The expansion of artificial intelligence (AI) and machine learning (ML) technologies presents a significant opportunity for growth in the North America IT services market. As organizations increasingly seek to leverage data for strategic decision-making, the demand for AI and ML solutions is on the rise. In line with a report by McKinsey, AI adoption has the potential to increase global GDP by $13 trillion by 2030, with North America expected to be a key contributor to this growth. AI and ML can enhance various aspects of IT services, including predictive analytics, automation of routine tasks, and improved customer experiences.

Growth of Managed Services

The growth of managed services represents another major opportunity for the North America IT services market. As organizations increasingly seek to offload their IT operations to third-party providers, the demand for managed services is on the rise. Managed services allow organizations to focus on their core business functions while relying on IT service providers to manage their infrastructure, applications, and security. This shift enables businesses to improve operational efficiency, reduce costs, and enhance service quality.

MARKET CHALLENGES

Rapid Technological Changes

The rapid pace of technological changes in the IT services landscape presents a challenge for organizations seeking to implement and maintain IT solutions. As new technologies emerge, organizations must continuously adapt their IT strategies to keep up with the evolving landscape. According to an investigation, 60% of organizations struggle to keep their IT systems aligned with the latest technological advancements. This challenge can lead to increased complexity in managing IT services, as organizations may need to invest in regular updates, training, and integration with new technologies. Apart from these, the constant introduction of new features and functionalities can overwhelm users and is leading to difficulties in adoption and utilization.

Integration with Legacy Systems

The integration of new IT services with existing legacy systems poses a significant challenge for organizations in the North America IT services market. Many organizations still rely on outdated systems that may not be compatible with modern IT solutions, creating barriers to effective data exchange and interoperability. As per a survey by the Healthcare Information and Management Systems Society, nearly 60% of healthcare providers reported difficulties in integrating their IT systems with other applications. This challenge can hinder the effectiveness of IT service implementations, as organizations may struggle to achieve seamless communication between new and legacy systems. Also, the complexity of legacy systems can lead to increased costs and extended timelines for technology upgrades.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Service Type, Enterprise Size, Deployment Mode, End Use Industry, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America |

|

Market Leader Profiled |

IBM, Accenture plc, Deloitte, Capgemini SE, Cisco Systems Inc., Cognizant, Dell Technologies Inc., HCL Technologies Limited, Hewlett Packard Enterprise Company, Infosys Limited, Microsoft Corporation, TATA Consultancy Services Limited, Toshiba Corporation, Wipro Limited, and Others. |

SEGMENTAL ANALYSIS

By Service Type Insights

The professional services segment was the largest by accounting for 57.3% of the total market share in 2024. This dominance can be attributed to the increasing demand for consulting, system integration, and implementation services as organizations seek to optimize their IT operations. A report by Gartner found that the professional services business is projected to grow at a notable pace over the years and is fuelled by the rising need for expert guidance in navigating complex IT environments. Professional services enable organizations to leverage the expertise of IT consultants to assess their needs, design tailored solutions, and implement best practices. Additionally, the growing emphasis on digital transformation and the adoption of emerging technologies further propel the demand for professional services.

The managed services segment is anticipated to register a CAGR of 15.3% in the coming years. This rise can be attached to the increasing demand for outsourced IT management and support services as organizations seek to enhance operational efficiency and reduce costs. Managed services allow organizations to offload their IT operations to third-party providers, enabling them to focus on their core business functions while relying on experts to manage their infrastructure, applications, and security. Because market participants continue to prioritize digital transformation and seek to optimize their IT operations, the demand for managed services is expected to drive significant growth.

By Enterprise Size Insights

The large enterprises represented the biggest segment by holding 72.1% of the total market share in 2024. This control over the market is backed by the significant investments made by large organizations in IT services to enhance their operational capabilities and maintain a competitive edge. According to a report by IDC, large enterprises are increasingly adopting advanced IT solutions to streamline their operations and improve efficiency. The complexity of large-scale IT environments necessitates robust support and management services, leading to higher demand for IT service providers. Additionally, large enterprises often have dedicated IT teams and resources, enabling them to implement and optimize IT services effectively. The demand for efficient and effective IT solutions continues to rise, so, the large enterprise segment is expected to maintain its leading position.

The rapidly expanding segment is the small and medium-sized enterprises (SMEs) category and is expected to witness fastest CAGR of 21.5% from 2025 to 2033. This emergence can be due to the rising recognition among SMEs of the importance of IT services in enhancing operational efficiency and competitiveness. According to data provided by a survey by the Small Business Administration, 60% of SMEs reported that they plan to invest in IT services to improve their business operations. As SMEs seek to leverage technology to optimize their processes and enhance customer experiences, the adoption of IT services is becoming essential. Also, the availability of cost-effective IT solutions and managed services is making it easier for SMEs to implement advanced technologies.

By Deployment Mode Insights

The cloud-based IT services segment prevailed in the North America IT services market by contributing 62.8% of the total market share in 2024. This rule can be credited to the increasing demand for flexible, scalable, and cost-effective solutions that cloud-based services offer. A study by Gartner reveals that the public cloud services trade around the world is likely to expand at a tremendous rate in the future and is driven by the rising adoption of cloud technologies among organizations of all sizes. Cloud-based IT services facilitate companies to access their systems from anywhere, giving remote work and collaboration. In addition, the lower upfront costs associated with cloud deployments make them an attractive option for small and medium-sized enterprises (SMEs) looking to implement IT services without significant capital investment.

The hybrid IT services segment is having a steep upward growth trajectory and is calculated to see a CAGR of 26.1% over the forecast period. This sudden development can be linked to the increasing demand for solutions that combine the benefits of both cloud and on-premises deployments. Hybrid IT services give businesses to maintain critical data on-premises while leveraging cloud capabilities for scalability and accessibility. This approach allows organizations to address specific regulatory and security requirements while benefiting from the cost-effectiveness and agility of cloud solutions.

By End Use Industry Insights

The banking, financial services, and insurance (BFSI) segment continued to be the dominant force in the North America IT services market by capturing 33.1% of the total market share in 2024. This authority is supported by the critical need for secure, efficient, and compliant IT solutions in the highly regulated financial sector. In line with a report by the American Bankers Association, U.S. banks inflused over $200 billion in technology in 2021 and is showcasing the relevance of IT services in the BFSI industry. These services enable financial institutions to enhance their operational efficiency, improve customer experiences and ensure compliance with regulatory requirements. The heightened attention to digital banking and fintech solutions further propels the need for IT services in this sector.

The fastest-growing segment is the healthcare segment and is estimated to experience highest CAGR of 23.5% from 2025 to 2033. This growth can be attributed to the expanding digitization of healthcare services and the rising demand for integrated IT solutions that enhance patient care and operational efficiency. Based on a report by the American Hospital Association, U.S. hospitals are expected to invest over $50 billion in health IT solutions by 2025 is signifying the growing importance of technology in healthcare delivery. IT services enable healthcare organizations to streamline their operations, improve patient engagement, and ensure compliance with regulations. Moreover, the expansion of telehealth and remote patient monitoring solutions is influencing the demand for IT services in the healthcare sector.

REGIONAL ANALYSIS

The United States retained the largest portin of the North America IT services market by accounting for 75.3% of the total market share in 2024. The advanced technological infrastructure and the presence of major technology companies driving innovation in the IT services sector is mainly pushing the U.S. ahead in this market. As per the U.S. Bureau of Economic Analysis, the IT services sphere is projected to grow at a rate of 5.4% each year and is further fueling the demand for IT services across various industries. The U.S. market is distinguished by significant investments in research and development, leading to the introduction of innovative IT solutions that cater to the evolving needs of businesses. Apart from this, the rising acceptance of cloud-based IT services among U.S. organizations is propelling the demand for these systems.

Canada is experiencing the quickest upswing in the North America IT services market and is on track to achieve a CAGR of 10.1% during the projection period. The progress spurred by the increasing demand for IT services driven by the expansion of the technology sector and the rising adoption of cloud-based solutions. According to a report by Statistics Canada, the Canadian IT services landscape is expected to advance by 7% annually by creating opportunities for IT providers. The Canadian market exhibits a firm emphasis on excellence and customer service, with organizations increasingly recognizing the importance of IT services in enhancing operational efficiency. Furthermore, government initiatives aimed at promoting innovation and technology adoption further support this trend.

The rest of North America progresses at a more gradual pace in the North America IT services market. This is bolstered by the increasing demand for IT services and the expansion of the technology sector in the region. The market is defined by an attention on affordability and accessibility, with organizations seeking cost-effective IT solutions that enhance operational efficiency. Also, the rising awareness of the importance of quality assurance in IT implementations is driving the adoption of reliable systems and vendors.

KEY MARKET PLAYERS

A few of the notable companies operating in the North America IT services market profiled in this report are IBM, Accenture plc, Deloitte, Capgemini SE, Cisco Systems Inc., Cognizant, Dell Technologies Inc., HCL Technologies Limited, Hewlett Packard Enterprise Company, Infosys Limited, Microsoft Corporation, TATA Consultancy Services Limited, Toshiba Corporation, Wipro Limited, and Others.

IBM

IBM is a leading player in the North America IT services market, known for its comprehensive suite of IT solutions that cater to various industries. The company's services include cloud computing, data analytics, cybersecurity, and consulting, enabling organizations to optimize their operations and enhance decision-making. IBM's commitment to innovation and research has positioned it as a dominant force in the IT services market, with a significant share of the North American landscape.

Accenture

Accenture is another major player in the North America IT services market, recognized for its consulting and technology services that help organizations navigate digital transformation. The company's focus on delivering tailored solutions and leveraging advanced technologies, such as AI and blockchain, has enabled it to capture a significant share of the market. Accenture's extensive industry expertise and global reach further enhance its competitive position in the IT services sector.

Deloitte

Deloitte is a prominent player in the North America IT services market, offering a wide range of consulting and technology services to organizations across various sectors. The company's services include IT strategy, implementation, and managed services, enabling clients to enhance their operational efficiency and drive innovation. Deloitte's strong brand reputation and commitment to delivering high-quality solutions have made it a trusted partner for businesses seeking to optimize their IT operations.

STRATEGIES EMPLOYED BY KEY PLAYERS

Key players in the North America IT services market employ various strategies to strengthen their market position and enhance competitiveness. One prominent strategy is the focus on innovation and research and development, enabling companies to introduce cutting-edge IT solutions that meet the evolving needs of organizations. For instance, IBM continuously invests in enhancing its cloud and AI capabilities to align with industry trends.

Additionally, strategic partnerships and collaborations play a crucial role in expanding market reach and enhancing product offerings. Accenture, for example, has formed alliances with various technology providers to integrate advanced solutions into its consulting services, allowing organizations to leverage the latest innovations in their IT strategies.

Furthermore, companies are increasingly prioritizing customer-centric approaches, offering tailored solutions and support services to address specific requirements of their clients. This focus on customer engagement not only fosters loyalty but also enhances the overall value proposition of their offerings. For instance, Deloitte emphasizes understanding the unique challenges faced by its clients and customizing its services accordingly, which helps in building long-term relationships.

Moreover, many key players are actively pursuing educational initiatives to empower organizations in their IT implementations. IBM, for instance, provides extensive training programs and resources to help clients navigate the complexities of adopting new technologies. By investing in workforce development and knowledge sharing, these companies can ensure that their clients are well-equipped to maximize the benefits of their IT services.

COMPETITION OVERVIEW

The competition in the North America IT services market is characterized by a dynamic landscape where innovation, efficiency, and customer experience are paramount. Major players are continuously striving to differentiate themselves through advanced technologies and comprehensive solutions. The market is witnessing a surge in the adoption of IT services, driven by increasing consumer demand for operational efficiency and integrated business processes. As organizations prioritize digital transformation and seek to enhance their software capabilities, companies that provide reliable, user-friendly platforms and robust functionalities are gaining a competitive edge.

Furthermore, the presence of both established players and emerging startups fosters a competitive environment that encourages rapid technological advancements. The ongoing digital transformation across various sectors is further intensifying competition, as organizations seek to optimize their operations through IT solutions.

RECENT ACTIONS BY KEY PLAYERS

- In January 2024, IBM announced the launch of a new AI-driven analytics platform designed to enhance data insights for healthcare organizations.

- In February 2024, Accenture expanded its cloud services portfolio by acquiring a leading cloud consulting firm, aiming to enhance its capabilities in cloud migration and management.

- In March 2024, Deloitte introduced a new cybersecurity service aimed at helping organizations protect against emerging threats in the digital landscape.

- In April 2024, Oracle announced enhancements to its cloud infrastructure, focusing on improving performance and security for enterprise applications.

- In May 2024, Microsoft launched a new suite of IT service management tools designed to streamline operations for IT departments across various industries.

- In June 2024, Cisco introduced a new managed services offering that combines networking and security solutions for small and medium-sized enterprises.

- In July 2024, ServiceNow announced a partnership with a leading AI company to integrate machine learning capabilities into its IT service management platform.

- In August 2024, SAP unveiled a new version of its ERP software that includes advanced analytics and machine learning features to enhance decision-making.

- In September 2024, VMware expanded its cloud services to include enhanced support for multi-cloud environments, allowing organizations to manage their IT resources more effectively.

- In October 2024, HPE announced a new initiative focused on providing IT services tailored to the needs of the healthcare sector, emphasizing data security and compliance.

MARKET SEGMENTATION

This research report on the North America IT services market is segmented and sub-segmented into the following categories.

By Service Type

- Professional Services (System Integration and Consulting)

- Managed Services

By Enterprise Size

- Small and Medium-sized Enterprises

- Large Enterprises

By Deployment Mode

- On-premises

- Cloud-based

By End Use Industry

- BFSI

- Telecommunication

- Healthcare

- Retail

- Manufacturing

- Government

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the projected growth rate of the North America healthcare packaging market?

The North America healthcare packaging market is expected to grow at a CAGR of 7.22% from 2025 to 2033.

2. What factors are driving the North America healthcare packaging market?

The market is driven by rising demand for biopharmaceutical packaging, medical device packaging, and regulatory compliance requirements

3. What materials are commonly used in the North America healthcare packaging market?

Common materials include plastic, glass, and paperboard for bottles, vials, syringes, and blister packs.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com