North America Isopropyl Alcohol Market Size, Share, Trends & Growth Forecast Report By Application (Antiseptic & Astringent, Cleaning Agent, Solvent, Chemical Intermediate), End-use (Cosmetics & Personal Care, Pharmaceutical, Food and Beverages, Paints and Coatings, Chemical), and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Isopropyl Alcohol Market Size

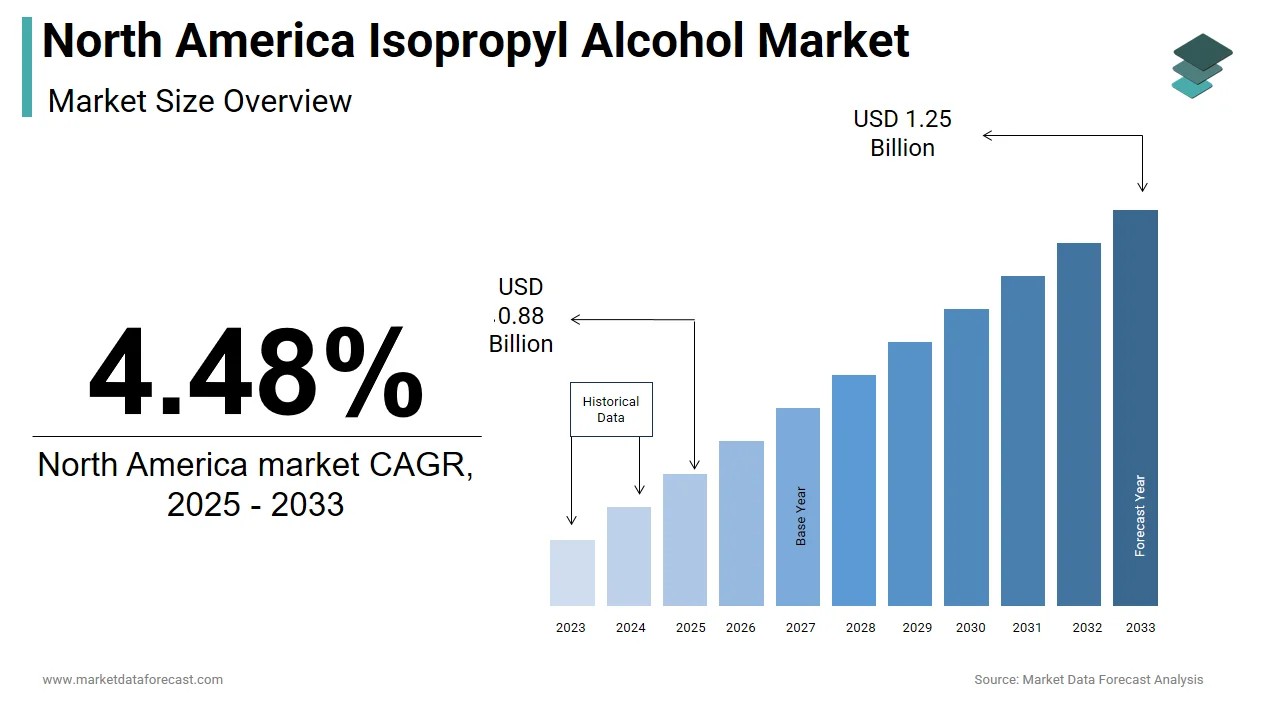

The size of the North America isopropyl alcohol market was worth USD 0.84 billion in 2024. The North America market is anticipated to grow at a CAGR of 4.48% from 2025 to 2033 and be worth USD 1.25 billion by 2033 from USD 0.88 billion in 2025.

The COVID-19 pandemic acted as a catalyst in surging the demand for IPA since 2020 due to its use in hand sanitizers and disinfectants. Beyond the pandemic, the market continues to thrive due to increasing industrial applications, such as solvents in paints and coatings, and chemical intermediates. Regulatory support for eco-friendly formulations has also boosted adoption in the pharmaceutical sector.

MARKET DRIVERS

Surge in Pharmaceutical Demand

The pharmaceutical industry serves as a primary driver for the North America isopropyl alcohol market. IPA is extensively utilized as an antiseptic and solvent in drug formulation and manufacturing processes. The rise in chronic diseases, coupled with an aging population, has propelled pharmaceutical spending in the region. Additionally, stringent FDA regulations mandating the use of high-purity IPA in sterile manufacturing have further amplified demand. The growing trend of personalized medicine and biologics will further propel IPA’s role in pharmaceutical innovation.

Rising Hygiene and Sanitization Standards

The heightened hygiene and sanitization standards post-pandemic have significantly bolstered IPA demand in North America. According to the World Health Organization (WHO), hand sanitizers containing at least 60% IPA are recommended for effective disinfection by driving a surge in production. According to the U.S. Environmental Protection Agency (EPA), sanitizer sales grew by 600% in 2020 by creating unprecedented demand for IPA. Beyond consumer use, industries such as food and beverages, hospitality, and healthcare have adopted rigorous cleaning protocols, further amplifying consumption. Additionally, the shift toward sustainable cleaning practices has spurred innovations in bio-based IPA formulations, aligning with corporate sustainability goals. This dual push from consumer awareness and industrial adoption ensures sustained demand for IPA in the region.

MARKET RESTRAINTS

Volatility in Raw Material Prices

Fluctuating raw material prices pose a significant restraint on the North America isopropyl alcohol market. Propylene, a key feedstock for IPA production, is subject to price volatility due to shifts in crude oil prices and geopolitical tensions. According to the U.S. Energy Information Administration (EIA), the growing prices of crude oil is directly impacting IPA production costs. This volatility creates uncertainty for manufacturers, who face challenges in maintaining stable pricing for end-users. Furthermore, supply chain disruptions, exacerbated by events like the Russia-Ukraine conflict, have led to shortages of critical raw materials. A study by the American Chemistry Council (ACC) reveals that these disruptions increased production costs by 15% in 2022, which is forcing companies to either absorb losses or pass costs onto consumers.

Stringent Environmental Regulations

Stringent environmental regulations present another major restraint, particularly regarding IPA production and disposal. The U.S. Environmental Protection Agency (EPA) mandates strict emission controls for volatile organic compounds (VOCs), including IPA, which is classified as a hazardous air pollutant. According to the EPA, industries must invest heavily in pollution control technologies to comply with these standards by increasing operational costs. Non-compliance can result in penalties exceeding USD 50,000 per violation, as per the Occupational Safety and Health Administration (OSHA).

MARKET OPPORTUNITIES

Expansion into Bio-Based Formulations

The growing demand for sustainable and eco-friendly solutions presents a lucrative opportunity for the North America isopropyl alcohol market. Bio-based IPA, derived from renewable resources such as corn and sugarcane, offers reduced carbon footprints and enhanced biodegradability compared to petroleum-based alternatives. According to the U.S. Department of Agriculture (USDA), bio-based chemicals can reduce greenhouse gas emissions by up to 60% by aligning with corporate sustainability goals. The adoption of bio-based IPA is expected to surge with industries like cosmetics and personal care prioritizing eco-conscious practices.

Growth in Emerging Applications

Emerging applications in the electronics and automotive industries will offer significant growth avenues for the North America isopropyl alcohol market. The market's growth is also fueled by advancements in semiconductor manufacturing. IPA is widely used as a cleaning agent to remove residues and contaminants from circuit boards and components. The U.S. Department of Transportation estimates that electric vehicle (EV) production will account for 30% of new car sales by 2030, which is creating additional demand for IPA in battery manufacturing and assembly processes. Furthermore, innovations in high-purity IPA formulations have expanded their application scope and are enhancing their adoption in precision cleaning tasks.

MARKET CHALLENGES

Intense Market Competition

Intense market competition poses a formidable challenge, with numerous players vying for market share in a saturated landscape. Established players leverage economies of scale to offer competitive pricing by making it challenging for smaller firms to penetrate the market. Furthermore, rapid technological advancements necessitate continuous innovation, placing additional pressure on companies to differentiate their offerings. A report by Deloitte Insights reveals that marketing and branding efforts account for nearly 20% of operational expenses for mid-sized firms. Price wars and aggressive promotional strategies exacerbate the situation are erode profit margins. This hyper-competitive environment forces companies to adopt strategic partnerships or mergers to sustain their position will complicate the market dynamics and increase barriers to entry.

Supply Chain Disruptions

Supply chain disruptions represent another significant challenge in light of recent global events. The Russia-Ukraine conflict and ongoing trade tensions have disrupted the availability of propylene, a critical raw material for IPA production. According to the American Chemistry Council (ACC), these disruptions caused a 20% reduction in propylene supply in 2022 by leading to production delays and increased costs. Additionally, logistical bottlenecks, such as port congestion and labor shortages, have further strained supply chains. For instance, the U.S. West Coast ports experienced a 15% decline in throughput during peak months in 2022 due to delays in shipments of IPA and other chemicals.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Application Type, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico, and the Rest of North America. |

|

Market Leaders Profiled |

Dow Chemical, Mistral Industrial Chemicals, INEOS Corporation, ReAgent Chemicals Ltd., LyondellBasell Industries, Linde Gas, Ecolab, Royal Dutch Shell, ExxonMobil Corporation, and others. |

SEGMENTAL ANALYSIS

By Application Insights

The cleaning agent segment dominated the North America isopropyl alcohol market by holding a market share of 40.6% in 2024. The growth of the segment is attributed to the IPA’s superior solvent properties, which make it ideal for removing grease, oil, and other contaminants across various industries. The rise in hygiene and sanitization standards post-pandemic has further amplified demand, with the U.S. Environmental Protection Agency (EPA) recommending IPA-based solutions for effective disinfection. Industries such as food and beverages, healthcare, and hospitality rely heavily on IPA for surface cleaning and sterilization. Additionally, innovations in high-purity IPA formulations have expanded their application scope and are enhancing their adoption in precision cleaning tasks.

The chemical intermediate segment is growing lucratively with a CAGR of 8.5% throughout the forecast period. This growth is fueled by IPA’s versatility as a precursor in the synthesis of various chemicals, including acetone and isopropyl acetate. Additionally, the automotive sector’s shift toward electric vehicles (EVs) has spurred the adoption of IPA in battery electrolyte production. Innovations in bio-based IPA formulations have further enhanced their appeal by aligning with sustainability trends.

By End-Use Insights

In 2024, the pharmaceutical sector dominated the North America isopropyl alcohol market, holding 28.7% of the share, due to its role in drug formulation and production processes as both an antiseptic and solvent. The rise in chronic diseases and an aging population has propelled pharmaceutical spending in the region. Additionally, stringent FDA regulations mandating the use of high-purity IPA in sterile manufacturing have further amplified demand.

The cosmetics and personal care segment is likely to witness the fastest CAGR of 9.2% in the coming years. This growth is driven by increasing consumer awareness about hygiene and skincare, coupled with the rising popularity of natural and organic products. IPA is widely used as a solvent and preservative in formulations such as toners, cleansers, and hand sanitizers. Additionally, the shift toward sustainable practices has spurred innovations in bio-based IPA formulations by aligning with consumer preferences for eco-friendly products. The growing prevalence of e-commerce platforms has further amplified demand is enabling brands to reach a wider audience.

COUNTRY LEVEL ANALYSIS

The United States led the North America isopropyl alcohol market with 78.1% of share in 2024, with the country’s robust pharmaceutical and cleaning agent industries, which rely heavily on IPA for various applications. The U.S. Food and Drug Administration (FDA) mandates the use of high-purity IPA in sterile manufacturing is driving demand in the pharmaceutical sector. Additionally, the rise in hygiene and sanitization standards post-pandemic has bolstered IPA consumption. The presence of major manufacturers and suppliers ensures a highly competitive yet innovative environment by fostering continuous advancements in IPA formulations.

In 2024, the Canada isopropyl alcohol market held 13.2% of the share. The country’s growing cosmetics and personal care sector creates a substantial demand for IPA in skincare and haircare formulations. Additionally, Canada’s commitment to reducing greenhouse gas emissions, outlined in its Net-Zero Emissions by 2050 plan, has spurred the adoption of bio-based IPA formulations. The growing prevalence of IPA in industrial cleaning applications further amplifies demand, with the manufacturing sector accounting for 40% of energy consumption.

MARKET KEY PLAYERS

Companies playing a dominant role in the North America isopropyl alcohol market profiled in this report are Dow Chemical, Mistral Industrial Chemicals, INEOS Corporation, ReAgent Chemicals Ltd., LyondellBasell Industries, Linde Gas, Ecolab, Royal Dutch Shell, ExxonMobil Corporation, and others.

TOP LEADING PLAYERS IN THE MARKET

The North America isopropyl alcohol market is dominated by key players such as Dow Inc., BASF SE, and Royal Dutch Shell, each contributing significantly to the global market. Dow Inc., headquartered in Michigan, specializes in high-purity IPA formulations, catering to industries like pharmaceuticals and electronics. BASF SE, based in Germany with operations in North America, focuses on bio-based IPA by aligning with sustainability trends

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North America isopropyl alcohol market employ strategies such as product innovation, strategic partnerships, and geographic expansion to strengthen their market position. Product innovation is central, with companies investing heavily in R&D to develop bio-based and high-purity IPA formulations. For instance, Dow Inc. launched a new line of sustainable IPA products in 2022, targeting the pharmaceutical sector. Strategic partnerships are another critical strategy, exemplified by BASF SE’s collaboration with renewable energy developers to enhance bio-based IPA production. Geographic expansion is also prominent, with Royal Dutch Shell establishing new manufacturing facilities in Mexico to cater to growing demand. These strategies collectively enable companies to adapt to evolving market dynamics and maintain a competitive edge.

COMPETITION OVERVIEW

The North America isopropyl alcohol market is characterized by intense competition, with established players and emerging entrants vying for dominance. The market’s competitive landscape is shaped by factors such as technological advancements, regulatory compliance, and sustainability trends. Key players like Dow Inc., BASF SE, and Royal Dutch Shell leverage their extensive R&D capabilities to introduce innovative products, setting high standards for performance and environmental safety. However, niche players focusing on bio-based and specialized IPA formulations are gaining traction, challenging traditional leaders. Price wars and aggressive marketing further intensify competition in price-sensitive industries like cleaning agents and cosmetics.

RECENT MARKET DEVELOPMENTS

- In June 2023, BASF SE partnered with a renewable energy developer to optimize bio-based IPA production, achieving a 15% cost reduction.

- In August 2023, Royal Dutch Shell opened a manufacturing facility in Monterrey, Mexico, to meet rising demand in Latin America and expand its regional footprint.

- In October 2023, Chevron Phillips Chemical acquired a specialty chemicals manufacturer, broadening its product range and strengthening its market position.

- In December 2023, ExxonMobil introduced a next-generation high-purity IPA with enhanced solvent properties, aiming to capture a larger share of the electronics market.

MARKET SEGMENTATION

This research report on the North America isopropyl alcohol market is segmented and sub-segmented into the following categories.

By Application

- Antiseptic & Astringent

- Cleaning Agent

- Solvent

- Chemical Intermediate

- Others

By End-use

- Cosmetics & Personal Care

- Pharmaceutical

- Food And Beverages

- Paints And Coatings

- Chemical

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What are the main factors driving the demand for isopropyl alcohol in North America?

Demand is driven by its extensive use in pharmaceuticals as an antiseptic and solvent, heightened hygiene and sanitization standards post-pandemic, and growing industrial applications such as solvents in paints, coatings, and electronics cleaning.

2. What challenges does the North America isopropyl alcohol market face?

The market faces challenges from fluctuating raw material prices due to crude oil volatility, stringent environmental regulations on emissions, supply chain disruptions, and intense competition among established and emerging players.

3. What opportunities are emerging in the North America isopropyl alcohol market?

Opportunities include the growing adoption of bio-based and sustainable IPA formulations, expanding applications in cosmetics and personal care, and increasing use in emerging industries like electric vehicle battery manufacturing and semiconductor cleaning.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]