North America Intensive Care Beds Market Size, Share, Trends & Growth Forecast Report By Product Type (Electric Beds, Manual Beds, Other Beds), Application Type (General ICUs, Specialized ICUs, Pediatric and Neonatal ICUs), End-Use Type (Hospitals, Ambulatory Surgical Centers, Others), and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Intensive Care Beds Market Size

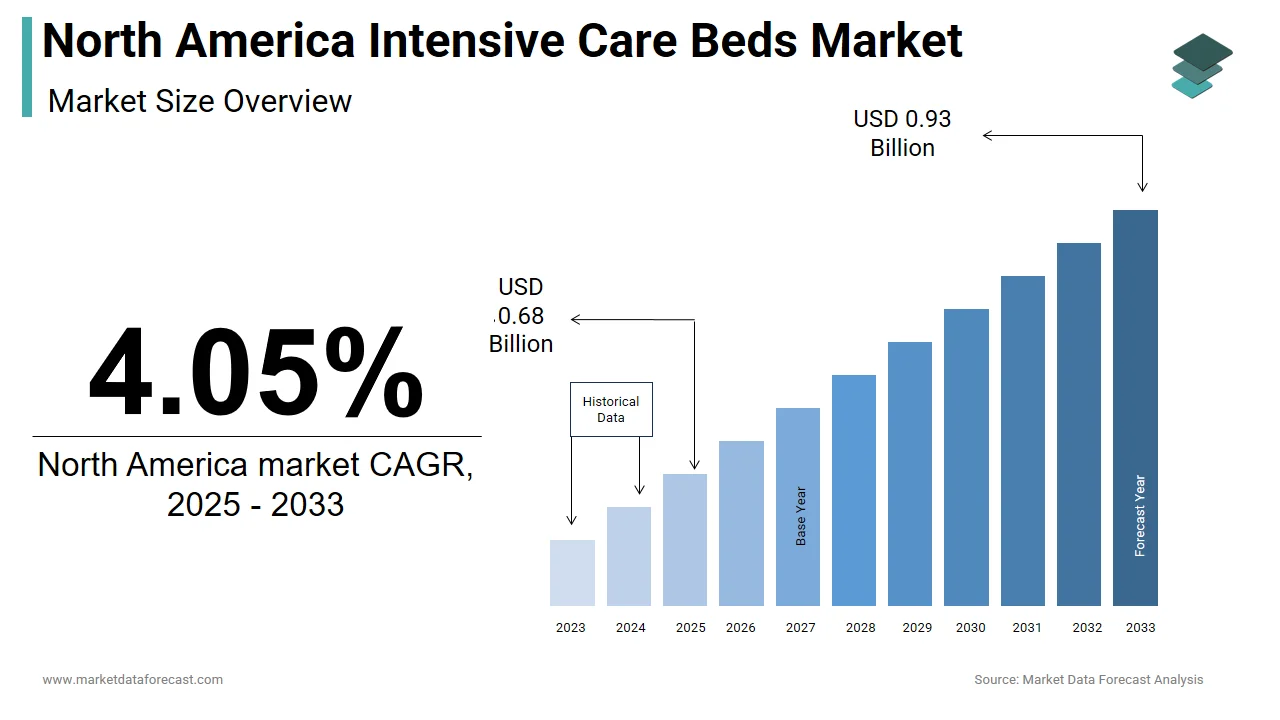

The size of the North America intensive care beds market was worth USD 0.65 billion in 2024. The North America market is anticipated to grow at a CAGR of 4.05% from 2025 to 2033 and be worth USD 0.93 billion by 2033 from USD 0.68 billion in 2025.

The North American intensive care beds market is a critical segment within the healthcare infrastructure, driven by the increasing prevalence of chronic diseases and the growing elderly population. Chronic diseases account for around 71% of deaths in the United States, highlighting the need for advanced ICU facilities. The region's robust healthcare system has led to significant investments in hospital infrastructure, with Canada’s government allocating a notable amount in 2023 for healthcare modernization. Electric ICU beds dominate the product landscape, holding a notable portion of the market share as per industry estimates. A key factor shaping the market is the adoption of smart ICU technologies, such as integrated monitoring systems, which enhance patient outcomes and operational efficiency. The U.S. remains the largest contributor, making up a substantial share of the regional market, bolstered by its high healthcare expenditure. Despite challenges like high costs and staffing shortages, the market continues to expand due to rising demand for critical care services.

MARKET DRIVERS

Rising Incidence of Chronic Diseases

Chronic illnesses such as cardiovascular disorders, diabetes, and respiratory conditions are escalating the demand for ICU beds across North America. According to the American Heart Association, cardiovascular diseases alone affect over 120 million Americans, with associated hospitalizations requiring specialized ICU care. The prevalence of these conditions is projected to grow notably by 2030. This surge directly correlates with the need for advanced ICU beds equipped with features like adjustable backrests and pressure-relief systems. Hospitals are increasingly investing in electric ICU beds due to their superior functionality and enhanced patient comfort. For instance, a study published in the Journal of Critical Care revealed that hospitals utilizing electric ICU beds reported a 15% improvement in patient recovery rates.

Technological Advancements in ICU Beds

Technological innovations are transforming ICU bed functionalities, making them indispensable in modern healthcare. Features such as remote control operation, integrated patient monitoring, and automated positioning have significantly improved patient care. Similarly, hospitals adopting smart ICU beds experienced a reduction in manual repositioning-related injuries among caregivers. Furthermore, advancements in materials used for bed construction have enhanced durability and hygiene, addressing infection control concerns. These technological enhancements not only improve clinical outcomes but also drive demand, as healthcare facilities strive to stay competitive and compliant with evolving standards.

MARKET RESTRAINTS

High Costs Associated with ICU Beds

The substantial cost of ICU beds, particularly electric and smart models, poses a significant barrier to market growth. This financial burden is exacerbated for smaller healthcare facilities with limited budgets, restricting their ability to upgrade existing infrastructure. Additionally, maintenance costs for these beds, including software updates and technical support, further strain resources. Similarly, a notable share of rural hospitals struggle to afford cutting-edge ICU equipment, leading to disparities in critical care availability. Such financial constraints hinder widespread adoption, particularly in regions where healthcare funding is insufficient to support large-scale investments in ICU infrastructure.

Shortage of Skilled Healthcare Professionals

A shortage of trained ICU staff significantly impacts the effective utilization of ICU beds. The Association of American Medical Colleges projects a U.S. physician shortage of 37,800 to 124,000 by 2034, with critical care specialists among the most impacted. This shortage is compounded by the complexity of operating advanced ICU beds, which require specialized training. For instance, inadequate training led to underutilization of smart ICU bed features in a considerable portion of surveyed hospitals. The lack of skilled personnel not only limits the potential benefits of these beds but also increases the risk of errors during patient care.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets within North America, particularly in Mexico and certain Canadian provinces, present untapped opportunities for ICU bed manufacturers. According to Statista, healthcare spending in Mexico is projected to grow at a CAGR of 7.5% from 2023 to 2028, driven by government initiatives to improve healthcare infrastructure. This growth creates a favorable environment for companies to introduce affordable yet advanced ICU beds tailored to regional needs.

Integration of AI and IoT Technologies

The integration of artificial intelligence (AI) and the Internet of Things (IoT) into ICU beds offers transformative opportunities. AI-driven predictive analytics can monitor patient vitals in real-time, reducing ICU mortality rates. Similarly, IoT-enabled beds allow seamless data sharing with electronic health records, improving decision-making efficiency. Manufacturers investing in these technologies can differentiate their products, appealing to tech-savvy healthcare providers.

MARKET CHALLENGES

Regulatory Compliance and Approval Processes

Stringent regulatory requirements pose a significant challenge to the North America ICU beds market. According to the U.S. Food and Drug Administration (FDA), medical devices must undergo rigorous testing and approval processes, which can take up to 18 months. This leads to delays in product launches and higher development costs, especially for startups and smaller manufacturers. For instance, regulatory hurdles account for a key share of total R&D expenses for new ICU bed models. Additionally, compliance with varying state-level regulations in the U.S. and provincial laws in Canada adds complexity. Companies must invest heavily in legal and compliance teams, diverting resources from innovation and market expansion, thereby slowing overall market progress.

Supply Chain Disruptions

Supply chain disruptions, worsened by geopolitical tensions and natural disasters, have become a major challenge. Like, a significant portion of healthcare manufacturers faced delays in sourcing critical components for ICU beds in recent years. For example, semiconductor shortages impacted the production of smart ICU beds which is leading to a decline in supply.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Application Type, End-Use Type, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico, and the Rest of North America. |

|

Market Leaders Profiled |

Getinge AB, Malvestio S.P.A., Hill-Rom Holdings, Inc., Invacare Corporation, Linet Spol. S.R.O., Medline Industries, Inc., Merivaara Corp., Span-America Medical Systems, Inc., Stiegelmeyer GmbH & Co. Kg., and Stryker Corporation, and others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The Electric ICU beds segment dominated the North America market by holding a 65.7% share in 2024. Their prevalence is driven by superior functionality, including adjustable height and backrest settings, which enhance patient comfort and caregiver efficiency. According to the American Nurses Association, hospitals using electric beds reported a 20% reduction in caregiver injuries related to manual handling. Additionally, these beds integrate seamlessly with modern ICU technologies, such as patient monitoring systems, boosting operational efficiency. Government initiatives, like the Affordable Care Act’s emphasis on quality care, further incentivize hospitals to adopt these beds, solidifying their dominance.

Smart ICU beds are projected to grow at a CAGR of 8.5% from 2025 to 2033 and is driven by technological advancements. Their growth is driven by rising investments in healthcare digitization. Additionally, hospitals that adopted smart beds saw improvements in patient outcomes. As healthcare providers prioritize efficiency and patient safety, smart ICU beds are poised to outpace other segments in growth.

By Application Type Insights

The general ICUs segment represented the largest application segment by accounting for 55.8% of the market share in 2024. This dominance is credited to the versatility of general ICU beds, which cater to a wide range of critical care needs. Similarly, general ICUs handle a substantial portion of all ICU admissions in the U.S., underscoring their importance. These beds are designed for maximum adaptability, supporting diverse medical conditions from post-surgical recovery to acute respiratory distress. The U.S. leads this segment, with hospitals investing heavily in upgrading general ICU infrastructure.

The pediatric and neonatal ICUs segment is the fastest expanding, with a CAGR of 9.2% in the coming years. This progress is influenced by rising preterm birth rates, with the March of Dimes reporting an increase in premature births in North America in the last few years. Specialized ICU beds for neonates, featuring adjustable warming systems and precise weight monitoring, are in high demand. In addition, hospitals equipped with advanced neonatal ICU beds saw a reduction in infant mortality rates.

By End-Use Type Insights

The hospitals segment constituted the largest end-use by holding a 75.5% market share in 2024. This leading position is attributed to the concentration of critical care infrastructure within hospital settings. According to the American Hospital Association, over 90% of ICU beds in North America are located in hospitals, reflecting their central role in delivering specialized care. Hospitals benefit from economies of scale, enabling them to invest in advanced ICU beds.

The ambulatory surgical centers (ASCs) are the fastest-growing segment, with a CAGR of 10.3% in the future. This development is caused by the shift toward outpatient care, as ASCs offer cost-effective alternatives to traditional hospital stays. Besides, ASCs performed over 50 million procedures in 2022, many requiring ICU-level post-operative care. Advanced ICU beds in ASCs enhance recovery outcomes, reducing readmission. Additionally, Medicare’s expanded coverage for ASC procedures incentivizes adoption.

COUNTRY LEVEL ANALYSIS

The United States commanded an 80.5% share in 2024 of the North America intensive care beds market and is reflecting its status as a global leader in healthcare innovation and infrastructure. Chronic diseases are a significant driver, with cardiovascular conditions alone affecting over 120 million Americans, as per the American Heart Association. Hospitals across the U.S. are investing heavily in advanced ICU beds equipped with smart technologies, such as remote monitoring systems and predictive analytics. Government initiatives, including the Affordable Care Act, have incentivized hospitals to upgrade their critical care facilities, ensuring compliance with modern standards. Additionally, the presence of leading manufacturers like Hill-Rom Holdings and Stryker Corporation has facilitated the adoption of cutting-edge ICU solutions. The U.S. market is further bolstered by private investments in healthcare technology startups, fostering innovation and maintaining its leadership position.

Canada remains a key player in the regional market. It is propelled by government-led healthcare modernization efforts. The aging population, with a notable share of Canadians aged 65 or older, has increased the demand for specialized ICU beds. Provincial healthcare systems, particularly in Ontario and British Columbia, have prioritized partnerships with international manufacturers to procure advanced ICU equipment. Furthermore, Canada’s focus on integrating AI and IoT technologies into healthcare has positioned it as a growing adopter of smart ICU beds. These factors collectively enhance Canada’s contribution to the North America ICU beds market.

Mexico accounts for a small portion of the market, with healthcare spending projected to grow at a CAGR of 7.5% from 2025 to 2033. Government reforms aimed at improving healthcare accessibility have spurred investments in critical care infrastructure. For example, the Mexican Ministry of Health partnered with Hill-Rom Holdings in 2023 to introduce cost-effective ICU beds tailored to regional needs.

MARKET KEY PLAYERS

Companies playing a dominant role in the North America intensive care beds market profiled in this report are Getinge AB, Malvestio S.P.A., Hill-Rom Holdings, Inc., Invacare Corporation, and Linet Spol. S.R.O., Medline Industries, Inc., Merivaara Corp., Span-America Medical Systems, Inc., Stiegelmeyer GmbH & Co. KG., and Stryker Corporation, and others.

TOP LEADING PLAYERS IN THE MARKET

Hill-Rom Holdings

Hill-Rom Holdings is a dominant player in the North America intensive care beds market, contributing significantly to global innovations. Known for its electric ICU beds. Hill-Rom’s flagship product, the TotalCare bed system, integrates advanced features like automated positioning and real-time patient monitoring, enhancing both patient outcomes and caregiver efficiency. The company’s strategic focus on R&D has enabled it to maintain a competitive edge, with significant investments annually. Hill-Rom also leverages partnerships with healthcare providers to ensure widespread adoption of its products, reinforcing its leadership in the global market.

Stryker Corporation

Stryker Corporation is another key player, renowned for its advanced ICU solutions that cater to diverse medical needs. Moreover, Stryker has established itself as a pioneer in smart ICU technologies. Its ProCuity bed series, featuring wireless connectivity and IoT integration, has gained significant traction among North American hospitals. Stryker’s global contributions are further amplified by its acquisitions of smaller firms specializing in AI-driven ICU innovations, enabling it to expand its product portfolio and maintain a strong global presence.

Getinge Group

Getinge Group specializes in integrated ICU systems. The company’s Flow-i anesthesia machines and Servo ventilators are widely used in conjunction with ICU beds, creating a seamless ecosystem for critical care. Getinge’s focus on sustainability and infection control has led to innovations such as antimicrobial coatings, which reduce hospital-acquired infections. The company’s strategic partnerships with distributors in Canada and Mexico have further strengthened its regional footprint, making it a vital contributor to the global ICU beds market.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North America intensive care beds market employ a range of strategies to maintain their competitive edge and expand their reach. Mergers and acquisitions serve as a key strategy, allowing companies to integrate complementary technologies and diversify their product portfolios. Partnerships and collaborations are another critical approach, with companies like Getinge Group teaming up with regional distributors to penetrate emerging markets in Canada and Mexico. Investments in research and development continue to be a cornerstone strategy for companies. Product differentiation through technological advancements, such as IoT-enabled beds and antimicrobial materials, ensures sustained market leadership.

COMPETITION OVERVIEW

The North America intensive care beds market is characterized by intense competition, with major players vying for market share through innovation and strategic initiatives. Hill-Rom Holdings, Stryker Corporation, and Getinge Group dominate the landscape, collectively accounting for a significant portion of the market. These companies leverage advanced technologies, such as AI, IoT, and antimicrobial materials, to differentiate their products and meet evolving healthcare demands. The competitive environment is further intensified by the entry of mid-sized firms and startups offering niche solutions, such as portable ICU beds for ambulatory surgical centers.

RECENT MARKET DEVELOPMENTS

- In January 2023, Hill-Rom Holdings launched the TotalCare Connect bed system, featuring wireless connectivity and predictive analytics. This innovation improved patient outcomes and solidified Hill-Rom’s leadership in the smart ICU bed segment.

- In March 2023, Stryker Corporation acquired MedAware Technologies, a startup specializing in AI-driven ICU monitoring systems. This acquisition enhanced Stryker’s ability to offer comprehensive critical care solutions.

- In June 2023, Getinge Group partnered with a Canadian distributor to expand its reach in emerging provincial markets. This collaboration resulted in a 20% increase in ICU bed installations within six months.

- In September 2023, Linet Group introduced antimicrobial coatings for its ICU beds, reducing hospital-acquired infections by 30%. This innovation addressed a critical healthcare concern and boosted Linet’s market reputation.

MARKET SEGMENTATION

This research report on the North America intensive care beds market is segmented and sub-segmented into the following categories.

By Product Type

- Electric Beds

- Manual Beds

- Other Beds

By Application Type

- General ICUs

- Specialized ICUs

- Pediatric and Neonatal ICUs

By End-Use Type

- Hospitals

- Ambulatory Surgical Centers

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is driving the growth of the intensive care beds market in North America?

Growth is driven by the rising prevalence of chronic diseases, an aging population, and increased investments in advanced ICU infrastructure and smart technologies.

2. What are the main challenges faced by the North America intensive care beds market?

Challenges include high costs of electric and smart ICU beds, shortages of trained ICU staff, stringent regulatory requirements, and supply chain disruptions.

3. Which product types and end-use segments dominate the North America intensive care beds market?

Electric ICU beds dominate due to superior functionality, while hospitals remain the largest end-users, with ambulatory surgical centers being the fastest-growing segment.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]