North America Insulated Packaging Market Research Report – Segmented By Type ( rigid insulated packaging , flexible insulated packaging ) , Product, Application and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Insulated Packaging Market Size

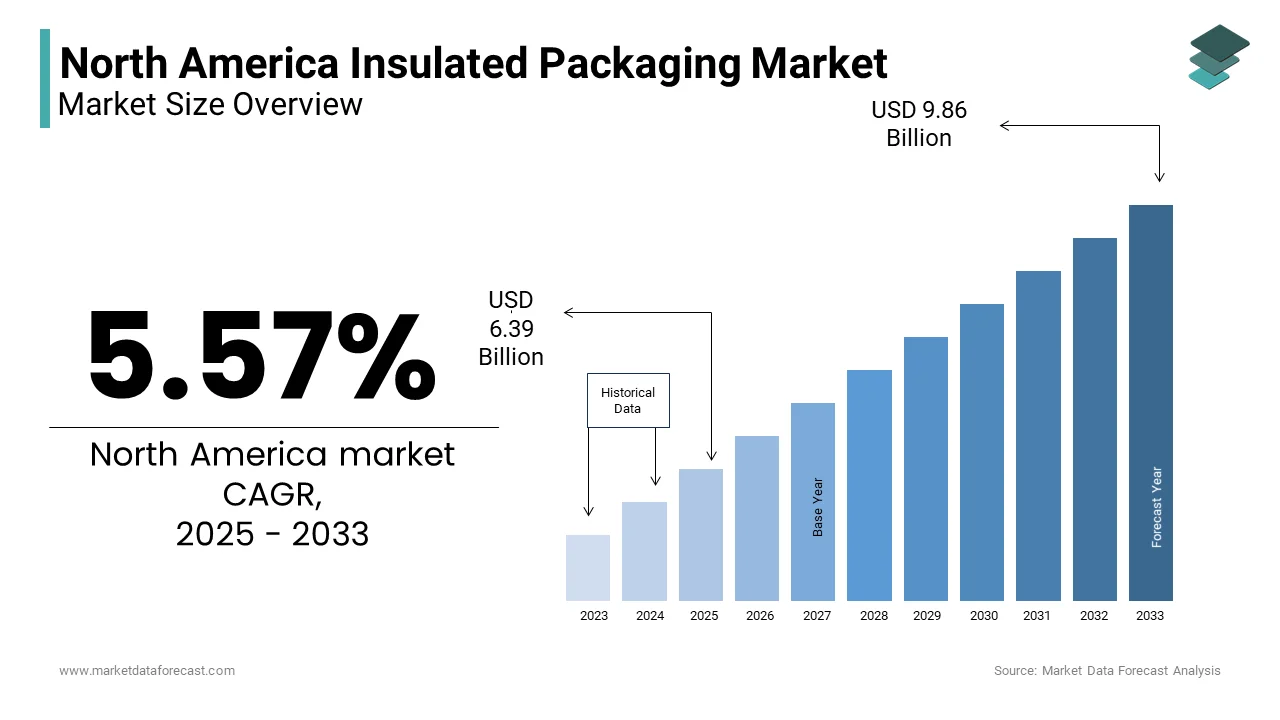

The North America Insulated Packaging Market Size was valued at USD 6.05 billion in 2024. The North America Insulated Packaging Market size is expected to have 5.57 % CAGR from 2025 to 2033 and be worth USD 9.86 billion by 2033 from USD 6.39 billion in 2025.

The North America insulated packaging market is driven by the region's robust logistics infrastructure and growing demand for temperature-sensitive goods. A key factor shaping the market is the increasing adoption of e-commerce platforms, which require reliable insulated packaging solutions to ensure product integrity during transit. Additionally, stringent regulations governing the transportation of perishable goods, such as those enforced by the FDA, have further propelled the adoption of insulated packaging.

MARKET DRIVERS

Rising Demand for Temperature-Sensitive Pharmaceuticals

The pharmaceutical sector is a major driver of the insulated packaging market in North America, fueled by the increasing need for cold chain logistics. Vaccines, biologics, and other temperature-sensitive drugs require precise thermal insulation during storage and transportation. The COVID-19 pandemic further amplified this demand, as vaccines like Pfizer-BioNTech required ultra-cold storage solutions. Data from the Centers for Disease Control and Prevention (CDC) indicates that over 500 million vaccine doses were distributed across the U.S. in 2021 alone, underscoring the reliance on insulated packaging. Consequently, manufacturers are investing heavily in advanced insulation materials to meet regulatory standards and ensure product efficacy.

Growth of Online Food Delivery Services

The proliferation of online food delivery platforms has significantly boosted the demand for insulated packaging. Consumers increasingly prefer meal kits and pre-packaged meals, which necessitate effective thermal insulation to maintain freshness. Many consumers now order takeout or delivery at least once a week that will drive the need for innovative packaging solutions. Furthermore, sustainability concerns are pushing companies to adopt eco-friendly insulated materials, such as biodegradable foams and recyclable plastics.

MARKET RESTRAINTS

High Production Costs of Advanced Materials

One of the primary challenges facing the insulated packaging market is the high cost associated with manufacturing advanced materials. According to a report by the U.S. Department of Commerce, the production of vacuum-insulated panels (VIPs) and phase-change materials (PCMs) involves complex processes and expensive raw materials, such as polyurethane and aerogels. These costs are often passed on to end-users, limiting adoption among small and medium-sized enterprises. For instance, a study by the Packaging Machinery Manufacturers Institute (PMMI) revealed that nearly 40% of businesses cited high upfront costs as a barrier to adopting premium insulated packaging solutions. Additionally, fluctuating prices of crude oil, a key input for plastic-based insulators, further exacerbate cost volatility.

Environmental Concerns and Regulatory Pressures

Environmental concerns pose another significant restraint to the insulated packaging market. Traditional materials like expanded polystyrene (EPS) and polyethylene are non-biodegradable, contributing to landfill waste and ocean pollution. Several states, including California and New York, have implemented bans on EPS products and forcing manufacturers to explore alternative materials. However, transitioning to sustainable options such as plant-based foams and recycled fibers is both costly and technically challenging.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets within North America present untapped potential for the insulated packaging market. The economic expansion has spurred demand for temperature-controlled logistics in sectors like fresh produce and pharmaceuticals. Additionally, the rise of cross-border trade agreements, such as the USMCA, facilitates the export of perishable goods is creating opportunities for insulated packaging manufacturers. The companies can capitalize on lower labor costs while meeting regional demand by establishing local production facilities.

Adoption of Smart Packaging Technologies

The integration of smart technologies into insulated packaging represents a transformative opportunity for the North American market. Innovations such as RFID tags, temperature sensors, and QR codes enable real-time monitoring of product conditions by enhancing supply chain transparency. Similarly, Amazon’s use of smart labels in its grocery deliveries has improved customer satisfaction and operational efficiency. These technologies not only address consumer demands for traceability but also align with regulatory requirements for quality assurance. The insulated packaging manufacturers can position themselves at the forefront of this digital revolution by investing in R&D and partnerships with tech firms.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions have emerged as a significant challenge for the insulated packaging market, exacerbated by geopolitical tensions and natural disasters. According to the U.S. Chamber of Commerce, supply chain bottlenecks caused a 20% increase in material costs for packaging manufacturers in 2022. The Russia-Ukraine conflict, for instance, disrupted the supply of key raw materials like aluminum and polystyrene is leading to shortages and delays. Additionally, extreme weather events, such as hurricanes in the Gulf Coast, have impacted production facilities and transportation networks. These challenges force companies to adopt contingency measures, such as diversifying suppliers and increasing inventory levels, which strain profitability and operational efficiency.

Balancing Sustainability and Performance

Achieving a balance between sustainability and performance remains a persistent challenge for the insulated packaging market. While there is growing pressure to adopt eco-friendly materials, these alternatives often fail to match the thermal efficiency of traditional options. According to a study by the American Chemistry Council, biodegradable packaging materials exhibit 30% lower insulation capacity compared to conventional plastics, compromising their suitability for long-distance transport. Moreover, the lack of standardized testing protocols for sustainable packaging creates confusion among manufacturers and consumers. This disconnect forces companies to invest in extensive R&D to develop materials that meet both environmental and functional requirements by adding complexity to the innovation process.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.57 % |

|

Segments Covered |

By Type, Product,Application and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Packaging Corporation of America,Sealed Air Corporation,Ball Corporation,Cold Chain Technologies,Temperpack Technologies Inc. |

SEGMENTAL ANALYSIS

By Type Insights

The rigid insulated packaging segment held 45.3% of the North America insulated packaging market share in 2024 due to its superior durability and ability to maintain consistent temperatures over extended periods. Industries such as pharmaceuticals and frozen foods rely heavily on rigid solutions like expanded polystyrene (EPS) boxes and vacuum-insulated panels (VIPs). As per a report by the Reusable Packaging Association, reusable rigid containers reduce waste by 40% is appealing to environmentally conscious businesses. Investments in automation and precision molding technologies have also lowered production costs by making rigid packaging more accessible to diverse industries.

The flexible insulated packaging segment is projected to register a CAGR of 8.5% from 2025 to 2033. This growth is fueled by the rising demand for lightweight and space-efficient solutions in e-commerce and food delivery. A study by the Flexible Packaging Association reveals that flexible materials reduce shipping costs by 25% compared to rigid alternatives by making them ideal for budget-conscious businesses. Innovations such as multi-layer films and bio-based polymers have enhanced their thermal performance by addressing earlier limitations. Furthermore, the shift toward minimalistic packaging designs aligns with consumer preferences for convenience and sustainability.

By Product Insights

The corrugated cardboards segment was the largest and held 55.4% of the North American insulated packaging market share in 2024. Their widespread adoption is driven by affordability, recyclability, and versatility across industries. The food and beverage sector, in particular, relies on corrugated solutions for their ability to integrate thermal liners and moisture-resistant coatings. As per a study by the American Forest & Paper Association, 96% of corrugated boxes are recovered for recycling by reinforcing their appeal as a sustainable option. Additionally, advancements in printing technologies have enabled customization, allowing brands to enhance their visual appeal. These attributes make corrugated cardboards a cornerstone of the insulated packaging market.

The metal-based insulated packaging segment is likely to register a CAGR of 9.2% during the forecast period. This growth is fueled by the increasing demand for durable and reusable solutions in industrial applications. Metals like aluminum and stainless steel offer exceptional thermal conductivity and resistance to wear by making them ideal for transporting sensitive goods. A report by the Aluminum Association reveals that aluminum packaging reduces energy consumption by 20% compared to plastic alternatives by aligning with sustainability goals. Furthermore, the rise of luxury packaging trends has boosted metal usage in cosmetics and premium beverages. For example, L’Oréal’s adoption of aluminum-based insulated containers has enhanced product shelf life by 30%, as per an internal study.

By Application Insights

The pharmaceutical applications segment dominated the North America insulated packaging market share in 2024 owing to the stringent temperature control requirements for vaccines, biologics, and diagnostic kits. The introduction of mRNA-based therapies, such as those developed by Moderna, has further heightened demand for advanced thermal solutions. As per a study by the Parenteral Drug Association, 80% of biologic drugs require cold chain logistics, creating sustained opportunities for manufacturers. Additionally, regulatory frameworks like the FDA’s Current Good Manufacturing Practices mandate the use of validated packaging systems, ensuring product safety and efficacy.

The cosmetic applications segment is ascribed to register a CAGR of 7.8% throughout the forecast perio. This growth is fueled by the rising popularity of premium skincare and beauty products that require temperature-sensitive packaging. E-commerce platforms demand insulated packaging to protect formulations from heat and light exposure is preserving product quality. According to a report by CosmeticsDesign.com, 65% of consumers associate packaging quality with brand reliability is driving investments in innovative solutions. Furthermore, the shift toward sustainable practices has encouraged the use of recyclable metals and bioplastics.

COUNTRY LEVEL ANALYSIS

The United States led the North American insulated packaging market with 75.5% of share in 2024. Additionally, the rise of e-commerce platforms like Amazon and Walmart has created a surge in demand for insulated packaging in food delivery and retail. Investments in automation and AI-driven packaging technologies further enhance the country’s competitive edge.

Canada ranks second in the regional market owing to its robust food and beverage industry. According to Agriculture and Agri-Food Canada, the country’s agri-food exports reached CAD 73 billion in 2022. The cold climate and focus on exporting perishable goods have accelerated the adoption of advanced materials like vacuum-insulated panels. A study by the Canadian Food Inspection Agency emphasizes the importance of maintaining product integrity during transit, boosting demand for thermal insulation. Furthermore, government initiatives to promote sustainable packaging align with consumer preferences for eco-friendly options is creating growth opportunities for manufacturers.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Insulated Packaging Market are Packaging Corporation of America,Sealed Air Corporation,Ball Corporation,Cold Chain Technologies,Temperpack Technologies Inc.,Smurfit Kappa Group,Insulated Products Corp.,Graphic Packaging International, Inc.,ProAmpac LLC

The North America insulated packaging market is highly competitive, characterized by the presence of multinational corporations and regional players. Companies like Sonoco, Sealed Air, and Owens-Illinois dominate the landscape by leveraging their technological expertise and strong distribution networks. Intense competition has spurred investments in R&D, with firms prioritizing sustainability and digitalization. Smaller players focus on niche segments, creating a fragmented yet dynamic market environment.

Top Players in the Market

Sonoco Products Company

Sonoco Products Company is a global leader in the insulated packaging market, contributing approximately 15% to the North American segment. The company specializes in rigid paperboard and thermoformed plastic solutions, catering to industries like pharmaceuticals and food.

Sealed Air Corporation

Sealed Air Corporation is another key player, renowned for its Cryovac brand of insulated packaging. Sealed Air’s emphasis on smart packaging technologies, such as temperature-monitoring systems, has positioned it as a pioneer in the industry. Its solutions are widely used in e-commerce and healthcare applications.

Owens-Illinois, Inc.

Owens-Illinois, Inc. focuses on glass-based insulated packaging with revenues exceeding USD 6.5 billion in 2022, as reported by Glass Worldwide, the company leverages its expertise in glass manufacturing to serve the cosmetic and beverage sectors. Its commitment to recyclability and aesthetic appeal has earned it a loyal customer base.

Top Strategies Used by Key Players

Key players in the North America insulated packaging market employ strategies such as mergers and acquisitions, product innovation, and sustainability initiatives. For instance, Sonoco acquired Corenso Holdings in 2021 to expand its paperboard capabilities. Sealed Air partnered with IBM to integrate AI into its packaging solutions by enhancing supply chain efficiency. Additionally, Owens-Illinois launched a campaign promoting 100% recyclable glass packaging by aligning with consumer preferences for eco-friendly options.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Sonoco Products acquired Corenso Holdings to enhance its paperboard insulation capabilities.

- In June 2023, Sealed Air partnered with IBM to integrate AI-driven temperature monitoring systems.

- In February 2023, Owens-Illinois launched a recyclable glass packaging initiative targeting cosmetic brands.

- In September 2022, Ardagh Group introduced lightweight metal-based insulated packaging for pharmaceuticals.

- In January 2022, Amcor unveiled a biodegradable flexible packaging solution for e-commerce applications.

MARKET SEGMENTATION

This research report on the north america insulated packaging market has been segmented and sub-segmented into the following.

By Type

- rigid insulated packaging

- flexible insulated packaging

By Product

- corrugated cardboards

- metal-based insulated packaging

By Application

- pharmaceutical applications

- cosmetic applications

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What is insulated packaging and why is it important in North America?

Insulated packaging refers to materials designed to protect products from temperature variations during storage and transport. It's crucial in North America due to the region’s vast geography, climate diversity, and growing demand for temperature-sensitive goods like food, pharmaceuticals, and chemicals.

What are the main types of insulated packaging used in North America?

Common types include insulated boxes, containers, bags, wraps, and pouches. Materials often used are expanded polystyrene (EPS), polyurethane, vacuum-insulated panels (VIPs), and reflective insulation.

Which industries are the biggest consumers of insulated packaging in North America?

The food & beverage industry, pharmaceuticals, healthcare, chemicals, and electronics sectors are the largest users, driven by the need for temperature control and product integrity.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]