North America Instant Noodles Market Size, Share, Trends & Growth Forecast Report By Product Type (Cup/Bowl Noodles, Packet Noodles), Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online Retail Stores, Specialty Stores), and Country (US, Canada, Rest of North America) Industry Analysis From 2025 to 2033.

North America Instant Noodles Market Size

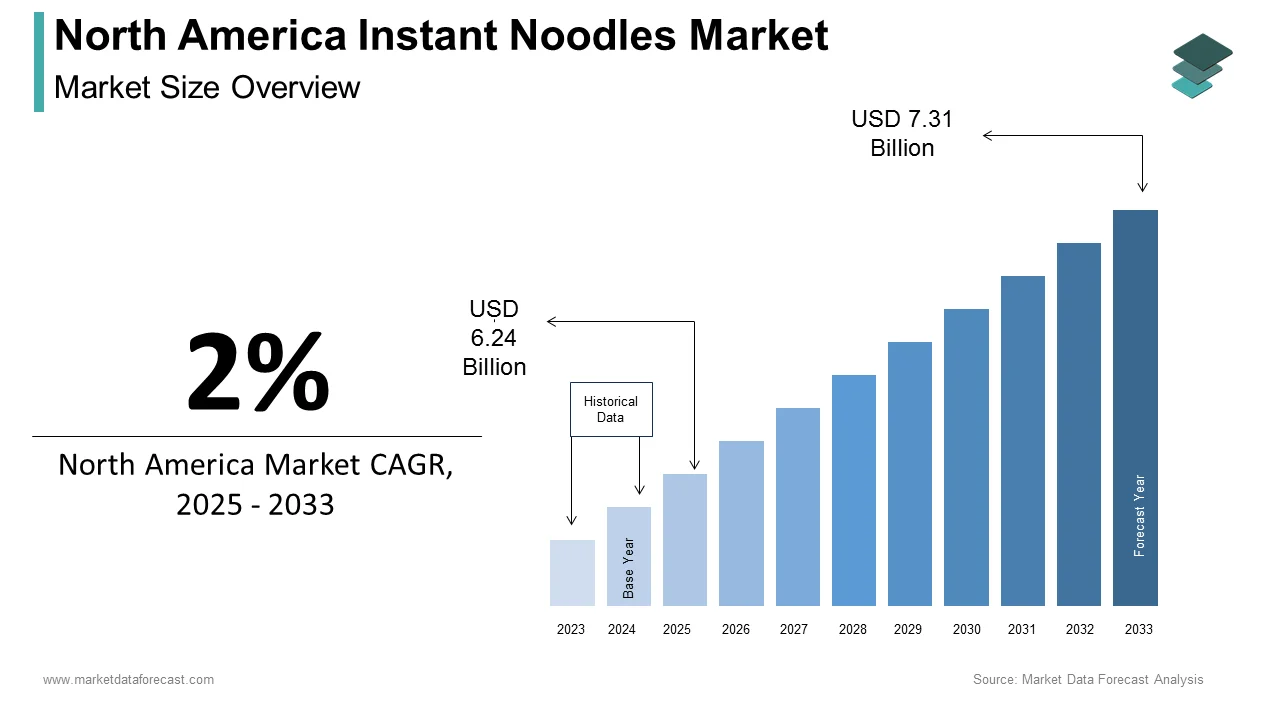

The instant noodles market size in North America was valued at USD 6.12 billion in 2024. The North American market is estimated to be worth USD 7.31 billion by 2033 from USD 6.24 billion in 2025, growing at a CAGR of 2% from 2025 to 2033.

Instant noodles, traditionally viewed as a convenient and affordable meal option, have transcended their initial reputation as a college-student staple to become a versatile product catering to diverse demographics. In 2023, the market is characterized by a growing emphasis on health-conscious formulations, premiumization, and innovative flavors that resonate with the region's multicultural palate. According to a report by the U.S. Census Bureau, the millennial population in North America, which heavily influences food trends, exceeds 72 million individuals, many of whom prioritize convenience without compromising quality. This demographic shift elevates the rising demand for instant noodles that align with contemporary dietary needs, such as reduced sodium levels, organic ingredients, and plant-based options.

Moreover, the cultural diversity of North America plays a pivotal role in shaping the instant noodles landscape. According to the Pew Research Center, immigrants account for approximately 14% of the U.S. population by bringing with them unique taste profiles and culinary traditions that drive innovation in flavor offerings. Additionally, the rise of single-person households, which now constitute nearly 30% of all U.S. households that further amplifies the appeal of instant noodles due to their portion-controlled servings and ease of preparation.

MARKET DRIVERS

Increasing Urbanization and Busy Lifestyles

The rapid pace of urbanization in North America has significantly contributed to the growth of the instant noodles market. According to the United Nations Department of Economic and Social Affairs, approximately 82% of the population in North America resides in urban areas, a figure expected to rise further. This urban lifestyle is often accompanied by time constraints, with the U.S. Bureau of Labor Statistics studies revealed that the average American spends about 3.5 hours per day on work-related activities and an additional 2.5 hours on leisure and personal care. Such busy schedules have fueled the demand for quick, ready-to-eat meal solutions like instant noodles. Furthermore, the National Center for Health Statistics reveals that over 30% of adults in the U.S. consume fast food daily by indicating a reliance on convenience foods.

Rising Demand for Affordable Meal Options

Economic considerations play a pivotal role in driving the popularity of instant noodles across North America. According to the U.S. Department of Agriculture, the average annual expenditure on food per household is approximately $8,000, with a significant portion allocated to convenience foods during periods of financial uncertainty. Instant noodles, priced at an average of $0.50 to $1.50 per pack, offer an economical solution for budget-conscious consumers. According to the Federal Reserve, nearly 40% of Americans lack sufficient savings to cover an unexpected $400 expense with the growing need for cost-effective meal options. Younger demographics, particularly students and entry-level workers, are key contributors to this trend. A study by the National Student Clearinghouse Research Center indicates that there are over 19 million college students in the U.S., many of whom rely on instant noodles for their affordability and ease of preparation.

MARKET RESTRAINTS

Health Concerns and Nutritional Challenges

Health-conscious consumer trends pose a significant restraint to the instant noodles market in North America. According to the Centers for Disease Control and Prevention, over 50% of American adults have at least one chronic health condition, such as hypertension or obesity, which are often linked to high sodium intake. Instant noodles, traditionally high in sodium, face scrutiny from health advocates and regulatory bodies. According to the Food and Drug Administration, the average sodium intake in the U.S. is approximately 3,400 mg per day, far exceeding the recommended limit of 2,300 mg. This has led to growing consumer skepticism about the nutritional value of instant noodles. Furthermore, the National Health and Nutrition Examination Survey reveals that nearly 70% of U.S. adults are attempting to reduce their sodium consumption. The manufacturers face pressure to reformulate products, which can increase production costs and potentially alienate traditional consumers who prioritize taste over health.

Competition from Alternative Convenient Foods

The instant noodles market faces stiff competition from other convenient food options, which limits its growth potential. According to the U.S. Department of Agriculture, frozen meals and ready-to-eat snacks account for over $50 billion in annual sales, significantly overshadowing the instant noodles segment. These alternatives often boast better nutritional profiles or innovative packaging by appealing to evolving consumer preferences. Additionally, the National Restaurant Association states that 68% of consumers are more likely to purchase meal kits or prepared foods that offer perceived freshness and variety. This shift is further supported by data from the Bureau of Labor Statistics, which shows that spending on dining out and prepared meals increased by 10% annually in recent years. The instant noodles struggle to maintain their relevance among affluent and health-focused demographics seeking premium convenience solutions.

MARKET OPPORTUNITIES

Growing Demand for Ethnic and Gourmet Flavors

The increasing cultural diversity in North America presents a significant opportunity for the instant noodles market to expand its product offerings. According to the U.S. Census Bureau, the Hispanic and Asian populations are among the fastest-growing ethnic groups, with Hispanics accounting for 18.7% of the population and Asians projected to reach 9.1% by 2025. These demographics bring unique culinary preferences are driving demand for authentic and exotic flavors. According to the National Restaurant Association, 64% of consumers are more interested in trying international cuisines by creating a niche for premium instant noodles infused with regional spices and ingredients. According to the U.S. Department of Agriculture, over 60% of millennials are willing to pay more for gourmet or specialty food products. The noodle manufacturers can cater to adventurous palates while differentiating their brands in a competitive market.

Expansion into Health-Conscious and Sustainable Product Lines

The rising focus on health and sustainability offers another promising avenue for growth in the instant noodles market. According to the Centers for Disease Control and Prevention, nearly 75% of Americans are attempting to adopt healthier eating habits, prioritizing organic, low-sodium, and plant-based options. This shift aligns with data from the Environmental Protection Agency, which states that 73% of consumers consider environmental impact when making purchasing decisions. Instant noodle brands have the opportunity to innovate by introducing biodegradable packaging and incorporating whole grains or legume-based noodles to appeal to eco-conscious buyers. Furthermore, the U.S. Food and Drug Administration emphasizes the growing popularity of clean-label products, with 85% of shoppers expressing a preference for transparent ingredient lists.

MARKET CHALLENGES

Regulatory Pressures on Food Safety and Labeling

The stringent food safety regulations and labeling requirements pose a significant challenge to the instant noodles market in North America. The U.S. Food and Drug Administration mandates that all packaged foods, including instant noodles, comply with detailed nutritional labeling and allergen disclosure laws, which can increase compliance costs for manufacturers. According to the Centers for Disease Control and Prevention, foodborne illnesses affect approximately 48 million Americans annually by prompting heightened scrutiny of processed foods. This has led to stricter inspections and recalls by impacting brand reputation and consumer trust. According to the Federal Trade Commission, misleading health claims on packaging can result in legal action, with over 200 cases filed against food companies in recent years. These regulatory hurdles require manufacturers to invest heavily in quality control and transparency by potentially straining smaller players in the market who lack the resources to adapt swiftly.

Supply Chain Disruptions and Rising Input Costs

The instant noodles market faces significant challenges due to supply chain disruptions and escalating input costs, exacerbated by global economic uncertainties. According to the U.S. Department of Agriculture, wheat, a primary ingredient in noodles, experienced price volatility, with costs rising by nearly 20% in the past year due to geopolitical tensions and climate-related disruptions. Additionally, the Bureau of Labor Statistics reports that transportation and logistics expenses surged by 15% annually, driven by fuel price fluctuations and labor shortages. These factors have increased production costs, squeezing profit margins for manufacturers. Moreover, the National Oceanic and Atmospheric Administration warns that extreme weather events are becoming more frequent that further threatening crop yields and raw material availability. The manufacturers must navigate these challenges while maintaining affordability by risking reduced competitiveness if prices are passed on to consumers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Distribution Channel, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

The United States, Canada, and, Rest of North America. |

|

Market Leader Profiled |

Nissin Foods Holdings Co., Ltd., Nestlé S.A., Campbell Soup Company, Unilever PLC, Maruchan Inc., Nongshim Co., Ltd., Ottogi Co., Ltd., Samyang Foods Co., Ltd., Acecook Vietnam Joint Stock Company, Thai President Foods Public Co., Ltd., and Others. |

SEGMENT ANALYSIS

By Product Type Insights

The packet noodles segment was the largest in the North American instant noodles market by accounting for 65.2% of share in 2024 due to their affordability and widespread availability that is making them accessible to a broad demographic. According to the Bureau of Labor Statistics, the average annual expenditure on food at home is $4,600 per household, with budget-conscious consumers favoring cost-effective options like packet noodles, which typically cost between $0.50 and $1.00 per serving. Furthermore, the National Center for Health Statistics studies have shown that over 30% of households in the U.S. include children, who often consume packet noodles as a quick and filling meal. Their versatility in preparation and ability to cater to diverse tastes reinforce their importance as the leading segment in the market.

The cup/bowl noodles segment is augmented in registering a prominent CAGR of 8.5% during the forecast period. This rapid growth is fueled by the increasing demand for single-serve, portable meal solutions among urban professionals and students. According to the National Center for Education Statistics, there are over 19 million college students in the U.S., many of whom rely on cup noodles for their convenience and minimal preparation time. According to the Bureau of Labor Statistics, the average American spends only 37 minutes per day on meal preparation due to the appeal of cup/bowl noodles, which can be prepared in under five minutes. As per the United Nations Department of Economic and Social Affairs, the need for compact, ready-to-eat meals continues to drive this segment's expansion as urbanization rises, with 82% of Americans living in cities.

By Distribution Channel Insights

The supermarkets and hypermarkets segment dominated the North American instant noodles market with 45.4% of share in 2024. Their extensive reach and ability to offer a wide variety of brands at competitive prices make them the preferred distribution channel for consumers. According to the Bureau of Labor Statistics, over 80% of grocery shopping is conducted in these outlets due to their central role in consumer purchasing behavior. Additionally, their strategic placement of products in high-traffic areas boosts visibility and sales.

The online retail stores segment is likely to exhibit a CAGR of 12.5% from 2025 to 2033. The rapid growth is driven by increasing internet penetration, with Pew Research Center reporting that 93% of Americans use the internet, and the surge in e-commerce adoption during the pandemic. According to the National Retail Federation, online grocery sales grew by over 25% annually in recent years by reflecting shifting consumer preferences toward convenience and home delivery. Younger demographics, particularly millennials and Gen Z, who account for 42% of the population, are key contributors to this trend. The importance of this segment lies in its ability to reach tech-savvy consumers to reduce overhead costs for retailers, and provide personalized shopping experiences by ensuring long-term market expansion.

REGIONAL ANALYSIS

The United States instant noodles market was the outperformer in the North America region with 55.7% of share in 2024. Presence of huge population of over 330 million and high urbanization rates is ascribed to fuel the growth of the market in this country. According to the U.S. Census Bureau, nearly 83% of Americans live in cities. This urban lifestyle fuels demand for convenient, ready-to-eat meals like instant noodles. According to the National Restaurant Association, 60% of consumers prioritize convenience in food choices. The country's robust retail infrastructure, including widespread supermarkets and e-commerce platforms is ensuring accessibility. The U.S. drives innovation and premiumization by making it pivotal for the market's overall growth.

Canada instant noodles market is projected to hit a prominent CAGR of 7.8% from 2025 to 2033. This growth is fueled by increasing multiculturalism, with over 21% of Canadians being immigrants, as reported by Immigration, Refugees and Citizenship Canada. These demographics drive demand for diverse and ethnic flavors. According to the Health Canada, 70% of Canadians are actively seeking healthier food options by prompting manufacturers to introduce low-sodium and organic variants. The rise of e-commerce, which grew by 30% annually during the pandemic, also contributes to this trend. Canada’s focus on health-conscious and sustainable products positions it as a key growth driver by ensuring its importance in expanding the regional market.

KEY MARKET PLAYERS

Some notable companies that dominate the North America instant noodles market profiled in this report are Nissin Foods Holdings Co., Ltd., Nestlé S.A., Campbell Soup Company, Unilever PLC, Maruchan Inc., Nongshim Co., Ltd., Ottogi Co., Ltd., Samyang Foods Co., Ltd., Acecook Vietnam Joint Stock Company, Thai President Foods Public Co., Ltd., and Others.

TOP LEADING PLAYERS IN THE MARKET

Nissin Foods Holdings Co., Ltd.

Nissin Foods is a trailblazer in the North American instant noodles market, renowned for introducing instant noodles to the world. The company’s "Cup Noodles" brand has become iconic, appealing to a wide range of consumers due to its convenience and diverse flavor profiles. Nissin has consistently adapted to changing consumer preferences by innovating its product lineup, including healthier options like reduced-sodium and plant-based variants. Its robust distribution network ensures widespread availability across multiple channels, from traditional retail to e-commerce platforms. By focusing on portability and aligning with modern dietary trends, Nissin has maintained its dominant position, making a significant impact on the global instant noodles market through its pioneering efforts and strong brand recognition.

Maruchan Inc.

Maruchan Inc. has established itself as a dominant player in the North American instant noodles market, known for offering affordable and accessible products. The company’s strategic partnerships with major retailers have ensured high visibility and availability, making it a go-to choice for budget-conscious consumers. Maruchan’s focus on portion-controlled servings resonates well with single-person households, while its introduction of ethnic flavors caters to diverse cultural tastes. By emphasizing affordability without compromising on variety, Maruchan has carved out a loyal customer base. Its ability to adapt to local preferences and maintain cost-effective production has strengthened its position as a key contributor to the global instant noodles market.

Nongshim Co., Ltd.

Nongshim stands out in the North American instant noodles market with its premium Shin Ramyun brand, celebrated for its bold and authentic Korean flavors. The company has successfully tapped into the growing demand for gourmet and spicy instant noodles, appealing to adventurous consumers seeking unique taste experiences. Nongshim’s focus on high-quality ingredients and innovative recipes has earned it a reputation for excellence. Additionally, the company’s commitment to sustainability, including eco-friendly packaging initiatives, aligns with evolving consumer values. By leveraging the multicultural appeal of its products and staying ahead of flavor trends, Nongshim has made a lasting impact on both the North American and global instant noodles markets, reinforcing the importance of cultural relevance and quality in driving growth.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Diversification

Key players in the North American instant noodles market, such as Nissin, Maruchan, and Nongshim, have consistently focused on product innovation to cater to evolving consumer preferences. These companies have introduced premium variants, such as organic, low-sodium, and plant-based noodles, to align with the growing demand for healthier options. For instance, Nissin has expanded its "Cup Noodles" line with reduced-sodium versions and protein-enriched offerings, while Nongshim has capitalized on the popularity of Korean cuisine by introducing bold, spicy flavors like Shin Ramyun. Additionally, Maruchan has diversified its portfolio with ethnic flavors that appeal to multicultural demographics. By continuously innovating and expanding their product ranges, these players have strengthened their market positions and attracted a broader customer base.

Strategic Partnerships and Expansions

To enhance distribution and accessibility, key players have formed strategic partnerships with major retailers and e-commerce platforms. For example, Maruchan has collaborated with large supermarket chains to ensure its products are prominently displayed, while Nissin has leveraged online retail channels to reach tech-savvy consumers. Nongshim has also expanded its presence in specialty stores catering to Asian cuisines, capitalizing on the growing interest in global flavors. Furthermore, these companies have invested in production facilities and supply chain optimization to meet increasing demand and reduce costs. Such expansions and partnerships enable them to maintain a competitive edge and improve market penetration.

Marketing and Brand Positioning

Effective marketing strategies have played a crucial role in strengthening the position of key players. Nissin, for instance, has used targeted advertising campaigns to promote its "Cup Noodles" brand as a trendy, on-the-go meal solution, particularly among younger audiences. Nongshim has emphasized authenticity and quality in its campaigns, positioning Shin Ramyun as a gourmet option for adventurous eaters. Maruchan, on the other hand, has focused on affordability and convenience, reinforcing its image as a budget-friendly choice. These companies also engage in social media marketing and influencer collaborations to connect with millennials and Gen Z consumers, ensuring their brands remain relevant in a dynamic market landscape.

Sustainability and Eco-Friendly Initiatives

In response to rising environmental concerns, leading players have adopted sustainable practices to appeal to eco-conscious consumers. Nongshim has introduced biodegradable packaging for some of its products, while Nissin has committed to reducing its carbon footprint through energy-efficient manufacturing processes. Maruchan has similarly explored sustainable sourcing of raw materials to enhance its brand reputation. These initiatives not only address consumer demand for environmentally responsible products but also differentiate these companies from competitors.

COMPETITIVE LANDSCAPE

The North American instant noodles market is characterized by intense competition, driven by the presence of both global giants and regional players striving to capture consumer attention in a rapidly evolving landscape. Key players such as Nissin Foods, Maruchan Inc., and Nongshim Co., Ltd. dominate the market, leveraging their strong brand equity, extensive distribution networks, and innovative product portfolios to maintain its dominance in the marketplace. These companies compete on multiple fronts, including pricing, flavor diversity, health-conscious options, and sustainability initiatives. For instance, Nissin’s "Cup Noodles" appeals to younger demographics with its convenience and trendy branding, while Nongshim’s Shin Ramyun targets adventurous eaters with its authentic Korean flavors. Meanwhile, Maruchan focuses on affordability, catering to budget-conscious consumers.

The competitive dynamics are further intensified by the growing demand for premium and gourmet instant noodles, prompting brands to introduce exotic and ethnic flavors that resonate with North America’s multicultural population. Additionally, the rise of e-commerce has leveled the playing field, allowing smaller players to challenge established brands by reaching niche audiences online. Sustainability is another critical battleground, with companies adopting eco-friendly packaging and sustainable sourcing to appeal to environmentally conscious buyers.

Despite the dominance of major players, the market remains fragmented, offering opportunities for emerging brands to innovate and carve out their niches. This competitive environment ensures constant innovation, driving the industry toward greater diversity, quality, and consumer-centric solutions. As a result, the North American instant noodles market continues to evolve, balancing affordability with premiumization and traditional offerings with bold, experimental flavors.

RECENT MARKET DEVELOPMENTS

- In August 2023, Nissin Foods launched the GEKI™ brand in the United States, offering chili-infused instant noodles targeting spice enthusiasts. This launch aimed to attract consumers seeking bold and spicy flavors, further strengthening Nissin’s presence in the North American market.

- In 2023, Nongshim achieved a top-three position in the U.S. instant noodles market, capturing approximately a 25% market share. This milestone reflects the brand's growing popularity and its successful expansion strategies in North America.

- In November 2023, Nestlé expanded its Maggi brand by introducing Maggi Korean noodles in BBQ chicken and BBQ vegetable flavors in the U.S. market. This expansion aimed to cater to consumers looking for globally inspired flavors and increase Maggi’s footprint in the region.

- In 2023, Samyang Foods increased its presence in the U.S. market with its Buldak spicy instant noodles, catering to consumers seeking spicy flavors. This move reinforced the company’s reputation for heat-packed instant noodle offerings.

- In 2022, Acecook expanded its distribution networks to North America, introducing Vietnamese-style instant noodles to the U.S. market. This initiative was part of Acecook’s strategy to bring authentic Vietnamese flavors to a broader consumer base.

- In 2022, Unilever enhanced its Knorr brand's instant noodle offerings in North America by introducing new flavors and healthier options. This move aligned with the growing consumer demand for convenient yet nutritious meal choices.

- In 2022, Ottogi increased exports of its Jin Ramen products to the U.S., focusing on authentic Korean flavors to attract diverse consumer bases. This strategy contributed to Ottogi’s growing popularity among North American consumers.

- In 2022, Thai President Foods expanded its Mama brand's presence in North America by collaborating with local distributors to reach a broader audience. This collaboration helped increase brand accessibility and strengthen its market position.

MARKET SEGMENTATION

This North America instant noodles market research report is segmented and sub-segmented into the following categories.

By Product Type

- Cup/bowl noodles

- Packet noodles

By Distribution Channel

- Supermarkets and hypermarkets

- Convenience stores

- Online retail stores

- Specialty stores

- Others

By Country

- The United States

- Canada

Rest of North America

Frequently Asked Questions

1. What is the market size of the North America Instant Noodles Market?

The North America Instant Noodles Market was valued at USD 6.12 billion in 2024 and is expected to reach USD 7.31 billion by 2033, growing at a CAGR of 2%.

2. What factors drive the North America Instant Noodles Market?

The North America Instant Noodles Market is driven by busy lifestyles, urbanization, and increasing demand for convenient and affordable meal options.

3. How is health consciousness impacting the North America Instant Noodles Market?

The North America Instant Noodles Market is seeing a shift towards low-sodium, organic, and high-protein variants due to rising health concerns.

4. Which flavors are popular in the North America Instant Noodles Market?

The North America Instant Noodles Market is witnessing growing demand for ethnic flavors, such as spicy Asian varieties and gourmet-inspired options.

5. What challenges does the North America Instant Noodles Market face?

The North America Instant Noodles Market faces challenges like high competition from other convenience foods, regulatory concerns, and changing dietary preferences.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]