North America Industrial Safety Footwear Market Size, Share, Trends & Growth Forecast, Segmented By Product, End-Use And By Country (The USA, Canada, Mexico and Rest of North America), Industry Analysis From 2025 to 2033

North America Industrial Safety Footwear Market Size

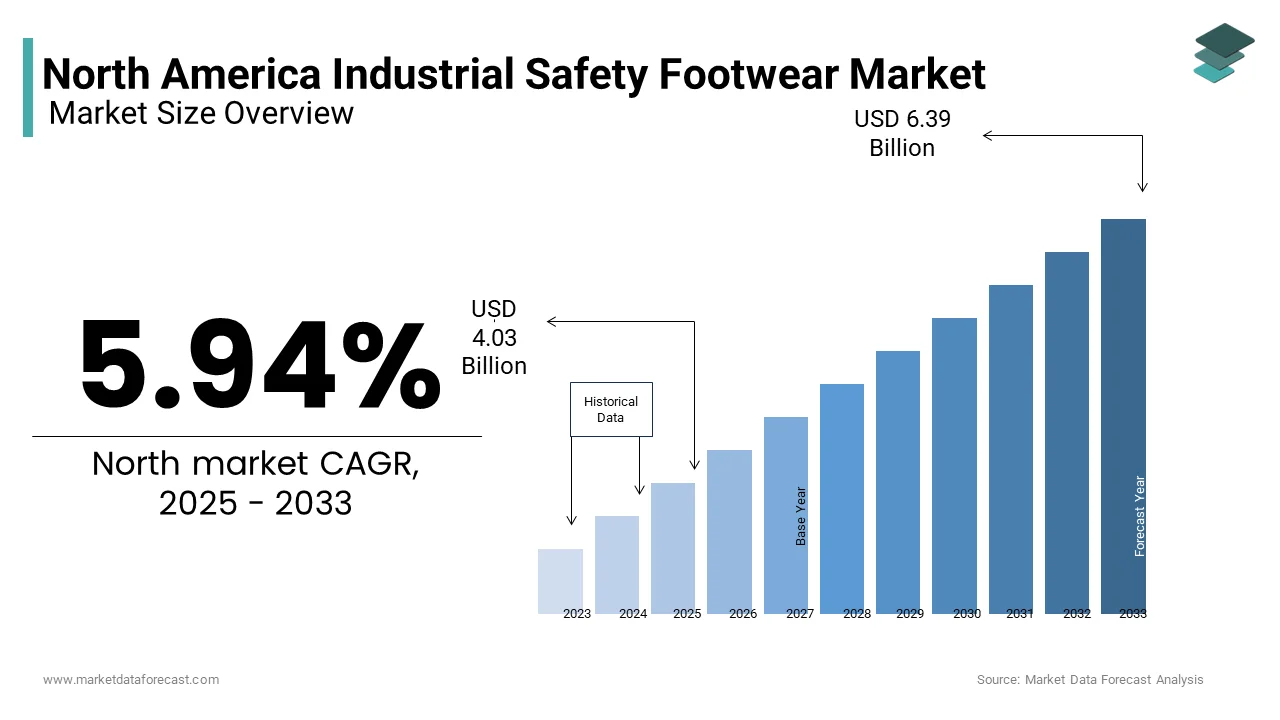

The North America industrial safety footwear market was valued at USD 3.80 billion in 2024 and is anticipated to reach USD 4.03 billion in 2025 from USD 6.39 billion by 2033, growing at a CAGR of 5.94% during the forecast period from 2025 to 2033.

MARKET DRIVERS

Stringent Occupational Safety Regulations

Regulatory frameworks play a pivotal role in shaping the industrial safety footwear market. In North America, agencies like OSHA mandate the use of certified safety footwear in hazardous environments. According to the U.S. Department of Labor, non-compliance with safety protocols results in over 2.8 million workplace injuries annually, emphasizing the need for protective gear. For instance, OSHA Standard 29 CFR 1910.136 requires employers to ensure employees wear protective footwear in areas with falling objects or electrical hazards. This regulatory push has led to an estimated a notable compliance rate in high-risk industries. Furthermore, Canada’s Workplace Hazardous Materials Information System (WHMIS) mandates similar requirements, ensuring consistent demand across the region.

Rising Industrialization and Infrastructure Development

Industrialization remains a key driver of the safety footwear market. Like, this initiative is expected to create a substantial number of jobs in the coming years, directly impacting safety footwear sales. Similarly, Canada’s investment in renewable energy projects has created new opportunities for safety gear manufacturers. These developments underscore the symbiotic relationship between industrial growth and the demand for protective footwear, driving market expansion.

MARKET RESTRAINTS

High Costs of Premium Safety Footwear

The elevated costs associated with premium industrial safety footwear act as a significant restraint. Similarly, advanced safety shoes equipped with features like puncture resistance and anti-static properties can cost upwards for each pair. This price point often deters small and medium-sized enterprises (SMEs) from adopting high-quality gear, especially when budget constraints are a concern. Also, SMEs account for a significant portion of all businesses in the country, showing their substantial influence on market dynamics. Furthermore, a considerable share of SMEs cite cost management as their primary challenge, making expensive safety footwear less accessible. While larger corporations can absorb these costs, smaller entities often opt for cheaper alternatives, which may not meet regulatory standards, thereby limiting overall market penetration.

Counterfeit Products and Market Fragmentation

The proliferation of counterfeit safety footwear poses a significant threat to the market. According to the International Anti-Counterfeiting Coalition, counterfeit goods account for nearly 3.3% of global trade, with safety gear being a prime target. These imitation products, often manufactured in unregulated facilities, fail to meet safety standards, endangering workers and eroding trust in branded offerings. Like counterfeit footwear lacks essential certifications, such as ASTM F2413, which ensures protection against impacts and compression. Additionally, market fragmentation exacerbates the issue, with numerous local manufacturers competing against established brands. This competition drives down prices but compromises quality, creating confusion among buyers.

MARKET OPPORTUNITIES

Growing Demand for Eco-Friendly Safety Footwear

The shift toward sustainable practices presents a lucrative opportunity for the industrial safety footwear market. This trend is particularly evident in North America, where consumers and corporations increasingly prioritize sustainability. Similarly, companies adopting green practices experience an increase in customer loyalty, driving manufacturers to innovate. For instance, several brands now incorporate recycled materials, such as rubber and polyester, into their designs. These products not only reduce environmental impact but also appeal to environmentally conscious industries, such as renewable energy and green construction.

Technological Advancements in Smart Footwear

The integration of technology into safety footwear represents another significant opportunity. These advancements enable real-time monitoring of worker safety, enhancing productivity and reducing injury risks. For example, smart boots equipped with temperature sensors can alert workers to extreme conditions, preventing heat-related illnesses. Like, such technologies can reduce workplace fatalities greatly. Additionally, Canada’s Digital Technology Supercluster has substantially invested in wearable tech, fostering innovation in this space. These developments not only cater to high-risk industries but also position safety footwear as a proactive tool for workforce management, unlocking new revenue streams for manufacturers.

MARKET CHALLENGES

Resistance to the Adoption of Advanced Technologies

Despite the potential benefits of smart safety footwear, resistance to technological adoption remains a significant challenge. Similarly, a large percentage of workers in traditional industries express skepticism about integrating technology into their daily routines. This resistance stems from concerns about complexity, perceived intrusiveness, and the learning curve associated with new tools. Also, older workers, who constitute a key share of the industrial workforce, are particularly hesitant to embrace such innovations. This financial barrier discourages widespread adoption, especially among smaller firms. In addition, only a small portion of industrial sites currently utilize smart safety gear, indicating a slow uptake.

Fluctuating Raw Material Prices

The volatility of raw material prices poses another major challenge for the industrial safety footwear market. This instability impacts production costs, forcing manufacturers to either absorb the expenses or pass them on to consumers. Like, rising material costs have led to a considerable increase in retail prices for safety footwear over the last few years. Additionally, synthetic alternatives, while cheaper, often compromise durability and safety standards, creating a dilemma for manufacturers. These fluctuations not only affect profit margins but also hinder the ability to offer competitive pricing.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.94% |

|

Segments Covered |

By Product, End-Use, and Country |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country's Covered |

The United States, Canada, and the Rest of North America |

|

Market Leaders Profiled |

Honeywell International Inc., Wolverine World Wide Inc., VF Corporation, Bata Corporation, Dunlop, Protective Footwear, Rock Fall (UK) LTD, Hilson Footwear Pvt. Ltd, U-power Group Spa, Cofra SRL, Uvex Group, elten gmbh, Saina Corporation Co. Ltd, Oftenrich Holdings Co. Ltd., Rahman Group, JAL Group. |

SEGMENTAL ANALYSIS

By Product Insights

The Leather-based safety footwear segment dominated the North American market by accounting for 60.5% of total sales in 2024. This dominance is attributed to its superior durability and comfort, making it ideal for prolonged use in harsh environments. Also, leather generally offers unmatched resistance to abrasions and punctures, ensuring compliance with ASTM safety standards. Additionally, the versatility of leather allows manufacturers to design products tailored to specific industries such as oil and gas or construction. Like, leather footwear reduces workplace injuries, further boosting its adoption. Moreover, Canada’s growing mining sector has increased demand for durable leather boots, reinforcing its market leadership.

The rubber-based safety footwear segment is the fastest-growing, with a projected CAGR of 9% through 2033. This growth is driven by its affordability and resistance to chemicals and oils are making it ideal for industries like manufacturing and chemical processing. Similarly, rubber footwear reduces chemical exposure incidents considerably, exhibiting its importance. Additionally, advancements in rubber compounding technologies have enhanced durability and comfort, addressing previous limitations. Canada’s focus on renewable energy projects, which require chemical-resistant gear, further accelerates demand.

By End-Use Insights

The construction sector accounted for 45.6% of the North American industrial safety footwear market in 2024. This dominance is fueled by the sector’s labor-intensive nature and strict safety regulations. The U.S. Department of Labor reports that construction workers face a 75% higher risk of foot injuries compared to other industries, necessitating robust protective gear. The Canadian Construction Association emphasizes that compliance with safety standards reduces workplace accidents, further strengthening the segment’s place. These factors ensure construction remains the largest end-use segment.

The manufacturing segment is quickly moving ahead, with a CAGR of 8.5. This expansion is propelled by automation and robotics, which require specialized footwear to protect workers from moving machinery. Similarly, manufacturing accounts for a notable share of GDP, showing its significance. These developments, coupled with increasing mechanization, position manufacturing as the fastest-growing segment.

COUNTRY LEVEL ANALYSIS

The United States prevailed in the North American industrial safety footwear market by accounting for 70.6% of the region’s total revenue in 2024. This dominance is supported by a robust industrial base and stringent occupational safety regulations enforced by agencies like OSHA. Additionally, the $2 trillion infrastructure bill passed in 2021 has created over 2 million new jobs in construction and related industries, further amplifying demand for safety footwear. The U.S. also leads in technological adoption, with smart safety footwear gaining traction among high-risk industries. Companies operating in this space benefit from a mature market characterized by high compliance rates.

Canada holds a significant share of the North American market. It is driven by its thriving mining, oil sands, and renewable energy sectors. Like, industries such as mining and oil extraction employ over 500,000 workers, all of whom require specialized safety footwear to mitigate risks associated with hazardous environments. Canada’s focus on sustainability and green initiatives has also spurred demand for eco-friendly safety gear. For instance, the Canadian government’s substantial investment in renewable energy projects has created new opportunities for manufacturers offering innovative solutions. Furthermore, regulatory frameworks like the Workplace Hazardous Materials Information System (WHMIS) mandate the use of certified safety footwear, ensuring steady market growth.

The Rest of North America segment comprises Mexico and other smaller economies. Mexico’s automotive and manufacturing industries are the primary contributors to this segment’s growth. Similarly, the country’s automotive sector generates substantial annual revenue and employs a significant number of workers, many of whom require specialized safety footwear. Additionally, Mexico’s participation in trade agreements like the USMCA has bolstered industrial activity, creating a fertile ground for market expansion. However, challenges such as lower awareness of safety standards and limited enforcement of regulations hinder rapid growth.

KEY MARKET PLAYERS

Honeywell International Inc., Wolverine World Wide Inc., VF Corporation, Bata Corporation, Dunlop, Protective Footwear, Rock Fall (UK) LTD, Hilson Footwear Pvt. Ltd, U-power Group Spa, Cofra SRL, Uvex Group, elten gmbh, Saina Corporation Co. Ltd, Oftenrich Holdings Co. Ltd., Rahman Group, JAL Group. Are the market players dominating the North American industrial safety footwear market?

Top Players In The Market

Honeywell International Inc.

Honeywell International Inc. is a global leader in the industrial safety footwear market. The company’s dominance stems from its extensive product portfolio, which includes advanced leather and rubber-based safety footwear tailored to diverse industries such as construction, manufacturing, and oil and gas. Honeywell’s commitment to innovation is evident in its development of smart safety boots equipped with sensors for real-time monitoring of worker health and environmental conditions. The company’s strong distribution network and partnerships with regulatory bodies like OSHA further solidify its leadership position.

Ansell Limited

Ansell Limited is another major player. The company specializes in ergonomic designs and sustainable materials, catering to environmentally conscious industries. In recent years, Ansell has focused on expanding its presence in North America through strategic acquisitions and partnerships. The company’s emphasis on research and development ensures that its products meet the evolving needs of workers in hazardous environments.

Rock Fall Ltd

Rock Fall Ltd is renowned for its lightweight yet durable safety footwear. The company’s products are particularly popular in industries requiring prolonged wear, such as construction and mining. Rock Fall’s success can be attributed to its innovative use of materials like microfiber and advanced rubber compounds, which enhance comfort without compromising safety. The company has also expanded its distribution network in North America, particularly in Canada, where its products have gained traction in the mining and oil sands sectors. Rock Fall’s ability to adapt to regional demands and regulatory requirements has enabled it to carve out a significant niche in the competitive landscape.

Top Strategies Used By Key Market Participants

Key players in the North American industrial safety footwear market employ a variety of strategies to maintain their competitive edge and drive growth. One of the most prominent strategies is product innovation, with companies investing heavily in research and development to create advanced solutions. For example, Honeywell has pioneered the integration of IoT technologies into safety footwear, enabling real-time monitoring of worker safety. Another strategy is strategic partnerships and collaborations.

Additionally, expanding distribution networks is a critical strategy for reaching underserved regions. Rock Fall Ltd, for instance, has significantly bolstered its presence in Canada by establishing partnerships with local distributors. Companies also focus on sustainability, leveraging eco-friendly materials to appeal to environmentally conscious consumers. Finally, compliance with regulatory standards remains a cornerstone of market strategies, as adherence to OSHA and WHMIS guidelines ensures trust and reliability among customers.

COMPETITION OVERVIEW

The North American industrial safety footwear market is highly competitive, characterized by the presence of both established multinational corporations and emerging regional players. Honeywell International Inc., Ansell Limited, and Rock Fall Ltd dominate the landscape. These companies leverage their extensive product portfolios, innovative technologies, and strong distribution networks to maintain their leadership positions. Innovation is a key battleground, with firms investing heavily in R&D to develop cutting-edge solutions such as smart footwear equipped with sensors for real-time monitoring. Regulatory compliance also plays a crucial role, as adherence to OSHA and WHMIS standards ensures customer trust and market access.

Emerging players, on the other hand, focus on niche markets and cost-effective solutions to carve out their share of the pie. For instance, smaller brands often target specific industries or geographic regions where larger companies may have limited penetration. Sustainability is another area of differentiation, with eco-friendly products gaining traction among environmentally conscious consumers.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Honeywell launched eco-friendly safety boots targeting sustainability-focused industries. This initiative aligns with the growing demand for green products, as highlighted by the Sustainable Apparel Coalition, which projects eco-friendly footwear to capture 25% of the global market by 2025.

- In June 2023, Ansell acquired a startup specializing in smart footwear technology. This acquisition enhances Ansell’s capabilities in integrating IoT solutions, addressing the rising demand for real-time worker safety monitoring.

- In January 2024, Rock Fall expanded its distribution network in Canada. By partnering with local distributors, the company increased its reach in the mining and oil sands sectors, boosting its market share in the region.

- In March 2023, Honeywell partnered with OSHA to promote safety awareness. This collaboration underscores Honeywell’s commitment to regulatory compliance and reinforces its reputation as a trusted provider of safety solutions.

- In July 2024, Ansell introduced a line of chemical-resistant rubber boots. Designed for high-risk industries like chemical processing, this product launch addresses the growing need for specialized safety gear, as reported by the Rubber Manufacturers Association.

MARKET SEGMENTATION

This research report on the North American industrial safety footwear market is segmented and sub-segmented into the following categories.

By Product

- Leather

- Rubber

- PVC

- Polyurethane

- Others

By End-use

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Healthcare

- Transportation

- Mining

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What is industrial safety footwear, and why is it essential in North American industries?

Industrial safety footwear includes boots and shoes designed to protect workers from hazards like impacts, compression, slips, electrical risks, and chemical spills, making them critical for compliance with workplace safety standards across sectors.

What’s driving the growth of the safety footwear market in North America?

Key growth drivers include strict workplace safety regulations (like OSHA mandates), increased construction and manufacturing activity, and rising employer focus on worker well-being and injury prevention.

Which industries are the largest users of safety footwear in North America?

Construction, manufacturing, oil & gas, mining, transportation, and warehousing are the leading sectors where durable, protective footwear is a legal and operational necessity.

What are the biggest challenges facing the safety footwear industry?

Challenges include balancing cost with compliance, adapting to changing safety standards, and producing footwear that combines functionality with comfort and style to encourage consistent worker use.

How is innovation shaping the future of safety footwear in North America?

The future is driven by lightweight composite toe technologies, eco-friendly materials, smart wearables (like sensors for fatigue or slip detection), and customizable designs for ergonomic comfort.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]