North America Industrial Filtration Market Size, Share, Trends & Growth Forecast Report By Type (Air & Gas Filtration and Liquid Filtration), Filter Media, Application, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2024 to 2033

North America Industrial Filtration Market Size

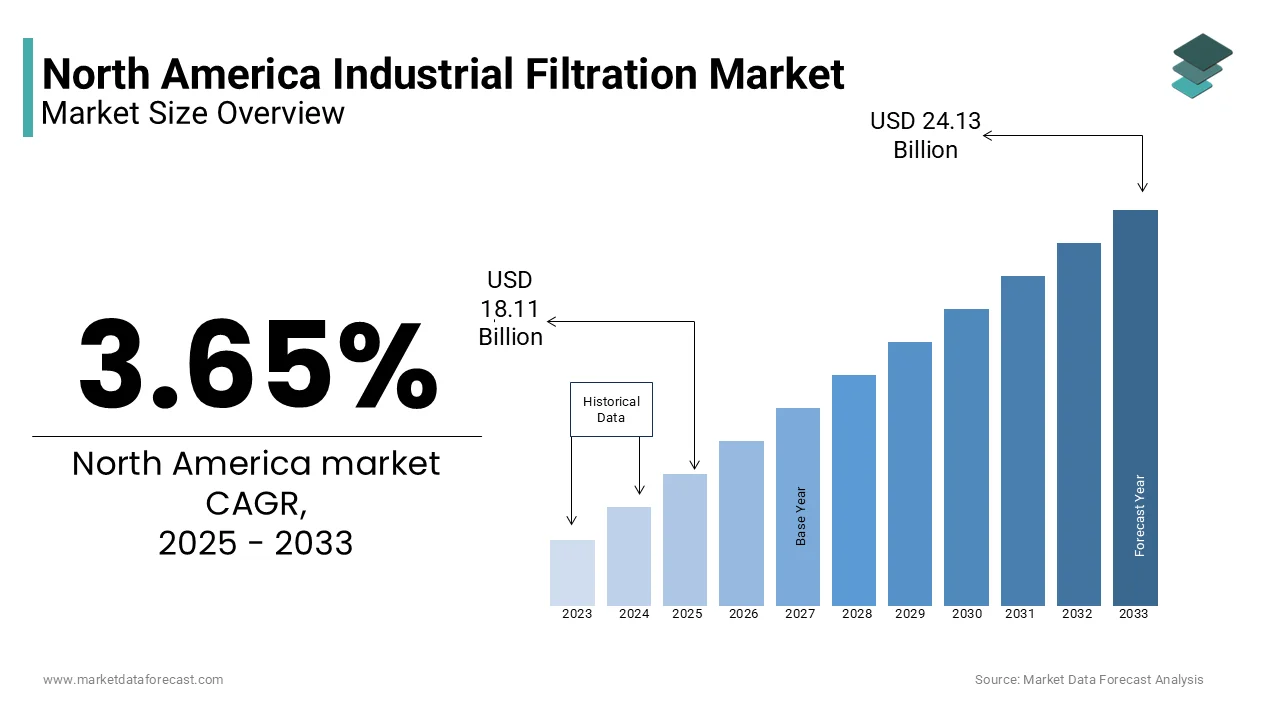

The North America Industrial Filtration market size was valued at USD 17.47 billion in 2024. The European market is estimated to be worth USD 24.13 billion by 2033 from USD 18.11 billion in 2025, growing at a CAGR of 3.65% from 2025 to 2033.

Industrial filtration includes a wide range of technologies and products designed to remove contaminants from air, water, and other fluids used in various industrial processes. This market plays a crucial role in ensuring compliance with environmental regulations, enhancing product quality, and protecting equipment from damage caused by particulate matter and other pollutants. The industrial filtration sector includes air and gas filtration, liquid filtration, and various filter media types, such as activated carbon, fiberglass, and nonwovens. As industries increasingly prioritize sustainability and operational efficiency, the demand for advanced filtration solutions is on the rise. This growth is driven by factors such as stringent environmental regulations, the need for improved air and water quality, and the rising awareness of health and safety standards in industrial operations. The industrial filtration market in North America is expected to witness significant innovations in filtration technologies, further enhancing their effectiveness and efficiency in various applications.

MARKET DRIVERS

Stringent Environmental Regulations in North America

The stringent environmental regulations aimed at reducing pollution and ensuring compliance with air and water quality standards is one of the major factors driving the growth of the North American industrial filtration market. Governments and regulatory bodies have implemented various laws and guidelines that mandate industries to adopt effective filtration systems to minimize emissions and effluents. According to the Environmental Protection Agency, the Clean Air Act and the Clean Water Act impose strict limits on the levels of pollutants that can be released into the environment, compelling industries to invest in advanced filtration technologies. As a result, companies across sectors such as manufacturing, power generation, and food processing are increasingly adopting industrial filtration solutions to meet these regulatory requirements. Furthermore, the rising public awareness regarding environmental issues is pushing industries to adopt sustainable practices, further fueling the demand for effective filtration systems. The combination of regulatory pressure and consumer expectations is creating a robust market environment for industrial filtration solutions.

Growing Focus on Health and Safety

The rising focus on health and safety standards within industrial environments is another key factor boosting the expansion of the North American industrial filtration market. The COVID-19 pandemic has heightened awareness of the importance of maintaining clean air and water in workplaces, leading to increased investments in filtration technologies. According to the Occupational Safety and Health Administration, ensuring proper air quality is essential for protecting workers' health and preventing occupational illnesses. Industries are now prioritizing the installation of advanced air and liquid filtration systems to mitigate health risks associated with airborne contaminants and pathogens. Additionally, the food and beverage sector is also investing in filtration solutions to ensure product safety and quality, further contributing to market growth. The emphasis on health and safety is reshaping the industrial filtration landscape, creating opportunities for innovative filtration solutions.

MARKET RESTRAINTS

High Initial Investment Costs

One of the primary restraints affecting the North American industrial filtration market is the high initial investment costs associated with advanced filtration systems. While these systems offer long-term benefits in terms of efficiency and compliance, the upfront costs can be a significant barrier for many companies, particularly small and medium-sized enterprises. This financial burden can deter businesses from upgrading their existing filtration systems or investing in new technologies, especially in industries with tight profit margins. Additionally, the ongoing maintenance and operational costs associated with advanced filtration systems can further strain budgets. As a result, many companies may opt for less effective, lower-cost alternatives that do not meet regulatory standards, ultimately impacting their operational efficiency and environmental compliance. Addressing the issue of high initial investment costs is crucial for unlocking the full potential of the industrial filtration market in North America.

Limited Awareness and Knowledge

The limited awareness and knowledge regarding the benefits and functionalities of advanced filtration technologies is further hindering the growth of the North American industrial filtration market. Many industrial operators may not fully understand the importance of investing in high-quality filtration systems or the potential consequences of neglecting proper filtration practices. According to a survey conducted by industry associations, nearly 40% of manufacturers reported a lack of knowledge about the latest filtration technologies and their advantages. This knowledge gap can lead to suboptimal decision-making when it comes to selecting filtration solutions, resulting in inadequate performance and compliance issues. Furthermore, the rapid pace of technological advancements in the filtration sector can overwhelm operators, making it difficult for them to keep up with the latest innovations. To overcome this challenge, industry stakeholders must prioritize education and outreach efforts to inform businesses about the importance of effective filtration systems and the long-term benefits they provide. By enhancing awareness and understanding, the market can foster greater adoption of advanced filtration technologies.

MARKET OPPORTUNITIES

Technological Innovations in Filtration Solutions

As industries increasingly seek to enhance efficiency and reduce environmental impact, the demand for advanced filtration technologies is on the rise. Innovations such as nanofiber filtration, membrane filtration, and smart filtration systems are gaining traction, offering improved performance and energy efficiency. These innovations not only improve the quality of air and water but also contribute to energy savings, making them attractive options for industries looking to optimize their operations. Additionally, the integration of IoT and automation in filtration systems is enabling real-time monitoring and predictive maintenance, further enhancing their effectiveness. As manufacturers continue to invest in research and development, the market is poised for significant advancements that will drive growth and create new opportunities.

Expansion in Emerging Industries

Another promising opportunity within the North American industrial filtration market lies in the expansion of emerging industries, such as renewable energy and electric vehicle manufacturing. As these sectors grow, the demand for effective filtration solutions to ensure product quality and compliance with environmental standards is also increasing. The renewable energy sector, particularly solar and wind energy, requires specialized filtration systems to maintain the efficiency of production processes. Similarly, the electric vehicle industry is witnessing rapid growth, with a projected increase in production that necessitates advanced filtration solutions to ensure the quality of components and materials. As these emerging industries continue to expand, they will drive demand for innovative filtration technologies, providing a significant growth avenue for the North American industrial filtration market.

MARKET CHALLENGES

Supply Chain Disruptions

The North American industrial filtration market faces significant challenges due to supply chain disruptions, which have been exacerbated by global events such as the COVID-19 pandemic. These disruptions have led to delays in the procurement of raw materials and components necessary for manufacturing filtration systems. According to industry reports, approximately 60% of manufacturers have experienced supply chain issues that have impacted their production schedules and delivery timelines. These delays can hinder the ability of companies to meet customer demands and regulatory requirements, ultimately affecting their competitiveness in the market. Additionally, rising costs of raw materials due to supply chain constraints can lead to increased prices for filtration products, further straining budgets for end-users. To mitigate these challenges, companies must adopt more resilient supply chain strategies, including diversifying suppliers and investing in local manufacturing capabilities. By addressing supply chain vulnerabilities, the industrial filtration market can enhance its stability and responsiveness to market demands.

Competition from Alternative Technologies

The North American industrial filtration market is also challenged by competition from alternative technologies that offer similar benefits at potentially lower costs. For instance, some industries are exploring the use of chemical treatments or other methods to achieve desired filtration outcomes without investing in traditional filtration systems. This competition can lead to price pressures and reduced market share for established filtration manufacturers. To remain competitive, companies must emphasize the unique advantages of their filtration solutions, such as superior performance, compliance with regulations, and long-term cost savings. Additionally, investing in research and development to innovate and improve filtration technologies will be essential for maintaining a competitive edge in a rapidly evolving market landscape.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.65% |

|

Segments Covered |

By Type, Filter Media, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

3M Company (U.S.), Pall Corporation (U.S.), Alfa Laval Inc. (Sweden), Ahlstrom-Munksjö (Finland), Filtration Group (U.S.), Lydall Inc. (U.S.), American Air Filter Company Inc. (U.S.), Dorstener Wire Tech (U.S.), Graver Technologies (U.S.), and Hollingsworth & Vose Company (U.S.), and others. |

SEGMENTAL ANALYSIS

By Type Insights

The air and gas filtration segment accounted for 54.5% of the regional market share in 2024. The dominance of air and gas filtration segment in the North American market can be attributed to the increasing need for clean air in various industrial applications, including manufacturing, power generation, and food processing. The demand for air filtration systems is further fueled by the rising awareness of indoor air quality and its impact on worker health. Industries are increasingly investing in high-efficiency particulate air (HEPA) filters and other advanced technologies to ensure compliance with air quality standards. Additionally, the expansion of industries such as pharmaceuticals and food and beverage processing, which require stringent air quality controls, is contributing to the growth of the air and gas filtration segment. As companies prioritize sustainability and operational efficiency, the air and gas filtration segment is expected to maintain its leading position in the North American industrial filtration market.

The liquid filtration segment is estimated to experience a CAGR of 7.7% over the forecast period owing to the increasing demand for clean water and the need for effective filtration solutions in various applications, including chemicals, pharmaceuticals, and food and beverage processing. The growing awareness of environmental issues and the need for sustainable practices are also propelling the demand for liquid filtration systems. Industries are increasingly adopting advanced filtration technologies, such as membrane filtration and activated carbon filtration, to ensure compliance with stringent water quality regulations. Additionally, the expansion of the semiconductor and electronics industries, which require high-purity water for manufacturing processes, is further driving the growth of the liquid filtration segment. As industries continue to prioritize water quality and sustainability, the liquid filtration segment is poised for significant growth in the coming years.

By Filter Media Insights

The activated carbon/charcoal segment dominated the market by holding 36.9% of the regional market share in 2024. The dominance of activated carbon/charcoal segment in the North American market is primarily due to the effectiveness of activated carbon in removing volatile organic compounds (VOCs), odors, and other contaminants from air and water. Activated carbon filters are widely used in various applications, including water treatment, air purification, and industrial processes. The versatility and efficiency of activated carbon make it a preferred choice for many industries seeking to enhance their filtration capabilities. Additionally, the rising demand for sustainable and eco-friendly filtration solutions is further propelling the growth of the activated carbon segment. As industries continue to prioritize environmental compliance and product quality, the activated carbon/charcoal segment is expected to maintain its leading position in the North American industrial filtration market.

The nonwovens segment is anticipated to witness a CAGR of 8.2% over the forecast period owing to the increasing demand for lightweight, high-efficiency filtration solutions across various industries. Nonwoven filter media are gaining popularity due to their superior filtration performance, ease of use, and cost-effectiveness. The versatility of nonwoven materials allows them to be used in a wide range of applications, including air and liquid filtration in sectors such as automotive, healthcare, and food processing. Their ability to capture fine particles and contaminants while maintaining low pressure drop makes them an attractive option for manufacturers seeking to enhance operational efficiency. Additionally, the growing focus on sustainability is driving the adoption of nonwoven filter media made from recycled or biodegradable materials, further contributing to their rapid growth. As industries increasingly prioritize performance and environmental responsibility, the nonwovens segment is poised for significant expansion in the North American industrial filtration market.

By Application Insights

The chemicals and petrochemicals segment occupied for 31.4% of the regional market share in 2024. The leading position of chemicals and petrochemicals segment in the North American market is primarily due to the stringent filtration requirements in the chemical manufacturing process, where the quality of raw materials and final products is critical. The chemicals and petrochemicals sector requires advanced filtration solutions to remove impurities, particulates, and contaminants from various fluids, including solvents, oils, and gases. The rising demand for specialty chemicals and the expansion of petrochemical production facilities are further fueling the growth of this segment. Additionally, the industry's commitment to sustainability and environmental responsibility is leading to increased investments in filtration technologies that minimize waste and enhance process efficiency. As the chemicals and petrochemicals sector continues to evolve, the demand for effective filtration solutions is expected to remain strong, solidifying its position as the largest application segment in the North American industrial filtration market.

The healthcare segment is anticipated to witness a CAGR of 9.7% over the forecast period due to the increasing demand for high-quality air and liquid filtration solutions in hospitals, laboratories, and pharmaceutical manufacturing. The COVID-19 pandemic has significantly accelerated the need for advanced filtration systems in healthcare settings, as facilities seek to improve indoor air quality and reduce the transmission of airborne pathogens. High-efficiency particulate air (HEPA) filters and other specialized filtration technologies are becoming essential components of HVAC systems in hospitals and clinics. Additionally, the growing emphasis on cleanroom environments in pharmaceutical manufacturing is further driving the demand for effective filtration solutions. As the healthcare sector continues to prioritize safety and quality, the demand for advanced filtration technologies is expected to grow rapidly, positioning healthcare as the fastest-growing application segment in the North American industrial filtration market.

REGIONAL ANALYSIS

The United States dominated the market by holding the major share of the North American industrial filtration market in 2024. The U.S. market is characterized by a robust demand for filtration solutions driven by stringent environmental regulations, a diverse industrial base, and a strong emphasis on health and safety. According to the U.S. Environmental Protection Agency, the implementation of regulations such as the Clean Air Act and Clean Water Act has compelled industries to invest in advanced filtration technologies to ensure compliance. The presence of major filtration manufacturers and a well-established distribution network further contribute to the country's dominant position in the market. Additionally, the growing focus on sustainability and operational efficiency is driving investments in innovative filtration solutions across various sectors, including chemicals, pharmaceuticals, and food processing. As industries increasingly prioritize environmental compliance and product quality, the U.S. industrial filtration market is expected to continue its growth trajectory, supported by technological advancements and regulatory pressures.

Canada is predicted to showcase a prominent CAGR in the North American industrial filtration market over the forecast period. The Canadian industrial filtration market is influenced by the country's diverse industrial landscape, which includes sectors such as mining, oil and gas, and manufacturing. According to Natural Resources Canada, the mining industry is a significant contributor to the demand for filtration solutions, as companies seek to minimize environmental impact and ensure compliance with regulations. The Canadian government has implemented various initiatives aimed at promoting sustainability and reducing emissions, further driving the adoption of advanced filtration technologies. Additionally, the growing focus on health and safety standards in industrial operations is leading to increased investments in air and liquid filtration systems. As the market evolves, the emphasis on environmental responsibility and product quality is expected to drive further growth in the Canadian industrial filtration sector, positioning it as a key player in the North American market.

KEY MARKET PLAYERS

The major key players in North America industrial filtration market are 3M Company (U.S.), Pall Corporation (U.S.), Alfa Laval Inc. (Sweden), Ahlstrom-Munksjö (Finland), Filtration Group (U.S.), Lydall Inc. (U.S.), American Air Filter Company Inc. (U.S.), Dorstener Wire Tech (U.S.), Graver Technologies (U.S.), and Hollingsworth & Vose Company (U.S.).

MARKET SEGMENTATION

This research report on the North America industrial filtration market is segmented and sub-segmented into the following categories.

By Type

- Air & Gas Filtration

- Liquid Filtration

By Filter Media

- Activated Carbon/Charcoal

- Fiberglass

- Nonwovens

- Metals

- Filter Paper

- Combination Filters & Others

By Application

- Food & Beverage

- Power Generation

- Semiconductors & Electronics

- Chemicals & Petrochemicals

- Healthcare

- Metals & Mining

- Paper & Paints

- Others

By Country

- The United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the projected growth rate for the North America Industrial Filtration market?

The market is expected to grow at a compound annual growth rate (CAGR) of 3.65% from 2025 to 2033.

2. What factors are driving the growth of the North America Industrial Filtration market?

Key drivers include increasing industrial activities, stringent pollution control regulations, and rising demand for clean air and water across various industries.

3. Who are the major players in the North America Industrial Filtration market?

Major companies in this market include Pall Corporation, 3M Company, Alfa Laval Inc., Ahlstrom-Munksjö, and Donaldson Company, Inc.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]