North America Industrial Catalyst Market Research Report – Segmented By Type ( heterogeneous catalysts, homogeneous catalysts) Material ( metal catalysts led , zeolites ) and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Industrial Catalyst Market Size

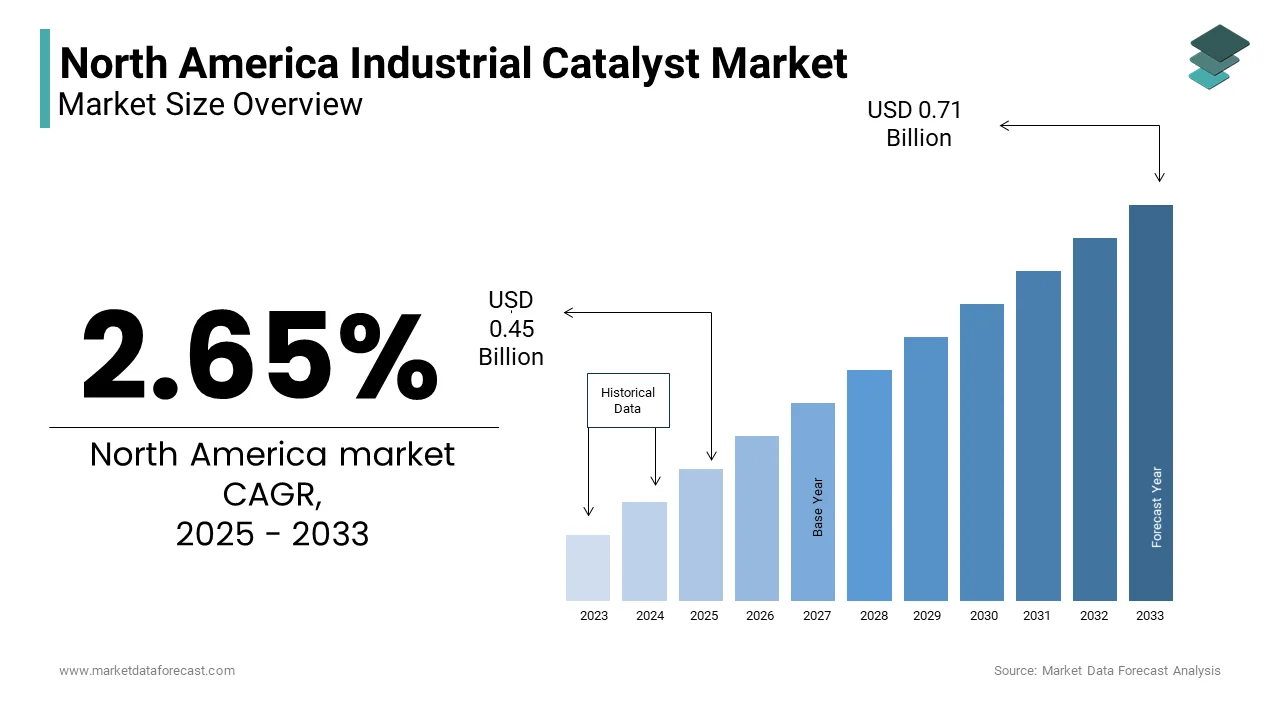

The North America Industrial Catalyst Market Size was valued at USD 6.9 billion in 2024. The North America Industrial Catalyst Market size is expected to have 2.65 % CAGR from 2025 to 2033 and be worth USD 0.71 billion by 2033 from USD 0.45 billion in 2025.

The presence of chemical and petrochemical industries is playing a pivotal role in driving efficiency and sustainability that is explicitly driving the growth of the North America industrial catalyst market. US’s robust manufacturing base and stringent environmental regulations are mandating the use of catalysts for emission control. Canada’s expanding oil sands operations and increasing adoption of green technologies will promote the growth of the market.

MARKET DRIVERS

Stringent Environmental Regulations Promoting Emission Control

Environmental regulations have emerged as a significant driver for the North America industrial catalyst market in the automotive and petrochemical sectors. According to the Environmental Protection Agency (EPA), approximately 28% of greenhouse gas emissions in the U.S. originate from transportation is amplifying the advanced catalytic converters to meet emission standards. Additionally, refineries are adopting catalysts to comply with sulfur reduction mandates under the International Maritime Organization’s (IMO) 2020 sulfur cap.

Rising Demand for Petrochemical Products

The burgeoning demand for petrochemical products, including plastics, polymers, and synthetic fibers, has significantly bolstered the industrial catalyst market. Catalysts play a critical role in cracking, reforming, and polymerization processes by enabling efficient production of these materials. Furthermore, the shift toward lightweight and recyclable packaging materials has increased the demand for catalysts in polymer manufacturing. The increasing plastic consumption in North America is amplifying the pivotal role of catalysts in meeting consumer demands.

MARKET RESTRAINTS

Fluctuating Prices of Raw Materials

The volatility in raw material prices poses a significant challenge to the North America industrial catalyst market. Catalysts often rely on precious metals like platinum, palladium, and rhodium, whose prices are subject to frequent fluctuations due to geopolitical tensions and supply chain disruptions. According to the London Metal Exchange, platinum prices surged by 22% in 2022 alone, driven by supply constraints in South Africa, a major producer. This price instability directly impacts the cost structure of catalyst manufacturers is making it difficult to maintain competitive pricing. Moreover, the dependency on imported raw materials exacerbates the issue, as currency fluctuations and trade policies further complicate procurement.

Limited Awareness Among Small-Scale Industries

Limited awareness about the benefits of industrial catalysts among small-scale industries remains a persistent barrier. According to a survey conducted by the Manufacturing Institute, only 35% of small-scale manufacturers in North America were familiar with advanced catalytic technologies as of 2022. Smaller players often lack access to technical expertise and resources required to integrate catalyst-based solutions into their operations. Additionally, the perceived complexity of implementing these technologies discourages adoption, despite their potential to enhance efficiency and reduce costs.

MARKET OPPORTUNITIES

Growing Adoption of Green Hydrogen Technologies

The transition toward renewable energy sources presents a transformative opportunity for the North America industrial catalyst market in green hydrogen production. According to the International Energy Agency (IEA), hydrogen demand is projected to grow by 7% annually through 2030, with green hydrogen accounting for 30% of total production. Catalysts are indispensable in electrolysis processes, which split water into hydrogen and oxygen using renewable electricity. The U.S. Department of Energy’s Hydrogen Shot initiative, launched in 2021, aims to reduce hydrogen production costs to USD 1 per kilogram, further accelerating adoption. Additionally, partnerships between catalyst manufacturers and renewable energy firms are fostering innovation in durable and cost-effective catalyst formulations is likely to create new opportunities for the market in next coming years.

Expansion into Emerging Applications Like Carbon Capture

Carbon capture, utilization, and storage (CCUS) technologies represent another promising avenue for the North America industrial catalyst market. Catalysts play a vital role in enhancing the efficiency of carbon capture processes by facilitating chemical reactions that convert CO2 into valuable products like methanol and synthetic fuels. A study by the Massachusetts Institute of Technology (MIT) reveals that catalyst-enabled CCUS systems can improve CO2 conversion rates by up to 40% by making them economically viable. Furthermore, government incentives, such as the U.S. Inflation Reduction Act of 2022, which offers tax credits of up to USD 85 per ton of captured CO2, are driving investments in this space.

MARKET CHALLENGES

Technological Barriers to Innovation

Technological barriers present a significant hurdle to innovation in the North America industrial catalyst market. Developing advanced catalysts with higher selectivity, durability, and efficiency requires substantial investment in research and development. This limited focus on innovation hampers the ability of manufacturers to address evolving customer needs in niche applications like biocatalysis and photocatalysis. Additionally, scaling up laboratory breakthroughs to industrial levels remains challenging due to the complex interplay of variables such as temperature, pressure, and reaction kinetics. Overcoming these technological barriers will require collaborative efforts between academia, industry, and government.

Intense Competition from Low-Cost Imports

Intense competition from low-cost imports poses another major challenge to domestic manufacturers in the North America industrial catalyst market. These imports often undercut domestic prices, making it difficult for local manufacturers to compete. A study by the Peterson Institute for International Economics reveals that import penetration has led to a 15% decline in market share for U.S.-based catalyst producers since 2018. Furthermore, trade disputes and tariffs have added uncertainty to the supply chain are complicating efforts to counteract foreign competition. While domestic manufacturers emphasize quality and customization, the price sensitivity of certain segments, such as small-scale industries, limits their ability to fully capitalize on these advantages. Addressing this challenge will require strategic measures, including tariff adjustments and export incentives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.65 % |

|

Segments Covered |

By Type,Material and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Albemarle Corporation (U.S.), BASF SE (Germany), Clariant AG (Switzerland), The DOW Chemicals Company (U.S.) |

SEGMENTAL ANALYSIS

By Type Insights

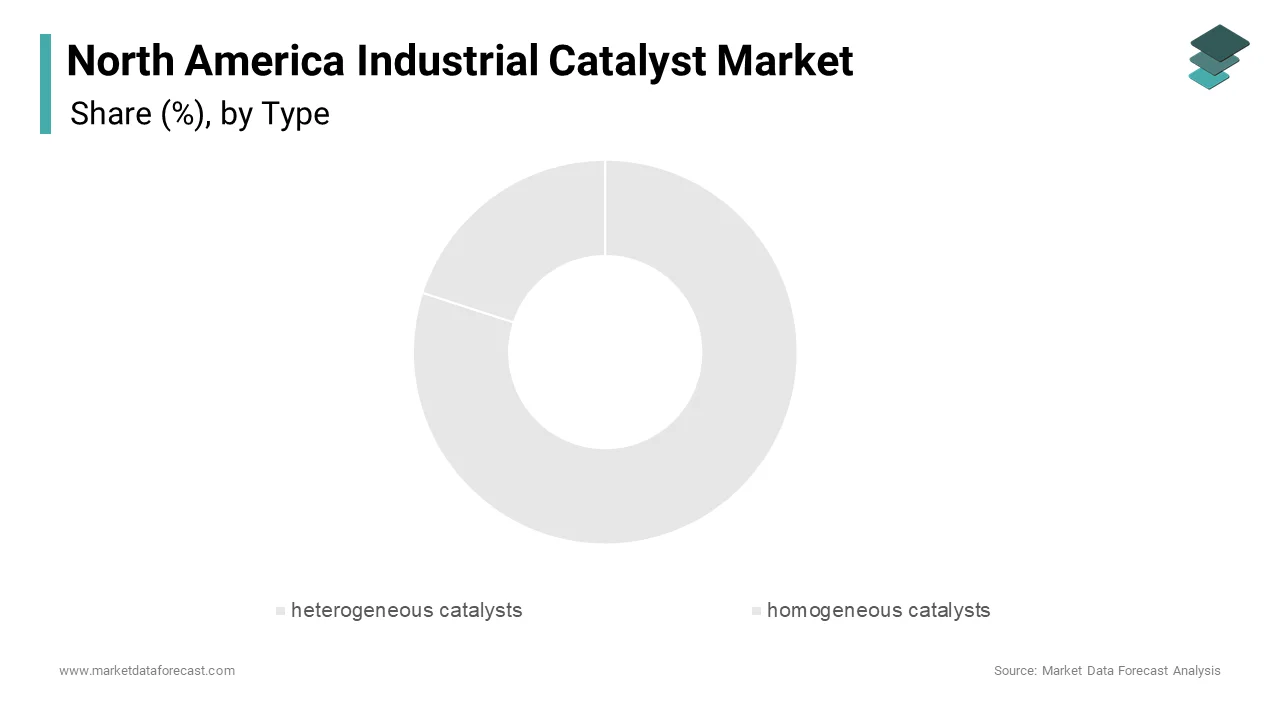

The heterogeneous catalysts segment dominated the North America industrial catalyst market with prominent share in 2024 with the adoption is attributed to their versatility and ease of separation from reaction mixtures by making them ideal for large-scale industrial applications. According to the American Chemical Society, heterogeneous catalysts account for over 90% of all catalysts used in refining and petrochemical processes. Their robust performance in high-temperature and high-pressure environments further enhances their appeal. For instance, zeolite-based catalysts are extensively used in fluid catalytic cracking (FCC) units to produce gasoline and other hydrocarbons. Additionally, advancements in nanotechnology have enabled the development of highly selective heterogeneous catalysts is propelling the growth of the segment.

The homogeneous catalysts segment is anticipated to register a fastest CAGR of 8.4% in the foreseen years. Their rapid growth is driven by their superior selectivity and activity in fine chemical and pharmaceutical synthesis. According to the Pharmaceutical Research and Manufacturers of America, the U.S. pharmaceutical industry grew by 6% annually from 2020 to 2022 is creating a strong demand for homogeneous catalysts in drug manufacturing. Transition metal complexes, such as rhodium and palladium catalysts, are widely used in processes like hydrogenation and cross-coupling reactions. A report by the Journal of Catalysis reveals that homogeneous catalysts can achieve reaction efficiencies of up to 95%, significantly reducing waste and production costs. Moreover, the growing emphasis on green chemistry has spurred interest in reusable and recyclable homogeneous catalysts by addressing previous limitations related to recovery and reuse.

By Material Insights

The metal catalysts led the North America industrial catalyst market by capturing a 50.2% of share in 2024 due to their widespread use in refining, petrochemicals, and emission control systems. According to the U.S. Geological Survey, platinum group metals (PGMs) are the most commonly used materials in automotive catalytic converters, with over 9 million vehicles equipped with PGM-based catalysts in 2022. Metal catalysts are also integral to hydrogen production and ammonia synthesis, critical processes for the energy and agricultural sectors. Additionally, advancements in alloy development have improved the durability and performance of metal catalysts will further escalate the growth of the segment.

The zeolites segment is likely to experience a CAGR of 9.5% in the foreseen years with the rapid expansion is fueled by their unique porous structure, which enables high surface area and excellent adsorption properties. According to the American Fuel & Petrochemical Manufacturers, zeolite catalysts are extensively used in fluid catalytic cracking (FCC) and hydrocracking processes, contributing to over 40% of global gasoline production. A report by the National Science Foundation reveals that zeolite-based catalysts can reduce energy consumption in refining processes by up to 20%, making them indispensable for sustainable operations. Furthermore, their ability to selectively catalyze reactions has expanded their application in fine chemicals and environmental remediation. Innovations in zeolite synthesis, such as hierarchical structures, are expected to drive the growth of the segment.

COUNTRY LEVEL ANALYSIS

The United States was the top performer in the North America industrial catalyst market with 75.4% of share in 2024. The country’s robust manufacturing base, stringent environmental regulations, and abundant natural resources are majorly driving the growth of the market. The Environmental Protection Agency (EPA) has implemented rigorous emission control standards in the automotive and energy sectors, driving demand for catalytic converters and refining catalysts. Additionally, the shale gas boom has positioned the U.S. as a global leader in petrochemical production, further boosting catalyst adoption. The low-cost ethane feedstock and advanced catalytic technologies in this country may also fuel the growth of the market. However, challenges such as fluctuating raw material prices and competition from low-cost imports persist. To address these issues, domestic manufacturers are increasingly focusing on innovation and strategic partnerships to maintain their competitive edge.

Canada was accounted in holding 15.4% of North America industrial catalyst market share in 2024 with the expanding oil sands operations and focus on sustainable technologies have significantly propelled catalyst demand. For instance, Natural Resources Canada reported that CAD 2 billion was allocated to clean energy projects in 2021 that is creating opportunities for catalyst manufacturers to develop solutions tailored to emission reduction and energy efficiency. Additionally, Canada’s cold climate necessitates advanced catalysts for fuel efficiency and emission control will enhance the growth of the market. According to the Canadian Energy Regulator, the country’s refining capacity increased by 8% in 2022 that is creating a strong demand for fluid catalytic cracking (FCC) and hydrocracking catalysts.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Industrial Catalyst Market are Albemarle Corporation (U.S.), BASF SE (Germany), Clariant AG (Switzerland), The DOW Chemicals Company (U.S.), ExxonMobil Chemical Co. (U.S.), E and Chevron Philips Chemical Company (U.S.),

The North America industrial catalyst market is characterized by intense competition. Companies like BASF SE, Johnson Matthey, and Honeywell UOP dominate the landscape, leveraging their expertise, distribution networks, and technological advancements to maintain their position in the marketplace. Smaller players, on the other hand, focus on niche applications and regional markets to carve out a foothold. The market’s competitive dynamics are shaped by evolving consumer preferences, regulatory frameworks, and technological breakthroughs. For instance, the growing demand for sustainable and eco-friendly solutions has fueled competition among manufacturers to develop green catalysts. The market’s fragmented nature, combined with the entry of new players, further intensifies competition by making it imperative for companies to differentiate themselves through quality, innovation, and customer-centric approaches.

Top Players in the Market

BASF SE

BASF SE is a global powerhouse in the industrial catalyst market, contributing significantly to North America’s growth trajectory. The company’s expertise spans refining, petrochemicals, and emission control technologies, positioning it as a leader in diverse applications. BASF’s proprietary zeolite-based catalysts are widely used in fluid catalytic cracking (FCC) processes by enhancing gasoline production efficiency by up to 25%. Furthermore, the company’s strategic partnerships with major refineries and automakers have strengthened its market presence. BASF continues to expand its footprint in North America while addressing evolving regulatory and sustainability demands.

Johnson Matthey

Johnson Matthey specializes in platinum group metal (PGM)-based catalysts, dominating key segments such as automotive emission control and petrochemical refining. Johnson Matthey’s innovative solutions, such as its advanced three-way catalytic converters, have become indispensable for meeting stringent emission standards. The company’s focus on sustainability aligns with regional trends, as evidenced by its development of recyclable catalysts and eco-friendly formulations. Additionally, strategic acquisitions and collaborations have bolstered its R&D capabilities by enabling it to stay ahead of competitors in a rapidly evolving market.

Honeywell UOP

Honeywell UOP is renowned for its cutting-edge zeolite and refining catalysts, which play a pivotal role in enhancing operational efficiency across various industries. The company’s proprietary Merox catalysts are widely used for removing sulfur from fuels by aligning with regulatory mandates for cleaner energy. Furthermore, the company’s emphasis on digital transformation has enabled it to integrate advanced analytics and AI into catalyst design by ensuring superior performance and durability.

Top Strategies Used by Key Players

Key players in the North America industrial catalyst market employ a variety of strategies to maintain their competitive edge and drive growth. Product innovation remains a cornerstone, with companies investing heavily in research and development to create advanced formulations tailored to specific applications. For instance, BASF SE has developed recyclable catalysts to address growing environmental concerns, while Johnson Matthey focuses on enhancing the selectivity and activity of its PGM-based catalysts for fine chemical synthesis. Strategic partnerships with governments, research institutions, and industry leaders also play a pivotal role in expanding market reach and fostering innovation. Geographic expansion is another critical strategy, with companies targeting emerging markets in Latin America and Asia-Pacific to diversify their revenue streams. Additionally, mergers and acquisitions have enabled key players to consolidate their market position and enhance operational efficiency.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, BASF SE launched a new line of emission control catalysts specifically designed for heavy-duty vehicles, addressing the growing demand for compliance with stringent Tier 3 Vehicle Emission Standards. This move not only enhanced its product portfolio but also strengthened its position in the automotive segment.

- In June 2023, Johnson Matthey partnered with a leading U.S. refinery to co-develop advanced PGM catalysts tailored for hydrocracking processes. This collaboration enabled Johnson Matthey to expand its market presence and deliver customized solutions to meet regional needs.

- In August 2023, Honeywell UOP acquired a Canadian startup specializing in zeolite synthesis, bolstering its R&D capabilities and enabling the development of next-generation catalysts with superior performance and durability.

- In October 2023, Clariant AG introduced a bio-based catalyst formulation targeting the pharmaceutical sector, capitalizing on the growing trend of green chemistry and sustainable manufacturing practices.

MARKET SEGMENTATION

This research report on the north america industrial catalyst market has been segmented and sub-segmented into the following.

By Type

- heterogeneous catalysts

- homogeneous catalysts

By Material

- metal catalysts led

- zeolites

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What is the current size of the North America Industrial Catalyst Market?

The market size varies year to year based on demand, supply chain dynamics, and key end-use industries like oil & gas, chemical manufacturing, and automotive. As of the most recent data, it is valued in the multi-billion dollar range.

Which industries are the major consumers of industrial catalysts in North America?

Key industries include petroleum refining, chemical manufacturing, automotive, pharmaceuticals, food processing, and environmental treatment sectors.

What trends are currently shaping the industrial catalyst market in North America?

Shift towards green and sustainable catalysts, Increased R&D for catalyst regeneration, Rising demand for cleaner fuel production

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]