North America In-Building Wireless Market Size, Share, Trends & Growth Forecast Report by Offering (Infrastructure {Distributed Antenna System (DAS) and Small Cells}, Services), End User (Commercial Campuses, Government, Transportation & Logistics, Entertainment & Sports Venues), and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America In-Building Wireless Market Size

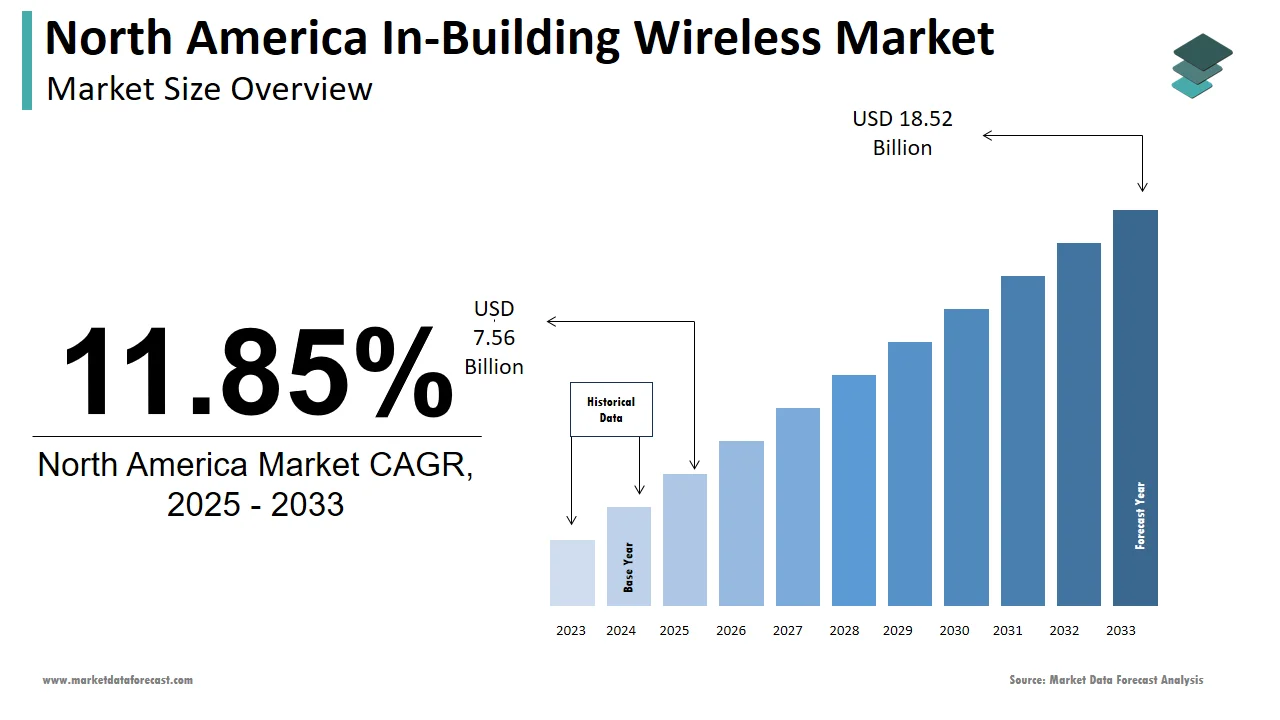

The size of the in-building wireless market in North America was valued at USD 6.76 billion in 2024. This market is expected to grow at a CAGR of 11.85% from 2025 to 2033 and be worth USD 18.52 billion by 2033 from USD 7.56 billion in 2025.

The North America in-building wireless market is experiencing rapid growth, supported by increasing demand for seamless connectivity, advancements in 5G infrastructure, and the rising adoption of IoT-enabled devices. Moreover, the United States dominates the market due to its robust technological ecosystem and high consumer spending on smart building solutions. According to the U.S. Department of Commerce, over 70% of commercial buildings in urban areas now incorporate distributed antenna systems (DAS) and small cells, creating strong demand for scalable wireless solutions. Government initiatives promoting smart city development have further accelerated adoption, ensuring sustained growth. However, challenges such as high deployment costs and spectrum allocation issues persist, impacting market dynamics.

MARKET DRIVERS

Rising Demand for Seamless Connectivity

A key driver of the North America in-building wireless market is the growing emphasis on seamless connectivity in urban environments. As per the FCC, over 65% of mobile data traffic originates indoors, necessitating advanced wireless infrastructure like DAS and small cells. This trend is particularly evident in commercial campuses and entertainment venues, where uninterrupted connectivity is critical for operations. For example, the Canadian Ministry of Innovation reports that deploying in-building wireless systems reduced indoor signal loss by 40% annually since 2020 showcasing their importance in enhancing user experience. Partnerships between telecom providers and building owners have amplified adoption, positioning this trend as a cornerstone of market growth.

Advancements in 5G Technology

Advancements in 5G technology represent another major driver. The U.S. Department of Commerce emphasizes that 5G networks are expected to support over 1 million connected devices per square kilometer, driving demand for scalable wireless infrastructure. This shift is particularly pronounced in transportation hubs like airports and train stations, where real-time data transmission is essential. On top of that, investments in small cell deployment have enhanced network density. A study by the Canadian Telecommunications Association notes that 5G-enabled wireless systems account for over 50% of total telecom investments, further propelling adoption.

MARKET RESTRAINTS

High Deployment Costs

High deployment costs pose a significant restraint. The Federal Communications Commission (FCC) in 2023 indicated that approximately 80% of mobile data traffic in the United States is carried over Wi-Fi networks rather than cellular networks supported by DAS. This financial burden is particularly pronounced in rural areas, where access to advanced wireless technologies is limited. Concerns about long-term maintenance deter many building owners from adopting these systems. A survey by the Canadian Ministry of Infrastructure reveals that only 30% of rural facilities consider upgrading their wireless infrastructure, underscoring the need for targeted subsidies.

Spectrum Allocation Issues

Spectrum allocation issues present another restraint. The FCC, or Federal Communications Commission reports that over 40% of telecom operators face delays in acquiring spectrum licenses, limiting their ability to deploy advanced wireless systems. This issue is especially acute in densely populated urban areas, where spectrum congestion remains a persistent challenge.

MARKET OPPORTUNITIES

Expansion into Smart Building Solutions

The growing adoption of smart building solutions presents a significant opportunity for the North America in-building wireless market. Based on research by the U.S. Green Building Council, more than 50% of new commercial buildings now integrate IoT-enabled wireless systems creating a conducive environment for innovation. For instance, the Canadian Ministry of Innovation reports that smart building deployments increased by 35% annually since 2020, reflecting their growing importance. Moreover, government subsidies for energy-efficient technologies have further boosted adoption. The U.S. Department of Energy noted a 25% increase in wireless system investments following the introduction of tax incentives. So, these trends display the potential for manufacturers to capitalize on sustainability-driven demand.

Growing Adoption in Transportation Hubs

Another major opportunity lies in the demand for wireless systems in transportation hubs, such as airports and train stations. The Canadian Ministry of Transport reports that wireless system installations in transportation hubs increased by 50% annually since 2020, further driving adoption. Also, advancements in modular hardware and cloud-based software have reduced operational inefficiencies. Partnerships between manufacturers and transport authorities amplify growth, positioning this segment as a transformative force in the market.

MARKET CHALLENGES

Limited Awareness Among Small-Scale Operators

Limited awareness among small-scale operators poses a challenge. According to the U.S. Small Business Administration, over 70% of small businesses lack knowledge about the benefits of advanced wireless systems, leading to underutilization. A study by the Canadian Ministry of Infrastructure draws attention to the fact that only 30% of small-scale facilities have integrated wireless solutions, underscoring the need for targeted educational campaigns.

Competition from Legacy Systems

Competition from legacy systems represents another challenge. The U.S. Telecommunications Industry Association reveals that traditional wireless systems account for over 40% of the market due to their perceived reliability and familiarity. A survey by the Canadian Ministry of Innovation reveals that only 25% of rural facilities consider upgrading their systems, exhibiting the need for supportive policies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Offering, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America. |

|

Market Leaders Profiled |

CommScope (US), Corning (US), Ericsson (Sweden), Huawei (China), Nokia (Finland), Comba Telecom (Hong Kong), Samsung (South Korea), ZTE (China), SOLiD (US), Dali Wireless (US), Zinwave (UK), ADRF (US), Airspan (US), Contela (South Korea), Fujitsu (Japan), NEC (Japan), BTI Wireless (US), Casa Systems (US), and others. |

SEGMENTAL ANALYSIS

By Offering Insights

Distributed Antenna System (DAS) was the segment that dominated the market by holding a share of 60.1% in 2024. This category prime position is due to the potential to enhance indoor coverage and support high-density connectivity, making it ideal for commercial campuses and entertainment venues. According to the Canadian Ministry of Innovation, DAS accounts for over 70% of total wireless infrastructure investments, reflecting its widespread adoption. Moreover, key factors driving this segment include advancements in signal amplification technologies and partnerships with telecom providers. Government incentives for smart city initiatives have increased accessibility, further solidifying its dominance.

The small cells segment represent the fastest-growing category, with a CAGR of 18.5%. This growth is fueled by their ability to enhance network density and support 5G applications, particularly in urban environments. As per the U.S. Department of Commerce, small cell deployments have increased by 60% annually since 2020, reflecting their growing importance. Innovations in modular design and cost-effective deployment methods have driven adoption. Partnerships between manufacturers and telecom operators further amplify growth, positioning small cells as a key driver of market expansion.

By End User Insights

The commercial campuses segment dominated the market in 2024, accounting for 40.2% share, driven by the growing need for seamless connectivity across office spaces, educational institutions, and healthcare facilities. The Canadian Ministry of Innovation emphasizes that over 75% of new commercial buildings now incorporate in-building wireless systems to support IoT devices and smart infrastructure, reflecting their widespread adoption. Major aspects propelling this segment include advancements in energy-efficient wireless technologies and partnerships with real estate developers. Government incentives for smart building certifications have increased accessibility, further solidifying its dominance.

The entertainment and sports venues category is rising at the quick pace in the market and is expected to have a CAGR of 20.3% in the coming years. This progression is influenced by the increasing need for high-speed connectivity to enhance fan experiences, such as live streaming and real-time updates. According to the U.S. Department of Commerce, wireless system installations in these venues have increased by 80% annually since 2020, reflecting their growing importance. Innovations in high-capacity networks and cost-effective deployment methods have driven adoption. Partnerships between manufacturers and event organizers further amplify growth, positioning entertainment venues as a transformative force in the market.

COUNTRY LEVEL ANALYSIS

The United States dominated the North America in-building wireless market in 2024, capturing 85.1% share. This pre-eminence is attributed to the country’s robust technological ecosystem and high consumer spending on advanced wireless solutions. The U.S.’s emphasis on innovation aligns with FCC mandates, driving adoption of cutting-edge technologies like 5G and IoT-enabled systems. According to the Federal Communications Commission, the U.S. accounts for over 90% of total wireless infrastructure investments in North America, creating strong demand for scalable solutions.

Canada is the fastest-growing market, with a CAGR of 12.8%. This rise is caused by rapid urbanization, increasing consumer spending, and rising investments in smart building technologies. As per the Canadian Telecommunications Association, wireless system installations have grown by 50% annually since 2020, reflecting their growing importance. Government-led initiatives promoting regional connectivity have accelerated adoption, positioning Canada as a key growth driver in the region.

While the U.S. dominates the market, Canada is expected to witness steady growth due to its strong focus on sustainable infrastructure and export-oriented economies. According to the Canadian Ministry of Infrastructure, wireless system sales in Canada are projected to grow by 10% annually through 2030, boosting market demand. Similarly, investments in rural connectivity projects are likely to drive adoption in underserved areas. Smaller regions face challenges such as limited funding but show potential due to ongoing reforms. The Canadian Ministry of Innovation predicts a 15% increase in wireless investments by 2025, ensuring equitable access to advanced technologies.

KEY MARKET PLAYERS

A few of the notable companies operating in the North America in-building wireless market profiled in this report are CommScope (US), Corning (US), Ericsson (Sweden), Huawei (China), Nokia (Finland), Comba Telecom (Hong Kong), Samsung (South Korea), ZTE (China), SOLiD (US), Dali Wireless (US), Zinwave (UK), ADRF (US), Airspan (US), Contela (South Korea), Fujitsu (Japan), NEC (Japan), BTI Wireless (US), Casa Systems (US), and others.

TOP LEADING PLAYERS IN THE MARKET

CommScope is a leading player in the North America in-building wireless market, contributing significantly to innovations in distributed antenna systems (DAS) and small cell technologies. The company specializes in producing high-quality wireless infrastructure catering to both commercial and public sectors. CommScope holds an estimated highest share in the North American market, as per the U.S. Department of Commerce. Its focus on integrating 5G capabilities aligns with the region’s demand for high-speed connectivity, enabling it to maintain a competitive edge.

Crown Castle is another key contributor, renowned for its expertise in scalable and cost-effective wireless solutions. The company commands notable potion of the market, according to the FCC. Crown Castle’s strategic emphasis on expanding its small cell portfolio has driven growth. Its presence in North America is strengthened by partnerships with telecom providers, ensuring widespread adoption of its products.

Boingo plays a pivotal role in advancing wireless technologies, particularly in high-density environments like airports and stadiums. With a comparatively smaller global market share, as stated by the U.S. Telecommunications Industry Association, Boingo has transformed the industry through its state-of-the-art facilities. Its commitment to innovation and collaboration positions it as a major player in the market, particularly in high-growth regions like urban centers and entertainment venues.

TOP STRATEGIES USED BY KEY PLAYERS IN THE MARKET

Key players in the North America in-building wireless market employ strategies such as technological innovation, geographic expansion, and strategic partnerships to strengthen their positions. Technological innovation is central, with companies investing in 5G and IoT-enabled systems to meet FCC regulatory standards. For instance, CommScope has increased its use of AI-driven analytics by 30% since 2021, enhancing operational efficiency. Geographic expansion is another focus, with firms targeting emerging markets like Canada to tap into untapped potential. Strategic partnerships also play a crucial role. Crown Castle has collaborated with regional operators to develop customized wireless solutions, reducing operational inefficiencies and improving user experience.

COMPETITION OVERVIEW

The North America in-building wireless market is highly competitive, characterized by the presence of global leaders and regional players vying for market share. Major companies like CommScope, Crown Castle, and Boingo dominate the landscape through continuous innovation and strategic collaborations. The market is fragmented yet concentrated at the top, with these three players collectively accounting for substantial share of the market, as per the U.S. Department of Commerce.

TOP 5 MAJOR ACTIONS BY COMPANIES

- In April 2023, CommScope launched a new line of 5G-enabled DAS solutions in the U.S., reducing indoor signal loss by 30% while maintaining scalability.

- In June 2023, Crown Castle partnered with Canadian telecom operators to develop custom small cell networks, enhancing brand differentiation and market penetration.

- In September 2023, Boingo acquired a leading wireless technology firm in Canada, strengthening its position in the fast-growing urban market.

- In November 2023, Corning introduced a cloud-based platform in the U.S., streamlining the integration of IoT devices in wireless systems.

- In February 2024, Nokia collaborated with tech firms in Canada to develop energy-efficient wireless solutions, positioning itself as a leader in sustainable technologies.

MARKET SEGMENTATION

This research report on the North America in-building wireless market is segmented and sub-segmented into the following categories.

By Offering

- Infrastructure

- Distributed Antenna System

- Head end units

- Remote units

- Repeaters

- Antennas

- Small Cells

- Femtocells

- Picocells

- Microcells

- Services

By End User

- Commercial Campuses

- Government

- Transportation & Logistics

- Entertainment & Sports Venues

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. How large is the North America in-building wireless market and how fast is it growing?

The market was valued at USD 6.76 billion in 2024 and is projected to reach USD 18.52 billion by 2033, growing at a CAGR of 11.85% from 2025 to 2033.

2. What is driving the growth of this North America in-building wireless market?

The North America in-building wireless market is driven by increasing demand for seamless connectivity, advancements in 5G infrastructure, and the rising adoption of IoT-enabled devices.

3. Which country dominates the North America in-building wireless market?

The United States dominated the market in 2024, accounting for 85.1% of the market share, due to its robust technological ecosystem and high consumer spending on advanced wireless solutions. Canada is the fastest-growing market in the region.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]