North America Ice Cream Market Research Report – Segmented By Type Insights (Impulse Ice cream, Take-home Ice cream), Flavor, Distribution channel, And Country (US, Canada And Rest Of North America) - Industry Analysis On Size, Share, Trends & Growth Forecast (2025 To 2033)

North American Ice Cream Market Size

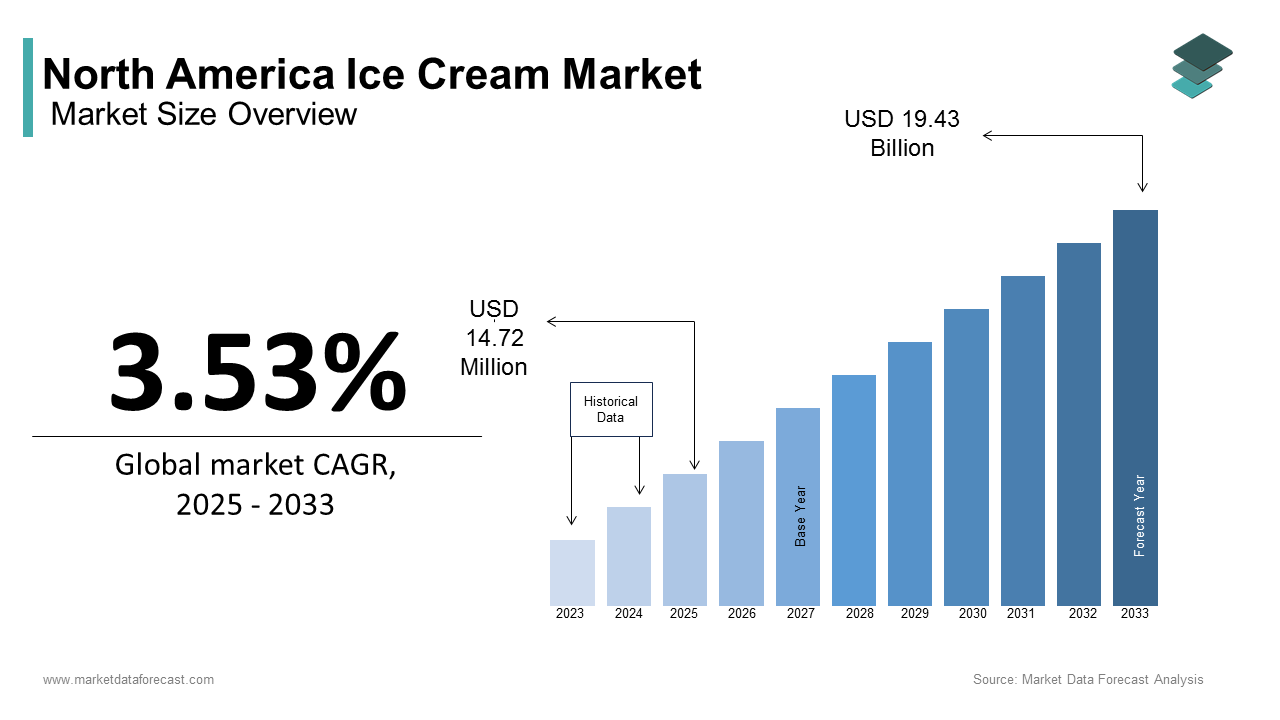

The North American ice cream market size was valued at USD 14.22 billion in 2024 and is expected to reach USD 19.43 billion by 2033 from USD 14.72 billion in 2025. The market is projected to grow at a CAGR of 3.53%.

The North American ice cream market incorporates the production, distribution, and retail sale of frozen dairy and non-dairy desserts consumed across the United States and Canada. This includes traditional milk-based ice creams, plant-based alternatives made from almond, coconut, or oat bases, as well as novelties, soft-serve, and premium varieties tailored to diverse consumer preferences. According to the International Dairy Foods Association (IDFA), ice cream remains one of the most beloved desserts in the U.S., with per capita consumption exceeding 20 pounds annually. In Canada, Statistics Canada reports that frozen dessert spending has remained stable even during economic downturns, highlighting its entrenched position in household food budgets. The market is characterized by a blend of global brands, regional dairies, and innovative startups continuously adapting to evolving dietary trends and flavor experimentation. The influence of social media, seasonal promotions, and cross-industry collaborations—such as those with confectionery and beverage brands—has further expanded the appeal of ice cream beyond traditional demographics.

MARKET DRIVERS

Rising Consumer Preference for Premium and Gourmet Ice Cream Varieties

One of the key drivers of the North American ice cream market is the growing consumer inclination toward premium and gourmet ice cream products that offer enhanced taste experiences, unique flavor combinations, and high-quality ingredients. As disposable incomes rise and consumers seek indulgent yet differentiated treats, premium ice cream brands are gaining traction over standard supermarket offerings. Brands such as Häagen-Dazs, Ben & Jerry’s, and Jeni’s Splendid Ice Creams have capitalized on this trend by introducing artisanal flavors, limited-edition releases, and ethically sourced ingredients that appeal to discerning palates.

Expansion of Plant-Based and Health-Conscious Ice Cream Options

A significant driver fueling the growth of the North American ice cream market is the rapid expansion of plant-based and health-conscious ice cream alternatives designed to cater to lactose-intolerant individuals, vegan diets, and calorie-conscious consumers. With increasing awareness around digestive health and dietary restrictions, plant-based ice creams have become a mainstream option rather than a niche product. According to the Plant Based Foods Association, sales of plant-based frozen desserts in the U.S. surged in 2023 compared to the previous year, with almond, coconut, and oat-based ice creams leading the charge. Major players like Ben & Jerry’s (with its Non-Dairy line) and newcomers such as Oatly and Magnum Vegan have successfully captured consumer interest through flavorful and creamy formulations that mimic traditional ice cream textures. In Canada, the Canadian Diabetes Association noted a rising preference for low-sugar and dairy-free frozen desserts among patients managing metabolic conditions.

MARKET RESTRAINTS

Increasing Health Concerns Over High Sugar and Fat Content

A primary restraint affecting the North American ice cream market is the growing consumer concern regarding the high sugar and fat content associated with traditional ice cream formulations. As public health campaigns gain momentum across both the U.S. and Canada, consumers are becoming more cautious about their dessert choices, often substituting full-fat ice cream with lower-calorie alternatives or eliminating it from their diets. According to the Centers for Disease Control and Prevention (CDC), obesity rates in the U.S. have been consistently high, prompting increased scrutiny of processed foods containing added sugars. Moreover, school districts across North America have implemented nutrition policies restricting the sale of high-sugar snacks on campuses, directly impacting youth consumption patterns.

Volatility in Raw Material Prices and Supply Chain Disruptions

Another critical restraint influencing the North American ice cream market is the fluctuating cost and availability of raw materials, particularly dairy, sugar, and cocoa—key components in ice cream production. Climatic variability, agricultural supply chain disruptions, and inflationary pressures have contributed to inconsistent pricing, affecting both manufacturers and consumers. According to the U.S. Department of Agriculture (USDA), wholesale milk prices in the U.S. rose by 14% in 2023 due to feed cost increases and labor shortages in the dairy industry. In Canada, the Canadian Federation of Agriculture reported that dairy processors faced a key increase in input costs in early 2024, leading some companies to raise retail prices or reformulate products to reduce ingredient dependency.

MARKET OPPORTUNITIES

Surge in Demand for Functional and Fortified Frozen Desserts

An emerging opportunity for the North American ice cream market lies in the growing consumer interest in functional and fortified frozen desserts that offer added nutritional benefits beyond indulgence. As modern consumers seek out products that align with their wellness goals, manufacturers are responding by incorporating probiotics, protein enhancements, vitamins, and adaptogens into ice cream formulations without compromising on taste or texture. According to the International Food Information Council (IFIC), 67% of U.S. consumers in 2024 indicated a preference for snacks and desserts that provide health benefits beyond basic nutrition. This shift has prompted companies like Halo Top, Enlightened, and Chobani to introduce lines enriched with plant-based proteins, prebiotic fibers, and digestive enzymes aimed at fitness-oriented consumers and office workers seeking satiating midday treats. In Canada, Health Canada’s updated labeling regulations have encouraged the development of healthier frozen desserts, including low-glycemic index options and calcium-fortified alternatives.

Growth of Direct-to-Consumer and E-commerce Distribution Channels

A significant opportunity shaping the future of the North American ice cream market is the rapid evolution of e-commerce platforms and direct-to-consumer (DTC) delivery services. As digital shopping becomes more ingrained in consumer behavior, brands are leveraging online channels to reach niche audiences, introduce specialty flavors, and enhance brand engagement through personalized offerings. Platforms such as Amazon Fresh, Instacart, and Goldbelly have enabled consumers to access regional and gourmet ice cream varieties that may not be widely available in local stores, including small-batch and ethnic-inspired options. Additionally, social commerce initiatives fueled by TikTok Shop and Shopify integrations have allowed independent ice cream brands to launch limited-edition flavors and track real-time customer feedback.

MARKET CHALLENGES

Regulatory Pressure and Nutrition Labeling Requirements

A major challenge facing the North American ice cream market is the tightening of food labeling regulations and increased scrutiny of nutritional content. Both the U.S. and Canadian governments have introduced stricter mandates aimed at improving consumer transparency and promoting healthier eating habits, which have placed pressure on manufacturers to reformulate products or disclose potential health risks. Similarly, Health Canada implemented mandatory “High in” labeling for packaged frozen desserts exceeding specified thresholds for critical nutrients, effective from January 2026. These changes are intended to help consumers make informed choices, but they also pose reputational risks for traditional ice cream brands. In response, several manufacturers have accelerated efforts to reduce added sugars, incorporate alternative sweeteners, and develop low-calorie versions. However, altering recipes can affect taste and texture, potentially deterring loyal customers.

Intensifying Competition from Alternative Frozen Treats

An additional challenge confronting the North American ice cream market is the intensifying competition from alternative frozen treats such as frozen yogurt, sorbets, gelato, and novelty desserts made from plant-based milk. As consumer preferences shift toward diverse textures and functional ingredients, traditional ice cream brands face mounting pressure to innovate or risk losing market share. Products made from coconut milk, almond milk, and oat milk are being marketed as lower-calorie, gut-friendly alternatives that appeal to health-conscious millennials and Gen Z consumers. At the same time, private-label brands offered by major retailers like Costco, Walmart, and Whole Foods have entered the fray with competitively priced alternatives, eroding the dominance of established national brands.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.53% |

|

Segments Covered |

By Type, Flavour, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

US, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

General Mills Inc (US), Mars (US), Blue Bell Creameries (US), Wells Dairy Inc (US), Turkey Hill (US), Buskin Robbins (US), Haagen Dazs (US), and Blue Bunny (US) |

SEGMENTAL ANALYSIS

By Type Insights

Take-home ice cream represents the largest segment in the North AAmericanice cream market capturing an estimated 58.4% of the total market share in 2024. This influence is linked to its convenience, affordability, and widespread availability through mass retail channels, making it a household staple for regular consumption. The category benefits from strong brand presence by companies like Unilever (Ben & Jerry’s), Nestlé, and Blue Bell, which ensure consistent product availability and marketing reach.

The artisanal ice cream segment is projected to grow at the fastest rate within the North American ice cream market, registering a CAGR of 7.9%. This rapid expansion is fueled by rising consumer demand for premium, small-batch, and locally sourced frozen desserts that emphasize quality ingredients and unique flavor profiles. Independent creameries such as Jeni’s Splendid Ice Creams, Salt & Straw, and Ample Hills have gained traction through direct-to-consumer models and experiential retail formats.

By Flavour Insights

The vanilla remained the biggest flavor segment in the North America ice cream market by holding 34.3% of total consumption in 2024. This enduring popularity stems from vanilla’s versatility as a base for various toppings, mix-ins, and desserts, making it a go-to choice for both children and adults across diverse demographic groups. In addition, major brands like Häagen-Dazs and Breyers frequently use vanilla as a foundation for limited-edition flavor collaborations with confectionery companies.

The fruit-flavored ice cream segment is coming up as the swiftest accelerating category in the North American market, expanding at a CAGR of 6.5%. This progress is caused by shifting consumer preferences toward lighter, refreshing frozen desserts that align with health-conscious lifestyles and seasonal indulgence patterns. According to the Plant Based Foods Association, sales of fruit-forward frozen desserts—including strawberry, mango, raspberry, and tropical blends—grew by 12% in 2023 compared to the previous year, particularly among younger consumers seeking lower-fat alternatives to traditional chocolate and cream-based flavors. Apart from these, plant-based and non-dairy ice cream brands are increasingly launching fruit-inspired lines to cater to vegan and lactose-intolerant demographics.

By Distribution Channel Insights

Supermarkets dominated the distribution landscape of the North American ice cream market by capturing an estimated 55.5% of total retail volume in 2024. This lead position is attributed to the broad accessibility, consistent availability, and promotional strategies employed by large retail chains such as Walmart, Kroger, Costco, and Sobeys. These stores frequently feature seasonal promotions, loyalty program discounts, and in-store sampling initiatives that drive trial and repeat purchases. Retailers such as Loblaw Companies Limited have expanded their store-brand frozen dessert lines to offer cost-effective alternatives to national brands, enhancing affordability and accessibility.

Online stores are rising as the quickest advancing distribution channel in the NortAmericanca ice cream market by expanding at a CAGR of 9.2%. This accelerated growth is driven by the increasing adoption of e-commerce platforms, improved cold-chain logistics, and the rising preference for specialty and regional ice cream varieties available exclusively online. Platforms such as Amazon Fresh, Instacart, and Goldbelly have enabled consumers to access regional and gourmet ice cream varieties that may not be widely available in local stores, including small-batch and ethnic-inspired options. Apart from these, social commerce initiatives fueled by TikTok Shop and Shopify integrations have allowed independent ice cream brands to launch limited-edition flavors and track real-time customer feedback.

REGIONAL ANALYSIS

The United States held the dominant position in the North American ice cream market by capturing an estimated 69.3% of total regional consumption in 2024. This is underpinned by high per capita consumption, well-established brand presence, and a robust manufacturing ecosystem that supports both domestic and international demand. According to the International Dairy Foods Association (IDFA), ice cream remains one of the most beloved desserts in the U.S., with per capita consumption exceeding 20 pounds annually. Additionally, the rise of experiential retail and boutique ice cream parlors has reinforced consumer engagement. The U.S. also serves as a hub for innovation, with major players like Ben & Jerry’s, Halo Top, and Magnum Vegan introducing new formulations tailored to evolving dietary preferences. Canada's positioning reflects a stable consumer base, strong retail networks, and a growing emphasis on premium and plant-based frozen desserts that cater to shifting dietary preferences. Moreover, Canada’s regulatory environment is increasingly focused on nutrition transparency and sustainable packaging, prompting manufacturers to reformulate existing products and introduce eco-friendly packaging solutions.

The remaining North American countries, including Mexico and select Caribbean territories, collectively hold around 7% of the regional ice cream market in 2024. Though smaller in scale, these markets are gradually gaining traction due to cross-border brand expansions, changing consumer habits, and increasing imports of frozen desserts from the U.S. and Canada. Brands such as Dreyer’s and Blue Bell have strengthened their presence in border regions, catering to urban consumers seeking premium frozen treats. While still a minor contributor to the overall market, this segment presents long-term potential for established players seeking geographic diversification and new consumer bases beyond traditional North American markets.

LEADING PLAYERS IN THE NORTH AMERICA ICE CREAM MARKET

Unilever (Ben & Jerry’s, Magnum)

Unilever is a dominant force in the North American ice cream market through its well-known brands Ben & Jerry’s and Magnum. Known for their rich flavors and strong brand identities, these brands have carved out significant niches—Ben & Jerry’s as a socially conscious artisanal ice cream and Magnum as a premium frozen novelty. In North America, Unilever leverages innovation, sustainability messaging, and strategic partnerships to maintain relevance across diverse consumer segments. Globally, the company uses its North American success as a blueprint for expansion into emerging markets.

Nestlé USA (Häagen-Dazs, Drumstick)

Nestlé plays a pivotal role in the North America ice cream landscape with flagship brands like Häagen-Dazs and Drumstick. These products are synonymous with indulgence and quality, appealing to consumers seeking premium frozen desserts. Nestlé’s extensive distribution network ensures widespread availability across retail and foodservice channels. The company also invests heavily in product development, particularly in plant-based and low-sugar alternatives. Its influence extends beyond North America, where it exports U.S.-developed ice cream innovations to global markets, reinforcing its leadership position in the frozen dessert sector.

Blue Bell Creameries

Blue Bell Creameries stands out as one of the largest regional ice cream producers in the United States, known for its commitment to quality, traditional manufacturing methods, and deep-rooted brand loyalty. Unlike multinational corporations, Blue Bell maintains tight control over production and distribution, ensuring consistency and freshness. This approach has earned it a cult-like following, particularly in the southern U.S. While its global presence is limited compared to larger competitors, Blue Bell contributes significantly to the domestic ice-cream culture by setting benchmarks for flavor authenticity and customer engagement within the regional market.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by leading players in the North American ice cream market is continuous flavor innovation and customization. Companies are investing heavily in research and development to introduce new taste profiles inspired by global cuisines, seasonal themes, and even collaborations with confectionery brands, ensuring sustained consumer engagement and brand differentiation.

Another key approach is expanding product portfolios to include plant-based, low-sugar, and functional ice creams, responding to growing health consciousness among consumers. As dietary preferences evolve, manufacturers are reformulating existing products and launching clean-label alternatives that align with wellness trends without compromising on taste or texture.

Lastly, strengthening omnichannel distribution networks has become a priority for major players. By optimizing both physical and digital sales channels—including supermarkets, convenience stores, e-commerce platforms, and direct-to-consumer models—companies are enhancing accessibility and brand visibility while adapting to shifting consumer purchasing behaviors.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the North American ice cream market include General Mills Inc (US), Mars (US), Blue Bell Creameries (US), Wells Dairy Inc (US), Turkey Hill (US), Buskin Robbins (US), Haagen Dazs (US), and Blue Bunny (US)

The competitive landscape of the North American ice cream market is marked by a blend of global giants, regional powerhouses, and independent craft creameries vying for consumer attention in an emotionally charged and highly discretionary category. Established companies such as Unilever, Nestlé, and Blue Bell dominate due to their strong brand equity, extensive distribution networks, and consistent marketing efforts aimed at emotional and nostalgic connections with consumers. These firms frequently launch co-branded promotions, seasonal flavors, and experiential packaging to reinforce consumer loyalty.

At the same time, boutique and artisanal ice cream brands are gaining traction by focusing on locally sourced ingredients, small-batch production, and eco-conscious operations that appeal to environmentally aware and health-focused shoppers. The rise of plant-based and functional frozen desserts has further diversified competition, attracting niche startups specializing in dairy-free and nutrition-enhanced offerings.

Retailers are intensifying the rivalry by developing private-label ice cream lines that offer cost-effective alternatives to national brands. This multi-layered competition encourages continuous innovation, sustainability efforts, and digital engagement, pushing all players to evolve rapidly in response to shifting dietary trends, regulatory changes, and evolving consumer expectations.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Unilever launched a new line of sustainably packaged single-serve pints under the Ben & Jerry’s brand, targeting eco-conscious millennials and emphasizing carbon-neutral production practices to align with broader corporate sustainability goals.

- In May 2024, Nestlé announced a strategic partnership with a leading U.S. grocery delivery platform to enhance the availability of Häagen-Dazs through same-day delivery services, strengthening its presence in the fast-growing online frozen dessert segment.

- In August 2024, Blue Bell Creameries introduced a limited-edition regional flavor collaboration with a popular Southern bakery chain, reinforcing its local market dominance and fostering deeper community engagement through hyper-localized product development.

- In November 2024, a rising plant-based ice cream startup secured a national retail deal with Whole Foods, significantly boosting its brand visibility and access to health-oriented consumers seeking dairy-free frozen dessert options.

- In March 2025, a Canadian ice cream brand expanded its distribution footprint into the northeastern U.S. via a cold-chain logistics alliance, enhancing cross-border availability and positioning itself as a premium import alternative to established U.S. brands.

MARKET SEGMENTATION

This research report on the North America Ice Cream Market has been segmented and sub-segmented based on type, flavor, distribution channel, and region.

By Type

- Take-Home Ice Cream

- Artisanal Ice Cream

By Flavour

- Vanilla

- Fruit-flavored Ice Cream

By Distribution Channel

- Supermarkets

- Online Stores

By Region

- US

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. Who are the key players in the North America ice cream market?

Major players include Unilever (Ben & Jerry’s, Breyers), Nestlé (Häagen-Dazs, Dreyer’s), General Mills (Blue Bunny), Blue Bell Creameries, Tillamook, and Turkey Hill.

2. What factors drive the growth of the ice cream market in North America?

Key factors include changing consumer preferences for premium and healthier options, innovation in flavors and ingredients, and the rise of plant-based alternatives.

3. Which distribution channels are dominant in the North America ice cream market?

Ice cream is sold through supermarkets, convenience stores, specialty ice cream shops, and online delivery platforms.

4. How is the North America ice cream market expected to grow in the future?

The market is expected to grow due to increasing demand for premium and plant-based products, along with innovation in flavors and packaging.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com