North America Hydroxypropyl Methylcellulose (HPMC) Market Size, Share, Trends & Growth Forecast Report By Application (Construction [Cement Mortar, Plasters, Refractory Materials, Paints, Gypsum Concrete Slurry, Fiber Wall, Others], Pharmaceuticals, Food, Cosmetics and Personal Care, Others), and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Hydroxypropyl Methylcellulose (HPMC) Market Size

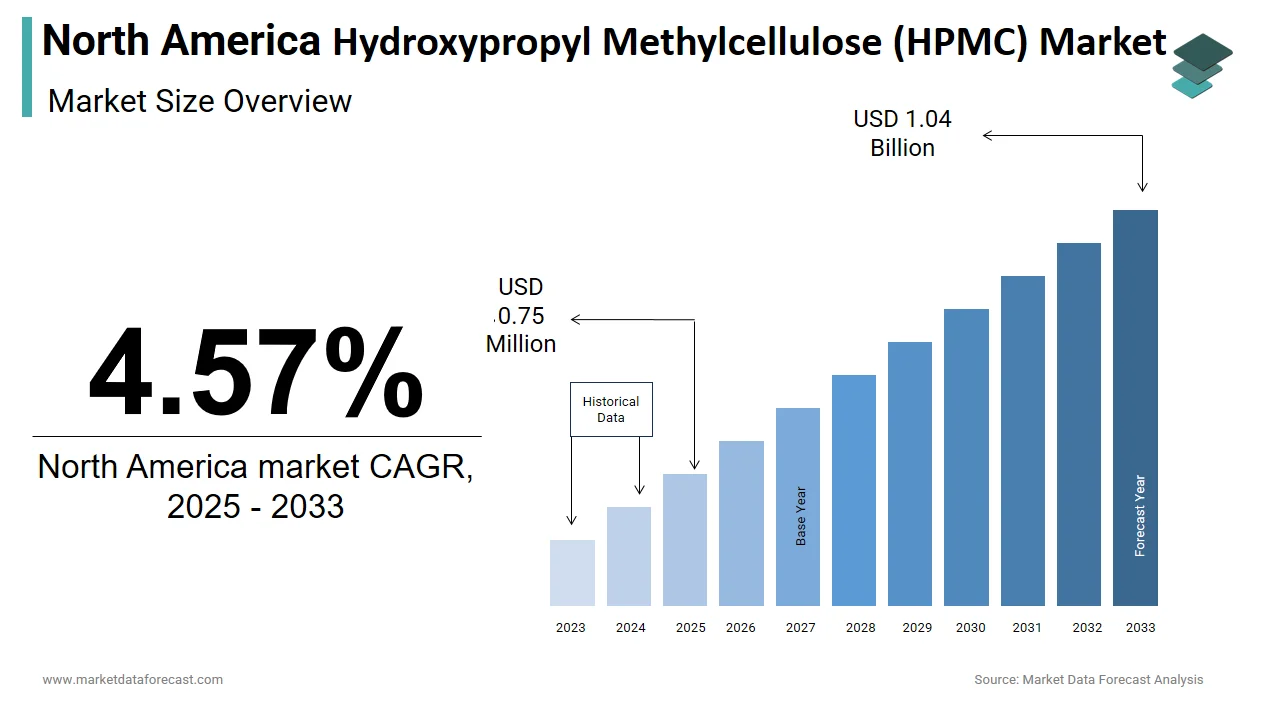

The North America hydroxypropyl methylcellulose (HPMC) market was valued at USD 0.72 billion in 2024 and is anticipated to reach USD 0.75 billion in 2025 from USD 1.04 billion by 2033, growing at a CAGR of 4.57% during the forecast period from 2025 to 2033.

The North America hydroxypropyl methylcellulose (HPMC) market is an important component of various industries, including construction, pharmaceuticals, food, and cosmetics. This growth is fueled by urbanization trends, increasing investments in infrastructure development, and rising demand for sustainable materials. Canada follows as the second-largest contributor, bolstered by its robust forestry sector and emphasis on eco-friendly construction practices. Regulatory support for sustainable materials has also strengthened market conditions. Additionally, advancements in biopolymer technologies have improved product performance by enhancing their appeal across diverse applications.

MARKET DRIVERS

Growing Demand in Construction Applications

Construction applications are a primary driver of the North America HPMC market. The surge in housing starts is driven by population growth and urbanization, has significantly increased the need for HPMC in cement mortars, tile adhesives, and plastering solutions. For instance, single-family home construction grew by 12% in 2022 by creating a robust pipeline for HPMC manufacturers. HPMC’s ability to enhance water retention, workability, and bonding strength makes it indispensable in modern construction practices. Furthermore, government initiatives like huge investments in infrastructure projects are likely to promote the growth of the market.

Rising Adoption in Pharmaceuticals

The pharmaceutical segment is another major driver, with HPMC widely used as a binder, thickener, and film-coating agent in drug formulations. HPMC’s biocompatibility and controlled-release properties make it ideal for applications in extended-release medications and nutraceuticals. Additionally, corporate commitments to sustainability, such as reducing plastic usage in packaging, have driven the adoption of plant-based HPMC in pharmaceutical coatings.

MARKET RESTRAINTS

Fluctuating Raw Material Costs

One of the primary restraints in the North America HPMC market is the volatility of raw material costs, particularly cellulose derivatives derived from wood pulp. According to the U.S. Department of Agriculture, the price of wood pulp increased by 15% in 2022 due to supply chain disruptions and rising transportation expenses. This cost pressure is often passed on to end-users, limiting the material's adoption in price-sensitive applications. Additionally, the reliance on imported raw materials, particularly from Asia, creates uncertainties, as trade restrictions and logistical bottlenecks further exacerbate pricing challenges. As per a study by the Forest Products Laboratory, raw material imports account for nearly 30% of production expenses, with the potential risks of reduced availability.

Stringent Environmental Regulations

Environmental regulations present a major challenge, especially regarding emissions during the manufacturing process. The U.S. Environmental Protection Agency enforces strict limits on volatile organic compound (VOC) emissions, requiring manufacturers to invest in advanced filtration systems. According to the National Pollution Prevention Roundtable, the cost of compliance with these regulations can raise operational expenses by up to 15%. Moreover, the disposal of by-products generated during HPMC synthesis requires adherence to hazardous waste management protocols, further raising costs. These regulatory hurdles not only impact profitability but also delay project timelines, as companies must secure necessary permits.

MARKET OPPORTUNITIES

Expansion in Sustainable Construction Practices

Sustainability presents a lucrative opportunity for the North America HPMC market, particularly in regions adopting green building standards. Manufacturers are increasingly focusing on developing products with higher renewable content, such as plant-based cellulose derivatives. This aligns with regulatory incentives, like tax credits for sustainable construction, which have further encouraged adoption. HPMC-based solutions with enhanced thermal stability and bonding strength are gaining traction in green buildings, which is driving innovation in product design.

Advancements in Controlled-Release Drug Formulations

Controlled-release drug formulations are another promising avenue, with HPMC playing a pivotal role in pharmaceutical innovations. HPMC is widely used in extended-release tablets and capsules due to its ability to control drug release rates and improve patient compliance. Additionally, its compatibility with active pharmaceutical ingredients (APIs) makes it ideal for meeting stringent safety regulations in modern applications. Collaborations between manufacturers and research institutions have accelerated innovation by creating opportunities for suppliers to diversify their product portfolios and tap into emerging markets.

MARKET CHALLENGES

Competition from Alternative Excipients

The HPMC market faces stiff competition from alternative excipients, such as starch and gelatin, which offer similar functionalities at competitive prices. This rivalry intensifies in regions where cost-effectiveness is prioritized over performance by limiting HPMC’s market share. Additionally, advancements in synthetic polymers, such as polyvinyl alcohol (PVA), have further eroded HPMC’s dominance in certain applications.

Supply Chain Disruptions

Supply chain disruptions have emerged as a critical challenge, exacerbated by geopolitical tensions and logistical bottlenecks. The reliance on global suppliers for raw materials, such as cellulose derivatives, further complicates the situation. For instance, trade restrictions imposed during the pandemic led to shortages are forcing manufacturers to seek alternative sources at higher costs. These disruptions not only affect production schedules but also strain customer relationships in time-sensitive industries like pharmaceuticals and construction.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Application, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico, and the Rest of North America. |

|

Market Leaders Profiled |

Ashland, Shin-Etsu Chemical Co., Ltd., Chemcolloid Limited, Zhejiang Haishen New Materials Limited, DuPont de Nemours, Inc., CP Kelco U.S., Inc., Celotech Chemicals Co., Ltd., Hebei Yibang Building Materials Co., Ltd., Changzhou Guoyu Environmental S&T Co., Ltd., and others. |

SEGMENTAL ANALYSIS

By Application Insights

The construction segment was the largest and held North America HPMC market with 45.5% of share in 2024 with its versatility and cost-effectiveness by making it suitable for a wide range of applications, including cement mortars, tile adhesives, and plastering solutions. The affordability of HPMC-based solutions, coupled with their ability to enhance water retention and bonding strength, has driven their adoption in large-scale construction projects. Additionally, government investments in infrastructure projects, such as road construction and bridge maintenance, will further boost the growth of the segment.

The pharmaceuticals segment is likely to witness a CAGR of 7.8% in the coming years. The growth of the segment is fueled by the increasing demand for controlled-release drug formulations due to advancements in drug delivery technologies. The aging population and rising healthcare expenditures have driven adoption in chronic disease management. HPMC is widely used in these applications due to its ability to control drug release rates and improve patient compliance.

COUNTRY LEVEL ANALYSIS

The United States HPMC market accounted in holding 75.8% of the share in 2024, with the country’s robust industrial base, coupled with advancements in construction, pharmaceuticals, and food industries. The infrastructure spending is growing exponentially, which is creating a surge in demand for HPMC-based solutions in cement mortars, tile adhesives, and plastering applications. Additionally, the aging population and rising healthcare expenditures have amplified demand for HPMC in pharmaceutical formulations in controlled-release medications. Government incentives, such as tax credits for sustainable materials under the Inflation Reduction Act of 2022, have further bolstered adoption.

Canada held 20.6% of the North America HPMC market share in 2024 by leveraging its strong forestry sector and commitment to eco-friendly construction practices. According to Natural Resources Canada, the country produces over 10% of the world’s wood-based cellulose derivatives by ensuring a stable supply chain for manufacturers. The Canadian government’s push for sustainable infrastructure has also bolstered demand. For example, the Green Infrastructure Fund, established in 2021, supports projects that incorporate renewable materials, including HPMC-based solutions. Furthermore, the country’s expertise in cold-weather construction has made HPMC a preferred choice for projects in northern regions, where its thermal stability and durability are highly valued. Canada’s focus on prefabricated construction has also created opportunities for HPMC in modular building solutions.

KEY MARKET PLAYERS

A few of the notable companies operating in the North America hydroxypropyl methylcellulose (HPMC) market profiled in this report are Ashland, Shin-Etsu Chemical Co., Ltd., Chemcolloid Limited, Zhejiang Haishen New Materials Limited, DuPont de Nemours, Inc., CP Kelco U.S., Inc., Celotech Chemicals Co., Ltd., Hebei Yibang Building Materials Co., Ltd., Changzhou Guoyu Environmental S&T Co., Ltd., and others.

TOP LEADING PLAYERS IN THE MARKET

Dow Inc.

Dow is a global leader in the HPMC market, renowned for its innovative products and commitment to sustainability. Headquartered in Midland, Michigan, the company has established itself as a pioneer in developing eco-friendly HPMC solutions, including plant-based cellulose derivatives. Dow’s state-of-the-art manufacturing facilities enable it to produce high-quality products tailored to specific project requirements, from pharmaceutical formulations for Pfizer to construction solutions for infrastructure projects. The company’s strategic partnerships with tech companies underscore its ability to meet the demands of high-performance projects. For instance, Dow partnered with Pfizer in 2024 to supply HPMC for its controlled-release drug formulations iss reinforcing its role in cutting-edge industrial applications. Its focus on reducing carbon footprints aligns with global sustainability goals by making it a preferred partner for architects and developers.

Ashland Global Holdings Inc.

Ashland is a key player in the engineered biopolymer market, holding a significant share of the HPMC segment. With a strong presence across North America, the company leverages its extensive distribution network to cater to diverse industries, including pharmaceuticals, food, and cosmetics.. The company’s recent investment in expanding its production facilities in Ohio highlights its commitment to meeting the growing demand for sustainable bonding solutions. Additionally, Ashland’s emphasis on research and development ensures continuous innovation by enabling it to stay ahead of competitors in a rapidly evolving market.

Shin-Etsu Chemical Co., Ltd.

Shin-Etsu specializes in premium HPMC solutions, catering to niche markets that prioritize performance and environmental sustainability. Based in Tokyo, Japan, the company has carved a niche for itself by offering bespoke products tailored to the unique needs of architects and builders. Its bio-based HPMC derivatives are widely used in pharmaceuticals, food, and construction due to their ability to create durable bonds while maintaining flexibility. Shin-Etsu’s focus on quality and craftsmanship has earned it a loyal customer base, particularly in regions with stringent sustainability requirements.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the North America HPMC market employ a range of strategies to maintain their competitive edge and capitalize on emerging opportunities. Strategic partnerships and collaborations form the foundation of these efforts. For instance, Dow’s partnership with Pfizer in 2024 to supply HPMC for its controlled-release drug formulations not only enhanced its brand visibility but also positioned it as a leader in sustainable industrial materials. Investments in production capacity and R&D are another critical strategy. Similarly, Shin-Etsu’s launch of bio-based HPMC reflects its focus on innovation and addressing market pain points.

COMPETITION OVERVIEW

The North America HPMC market is highly competitive, with established players like Dow, Ashland, and Shin-Etsu driving the competition. These companies compete for market share through product differentiation, pricing strategies, and technological innovations. The market’s competitive dynamics are further intensified by the entry of new players and the growing availability of alternative excipients like starch and gelatin. To counteract this, leading players focus on enhancing product quality and performance, often tailoring their offerings to meet the specific needs of high-growth sectors such as pharmaceuticals, construction, and food. Regulatory pressures and environmental concerns also play a pivotal role by compelling companies to adopt sustainable practices and develop eco-friendly solutions.

RECENT MARKET DEVELOPMENTS

- In April 2024, Dow partnered with Pfizer to supply HPMC for its controlled-release drug formulations by reinforcing its position as a leader in sustainable industrial materials.

- In June 2023, Ashland expanded its production facility in Ohio, increasing capacity by 25% to meet rising demand for HPMC in pharmaceutical and construction applications.

- In September 2022, Dow acquired a Canadian manufacturer to strengthen its supply chain and diversify its product offerings by ensuring timely delivery for large-scale projects.

- In March 2022, Ashland invested $30 million in R&D for sustainable HPMC solutions by aligning its products with global sustainability goals and regulatory requirements.

MARKET SEGMENTATION

This research report on the North America hydroxypropyl methylcellulose (HPMC) market is segmented and sub-segmented into the following categories.

By Application

- Construction

- Cement Mortar

- Plasters

- Refractory Materials

- Paints

- Gypsum Concrete Slurry

- Fiber Wall

- Others

- Pharmaceuticals

- Food

- Cosmetics and Personal Care

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What are the main applications of hydroxypropyl methylcellulose in North America?

HPMC is widely used in construction (for cement mortars, tile adhesives, and plasters), pharmaceuticals (as a tablet binder and controlled-release agent), food (as a stabilizer and thickener), and personal care products

2. What factors are driving market growth in this region?

Growth is driven by robust construction activity, increasing demand for sustainable building materials, expanding pharmaceutical and food industries, and advancements in biopolymer technologies

3. What challenges does the HPMC market face in North America?

The market faces challenges such as competition from alternative materials, regulatory hurdles in pharmaceuticals and food applications, and price volatility of raw materials

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]