North America Hydrophobic Coatings Market Size, Share, Trends & Growth Forecast Report By Type (PCE, SNF, SMF, MLS, Others), Application, Form and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Hydrophobic Coatings Market Size

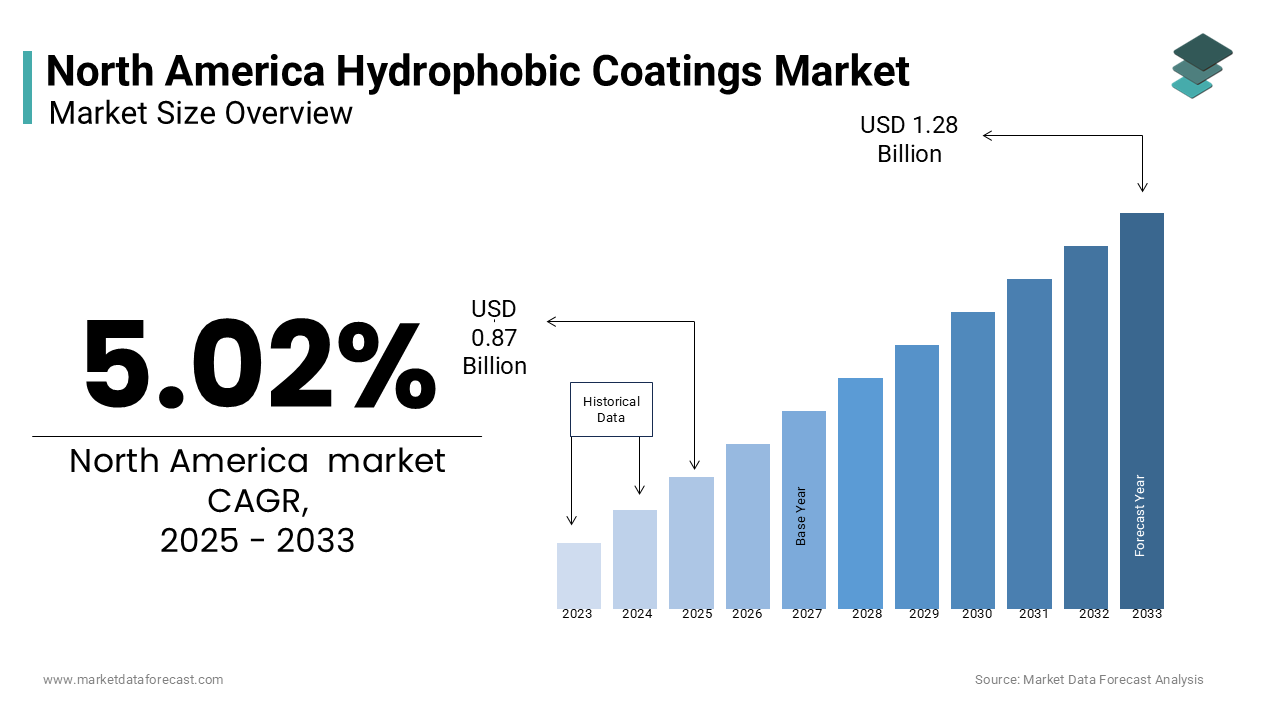

The North America Hydrophobic Coatings Market was worth USD 0.82 billion in 2024. The North America market is expected to reach USD 1.28 billion by 2033 from USD 0.87 billion in 2025, rising at a CAGR of 5.02% from 2025 to 2033.

MARKET DRIVERS

Rising Demand in Automotive Applications

One of the primary drivers of the North America hydrophobic coatings market is the growing adoption in the automotive sector. These coatings are used to enhance vehicle durability by providing water-repellent and anti-corrosion properties, which improve safety and aesthetics. According to the National Highway Traffic Safety Administration (NHTSA), only 58% of drivers completed their vehicle recall repairs in 2022 were linked to issues caused by moisture or corrosion, underscoring the need for advanced protective solutions. Hydrophobic coatings mitigate these problems by creating a barrier against environmental elements. Furthermore, electric vehicles (EVs) are driving demand, as they require specialized coatings to protect sensitive components. Also, EV sales in North America grew significantly in recent years, creating a lucrative avenue for hydrophobic coatings.

Increasing Adoption in Electronics

Another critical driver is the rising use of hydrophobic coatings in the electronics industry, where they protect devices from moisture damage and enhance performance. Hydrophobic coatings are particularly valuable for smartphones, wearables, and IoT devices, which are exposed to varying environmental conditions. Additionally, the proliferation of 5G technology has increased demand for coatings that prevent signal interference caused by moisture.

MARKET RESTRAINTS

High Production Costs

A significant restraint impacting the North America hydrophobic coatings market is the high cost of production, primarily due to the use of advanced materials and technologies. Like, the raw materials required for hydrophobic coatings, such as fluoropolymers and nanoparticles, are expensive and subject to price volatility. This increases the overall cost of coatings, making them less accessible for small and medium-sized enterprises (SMEs). For instance, only a small portion of SMEs in the manufacturing sector can afford premium coatings, limiting their adoption. Furthermore, the complexity of application processes, which often require specialized equipment and expertise, adds to the financial burden. These cost-related challenges hinder widespread implementation, particularly in price-sensitive industries like construction and textiles.

Regulatory Hurdles

Another critical restraint is the stringent regulatory framework governing chemical usage, which poses challenges for hydrophobic coatings manufacturers. According to the Environmental Protection Agency (EPA), certain chemicals used in these coatings, such as perfluorinated compounds (PFCs), are classified as hazardous due to their environmental and health impacts. This has led to bans and restrictions in several states, including California and New York. Manufacturers must invest heavily in research and development to develop alternative formulations that comply with regulations, increasing operational costs. Moreover, the lack of standardized testing protocols for eco-friendly coatings creates uncertainty, delaying product approvals. These regulatory hurdles not only increase compliance burdens but also slow down market growth, particularly for smaller players.

MARKET OPPORTUNITIES

Expansion into Healthcare Applications

A promising opportunity for the North America hydrophobic coatings market lies in their increasing adoption in the healthcare sector, where they enhance the durability and hygiene of medical devices. According to the Centers for Disease Control and Prevention (CDC), hospital-acquired infections (HAIs) affect approximately 1.7 million patients annually in the U.S., underscoring the need for antimicrobial solutions. Hydrophobic coatings, with their ability to repel liquids and reduce bacterial adhesion, are becoming integral to medical equipment such as catheters, surgical instruments, and diagnostic tools. For example, Johnson & Johnson introduced hydrophobic-coated catheters, resulting in a reduction in infection rates. Additionally, the aging population and rising healthcare expenditures are driving demand for advanced medical technologies, further boosting the market for hydrophobic coatings.

Growth in Renewable Energy Sector

A different significant opportunity is the growing application of hydrophobic coatings in the renewable energy sector, particularly in solar panels and wind turbines. Like, renewable energy accounted for a major share of total electricity generation in recent years, with solar and wind energy leading the expansion. Hydrophobic coatings are used to prevent dust, dirt, and moisture accumulation on solar panels, improving efficiency. Similarly, wind turbine blades coated with hydrophobic materials experience reduced ice buildup, enhancing performance during winter months. Companies like Siemens Gamesa have adopted these coatings to optimize energy output, signaling a shift toward sustainable solutions. These developments position the renewable energy sector as a key growth avenue for hydrophobic coating.

MARKET OPPORTUNITIES

Limited Awareness Among End-Users

One of the foremost challenges facing the North America hydrophobic coatings market is the limited awareness among end-users about their benefits and applications. Many industries, particularly small-scale manufacturers, remain unfamiliar with the advantages of hydrophobic coatings, such as improved durability and reduced maintenance costs. Similarly, only a small percentage of SMEs in North America are aware of advanced coating technologies, with even fewer actively adopting them. This lack of awareness is compounded by insufficient marketing efforts from manufacturers, who often focus on larger clients. Besides, misconceptions about the complexity of application processes deter potential users, despite advancements that have simplified these procedures.

Environmental Concerns and Sustainability Issues

A pressing challenge is the environmental impact of certain hydrophobic coatings, which raises concerns among consumers and regulators alike. According to the Environmental Working Group (EWG), some coatings contain toxic substances, such as PFCs, which persist in the environment and pose health risks. This has led to increased scrutiny and calls for more sustainable alternatives. While manufacturers are investing in eco-friendly formulations, the transition is slow and costly. Moreover, the perception of hydrophobic coatings as environmentally harmful undermines their adoption, even when safer options are available.

SEGMENTAL ANALYSIS

By Property Insights

The anti-corrosion hydrophobic coatings segment dominated the North America market by accounting for 35.6% of the total share in 2024. This segment’s leading position is supported by its widespread application in industries such as automotive, aerospace, and construction, where protection against moisture and environmental damage is critical. Like, corrosion-related damages substantial cost the U.S. economy annually, noting the urgent need for effective solutions. Anti-corrosion coatings mitigate these losses by creating a protective barrier on metal surfaces, extending the lifespan of structures and equipment. For example, Boeing implemented anti-corrosion hydrophobic coatings in its aircraft manufacturing process, reducing maintenance costs. Apart from these, infrastructure projects like bridges and pipelines rely heavily on these coatings to combat harsh weather conditions. The growing emphasis on sustainability has also spurred demand, as these coatings reduce material waste by preventing structural degradation.

On the other hand, the anti-microbial hydrophobic coatings are the fastest-growing segment, with a CAGR of 9.2% from 2025 to 2033. This growth is fueled by their increasing adoption in healthcare and food processing industries, where hygiene and safety are paramount. Data from the Centers for Disease Control and Prevention (CDC) reveals that hospital-acquired infections (HAIs) affect over 1.7 million patients annually in the U.S., driving demand for advanced protective solutions. For instance, Medtronic integrated anti-microbial coatings into its medical devices, resulting in a reduction in infection rates. Another key factor is the rise of antimicrobial resistance, which has prompted regulatory bodies to mandate stricter hygiene standards. In addition, the food industry is adopting these coatings to prevent bacterial contamination on surfaces, with companies like Tyson Foods achieving an improvement in food safety compliance.

REGIONAL ANALYSIS

The United States held the largest share of the North America hydrophobic coatings market by commanding 75.6% of the total market in 2024. The country’s dominance is due to its robust industrial base and technological advancements, particularly in sectors like automotive, aerospace, and healthcare. Also, the automotive industry alone accounts for a major share of hydrophobic coatings demand, driven by the need for water-repellent and anti-corrosion solutions. Companies like Tesla and General Motors have adopted these coatings to enhance vehicle durability and performance. Furthermore, the aging infrastructure in the U.S. has increased demand for anti-corrosion coatings. Innovations in nanotechnology have also bolstered growth, enabling manufacturers to develop eco-friendly formulations that comply with stringent regulations.

Canada represents the second-largest market for hydrophobic coatings. The country’s rise is propelled by its focus on renewable energy and sustainable practices, particularly in the wind and solar sectors. For instance, Siemens Gamesa utilized these coatings on wind turbine blades to reduce ice buildup, enhancing performance during winter months. Additionally, Canada’s stringent environmental regulations have encouraged the adoption of eco-friendly coatings, with companies like BASF investing in sustainable alternatives. The construction industry also contributes significantly, as hydrophobic coatings protect buildings from harsh weather conditions.

Mexico is emerging as a dynamic player in the North America hydrophobic coatings market. The nation’s rapid industrialization and expanding automotive sector are key drivers. Additionally, the rise of maquiladoras (manufacturing hubs) has increased demand for coatings that enhance product durability. The government’s investments in infrastructure development have further amplified demand, with hydrophobic coatings used to protect roads and bridges from environmental damage.

The Rest of North America holds a modest share but is witnessing steady growth due to tourism and disaster resilience initiatives. In addition, these coatings are widely used in disaster-prone areas to protect buildings from water damage during hurricanes and floods. The region’s focus on sustainability has also spurred demand, with local governments promoting eco-friendly solutions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

3M Company, AkzoNobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, NANOPROTECH, NEI Corporation, BASF SE, Covestro AG, SC Johnson Professional, and HZO, Inc. are some of the key market players in the North America hydrophobic coatings market.

The North America hydrophobic coatings market is highly competitive, characterized by the presence of global giants and regional players striving to innovate and capture market share. Companies like PPG Industries, 3M, and AkzoNobel dominate the landscape through their emphasis on sustainability, technological advancements, and strategic collaborations. The competition is intensified by the growing demand for eco-friendly solutions, prompting firms to invest heavily in R&D and recycling technologies. Smaller players are adopting niche strategies, targeting sectors like healthcare and renewable energy, to compete effectively. Regulatory pressures and environmental concerns further shape the competitive dynamics, pushing companies to adopt sustainable practices.

Top Players in the North America Hydrophobic Coatings Market

PPG Industries

PPG Industries is a prominent player in the North America hydrophobic coatings market, known for its innovative solutions tailored to diverse industries like automotive, aerospace, and construction. The company has consistently invested in research and development to introduce eco-friendly and high-performance coatings. Apart from these, the company collaborated with Boeing to integrate advanced coatings into aircraft manufacturing, enhancing fuel efficiency and reducing maintenance costs. These initiatives note PPG’s commitment to innovation and sustainability, solidifying its leadership in the market.

3M Company

3M Company is a global leader in advanced materials, with a strong presence in the hydrophobic coatings segment. The company leverages its expertise in nanotechnology to develop coatings with superior water-repellent and anti-microbial properties. The company also partnered with healthcare providers to supply anti-microbial coatings for medical devices, aligning with rising hygiene standards. Furthermore, 3M’s focus on sustainable practices has led to the development of bio-based formulations, catering to environmentally conscious consumers.

AkzoNobel N.V.

AkzoNobel N.V. is renowned for its premium coatings that cater to industrial and architectural applications. The company has made significant contributions to the North American market by promoting sustainable solutions and circular economy principles. The company also launched a recycling initiative to reuse raw materials from old coatings, reducing environmental impact. Additionally, AkzoNobel collaborated with automotive manufacturers to develop lightweight coatings that enhance vehicle performance.

Major Strategies Used by Key Players in the North America Hydrophobic Coatings Market

Key players in the North America hydrophobic coatings market have adopted several strategies to maintain their competitive edge. A primary focus has been on sustainability, with companies investing in eco-friendly formulations and recyclable materials. Strategic collaborations with end-users, such as automakers and healthcare providers, have enabled firms to tailor solutions to specific needs. Also, players are emphasizing technological advancements, such as integrating nanotechnology to enhance coating performance. Expanding production capacities and launching innovative products, like self-cleaning and anti-microbial coatings, have further strengthened their market positions.

RECENT MARKET DEVELOPMENTS

- In April 2023, PPG Industries launched a new line of anti-corrosion hydrophobic coatings for marine applications, enhancing durability and reducing maintenance costs for ships and offshore structures.

- In June 2023, 3M Company introduced self-cleaning hydrophobic coatings for solar panels, improving energy efficiency by reducing dust accumulation and boosting output by up to 15%.

- In August 2023, AkzoNobel N.V. expanded its anti-icing hydrophobic coatings portfolio for wind turbines, addressing challenges posed by harsh weather conditions and increasing operational efficiency.

- In October 2023, PPG Industries collaborated with Boeing to integrate advanced hydrophobic coatings into aircraft manufacturing, reducing drag and improving fuel efficiency for commercial airliners.

- In December 2023, 3M partnered with healthcare providers to supply anti-microbial hydrophobic coatings for medical devices, addressing rising hygiene standards and reducing hospital-acquired infections.

MARKET SEGMENTATION

This research report on the North America hydrophobic coatings market is segmented and sub-segmented into the following categories.

By Property

- Anti-microbial

- Anti-icing/wetting

- Anti-fouling

- Anti-corrosion

- Self-cleaning

- Others

By Country

- The United States

- Canada

- Rest of North America

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]