North America HVAC System Market Size, Share, Trends & Growth Forecast Report Segmented By Product Type (Cooling Equipment, Ventilation Equipment) And By Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North American HVAC System Market Report

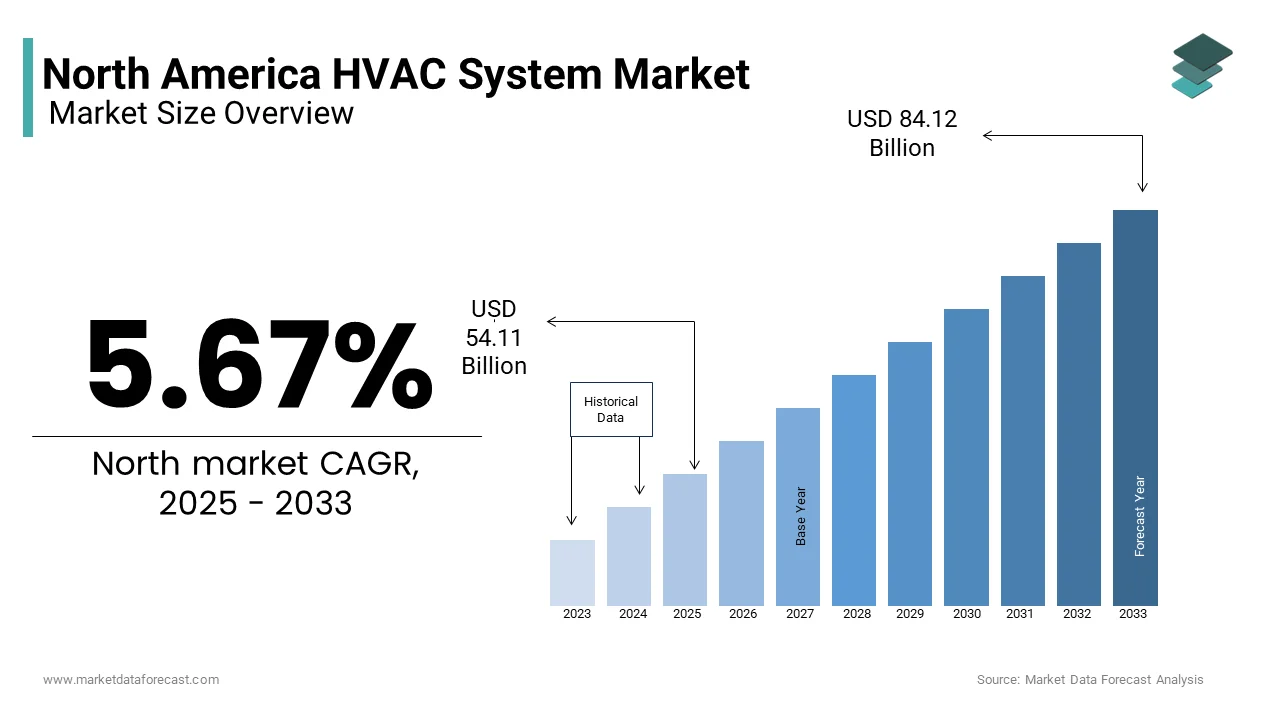

The North America HVAC system market was valued at USD 51.21 billion in 2024 and is anticipated to reach USD 54.11 billion in 2025 from USD 84.12 billion by 2033, growing at a CAGR of 5.67% during the forecast period from 2025 to 2033.

The North American HVAC (Heating, Ventilation, and Air Conditioning) system is a diverse range of products, including heating systems, air conditioning units, and ventilation solutions, which are essential for both residential and commercial applications. The increasing focus on energy efficiency and sustainability has propelled the adoption of advanced HVAC technologies, as consumers and businesses alike seek to reduce their carbon footprints and operational costs. This growth is driven by factors such as urbanization, rising disposable incomes, and stringent regulatory standards aimed at improving energy efficiency. Furthermore, the ongoing trend towards smart home technologies is reshaping consumer expectations by leading to a surge in demand for integrated HVAC solutions that offer enhanced control and automation.

MARKET DRIVERS

Energy Efficiency and Sustainability

The demand for HVAC systems in North America is significantly influenced by the increasing emphasis on energy efficiency and sustainability. Both consumers and businesses are prioritizing HVAC solutions that not only provide comfort but also minimize energy consumption as energy costs continue to rise. According to the U.S. Department of Energy, heating and cooling account for nearly 50% of the energy use in a typical American home due to the importance of efficient HVAC systems.

The implementation of energy-efficient technologies, such as variable refrigerant flow (VRF) systems and high-efficiency furnaces, has gained traction. Additionally, government incentives and rebates for energy-efficient upgrades are further stimulating demand. The push for sustainability is also reflected in the growing popularity of renewable energy sources, such as solar-powered HVAC systems, which are becoming increasingly viable options for consumers. As per the Environmental Protection Agency, the adoption of energy-efficient HVAC systems can lead to energy savings of up to 30% by making them an attractive choice for environmentally conscious consumers.

Technological Advancements and Smart HVAC Solutions

The North American HVAC system market is also experiencing a surge in demand for smart technologies. The integration of Internet of Things (IoT) devices and smart home systems is transforming the HVAC landscape, allowing for enhanced control and efficiency. This growth is driven by consumer demand for convenience, energy savings, and improved indoor air quality. Smart HVAC systems enable users to monitor and control their heating and cooling remotely, optimizing energy usage and reducing costs. Furthermore, the integration of artificial intelligence and machine learning into HVAC systems is paving the way for predictive maintenance and real-time performance monitoring, which can significantly enhance system efficiency and longevity. The demand for smart HVAC solutions that align with sustainability goals is expected to rise is creating a lucrative opportunity for manufacturers and service providers in the market.

MARKET RESTRAINTS

High Initial Costs of Advanced Technologies

The North American HVAC system market faces significant challenges due to the high initial costs associated with advanced HVAC technologies. While energy-efficient systems can lead to long-term savings, the upfront investment often deters consumers in economically constrained environments. According to a report by the American Society of Heating, Refrigerating and Air-Conditioning Engineers, the average cost of installing a new HVAC system can range from $5,000 to $10,000, depending on the complexity and efficiency of the system.

This financial barrier is particularly pronounced in the residential sector, where many homeowners may opt for less efficient, lower-cost alternatives. Furthermore, the market is also impacted by the fluctuating prices of raw materials, which can lead to increased costs for manufacturers and, consequently, consumers. The ongoing supply chain disruptions exacerbated by global events have further complicated the situation is leading to delays and increased costs.

Skilled Labor Shortages

The North American HVAC system market is also constrained by the challenge of skilled labor shortages. The installation and maintenance of HVAC systems require specialized knowledge and expertise, which is increasingly difficult to find in the current labor market. According to the Bureau of Labor Statistics, the HVAC technician workforce is projected to grow by 5% from 2021 to 2031, which is slower than the average for all occupations. This shortage of skilled labor can lead to delays in project completion and increased labor costs by affecting the overall market growth. Additionally, the lack of training programs and educational initiatives aimed at attracting new talent into the HVAC field further exacerbates this issue. The industry must address this labor gap to ensure that there are enough qualified technicians to meet the needs of consumers and businesses as the demand for advanced HVAC technologies continues to rise. The National Association of Home Builders has emphasized the importance of investing in training and apprenticeship programs to cultivate a new generation of skilled HVAC professionals, which is essential for sustaining market growth in the long term.

MARKET OPPORTUNITIES

Smart Technology Integration

The North American HVAC system market presents significant opportunities for growth in the realm of smart technology integration. The increasing adoption of Internet of Things (IoT) devices and smart home systems is transforming the HVAC landscape, allowing for enhanced control and efficiency. This growth is driven by consumer demand for convenience, energy savings, and improved indoor air quality. Smart HVAC systems enable users to monitor and control their heating and cooling remotely by optimizing energy usage and reducing costs. Furthermore, the integration of artificial intelligence and machine learning into HVAC systems is paving the way for predictive maintenance and real-time performance monitoring, which can significantly enhance system efficiency and longevity. The demand for smart HVAC solutions that align with sustainability goals is expected to rise by creating a lucrative opportunity for manufacturers and service providers in the market.

Focus on Indoor Air Quality (IAQ)

Another promising opportunity within the North American HVAC system market lies in the growing emphasis on indoor air quality (IAQ). The COVID-19 pandemic has heightened awareness of the importance of clean air in residential and commercial spaces by leading to increased demand for HVAC systems equipped with advanced filtration and purification technologies. According to the American Society of Heating, Refrigerating and Air-Conditioning Engineers, improving IAQ can lead to significant health benefits, including reduced respiratory issues and improved overall well-being.

The growing consumer concerns about airborne pathogens and pollutants is also to enhance the growth of the market. Additionally, regulatory bodies are increasingly mandating stricter IAQ standards that is propelling the demand for HVAC systems that can effectively filter and purify indoor air. Manufacturers are responding by developing innovative solutions, such as UV-C light systems and high-efficiency particulate air (HEPA) filters, which are becoming essential components of modern HVAC installations. This focus on IAQ not only enhances the value proposition of HVAC systems but also aligns with broader public health initiatives by creating a robust opportunity for market expansion.

MARKET CHALLENGES

Rapid Technological Advancements

The North American HVAC system market is confronted with the challenge of rapid technological advancements, which can create a knowledge gap among consumers and industry professionals. There is a risk that consumers may struggle to understand the benefits and functionalities of these innovations as new technologies emerge, such as variable refrigerant flow systems and smart thermostats. According to a survey conducted by the Air Conditioning Contractors of America, nearly 60% of homeowners reported feeling overwhelmed by the variety of HVAC options available, which can lead to indecision and delayed purchasing.

This challenge is compounded by the fact that many HVAC contractors may not be fully trained in the latest technologies by resulting in inconsistent service quality and customer satisfaction. To address this issue, industry stakeholders must prioritize education and outreach efforts to inform consumers about the advantages of modern HVAC systems. The accessible information and training programs for contractors with the industry can bridge the knowledge gap and facilitate the adoption of advanced technologies, ultimately driving market growth.

Regulatory Compliance

The North American HVAC system market also faces the challenge of regulatory compliance, particularly as governments implement stricter energy efficiency standards. The U.S. Department of Energy has established regulations that require HVAC systems to meet specific efficiency ratings, which can pose challenges for manufacturers and consumers alike. According to the Energy Information Administration, approximately 30% of existing HVAC systems do not meet current efficiency standards with costly upgrades for homeowners and businesses.

This regulatory landscape can create uncertainty for manufacturers, as they must continuously adapt their products to comply with evolving standards. Additionally, the costs associated with upgrading or replacing non-compliant systems can deter consumers from investing in new technologies. As the market shifts towards more stringent regulations, manufacturers must navigate these challenges while also educating consumers about the benefits of compliance. The HVAC market can work towards achieving a balance between compliance and innovation by ensuring sustainable growth in the face of regulatory pressures.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.67% |

|

Segments Covered |

By Product Type By Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

United States, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

AAON Inc. (U.S.), Carrier Corporation (U.S.), Midea Group Co. Ltd., Lennox International Inc. (U.S.), SAMSUNG (South Korea), DAIKIN INDUSTRIES, Ltd. (Japan), Trane (Ireland), Johnson Controls (Ireland), LG Electronics (South Korea), Mitsubishi Electric Corporation (Japan). |

SEGMENTAL ANALYSIS

By Product Type insights

The cooling equipment segment was the largest and held 45.5% of the North American HVAC system market share in 2024. This dominance can be attributed to the increasing demand for air conditioning systems, particularly in regions with extreme summer temperatures. According to the U.S. Energy Information Administration, about 90% of American homes are equipped with air conditioning due to increasing importance of cooling systems in residential comfort.

The growing trend of urbanization and the expansion of commercial spaces further drive the demand for cooling solutions, as businesses seek to provide comfortable environments for employees and customers. Additionally, advancements in cooling technologies, such as inverter-driven systems and eco-friendly refrigerants, are enhancing the efficiency and appeal of modern air conditioning units. The shift towards energy-efficient cooling solutions is expected to continue as consumers become more environmentally conscious.

The ventilation equipment segment is anticipated to experience a CAGR of 7.4% during the forecast period. This growth is primarily driven by the increasing awareness of indoor air quality and the need for effective ventilation solutions in both residential and commercial settings. The COVID-19 pandemic has significantly heightened concerns about airborne pathogens and pollutant by prompting consumers and businesses to prioritize ventilation systems that enhance air circulation and filtration.

According to the American Society of Heating, Refrigerating and Air-Conditioning Engineers, proper ventilation can reduce the concentration of indoor contaminants by up to 80% by making it a critical component of modern HVAC systems. Furthermore, regulatory initiatives aimed at improving indoor air quality standards are further propelling the demand for advanced ventilation solutions.

COUNTRY ANALYSIS

The United States HVAC system was the top performer with 75.5% of share in 2024. The U.S. market is characterized by a robust demand for HVAC systems driven by factors such as urbanization, population growth, and a strong emphasis on energy efficiency. According to the U.S. Census Bureau, the population is projected to reach over 400 million by 2050, further increasing the demand for residential and commercial HVAC solutions. Additionally, the U.S. government has implemented various incentives and rebates to encourage the adoption of energy-efficient technologies, which has spurred investment in HVAC upgrades. The presence of major HVAC manufacturers and a well-established distribution network also contribute to the country's dominant position in the market. The U.S. HVAC market is expected to continue its growth trajectory owing to the innovation and advancements in technology.

Canada is lucratively growing with a CAGR of 6.2% during the forecast period in the North America HVAC systems market. The Canadian HVAC market is influenced by the country's diverse climate, which necessitates effective heating and cooling solutions. According to Natural Resources Canada, residential heating accounts for about 60% of energy consumption in Canadian homes with the importance of efficient HVAC systems. The Canadian government has introduced various initiatives aimed at promoting energy efficiency, including the Energy Efficiency Regulations, which mandate specific performance standards for HVAC equipment. Additionally, the growing trend of smart home technologies is gaining traction in Canada, with consumers increasingly seeking integrated HVAC solutions that offer enhanced control and automation. The focus on sustainability and energy efficiency is expected to drive further growth in the Canadian HVAC sector is positioning it as a key player in the North American market.

KEY MARKET PLAYERS

AAON Inc. (U.S.), Carrier Corporation (U.S.), Midea Group Co. Ltd., Lennox International Inc. (U.S.), SAMSUNG (South Korea), DAIKIN INDUSTRIES, Ltd. (Japan), Trane (Ireland), Johnson Controls (Ireland), LG Electronics (South Korea), Mitsubishi Electric Corporation (Japan). are the market players that are dominating the North America HVAC systems market.

MARKET SEGMENTATION

This research report on the North American HVAC systems market is segmented and sub-segmented into the following categories.

By Product Type

- Cooling Equipment

- Ventilation Equipment

By Country

- North America

- U.S.

- Canada

- Mexico

Frequently Asked Questions

What factors are fueling the demand for HVAC systems in North America?

Growing urbanization, extreme weather conditions, energy efficiency regulations, and the rise of smart home automation.

How are technological advancements transforming the HVAC industry?

Innovations like smart thermostats, IoT-enabled monitoring, AI-driven predictive maintenance, and eco-friendly refrigerants are revolutionizing HVAC systems.

Which sectors rely the most on HVAC systems in North America?

Residential, commercial (offices, malls, hotels), and industrial sectors (factories, data centers) are key consumers of HVAC solutions.

Which states and provinces lead in HVAC market growth?

The U.S. states of Texas, California, and Florida, along with Canadian provinces like Ontario and British Columbia, show high demand due to extreme climate variations.

Who are the top companies shaping the North American HVAC market?

Leading brands include Carrier, Trane Technologies, Daikin, Johnson Controls, and Lennox International, driving innovation and market expansion.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]