North America Human-Centric Lighting Market Size, Share, Trends & Growth Forecast Report By Offering (Hardware, Software), Installation Type, And Country (Us, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Human-Centric Lighting Market Size

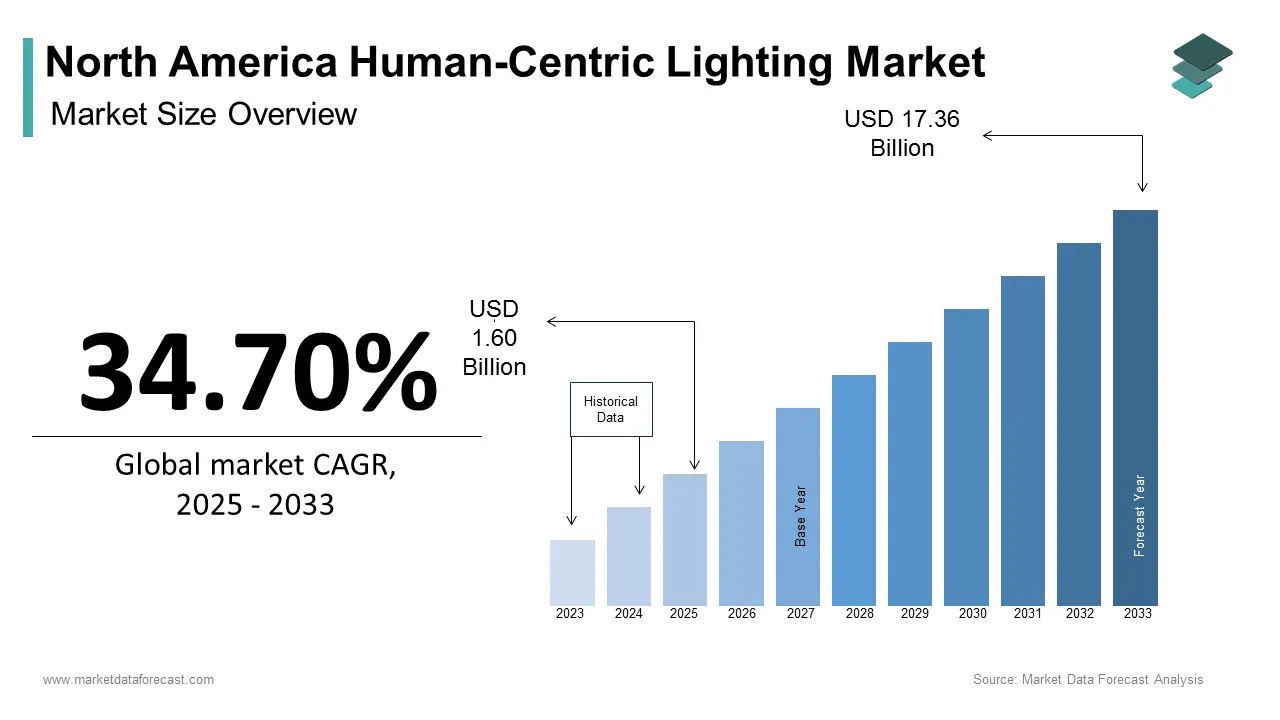

The North America human-centric lighting market size was calculated to be USD 1.19 billion in 2024 and is anticipated to be worth USD 17.36 billion by 2033 from USD 1.60 billion in 2025, growing at a CAGR of 34.70% during the forecast period.

The North American human-centric lighting (HCL) market has emerged as a transformative segment within the broader lighting industry and is driven by its potential to enhance well-being and productivity in various environments. Moreover, the United States dominates the regional landscape. A key factor influencing this growth is the increasing awareness of the health benefits associated with circadian rhythm-aligned lighting, particularly in workplaces, schools, and healthcare facilities.

Additionally, the rise of smart building technologies has expanded the adoption of HCL systems, which integrate seamlessly with IoT platforms.

MARKET DRIVERS

Growing Awareness of Health and Well-Being Benefits

The increasing emphasis on health and well-being in indoor environments is a significant driver for the North American HCL market. This awareness has spurred demand across sectors like healthcare, education, and corporate offices. For example, Kaiser Permanente, a leading healthcare provider, reported a 12% reduction in patient recovery times after implementing HCL systems in its facilities. The proliferation of wellness certifications like WELL Building Standard has further accelerated adoption.

Integration with Smart Building Technologies

The integration of human-centric lighting with smart building technologies represents another major driver. Also, this synergy between HCL and IoT platforms enables real-time data collection and automation and is making buildings more adaptive and sustainable. Apart from these, government incentives promoting energy-efficient technologies have bolstered adoption. A report by the U.S. Green Building Council emphasizes that LEED-certified buildings using HCL systems have reduced energy consumption by 25%. As smart cities gain traction, the demand for interconnected HCL solutions is expected to surge, further driving market growth.

MARKET RESTRAINTS

High Initial Costs and Installation Challenges

A significant restraint impacting the North American HCL market is the high initial cost associated with installation and system integration. So, this financial barrier limits adoption, particularly among small and medium enterprises (SMEs) and residential users. Besides, retrofitting existing buildings with HCL systems often requires extensive modifications to electrical infrastructure, further escalating costs. While technological advancements have reduced costs over time, the upfront investment remains prohibitive for many, slowing market penetration.

Limited Consumer Awareness and Education

limited awareness and understanding is another critical restraint of human-centric lighting among consumers. This lack of awareness creates hesitation among potential buyers, who may perceive HCL as a luxury rather than a necessity. Furthermore, misconceptions about the technology’s complexity and functionality deter adoption. Bridging this knowledge gap requires concerted efforts from manufacturers and industry stakeholders to educate consumers and demonstrate the tangible benefits of HCL.

MARKET OPPORTUNITIES

Expansion in Healthcare Facilities

The healthcare sector presents a significant opportunity for the player operating in the North American HCL market. It is supported by its proven benefits in improving patient outcomes and staff well-being. Hospitals and clinics are increasingly adopting HCL systems to regulate circadian rhythms, reduce stress, and accelerate recovery times. In addition, the rise of telemedicine and remote healthcare has expanded applications in home-based settings.

Adoption in Educational Institutions

Educational institutions give further promising avenue for growth of this market which is fueled by the need to create conducive learning environments. Schools and universities are adopting HCL to enhance student concentration, reduce eye strain, and promote overall well-being. Additionally, government funding for modernizing educational infrastructure has accelerated adoption. A report by the National Center for Education Statistics reveals that over $50 billion was allocated to school upgrades in 2022, with lighting systems being a key focus area.

MARKET CHALLENGES

Intense Competition from Conventional Lighting Solutions

One of the foremost challenges facing the North American HCL market is the intense competition posed by conventional lighting solutions and that remain more affordable and widely available. Moreover, traditional LED lighting accounts for a notable share of the total lighting market, creating pricing pressure for HCL manufacturers. For instance, companies like Philips and GE Lighting offer low-cost alternatives that meet basic energy efficiency standards, making it difficult for HCL systems to penetrate price-sensitive segments. Also, the entrenched presence of established lighting brands complicates market entry for smaller players. Businesses prefer conventional lighting due to its familiarity and lower maintenance costs, underscoring the challenge of shifting consumer preferences.

Technological Compatibility and Standardization Issues

Another significant challenge is the lack of standardization and compatibility across HCL systems. It is hindering their widespread adoption. In addition, the absence of universal protocols for integrating HCL with IoT platforms creates interoperability issues as well as limiting scalability. For example, a considerable percentage of installers faced challenges in ensuring seamless connectivity between HCL systems and existing smart building infrastructures. This fragmentation forces manufacturers to invest heavily in custom solutions, increasing costs and delaying project timelines. Furthermore, the rapid pace of technological innovation often renders systems obsolete, forming uncertainty for end-users

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

34.70% |

|

Segments Covered |

By Offering, Installation Type, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, And Rest Of North America |

|

Market Leaders Profiled |

Signify, Acuity Brands, Hubbell Lighting, Zumtobel Group, Cree Lighting, OSRAM, Lutron Electronics, Fagerhult Group, Legrand, Eaton Corporation |

SEGMENTAL ANALYSIS

By Offering Insights

The hardware segment dominated the North American HCL market and held 65.1% of the total share in 2024. This market position of the segment is credited to the foundational role of lighting fixtures, control systems, and sensors in delivering HCL solutions. For instance, tunable white LEDs, which adjust color temperature and intensity, are integral to mimicking natural daylight. Apart from these, advancements in semiconductor technology have improved the efficiency and affordability of HCL hardware.

The software segment is growing at the fastest pace and is expected to have the CAGR of 25.1% from 2025 to 2033. This progress is fueled by the increasing integration of AI and machine learning algorithms, enabling personalized lighting experiences. For instance, software platforms like Enlighted by Siemens use occupancy sensors and real-time data to optimize lighting schedules and energy usage. Besides, the rise of cloud-based solutions has expanded software applications, allowing remote monitoring and control.

By Installation Type Insights

The new installations segment commanded under this category of the North American HCL market and captured a notable portion of the overall share in 2024. This dominance of the segment is due to the growing trend of constructing smart buildings equipped with HCL systems from the outset. Additionally, government incentives promoting green construction have accelerated adoption. Companies like Signify have capitalized on this trend, launching HCL solutions tailored for new construction projects, further strengthening the segment’s place in the market.

The retrofit installations segment is the fastest expanding category and is projected to have a CAGR of 22.5% in the coming years. This development is backed by the increasing focus on upgrading existing buildings to meet modern lighting standards. For instance, a notable of commercial property owners in North America plan to retrofit their lighting systems. Also, technological break-throughs in wireless technology have simplified retrofitting processes and that is reducing costs and installation times

REGIONAL ANALYSIS

The United States led the North American HCL market and commanded an 80.3% share in 2024. Such presence in the regional landscape is driven by its robust commercial real estate sector and strong emphasis on workplace wellness. Further, federal initiatives promoting energy-efficient technologies have bolstered adoption. For instance, the Department of Energy allocated $100 million in 2022 to support lighting upgrades in public facilities. So, companies have capitalized on this trend by offering tailored solutions for diverse applications, from healthcare to education.

Canada is experiencing significant growth in the regional market. It is fueled by investments in sustainable infrastructure and smart city projects. According to Natural Resources Canada, municipalities like Vancouver and Toronto are prioritizing HCL in public spaces to improve citizen well-being. For example, Vancouver’s transit system uses HCL to enhance passenger comfort and safety. Additionally, the healthcare sector has embraced HCL for its proven benefits in patient recovery. Therefore, these shifts exhibit Canada’s commitment to innovation and sustainability.

Mexico is likely to grow in this market in the coming years. The advancement is primarily to be driven by the expanding industrial and manufacturing sectors, supported by trade agreements. Additionally, the hospitality sector has embraced HCL to enhance guest experiences, particularly in luxury resorts. Government-led urbanization projects have also expanded HCL applications in residential and commercial buildings.

The Rest of North America collectively held a smaller share of the market. This region’s progress is expected to be propelled by tourism and hospitality industries, which rely on HCL for guest comfort and well-being. According to the Caribbean Tourism Organization, hotel revenue grew by 73.6% in 2022, spurring investments in advanced lighting systems. Also, agricultural modernization in Central America has expanded HCL applications in controlled-environment farming. Costa Rica’s vertical farms, for instance, employ HCL to optimize plant growth and yield quality

LEADING PLAYERS IN THE NORTH AMERICA HUMAN-CENTRIC LIGHTING MARKET

Signify Holding

Signify leads the North American HCL market. Its Interact portfolio, designed for smart lighting, integrates seamlessly with IoT platforms, making it a preferred choice for commercial and industrial applications. For instance, Signify’s HCL systems are widely used in U.S. office buildings to enhance employee well-being and productivity. The company’s focus on sustainability and energy efficiency has strengthened its global presence.

Acuity Brands Inc.

Acuity Brands is known for its innovative lighting solutions, the company serves sectors ranging from healthcare to education. Its emphasis on modularity and scalability has positioned it as a leader in adaptive lighting technologies, catering to diverse customer needs.

Lutron Electronics Co., Inc.

Lutron specializes in smart lighting controls like Lutron serves residential, commercial, and hospitality markets. Its Ketra line of tunable lighting products, designed for circadian rhythm alignment, gained popularity among luxury homeowners and boutique hotels. Lutron’s partnerships with architects and designers have expanded its footprint, strengthen its reputation for precision and reliability.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North American HCL market employ diverse strategies to maintain their competitive edge. Innovation remains central, with companies investing heavily in R&D to develop AI-driven and IoT-enabled solutions. Strategic partnerships with end-user industries, such as healthcare and education, ensure tailored offerings. For instance, Signify collaborates with hospitals to design HCL systems that improve patient recovery rates. Expanding geographic reach through distribution networks and targeting emerging markets like smart cities further strengthens market presence. Finally, sustainability initiatives, such as eco-friendly materials and energy-efficient designs, align with global trends, appealing to environmentally conscious consumers.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the North America Human-Centric Lighting Market include Signify, Acuity Brands, Hubbell Lighting, Zumtobel Group, Cree Lighting, OSRAM, Lutron Electronics, Fagerhult Group, Legrand, Eaton Corporation

The North American HCL market is characterized by fierce competition, driven by rapid technological advancements and diverse applications. Leading players like Signify, Acuity Brands, and Lutron have notable presence in the landscape by leveraging their expertise in IoT, AI, and material science to differentiate offerings. Smaller firms, however, face challenges due to high R&D costs and the dominance of established brands. The market is also witnessing increased competition from conventional lighting solutions, which remain more affordable and accessible. Regulatory pressures and the need for compliance with energy efficiency standards further complicate the competitive environment. Despite these challenges, opportunities abound in emerging sectors like healthcare, education, and smart homes. Companies that balance innovation with affordability while addressing regional needs are likely to thrive.

RECENT HAPPENINGS IN THE MARKET

- In February 2023, Signify launched its Interact Pro platform, a cloud-based HCL solution designed for small and medium businesses. This move strengthened its position in the commercial sector.

- In April 2023, Acuity Brands acquired SensorSwitch, a wireless lighting controls company. This acquisition enhanced its retrofit capabilities and expanded its product portfolio.

- In July 2023, Lutron partnered with Marriott International to supply HCL systems for its luxury hotels. This collaboration expanded its footprint in the hospitality sector.

- In October 2023, Signify introduced a new line of tunable white LEDs for educational institutions, targeting improved student performance. This launch boosted its brand appeal in the education market.

- In December 2023, Acuity Brands unveiled a next-generation HCL system with AI-driven analytics, positioning itself as a leader in predictive lighting solutions.

MARKET SEGMENTATION

This research report on the North America human-centric lighting market has been segmented and sub-segmented based on offering, installation type and region.

By Offering

- Hardware

- Software

By Installation Type

- New Installations

- Retrofit Installations

By Region

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is human-centric lighting and how does it differ from traditional lighting?

Human-centric lighting (HCL) is designed to support human health and well-being by mimicking natural light patterns. Unlike traditional lighting, HCL adjusts brightness and color temperature to align with circadian rhythms.

2. How is the demand for human-centric lighting evolving in North America?

The demand is growing rapidly due to increased awareness of health and wellness, rising adoption in workplaces and educational institutions, and the push for smart building technologies.

3. Who are the major players in the North America human-centric lighting market?

Key players include Signify, Acuity Brands, Hubbell Lighting, Zumtobel Group, Cree Lighting, OSRAM, Lutron Electronics, Fagerhult Group, Legrand, and Eaton Corporation.

4. Which sectors are driving the demand for human-centric lighting in North America?

The healthcare, education, corporate offices, and residential sectors are the primary drivers, as they increasingly adopt lighting solutions that promote well-being, productivity, and energy efficiency.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]