North America Home Healthcare Market Research Report By Product Type, Services Type, Software, Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Home Healthcare Market Size

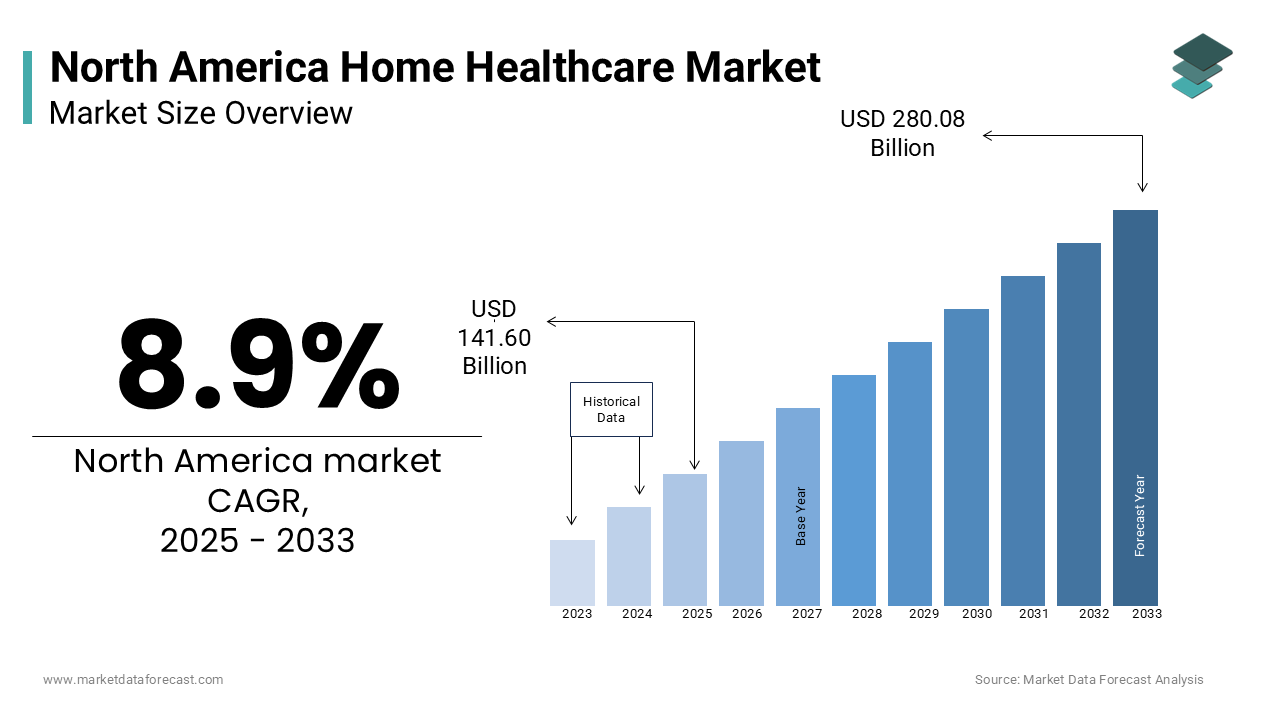

The North American home healthcare market size was valued at USD 130.03 billion in 2024. The North American market is further expected to reach USD 280.08 billion by 2033 from USD 141.60 billion in 2025, growing at a compound annual growth rate (CAGR) of 8.9% during the forecast period.

Home healthcare encompasses a wide range of services, including skilled nursing, physical therapy, occupational therapy, medication management, and assistance with daily living activities such as bathing, grooming, and meal preparation. This model of care has gained immense traction due to its cost-effectiveness, convenience, and ability to reduce hospital readmissions, aligning with the broader shift toward patient-centered care. According to the U.S. Census Bureau, the aging population in North America is expanding significantly, with projections indicating that by 2034, adults aged 65 and older will outnumber children for the first time in U.S. history.

According to the Centers for Disease Control and Prevention, approximately 60% of adults in the United States have at least one chronic condition, such as diabetes or hypertension, which often necessitates ongoing care and monitoring. The home healthcare model addresses these needs while fostering independence and improving quality of life. Additionally, the COVID-19 pandemic accelerated the adoption of home-based care, as individuals sought safer alternatives to traditional hospital visits. These dynamics, coupled with advancements in telehealth technologies and remote patient monitoring devices, are reshaping how care is delivered by emphasizing the critical role of home healthcare in modern medicine.

MARKET DRIVERS

Aging Population and Increased Dependency on Home Healthcare

The aging population in North America is a significant driver of the home healthcare market. The U.S. Census Bureau projects that by 2040, the number of individuals aged 65 and older will reach approximately 80.8 million by accounting for nearly 21% of the total population. This demographic shift has profound implications for healthcare needs, as older adults are more likely to require ongoing medical attention and assistance with daily activities. According to the National Institute on Aging, about 85% of older adults have at least one chronic condition, which often necessitates long-term care solutions. Home healthcare offers a cost-effective and convenient alternative to institutional care by enabling seniors to age in place while receiving necessary support. The demand for home-based care services is expected to surge that is further fueling market growth.

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases is another critical factor propelling the home healthcare market in North America. According to the Centers for Disease Control and Prevention, chronic diseases such as heart disease, cancer, and diabetes account for 90% of the nation's $4.1 trillion annual healthcare expenditure. Approximately 60% of American adults live with at least one chronic condition, and 40% have two or more by creating a sustained need for continuous medical oversight. Home healthcare provides an ideal solution by offering personalized care plans, reducing hospital readmissions, and improving patient outcomes. According to the Agency for Healthcare Research and Quality, patients receiving home health services experience a 25% lower risk of rehospitalization compared to those discharged without such support.

MARKET RESTRAINTS

Workforce Shortages and Staffing Challenges

A significant restraint in the North American home healthcare market is the persistent shortage of qualified healthcare professionals. The U.S. Bureau of Labor Statistics estimates that by 2030, there will be a shortfall of approximately 154,000 registered nurses and over 3.2 million home health aides required to meet growing demand. This workforce gap is exacerbated by high turnover rates, with the Home Care Association of America reporting that the annual turnover rate for home health workers exceeds 60%. Many caregivers face challenges such as low wages, inadequate benefits, and physically demanding work conditions, which contribute to recruitment and retention difficulties. According to the Occupational Safety and Health Administration, home healthcare workers experience higher injury rates compared to other sectors, further complicating staffing stability.

Financial Barriers and Inadequate Reimbursement Policies

Financial barriers, including insufficient reimbursement policies, significantly restrain the growth of the home healthcare market. The Centers for Medicare & Medicaid Services reveals that Medicare covers only intermittent skilled nursing and therapy services, leaving many patients with limited access to long-term or custodial care. Additionally, Medicaid programs, which often fund home healthcare for low-income individuals, vary widely across states by leading to inconsistent coverage and disparities in service availability. According to the Kaiser Family Foundation, nearly 70% of home healthcare agencies report challenges related to delayed or denied payments from insurers by impacting their operational sustainability. High out-of-pocket costs also deter patients from utilizing these services, particularly among middle-income households who do not qualify for public assistance. These financial constraints limit accessibility and impede the expansion of home healthcare services across North America.

MARKET OPPORTUNITIES

Advancements in Telehealth and Remote Monitoring Technologies

The integration of telehealth and remote monitoring technologies presents a transformative opportunity for the North American home healthcare market. The U.S. Food and Drug Administration emphasizes that remote patient monitoring devices have seen a 30% increase in adoption since the onset of the COVID-19 pandemic by enabling real-time tracking of vital signs such as blood pressure, glucose levels, and heart rate. These innovations enhance the ability of healthcare providers to deliver timely interventions and personalized care plans. According to the National Center for Health Statistics, approximately 37% of adults in the United States used telehealth services in 2022, reflecting growing acceptance and reliance on virtual care models. The home healthcare providers can expand their reach, reduce costs, and improve patient outcomes for individuals living in rural or underserved areas. This technological shift is poised to redefine accessibility and efficiency in home-based care.

Expansion of Preventive and Wellness-Oriented Services

A growing emphasis on preventive care and wellness-oriented services offers significant opportunities for the home healthcare market. According to the Centers for Disease Control and Prevention, preventive services, such as health screenings and lifestyle counseling, could prevent up to 70% of chronic diseases by reducing the need for costly acute care interventions. The providers can address modifiable risk factors like obesity, smoking, and physical inactivity, which affect nearly 45% of Americans, according to the U.S. Department of Health and Human Services. Additionally, the National Association of Home Care & Hospice notes that early intervention through home-based preventive care reduces hospital admissions by 23%. The home healthcare providers are well-positioned to capitalize on this trend by offering tailored wellness programs that promote long-term health and independence while lowering overall healthcare expenditures.

MARKET CHALLENGES

Regulatory and Compliance Complexities

The North American home healthcare market faces significant challenges due to the complexity of regulatory and compliance requirements. The Office of Inspector General under the U.S. Department of Health and Human Services reports that home healthcare providers must adhere to over 60 federal and state regulations, including those related to patient privacy, safety standards, and billing practices. Non-compliance can lead to severe penalties, with fines exceeding $50,000 per violation under the False Claims Act. According to the Centers for Medicare & Medicaid Services, audits and documentation reviews have increased by 40% in recent years by creating administrative burdens for providers. These stringent oversight measures often divert resources away from patient care by impacting operational efficiency. For smaller agencies, navigating this intricate regulatory landscape can be particularly daunting, leading to potential service disruptions or closures, thereby limiting access to care for vulnerable populations.

Limited Access in Rural and Underserved Areas

Geographic disparities in access to home healthcare services remain a pressing challenge in North America. As per a study by U.S. Census Bureau, approximately 19% of the U.S. population resides in rural areas, where healthcare infrastructure is often inadequate. The Health Resources and Services Administration identifies over 80% of rural counties as medically underserved areas, with limited availability of home healthcare providers. According to the National Rural Health Association, rural residents are more likely to experience chronic conditions and disabilities, yet only 10% of physicians practice in these regions. Transportation barriers also exacerbate the issue, as nearly 3.6 million Americans miss or delay medical care annually due to lack of access, according to the American Hospital Association.

SEGMENTAL ANALYSIS

By Component Insights

The "Services" segment dominated the North American home healthcare market with a prominent share of 45.6% in 2024 with the increasing demand for skilled nursing, rehabilitation therapies, and personal care services driven by an aging population. The U.S. Census Bureau projects that by 2030, over 20% of Americans will be aged 65 or older is amplifying the need for in-home assistance. Services are critical in reducing hospital readmissions and managing chronic conditions, with the Centers for Medicare & Medicaid Services reporting a 25% reduction in rehospitalizations due to effective home health interventions due to their pivotal role in modern healthcare delivery.

The "Equipment" segment is likely to experience a CAGR of 8.5% during the forecast period. This rapid expansion is fueled by advancements in medical devices such as portable oxygen concentrators, blood glucose monitors, and mobility aids, which empower patients to manage their conditions independently at home. According to the Centers for Disease Control and Prevention, 60% of adults have at least one chronic condition requiring ongoing monitoring that is driving demand for innovative equipment. Additionally, the rise in telehealth adoption has complemented equipment usage is enabling remote diagnostics and real-time data sharing. According to the Agency for Healthcare Research and Quality, home-based medical devices reduce healthcare costs by 15% by making them indispensable for cost-effective care delivery while improving patient convenience and outcomes.

By Indication Insights

The cardiovascular disorders and hypertension segment dominated the North American home healthcare market by capturing 35.3% of the share in 2024 owing to the high prevalence of these conditions, with nearly 48% of adults in the U.S. having some form of cardiovascular disease. Hypertension alone affects over 116 million Americans, creating a sustained demand for home-based monitoring and care. According to the American Heart Association, home healthcare reduces hospital readmissions by 20% for cardiovascular patients. Managing these chronic conditions at home not only improves patient outcomes but also alleviates the burden on traditional healthcare systems.

Cancer segment is projected to witness a fastest CAGR of 8.5% in the net coming years. This rapid growth is driven by the increasing incidence of cancer diagnoses, with an estimated 2 million new cases expected annually by 2030 in the U.S. Advances in early detection and treatment have extended survival rates by necessitating long-term supportive care at home. According to the Agency for Healthcare Research and Quality, home-based palliative care reduces symptom severity by 30% and enhances quality of life for cancer patients. Additionally, the rising adoption of personalized medicine and targeted therapies has increased the need for specialized home care services. The home healthcare plays a pivotal role in addressing this demand while improving accessibility and affordability.

REGIONAL ANALYSIS

The United States dominated the North American home healthcare market with a estimated share of 85.4% in 2024 owing to its large aging population, with over 54 million adults aged 65 and older requiring ongoing care. According to the Centers for Medicare & Medicaid Services, U.S. healthcare spending reached $4.3 trillion in 2021, with a significant portion allocated to home-based services. The country’s advanced healthcare infrastructure, widespread adoption of telehealth, and favorable reimbursement policies further propels its dominance. According to the home healthcare in the U.S. reduces hospital readmissions by 25% by making it a critical component of the nation's healthcare system.

Canada is likely to grow with an anticipated CAGR of 7.2% during the forecast period. This growth is fueled by an aging population, with the number of Canadians aged 65 and older expected to reach 10.4 million by 2030. The Canadian Institute for Health Information notes that home care utilization has increased by 30% over the past decade due to rising chronic disease prevalence, such as diabetes, which affects 9% of adults. Additionally, provincial governments are investing in home healthcare to alleviate hospital overcrowding, reducing healthcare costs by 15%. The emphasis on patient-centered care and technological advancements like remote monitoring further accelerates this growth by positioning Canada as a key contributor to the region’s market expansion.

The Canadian home healthcare market is one of the most lucrative regional markets in the global market. The market in this country has represented growth in medical devices and services that provide safety to the patient. Due to the illness of chronic disorder, Canada has continued growth in the home healthcare market. Also, increasing technological development, changing lifestyles, and using alternatives instead of long-term hospital treatments demand home healthcare services. Canada was the hub of the home medical devices market in 2019. The Government of Canada has started conducting awareness programs related to Hypertension, diabetes, and schizophrenia in a nod to the medical and monitoring devices market.

Mexico is anticipated to grow in the coming years due to government regulations and advancements in North America's home healthcare market.

KEY MARKET PARTICIPANTS

Some of the prominent companies leading the North American home healthcare market profiled in the report are Almost Family Inc., Amedisys Inc., General Electric CompaG.E. (G.E.), Kinnser Software Inc., Linde Group, Omron Corporation, Roche Holding AG, Philips Healthcare, Mckesson Corporation, LHC Group Inc., Kindred Healthcare, Fresenius Se & Co Kgaa, Abbott Laboratories, and Apria Healthcare Group.

The North American home healthcare market is characterized by intense competition, driven by the presence of established multinational corporations, regional players, and emerging startups. This competitive landscape is shaped by the growing demand for cost-effective, patient-centered care solutions, particularly among aging populations and individuals with chronic conditions. Major companies such as Medtronic, Abbott, and B. Braun SE dominate the market, leveraging their extensive product portfolios, robust R&D capabilities, and global distribution networks to maintain leadership. These firms focus on innovation, introducing advanced technologies like remote monitoring devices, wearable health trackers, and AI-driven analytics to enhance patient outcomes and operational efficiency.

However, the market also witnesses significant contributions from mid-sized and smaller players, such as Amedisys and ARKRAY, Inc., which cater to niche segments like palliative care and diabetes management. According to the U.S. Department of Health and Human Services, smaller firms often excel in personalized care models, fostering strong patient loyalty. The competitive dynamics are further intensified by strategic initiatives such as mergers and acquisitions, partnerships, and collaborations. For instance, companies frequently collaborate with technology firms to integrate telehealth platforms by addressing the rising demand for virtual care solutions.

Government regulations and reimbursement policies also play a pivotal role in shaping competition, as compliance requirements create barriers to entry for new players while incentivizing innovation among incumbents.

Top 3 Players in the market

B. Braun SE

B. Braun SE is a leading player in the North American home healthcare market with a renowned for its innovative medical devices and solutions tailored to chronic disease management and infusion therapy. The company contributes significantly to the global market by offering advanced home healthcare products such as ambulatory infusion pumps and IV systems, which are critical for patients requiring long-term care. According to the U.S. Food and Drug Administration, infusion therapies account for over 60% of home healthcare services. Its commitment to sustainability and patient safety has positioned it as a trusted provider. By integrating digital technologies into its devices, B. Braun enhances remote monitoring capabilities, ensuring better patient outcomes while reducing hospital readmissions.

Medtronic

Medtronic is another key contributor to the North American home healthcare market, particularly in the cardiovascular and diabetes care segments. Its focus on innovation is evident in products like the MiniMed 780G system, which offers automated insulin delivery.

Abbott

Abbott stands out as a major player in the home healthcare market, especially in diagnostic and monitoring solutions. Abbott’s FreeStyle Libre system, a leader in continuous glucose monitoring, has been adopted by over 4 million users worldwide, according to data from the National Institute of Diabetes and Digestive and Kidney Diseases. Beyond diabetes, Abbott’s portfolio includes rapid diagnostic tests and portable cardiac monitors, enabling early detection and management of chronic conditions at home. Abbott ensures its products cater to diverse populations, including underserved communities by emphasizing accessibility and affordability. Its contributions to enhancing preventive care and chronic disease management make it a pivotal player in shaping the future of home healthcare globally.

Top strategies used by the key market participants

Mergers and Acquisitions

Mergers and acquisitions are a cornerstone strategy for expanding service portfolios and geographic reach. For instance, Medtronic has actively acquired innovative startups to bolster its diabetes care division, such as its acquisition of Nutrino Health, which enhanced its data-driven insulin management solutions. Similarly, Cardinal Health has pursued acquisitions to diversify its home healthcare offerings, ensuring a comprehensive suite of products and services. According to the Federal Trade Commission, the healthcare companies engage in M&A activities annually to consolidate market share and streamline operations by enabling them to meet growing demand efficiently.

Product Innovation and R&D Investments

Investing in research and development is another critical strategy. Companies like Abbott and B. Braun SE prioritize innovation to introduce cutting-edge technologies. Abbott’s FreeStyle Libre system exemplifies this approach, offering patients a minimally invasive, cost-effective solution for glucose monitoring. According to the National Institutes of Health, R&D investments in home healthcare technologies have grown by 15% annually, reflecting the company’s focus on enhancing patient convenience and outcomes. These companies maintain their competitive edge while addressing unmet medical needs by continuously innovating.

Strategic Partnerships and Collaborations

Partnerships with technology firms and healthcare providers are vital for scaling operations and integrating digital health solutions. F. Hoffmann-La Roche Ltd collaborates with IT companies to enhance its diagnostic tools' connectivity, enabling seamless data sharing between patients and physicians. Additionally, Amedisys partners with hospitals and payers to offer integrated care models by improving patient transition from hospital to home.

Digital Transformation and Telehealth Integration

The adoption of digital tools and telehealth platforms has become a key differentiator. Companies like Baxter and 3M have invested in remote monitoring systems and AI-driven analytics to improve patient engagement and operational efficiency. The U.S. Department of Health and Human Services reports that telehealth usage surged post-pandemic that is driving demand for connected devices.

RECENT MARKET DEVELOPMENTS

- In August 2024, B. Braun SE acquired a leading U.S.-based home infusion therapy provider. This acquisition is expected to enhance B. Braun’s presence in the North American home healthcare market.

- In November 2024, Abbott launched a new line of remote patient monitoring devices tailored for chronic disease management at home. This launch aims to improve patient outcomes and reduce hospital readmissions.

- In January 2025, Sunrise Medical introduced an advanced series of power wheelchairs with smart connectivity features. This introduction targets increased comfort and mobility for home care patients.

- In September 2024, 3M expanded its home healthcare product line by acquiring a company specializing in advanced wound care solutions. This acquisition strengthens 3M’s offerings for in-home patient care.

- In October 2024, Baxter launched a new home dialysis system designed to provide patients with greater flexibility and ease of use. This launch reinforces Baxter’s commitment to home-based renal care.

- In December 2024, Medtronic acquired a digital health company specializing in remote patient monitoring. This acquisition enhances Medtronic’s capabilities in providing comprehensive home healthcare solutions.

- In February 2025, Cardinal Health expanded its home medical equipment distribution network by partnering with a leading logistics provider. This expansion improves delivery times and service efficiency for home healthcare patients.

- In July 2024, F. Hoffmann-La Roche Ltd introduced a new at-home diagnostic testing platform. This introduction enables patients to perform a range of medical tests from the comfort of their homes, expanding access to timely health information.

- In March 2025, Amedisys merged with another home health provider. This merger creates one of the largest home healthcare networks in North America, aimed at delivering more comprehensive in-home care services.

- In June 2024, ARKRAY, Inc. launched a new line of user-friendly blood glucose monitoring systems designed specifically for the home care market. This launch enhances support for diabetic patients managing their condition at home.

MARKET SEGMENTATION

This research report on the North American home healthcare market has been segmented and sub-segmented into the following categories.

By Component

- Equipment

- Services

By Indication

- Cardiovascular Disorder & Hypertension

- Cancer

By Country

- The U.S.

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

Which factors are driving the growth of the home healthcare market in Canada?

The growth in the Canadian home healthcare market is primarily driven by an aging population, increasing prevalence of chronic diseases, and government initiatives promoting home-based care.

What are the notable trends influencing the home healthcare market in the United States?

Telehealth adoption, personalized care plans, and integration of advanced technologies such as wearable devices are key trends shaping the home healthcare landscape in the United States.

How has the COVID-19 pandemic impacted the home healthcare market in North America?

The pandemic has accelerated the adoption of telehealth, increased awareness of home-based care, and prompted a shift towards decentralized healthcare delivery models, influencing the growth trajectory of the home healthcare market in North America.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]