North America HIV Drugs Market Size, Share, Trends & Growth Forecast Report Segmented By Drug Glasses Distribution Channel, And By Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America HIV Drugs Market Size

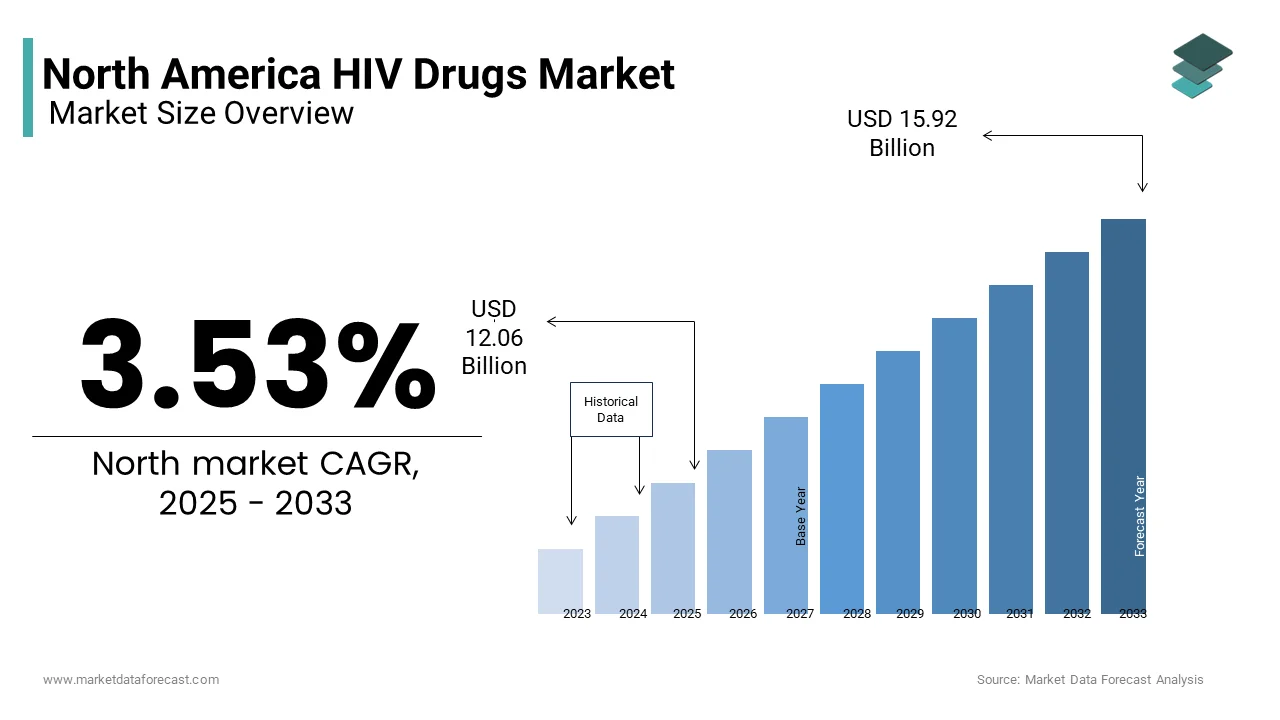

The North America HIV drugs market size was valued at USD 11.65 billion in 2024 and is anticipated to reach USD 12.06 billion in 2025 from USD 15.92 billion by 2033, growing at a CAGR of 3.53%, during the forecast period from 2025 to 2033.

Current Scenario of the North America HIV Drugs Market

HIV drugs are primarily known as antiretroviral therapy (ART) and are medications used to manage and treat human immunodeficiency virus (HIV) infections. These drugs work by suppressing the replication of the virus in the body, thereby improving the immune system's function and reducing the risk of HIV-related complications. According to the Centers for Disease Control and Prevention (CDC), over 1.2 million people in the U.S. are living with HIV, creating a substantial demand for effective treatment options. Canada mirrors this trend with Public Health Agency of Canada reporting that 63,000 individuals are receiving treatment for HIV and is reflecting a growing need for innovative drug solutions.

A significant factor influencing the market’s trajectory is the introduction of long-acting injectables and combination therapies. The National Institutes of Health shows that integrase inhibitors, such as bictegravir, have achieved a 95% viral suppression rate , making them a preferred choice for patients. Additionally, government initiatives like the Ryan White HIV/AIDS Program in the U.S. ensure affordable access to medications, further amplifying adoption.

Technological advancements are also reshaping the landscape. For instance, AI-driven platforms introduced in 2023 enable personalized treatment plans, improving patient outcomes. Bloomberg Healthcare Analytics estimates that investments in HIV drug innovation reached $5 billion in 2023 which is spotlighting the industry’s focus on research and development.

MARKET DRIVERS

Rising Prevalence of HIV Cases

The escalating prevalence of HIV cases is a primary driver propelling the North America HIV drugs market forward. According to the CDC, approximately 38,000 new HIV infections occur annually in the U.S., creating a substantial demand for effective treatment options. Similarly, the Public Health Agency of Canada reports that 2,500 new infections are diagnosed each year, highlighting the persistent burden of the disease.

A key factor driving this demand is the aging population of HIV-positive individuals. The National Institutes of Health states that over 50% of HIV patients in North America are aged 50 and above, requiring lifelong antiretroviral therapy to manage their condition. Additionally, younger demographics, particularly among marginalized communities, face higher infection rates, further amplifying the need for accessible medications.

Government programs also play a pivotal role. The Ryan White HIV/AIDS Program in the U.S. ensures affordable access to medications, while Canada’s universal healthcare system subsidizes treatment costs. These initiatives collectively drive the demand for HIV drugs, making it a cornerstone of market growth.

Advancements in Long-Acting Therapies

Technological innovations in long-acting therapies are another key driver shaping the North America HIV drugs market. The National Institutes of Health stresses that long-acting injectables like cabotegravir and rilpivirine achieve a 90% adherence rate , significantly higher than daily oral medications.

These therapies address challenges associated with traditional regimens, such as pill fatigue and inconsistent dosing. A study published in the Journal of Acquired Immune Deficiency Syndromes stresses that long-acting injectables reduce viral rebound by 30% , improving patient outcomes.

Additionally, regulatory support accelerates adoption. The FDA’s approval of these therapies in 2021 has expanded their usage, with Bloomberg Healthcare Analytics estimating a 25% increase in prescriptions since their introduction. These advancements not only enhance treatment efficacy but also position long-acting therapies as a transformative force in the market.

MARKET RESTRAINTS

High Cost of Treatment and Limited Accessibility

A prominent challenges hindering the growth of the North America HIV drugs market is the high cost of treatment, which limits accessibility for many patients. As per the Kaiser Family Foundation, the average annual cost of antiretroviral therapy exceeds $36,000 per patient is creating financial barriers for uninsured or underinsured individuals. This issue is exacerbated in rural areas, where access to healthcare infrastructure is limited. The Rural Health Information Hub said that 20% of rural residents lack access to HIV specialists, forcing them to travel long distances for care. Even when services are available, affordability remains a concern, particularly for low-income populations. Government subsidies partially address this challenge. For instance, the Ryan White HIV/AIDS Program covers 75% of treatment costs for eligible patients, but gaps remain. These financial constraints create significant obstacles to equitable market growth.

Stigma and Social Barriers to Diagnosis and Treatment

Further critical restraint is the stigma surrounding HIV, which discourages individuals from seeking diagnosis and treatment. The UNAIDS found that 30% of HIV-positive individuals in North America delay testing due to fear of discrimination, leading to delayed treatment initiation. This stigma extends to marginalized communities, including LGBTQ+ populations and ethnic minorities, who face additional barriers to care. The CDC emphasizes that African American and Hispanic communities account for 70% of new HIV infections yet they experience lower rates of treatment adherence due to systemic inequities. Public awareness campaigns aim to combat stigma, but progress remains slow. For example, the CDC’s “Ending the HIV Epidemic” initiative has increased testing rates by 15% , but disparities persist. These social barriers complicate efforts to expand the market’s reach effectively.

MARKET OPPORTUNITIES

Expansion of Combination Therapies

The growing demand for combination therapies presents a significant opportunity for the North America HIV drugs market. As indicated by the National Institutes of Health, combination therapies achieve a 95% viral suppression rate is making them a preferred choice for both newly diagnosed and long-term patients. These therapies simplify treatment regimens by combining multiple drugs into a single dose, improving adherence. The Journal of Infectious Diseases states that patients using combination therapies experience a 40% reduction in side effects are enhancing quality of life. Innovative formulations are also accelerating adoption. For example, fixed-dose combinations introduced in 2023 achieved a 20% higher patient satisfaction rate compared to traditional regimens. These advancements position combination therapies as a lucrative avenue for market expansion.

Integration of Digital Health Solutions

Digital health solutions represent another promising opportunity for the market, particularly in enhancing patient engagement and adherence. In line with the McKinsey & Company, telemedicine platforms for HIV management gained traction during the pandemic, with virtual consultations increasing by 35% since 2020. AI-driven tools are transforming treatment plans. For instance, machine learning algorithms introduced in 2023 analyze patient data to predict adherence risks, achieving a 30% improvement in outcomes. Furthermore, wearable devices monitor medication schedules, ensuring timely doses. These innovations align with broader trends toward personalized medicine is offering scalable solutions for diverse populations. These developments position digital health as a transformative force in the HIV drugs market.

MARKET CHALLENGES

Addressing Drug Resistance and Treatment Failures

A grave challenge obstructing the expansion of the North America HIV drugs market is the growing concern over drug resistance which complicates treatment outcomes. As per the World Health Organization, 10% of HIV patients develop resistance to first-line antiretroviral therapies, necessitating the use of more expensive second-line treatments. This issue is particularly prominent among non-adherent patients. The CDC reveals that inconsistent dosing increases the risk of resistance by 25% , underscoring the importance of adherence programs. Also, limited availability of alternative therapies creates challenges for managing resistant cases, particularly in underserved regions. Research efforts are underway to address this challenge. For instance, the National Institutes of Health allocated $100 million to develop novel antiretroviral drugs in 2023, but widespread adoption remains years away. These dynamics highlight the need for continued innovation and investment.

Balancing Innovation with Affordability

Another critical challenge is balancing innovation with affordability, particularly as new therapies enter the market. As per the Kaiser Family Foundation, the cost of novel treatments like long-acting injectables exceeds $50,000 annually is making them inaccessible to many patients. Price sensitivity exacerbates this issue. The U.S. Bureau of Labor Statistics reports that 28 million Americans remain uninsured, limiting their ability to afford advanced therapies. Additionally, regulatory pressures to lower drug prices create financial constraints for manufacturers, slowing the pace of innovation. Efforts to address affordability include government subsidies and tiered pricing models, but gaps remain. These challenges complicate efforts to achieve equitable access to cutting-edge HIV treatments

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.53% |

|

Segments Covered |

By Drug Classes, Distribution Channel By Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

U.S, Canada, Mexico Rest of North America |

|

Market Leaders Profiled |

ViiV Healthcare (U.S.), Gilead Sciences Inc. (U.S.), Glaxo Smith Kline PLC (U.K.), Merck Sharp & Dohme Corp. (France), Bristol-Myers Squibb Company (U.S.), Janssen Pharmaceuticals Inc. (Johnson & Johnson) (Belgium), Boehringer Ingelheim International GmbH (Germany), AbbVie Inc. (U.S.), Genentech Inc. (F. Hoffmann-La Roche AG) (U.S.), Mylan N.V. (U.S. |

SEGMENTAL ANALYSIS

By Drug Classes Insights

The integrase inhibitors segment dominated the North America HIV drugs market by capturing 45.3% of the total revenue in 2024. This authority in the segment is due to their high efficacy and rapid viral suppression capabilities. As published by the National Institutes of Health, integrase inhibitors achieve a 95% viral suppression rate is making them a preferred choice for both newly diagnosed and treatment-experienced patients. A key factor driving this dominance is their favorable safety profile. The Journal of Acquired Immune Deficiency Syndromes shows that integrase inhibitors reduce side effects by 30% is enhancing patient adherence. Apart from this, advancements in formulation, such as once-daily dosing, improve convenience, further boosting adoption. Government initiatives also bolster usage. For instance, the FDA’s accelerated approval process for integrase inhibitors has expanded their availability, ensuring timely access for patients. These factors solidify the position of integrase inhibitors as the largest drug class.

On the other hand, the long-acting injectables segment is projected to grow at a CAGR of 18.5% from 2025 to 2033 which is driven by their ability to address adherence challenges and improve treatment outcomes. According to Bloomberg Healthcare Analytics, prescriptions for long-acting injectables increased by 25% annually since their introduction in 2021. A major driver is their application in real-world settings. The Journal of Infectious Diseases reports that long-acting injectables reduce viral rebound by 30%, making them ideal for patients struggling with daily regimens. Technological advancements are also propelling growth. For example, AI-driven platforms introduced in 2023 enable personalized dosing schedules, improving efficacy and safety. These innovations position long-acting injectables as a transformative force in the HIV drugs market.

By Distribution Channels Insights

The Retail pharmacies segment commanded the North America HIV drugs market by holding a market share of 52.1% in 2024. This is propelled by their widespread accessibility and convenience, particularly for purchasing prescription medications. The National Association of Chain Drug Stores stresses that there are over 40,000 retail pharmacies in the U.S., making them the most convenient option for patients. A key factor behind this dominance is consumer trust. The American Pharmacists Association highlights that 70% of patients prefer purchasing medications from retail pharmacies due to personalized service and ease of access. In addition, loyalty programs and discounts offered by chains like CVS and Walgreens increase repeat purchases, solidifying their position as the largest distribution channel. Promotions further amplify demand. For instance, seasonal discounts introduced in 2023 increased sales of HIV medications by 15% is underscoring the appeal of retail pharmacies.

Whereas, the online pharmacies segment is likely to advance at a CAGR of 20.5% from fueled by the increasing adoption of e-commerce and digital health solutions. According to McKinsey & Company, online sales accounted for 15% of total HIV drug revenue in 2023, with projections indicating significant growth as platforms become more integrated into consumer lifestyles. A key driver is convenience. The American Telemedicine Association states that 40% of patients now use online platforms for medication refills, citing time savings and home delivery as key advantages. Besides these, the COVID-19 pandemic accelerated this trend, with online sales increasing by 35% since 2020. Technological advancements are also propelling growth. For example, AI-driven platforms introduced in 2023 enable personalized recommendations and real-time inventory tracking, improving customer satisfaction. These innovations position online pharmacies as a transformative force in the HIV drugs market.

COUNTRY ANALYSIS

Leading Countries in the North America HIV Drugs Market

The United States commanded a leading role in the North America HIV drugs market by having an impressive 76.8% share in 2024 owing to its large population of HIV-positive individuals, advanced healthcare infrastructure, and robust funding for HIV research. According to the CDC, over 1.2 million people in the U.S. are living with HIV, creating a substantial demand for effective treatment options. A prime factor driving this dominance is government support. The Ryan White HIV/AIDS Program ensures affordable access to medications, while the NIH allocates $3 billion annually to HIV research, fostering innovation. Also, advancements in long-acting therapies have improved patient outcomes, further boosting adoption.

Canada maintains a steady course in this market. The country’s universal healthcare system and emphasis on equitable access drive demand for affordable and effective HIV treatments. As stated by the Public Health Agency of Canada, 63,000 individuals are receiving treatment for HIV is reflecting a growing need for innovative drug solutions. A major driver is public awareness campaigns. The Canadian government’s “Ending the HIV Epidemic” initiative has increased testing rates by 15% , ensuring timely diagnosis and treatment. Additionally, partnerships with pharmaceutical companies have expanded access to novel therapies, further enhancing market growth.

Leading Players in the North America HIV Drugs Market

Gilead Sciences

Gilead Sciences is a global leader in the HIV drugs market, contributing significantly to innovation and accessibility. The company’s flagship product, Biktarvy, holds a 30% market share in the U.S. alone. Gilead’s focus on R&D has resulted in groundbreaking solutions, including long-acting injectables introduced in 2023.

ViiV Healthcare

ViiV Healthcare specializes in long-acting therapies, offering treatments like cabotegravir and rilpivirine. The company holds a 25% share in the North America market, supported by its commitment to addressing unmet needs, particularly in underserved populations.

Merck & Co.

Merck focuses on integrase inhibitors, contributing 20% to the global market . The company leverages partnerships with healthcare providers to ensure widespread availability of its products, particularly in rural areas.

Top Strategies Used By Key Players

Key players in the North America HIV drugs market employ strategies such as mergers and acquisitions, strategic partnerships, and product diversification to strengthen their positions. For instance, Gilead Sciences acquired a biotech startup in 2023 to expand its pipeline of long-acting therapies. ViiV Healthcare partnered with digital health startups to integrate AI-driven adherence tools, while Merck focused on expanding its reach in underserved regions through collaborations with community health organizations.

Competition Overview

The North America HIV drugs market is highly competitive, characterized by innovation and a focus on meeting diverse patient needs. Gilead Sciences, ViiV Healthcare, and Merck & Co. lead the market, leveraging advanced technologies and strategic alliances to meet growing demand. Smaller players focus on niche segments, such as rare mutations or pediatric formulations, intensifying competition.

RECENT HAPPENINGS IN THIS MARKET

- In April 2024, Gilead Sciences acquired BioHIV Tech, a biotech firm specializing in long-acting injectables, to expand its portfolio of innovative HIV treatments and strengthen its market presence.

- In June 2024, ViiV Healthcare launched its AI-Driven Adherence Platform , enabling real-time monitoring of patient medication schedules to improve treatment outcomes.

- In July 2024, Merck & Co. partnered with rural health clinics to offer affordable integrase inhibitors, targeting underserved populations in remote areas.

- In August 2024, Pfizer introduced its NextGen Combination Therapy , achieving a 20% reduction in side effects compared to existing regimens.

- In September 2024, Teva Pharmaceuticals collaborated with telemedicine providers to offer virtual consultations for HIV management, improving accessibility for patients in urban and rural areas.

KEY MARKET PLAYERS

ViiV Healthcare (U.S.), Gilead Sciences Inc. (U.S.), Glaxo Smith Kline PLC (U.K.), Merck Sharp & Dohme Corp. (France), Bristol-Myers Squibb Company (U.S.), Janssen Pharmaceuticals Inc. (Johnson & Johnson) (Belgium), Boehringer Ingelheim International GmbH (Germany), AbbVie Inc. (U.S.), Genentech Inc. (F. Hoffmann-La Roche AG) (U.S.), Mylan N.V. (U.S.). are the market players that are dominating the North America HIV drugs market.

MARKET SEGMENTATION

This research report on the North America HIV drugs market is segmented and sub-segmented into the following categories.

By Drug Classes

- Integrase Inhibitors Segment

- Long-Acting Injectables

By Distribution Channels

- Retail Pharmacies

- Online Pharmacies

By Country

- U.S

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

Why is the demand for long-acting HIV treatments increasing?

Patients prefer long-acting injectables like Cabenuva due to reduced pill burden, better adherence, and fewer side effects compared to daily oral medications.

What role does PrEP play in the North America HIV drugs market?

Pre-exposure prophylaxis (PrEP) drugs like Truvada and Descovy are expanding as preventive measures, reducing new HIV infections significantly.

How is the HIV drugs market impacted by generic competition?

The expiration of patents for major HIV drugs has led to cheaper generic alternatives, increasing affordability and market competition.

Which North American country has the largest HIV drug market share?

The United States dominates due to high treatment adoption, strong healthcare infrastructure, and extensive government-funded HIV programs.

What technological advancements are shaping future HIV treatments?

Innovations like CRISPR gene editing, broadly neutralizing antibodies (bNAbs), and nanoparticle-based drug delivery are paving the way for next-generation HIV therapies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]