North America Heavy Construction Equipment Market Size, Share, Trends, & Growth Forecast Report Segmented By Types, Application, End-User And By Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America Heavy Construction Equipment Market Size

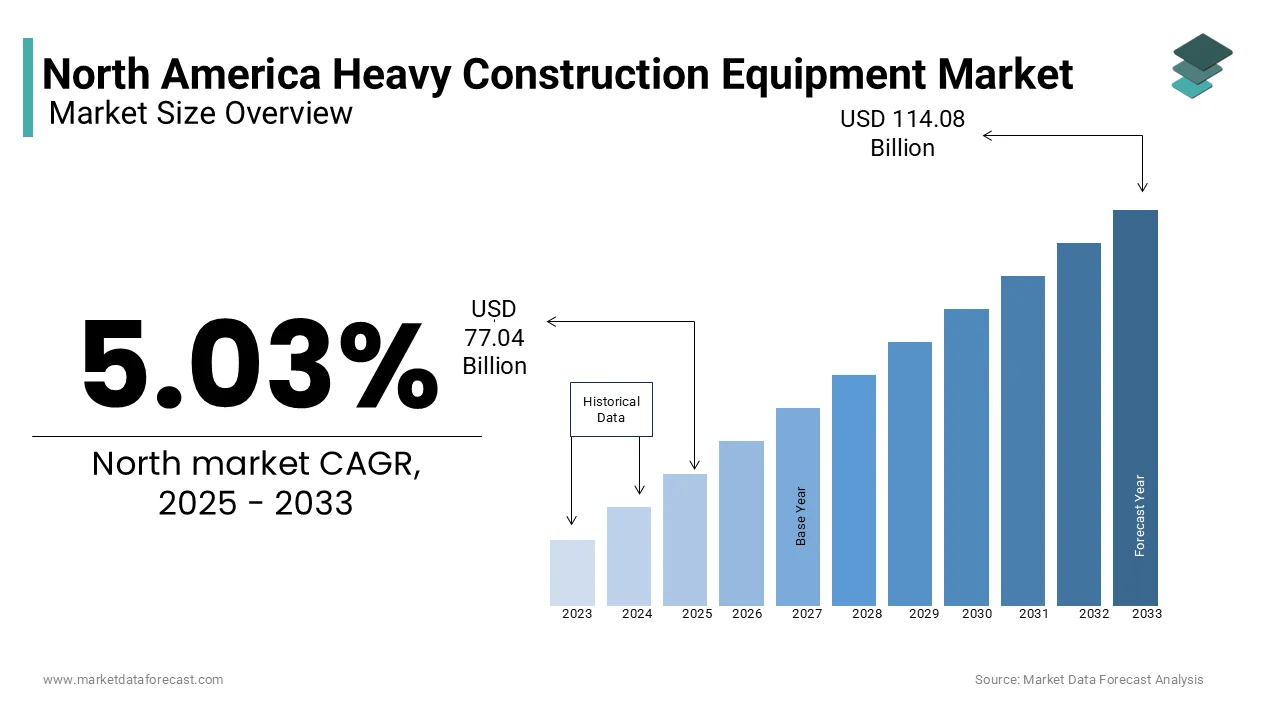

The North America heavy construction equipment market size was valued at USD 73.35 billion in 2024 and is anticipated to reach USD 77.04 billion in 2025 from USD 114.08 billion by 2033, growing at a CAGR of 5.03% during the forecast period from 2025 to 2033.

The North American heavy construction equipment market includes earthmoving equipment, material handling equipment, heavy construction vehicles, and specialized machinery such as cranes and excavators. The heavy construction equipment sector is essential for executing large-scale projects, including road construction, building infrastructure, and mining operations. This growth is driven by several factors, including increased public and private investments in infrastructure development, urbanization, and the rising demand for efficient construction solutions. Additionally, advancements in technology, such as automation and telematics, are enhancing the performance and efficiency of heavy construction equipment. As the market continues to evolve, the demand for innovative and sustainable construction solutions will play a crucial role in shaping the future of the North American heavy construction equipment market.

MARKET DRIVERS

Infrastructure Development and Investment

The increasing investment in infrastructure development is a primary driver of the North American heavy construction equipment market. Governments at both federal and state levels are prioritizing infrastructure projects to enhance transportation networks, utilities, and public facilities. According to the American Society of Civil Engineers, the United States requires an estimated $4.5 trillion investment by 2025 to address its infrastructure needs. This substantial funding is expected to spur a wave of construction activities, driving demand for heavy construction equipment. Also, the Biden Administration of the US wants to spend a lot on fixing up things like roads, bridges, and buses as part of their plan to help the economy bounce back. When government and companies team up to update old stuff, they’ll need more big construction machines. This shows how important heavy equipment is for doing big jobs well and fast, setting up the North American heavy construction equipment market to keep growing strong.

Urbanization and Population Growth

Another big reason the North American heavy construction equipment market is growing is that cities are getting bigger and more people are living in them. As towns spread out and more folks move in, there’s a bigger need for homes, shops, and factories. The U.S. Census Bureau says the U.S. will have about 400 million people by 2050, meaning we’ll need new houses, roads, and stuff like that. Building all this takes a lot of work, so people are spending more on big machines. Plus, the push for smart cities and eco-friendly growth means we need new tools to handle modern building needs. Heavy equipment is super important here, giving the strength and speed to finish huge jobs. As cities keep changing North America, the heavy construction equipment market should see strong growth, thanks to the demand for fresh and fast building ideas.

MARKET RESTRAINTS

High Initial Capital Investment

The North American heavy construction equipment market runs into grave problems, especially because buying and keeping heavy machines costs a lot of money upfront. New equipment isn’t cheap—prices can start at tens of thousands of dollars and go up to millions, depending on what kind it is and how it’s built. Industry guesses say a new excavator might cost over $100,000, and bigger stuff like cranes could be millions. This money problem makes it tough for small or medium construction companies to buy new gear, holding them back from keeping up in a fast-changing market. Plus, the regular upkeep and running costs of these machines can make it even harder for buyers to afford them. Because of this, the big starting cost of heavy construction equipment is a major roadblock that might slow down market growth, especially for smaller businesses that care more about saving money now than spending for the future.

Regulatory Compliance and Safety Standards

Another major roadblock for the North American heavy construction equipment market is all those tough rules and safety checks that folks making and using the gear have to deal with. You’ve got agencies like OSHA (Occupational Safety and Health Administration) and the EPA (Environmental Protection Agency) laying down some pretty strict laws to keep workers safe and the planet from taking a hit. I was talking to some industry pals, and they say following these rules can really hit the wallet hard especially if companies have to shell out for fancy new tech or tweak their ways to match the latest standards. Plus, when the rules might shift, it’s like trying to plan a picnic without knowing the weather tricky. And don’t get me started on the constant training and certificates workers need just to stay legit. All this red tape makes it a tough gig for the heavy construction equipment scene here, forcing everyone to stay on their toes and roll with whatever new safety or compliance curveball comes their way.

MARKET OPPORTUNITIES

Technological Advancements and Automation

The North American heavy construction equipment market has a good chance to grow with all this new tech and automation. Better designs, tracking tools like telematics, and machines that work on their own are making heavy gear faster and stronger. A report from the International Federation of Robotics states that construction might use 25% more robots and automation by 2025. That’s great because it helps workers finish jobs quicker, cuts down on labour costs, and makes sites safer. Like, those machines that drive themselves they get stuff done right and fast. As building companies try to use tech to beat the competition, they’ll want more of this smart equipment with the latest features. It’s a big opening for companies making this stuff to build tools that fit what construction needs, setting up the North American heavy construction equipment market to keep getting bigger.

Sustainable Construction Practices

Another promising opportunity for the North American heavy construction equipment market lies in the growing emphasis on sustainable construction practices. As environmental concerns become more pressing, construction companies are increasingly prioritizing eco-friendly solutions that minimize their carbon footprint. According to a survey conducted by the World Green Building Council, 75% of construction professionals believe that sustainability will be a key driver of growth in the industry over the next decade. This shift towards sustainable practices is driving demand for heavy construction equipment that is energy-efficient, utilizes alternative fuels, and incorporates environmentally friendly technologies. Manufacturers that invest in developing equipment designed for sustainable construction will be well-positioned to capture market share as more companies seek to align their operations with environmental goals. The increasing focus on green building certifications and regulations further supports this trend, creating opportunities for innovation and growth in the North American heavy construction equipment market.

MARKET CHALLENGES

Fluctuating Raw Material Prices

The North American heavy construction equipment market hits rough patches because the costs of basic materials like steel, aluminium, and rubber keep shifting. These changes happen due to stuff like global supply messes, trade laws, and swings in what people want. Experts say steel costs have bounced around by as much as 30% lately, driving up what it takes to build heavy gear. This instability makes it tricky for companies to set firm prices for their goods. Also, when material costs climb, they cut into earnings especially for smaller businesses that don’t have spare funds to cover it. So, these unpredictable material prices create a serious obstacle for the North American heavy construction equipment market, pushing folks to come up with clever strategies and safeguards to handle the impact.

Skilled Labor Shortages

Another formidable challenge facing the North American heavy construction equipment market is the ongoing skilled labour shortages in the construction industry. As the demand for construction projects continues to rise, the lack of qualified workers poses a significant barrier to growth. According to the Associated General Contractors of America, 80% of construction firms reported difficulties in finding skilled labour in 2021, with many citing a lack of training and apprenticeship programs as contributing factors. This shortage of skilled labour can lead to project delays, increased labour costs, and reduced productivity, ultimately impacting the demand for heavy construction equipment. Additionally, the aging workforce in the construction industry exacerbates this issue, as experienced workers retire without sufficient new talent to replace them. As a result, the skilled labour shortage represents a significant challenge for the North American heavy construction equipment market, requiring industry stakeholders to invest in training and development initiatives to attract and retain a qualified workforce.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.03% |

|

Segments Covered |

By Types, Application, End-User And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

United States, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

Caterpillar, Komatsu Ltd., AB Volvo, Hitachi Construction Machinery Co., Ltd. Deere & Company., CNH, Industrial N.V., LIEBHERR, Kobelco Construction Machinery Co., Ltd., SANY, XCMG GROUP. |

SEGMENTAL ANALYSIS

By Types Insights

The earthmoving equipment secured the largest market share of the North American heavy construction equipment market and possessed a 43.5% of the total market in 2024. This top spot comes from using earthmoving machines a lot in building tasks like digging, smoothing land, and setting up sites. Industry predictions say the earthmoving equipment part will grow by 5% each year for the next five years, showing how much people still need fast and handy machines for construction work. Machines like excavators, bulldozers, and backhoes are super useful for all kinds of jobs, from small home projects to big roads and bridges. More focus on city growth and building things also pushes the need for these machines, as companies want to work quicker and better. As the market keeps changing, earthmoving equipment should stay on top, helped by new tech and the rising call for solid building tools.

The quickest-growing part in the North American heavy construction equipment market is the material handling equipment section, expected to rise by 7% yearly for the next five years. This increase comes from a bigger need for smart material handling tools in fields like construction, shipping, and production. As companies try to make their work smoother and boost output, the use of high-tech material handling gear like forklifts, pallet jacks, and self-moving carts should grow a lot. Market studies say the material handling equipment part will take a bigger slice of the market as more firms see the value in spending on dependable and efficient ways to handle materials and stock. The rising attention on automation and the push for simpler operations also set this section up for big growth in the years ahead.

By Application Insights

The earthmoving segment of the North American heavy construction equipment market held the largest market share and accounted for 36.3% of the total market in 2024. This leading role comes from the wide use of earthmoving equipment in different construction tasks like digging, levelling, and getting sites ready. Industry data shows that the earthmoving part is expected to grow by 6% each year for the next five years, showing the steady need for useful and flexible machines in building projects. The growing push for infrastructure and city growth also boosts the need for earthmoving equipment, as construction firms aim to improve their work speed and output. As the market keeps changing, the earthmoving section’s top spot should continue, helped by new technology and the rising demand for trusty construction tools.

The mining and excavation segment is predicted to grow the fastest in the North American heavy construction equipment market, with a CAGR of 8% over the forecast period. This growth is fuelled by the rising need for heavy machinery in mining, as demand for minerals and resources increases. Study exhibits that this segment will take a larger share of the market as companies invest in advanced equipment to improve efficiency and safety. The emphasize on sustainable mining practices and better resource extraction methods also drives this trend. These factors are expected to push the mining and excavation segment toward strong growth in the near future.

By End-Users Insights

The construction industry makes up 50.3% of the North American heavy construction equipment market and giving it the biggest share in 2024. This is because heavy equipment is widely used in all kinds of projects, such as building homes, commercial spaces, and major infrastructure. Industry data shows this segment will grow by around 6% each year for the next five years, as the need for dependable and efficient machines stays strong. The growing push for urban development and new infrastructure is also boosting demand, as construction companies look for ways to work more efficiently and get more done.

The mining sector is set to be the fastest-growing part of the North American heavy construction equipment market, with a forecasted growth rate of 9% each year. This rise is mainly due to the increasing demand for heavy machines in mining, as more minerals and resources are needed. Research shows that mining companies are expected to make up a larger share of the market, as they turn to advanced equipment to boost productivity and safety. The focus on eco-friendly mining and the push for more efficient resource extraction are also helping this segment grow strongly in the years ahead.

COUNTRY ANALYSIS

The United States heavy construction equipment market is highly evolved and competitive, marked by strong demand from both the private and public sectors. It commanded 71.4% of the total market share in 2024. Major infrastructure programs like the Bipartisan Infrastructure Law are stimulating fresh equipment purchases across roadways, energy, and civil works. The U.S. market is characterized by a robust demand for heavy construction equipment driven by significant investments in infrastructure development and urbanization. According to the American Society of Civil Engineers, the U.S. requires an estimated $4.5 trillion investment in infrastructure by 2025, which is expected to spur a wave of construction activities. Major manufacturers and suppliers are investing heavily in advanced technologies and equipment to meet the growing demand.

Canadian market is defined by its unique regional dynamics. Demand is strongest in areas supporting resource extraction, such as Alberta’s oil sands and mining operations in Quebec and British Columbia. Here, the need for specialized heavy equipment, capable of withstanding rugged conditions, fuels steady growth. Canada’s construction equipment market also benefits from government-backed infrastructure and green energy projects. The customer base skews towards firms engaged in natural resources and infrastructure, but mid-sized contractors are increasingly investing in new technologies to boost productivity in colder and The Canadian government has implemented various initiatives aimed at promoting energy efficiency and sustainability, further supporting the growth of the heavy construction equipment market.

Mexico’s heavy construction equipment market is entering a transformative phase. With large-scale infrastructure projects like the Maya Train and new airport expansions, the country is ramping up its investment in modern construction fleets. The market is fuelled by a rising number of local contractors who are modernizing their equipment to compete for public works and private sector projects. Demand intensity is growing as Mexico focuses on urban development and export-driven industrial zones, positioning the market as a hub for construction growth in Latin America. As per the Mexican National Institute of Statistics and Geography, the country has been experiencing rapid growth in its construction sector, leading to heightened demand for modern machinery. The Mexican government has also been promoting infrastructure development initiatives, which further supports the growth of the heavy construction equipment market.

MARKET SEGMENTATION

This research report on the North heavy construction market is segmented and sub-segmented into the following categories.

By Types

- Earthmoving Equipment

- Excavators

- Bulldozers

- Graders

- Material Handling Equipment

- Cranes

- forklifts

- Heavy Construction Vehicles

- Dump trucks

- concrete mixers

- Others (Cranes, Excavators, Dozer)

By Applications

- Mining & Excavation

- Earthmoving

- Transportation

- Lifting

- Material Handling

By End-Users

- Oil & Gas Industry

- Construction Industry

- Military

- Mining

- Agriculture & Forestry

By Country

- U.S

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What role does heavy construction equipment play in North America's infrastructure development?

It is crucial for large-scale projects like roads, bridges, commercial buildings, and smart cities, driving efficiency and productivity in the construction sector.

Why is the demand for heavy construction equipment rising in North America?

Growing urbanization, government investments in infrastructure, and advancements in automation & electrification are fueling market growth.

Which types of heavy construction equipment are most commonly used in the region?

Excavators, loaders, bulldozers, cranes, and dump trucks are widely used across various construction and mining projects.

How is technology shaping the future of heavy construction equipment in North America?

The industry is witnessing a shift toward AI-powered automation, electric & hybrid machinery, and telematics for real-time performance monitoring.

Who are the major players driving innovation in this market?

Leading companies like Caterpillar, John Deere, Komatsu, Volvo Construction Equipment, and Hitachi are pioneering advancements in sustainable and smart construction machinery.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]