North America Healthcare Revenue Cycle Management (RCM) Market Size, Share, Trends & Growth Forecast Report By Delivery Mode (Cloud-based Solutions, On-premise Solutions), End-User, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2024 to 2033

North America Healthcare Revenue Cycle Management (RCM) Market Size

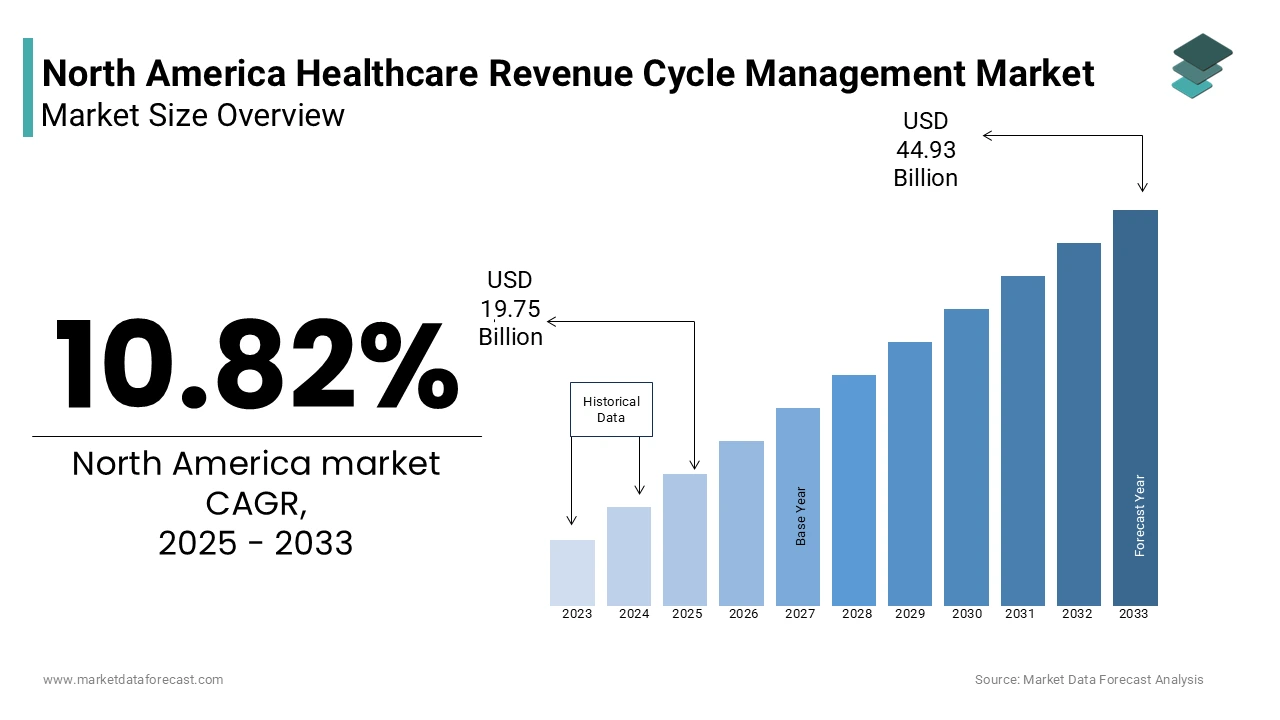

The Healthcare Revenue Cycle Management (RCM) market size in North America was valued at USD 17.83 billion in 2024 and is predicted to be worth USD 44.93 billion by 2033 from USD 19.75 billion in 2025 and grow at a CAGR of 10.82% from 2025 to 2033.

The North America healthcare revenue cycle management (RCM) market is a critical component of the region's healthcare infrastructure, addressing the financial complexities of patient care. As per a study by Deloitte, the U.S. accounts for approximately 85% of the regional RCM market and is driven by its highly privatized healthcare system and stringent regulatory frameworks. The market is witnessing robust growth due to increasing patient volumes and the rising adoption of digital health solutions. Moreover, according to McKinsey & Company, around 30% of healthcare providers in North America are investing heavily in RCM technologies to streamline billing processes and reduce claim denials. On the other hand, Canada is experiencing gradual adoption, primarily due to its publicly funded healthcare model. A report by Accenture states that over 60% of healthcare organizations in North America have implemented cloud-based RCM solutions to enhance operational efficiency. The market is further bolstered by the growing prevalence of chronic diseases, which has amplified the need for accurate billing and reimbursement systems.

MARKET DRIVERS

Increasing Adoption of Digital Health Solutions

The proliferation of digital health solutions is a pivotal driver propelling the North America healthcare RCM market forward. Electronic health records (EHRs) and telehealth platforms are now integral to modern healthcare delivery, necessitating advanced RCM systems to manage complex billing workflows. As per a study by HIMSS Analytics, over 90% of hospitals in the U.S. have adopted EHR systems creating a strong demand for integrated RCM solutions. Furthermore, as per PwC’s Health Research Institute, telehealth usage surged by 38 times compared to pre-pandemic levels, amplifying the need for seamless billing processes. These trends underscore the importance of RCM systems in ensuring compliance with HIPAA regulations while optimizing revenue streams. This digital transformation not only enhances operational efficiency but also reduces administrative burdens, making it a key growth driver.

Stringent Regulatory Frameworks

Stringent regulatory requirements governing healthcare billing and reimbursement processes are another significant driver shaping the North America RCM market. The Centers for Medicare & Medicaid Services (CMS) mandates strict adherence to coding standards such as ICD-10, which necessitates sophisticated RCM tools for error-free claims processing. According to KPMG, nearly 25% of denied claims in the U.S. stem from coding errors costing healthcare providers an estimated $262 billion annually. To mitigate these losses, organizations are increasingly adopting RCM solutions that ensure compliance with evolving regulations. Also, the introduction of value-based care models has intensified the focus on accurate billing and reimbursement practices. As per a report by BCG, over 70% of healthcare providers have transitioned to value-based payment structures, further fueling demand for RCM systems. These regulatory pressures, coupled with the need for financial sustainability, are driving widespread adoption of RCM technologies across the region.

MARKET RESTRAINTS

High Implementation Costs

The high cost associated with implementing advanced RCM systems poses a significant barrier to market growth, particularly for small and medium-sized healthcare providers. This financial burden often deters smaller practices from adopting cutting-edge technologies, limiting market penetration. Moreover, ongoing maintenance and software upgrade costs further exacerbate the financial strain. While larger institutions can absorb these expenses, smaller entities struggle to justify the return on investment, especially in regions with limited technological infrastructure. This economic disparity creates a fragmented market landscape, hindering uniform adoption rates.

Resistance to Change

Resistance to change among healthcare professionals and staff represents another major restraint impacting the RCM market. Despite the availability of advanced RCM tools, many healthcare organizations face challenges in transitioning from legacy systems due to a lack of technical expertise and resistance to new workflows. According to a study by the American Medical Association, nearly 60% of physicians expressed concerns about the additional workload associated with adopting new RCM technologies. To add to this, as per a report by Gartner, inadequate training programs and insufficient stakeholder engagement result in low user adoption rates, undermining the potential benefits of RCM solutions. This resistance is particularly pronounced in rural areas where access to skilled IT professionals is limited. The resulting inefficiencies not only impede market growth but also hinder the realization of long-term financial gains. Addressing this cultural barrier requires targeted educational initiatives and stakeholder collaboration.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into RCM systems presents a transformative opportunity for the North America healthcare market. AI-powered tools can automate repetitive tasks such as claims processing, eligibility verification, and denial management significantly reducing administrative overheads. As per the findings by Accenture, AI-driven RCM solutions could save the U.S. healthcare industry up to $150 billion annually by 2026. For instance, predictive analytics can identify patterns in denied claims, enabling proactive measures to minimize rejections. A study by Optum reveals that AI-based denial prevention strategies have reduced claim denials by 20% in pilot programs. In conjunction with, natural language processing (NLP) capabilities allow for accurate extraction of data from unstructured documents enhancing coding accuracy. As healthcare organizations increasingly prioritize cost optimization, the demand for AI-integrated RCM systems is expected to surge, unlocking substantial growth potential in the coming years.

Expansion of Value-Based Care Models

The expansion of value-based care models offers a lucrative opportunity for the North America RCM market. These models emphasize patient outcomes over service volume, necessitating precise tracking of performance metrics and financial reimbursements. Based on a report by Leavitt Partners, over 50% of healthcare payments in the U.S. are now tied to value-based arrangements driving the need for advanced RCM solutions. These systems enable providers to align financial incentives with clinical outcomes ensuring compliance with pay-for-performance contracts. For example, a study by Avalere Health notes that hospitals utilizing RCM tools tailored for value-based care experienced a 15% increase in revenue capture. Together with, the shift towards accountable care organizations (ACOs) has created a demand for interoperable RCM platforms that facilitate seamless data exchange. As value-based care continues to gain traction, the RCM market stands to benefit from increased adoption and innovation.

MARKET CHALLENGES

Data Security Concerns

Data security remains a pressing challenge for the North America healthcare RCM market, given the sensitive nature of patient information processed through these systems. Cyberattacks targeting healthcare organizations have surged by 45% over the past two years, according to a report by IBM Security. Breaches not only compromise patient privacy but also result in significant financial losses, with the average cost of a healthcare data breach exceeding $9 million, as per the Ponemon Institute. The complexity of securing vast amounts of data across multiple platforms exacerbates the issue, particularly for cloud-based RCM solutions. Along with, regulatory penalties for non-compliance with HIPAA further compound the risks. A study by Verizon stresses that human error accounts for 30% of data breaches in healthcare spotlighting the need for robust cybersecurity measures. Addressing these vulnerabilities requires continuous investment in encryption technologies and employee training programs.

Interoperability Issues

Interoperability issues pose a significant challenge to the seamless functioning of RCM systems in North America. Many healthcare organizations operate disparate systems that lack compatibility leading to fragmented data exchange and operational inefficiencies. According to a study by the Office of the National Coordinator for Health Information Technology (ONC), only 46% of hospitals in the U.S. can effectively share patient data with external providers. This lack of interoperability hinders accurate billing and reimbursement processes resulting in delayed payments and increased administrative burdens. Furthermore, as per a report by Chilmark Research, integrating legacy systems with modern RCM platforms requires substantial customization often at a high cost. The absence of standardized protocols across different healthcare IT systems exacerbates these challenges, impeding the scalability of RCM solutions. Overcoming these barriers necessitates collaborative efforts to establish universal interoperability standards.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.82% |

|

Segments Covered |

By Delivery Mode, End-User, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Cerner Corporation, General Electric, McKesson Corporation, SAP SE, IBM, NetSuite Inc., Workday, Inc., ADP LLC, Cornerstone OnDemand, Benefitfocus Inc., Zoho Corporation Pvt. Ltd., Sage Global Services Limited, and others |

SEGMENTAL INSIGHTS

By Delivery Mode Insights

The cloud-based solutions segment dominated the North America healthcare RCM market by capturing 65.8% of the total market share in 2024. Such performance is credited to the scalability and cost-effectiveness of cloud platforms, which cater to the diverse needs of healthcare providers. Based on a study by IDC, over 70% of healthcare organizations have migrated their RCM operations to the cloud, citing enhanced accessibility and real-time data processing as key advantages. Also,the flexibility of cloud-based systems allows providers to scale operations without significant upfront investments making them particularly appealing to smaller practices. The growing emphasis on remote work and telehealth services has further accelerated cloud adoption, solidifying its position as the largest segment in the market.

The fastest-growing segment in the North America healthcare RCM market is the cloud-based solutions which is expected to have a CAGR of 12.5% from 2025 to 2033. This rapid growth is fueled by advancements in cloud computing technologies and the increasing demand for real-time data analytics. A study by Gartner reveals that cloud-based RCM systems can improve billing efficiency by 30%, attracting widespread adoption. Beyond this, the ability to integrate with emerging technologies such as AI and machine learning enhances their appeal. As per a report by Deloitte, over 80% of healthcare organizations plan to expand their cloud investments by 2025 driven by the need for agile and secure data management solutions. The scalability of cloud platforms ensures they remain at the forefront of innovation positioning them as the fastest-growing segment in the market.

By End User Insights

The healthcare providers segment represented the biggest end-user in the North America healthcare RCM market by accounting for a control portion of the total market share in 2024. This influence over the market is linked to the critical role RCM systems play in streamlining billing processes and improving financial performance. A study by the Healthcare Financial Management Association (HFMA) states that providers using advanced RCM solutions experience a 25% reduction in claim denials, underscoring their importance. The increasing volume of patient interactions, coupled with the complexity of insurance claims, has heightened the demand for efficient RCM tools. Furthermore, as per a report by McKinsey, providers leveraging RCM technologies achieve a 15% increase in revenue collection within the first year of implementation. These factors, combined with the growing emphasis on patient-centric care, reinforce the prominence of healthcare providers as the largest segment in the market.

The healthcare payers segment is moving ahead quickly in the market, with a projected CAGR of 11.8% in the coming years. This progress is because of the increasing adoption of value-based care models which require payers to closely monitor provider performance and reimbursement accuracy. A study by Oliver Wyman reveals that payers utilizing RCM systems achieve a 20% improvement in claims processing efficiency reducing administrative costs. On top of that, the shift towards digital health solutions has prompted payers to invest in advanced RCM platforms to ensure seamless data exchange with providers. As per a report by PwC, over 65% of payers plan to enhance their RCM capabilities by 2025 driven by the need for greater transparency and accountability. These dynamics position healthcare payers as the fastest-growing segment in the market.

REGIONAL ANALYSIS

The U.S. remains the epicenter of RCM innovation and deployment. It held 82.7% of the regional share in 2024. Its dominance is linked to the highly privatized healthcare system which necessitates robust RCM solutions to manage complex billing processes. A study by Accenture notes that over 60% of U.S. healthcare organizations have adopted cloud-based RCM systems reflecting the country’s technological advancements. Also, the growing prevalence of chronic diseases coupled with stringent regulatory frameworks, further drives demand. According to Centers for Medicare & Medicaid Services (CMS), the U.S. healthcare expenditure reached $4.3 trillion in 2022 showcasing the critical role of RCM in optimizing financial performance. Investments in AI and machine learning are also gaining traction with over 50% of providers exploring these technologies to enhance billing accuracy.

Canada’s publicly funded healthcare system presents unique dynamics for RCM vendors. The country’s publicly funded healthcare system presents unique challenges, including limited budgets and slower adoption rates of advanced RCM technologies. However, as per Statistics Canada, healthcare spending increased by 5% in 2022, signaling growing interest in RCM solutions. The Canadian government’s push for digital health initiatives has spurred adoption, with over 40% of hospitals implementing electronic medical records. Based on a study by PwC, cloud-based RCM systems are gaining popularity, driven by their cost-effectiveness and scalability. These trends indicate steady growth potential in the Canadian market.

Mexico is emerging as the fastest-growing market in the region and is expected to attain a CAGR of 9.6% in the coming years. The nation’s healthcare system is undergoing significant reforms, with private healthcare providers increasingly adopting RCM technologies to improve financial efficiency. According to National Institute of Statistics and Geography of Mexico (INEGI), the healthcare expenditure grew by 6% in 2022, reflecting rising demand for advanced billing solutions. The Mexican government’s focus on universal healthcare coverage has also fueled investments in RCM systems. These developments underscore Mexico’s emerging role in the regional market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Cerner Corporation, General Electric, McKesson Corporation, SAP SE, IBM, NetSuite Inc., Workday, Inc., ADP LLC, Cornerstone OnDemand, Benefitfocus Inc., Zoho Corporation Pvt. Ltd., Sage Global Services Limited are playing dominating role in North America Healthcare Revenue Cycle Management (RCM).

The North America healthcare RCM market is characterized by intense competition, with numerous players vying for market share. Established companies leverage their extensive networks and technological expertise to maintain dominance, while emerging players focus on niche markets to differentiate themselves. The market is witnessing a wave of consolidation, with mergers and acquisitions becoming increasingly common. Additionally, the growing emphasis on digital transformation has intensified competition, as companies strive to offer innovative solutions that meet the evolving needs of healthcare providers. This dynamic landscape underscores the importance of strategic differentiation and continuous innovation.

TOP PLAYERS IN THIS MARKET

Cerner Corporation

Cerner Corporation is a prominent player in the North America healthcare RCM market, renowned for its innovative solutions that integrate seamlessly with electronic health records (EHRs). The company’s strengths lie in its ability to provide end-to-end RCM services, from patient registration to final reimbursement. Its advanced analytics capabilities enable healthcare providers to optimize revenue streams while ensuring compliance with regulatory standards. Cerner’s commitment to innovation is evident in its recent partnerships with AI startups to enhance predictive analytics in RCM workflows. Its global presence and extensive client base further solidify its leadership position in the market.

McKesson Corporation

McKesson Corporation is a key contributor to the North America healthcare RCM market, offering comprehensive solutions tailored to the needs of both providers and payers. The company’s strengths include its scalable cloud-based platforms and robust customer support services. McKesson’s focus on interoperability ensures seamless integration with existing healthcare IT systems, enhancing operational efficiency. Its strategic investments in AI and machine learning have enabled the development of cutting-edge tools for denial management and claims processing. McKesson’s reputation for reliability and innovation makes it a trusted partner for healthcare organizations seeking to streamline their financial operations.

Allscripts Healthcare Solutions

Allscripts Healthcare Solutions is a leading player in the North America healthcare RCM market, known for its user-friendly platforms and comprehensive service offerings. The company’s strengths lie in its ability to deliver customizable solutions that cater to the unique needs of healthcare providers. Allscripts’ emphasis on value-based care has resulted in the development of RCM tools that align financial incentives with clinical outcomes. Its strategic collaborations with telehealth providers have expanded its reach enabling it to address the growing demand for remote billing solutions. Allscripts’ commitment to innovation and customer satisfaction positions it as a key player in the market.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the North America healthcare RCM market employ several strategies to maintain their competitive edge. Strategic acquisitions are a common approach, allowing companies to expand their service portfolios and enter new markets. Partnerships with technology firms, particularly those specializing in AI and machine learning, are also prevalent, enabling the development of advanced RCM tools. Additionally, investments in research and development drive innovation, ensuring compliance with evolving regulatory standards. Companies also focus on enhancing customer engagement through training programs and support services. These strategies collectively strengthen their market position and drive growth.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Cerner Corporation partnered with an AI startup to enhance its predictive analytics capabilities, enabling more accurate denial management.

- In June 2023, McKesson Corporation acquired a cloud-based RCM platform, expanding its service offerings and strengthening its market presence.

- In January 2024, Allscripts Healthcare Solutions launched a new module focused on value-based care, aligning financial incentives with clinical outcomes.

- In September 2023, Athenahealth introduced a mobile app for RCM, improving accessibility and user engagement among healthcare providers.

- In November 2023, Epic Systems collaborated with a telehealth provider to integrate remote billing solutions into its RCM platform.

MARKET SEGMENTATION

This research report on the North America healthcare revenue cycle management (RCM) market has been segmented and sub-segmented based on the following categories.

By Delivery Mode

- Cloud-based Solutions

- On-premise Solutions

By End-User

- Healthcare Providers

- Inpatient Facilities

- Hospitals

- Others

- Outpatient Facilities

- Physicians Practices

- Ambulatory Surgical Centers (ASCs)

- Hospital Outpatient Facilities

- Diagnostic & Imaging Centers

- Other Outpatient Facilities

- Inpatient Facilities

- Healthcare Payers

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What is the projected size of the North America Healthcare Revenue Cycle Management market by 2033?

The market is expected to grow from USD 19.75 billion in 2025 to USD 44.93 billion by 2033, at a CAGR of 10.82%.

2. What factors are driving growth in the RCM market?

Key drivers include increasing healthcare costs, adoption of digital and cloud-based solutions, regulatory changes, and the need for efficient billing and payment systems.

3. Which end-users drive demand for RCM solutions?

Hospitals, physician offices, diagnostic labs, and ambulatory surgical centers are key end-users driving demand for RCM systems.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]