North America Healthcare Packaging Market Size, Share, Trends & Growth Forecast Report by End-User Vertical (Pharmaceutical, Medical Devices), Product Type (Bottles and Containers, Vials and Ampoules, Cartridges and Syringes, Pouch and Bags, Blister Packs, Tubes, Paper Board Boxes, Caps and Closures and Labels), Material (Glass, Plastic), and Country (United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033.

North America Healthcare Packaging Market Size

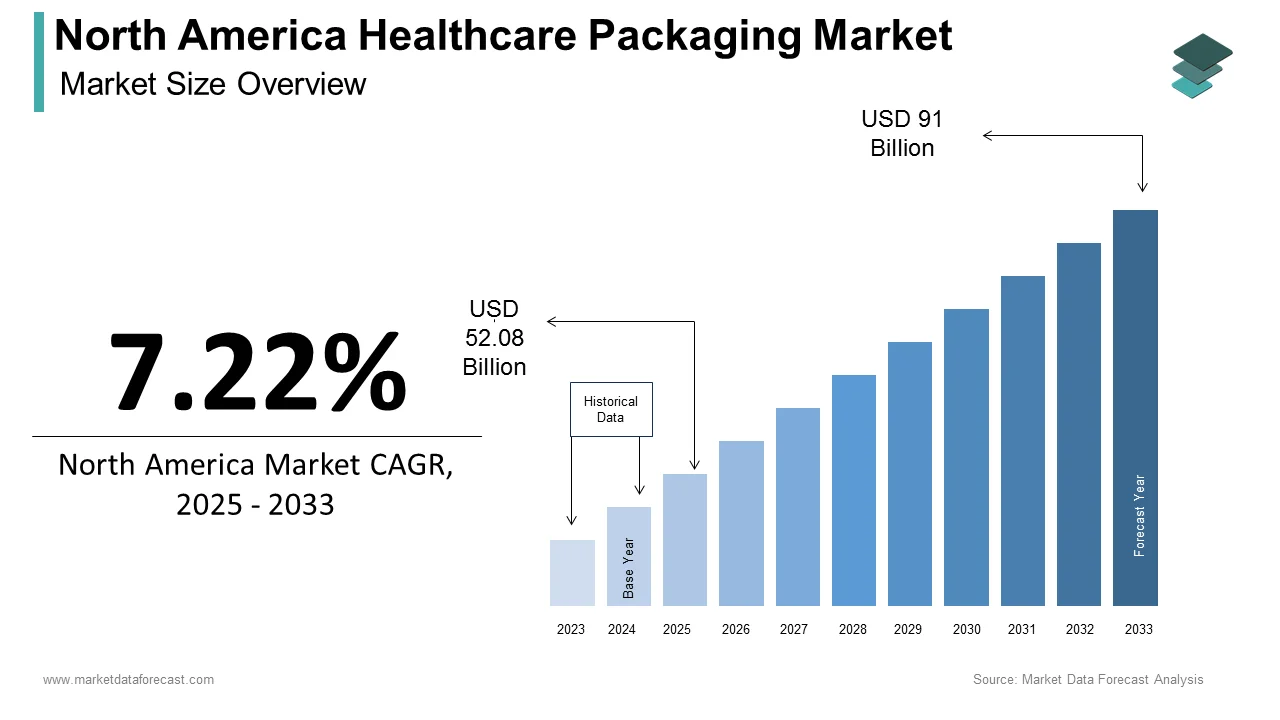

The size of the North America healthcare packaging market was valued at USD 48.57 billion in 2024. This market is expected to grow at a CAGR of 7.22% from 2025 to 2033 and be worth USD 91 billion by 2033 from USD 52.08 billion in 2025.

Healthcare packaging includes materials and containers used for pharmaceuticals, medical devices, and diagnostic products, with a focus on maintaining sterility, preventing contamination, and providing clear labeling. This rise is backed by the increasing demand for advanced packaging solutions that meet stringent regulatory requirements and enhance patient safety. As per market insights, the North America healthcare packaging market is poised for continued expansion, with manufacturers focusing on innovation, sustainability, and the development of smart packaging technologies to meet the evolving needs of the healthcare sector. The market is also benefiting from the growing trend of personalized medicine, which requires specialized packaging solutions to accommodate unique patient needs and dosage forms.

MARKET DRIVERS

Increasing Demand for Biopharmaceuticals

The North America healthcare packaging market is significantly driven by the increasing demand for biopharmaceuticals. As the biopharmaceutical sector continues to expand, there is a growing need for specialized packaging solutions that can accommodate the unique requirements of biologics, such as temperature sensitivity and sterility. This trend is prompting manufacturers to develop advanced packaging solutions, including prefilled syringes, vials, and specialized containers that ensure the stability and integrity of biopharmaceutical products. The versatility of healthcare packaging allows it to be tailored to meet the specific needs of biopharmaceuticals, appealing to a wide range of stakeholders, including pharmaceutical companies and healthcare providers.

Growth in the Medical Device Sector

Another significant driver of the North America healthcare packaging market is the growth in the medical device sector. The increasing prevalence of chronic diseases and the aging population are driving the demand for medical devices, which require effective packaging solutions to ensure their safety and functionality. According to the U.S. Food and Drug Administration, the medical device trade in the United States is projected to reach $208 billion by 2023 is indicating a robust growth trajectory. This trend is particularly evident in the development of advanced medical devices, such as implantable devices, diagnostic equipment, and surgical instruments, which necessitate specialized packaging to maintain sterility and prevent contamination. The versatility of healthcare packaging allows it to be used in various applications, including sterile barrier systems, protective packaging, and labeling solutions, appealing to a broad range of manufacturers in the medical device industry.

MARKET RESTRAINTS

Regulatory Compliance Challenges

One of the primary restraints affecting the North America healthcare packaging market is the regulatory compliance challenges imposed by government agencies. The production and sale of healthcare packaging are subject to stringent regulations regarding safety, quality, and labeling, which can vary significantly across different jurisdictions. According to the U.S. Food and Drug Administration, manufacturers must adhere to specific guidelines to ensure the safety and efficacy of packaging materials used for pharmaceuticals and medical devices. This regulatory landscape can pose challenges for packaging producers, particularly smaller companies that may lack the resources to navigate complex compliance requirements. Additionally, the lack of standardized definitions for terms such as "biodegradable" or "recyclable" can create confusion among consumers and complicate marketing efforts. Companies must invest time and resources to ensure compliance with regulations while effectively communicating their product benefits to consumers.

Price Fluctuations of Raw Materials

A grave restraint in the North America healthcare packaging market is the price fluctuations of raw materials used in packaging production. The healthcare packaging industry relies on various materials, including plastics, glass, and metals, which can be subject to price volatility due to factors such as supply chain disruptions, geopolitical tensions, and changes in demand. According to industry reports, fluctuations in the prices of raw materials can significantly impact the overall cost of healthcare packaging, leading to increased production costs for manufacturers. This situation can pose challenges for companies that must balance the need to maintain competitive pricing with the rising costs of materials. Besides, the reliance on a limited number of suppliers for high-quality raw materials can create supply chain vulnerabilities, further complicating the market landscape.

MARKET OPPORTUNITIES

Expansion of Sustainable Packaging Solutions

The North America healthcare packaging market presents significant opportunities for growth through the expansion of sustainable packaging solutions. As consumers and regulatory bodies increasingly prioritize environmental sustainability, there is a growing demand for packaging materials that are eco-friendly and recyclable. This trend is driving manufacturers to innovate and develop sustainable packaging solutions that minimize environmental impact while maintaining product safety and efficacy. The versatility of sustainable packaging materials such as biodegradable plastics and recycled paper allows them to be used in various healthcare applications, including pharmaceuticals and medical devices.

Rising Demand for Smart Packaging Technologies

Another major opportunity in the North America healthcare packaging market lies in the rising demand for smart packaging technologies. As the healthcare industry increasingly embraces digital transformation, there is a growing interest in packaging solutions that incorporate technology to enhance product safety, traceability, and consumer engagement. This trend is driving manufacturers to develop smart packaging solutions that utilize technologies such as QR codes, RFID tags, and temperature sensors to provide real-time information about product conditions and usage. The versatility of smart packaging allows it to be used in various applications, including pharmaceuticals, medical devices, and food products, appealing to a wide range of consumer preferences.

MARKET CHALLENGES

Supply Chain Disruptions

Among the key challenges facing the North America healthcare packaging market is the potential for supply chain disruptions. The production of healthcare packaging relies on key materials such as plastics, glass, and metals, which can be affected by fluctuations in supply and demand. As per industry reports, disruptions in the supply chain, particularly during adverse weather conditions or global events like the COVID-19 pandemic, have led to increased prices and shortages of essential materials. This situation poses a challenge for manufacturers who must ensure a consistent supply of high-quality materials to meet consumer demand. Also, the sourcing of packaging materials can be impacted by ethical and sustainability concerns, leading some consumers to seek alternatives.

Competition from Alternative Packaging Solutions

A serious challenge in the North America healthcare packaging market is the increasing competition from alternative packaging solutions. The rise of health-conscious consumers has led to a surge in demand for various natural and plant-based alternatives, such as biodegradable and compostable packaging, which can pose a challenge to traditional healthcare packaging materials. This trend is particularly pronounced among environmentally conscious consumers who are increasingly seeking packaging that aligns with their values. Hence, healthcare packaging manufacturers must compete not only with other traditional packaging brands but also with a wide array of alternative packaging solutions that cater to evolving consumer preferences.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By End-user Vertical, Product Type, Material, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America |

|

Market Leader Profiled |

Amcor, West Pharmaceutical Services, Berry Global, Gerresheimer AG, Corning Incorporated, Nipro Corporation, SGD SA (SGD Pharma), Stölzle-Oberglas GmbH (CAG Holding GmbH), and Others. |

SEGMENTAL ANALYSIS

By End-User Vertical Insights

The pharmaceutical segment emerged as the largest category by commanding a market share of approximately 55.7%. This rule can be caused by the extensive use of packaging solutions in the pharmaceutical industry, where safety, compliance, and product integrity are paramount. The versatility of pharmaceutical packaging allows it to encompass a wide range of products, including tablets, capsules, and liquid medications, appealing to a broad consumer base. In addition, the growing trend of personalized medicine and the increasing focus on patient safety have further propelled the demand for innovative packaging solutions that enhance the delivery and administration of pharmaceutical products.

The medical devices segment is witnessing quick expansion, with a estimated CAGR of 6.6% in the forecast period. This is because of the increasing prevalence of chronic diseases and the aging population, which are driving the demand for medical devices that require effective packaging solutions to ensure their safety and functionality. This trend is particularly evident in the development of advanced medical devices, such as implantable devices, diagnostic equipment, and surgical instruments, which necessitate specialized packaging to maintain sterility and prevent contamination. The versatility of healthcare packaging allows it to be used in various applications, including sterile barrier systems, protective packaging, and labeling solutions, appealing to a broad range of manufacturers in the medical device industry.

By Product Type Insights

The bottles and containers represented the largest product type segment by contributing 40.8% of the market share in 2024. This authority is primarily due to the extensive use of bottles and containers for packaging pharmaceuticals, dietary supplements, and liquid medications. The versatility of bottles and containers allows them to be designed in various sizes and materials, catering to a wide range of products and consumer preferences. Moreover, the growing trend of personalized medicine and the increasing focus on patient safety have further propelled the demand for innovative bottle and container designs that enhance the delivery and administration of healthcare products.

Conversely, the blister packs segment is seeing quick growth, with an estimated CAGR of 7.7% in the coming years. This development can be due to the increasing demand for unit-dose packaging solutions that enhance medication adherence and patient safety. Blister packs are widely used in the pharmaceutical industry for packaging tablets and capsules, providing a protective barrier against moisture and contamination. The market insights states that the demand for blister packs is on the rise, driven by the growing trend of personalized medicine and the increasing focus on patient compliance. The convenience of blister packs allows patients to easily access their medications while minimizing the risk of dosage errors. Further, the rise of e-commerce and online pharmacies has further propelled the demand for blister packs, as these packaging solutions are well-suited for shipping and handling.

By Material Insights

The plastic segment spearheaded the North America healthcare packaging market by commanding a market share of 60.8% in 2024. This dominance can be attributed to the versatility, lightweight nature, and cost-effectiveness of plastic materials, which make them ideal for a wide range of healthcare applications. The adaptability of plastic allows it to be molded into various shapes and sizes, catering to diverse product requirements, from bottles and containers to blister packs and pouches. Besides, the growing trend of sustainability has prompted manufacturers to explore biodegradable and recyclable plastic options, further enhancing the appeal of plastic packaging in the healthcare sector.

Whereas, the glass segment is experiencing rapid growth, with a projected CAGR of 6.2% over the forecasted period. This segment's growth can be attributed to the increasing preference for glass packaging in the pharmaceutical industry, where the need for product integrity and safety is paramount. Glass is often favored for its inert properties, which prevent chemical interactions with the contents, making it an ideal choice for sensitive medications and biologics. As per the industry insights, the demand for glass packaging is on the rise, driven by the growing trend of high-quality and premium products in the healthcare sector. The aesthetic appeal and recyclability of glass also contribute to its popularity among consumers and manufacturers alike. Also, the rise of personalized medicine and the increasing focus on sustainability have further propelled the demand for glass packaging solutions that enhance the delivery and administration of healthcare products.

REGIONAL ANALYSIS

The United States leads with a significant edge in the North American healthcare packaging market by accounting for a dominant market share of 70.8% in 2024. The U.S. market is distinguished by a robust demand for healthcare packaging solutions, driven by the increasing prevalence of chronic diseases and the growing focus on patient safety. According to the U.S. Food and Drug Administration, the healthcare packaging landscape in the United States is projected to grow at a notable rate over the next five years and is fueled by the rising demand for advanced packaging solutions that meet stringent regulatory requirements. The U.S. market benefits from a well-established healthcare infrastructure, with a wide range of healthcare packaging products available in hospitals, pharmacies, and retail outlets. Additionally, the growing interest in personalized medicine and the increasing focus on sustainability have led to increased innovation among manufacturers, further driving market growth. The popularity of healthcare packaging in seasonal events, such as flu vaccination campaigns, also contributes to its sustained demand.

Canada demonstrates the most rapid expansion in the market for healthcare packaging in North America and is estimated to attain a CAGR of 6.2% to become the fastest moving trajectory. The Canadian market is experiencing a similar trend to that of the U.S., with an increasing number of healthcare providers and consumers seeking advanced packaging solutions for pharmaceuticals and medical devices. The Canadian market is also witnessing a growing interest in sustainable packaging solutions, reflecting the broader trend towards environmentally friendly practices in the healthcare sector. The expansion of retail channels including online shopping, is further enhancing the accessibility of healthcare packaging products across Canada.

The Rest of North America is evolving steadily in the North America healthcare packaging market and is supported by the expansion of healthcare infrastructure, rising awareness of medical safety standards, and growing imports of packaged pharmaceutical and medical products across several emerging nations. The growing trend of home healthcare and the incorporation of innovative packaging solutions into traditional healthcare practices are contributing to the market's expansion. Additionally, the increasing availability of imported healthcare packaging products from the U.S. is enhancing consumer access to a wider variety of options.

KEY MARKET PLAYERS

A few of the notable companies operating in the North America healthcare packaging market profiled in this report are Amcor, West Pharmaceutical Services, Berry Global, Gerresheimer AG, Corning Incorporated, Nipro Corporation, SGD SA (SGD Pharma), Stölzle-Oberglas GmbH (CAG Holding GmbH), and Others.

KEY PLAYERS MARKET OVERVIEW

The North America healthcare packaging market is characterized by the presence of several key players who dominate the landscape. Notable companies include Amcor, which is recognized for its extensive range of packaging solutions, and West Pharmaceutical Services, a leading provider of packaging and delivery systems for injectable drugs. These companies leverage their extensive distribution networks and brand recognition to capture a significant share of the market. Additionally, smaller, niche players are emerging, focusing on innovative formulations and health-oriented products, such as sustainable and smart packaging solutions. The competitive landscape is further intensified by the growing trend of e-commerce, as brands increasingly adopt online sales strategies to reach a broader audience.

MAJOR STRATEGIES USED BY KEY PLAYERS

Key players in the North America healthcare packaging market employ various strategies to strengthen their market position and enhance competitiveness. One prominent strategy is product innovation, where companies continuously develop new formulations and applications for healthcare packaging to cater to changing consumer preferences. For instance, introducing sustainable and smart packaging solutions has become a popular tactic to attract environmentally conscious consumers. Additionally, many manufacturers are focusing on sustainability initiatives, such as reducing packaging waste and sourcing materials responsibly, to appeal to environmentally aware consumers.

Another strategy involves expanding distribution channels, particularly through e-commerce platforms, to enhance product accessibility. Companies are increasingly partnering with online retailers to reach a wider audience and capitalize on the growing trend of online shopping. Furthermore, marketing campaigns that emphasize the safety, efficacy, and versatility of healthcare packaging in various applications are being utilized to engage consumers and drive brand loyalty. Collaborations with healthcare professionals and influencers are also becoming common practices to create buzz around new product launches.

COMPETITION OVERVIEW

The North America healthcare packaging market is characterized by a competitive landscape that includes both established brands and emerging players. Major companies such as Amcor, West Pharmaceutical Services, and Berry Global dominate the market, leveraging their extensive distribution networks and brand recognition to capture significant market shares. These companies invest heavily in product innovation, focusing on new formulations and applications to meet the evolving preferences of health-conscious consumers. Additionally, the rise of niche brands specializing in sustainable and smart packaging solutions has intensified competition, as these companies cater to a growing demographic seeking environmentally friendly alternatives. The increasing trend of e-commerce has further transformed the competitive landscape, with brands adopting online sales strategies to reach a broader audience. As consumer preferences continue to shift towards unique and health-oriented products, competition is expected to intensify, prompting manufacturers to differentiate themselves through quality, safety, and innovative marketing strategies.

MAJOR MARKET ACTIONS TAKEN BY COMPANIES

- In January 2023, Amcor launched a new line of sustainable healthcare packaging solutions, expanding its product portfolio to cater to the growing demand for eco-friendly options. This initiative aims to enhance consumer accessibility to clean-label products.

- In March 2023, West Pharmaceutical Services introduced a new range of smart packaging solutions, targeting the increasing interest in advanced delivery systems among consumers.

- In May 2023, Berry Global announced a partnership with a popular health influencer to promote its healthcare packaging products through social media campaigns, aimed at increasing brand awareness and consumer engagement.

- In July 2023, Amcor expanded its distribution network by partnering with major healthcare providers across North America, enhancing the availability of its packaging solutions to a wider audience.

- In September 2023, West Pharmaceutical Services launched a marketing campaign focused on educating consumers about the versatility of healthcare packaging in ensuring product safety and efficacy, aiming to increase brand loyalty and consumer engagement.

- In November 2023, Berry Global participated in a major healthcare expo, showcasing its packaging solutions and engaging with health-conscious consumers to promote brand awareness.

- In January 2024, Amcor introduced a new line of biodegradable healthcare packaging options, capitalizing on the growing trend of sustainability among consumers.

- In March 2024, West Pharmaceutical Services announced the launch of a healthcare packaging subscription service, allowing consumers to receive regular shipments of their favorite products, thereby enhancing customer convenience and loyalty.

- In April 2024, Berry Global collaborated with a renowned healthcare professional to create a series of educational materials on the importance of packaging in product safety, leveraging social media to reach a broader audience.

- In June 2024, Amcor launched a limited-edition seasonal packaging design for healthcare products, aiming to attract consumers looking for unique and festive options during the holiday season.

MARKET SEGMENTATION

This research report on the North America healthcare packaging market is segmented and sub-segmented into the following categories.

By End-user Vertical

- Pharmaceutical

- Medical Devices

By Product Type

- Bottles and Containers

- Vials and Ampoules

- Cartridges and Syringes

- Pouch and Bags

- Blister Packs

- Tubes

- Paper Board Boxes

- Caps and Closures

- Labels

By Material

- Glass

- Plastic

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the projected growth rate of the North America healthcare packaging market?

The North America healthcare packaging market is expected to grow at a CAGR of 7.22% from 2025 to 2033.

2. What factors are driving the North America healthcare packaging market?

The market is driven by rising demand for biopharmaceutical packaging, medical device packaging, and regulatory compliance requirements.

3. What materials are commonly used in the North America healthcare packaging market?

Common materials include plastic, glass, and paperboard for bottles, vials, syringes, and blister packs.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]