North America Healthcare IT Market Size, Share, Trends & Growth Forecast Report By Product Type (Healthcare Provider Solutions, Healthcare Payer Solutions, HCIT Outsourcing Services), By End User (Healthcare Providers, Healthcare Payers), and Country (The United States, Canada, Mexico, Rest of North America) Industry Analysis From 2025 to 2033.

North America Healthcare IT Market Size

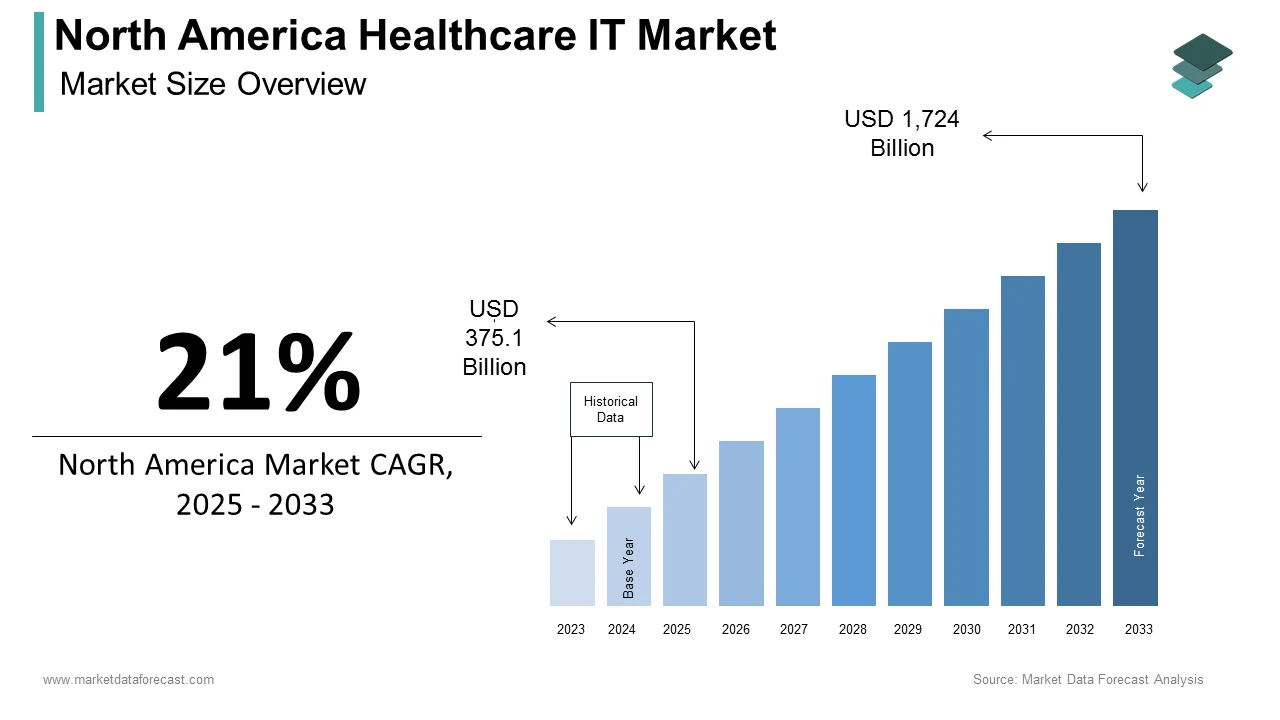

The size of the North America healthcare IT market was worth USD 310 billion in 2024. The North america market is anticipated to grow at a CAGR of 21% from 2025 to 2033 and be worth USD 1,724 billion by 2033 from USD 375.1 billion in 2025.

The North America healthcare IT market involves a wide range of technologies and solutions designed to improve the efficiency, quality, and accessibility of healthcare services. This market includes electronic health records (EHR), telemedicine, health information exchange (HIE), and various software applications that facilitate clinical and administrative processes within healthcare organizations. The increasing digitization of healthcare systems is driven by the need for enhanced patient care, regulatory compliance, and operational efficiency. This progress is backed by the rising adoption of EHR systems, the expansion of telehealth services, and the increasing focus on data analytics and interoperability among healthcare providers. As healthcare organizations strive to improve patient outcomes and streamline operations, the demand for innovative healthcare IT solutions is expected to continue to rise, positioning the market for significant expansion in the coming years.

MARKET DRIVERS

Rising Demand for Telehealth Services

The increasing demand for telehealth services is a significant driver of the North America healthcare IT market. The COVID-19 pandemic has accelerated the adoption of telehealth solutions, as healthcare providers sought to maintain continuity of care while minimizing the risk of virus transmission. As outlined in a report by the McKinsey, telehealth utilization in the United States surged by 38 times higher than pre-pandemic levels, with 46% of consumers reporting that they had used telehealth services in 2021. This shift has prompted healthcare organizations to invest in telehealth platforms and related IT infrastructure to support remote consultations, patient monitoring, and follow-up care. The convenience and accessibility of telehealth services have also contributed to their popularity, as patients can receive care from the comfort of their homes.

Emphasis on Data Interoperability and Analytics

The emphasis on data interoperability and analytics is another key driver propelling the North America healthcare IT market. As healthcare organizations increasingly recognize the importance of data-driven decision-making, the need for integrated systems that facilitate the seamless exchange of information has become paramount. Based on a investigation by the Office of the National Coordinator for Health Information Technology, nearly 80% of healthcare providers reported that they are using EHR systems, yet many struggle with data interoperability. The ability to share patient data across different platforms and systems is essential for improving care coordination, enhancing patient outcomes, and reducing costs. Also, the growing focus on population health management and value-based care models necessitates advanced analytics capabilities to derive actionable insights from healthcare data.

MARKET RESTRAINTS

High Implementation Costs

Among the key restraints affecting the North America healthcare IT market is the high implementation costs associated with healthcare IT solutions. The initial investment required for software licenses, hardware, and training can be substantial, often deterring smaller healthcare organizations from adopting advanced IT systems. According to data provided by the Healthcare Information and Management Systems Society, the average cost of implementing an EHR system can range from $15,000 to $70,000 per provider, depending on the size and complexity of the organization. Additionally, ongoing costs related to maintenance, upgrades, and support can further strain budgets. This financial barrier can lead to a slower rate of technology adoption among smaller healthcare providers, limiting their ability to compete effectively in the market.

Data Security and Privacy Concerns

A serious restraint impacting the North America healthcare IT market is the growing concern over data security and privacy. As healthcare organizations increasingly rely on digital systems to manage sensitive patient information, the risk of data breaches and cyberattacks becomes a pressing issue. As indicated in a report by the Identity Theft Resource Center, healthcare data breaches accounted for 25% of all reported data breaches in 2021 is spotlighting the vulnerability of healthcare organizations to cyber threats. Compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) adds another layer of complexity, as organizations must ensure that their IT systems meet stringent security and privacy requirements. Failure to address these security concerns can result in severe financial penalties, reputational damage, and loss of patient trust. To mitigate these risks, healthcare organizations must invest in robust cybersecurity measures, employee training, and regular security audits.

MARKET OPPORTUNITIES

Growth of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies into healthcare IT solutions presents a significant opportunity for growth in the North America market. These advanced technologies can enhance various aspects of healthcare delivery, including diagnostics, treatment planning, and patient management. AI-driven solutions can analyze vast amounts of healthcare data to identify patterns, predict outcomes, and support clinical decision-making. Moreover, AI can automate administrative tasks, such as scheduling and billing, allowing healthcare providers to focus more on patient care. As organizations increasingly seek to leverage AI and ML to improve operational efficiency and patient outcomes, the demand for healthcare IT solutions that incorporate these technologies is expected to rise significantly.

Expansion of Telehealth and Remote Patient Monitoring

The expansion of telehealth and remote patient monitoring solutions represents another major opportunity for growth in the North America healthcare IT market. The increasing acceptance of telehealth services, driven by the COVID-19 pandemic, has created a demand for technologies that facilitate remote consultations and patient monitoring. As per a study by the American Telemedicine Association, the telehealth landscape is projected to reach a major milestone by 2026 which is reflecting a significant shift in how healthcare is delivered. Remote patient monitoring technologies enable healthcare providers to track patients' health metrics in real-time, improving care management and reducing hospital readmissions.

MARKET CHALLENGES

Integration with Legacy Systems

A major challenge encountered by the North America healthcare IT market is the integration of new technologies with existing legacy systems. Many healthcare organizations still rely on outdated systems that may not be compatible with modern IT solutions, creating barriers to effective data exchange and interoperability. According to a survey by the Healthcare Information and Management Systems Society, nearly 60% of healthcare providers reported difficulties in integrating their EHR systems with other applications. This challenge can hinder the effectiveness of healthcare IT implementations, as organizations may struggle to achieve seamless communication between new and legacy systems. In addition, the complexity of legacy systems can lead to increased costs and extended timelines for technology upgrades.

Rapid Technological Advancements

The rapid pace of technological advancements in the healthcare IT landscape presents a challenge for organizations seeking to implement and maintain IT systems. As new technologies emerge, healthcare providers must continuously adapt their IT strategies to keep up with the evolving landscape. The Forrester via its report states that 60% of healthcare organizations struggle to keep their IT systems aligned with the latest technological trends. This challenge can lead to increased complexity in managing healthcare IT systems, as organizations may need to invest in regular updates, training, and integration with new technologies. Apart from these, the constant introduction of new features and functionalities can overwhelm users, leading to difficulties in adoption and utilization.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, End-user, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America |

|

Market Leader Profiled |

Cognizant, Veradigm, GE Healthcare, Oracle, Nvidia Corporation, Change Healthcare, Siemens Healthineers, McKesson Corporation, Epic Systems Corporation, Cerner Corporation, eClinicalWorks, Dell Technologies, Optum, Athenahealth, NextGen Healthcare, and Others., and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

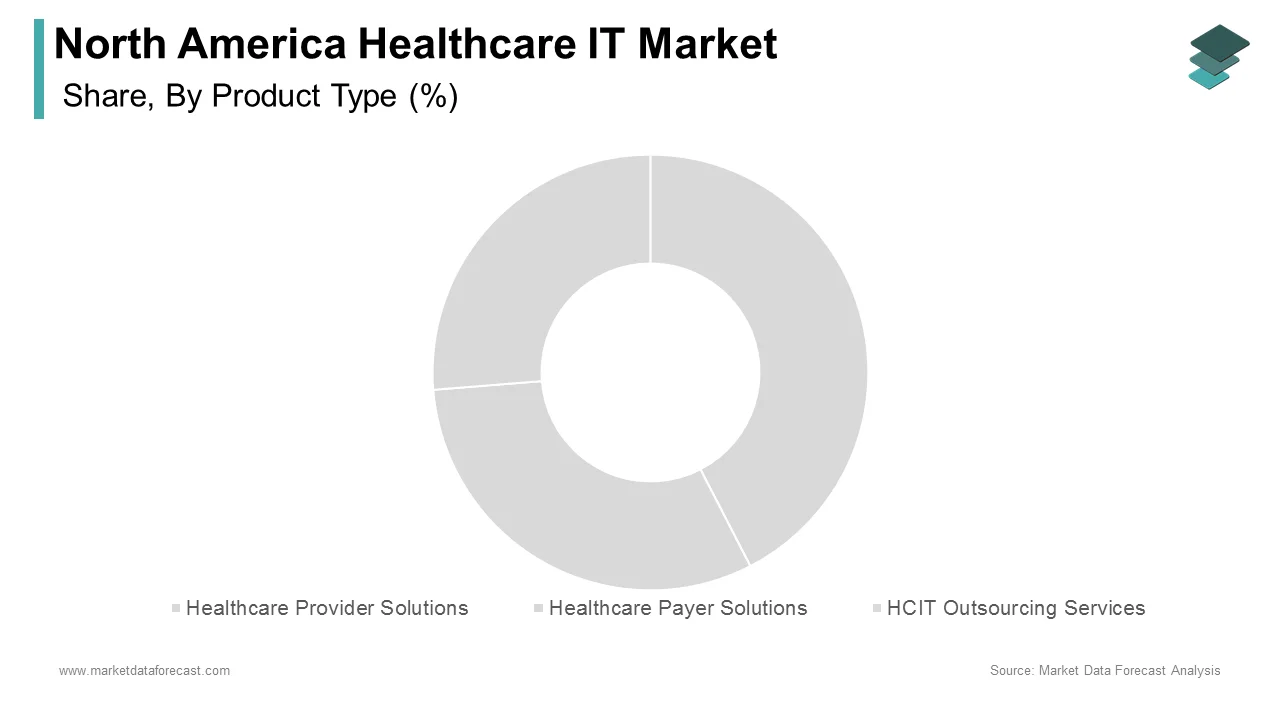

The healthcare provider solutions segment dominated the North America healthcare IT market by capturing 58.4% of the total market share in 2024 because of the increasing demand for solutions that enhance clinical workflows, improve patient care, and ensure regulatory compliance. These solutions enable healthcare providers to streamline their operations, reduce administrative burdens, and enhance patient engagement. Furthermore, the growing emphasis on value-based care and population health management is propelling the demand for integrated healthcare provider solutions that facilitate data sharing and care coordination.

The fastest-growing healthcare payer solutions segment is estimted to register a CAGR of 15.3% over the forecast period. This expansion can be credited to the rising need for efficient claims processing, fraud detection, and regulatory compliance among healthcare payers. Healthcare payers are progressively investing in IT solutions that enable them to streamline their operations, improve customer service, and enhance decision-making capabilities. Moreover, the strengthening commitment to the value-based care and the need for interoperability among payers and providers are further fueling the demand for healthcare payer solutions.

By End User Insights

The healthcare providers segment represented the biggest end-user category and captured 72.5 % of the total market share in 2024. This control over the market is driven by the increasing adoption of healthcare IT solutions among hospitals, clinics, and other healthcare facilities to enhance patient care and operational efficiency. As stated by a report from the American Hospital Association, over 96% of U.S. hospitals have adopted electronic health records (EHR) systems, underscoring the critical role of healthcare IT in modern healthcare delivery. Healthcare providers are increasingly investing in IT solutions that facilitate clinical workflows, improve patient engagement, and ensure regulatory compliance. The intensifying spotlight on value-based care and population health management further propels the demand for integrated healthcare IT solutions that enable providers to share data and coordinate care effectively.

The rapidly growing segment in the North America healthcare IT market is the healthcare payers category and is projected to see highest CAGR of 18.3% from 2025 to 2033. This sudden development can be attached to the escalating need for efficient claims processing, fraud detection, and regulatory compliance among healthcare payers. Healthcare payers are increasingly investing in IT solutions that enable them to streamline their operations, improve customer service, and enhance decision-making capabilities. Apart from these, the amplified focus on value-based care and the need for interoperability among payers and providers are further influencing the demand for healthcare payer solutions.

REGIONAL ANALYSIS

The United States spearhead the North America healthcare IT market and secured a ruling market share of 74.9% in 2024. This authority is supported by the country's advanced technological infrastructure and the presence of major technology companies driving innovation in the healthcare IT sector. According to the U.S. Bureau of Economic Analysis, the healthcare industry is projected to grow at a notable rate annually and is further fuelling the demand for healthcare IT solutions. The U.S. market is defined by enormous investments in research and development, leading to the introduction of innovative healthcare IT systems that cater to the evolving needs of providers and payers. Besides, the growing adoption of cloud-based healthcare IT solutions among U.S. organizations is propelling the demand for these systems.

Canada emerges as the most accelerated market in the North American healthcare IT sphere and the ecosystem is forecast to progress at a CAGR of 9.8%. This progress can be linked to the surging demand for healthcare IT solutions driven by the expansion of the technology sector and the rising adoption of electronic health records (EHR). Based on a report by Statistics Canada, the Canadian healthcare IT trade is expected to grow by 7% yearly and is creating opportunities for IT providers. The Canadian market exhibits a substantial attention to quality and patient safety, with organizations increasingly recognizing the importance of healthcare IT in enhancing operational efficiency. Furthermore, government initiatives aimed at promoting innovation and technology adoption further support this trend.

The rest of North America which covers nation like Mexico moves steadily forward in the healthcare IT market. This region is benefiting from the increasing demand for healthcare IT solutions and the expansion of the technology sector in the region. The market is characterized by a focus on affordability and accessibility, with organizations seeking cost-effective healthcare IT solutions that enhance operational efficiency. Also, the rising awareness of the importance of quality assurance in healthcare IT implementations is driving the adoption of reliable systems and vendors.

KEY MARKET PLAYERS

Some notable companies that dominate the North America healthcare IT market profiled in this report are Cognizant, Veradigm, GE Healthcare, Oracle, Nvidia Corporation, Change Healthcare, Siemens Healthineers, McKesson Corporation, Epic Systems Corporation, Cerner Corporation, eClinicalWorks, Dell Technologies, Optum, Athenahealth, NextGen Healthcare, and Others.

Epic Systems

Epic Systems is a leading player in the North America healthcare IT market, known for its comprehensive electronic health record (EHR) solutions that cater to large healthcare organizations. The company's software is widely used in hospitals and healthcare systems across the United States, enabling providers to streamline their operations and improve patient care. Epic's commitment to innovation and user-friendly design has positioned it as a dominant force in the EHR market, with a significant share of the North American healthcare IT landscape.

Cerner Corporation

Cerner Corporation is another major player in the North America healthcare IT market, recognized for its advanced health information technology solutions. The company's EHR systems are designed to enhance clinical workflows, improve patient engagement, and facilitate data sharing among healthcare providers. Cerner's focus on interoperability and population health management has enabled it to capture a significant share of the healthcare IT market. The company's ongoing investments in research and development further enhance its competitive position in the industry.

Allscripts Healthcare Solutions

Allscripts Healthcare Solutions is a prominent player in the North America healthcare IT market, offering a range of EHR and practice management solutions for healthcare providers. The company's software is designed to improve clinical efficiency, enhance patient care, and support value-based care initiatives. Allscripts' commitment to innovation and customer service has made it a trusted partner for healthcare organizations seeking to optimize their operations. As the demand for integrated healthcare IT solutions continues to rise, Allscripts is well-positioned to capitalize on this trend.

STRATEGIES EMPLOYED BY KEY PLAYERS

Key players in the North America healthcare IT market employ various strategies to strengthen their market position and enhance competitiveness. One prominent strategy is the focus on innovation and research and development, enabling companies to introduce cutting-edge healthcare IT solutions that meet the evolving needs of organizations. For instance, Epic Systems continuously invests in enhancing its EHR platform to incorporate advanced features and functionalities that align with industry trends.

Additionally, strategic partnerships and collaborations play a crucial role in expanding market reach and enhancing product offerings. Cerner Corporation, for example, has formed alliances with various healthcare organizations to ensure a diverse range of high-quality solutions for its users, allowing providers to differentiate themselves in a competitive landscape.

Furthermore, companies are increasingly prioritizing customer-centric approaches, offering tailored solutions and support services to address specific requirements of their clients. This focus on customer engagement not only fosters loyalty but also enhances the overall value proposition of their offerings.

Moreover, many key players are actively pursuing educational initiatives to empower organizations in their healthcare IT implementations. Allscripts, for instance, provides extensive resources and training programs to help users navigate the complexities of its solutions.

COMPETITION OVERVIEW

The competition in the North America healthcare IT market is characterized by a dynamic landscape where innovation, efficiency, and user experience are paramount. Major players are continuously striving to differentiate themselves through advanced technologies and comprehensive solutions. The market is witnessing a surge in the adoption of healthcare IT systems, driven by increasing consumer demand for operational efficiency and integrated healthcare processes. As organizations prioritize digital transformation and seek to enhance their software capabilities, companies that provide reliable, user-friendly platforms and robust functionalities are gaining a competitive edge.

Furthermore, the presence of both established players and emerging startups fosters a competitive environment that encourages rapid technological advancements. The ongoing digital transformation across various sectors is further intensifying competition, as healthcare organizations seek to optimize their operations through IT solutions.

RECENT ACTIONS BY KEY PLAYERS

- In January 2024, Epic Systems announced the launch of a new version of its EHR platform, featuring enhanced interoperability capabilities to improve data sharing among healthcare providers.

- In February 2024, Cerner Corporation introduced new analytics tools designed to help healthcare organizations optimize their operations and improve patient outcomes.

- In March 2024, Allscripts expanded its EHR offerings to include telehealth capabilities, allowing providers to conduct virtual visits seamlessly.

- In April 2024, Meditech announced a partnership with a leading cloud service provider to enhance its EHR solutions with advanced cloud capabilities.

- In May 2024, Athenahealth launched a new patient engagement platform aimed at improving communication between providers and patients.

- In June 2024, NextGen Healthcare introduced a new suite of solutions designed specifically for behavioral health providers, addressing the unique needs of this sector.

- In July 2024, GE Healthcare announced the acquisition of a startup specializing in AI-driven imaging solutions to enhance its healthcare IT offerings.

- In August 2024, Philips Healthcare expanded its telehealth solutions to include remote patient monitoring

MARKET SEGMENTATION

This North America healthcare IT market research report is segmented and sub-segmented into the following categories.

By Product Type

- Healthcare Provider Solutions

- Healthcare Payer Solutions

- HCIT Outsourcing Services

By End User

- Healthcare Providers

- Healthcare Payers

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the current market size and projected growth of the north america healthcare it market?

The north america healthcare it market was valued at USD 310 billion in 2024 and is expected to reach USD 1,724 billion by 2033, growing at a CAGR of 21%.

2. What factors are driving the growth of the north america healthcare it market?

The north america healthcare it market is driven by rising demand for telehealth services, increased focus on data interoperability, and the growing adoption of electronic health records (EHR) systems.

3. What challenges does the north america healthcare it market face?

The north america healthcare it market faces challenges such as high implementation costs, data security concerns, and the need for significant training and change management in healthcare organizations.

4. Which segments are prominent within the north america healthcare it market?

The north america healthcare it market includes key segments such as electronic health records (EHR), telemedicine, health information exchange (HIE), and various software solutions for clinical and administrative processes.

5. How has the COVID-19 pandemic impacted the north america healthcare it market?

The north america healthcare it market saw a rapid increase in telehealth adoption, with utilization surging to 38 times pre-pandemic levels, leading to increased investments in healthcare IT infrastructure.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]