North America Healthcare Analytics Market Research Report – Segmented By Technology Type (largest technology segment ,prescriptive analytics segment ) Application (clinical data analytics segment, financial data analytics segment) Component ( software segment, services segment ) End-User ( healthcare providers segment , pharmaceutical and biotechnology industries segment ) and Country (The United States, Canada & Rest of North America) – Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

North American Healthcare Analytics Market Size

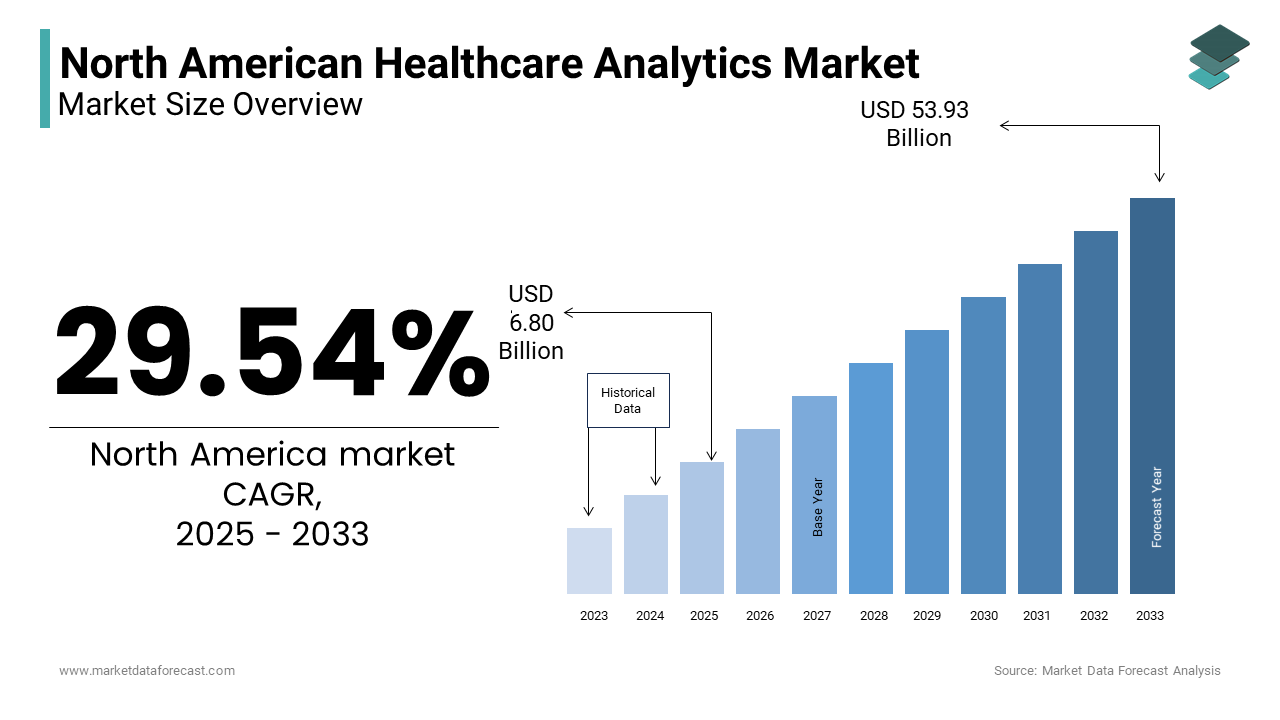

The North American healthcare analytics market was worth USD 5.25 Billion in 2024 and is set to reach USD 53.93 Billion by 2033 from USD 6.80 Billion in 2025, growing at a CAGR of 29.54% from 2024 to 2033.

Healthcare analytics involves the systematic collection, processing, and analysis of data from various sources, including electronic health records (EHRs), clinical trials, and patient feedback. This market is increasingly recognized for its potential to enhance the quality of care, reduce costs, and streamline operations within healthcare organizations. This growth is driven by several factors, including the increasing volume of healthcare data generated, the need for data-driven decision-making, and the rising emphasis on value-based care. The demand for advanced analytics solutions is expected to rise as healthcare providers and organizations seek to leverage data to improve patient outcomes and operational efficiency.

MARKET DRIVERS

Increasing Volume of Healthcare Data

The North American healthcare analytics market is significantly driven by the increasing volume of healthcare data generated from various sources. The advent of electronic health records (EHRs), wearable health devices, and telemedicine has led to an exponential growth in data collection. According to a report by the International Data Corporation, the global healthcare data is expected to reach 2,314 exabytes by 2020 augmenting with the vast amount of information available for analysis.

This surge in data presents both challenges and opportunities for healthcare organizations is ascribed to propel the growth of the North America healthcare analytics market. The ability to analyze large datasets enables providers to gain valuable insights into patient care, operational efficiency, and population health management. Advanced analytics tools can identify trends, predict outcomes, and support clinical decision-making, ultimately leading to improved patient outcomes and reduced costs. The demand for healthcare analytics solutions is expected to grow by driving the expansion of the North American healthcare analytics market.

Shift Towards Value-Based Care

Another major driver of the North American healthcare analytics market is the shift towards value-based care, which emphasizes the quality of care provided rather than the volume of services rendered. This transformation is prompting healthcare organizations to adopt analytics solutions that can measure and improve patient outcomes. According to a study by the National Academy of Medicine, value-based care models can lead to a 20% reduction in healthcare costs while improving patient satisfaction and outcomes.

Healthcare analytics plays a crucial role in supporting value-based care initiatives by providing insights into patient populations, treatment effectiveness, and resource utilization. Organizations can identify high-risk patients, optimize care pathways, and implement preventive measures that enhance overall health outcomes by leveraging data analytics. The growing emphasis on accountability and performance measurement in healthcare is driving investments in analytics solutions that support value-based care initiatives. The demand for healthcare analytics is expected to increase significantly that further propels the growth of the North American market.

MARKET RESTRAINTS

Data Privacy and Security Concerns

One of the primary restraints affecting the North American healthcare analytics market is the growing concern over data privacy and security. The risk of data breaches and unauthorized access to sensitive patient information has become a significant issue as healthcare organizations increasingly rely on data analytics to inform decision-making. According to a report by the Identity Theft Resource Center, healthcare data breaches accounted for 25% of all reported data breaches in 2021.

The implementation of regulations such as the Health Insurance Portability and Accountability Act (HIPAA) imposes strict requirements on how healthcare organizations handle and protect patient data. Compliance with these regulations can be complex and costly, deterring some organizations from fully embracing analytics solutions. Additionally, concerns about patient trust and the potential for reputational damage in the event of a data breach can hinder the adoption of healthcare analytics. They must prioritize robust data security measures and transparent data practices to mitigate these risks and foster positive patient relationships as organizations strive to enhance their analytics capabilities.

Integration Challenges with Legacy Systems

Another significant challenge facing the North American healthcare analytics market is the integration of analytics solutions with existing legacy systems. Many healthcare organizations still rely on outdated IT infrastructure and disparate data sources by making it difficult to implement comprehensive analytics solutions. According to a survey by the Healthcare Information and Management Systems Society, approximately 60% of healthcare organizations reported challenges in integrating new technologies with their legacy systems.

These integration challenges can lead to data silos, where critical information is not easily accessible for analysis, ultimately limiting the effectiveness of analytics initiatives. Additionally, the complexity of healthcare data, which often includes unstructured formats, can further complicate integration efforts. Organizations may face difficulties in achieving a unified view of patient data, hindering their ability to derive actionable insights. To overcome these challenges, healthcare organizations must invest in modernizing their IT infrastructure and adopting interoperable solutions that facilitate seamless data integration. This may involve transitioning to cloud-based systems or implementing application programming interfaces (APIs) that enable better connectivity between disparate data sources. The healthcare organizations can unlock the full potential of their analytics initiatives by leading to improved patient care and operational efficiency.

MARKET OPPORTUNITIES

Growth of Telehealth Services

The North American healthcare analytics market presents significant opportunities for growth through the expansion of telehealth services. The COVID-19 pandemic has accelerated the adoption of telehealth, with many healthcare providers integrating virtual consultations into their service offerings. According to a report by McKinsey, telehealth utilization has stabilized at levels 38 times higher than before the pandemic by indicating a lasting shift in how healthcare is delivered.

Telehealth generates vast amounts of data that can be analyzed to improve patient outcomes and operational efficiency. Healthcare analytics can help providers assess the effectiveness of telehealth services, monitor patient engagement, and identify trends in patient health. Additionally, the integration of analytics with telehealth platforms can enhance decision-making by providing real-time insights into patient conditions and treatment responses. The demand for healthcare analytics solutions that support these services is expected to increase significantly by creating lucrative opportunities for market participants.

Advancements in Artificial Intelligence and Machine Learning

Another promising opportunity within the North American healthcare analytics market lies in the advancements in artificial intelligence (AI) and machine learning (ML) technologies. These technologies are revolutionizing the way healthcare data is analyzed and utilized by enabling organizations to derive deeper insights and make more informed decisions. AI and ML can enhance healthcare analytics by automating data analysis, identifying patterns, and predicting outcomes based on historical data. This capability allows healthcare providers to implement proactive measures, improve patient care, and optimize resource allocation. For instance, AI-driven predictive analytics can help identify high-risk patients by enabling early interventions that can lead to better health outcomes. The demand for advanced healthcare analytics solutions is expected to grow by creating significant opportunities for innovation and market expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

29.54 % |

|

Segments Covered |

By Technology Type,Application,Component,End-User and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

SAS Institute, Inc., Optum, Inc., IBM Corporation, Truven Health Analytics Inc. |

SEGMENTAL ANALYSIS

By Technology Type Insights

The largest technology segment dominated the market and held 45.3% of share in 2024. This dominance can be attributed to the increasing demand for data-driven insights that enable healthcare organizations to anticipate patient needs and optimize resource allocation. Predictive analytics leverages historical data and advanced algorithms to identify trends and forecast future outcomes. This capability is particularly valuable in areas such as patient risk assessment, disease outbreak prediction, and resource utilization optimization. The healthcare providers can implement targeted interventions, reduce hospital readmissions, and improve overall patient outcomes by utilizing predictive analytics. The demand for predictive analytics solutions is expected to remain strong, solidifying its position as the largest technology type segment in the North American healthcare analytics market.

The prescriptive analytics segment is projected to experience a CAGR of 30.3% from 2025 to 2033. This growth is driven by the increasing recognition of the value of prescriptive analytics in providing actionable recommendations based on data analysis. Prescriptive analytics goes beyond predictive capabilities by offering recommendations for optimal actions based on analyzed data. This technology enables healthcare organizations to evaluate various scenarios and determine the best course of action for patient care, resource allocation, and operational efficiency. The demand for prescriptive analytics solutions is expected to grow significantly by positioning this segment for rapid expansion in the North American healthcare analytics market.

By Application Insights

The clinical data analytics segment was the largest and held 50.4% of the North America healthcare analytics market share in 2024. This dominance is primarily due to the critical need for healthcare organizations to analyze clinical data to improve patient care and outcomes. The Clinical data analytics involves the analysis of patient data, treatment outcomes, and clinical workflows to identify trends and inform decision-making. The healthcare providers can enhance patient safety, reduce medical errors, and optimize treatment protocols by leveraging clinical data. The growing emphasis on value-based care and regulatory compliance is further propelling the demand for clinical data analytics solutions.

The financial data analytics segment is expected to achieve a CAGR of 25.4% from 2025 to 2033. This growth is driven by the increasing need for healthcare organizations to optimize their financial performance and manage costs effectively. Financial data analytics enables healthcare organizations to analyze revenue cycles, operational costs, and reimbursement patterns to identify areas for improvement. The organizations can enhance budgeting, forecasting, and financial planning processes that is leading to improved profitability and sustainability. The growing emphasis on cost containment and financial transparency in the healthcare sector is driving demand for financial data analytics solutions.

By Component Insights

The software segment in the North America healthcare analytics market held the dominant share in 2024. This dominance can be attributed to the widespread adoption of healthcare analytics software solutions that provide comprehensive tools for data analysis and visualization. Healthcare analytics software encompasses a range of solutions, including data management platforms, visualization tools, and predictive analytics applications. These solutions are essential for organizations seeking to harness the power of data to improve patient outcomes, optimize operations, and enhance decision-making. The growing emphasis on regulatory compliance and data-driven performance improvement is further propelling the demand for healthcare analytics software.

The services segment is projected to experience a CAGR of 20.4% from 2025 to 2033. This growth is driven by the increasing demand for consulting, implementation, and support services that help organizations effectively leverage healthcare analytics solutions. Many are turning to service providers for expertise and support as healthcare organizations face the complexities of implementing and managing analytics solutions. Consulting services can assist organizations in developing tailored analytics strategies, while implementation services ensure that analytics solutions are integrated seamlessly into existing workflows. Additionally, ongoing support services help organizations optimize their analytics capabilities and adapt to changing needs.

By End-User Insights

The healthcare providers segment was accounted in capturing 60.3% of the North American healthcare analytics market share in 2024. This dominance can be attributed to the critical need for healthcare organizations to leverage analytics to improve patient care, operational efficiency, and regulatory compliance. Healthcare providers utilize analytics to analyze patient data, treatment outcomes, and operational workflows by enabling them to identify trends and implement improvements. The growing emphasis on value-based care and population health management is further propelling the demand for healthcare analytics solutions among providers. The demand for analytics solutions tailored to healthcare providers is expected to remain strong as organizations increasingly prioritize quality improvement and patient-centered care.

The pharmaceutical and biotechnology industries segment is expected to register a CAGR of 22.4% from 2025 to 2033. This growth is driven by the increasing need for data analytics in drug development, clinical trials, and market access strategies. Pharmaceutical and biotechnology companies are increasingly leveraging analytics to optimize clinical trial designs, monitor patient safety, and analyze market trends. The ability to analyze large datasets from clinical trials and real-world evidence enables these organizations to make informed decisions regarding drug development and commercialization. Additionally, the growing emphasis on personalized medicine and targeted therapies is driving demand for analytics solutions that can support these initiatives. The demand for healthcare analytics solutions tailored to their needs is expected to grow significantly.

Country Level Analysis

The United States healthcare analytics market was the top performer with 70.4% of share in 2024. The U.S. market is characterized by a robust demand for healthcare analytics solutions driven by advancements in technology and the increasing adoption of data-driven decision-making across various sectors. According to the U.S. Department of Health and Human Services, the adoption of electronic health records has significantly increased is reflecting a growing preference for data-driven healthcare. The presence of major healthcare analytics providers and a well-established technology infrastructure further contribute to the country's dominant position in the market. Additionally, the growing emphasis on value-based care and regulatory compliance is driving investments in innovative analytics solutions across healthcare organizations. The healthcare analytics market is expected to maintain its growth trajectory by technological advancements and evolving consumer preferences as the U.S. healthcare system continues to evolve and adapt to new challenges.

Canada healthcare analytics market is likely to hit a fastest CAGR of 24.7% in the next coming years owing to diverse healthcare landscape, which includes public and private healthcare providers, pharmaceutical companies, and research institutions. The adoption of healthcare analytics solutions is increasing by the need for improved patient outcomes and operational efficiency that is gearing up the growth of the market. The Canadian government has implemented various initiatives aimed at promoting digital health and data analytics that further drives the adoption of healthcare analytics technologies. Additionally, the growing focus on patient-centered care and population health management is leading to increased investments in analytics solutions within the healthcare sector. The emphasis on innovation and data-driven decision-making is expected to drive further growth in the Canadian healthcare analytics market.

KEY MARKET PLAYERS

A few of the prominent companies operating in the North American healthcare analytics market profiled in the report are SAS Institute, Inc., Optum, Inc., IBM Corporation, Truven Health Analytics Inc., Cerner Corporation, Verisk Analytics, Inc., McKesson Corporation, Allscripts Health Solutions, Oracle Corporation, MedeAnalytics, Inovalon, Inc., and Health Catalyst.

MARKET SEGMENTATION

This research report on the North America Healthcare Analytics Market has been segmented and sub-segmented into the following

By Technology Type

- largest technology segment

- prescriptive analytics segment

By Application

- clinical data analytics segment

- financial data analytics segment

By Component

- software segment

- services segment

By End-User

- healthcare providers segment

- pharmaceutical and biotechnology industries segment

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What are the key factors driving the growth of healthcare analytics in Canada?

In Canada, the growth of healthcare analytics is primarily driven by increasing adoption of electronic health records (EHR) and a focus on improving healthcare efficiency.

What are the prominent trends shaping the healthcare analytics market in the United States?

In the United States, trends such as the integration of artificial intelligence (AI) and machine learning (ML) in healthcare analytics and the emphasis on value-based care are significant.

Which country in North America has the largest share in the healthcare analytics market?

The United States dominates the North American healthcare analytics market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]