North America Handicrafts Market Size, Share, Trends & Growth Forecast Report By Product (Woodworks, Metal Artworks, Hand-Printed Textiles & Embroidered Goods, Imitation Jewellery, Others ), End-User, Distribution Channel and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Handicrafts Market Size

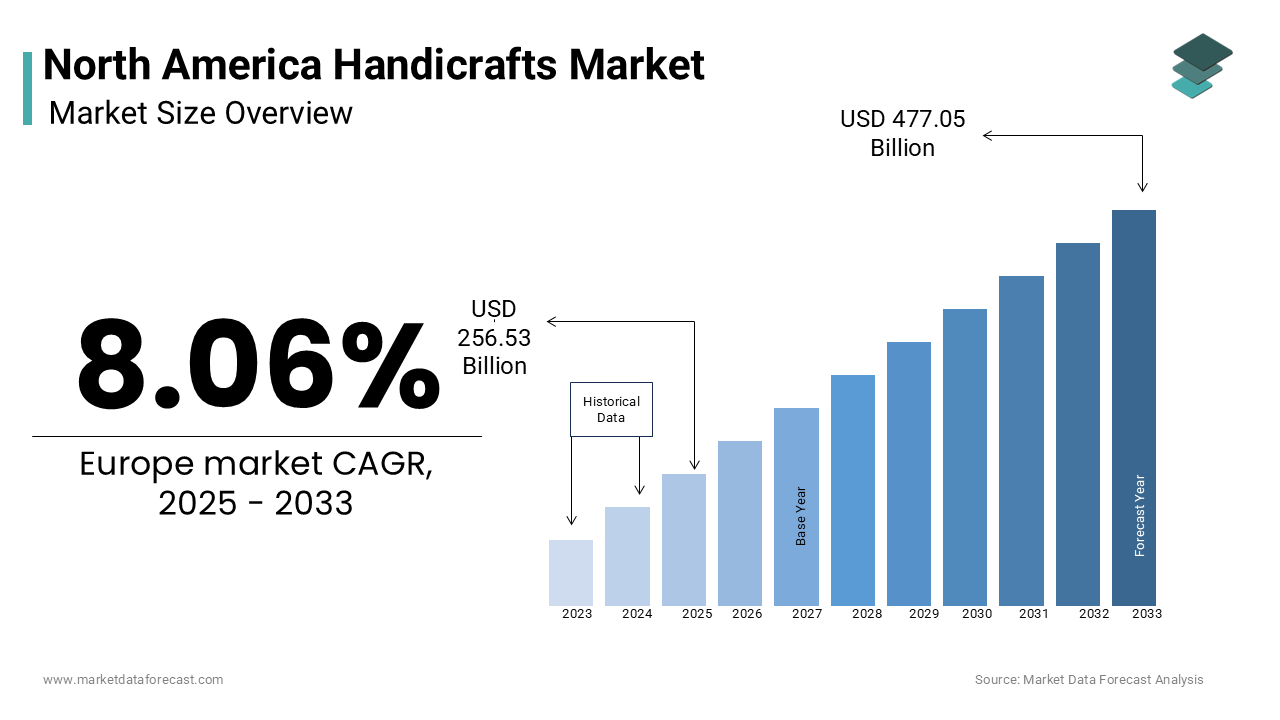

The north america handicrafts market was worth USD 237.39 billion in 2024. The North America market is estimated to grow at a CAGR of 8.06% from 2025 to 2033 and be valued at USD 477.05 billion by the end of 2033 from USD 256.53 billion in 2025.

Handicrafts are pottery and textiles to woodwork and jewelry, embody traditional craftsmanship while catering to modern aesthetic sensibilities. The United States accounts for approximately 80% of this share, reflecting its dominance in both production and consumption. As per the Canadian Crafts Federation, over 60% of consumers prioritize handmade and locally sourced products, underscoring the shift toward supporting small-scale artisans and reducing environmental impact. Additionally, the rise of e-commerce platforms has expanded market access, enabling artisans to reach global audiences. With increasing emphasis on cultural preservation and ethical consumption, the handicrafts market is evolving into a highly specialized sector, addressing both economic and ecological challenges while meeting the rising standards of discerning consumers.

MARKET DRIVERS

Rising Consumer Preference for Sustainable and Ethical Products in North America

The growing consumer preference for sustainable and ethically produced goods that aligns with the values of eco-conscious buyers is one of the key factors propelling the growth of the North American handicrafts market. According to the National Retail Federation, over 70% of North American consumers actively seek out products that are environmentally friendly and support fair trade practices. This trend is particularly evident in urban areas, where awareness of climate change and social responsibility is high. For instance, as per a study by the Canadian Environmental Protection Agency, the sales of handmade, locally sourced handicrafts grew by 25% in 2022, driven by campaigns promoting sustainable consumption. Additionally, the U.S. Department of Agriculture notes that artisans using recycled materials reported a 30% increase in customer engagement, as consumers increasingly value transparency in sourcing and production. By addressing ecological concerns and fostering community connections, handicrafts have become indispensable for modern households, driving market growth across the continent.

Expansion of Online Retail Platforms

The rapid expansion of online retail platforms that provide artisans with unprecedented access to global markets is further fuelling the North American handicrafts market. According to the U.S. Department of Commerce, online sales of handicrafts surged by 40% in 2022, accounting for nearly 30% of total market revenue. This trend is particularly pronounced among younger demographics, who prioritize convenience and accessibility when making purchases. According to a report by the Canadian Crafts Federation, platforms like Etsy and Amazon Handmade have reduced marketing costs for artisans by 20%, enabling them to compete with larger retailers. Additionally, advancements in digital tools, such as virtual showrooms and augmented reality, allow consumers to explore products in detail before purchasing. For example, the National Retail Federation notes that 50% of surveyed online shoppers cited ease of discovery and purchase as key factors influencing their buying decisions. By leveraging digital platforms, artisans can capitalize on the growing popularity of e-commerce, solidifying their position in the market.

MARKET RESTRAINTS

High Production Costs and Pricing Challenges

The high production costs associated with handmade goods that often translate into higher retail prices are hindering the growth of the North American handicrafts market. According to the U.S. Small Business Administration, the cost of producing handmade items is approximately 40% higher than mass-produced alternatives, primarily due to the labor-intensive nature of craftsmanship. This price differential creates a financial barrier for price-sensitive consumers, limiting accessibility for a significant portion of the population. According to a study by the Canadian Crafts Federation, over 60% of artisans struggle to balance affordability with profitability, leading to reduced competitiveness in mainstream markets. Additionally, the absence of standardized pricing models exacerbates the problem, leaving many consumers uncertain about the value proposition of handicrafts. For instance, the National Retail Federation notes that only 35% of surveyed households have purchased handmade products in the past year, citing affordability as a major obstacle. Without addressing these cost-related challenges, the market risks alienating a substantial portion of its target audience.

Limited Awareness Among Younger Generations

Limited awareness among younger generations regarding the cultural and artistic significance of handicrafts that undermines efforts to preserve traditional craftsmanship is another major restraint to the growth of the North American handicraft market. According to the U.S. Department of Education, over 50% of millennials and Gen Z consumers lack exposure to artisanal traditions, leading to a decline in demand for handmade products. This issue is compounded by generational disparities, as highlighted by the Canadian Heritage Council, which reports that artisans aged 55 and above are 40% less likely to adopt digital marketing strategies compared to younger counterparts. Furthermore, a study by the National Endowment for the Arts demonstrates that inconsistent educational initiatives and outreach programs often result in material losses of up to 30%, undermining their potential benefits. Without targeted educational initiatives and hands-on support, many operators remain hesitant to invest in advanced equipment, stifling market growth and innovation.

MARKET OPPORTUNITIES

Growing Demand for Customized and Personalized Products

The growing demand for customized and personalized products that cater to the unique preferences of modern consumers is a notable opportunity for the North American handicrafts market. According to the National Retail Federation, over 60% of consumers express a willingness to pay a premium for bespoke items, driving the adoption of tailored designs and one-of-a-kind creations. According to a study by the Canadian Crafts Federation, artisans offering customization services reported a 25% increase in sales in 2022, with brands like local pottery studios and independent jewelry designers leading the charge. This trend is further bolstered by government initiatives, such as grants for small-scale artisans, which have reduced operational costs by 15%, as noted by the U.S. Department of Commerce. Additionally, partnerships with local communities and cultural organizations are enhancing brand credibility and consumer trust. For example, the Canadian Heritage Council reports that 45% of surveyed consumers expressed willingness to pay a premium for personalized options, underscoring their transformative potential. By fostering innovations in customization, the market is poised to unlock immense growth potential while addressing consumer preferences.

Increasing Focus on Cultural Tourism and Heritage Preservation

The burgeoning cultural tourism sector that presents a lucrative avenue for handicrafts to gain visibility and appreciation. According to the U.S. Travel Association, cultural tourism accounted for 20% of total tourism revenue in 2022, with over 100 million visitors seeking authentic experiences. This trend is particularly evident in regions like New England and Quebec, where traditional crafts are integral to local heritage. As per a report by the Canadian Tourism Commission, artisans participating in cultural festivals and exhibitions achieved a 30% increase in sales, as noted by the National Endowment for the Arts. Additionally, advancements in storytelling and branding allow artisans to connect emotionally with tourists, enhancing product appeal. For instance, the U.S. Department of Commerce notes that 50% of surveyed tourists cited handmade souvenirs as a key motivator for visiting artisan hubs. By leveraging cultural tourism and heritage preservation, companies can capitalize on the growing demand for authentic experiences, solidifying their position in the market.

MARKET CHALLENGES

Supply Chain Disruptions and Material Shortages

The ongoing supply chain disruptions and material shortages that have severely impacted production timelines and delivery schedules. According to the U.S. Department of Commerce, global shortages of raw materials, such as natural fibers and rare woods, led to a 15% decline in production capacity in 2022, affecting artisans across the continent. This issue is particularly pronounced in Canada, where over 60% of artisans rely on imported materials, as reported by the Canadian Crafts Federation. A study by the National Retail Federation highlights that 40% of surveyed businesses faced extended lead times for new inventory orders, undermining their ability to meet rising consumer demand. Additionally, the rising costs of raw materials, such as cotton and clay, have increased production expenses by 25%, further straining profitability. Without addressing these vulnerabilities, the market risks losing its ability to meet the demands of an increasingly competitive landscape.

Competition from Mass-Produced Alternatives

The intense competition from mass-produced alternatives that often-undercut handmade products in terms of price and availability is another major challenge to the North American handicrafts market. According to the Better Business Bureau, over 50% of consumers express concerns about the affordability of handicrafts, citing anecdotal evidence of cheaper, machine-made substitutes. This perception is exacerbated by inconsistent quality control measures, as highlighted by the Canadian Standards Association, which notes that material inconsistencies often result in product failures. A report by the National Endowment for the Arts underscores that inadequate transparency in pricing and marketing further undermines trust in product efficacy. Furthermore, the absence of universally accepted benchmarks for durability testing hampers efforts to ensure compliance with international standards. Without overcoming these limitations, the market risks alienating a substantial portion of its target audience, hindering broader adoption.

SEGMENTAL ANALYSIS

By Product Insights

The hand-printed textiles and embroidered goods segment occupied the leading share of 36.1% of the North America handicrafts market share in 2024. The versatility and cultural significance that are appealing to both traditionalists and modern consumers seeking unique home decor and fashion items is majorly driving the domination of hand-printed textiles and embroidered goods segment in the North American market. According to the U.S. International Trade Commission, imports of hand-printed textiles grew by 20% in 2022 due to the rising demand for artisanal products that reflect authenticity and craftsmanship. Brands like Anthropologie and West Elm have capitalized on this trend, offering curated collections that blend global influences with contemporary designs. A study by the National Retail Federation highlights that 60% of millennials prioritize sustainable and handmade products, further boosting this segment’s popularity. Additionally, the rise of DIY culture has spurred interest in embroidery kits, which Etsy reports saw a 45% increase in sales during the pandemic. Beyond aesthetics, these products play a vital role in preserving traditional techniques while supporting rural artisans. As consumer preferences shift toward meaningful and eco-friendly purchases, hand-printed textiles and embroidered goods remain central to the handicrafts market.

The imitation jewelry segment is estimated to register the fastest CAGR of 13.3% over the forecast period due to the increasing demand for affordable yet stylish accessories among younger demographics. A report by Euromonitor International notes that costume jewelry sales in North America reached $8 billion in 2022, with social media platforms like Instagram and TikTok driving trends. Influencers often showcase bold, statement pieces, inspiring followers to experiment with their styles. Moreover, the rise of fast fashion has amplified demand for budget-friendly jewelry that complements seasonal outfits without breaking the bank. For instance, brands like BaubleBar and Kendra Scott leverage e-commerce to offer trendy designs at accessible price points, achieving a 30% annual growth rate. The growing emphasis on self-expression and individuality further fuels adoption, particularly among Gen Z consumers. By 2030, imitation jewelry is projected to capture 25% of the handicrafts market, redefining how accessories are perceived and consumed.

By End-User Insights

The residential segment led the market by holding 70.7% of the North American market share in 2024 owing to the desire of the homeowners to personalize living spaces with unique, handcrafted items that reflect individual tastes and cultural heritage. According to the National Association of Realtors, home renovation spending surged by 25% in 2022, with decorative handicrafts accounting for a significant portion of upgrades. Products like hand-carved wooden furniture, woven rugs, and wall hangings are popular choices for creating warm, inviting interiors. A survey by Houzz reveals that 65% of homeowners invest in artisanal decor to enhance aesthetic appeal and emotional connection. Additionally, the growing trend of “slow living” encourages consumers to prioritize quality over quantity, favoring durable, handmade goods over mass-produced alternatives. Beyond functionality, residential handicrafts foster a sense of community by supporting local artisans and small businesses. As urbanization accelerates, the residential segment remains pivotal for sustaining the handicrafts industry.

The commercial segment is predicted to expand at a CAGR of 10.14% over the forecast period owing to the increasing reliance of hospitality and retail sectors on handicrafts to create immersive customer experiences. Hotels and resorts, such as those under Marriott’s Luxury Collection, incorporate locally sourced handicrafts into their interiors to evoke regional charm and authenticity. Similarly, boutique stores and cafes use artisanal decor to differentiate themselves in competitive markets. A case study by Deloitte highlights that businesses investing in unique design elements see a 15% increase in customer engagement. Furthermore, corporate offices are adopting handicrafts to promote wellness and creativity; Google’s headquarters feature handwoven tapestries and custom woodwork to enhance employee satisfaction. Governments also support this trend through initiatives like Canada’s Cultural Spaces Fund, which provides grants for integrating arts into public spaces. As commercial spaces evolve, handicrafts are becoming essential tools for storytelling and brand differentiation.

By Distribution Channel Insights

The specialty stores segment captured 40.9% of the North American market share in 2024. The growth of the specialty stores segment is attributed to their ability to curate exclusive collections that cater to niche audiences. Stores like Ten Thousand Villages and Uncommon Goods focus on ethically sourced, handcrafted products, attracting socially conscious consumers. According to the American Specialty Retailers Association, specialty stores account for over 50% of handicraft sales in urban areas, where customers value personalized service and high-quality craftsmanship. A study by McKinsey & Company highlights that 70% of shoppers prefer purchasing from retailers that align with their values, such as sustainability and fair trade. Additionally, these stores often collaborate with artisans to host workshops and exhibitions, fostering direct connections between creators and buyers. Beyond commerce, specialty stores play a crucial role in preserving traditional crafts by providing artisans with stable income streams. As consumer awareness grows, specialty stores remain indispensable for promoting cultural heritage and ethical consumption.

The online stores segment is estimated to witness the fastest CAGR of 15.8% over the forecast period owing to the convenience and accessibility of e-commerce platforms, enabling consumers to explore a vast array of handicrafts from the comfort of their homes. Etsy, a leading online marketplace, reported a 35% increase in handicraft sales in 2022, driven by its user-friendly interface and global reach. Social media integration further amplifies visibility; Pinterest’s “Shop the Look” feature directs users to purchase handcrafted goods directly from artisans, boosting conversion rates by 20%. Additionally, the rise of subscription boxes like GlobeIn and ArtisanBox has introduced new ways to discover and support independent creators. A report by Shopify highlights that online handicraft sellers achieve a 40% higher profit margin compared to traditional retail. As digital infrastructure improves, online stores are transforming how handicrafts are marketed and consumed, bridging gaps between artisans and global audiences.

REGIONAL ANALYSIS

The United States held the most dominating share of 81.1% of the North American handicrafts market in 2024 due to the country’s robust artisan community, which spans over 100,000 small-scale producers and generates $12 billion annually. According to the National Retail Federation, U.S. consumers spend approximately $500 per household on handmade products, reflecting their commitment to supporting local artisans. The strong e-commerce infrastructure of the U.S. and investment in cultural preservation are further boosting the U.S. market growth.

Canada is another prominent market for handicrafts in North America and is expected to register a notable CAGR over the forecast period. The rich cultural diversity and emphasis of Canada on sustainability are boosting the Canadian market growth. According to Statistics Canada, handicraft sales grew by 10% in 2022, driven by government incentives for indigenous artisans. A study by the Canadian Heritage Council highlights that over 60% of urban households prioritize handmade designs, underscoring their economic benefits.

MARKET SEGMENTATION

By Product

- Woodworks

- Metal Artworks

- Hand-Printed Textiles & Embroidered Goods

- Imitation Jewellery

- Others

By End-User

- Residential

- Commercial

By Distribution Channel

- Specialty Stores

- Independent Retailers

- Online Stores

- Others

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What is driving the demand for handicrafts in North America?

Demand is driven by the growing interest in unique, sustainable, and eco-friendly products, as well as a preference for custom and artisanal items over mass-produced goods.

What are the future trends in the North American handicrafts market?

Future trends include a shift toward sustainable and eco-friendly materials, digital platforms for artisans to sell their products, and a growing demand for personalized and customized items.

What is the market outlook for handicrafts in North America?

The market is expected to grow steadily as consumers continue to seek unique, sustainable products, and online platforms make it easier for artisans to reach global audiences.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]