North America Gypsum Board Market Size, Share, Trends & Growth Forecast Report By Product (Wallboard, Ceiling Board, Pre-decorated Board, Others), Application and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Gypsum Board Market Size

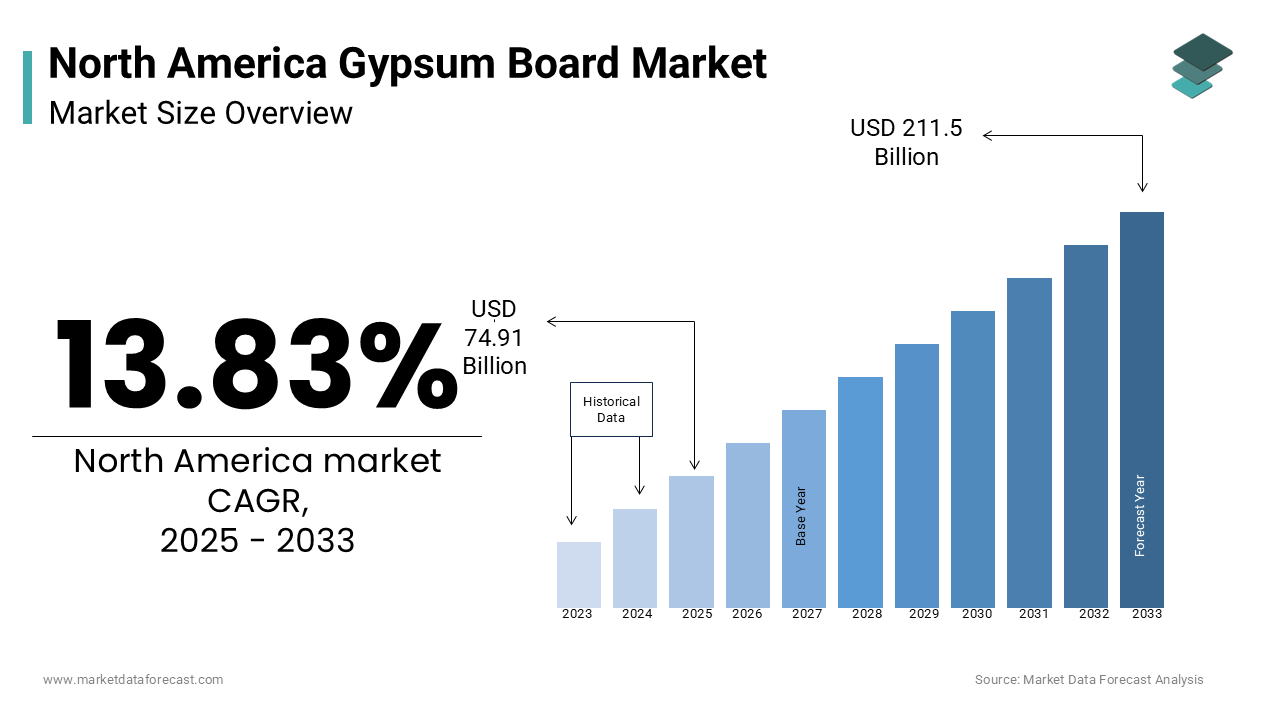

The North America gypsum board market was worth USD 65.81 billion in 2024. The North American market is estimated to grow at a CAGR of 13.83% from 2025 to 2033 and be valued at USD 211.15 billion by the end of 2033 from USD 74.91 billion in 2025.

The North America gypsum board market growth is fueled by urbanization trends and a surge in infrastructure development in the U.S., where housing starts reached 1.7 million units in 2022, as per data from the National Association of Home Builders. Government investments in green building projects and sustainable construction practices are expected to fuel the growth of the market. Regulatory support for energy-efficient materials has also strengthened market conditions. For instance, the Leadership in Energy and Environmental Design (LEED) certification program encourages the use of gypsum boards due to their fire-resistant and soundproofing properties. Additionally, advancements in manufacturing technologies have improved product performance, enhancing its appeal across diverse construction projects.

MARKET DRIVERS

Rising Demand for Residential Construction

Residential construction is a primary driver of the North America gypsum board market. The surge in housing starts, driven by population growth and urbanization, has significantly increased the need for gypsum boards in wall and ceiling applications. For instance, single-family home construction grew by 12% in 2022 by creating a robust pipeline for gypsum board manufacturers. Additionally, the shift toward open-concept living spaces has amplified demand, as gypsum boards are ideal for creating smooth, seamless walls and ceilings. As per a report by the Joint Center for Housing Studies, remodeling activities in existing homes also contribute to sustained consumption, with homeowners investing heavily in interior upgrades. Furthermore, the affordability of gypsum boards compared to alternative materials like wood or metal makes them a preferred choice for budget-conscious builders and contractors.

Increasing Adoption in Commercial Projects

The commercial sector is another major driver, with gypsum boards widely used in office buildings, retail spaces, and hospitality projects. The material’s fire-resistant properties make it indispensable in high-rise buildings and public infrastructure projects, where safety regulations are stringent. For example, gypsum boards are increasingly used in atriums, conference halls, and shopping malls due to their ability to enhance acoustic performance and thermal insulation. Additionally, corporate commitments to sustainability, such as net-zero carbon goals, have driven its adoption in LEED-certified buildings. Data from the U.S. Green Building Council indicates that gypsum board usage in commercial projects increased by 15% in 2022, reflecting its growing popularity.

MARKET RESTRAINTS

Fluctuating Raw Material Costs

One of the primary restraints in the North America gypsum board market is the volatility of raw material costs, particularly gypsum and synthetic gypsum. This cost pressure is often passed on to end-users, limiting the material's adoption in price-sensitive applications. Additionally, the reliance on coal-fired power plants for synthetic gypsum production has created uncertainties, as many plants are being decommissioned due to environmental regulations.

Stringent Environmental Regulations

Environmental regulations pose another significant challenge, particularly concerning emissions during the manufacturing process. The U.S. Environmental Protection Agency mandates strict limits on sulfur dioxide emissions by compelling manufacturers to invest in advanced filtration systems. According to the National Pollution Prevention Roundtable, compliance costs for such regulations can increase operational expenses by up to 15%. Moreover, the disposal of by-products generated during gypsum board production requires adherence to hazardous waste management protocols, further raising costs. These regulatory hurdles not only impact profitability but also delay project timelines, as companies must secure necessary permits.

MARKET OPPORTUNITIES

Expansion in Sustainable Construction Practices

Sustainability presents a lucrative opportunity for the North America gypsum board market, particularly in regions adopting green building standards. According to the U.S. Green Building Council, over 70,000 projects in the U.S. are LEED-certified by creating a fertile ground for eco-friendly materials like gypsum boards. Manufacturers are increasingly focusing on developing products with higher recycled content, such as synthetic gypsum derived from flue gas desulfurization. This aligns with regulatory incentives, such as tax credits for sustainable construction, which have further bolstered adoption. These gypsum boards with enhanced fire resistance and acoustic properties are gaining traction in green buildings, which is driving innovation in product design.

Advancements in Prefabricated Construction

Prefabricated construction is another promising avenue, with gypsum boards playing a pivotal role in modular building solutions. Gypsum boards are widely used in prefabricated walls and ceilings due to their lightweight nature and ease of installation. Additionally, their fire-resistant properties make them ideal for meeting stringent safety regulations in modular projects. Collaborations between manufacturers and modular construction firms have accelerated innovation is creating opportunities for suppliers to diversify their product portfolios and tap into emerging markets.

MARKET CHALLENGES

Competition from Alternative Materials

The gypsum board market faces stiff competition from alternative materials, such as fiber cement boards and drywall alternatives, which offer similar functionalities at competitive prices. This rivalry intensifies in humid regions, where moisture-resistant materials are preferred for interior applications. Additionally, advancements in drywall technology, such as moisture-resistant coatings, have further eroded gypsum board’s market share. These dynamics create pricing pressures and force manufacturers to differentiate their offerings through innovation and marketing strategies.

Supply Chain Disruptions

Supply chain disruptions have emerged as a critical challenge by geopolitical tensions and logistical bottlenecks. According to the Institute for Supply Management, delivery times for construction materials extended by 20% in 2022 is impacting gypsum board availability. The reliance on global suppliers for raw materials, such as synthetic gypsum, further complicates the situation. For instance, trade restrictions imposed during the pandemic led to shortages is forcing manufacturers to seek alternative sources at higher costs. These disruptions not only affect production schedules but also strain customer relationships in time-sensitive industries like residential construction.

SEGMENTAL ANALYSIS

By Product Insights

The wallboard segment was accounted in holding the dominant share of the North America gypsum board market in 2024 owing to its versatility and cost-effectiveness by making it suitable for a wide range of applications, including residential and commercial interiors. The affordability of wallboards, coupled with their ease of installation, has driven their adoption in large-scale construction projects. According to the National Association of Home Builders, the demand for wallboards in residential construction alone grew by 7% in 2022. Additionally, their compatibility with modern design trends, such as open-concept living spaces, aligns with consumer preferences will further enhance the growth of the segment.

The pre-decorated boards segment is likely to register a CAGR of 6.2% during the forecast period. This growth is driven by their superior aesthetic appeal and performance in high-end applications, such as luxury homes and boutique hotels. The increasing demand for ready-to-install solutions, driven by labor shortages and time constraints, has fueled their adoption.

By Application Insights

The residential segment dominated the North America gypsum board market with an estimated share of 55.5% in 2024 with the material’s aesthetic appeal and structural versatility by making it ideal for custom homes and luxury developments. The growing trend toward open-concept living spaces has further amplified demand, as gypsum boards can span large distances without intermediate supports. Additionally, the rise in eco-conscious homeownership, which is driven by millennials and Gen Z buyers, has increased the adoption of sustainable materials like gypsum boards.

The industrial segment is likely to experience a CAGR of 7.2% in the next coming years. This growth is fueled by the increasing use of gypsum boards in warehouses, factories, and data centers. The material’s fire-resistant properties make it indispensable in industrial applications, where safety regulations are stringent. For instance, gypsum boards are widely used in partition walls and ceilings due to their ability to enhance acoustic performance and thermal insulation. Corporate commitments to sustainability, such as net-zero carbon goals, have driven its adoption in LEED-certified buildings.

REGIONAL ANALYSIS

The United States was the top performer in the North American gypsum board market by accounting for 75.6% of the share in 2025, with the country’s robust construction sector, which has witnessed exponential growth due to urbanization and infrastructure development. Gypsum boards are integral to these projects in wall and ceiling applications, where their affordability, fire resistance, and ease of installation make them indispensable. The commercial sector also contributes significantly, with office buildings, retail spaces, and hospitality projects driving demand for high-performance gypsum solutions.

Canada held 20.5% of the North America gypsum board market share in 2024 by leveraging its strong forestry sector and commitment to green construction practices. According to Natural Resources Canada, the country produces over 10% of the world’s synthetic gypsum, derived from flue gas desulfurization processes by ensuring a stable supply chain for manufacturers. The Canadian government’s push for sustainable infrastructure has also bolstered demand. For example, the Green Infrastructure Fund, established in 2021, supports projects that incorporate renewable materials, including gypsum boards.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Key players in the North America Gypsum Board Market include CertainTeed Corporation, Continental Building Products, Georgia-Pacific LLC, KNAUF Gypsum, Lafarge North America, National Gypsum Company, PABCO Gypsum, and USG Corporation.

The North America gypsum board market is characterized by intense competition, driven by the presence of established players like USG Corporation, CertainTeed, and Georgia-Pacific. These companies vie for market share through a combination of product differentiation, pricing strategies, and technological advancements. The market’s competitive dynamics are further intensified by the entry of new players and the growing availability of alternative materials like fiber cement boards. Regulatory pressures and environmental concerns also play a pivotal role, compelling companies to adopt sustainable practices and develop eco-friendly solutions. This competitive landscape fosters innovation and ensures that customers have access to cutting-edge materials, ultimately driving the market forward.

Top Players in the Market

1. USG Corporation

USG Corporation is a global leader in the gypsum board market, renowned for its innovative products and commitment to sustainability. Headquartered in Chicago, Illinois, the company has established itself as a pioneer in developing eco-friendly gypsum solutions, including boards with higher recycled content. USG’s state-of-the-art manufacturing facilities enable it to produce high-quality products tailored to specific project requirements, from residential homes to large-scale commercial developments. The company’s strategic partnerships with tech giants like Tesla and Amazon escalates its ability to meet the demands of high-performance projects. For instance, USG supplied gypsum boards for Tesla’s Gigafactory in Texas, highlighting its role in cutting-edge construction projects. Its focus on reducing carbon footprints aligns with global sustainability goals by making it a preferred partner for architects and developers.

2. CertainTeed Corporation

CertainTeed Corporation is a key player in the engineered building materials market, holding a significant share of the gypsum board segment. With a strong presence across North America, the company leverages its extensive distribution network to cater to both residential and commercial sectors. CertainTeed’s gypsum boards are known for their superior strength and aesthetic appeal, making them ideal for applications ranging from luxury homes to commercial atriums. Additionally, CertainTeed’s emphasis on research and development ensures continuous innovation by enabling it to stay ahead of competitors in a rapidly evolving market.

3. Georgia-Pacific LLC

Georgia-Pacific specializes in premium gypsum solutions, catering to niche markets that prioritize design flexibility and environmental sustainability. Based in Atlanta, Georgia, the company has carved a niche for itself by offering bespoke products tailored to the unique needs of architects and builders. Its gypsum boards are widely used in educational institutions, healthcare facilities, and cultural centers due to their ability to create visually striking designs while maintaining structural integrity. Georgia-Pacific’s focus on quality and craftsmanship has earned it a loyal customer base, particularly in regions with stringent sustainability requirements.

Top Strategies Used by Key Players

Key players in the North America gypsum board market employ a range of strategies to maintain their competitive edge and capitalize on emerging opportunities. Strategic partnerships and collaborations are a cornerstone of these efforts. For instance, USG Corporation’s partnership with Tesla in 2024 to supply gypsum boards for its Gigafactory in Texas not only enhanced its brand visibility but also positioned it as a leader in eco-friendly construction materials. Investments in production capacity and R&D are another critical strategy. Similarly, Georgia-Pacific’s launch of fire-resistant gypsum boards reflects its focus on innovation and addressing market pain points. Sustainability initiatives also play a pivotal role, with companies aligning their offerings with global net-zero carbon goals.

RECENT MARKET DEVELOPMENTS

- In April 2024, USG Corporation partnered with Tesla to supply gypsum boards for its Gigafactory in Texas by reinforcing its position as a leader in eco-friendly construction materials.

- In June 2023, CertainTeed expanded its production facility in Ohio is increasing capacity by 25% to meet rising demand for gypsum boards in residential and commercial projects.

- In January 2023, Georgia-Pacific launched a new line of fire-resistant gypsum boards targeting industrial applications by addressing a key industry challenge and broadening its market reach.

- In September 2022, USG Corporation acquired a Canadian manufacturer to strengthen its supply chain and diversify its product offerings by ensuring timely delivery for large-scale projects.

- In March 2022, CertainTeed invested $30 million in R&D for eco-friendly coatings by aligning its products with global sustainability goals and regulatory requirements.

MARKET SEGMENTATION

This research report on the North America gypsum board market is segmented and sub-segmented based on categories.

By Product

- Wallboard

- Ceiling Board

- Pre-decorated Board

- Others

By Application

- Pre-engineered Metal Buildings

- Residential

- Industrial

- Commercial

- Institutional

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What factors are driving growth in the North America Gypsum Board Market?

Rapid urbanization, rising construction activities, and demand for fire-resistant and cost-effective building materials are key drivers. Increased renovation and remodeling projects also contribute to market expansion.

What trends are shaping the North America Gypsum Board Market?

Trends include the adoption of eco-friendly and lightweight boards, increased use in green buildings, and product innovations like moisture-resistant and soundproof variants. Digital construction tools and prefabrication also influence demand.

What is the future outlook of the North America Gypsum Board Market?

The market is expected to grow steadily due to rising construction activity and demand for cost-efficient, fire-rated wall solutions. Product innovation and green building trends will fuel further expansion.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]