North America HbA1c Testing Market Size, Share, Trends & Growth Forecast Report By Technology(Ion-Exchange HPCL, Enzymatic Assay, Affinity Binding Chromatography, Turbidimetric Inhibition Immunoassay, Other) , End User and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America HbA1c Testing Market Size

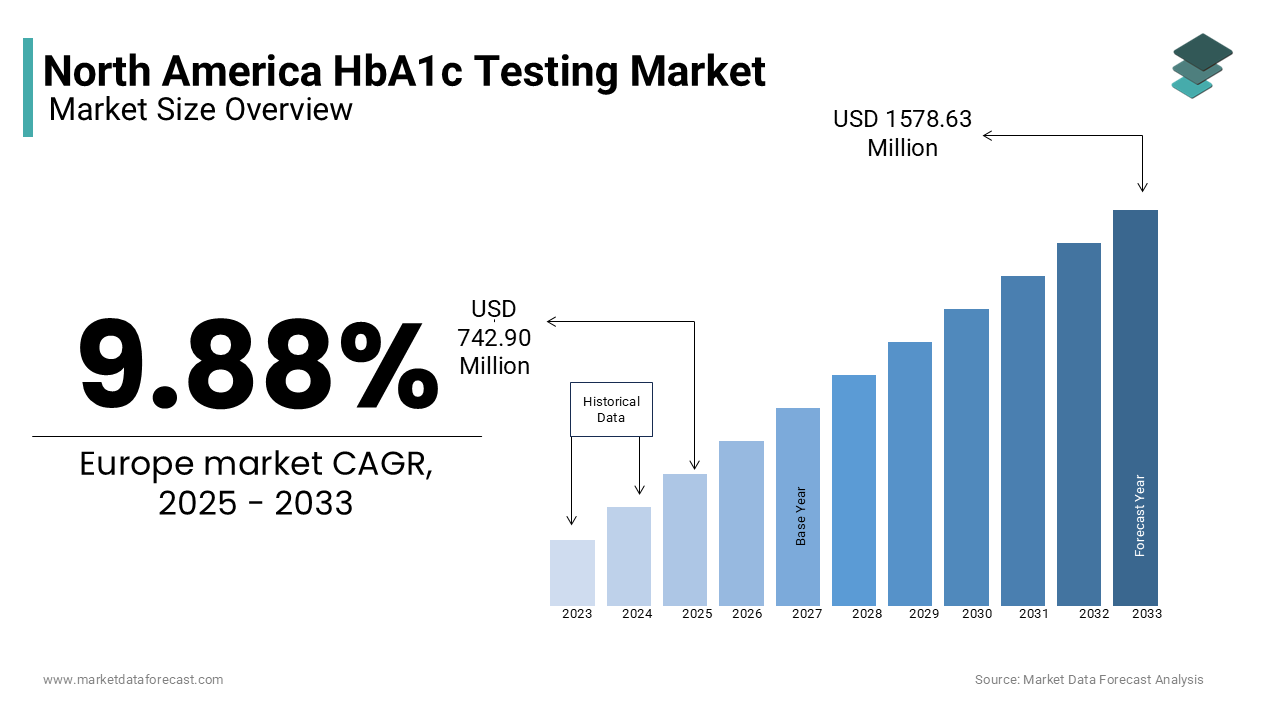

The HbA1c testing market size in North America was valued at 676.1 million in 2024. The regional market is anticipated to grow at 9.88% CAGR from 2025 to 2033 and be worth USD 1578.63 million by 2033 from USD 742.90 million in 2025.

HbA1c testing provides a reliable indicator of a patient’s average blood glucose levels over the past two to three months, which is making it a critical tool for diagnosing diabetes, assessing treatment efficacy, and preventing complications.

North America, particularly the United States, dominates the global HbA1c testing market due to its advanced healthcare infrastructure, high prevalence of diabetes, and strong emphasis on preventive care. The diabetes epidemic in North America is a key driver of the HbA1c testing market. According to the Centers for Disease Control and Prevention, over 37 million Americans have diabetes, with an additional 96 million adults diagnosed with prediabetes as of 2022. This high prevalence has led to increased demand for regular HbA1c testing, which is recommended by the American Diabetes Association for diabetes management. Furthermore, the growing adoption of POC HbA1c testing devices in clinics and homecare settings is enhancing accessibility and convenience for patients. The U.S. Food and Drug Administration has approved several innovative POC devices, contributing to market expansion.

MARKET DRIVERS

Rising Prevalence of Diabetes and Prediabetes

The increasing prevalence of diabetes and prediabetes is a major driver of the North America HbA1c Testing Market. According to the Centers for Disease Control and Prevention, over 37 million Americans have diabetes, and 96 million adults have prediabetes as of 2022. This alarming rise in diabetes cases has heightened the demand for regular HbA1c testing, which is essential for diagnosis, monitoring, and management. The American Diabetes Association recommends HbA1c testing at least twice a year for diabetic patients, further boosting market growth. The growing awareness of diabetes complications, such as cardiovascular diseases and kidney failure, has also emphasized the importance of early and accurate HbA1c testing in preventive healthcare.

Technological Advancements in Point-of-Care Testing

Technological advancements in point-of-care (POC) HbA1c testing devices are significantly driving market growth. The U.S. Food and Drug Administration has approved several innovative POC devices that provide rapid and accurate results, enhancing patient convenience and accessibility. These devices are increasingly adopted in clinics, pharmacies, and home care settings, reducing the need for laboratory visits. According to the National Institutes of Health, the use of POC HbA1c testing has increased by 25% since 2020, particularly in rural and underserved areas. The integration of digital health technologies, such as cloud-based data management, has further improved the efficiency and reliability of HbA1c testing, making it a cornerstone of modern diabetes care.

MARKET RESTRAINTS

High Cost of HbA1c Testing

The high cost of HbA1c testing is a significant restraint in the North American market. According to the Centers for Disease Control and Prevention (CDC), the average cost of an HbA1c test in the U.S. ranges from $50 to $100, depending on the healthcare provider and location. For uninsured or underinsured patients, this expense can be prohibitive, leading to reduced testing frequency. The American Diabetes Association reports that approximately 10.5% of the U.S. population has diabetes, but many individuals delay or avoid testing due to financial constraints. This limits market growth and early diagnosis, which is critical for effective diabetes management.

Regulatory Challenges and Reimbursement Issues

Regulatory hurdles and inconsistent reimbursement policies hinder the HbA1c testing market in North America. The U.S. Food and Drug Administration (FDA) requires rigorous validation for HbA1c testing devices, which can delay product approvals. Additionally, Medicare and private insurers often impose strict criteria for reimbursement, limiting patient access. According to the Centers for Medicare & Medicaid Services, only 60% of HbA1c tests are fully reimbursed, leaving patients to cover the remaining costs. This creates a barrier to widespread adoption, particularly among low-income populations, and restricts market expansion despite the growing prevalence of diabetes.

MARKET OPPORTUNITIES

Increasing Prevalence of Diabetes

The rising prevalence of diabetes in North America presents a significant opportunity for the HbA1c testing market. According to the Centers for Disease Control and Prevention, over 34 million Americans have diabetes, and 88 million adults have prediabetes, highlighting the need for regular monitoring. The International Diabetes Federation estimates that by 2045, the number of people with diabetes in North America could reach 49 million. This growing patient pool drives demand for HbA1c testing, as it is a critical tool for diabetes management and early detection. The increasing awareness of diabetes prevention and control further amplifies market growth potential.

Technological Advancements in Testing Devices

Technological innovations in HbA1c testing devices are creating new opportunities in the North American market. The U.S. Food and Drug Administration has approved several advanced point-of-care HbA1c testing devices that provide rapid and accurate results, enhancing patient convenience. According to the National Institutes of Health, the adoption of portable and user-friendly devices is increasing, particularly in rural and underserved areas. These advancements improve accessibility and encourage frequent testing, which is essential for effective diabetes management. Additionally, the integration of digital health tools, such as cloud-based data storage, is further driving market expansion by enabling better patient monitoring and care coordination.

MARKET CHALLENGES

Limited Awareness in Underserved Populations

A major challenge in the North America HbA1c testing market is the limited awareness and access to diabetes testing in underserved populations. According to the Centers for Disease Control and Prevention, minority groups, including African Americans and Hispanics, are disproportionately affected by diabetes but often lack access to healthcare services. The American Diabetes Association reports that 15% of African Americans and 12.5% of Hispanics have diabetes, compared to 7.5% of non-Hispanic whites. However, many in these communities are unaware of the importance of regular HbA1c testing. This lack of awareness and healthcare disparities hinder market penetration and delay early diagnosis, exacerbating diabetes-related complications.

Inconsistent Accuracy of Point-of-Care Testing

Inconsistent accuracy of point-of-care HbA1c testing devices poses a significant challenge in the North American market. The U.S. Food and Drug Administration has raised concerns about the variability in results from some portable devices, which can lead to misdiagnosis or improper diabetes management. According to the National Institutes of Health, studies have shown that certain point-of-care devices have an error margin of up to 0.5% in HbA1c readings, which is clinically significant. This inconsistency undermines trust in these devices, particularly among healthcare providers, and limits their widespread adoption. Ensuring accuracy and reliability remains a critical hurdle for manufacturers and the market as a whole.

SEGMENTAL ANALYSIS

By Technology

The ion-exchange HPCL segment dominated the HbA1c testing market in North America by capturing 40.4% of the North American market share in 2024. HPLC is the gold standard for HbA1c testing due to its unmatched accuracy and reliability, which are critical for diabetes diagnosis and management. The Centers for Disease Control and Prevention highlights that over 60% of laboratory-based HbA1c tests in the U.S. rely on HPLC. Its precision in separating and quantifying glycated hemoglobin makes it indispensable, particularly in clinical settings where accurate results are essential for effective patient care and treatment decisions.

The enzymatic assays segment is projected to expand at a CAGR of 9.2% over the forecast period. The Centers for Medicare & Medicaid Services emphasize their cost-effectiveness, simplicity, and suitability for point-of-care testing, making them ideal for decentralized healthcare settings. The National Institutes of Health notes that enzymatic assays are increasingly adopted in resource-limited areas due to their rapid results and minimal sample preparation. This growth is driven by the rising demand for accessible and efficient diabetes monitoring, particularly in underserved populations, highlighting their importance in expanding HbA1c testing accessibility.

By End-use

The hospitals segment ruled the market by accounting for 50.8% of the North American market share in 2024. These facilities are the primary settings for diabetes diagnosis and management, utilizing advanced technologies like HPLC and immunoassays to ensure accurate results. The American Diabetes Association highlights that hospitals and clinics provide comprehensive care, making HbA1c testing a critical component of patient treatment plans. Their widespread infrastructure, skilled healthcare professionals, and ability to handle high testing volumes solidify their position as the leading end-user segment, ensuring effective diabetes management for millions of patients.

The homecare segment is predicted to showcase a CAGR of 10.5% over the forecast period. The Centers for Medicare & Medicaid Services emphasize the rising demand for point-of-care HbA1c testing devices, driven by the need for convenient and frequent monitoring, especially among elderly and chronically ill patients. The National Institutes of Health notes that advancements in portable testing devices have improved accuracy and usability, making home-based testing more reliable. This growth reflects a shift toward patient-centric care, enabling better diabetes management in remote and underserved areas.

REGIONAL ANALYSIS

As of 2023, North America accounted for the largest share of the HbA1c Testing market due to heavy expenditure on health care in developed nations such as the U.S. and Canada. The HbA1c testing market in North America also benefits from the introduction of point-of-care and other recent technologies that reduce diabetes testing costs. Diabetes patients are on the rise across North America as the aging population continues to grow. In addition, the market for HbA1c testing equipment is being boosted by the growing scope of medical tourism in underdeveloped countries.

The U.S. HbA1C testing market is predicted to lead the North American market during the forecast period. The HbA1c market in the United States is expected to be favored by the increased usage of improved diagnostic tools and technologies and strategic initiatives such as collaborations and agreements by the key market players.

KEY MARKET PLAYERS

Companies playing a notable role in the North American HbA1c Testing market profiled in this report are Transasia Biomedicals Ltd., Abbott Laboratories, Alere, Inc., Arkray, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., Siemens Healthcare, and Trinity Biotech plc.

MARKET SEGMENTATION

This research report on the North American HbA1c testing market has been segmented and sub-segmented into the following categories.

By Technology

- Ion-Exchange HPCL

- Enzymatic Assay

- Affinity Binding Chromatography

- Turbidimetric Inhibition Immunoassay

- Other

By End Use

- Hospital

- Home Care

- Diagnostic laboratory

- Research Institutions

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What challenges does the North American HbA1c testing market face?

The main challenges include the high cost of testing equipment, regulatory hurdles, and competition from alternative glucose testing methods. Additionally, healthcare providers may face difficulties in training staff to use newer technologies effectively.

What factors are driving the growth of the HbA1c testing market in North America?

The increasing prevalence of diabetes and advancements in testing technologies are key drivers. Rising awareness of diabetes management and government healthcare initiatives are also contributing to market expansion.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]