North America Gas Turbine Market Size, Share, Trends & Growth Forecast Report By Capacity (Less than 30 MW, 31-120 MW, and Above 120 MW), Type, End-User Industries, and Country (The United States, Canada, and Rest of North America), Industry Analysis From 2024 to 2033

North America Gas Turbine Market Size

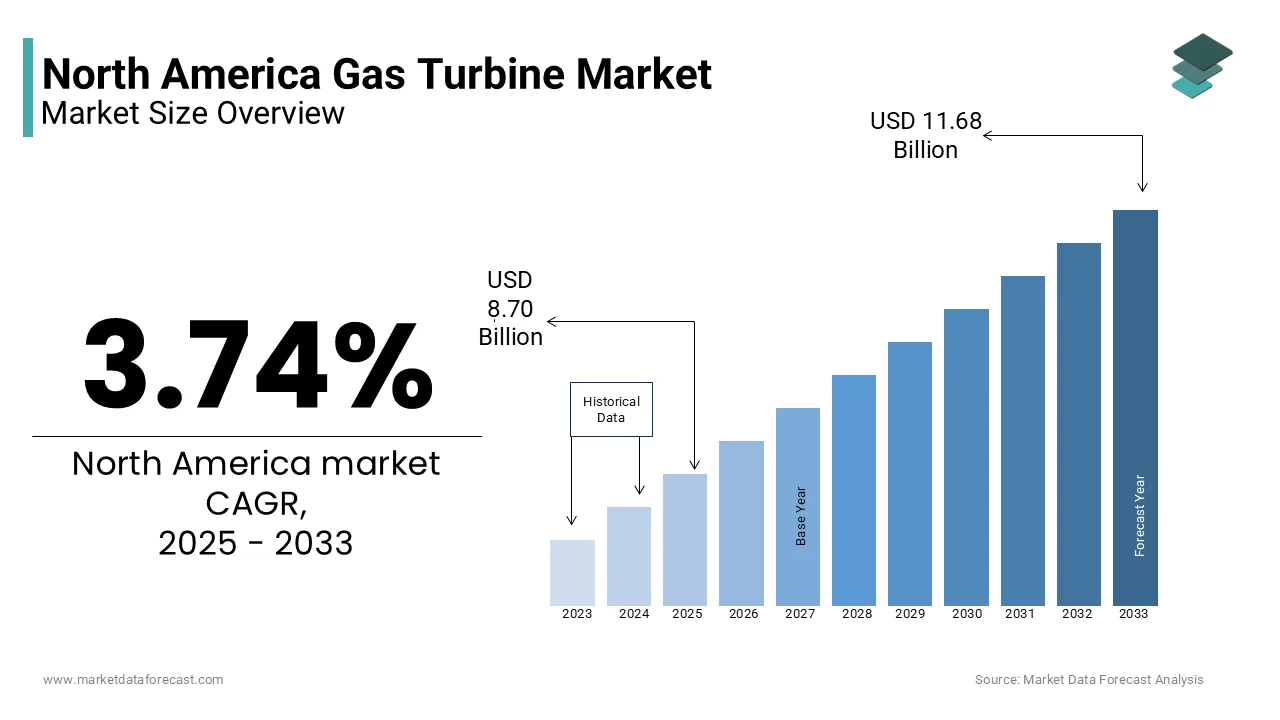

The North America gas turbine market was worth USD 8.39 billion in 2024. The North America market is projected to reach USD 11.68 billion by 2033 from USD 8.70 billion in 2025, rising at a CAGR of 3.74% from 2025 to 2033.

Gas turbines are known for their efficiency, reliability, and ability to operate on various fuels is making them a preferred choice for both utility-scale power plants and industrial applications. The market has been witnessing significant growth is driven by the increasing demand for cleaner energy sources and the need for flexible power generation solutions. This growth is further supported by advancements in gas turbine technology which have led to improved efficiency and reduced emissions. Furthermore, the ongoing transition towards renewable energy sources and the need for grid stability are driving investments in gas turbine systems as a complementary solution. The field of energy continues to evolve, and the North America gas turbine market is expected to adapt by incorporating innovative technologies and sustainable practices to meet the changing demands of the energy sector.

MARKET DRIVERS

Increasing Demand for Clean Energy Solutions

The Escalating need for clean energy solutions is influencing the development of the North America gas turbine market. The concerns over climate change and environmental sustainability grows, so, there is a concerted effort to transition from traditional fossil fuels to cleaner energy sources. Gas turbines and especially those that utilize natural gas, are considered a more environmentally friendly option compared to coal and oil-fired power plants. The U.S. Energy Information Administration revealed that natural gas accounted for approximately 40% of electricity generation in the United States in 2022 is signifying a shift towards cleaner energy sources. The efficiency of gas turbines which can achieve thermal efficiencies of up to 60% in combined cycle configurations further enhances their appeal as a low-emission power generation solution. In addition, the ability of gas turbines to quickly ramp up and down in response to fluctuating energy demands makes them an ideal complement to intermittent renewable energy sources such as wind and solar. As the push for cleaner energy solutions continues, the demand for gas turbines is expected to grow.

Technological Advancements in Gas Turbine Design

Technological advancements in gas turbine design and efficiency are another major driver of the North America gas turbine market. Innovations in materials, aerodynamics and combustion technology have led to the development of next-generation gas turbines that offer improved performance and reduced emissions. According to a report by the Gas Technology Institute, advancements in turbine blade materials and cooling techniques have enabled gas turbines to operate at higher temperatures, resulting in increased efficiency and power output. The introduction of digital technologies, such as predictive maintenance and real-time monitoring, has also enhanced the operational reliability of gas turbines, reducing downtime and maintenance costs. Furthermore, the integration of combined cycle technology, which utilizes both gas and steam turbines, has become increasingly popular, allowing for higher overall efficiency and lower emissions.

MARKET RESTRAINTS

High Initial Capital Investment

A key restraint affecting the North America gas turbine market is the high initial capital investment required for gas turbine systems. The cost of purchasing and installing gas turbines can be substantial, often ranging from $1,000 to $5,000 per kilowatt of installed capacity, depending on the size and specifications of the turbine. As per the U.S. Energy Information Administration, the average capital cost for new natural gas-fired power plants was approximately $1,200 per kilowatt in 2022. This significant upfront investment can deter potential buyers, particularly smaller utilities and independent power producers, from pursuing gas turbine projects. Furthermore, the financial implications of financing and maintaining gas turbine systems can further complicate decision-making for stakeholders. The need for long-term contracts and stable revenue streams to justify the investment can also pose challenges, particularly in a competitive energy market where prices can fluctuate.

Regulatory and Environmental Compliance

The North America gas turbine market is also constrained by stringent regulatory and environmental compliance requirements that must be adhered to during the design, installation, and operation of gas turbine systems. Various federal and state regulations govern emissions standards, air quality, and fuel usage, imposing rigorous requirements on gas turbine operators. In line with the U.S. Environmental Protection Agency, the Clean Air Act mandates strict limits on nitrogen oxides (NOx) and carbon dioxide (CO2) emissions from power plants which can necessitate costly upgrades to existing gas turbine systems. Compliance with these regulations can be complex and may require significant investments in emissions control technologies such as selective catalytic reduction (SCR) systems and low-NOx burners. Additionally, the evolving nature of environmental regulations can create uncertainty for gas turbine operators, as they must continuously adapt to new standards and ensure that their systems remain compliant. This regulatory burden can deter some companies from investing in gas turbine projects or limit the ability of existing players to innovate and expand their offerings.

MARKET OPPORTUNITIES

Expansion of Renewable Energy Integration

The expansion of renewable energy integration presents a significant opportunity for the North America gas turbine market. As the energy landscape shifts towards a more sustainable model, gas turbines are increasingly being recognized for their ability to complement intermittent renewable energy sources such as wind and solar. According to the U.S. Department of Energy, the share of renewable energy in the U.S. electricity generation mix is projected to reach 50% by 2030. Gas turbines can provide the necessary flexibility and reliability to support this transition, as they can quickly ramp up or down to balance supply and demand. This capability is particularly valuable in regions with high penetration of renewables, where grid stability is essential. Also, advancements in hybrid systems that combine gas turbines with renewable energy sources are gaining traction, further enhancing the appeal of gas turbines in a decarbonized energy future.

Growth in Industrial Applications

The growth in industrial applications for gas turbines represents another major opportunity for the North America gas turbine market. Industries such as oil and gas, manufacturing, and chemical processing are increasingly adopting gas turbines for power generation and mechanical drive applications due to their efficiency and reliability. A report by the U.S. Department of Energy states that industrial gas turbine installations are expected to increase by 4% annually through 2028 is driven by the need for efficient energy solutions in various industrial processes. Gas turbines are particularly well-suited for combined heat and power (CHP) applications, where they can provide both electricity and useful thermal energy, enhancing overall energy efficiency. Additionally, the growing focus on reducing greenhouse gas emissions in industrial operations is prompting companies to transition from coal and oil to cleaner natural gas solutions.

MARKET CHALLENGES

Supply Chain Disruptions

The North America gas turbine market faces significant challenges from supply chain disruptions, particularly in the wake of the COVID-19 pandemic. The gas turbine industry relies on a complex network of suppliers for components and materials, and the pandemic has exposed vulnerabilities in these supply chains. survey conducted by the National Association of Manufacturers, nearly 80% of manufacturers reported supply chain disruptions due to the pandemic, leading to delays in production and project timelines. These disruptions can result in increased costs for gas turbine manufacturers, as they may need to source materials from alternative suppliers or expedite shipping to meet project deadlines. Additionally, the ongoing global semiconductor shortage has further exacerbated supply chain challenges, impacting the availability of critical components for gas turbine systems.

Intense Market Competition

The North America gas turbine market is characterized by intense competition among established players and new entrants. The market is populated by a mix of global corporations and regional companies, each vying for market share in a competitive landscape This competitive environment can lead to price wars, which may erode profit margins and compel companies to invest heavily in marketing and innovation to differentiate their offerings. Additionally, the rapid pace of technological advancements necessitates continuous investment in research and development, further straining financial resources. Smaller companies may struggle to compete with larger firms that have greater access to capital and established brand recognition. As a result, the intense competition in the gas turbine market can pose challenges for companies seeking to maintain profitability and market position, as highlighted by the National Gas Turbine Association.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.74% |

|

Segments Covered |

By Capacity, Type, End-User Industries, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

General Electric Company, Rolls-Royce Holding PLC, Mitsubishi Hitachi Power Systems Americas, Inc, Capstone Turbine Corporation, and Solar Turbines Inc. |

SEGMENTAL ANALYSIS

By Capacity Insights

The segment of gas turbines with a capacity of 31-120 MW secured the top spot in the North America gas turbine market by commanding a market share of 50.7% in 2024. This control is mainly driven by the widespread use of gas turbines in utility-scale power generation and industrial applications, where this capacity range is often optimal for meeting energy demands. The industry estimates indicates that the 31-120 MW segment is projected to arrive at a valuation of $5 billion by 2025 which is fuelled by the increasing demand for reliable and efficient power generation solutions. The versatility of gas turbines in this capacity range allows them to be deployed in various settings, including combined cycle power plants and peaking power plants, which are essential for grid stability. Besides, the rising attention on lowering emissions and transitioning to cleaner energy sources is further driving the adoption of gas turbines in this capacity range because they offer a more environmentally friendly alternative to traditional fossil fuel-based power generation, as noted by the U.S. Energy Information Administration.

The rapidly expanding segment in the North America gas turbine market is the category of gas turbines with a capacity of less than 30 MW, which is predicted to rise at a CAGR of 9.1% owing to the increasing demand for distributed energy generation and the rise of microgrids, which often utilize smaller gas turbine systems to provide localized power solutions. According to a report by the International Energy Agency, the market for distributed energy resources is expected to expand significantly, driven by the need for energy resilience and sustainability. The ability of smaller gas turbines to operate efficiently in off-grid and remote applications makes them an attractive option for various industries, including agriculture, mining, and remote communities.

By Type Insights

In the analysis of the North America gas turbine market by type, the combined cycle gas turbine (CCGT) segment emerges as the largest contributor, commanding a significant market share of approximately 70%. This dominance is primarily driven by the high efficiency and low emissions associated with combined cycle technology, which utilizes both gas and steam turbines to maximize energy output. According to industry estimates, the CCGT segment is projected to reach a valuation of $7 billion by 2025, fueled by the increasing demand for efficient power generation solutions in utility-scale applications. The ability of CCGT systems to achieve thermal efficiencies of up to 60% makes them a preferred choice for utilities seeking to reduce their carbon footprints while meeting growing energy demands. Additionally, the flexibility of combined cycle systems allows them to quickly respond to fluctuations in energy demand, further enhancing their appeal in a rapidly changing energy landscape. As the push for cleaner energy solutions continues, the demand for combined cycle gas turbines is expected to remain strong, solidifying their position as the leading type in the North American gas turbine market, as highlighted by the U.S. Department of Energy.

The fastest-growing segment within the North America gas turbine market is the open cycle gas turbine (OCGT) category, which is projected to grow at a CAGR of 7.3% over the forecast period. This progress can be linked to the increasing need for peaking power plants and backup generation solutions and particularly in regions with high renewable energy penetration. As per a report by the Electric Power Research Institute, the need for flexible and responsive power generation is becoming increasingly important as utilities integrate more intermittent renewable sources into their energy portfolios. Open cycle gas turbines are well-suited for this role, as they can be quickly started and stopped to provide additional capacity during peak demand periods. Additionally, advancements in OCGT technology such as improved efficiency and reduced emissions, are enhancing their competitiveness in the market. The demand for flexible power generation solutions continues to rise, hence, the open cycle gas turbine segment is well-positioned for growth, reflecting the evolving dynamics of the North American energy landscape.

By End-User Industries Insights

The power generation segment was the largest contributor by accounting for 65.5% of the total market share in 2024. This authority is basically propelled by the increasing demand for electricity and the need for reliable power generation solutions to meet the growing energy needs of residential, commercial, and industrial sectors. According to the U.S. Energy Information Administration, electricity consumption in the United States is projected to increase by 1.5% annually through 2025 is necessitating investments in new power generation capacity. Gas turbines play a crucial role in this landscape, providing efficient and flexible power generation options that can quickly respond to fluctuations in demand. Also, the transition towards cleaner energy sources is driving the adoption of gas turbines in power generation, as they offer lower emissions compared to traditional coal and oil-fired plants.

The oil and gas sector is projected to grow at a highest CAGR of 7.9% from 2025 to 2033. This sudden rise can be caused by the surging demand for gas turbines in various applications within the oil and gas industry including natural gas processing, compression, and power generation for offshore platforms. As per the U.S. Energy Information Administration, the natural gas sector is expected to see significant investments, with production projected to rise by 3% annually through 2025. These turbines are preferred in this sector due to their ability to operate efficiently on natural gas, which is increasingly being utilized as a cleaner alternative to oil and coal. Besides, the need for reliable power generation in remote locations such as drilling sites and offshore facilities and further drives the demand for gas turbines. The potential to provide quick-start capabilities and high operational flexibility makes them ideal for meeting the variable energy demands of the oil and gas industry. The sector evolves and adapts continuously to changing energy landscapes, the demand for gas turbines in oil and gas applications is anticipated to grow significantly and is placing this segment as a major benefiter for the market dynamics in North America.

REGIONAL ANALYSIS

The United States led the North America gas turbine market by holding a market share of 80.8% in 2024. It is firmly established and moving through a mature but innovative phase. The U.S. gas turbine industry is marked by its size and diversity, with substantial investments in power generation, oil and gas, and industrial applications. As per the U.S. Energy Information Administration, natural gas accounted for about 40% of the total electricity generation in the country in 2022 is reflecting a strong reliance on gas turbines for power generation. The demand for gas turbines is driven by the need for efficient and flexible energy solutions, particularly as the country transitions towards cleaner energy sources. Also, the ongoing infrastructure investments and the push for renewable energy integration are expected to further stimulate the gas turbine market.

Canada accounted for 13.8% of the total market share in 2024. It is in a transitional growth phase. While not as large as the U.S., Canada is seeing increasing demand for gas turbines, especially in regions shifting away from coal and toward natural gas for power generation. The Canadian gas turbine industry has been seeing steady growth is driven by investments in power generation and the oil and gas sector. According to Natural Resources Canada, the country is one of the largest producers of natural gas, with production levels reaching approximately 16 billion cubic feet per day in 2022. The demand for gas turbines in Canada is influenced by the need for efficient power generation solutions and the growing emphasis on reducing greenhouse gas emissions. Additionally, the increasing focus on renewable energy integration and the development of natural gas-fired power plants are expected to drive the demand for gas turbines in the coming years.

The rest of North America which includes countries such as Mexico and various Caribbean nations is a smaller but emerging segment of the gas turbine market. The gas turbine industry in Mexico has been gaining intensity backed by government initiatives promoting energy reform and investments in infrastructure. The Mexican National Institute of Statistics and Geography states that electricity generation from natural gas reached approximately 60% of the total generation mix in 2022, reflecting a growing reliance on gas turbines for power generation. The need for gas turbines in this region is described by a mix of local and international players, each vying for market share in a competitive landscape. As the energy sector in Mexico and neighboring countries continues to expand, the demand for gas turbines is expected to rise, providing opportunities for growth in the North American gas turbine market. The rising attention on energy efficiency and the need for reliable power generation solutions are likely to drive the adoption of gas turbines in these regions are further enhancing the market's potential.

KEY MARKET PLAYERS

The major players in the North America gas turbine market include General Electric Company, Rolls-Royce Holding PLC, Mitsubishi Hitachi Power Systems Americas, Inc, Capstone Turbine Corporation, and Solar Turbines Inc.

MARKET SEGMENTATION

This research report on the North America gas turbine market is segmented and sub-segmented into the following categories.

By Capacity

- Less than 30 MW

- 31-120 MW

- Above 120 MW

By Type

- Combined Cycle

- Open Cycle

By End-User Industries

- Power

- Oil and Gas

- Other End-User Industries

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What factors are driving the North America gas turbine market?

The market is driven by increasing electricity demand, a shift toward cleaner energy sources, advancements in turbine technology, and the expansion of industrial and power generation sectors.

Which industries are the primary users of gas turbines in North America?

Key industries include power generation, oil and gas, aerospace, and manufacturing, with utilities and independent power producers being major consumers.

How is technology influencing the North America gas turbine market?

Innovations such as digital twin technology, AI-based predictive maintenance, and advanced materials for higher efficiency are improving turbine performance and reliability.

What is the future outlook for the North America gas turbine market?

The market is expected to grow due to the increasing adoption of combined-cycle power plants, demand for efficient gas turbines, and the integration of hydrogen-based fuel technologies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]