North America Fuel Cell Technology Market Size, Share, Trends & Growth Forecast Report By Product (PEMFC, DMFC, SOFC, PAFC & AFC, MCFC), Application and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Fuel Cell Technology Market Size

The north america fuel cell technology market was worth USD 1.68 billion in 2024. The North American market is estimated to grow at a CAGR of 8.43% from 2025 to 2033 and be valued at USD 3.48 billion by the end of 2033 from USD 1.82 billion in 2025.

Fuel cells are recognized for their efficiency, low emissions, and versatility, making them suitable for a variety of applications, including transportation, stationary power generation, and portable power systems. The growth of this market is propelled by rising investments in clean energy technologies, government incentives for hydrogen fuel cell adoption, and the surging demand for sustainable energy solutions to combat climate change. Moreover, the market insights suggest that the North America fuel cell technology market is poised for continued expansion, with advancements in fuel cell efficiency, durability, and cost reduction playing a pivotal role in driving adoption across various sectors. The market is also benefiting from the growing trend of hydrogen infrastructure development, which is essential for supporting the widespread use of fuel cell technologies.

MARKET DRIVERS

Growing Demand for Clean Energy Solutions

The North America fuel cell technology market is significantly driven by the growing demand for clean energy solutions. As concerns over climate change and environmental sustainability intensify, governments and consumers are increasingly seeking alternatives to fossil fuels. According to the U.S. Department of Energy, the demand for hydrogen fuel cells is projected to grow significantly, with the trade expected to reach $25 billion by 2030. Fuel cells offer a clean and efficient energy source, producing only water and heat as byproducts, which aligns with global efforts to reduce greenhouse gas emissions. The versatility of fuel cells allows them to be utilized in various applications, including transportation, stationary power generation, and backup power systems, catering to a wide range of consumer preferences. Apart from these, the increasing focus on energy independence and security is prompting investments in hydrogen infrastructure and fuel cell technologies.

Government Incentives and Support

Additional driver of the North America fuel cell technology market is the increasing government incentives and support for hydrogen and fuel cell projects. Various federal and state-level initiatives aim to promote the development and adoption of fuel cell technologies as part of broader efforts to transition to a low-carbon economy. According to the Hydrogen and Fuel Cell Technical Advisory Committee, funding for hydrogen and fuel cell research and development has increased significantly in recent years, providing financial support for innovative projects and commercialization efforts. Besides this, renewable energy mandates and tax credits further incentivize investments in fuel cell technologies, making them more economically viable for developers and investors. The growing recognition of hydrogen as a key component of a sustainable energy future has led to the establishment of favorable regulatory frameworks that facilitate project development and streamline permitting processes.

MARKET RESTRAINTS

High Initial Investment Costs

A primary restraint affecting the North America fuel cell technology market is the high initial investment costs associated with the development and implementation of fuel cell systems. The construction of fuel cell facilities and the integration of fuel cell technologies into existing infrastructure often require significant capital investment in both hardware and software. As per the industry estimates, the cost of fuel cell systems can range from $1,000 to $3,000 per kilowatt, depending on the technology and application. This financial barrier can deter potential investors and developers, particularly smaller companies or those with limited access to financing. Additionally, the ongoing costs associated with maintaining and operating fuel cell systems can further strain budgets, particularly for companies operating on thin margins. The need for specialized training and expertise to manage fuel cell technologies can also add to the overall costs. As a result, companies may be hesitant to invest in fuel cell systems, particularly if they are uncertain about the return on investment.

Limited Hydrogen Infrastructure

A significant restraint in the North America fuel cell technology market is the limited hydrogen infrastructure that currently exists to support fuel cell adoption. The widespread use of fuel cells, particularly in transportation applications, relies heavily on the availability of a robust hydrogen supply chain, including production, storage, and distribution facilities. As stated by the U.S. Department of Energy, there are currently only about 50 hydrogen refueling stations in the United States, which poses a significant challenge for the growth of fuel cell vehicles. The lack of infrastructure can deter consumers from purchasing fuel cell vehicles, as the convenience of refueling is a critical factor in consumer decision-making. Further, the high costs associated with building hydrogen infrastructure can pose challenges for investors and developers, further limiting the growth of the market.

MARKET OPPORTUNITIES

Expansion of Hydrogen Infrastructure

The North America fuel cell technology market presents significant opportunities for growth through the expansion of hydrogen infrastructure. As the demand for hydrogen fuel cells increases, there is a growing need for a comprehensive network of hydrogen production, storage, and distribution facilities. In line with the Hydrogen and Fuel Cell Technical Advisory Committee, investments in hydrogen infrastructure are expected to reach $10 billion by 2030, driven by government initiatives and private sector partnerships. This trend is prompting manufacturers and energy companies to collaborate on developing hydrogen refueling stations and production facilities, which will enhance the accessibility of hydrogen fuel for consumers and businesses alike. The establishment of a robust hydrogen infrastructure not only supports the growth of fuel cell vehicles but also facilitates the integration of hydrogen into various sectors, including industrial applications and renewable energy storage. This focus on infrastructure expansion is expected to significantly contribute to the growth of the fuel cell technology market in North America.

Technological Advancements in Fuel Cell Systems

A major opportunity in the North America fuel cell technology market lies in the technological advancements in fuel cell systems. Innovations in fuel cell technology, such as improved efficiency, durability, and cost reduction, are driving the adoption of fuel cells across various applications. According to industry experts, advancements in proton exchange membrane fuel cells (PEMFCs) and solid oxide fuel cells (SOFCs) are expected to enhance the overall performance of fuel cell systems, making them more competitive with traditional energy sources. Additionally, the development of hybrid fuel cell systems that combine fuel cells with batteries is gaining traction, providing a versatile solution for energy storage and transportation. As the demand for cleaner and more efficient energy solutions continues to rise, companies that invest in research and development of advanced fuel cell technologies can gain a competitive edge in the market.

MARKET CHALLENGES

Supply Chain Disruptions

Potential for supply chain disruptions is among the significant challenges facing the North America fuel cell technology market. The production of fuel cell systems relies on key materials such as platinum, which is used as a catalyst, and other specialized components that can be affected by fluctuations in supply and demand. According to industry reports, disruptions in the supply chain, particularly during adverse weather conditions or global events like the COVID-19 pandemic, have led to increased prices and shortages of essential materials. This situation poses a challenge for manufacturers who must ensure a consistent supply of high-quality materials to meet consumer demand. In addition, the sourcing of materials can be impacted by ethical and sustainability concerns, leading some consumers to seek alternatives. Resolving these supply chain problems will be crucial for maintaining product availability and quality in the fuel cell technology market.

Competition from Alternative Energy Sources

Another challenge in the North America fuel cell technology market is the increasing competition from alternative energy sources. The rise of health-conscious consumers has led to a surge in demand for various renewable energy solutions, such as solar, wind, and hydroelectric power, which can pose a challenge to the adoption of fuel cell technologies. The market research revealed that the global business for alternative energy sources is projected to grow at a notable pace over the next five years, indicating a robust interest in non-fuel cell options. This trend is particularly pronounced among consumers who are increasingly seeking energy solutions that align with their values of sustainability and efficiency. As a result, fuel cell manufacturers must compete not only with other fuel cell brands but also with a wide array of alternative energy technologies that cater to evolving consumer preferences.

SEGMENTAL ANALYSIS

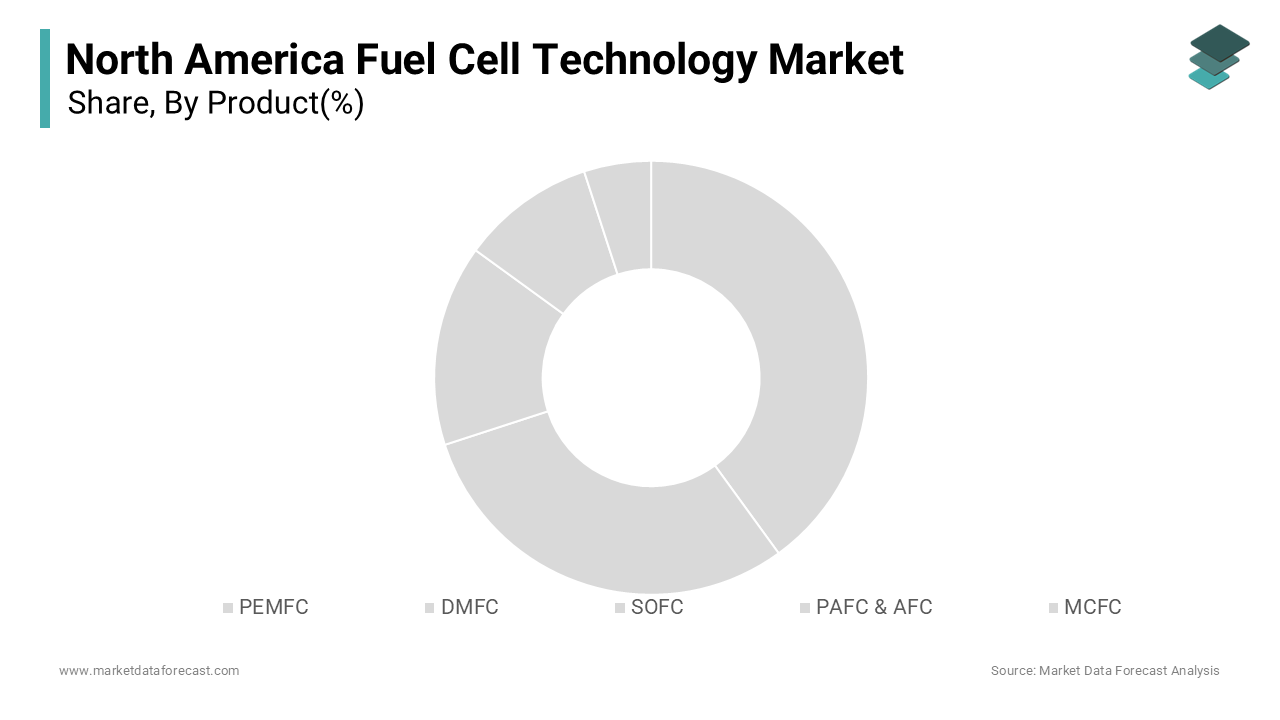

By Product Insights

The Proton Exchange Membrane Fuel Cells (PEMFC) dominated the North America fuel cell technology market and held a market share of 51.7% in 2024. This prominence can be credited to the extensive use of PEMFCs in various applications, particularly in transportation and portable power systems. PEMFCs are preferred for their high efficiency, low operating temperatures, and quick start-up times, making them ideal for use in fuel cell vehicles and backup power systems. Additionally, the growing trend of electrification and the increasing focus on reducing greenhouse gas emissions have further propelled the demand for PEMFC technology, as it provides a sustainable alternative to traditional fossil fuel-based energy sources.

On the other hand, the Solid Oxide Fuel Cell (SOFC) segment gained quick expansion, with a calculated CAGR of 18.5% in the coming years. This can be linked to the increasing adoption of SOFC technology in stationary power generation and large-scale applications. According to market insights, the demand for SOFCs is on the rise, driven by the growing trend of distributed energy generation and the need for efficient, low-emission power solutions. SOFCs are favored for their high efficiency, fuel flexibility, and ability to operate on a variety of fuels, including natural gas and biogas. Apart from these, the rise of government incentives and regulations promoting the use of clean energy technologies is making SOFC systems more accessible to consumers and businesses by contributing to their popularity.

By Application Insights

The stationary power generation segment was regarded as the largest application segment by commanding a market share approximately 60.9% in 2024. This dominance can be attributed to the extensive use of fuel cells in providing reliable and efficient power for residential, commercial, and industrial applications. The industry statistics indicate that the stationary power generation segment is forecasted to move ahead at an impressive rate in the coming decade and is propelled by the increasing demand for clean and sustainable energy solutions. Fuel cells are favoured for their ability to provide continuous power with minimal emissions, making them an attractive option for businesses and consumers seeking to reduce their carbon footprint. Furthermore, the rising wave of energy independence and the need for backup power solutions have further propelled the demand for fuel cells in stationary applications.

Whereas, the transportation segment is seeing swift progression, with a projected CAGR of 20.2% over the forecasting years. This growth of the segment can be attributed to the surging acceptance of fuel cell vehicles (FCVs) as a sustainable alternative to traditional gasoline and diesel-powered vehicles. In accordance with market insights, the demand for FCVs is on the rise and is backed by the growing attention to reducing greenhouse gas emissions and the need for cleaner transportation solutions. FCVs offer several advantages including longer driving ranges and faster refueling times compared to battery electric vehicles. Additionally, the rise of government incentives and the expansion of hydrogen refueling infrastructure are making FCVs more accessible to consumers and is contributing to their popularity.

REGIONAL ANALYSIS

The United States remained the undisputed leader in the North American fuel cell technology market and accounted for a market share of 75.2% in 2024. The U.S. market is defined by a robust requirement for these, supported by the increasing focus on renewable energy and sustainability. This wave is compelling manufacturers to develop innovative fuel cell solutions that cater to the needs of energy producers and consumers. The U.S. market benefits from a well-established infrastructure for hydrogen production and distribution, with a wide range of fuel cell products available across various sectors, including transportation, stationary power generation, and portable power systems. Additionally, the growing interest in waste-to-energy initiatives and the increasing focus on reducing greenhouse gas emissions have led to increased innovation among manufacturers, further driving market growth.

Canada exhibits steady advancement in the North America fuel cell technology market. The Canadian market is experiencing a similar trend to that of the U.S., with an increasing number of businesses and municipalities seeking fuel cell solutions to enhance energy production and reduce emissions. According to Natural Resources Canada, the need for fuel cell technologies is estimated to grow substantially over the next five years and is driven by the rising focus on renewable energy and sustainability. The Canadian market is also witnessing a growing interest in hydrogen as a clean energy source, reflecting the broader trend towards environmentally friendly practices in the energy sector. As people become more aware of the importance of sustainable energy solutions, manufacturers are responding by introducing advanced fuel cell technologies that cater to these demands. The expansion of government incentives and support for renewable energy projects is further enhancing the accessibility of fuel cell solutions across Canada.

The Rest of North America posts the most dynamic progression in the regional fuel cell technology market and this traction is projected to deliver a CAGR of 7% during the forecast period to outpace other areas. Since it is smaller compared to the U.S. and Canada, it brings to light distinctive growth prospects. The awareness of fuel cell technologies in Mexico is gradually increasing, especially among businesses and municipalities looking to enhance their energy production and reduce emissions. The rising trend of waste-to-energy initiatives and the incorporation of fuel cells into traditional energy practices are contributing to the market's expansion. Additionally, the increasing availability of imported fuel cell products from the U.S. is enhancing consumer access to a wider variety of options. The increasing focus on energy independence and sustainability among consumers and businesses in these regions is also expected to bolster the demand for fuel cell technologies.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The North America fuel cell technology market is characterized by the presence of several key players who dominate the landscape. Notable companies include Ballard Power Systems, which is recognized for its extensive range of fuel cell solutions, and Plug Power, a leading provider of hydrogen fuel cell systems that has established a strong foothold in the market. These companies leverage their extensive distribution networks and technological expertise to capture a significant share of the market.

Besides these, smaller, niche players are emerging, focusing on innovative fuel cell technologies and specialized applications. The competitive landscape is further intensified by the growing trend of partnerships and collaborations, as companies seek to enhance their technological capabilities and expand their market reach.

The North America fuel cell technology market is characterized by a competitive landscape that includes both established brands and emerging players. Major companies such as Ballard Power Systems, Plug Power, and FuelCell Energy dominate the market, leveraging their extensive distribution networks and technological expertise to capture significant market shares. These companies invest heavily in research and development to innovate and improve their fuel cell technologies, focusing on enhancing efficiency, safety, and sustainability.

Additionally, the rise of niche brands specializing in advanced fuel cell solutions has intensified competition, as these companies cater to a growing demographic seeking high-performance and environmentally friendly technologies. The increasing trend of partnerships and collaborations has further transformed the competitive landscape, with brands adopting joint ventures to enhance their technological capabilities and market reach. Further, the shift in consumer preferences continue towards unique and efficient energy solutions, so, competition is believed to intensify which is prompting manufacturers to differentiate themselves through quality, performance, and innovative marketing strategies.

Major Strategies Used by Key Players in the North America Fuel Cell Technology Market

Key players in the North America fuel cell technology market employ various strategies to strengthen their market position and enhance competitiveness. One prominent strategy is product innovation, where companies continuously develop new fuel cell technologies and applications to cater to changing consumer preferences. For instance, introducing advanced proton exchange membrane fuel cells (PEMFCs) and solid oxide fuel cells (SOFCs) has become a popular tactic to attract energy producers looking for efficient and sustainable solutions.

Additionally, many manufacturers are focusing on sustainability initiatives, such as enhancing the recyclability of fuel cell components and improving the overall environmental impact of fuel cell systems, to appeal to environmentally aware consumers.

Apart from these, strategy involves expanding distribution channels and particularly through partnerships with energy producers and municipalities to enhance product accessibility. Companies are progressively collaborating with local governments and organizations to promote fuel cell technology as a viable energy solution.

Furthermore, marketing campaigns that emphasize the benefits of fuel cells in reducing emissions and generating renewable energy are being utilized to engage consumers and drive brand loyalty.

RECENT MARKET DEVELOPMENTS

- In January 2023, Ballard Power Systems launched a new line of hydrogen fuel cell systems aimed at improving efficiency and reducing emissions, expanding its product portfolio to cater to the growing demand for sustainable energy solutions.

- In March 2023, Plug Power announced a partnership with a leading logistics company to implement its fuel cell systems in material handling equipment, targeting the increasing interest in renewable energy projects.

- In May 2023, FuelCell Energy introduced a new range of solid oxide fuel cells designed for large-scale power generation, aiming to enhance the conversion of natural gas into clean electricity.

- In July 2023, Ballard Power Systems expanded its research and development efforts by investing in a new facility focused on fuel cell technologies, enhancing its ability to innovate and meet market demands.

- In September 2023, Plug Power launched a marketing campaign highlighting the benefits of its fuel cell solutions in reducing emissions and improving operational efficiency, aimed at increasing brand awareness and consumer engagement.

- In November 2023, FuelCell Energy participated in a major renewable energy expo, showcasing its latest innovations in fuel cell technology and engaging with industry professionals to promote brand awareness.

- In January 2024, Ballard Power Systems introduced a new line of eco-friendly fuel cell systems made from sustainable materials, capitalizing on the growing trend of sustainability among consumers.

- In March 2024, Plug Power announced the launch of a fuel cell training program for industry professionals, aimed at enhancing knowledge and skills related to fuel cell technologies.

- In April 2024, FuelCell Energy collaborated with a renowned environmental organization to create educational materials on the importance of fuel cells in achieving sustainability goals, leveraging social media to reach a broader audience.

- In June 2024, Ballard Power Systems launched a limited-edition fuel cell system designed for small-scale applications, aiming to attract consumers looking for innovative and efficient energy solutions.

MARKET SEGMENTATION

This research report on the North American fuel cell technology market is segmented and sub-segmented based on categories.

By Product

- PEMFC

- DMFC

- SOFC

- PAFC & AFC

- MCFC

By Application

- Stationary

- Portable

- Transport

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What factors are driving the growth of the North America Fuel Cell Technology Market?

Increasing demand for clean energy, government incentives for hydrogen fuel adoption, advancements in fuel cell efficiency, and the shift toward decarbonization drive market growth.

What are the challenges in the North America Fuel Cell Technology Market?

Challenges include high initial costs, limited hydrogen infrastructure, storage and transportation issues, and competition from other renewable energy sources.

What is the future outlook for the North America Fuel Cell Technology Market?

The market is expected to grow significantly due to increasing investments in hydrogen production, fuel cell-powered vehicles, and decarbonization strategies across industries.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]