North America Frozen Finger Chips Market Size, Share, Trends & Growth Forecast Report By End Use (Food Service and Retail), Country (The United States, Canada, and Rest of North America), Industry Analysis From 2024 to 2033

North America Frozen Finger Chips Market Size

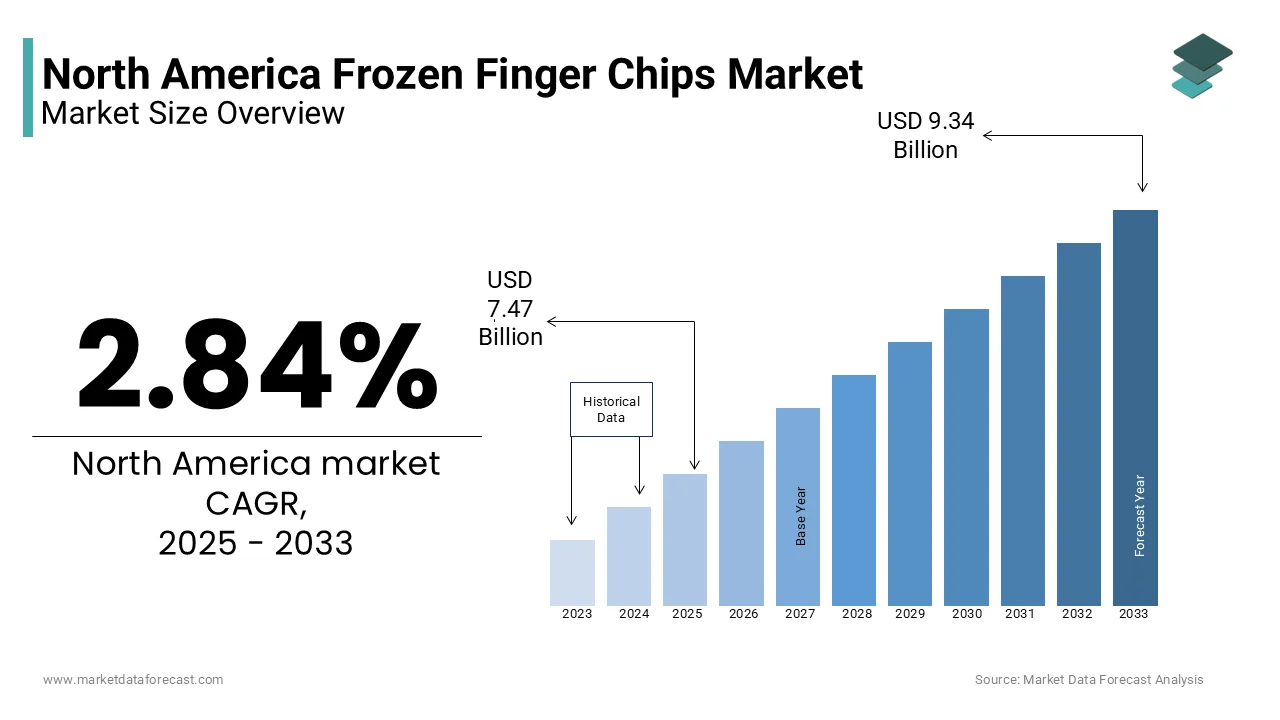

The North America Frozen finger chips market was worth USD 7.26 billion in 2024. The North America market is expected to reach USD 9.34 billion by 2033 from USD 7.47 billion in 2025, rising at a CAGR of 2.84% from 2025 to 2033.

The North America frozen finger chips market is a dynamic segment within the broader frozen food industry, characterized by the production and distribution of pre-cut, frozen potato products, commonly known as French fries or finger chips. These products are favored for their convenience, versatility, and ease of preparation, making them a staple in both household and commercial kitchens. The market has witnessed substantial growth, driven by changing consumer preferences towards quick and easy meal solutions particularly among busy families and millennials. This growth is further fueled by the increasing popularity of fast food and casual dining establishments, which heavily rely on frozen finger chips as a core menu item. Additionally, the rise of e-commerce platforms has facilitated greater accessibility to frozen food products, allowing consumers to purchase their favorite finger chips with ease. As health-conscious trends continue to evolve, manufacturers are also exploring healthier alternatives, such as air-fried or baked options, to cater to the changing dietary preferences of consumers.

MARKET DRIVERS

The increasing demand for convenience foods is a significant driver of the North America frozen finger chips market.

As lifestyles become busier, consumers are increasingly seeking quick and easy meal solutions that require minimal preparation time. In line with a survey conducted by the Food Marketing Institute, nearly 60% of American consumers prioritize convenience when selecting food products and is leading to a surge in the popularity of frozen foods including finger chips. This trend is particularly pronounced among millennials and working professionals who often opt for ready-to-cook options to save time in their daily routines. The versatility of frozen finger chips, which can be served as a side dish, snack, or main course, further enhances their appeal. Also, the rise of food delivery services and online grocery shopping has made it easier for consumers to access frozen products are contributing to the growth of this market segment.

The growing popularity of fast food and casual dining restaurants is another key driver propelling the North America frozen finger chips market.

According to the National Restaurant Association, the U.S. restaurant industry is projected to reach $899 billion in sales by 2023, with fast food establishments accounting for a significant portion of this growth. Frozen finger chips are a staple menu item in many of these restaurants, valued for their ability to deliver consistent quality and taste while minimizing preparation time. The convenience of frozen products allows restaurants to streamline their operations and reduce food waste, making them an attractive option for foodservice operators. Furthermore, the trend towards indulgent eating experiences, particularly among younger consumers has led to an increased demand for fried foods, including finger chips.

MARKET RESTRAINTS

Among the primary restraints affecting the North America frozen finger chips market is the growing health consciousness among consumers.

As awareness of the health implications of consuming fried and processed foods increases, many consumers are shifting towards healthier dietary choices. Based on the details shared by the International Food Information Council, 77% of consumers are actively trying to improve their diets, leading to a decline in the consumption of traditional fried foods. This trend poses a challenge for frozen finger chips manufacturers, as they must adapt to changing consumer preferences by offering healthier alternatives, such as baked or air-fried options. Additionally, the perception of frozen foods as less nutritious compared to fresh produce can further hinder market growth.

The volatility of raw material prices and particularly potatoes which are the primary ingredient in frozen finger chips but continues to affect this market.

Fluctuations in potato prices can significantly impact production costs for manufacturers, leading to potential price increases for consumers. According to the United States Department of Agriculture, potato prices have experienced considerable volatility in recent years, influenced by factors such as weather conditions, crop yields, and supply chain disruptions. This unpredictability can create challenges for manufacturers in maintaining consistent pricing and profitability. Additionally, rising transportation and logistics costs, exacerbated by global supply chain issues, further complicate the situation.

MARKET OPPORTUNITIES

The increasing trend towards healthier eating habits presents a significant opportunity for the North America frozen finger chips market. As consumers become more health-conscious, there is a growing demand for frozen finger chips that offer better nutritional profiles. According to a survey by the Hartman Group, 60% of consumers are actively seeking healthier options when purchasing frozen foods. This shift in consumer behavior is prompting manufacturers to innovate and develop products that align with health trends, such as baked or air-fried finger chips that contain lower fat and calorie content. Additionally, the incorporation of whole grains, organic ingredients, and natural seasonings can further enhance the appeal of these products.

The rise of e-commerce and online grocery shopping is another promising opportunity for the North America frozen finger chips market.

The COVID-19 pandemic has accelerated the adoption of online shopping, with many consumers now preferring the convenience of purchasing groceries from the comfort of their homes. This trend allows manufacturers to reach a broader audience and increase their sales through various online platforms. Moreover, the ability to offer promotions, discounts, and subscription services can further enhance consumer engagement and loyalty. E-commerce persistently grows, so, frozen finger chips producers can take advantage of this channel to develop their distribution and enhance brand visibility in the competitive market.

MARKET CHALLENGES

The intense competition among manufacturers is hurting the progress of the North America frozen finger chips market.

The market exhibits a large number of players, ranging from established brands to emerging companies, all vying for market share. This competition can lead to price wars, which may erode profit margins for manufacturers. Additionally, the need for continuous product innovation to meet changing consumer preferences adds pressure on companies to invest in research and development. Henceforth, makers must find ways to differentiate their products and maintain a competitive edge, which can be challenging in a saturated market.

The impact of supply chain disruptions is another major challenge for the frozen finger chips market.

The COVID-19 pandemic has shows vulnerabilities in global supply chains, leading to delays and increased costs for manufacturers. According to a survey by the National Restaurant Association, 75% of restaurant operators reported supply chain disruptions affecting their ability to obtain food and beverage products. These disruptions can lead to shortages of key ingredients, such as potatoes, and impact production schedules. Apart from this, rising transportation costs and logistical challenges can further complicate the supply chain which is affecting the timely delivery of frozen products to retailers and consumers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.84% |

|

Segments Covered |

By End Use, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

McCain Foods Limited, Lamb Weston Holdings, J.R. Simplot Company, Aviko, Farm Frites, Ore-Ida (a brand of H.J. Heinz Company Brands LLC), Cavendish Farms Corporation, Agristo NV, and Agrarfrost GmbH & Co. KG. |

SEGMENTAL ANALYSIS

By End Use Insights

The food service segment represented the largest share and accounted for 60.3% of the total market in 2024. This control over the market is basically caused by the extensive use of frozen finger chips in restaurants, fast food chains, and catering services, where they are valued for their convenience and consistent quality. The National Restaurant Association says the U.S. restaurant industry is estimated to arrive at the mark of $899 billion in sales by 2023, with frozen finger chips being a staple menu item in many establishments. The ability to quickly prepare and serve frozen finger chips allows food service operators to streamline their operations and reduce food waste, making them an attractive option. Moreover, the growing trend of casual dining and fast food consumption further fuels the demand for frozen finger chips in the food service sector.

The retail sector is anticipated to register highest CAGR of 5.2% from 2025 to 2033. This developed can be linked to the surging people choice for easy meal solutions and the rising popularity of frozen foods among households. Based on a report by the Food Marketing Institute, 60% of consumers are purchasing more frozen foods than they did before the pandemic is displaying a significant shift in shopping habits. The convenience of frozen finger chips, which can be easily prepared at home, appeals to busy families and individuals seeking quick meal options. Besides, the expansion of e-commerce platforms and online grocery shopping has made it easier for consumers to access frozen products and is further driving growth in the retail segment.

REGIONAL ANALYSIS

The United States had a controlling market share of 68.4% of the North America frozen finger chips market. This rule is propelled by the country's robust food service industry and high consumer demand for frozen convenience foods. Based on the details shared by the U.S. Department of Agriculture, the frozen potato products trade in the U.S. is believed to reach $8 billion by 2025, driven by the increasing consumption of frozen finger chips in restaurants and households. The popularity of fast food and casual dining establishments further fuels this demand, as frozen finger chips are a staple menu item. Also, the rise of e-commerce and online grocery shopping has made it easier for consumers to access frozen products, contributing to market growth.

Northward, Canada heats up as the fastest mover in the market for frozen finger chips in North America and accelerates at a promising CAGR of 9.1% throughout the forecast period. The Canadian food landscape is witnessing growth and is driven by an increasing focus on convenience and ready-to-eat meal solutions among consumers. According to Statistics Canada, the frozen food sphere is likely to attain CAD 3 billion by 2025, with frozen finger chips being a popular choice among households. The rising trend of health-conscious eating is also influencing consumer preferences, prompting manufacturers to develop healthier frozen finger chip options. Apart from these, the expansion of retail channels and online grocery shopping is enhancing accessibility to frozen products are further driving market growth

Meanwhile, Rest of America charts a steady path, gradually catching up through urbanization, increasing frozen food adoption, and evolving retail landscapes, though it continues to trail the more mature markets. It includes countries such as Mexico. Also, Mexico's food industry is rapidly evolving, with a growing demand for frozen convenience foods. As per the Mexican Association of Food Industry, the processed food business in Mexico is projected to reach $50 billion by 2025 and is contributing to the demand for frozen finger chips. The increasing urbanization and changing dietary habits among the Mexican population are driving the consumption of frozen products. Besides, the rise of fast food chains and casual dining establishments in Mexico is further fueling the demand for frozen finger chips.

KEY MARKET PLAYERS

Key players in the North American frozen finger chips market include McCain Foods Limited, Lamb Weston Holdings, J.R. Simplot Company, Aviko, Farm Frites, Ore-Ida (a brand of H.J. Heinz Company Brands LLC), Cavendish Farms Corporation, Agristo NV, and Agrarfrost GmbH & Co. KG.

TOP PLAYERS IN THE MARKET

McCain Foods Limited

McCain Foods Limited is a leading player in the North America frozen finger chips market, known for its extensive range of frozen potato products. The company has established a strong presence in both the retail and food service sectors, offering a variety of frozen finger chips that cater to diverse consumer preferences. McCain's commitment to quality and innovation has enabled it to maintain a significant market share, with a focus on developing healthier options and sustainable practices. The company's global reach and strong distribution network further enhance its position in the market.

Lamb Weston Holdings, Inc.

Lamb Weston Holdings, Inc. is another major player in the North America frozen finger chips market, recognized for its high-quality frozen potato products. The company specializes in producing a wide range of frozen finger chips, including traditional and specialty varieties. Lamb Weston’s focus on product innovation and sustainability has allowed it to capture a substantial share of the market. The company’s strong relationships with food service operators and retailers contribute to its competitive advantage, enabling it to meet the evolving demands of consumers.

Conagra Brands, Inc.

Conagra Brands, Inc. is a significant contributor to the North America frozen finger chips market, offering a diverse portfolio of frozen food products, including frozen finger chips. The company’s commitment to quality and innovation has positioned it favorably in the market, with a focus on developing convenient and flavorful options for consumers. Conagra's strong distribution network and brand recognition further enhance its market presence, allowing it to compete effectively in the frozen food segment.

TOP STRATEGIES USED BY KEY PLAYERS IN THE MARKET

Key players in the North America frozen finger chips market are employing various strategies to strengthen their market positions and enhance their competitive advantage. One prominent strategy is product innovation, where companies invest in research and development to create new and improved frozen finger chip varieties. This includes the introduction of healthier options, such as baked or air-fried finger chips, which cater to the growing health-conscious consumer base. For instance, many manufacturers are exploring alternative ingredients and cooking methods to reduce fat content while maintaining taste and texture. This focus on innovation not only meets consumer demands but also helps companies differentiate their products in a crowded market.

Another significant strategy is expanding distribution channels. Companies are increasingly leveraging e-commerce platforms and online grocery services to reach a broader audience. The COVID-19 pandemic has accelerated the shift towards online shopping, prompting manufacturers to enhance their digital presence and offer convenient purchasing options. By partnering with major online retailers and food delivery services, companies can improve accessibility to their frozen finger chips, thereby driving sales growth. Additionally, strengthening relationships with traditional retail outlets, such as supermarkets and convenience stores, remains crucial for maintaining market share.

Sustainability initiatives are also becoming a focal point for many key players. Companies are adopting environmentally friendly practices in their production processes, sourcing of raw materials, and packaging. This commitment to sustainability not only appeals to environmentally conscious consumers but also aligns with regulatory trends favoring sustainable practices in the food industry.

COMPETITIVE LANDSCAPE

The competition in the North America frozen finger chips market is characterized by a mix of established players and emerging companies, all vying for market share in a rapidly evolving landscape. Major corporations dominate the market, leveraging their extensive resources, research capabilities, and established distribution networks to maintain a competitive edge. These companies are continuously innovating to meet the changing demands of consumers, particularly the shift towards healthier and more convenient food options.

Emerging players are also making their mark by focusing on niche markets and offering specialized frozen finger chip solutions that cater to specific dietary preferences, such as gluten-free or organic products. This trend fosters a dynamic competitive environment where innovation and adaptability are crucial for success. Additionally, the increasing emphasis on sustainability is prompting companies to adopt eco-friendly practices, further intensifying competition as consumers become more discerning about the products they choose.

As the market continues to grow, companies are likely to engage in strategic mergers and acquisitions to enhance their capabilities and expand their market reach. This competitive landscape is expected to drive further innovation and improvements in product offerings, ultimately benefiting consumers with a wider array of high-quality frozen finger chip solutions.

RECENT HAPPENINGS IN THE MARKET

- In January 2023, McCain Foods Limited launched a new line of air-fried frozen finger chips aimed at health-conscious consumers, enhancing their product portfolio in the frozen food segment.

- In March 2023, Lamb Weston Holdings, Inc. announced the expansion of its production facility in Idaho to increase capacity for frozen potato products, including finger chips, in response to rising demand.

- In June 2023, Conagra Brands, Inc. introduced a new range of organic frozen finger chips, catering to the growing consumer preference for clean label and organic food options.

- In August 2023, McCain Foods Limited partnered with a leading online grocery platform to enhance its e-commerce presence and improve accessibility for consumers purchasing frozen products.

- In September 2023, Lamb Weston Holdings, Inc. launched a marketing campaign promoting the versatility of frozen finger chips, targeting both food service operators and retail consumers.

- In October 2023, Conagra Brands, Inc. acquired a specialty frozen food company to diversify its product offerings and strengthen its position in the frozen finger chips market.

- In November 2023, McCain Foods Limited announced a sustainability initiative aimed at reducing water usage in its production processes, aligning with consumer demand for environmentally responsible practices.

- In December 2023, Lamb Weston Holdings, Inc. expanded its distribution network to include more regional grocery chains, enhancing its market reach for frozen finger chips.

- In January 2024, Conagra Brands, Inc. launched a new line of frozen finger chips featuring unique flavor profiles, such as spicy jalapeño and garlic herb, to attract adventurous consumers.

- In February 2024, McCain Foods Limited participated in a major food industry trade show to showcase its latest innovations in frozen finger chips and connect with potential retail partners.

MARKET SEGMENTATION

This research report on the North America frozen finger chips market is segmented and sub-segmented into the following categories.

By End Use

- Food Service

- Retail

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What is driving the growth of the North America frozen finger chips market?

The market is growing due to rising demand for convenient and ready-to-cook food, increasing fast-food consumption, and the expanding retail sector.

Which distribution channels dominate the North America frozen finger chips market?

Major distribution channels include supermarkets, hypermarkets, convenience stores, and online retailers.

How is technology impacting the production of frozen finger chips?

Advancements in freezing technology, improved packaging techniques, and automation in production lines are enhancing product quality and shelf life.

What is the future outlook for the North America frozen finger chips market?

The market is expected to grow due to increasing consumer preference for convenience foods, product innovations, and the expansion of online grocery shopping.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]