North America Fraud Detection and Prevention Market Size, Share, Trends, & Growth Forecast Report By Solution Type (Fraud analytics solutions, Authentication solutions, and Governance, Risk, and Compliance (GRC) solutions), Application, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Fraud Detection and Prevention Market Size

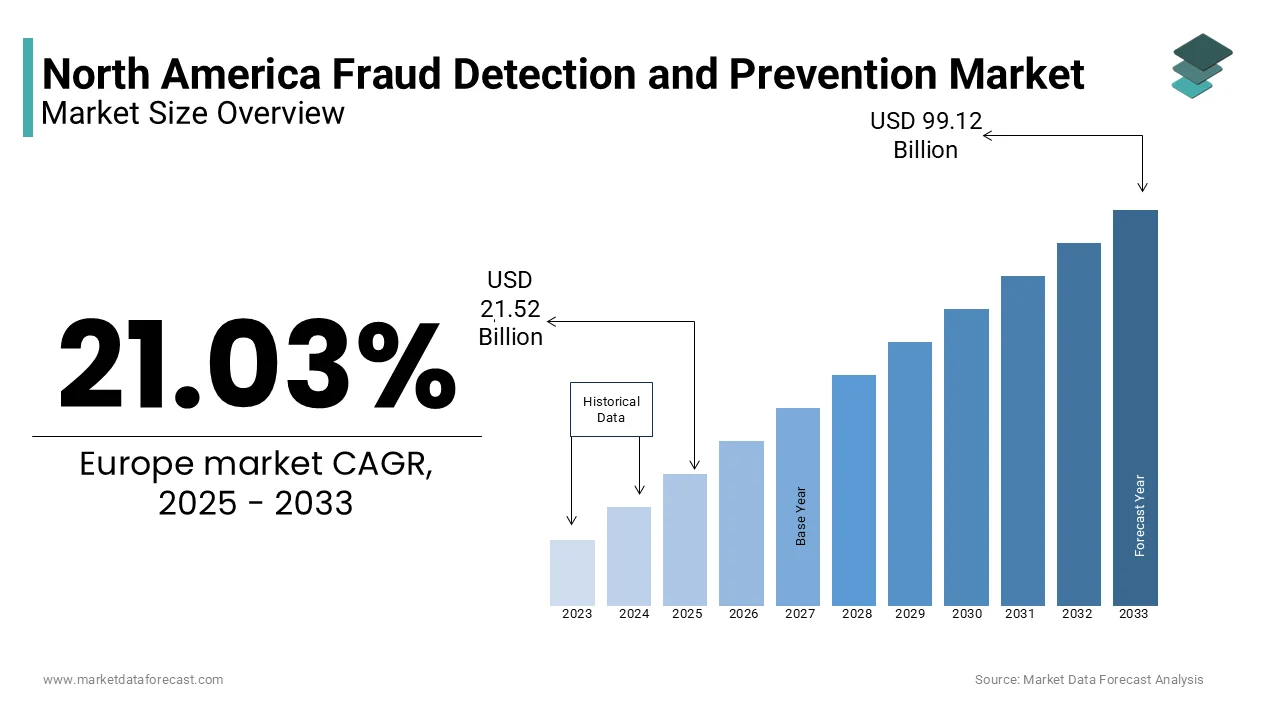

The North America fraud detection and prevention market was worth USD 17.78 billion in 2024. The North America market is expected to reach USD 99.12 billion by 2033 from USD 21.52 billion in 2025, rising at a CAGR of 21.03% from 2025 to 2033.

The North America fraud detection and prevention is a comprehensive array of technologies and methodologies designed to identify, mitigate, and prevent fraudulent activities across various sectors, including finance, retail, healthcare, and e-commerce. The region has witnessed a corresponding surge in fraudulent activities with robust solutions to safeguard sensitive information and financial assets. The market is characterized by the integration of advanced technologies such as artificial intelligence, machine learning, and big data analytics, which enhance the ability to detect anomalies and predict fraudulent behavior in real-time.

In recent years, the financial services sector has been particularly vulnerable with the consumers lost over $5.8 billion to fraud in 2021, according to the Federal Trade Commission. Additionally, the rise of online shopping has led to a 30% increase in e-commerce fraud, as reported by the Association of Certified Fraud Examiners. The healthcare industry is not exempt, with the National Health Care Anti-Fraud Association estimating that healthcare fraud costs the United States approximately $68 billion annually. These alarming statistics prioritize the need for effective fraud detection and prevention mechanisms, as organizations strive to protect their assets and maintain consumer trust in an increasingly digital landscape. The North America fraud detection and prevention market is thus positioned as a vital component in the broader effort to combat financial crime and enhance security across various industries.

MARKET DRIVERS

Increasing Cyber Threats

The escalating sophistication of cyberattacks is a significant driver of the North America fraud detection and prevention market. The businesses across sectors such as finance, retail, and healthcare are compelled to enhance their security measures as cybercriminals employ advanced techniques. According to the Federal Bureau of Investigation, cybercrime losses reached $4.2 billion in 2020, a stark increase from previous years. This alarming trend has led organizations to invest in advanced fraud detection technologies, including artificial intelligence and machine learning, which can analyze vast amounts of data to identify anomalies and potential threats. The urgency to protect sensitive information and maintain consumer trust is paramount by making robust fraud prevention systems essential in today’s digital landscape.

Proliferation of Digital Transactions

The rapid growth of digital transactions in e-commerce and mobile banking is another critical driver of the fraud detection and prevention market in North America. According to the U.S. Department of Commerce, e-commerce sales reached $870 billion in 2021 by reflecting a 14.2% increase from the previous year. This surge in online transactions has created new opportunities for fraud, with the Association of Certified Fraud Examiners noting a 30% rise in e-commerce fraud cases. The businesses must implement effective fraud detection solutions to mitigate risks as consumers increasingly rely on digital payment methods. The integration of innovative technologies enables real-time monitoring and response to fraudulent activities by ensuring the security of financial transactions and protecting consumer interests.

MARKET RESTRAINTS

High Implementation Costs

The high implementation costs associated with advanced fraud detection technologies is one of the restraining factors for the North America fraud detection and prevention market. Organizations often face significant financial barriers when integrating sophisticated systems such as artificial intelligence and machine learning into their existing infrastructure. According to a report by the Ponemon Institute, the average cost of a data breach in the United States was approximately $4.24 million in 2021. Smaller businesses may struggle to allocate sufficient budgets for these technologies by leading to a reliance on outdated systems that are less effective in combating modern fraud tactics.

Complex Regulatory Environment

The complex regulatory environment surrounding data protection and privacy is another significant restraint on the North America fraud detection and prevention market. Organizations must navigate a myriad of regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), which impose stringent requirements on data handling and consumer privacy. According to the National Conference of State Legislatures, over 1,000 data privacy bills were introduced in state legislatures across the U.S. in 2021 alone by reflecting the growing complexity of compliance. This regulatory landscape can create challenges for businesses seeking to implement effective fraud detection solutions, as they must ensure that their systems comply with various legal standards while also addressing the evolving nature of fraud. Consequently, the burden of compliance can slow down the adoption of necessary technologies in the market.

MARKET OPPORTUNITIES

Adoption of Advanced Technologies

The increasing adoption of advanced technologies presents a significant opportunity for the North America fraud detection and prevention market. Organizations are increasingly leveraging artificial intelligence, machine learning, and blockchain technology to enhance their fraud detection capabilities. According to a report by McKinsey & Company, companies that implement AI-driven solutions can reduce fraud losses by up to 50%. The ability of these technologies to analyze vast datasets in real-time allows for more accurate detection of fraudulent activities, enabling businesses to respond swiftly to potential threats. The demand for sophisticated fraud detection solutions is expected to grow with the quick adoption of the technological advancements.

Growing Focus on Customer Experience

Another promising opportunity lies in the growing focus on customer experience within the fraud detection and prevention market. Businesses are increasingly aware that effective fraud prevention measures can enhance customer trust and satisfaction. A survey conducted by the American Bankers Association revealed that 70% of consumers are more likely to remain loyal to a financial institution that prioritizes security and fraud prevention. The organizations can improve customer engagement while simultaneously safeguarding against fraud by implementing user-friendly fraud detection systems that minimize friction during transactions. This dual focus on security and customer experience not only helps in retaining existing customers but also attracts new ones, thereby fostering growth in the North America fraud detection and prevention market.

MARKET CHALLENGES

Rapidly Evolving Fraud Tactics

The rapidly evolving nature of fraud tactics employed by cybercriminals is posing huge challenges for the North America fraud detection and prevention market growth. The methods used to exploit vulnerabilities in systems as technology advances is hindering the market growth. The Federal Bureau of Investigation reported that in 2021, there were over 847,000 reported incidents of fraud, with losses exceeding $6.9 billion by indicating a persistent and growing threat. Fraudsters continuously adapt their strategies by utilizing sophisticated techniques such as social engineering and deepfake technology to bypass traditional detection systems. This constant evolution necessitates that organizations remain vigilant and invest in ongoing training and technology upgrades, which can strain resources and complicate the implementation of effective fraud prevention measures.

Data Privacy Concerns

Data privacy concerns represent another significant challenge for the North America fraud detection and prevention market. The U.S. Federal Trade Commission has emphasized the importance of consumer privacy with enforcement actions increasing against companies that fail to protect sensitive information. A survey by the International Association of Privacy Professionals found that 70% of organizations reported challenges in balancing effective fraud detection with compliance to privacy laws. This tension can lead to hesitancy in adopting advanced fraud detection technologies, as businesses fear potential legal repercussions and reputational damage that is hindering market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

21.03% |

|

Segments Covered |

By Solution Type, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

IBM Corporation, FICO, SAS Institute, NICE Systems, ACI Worldwide, BAE Systems, LexisNexis Risk Solutions, TransUnion, Oracle Corporation, and Experian. |

SEGMENT ANALYSIS

By Solution Type Insights

The fraud analytics solutions segment was the largest of the North America fraud detection and held 45.2% in 2024 owing to the increasing need for organizations to leverage data-driven insights to identify and mitigate fraudulent activities effectively. According to the Association of Certified Fraud Examiners, organizations that implement fraud analytics can reduce fraud losses by up to 50%. The ability to analyze vast datasets in real-time allows businesses to detect anomalies and respond swiftly by making fraud analytics essential for maintaining financial integrity and consumer trust in an increasingly digital landscape.

The authentication solutions segment is likely to experience a CAGR of 20.2% during the forecast period. This rapid growth is driven by the rising incidence of identity theft and account takeover fraud, which have become prevalent in the digital age. According to the Federal Trade Commission, identity theft complaints surged by 113% in 2020 with the urgent need for robust authentication measures. The demand for advanced authentication technologies is expected to rise as organizations increasingly adopt multi-factor authentication and biometric solutions. This segment's growth is crucial for enhancing security and protecting sensitive consumer information in a rapidly evolving threat landscape.

By Application Insights

The Banking, Financial Services, and Insurance (BFSI) sector was the largest segment of the North America fraud detection and prevention market with a significant share of 50.3% in 2024. This dominance is primarily due to the high value of financial transactions and the sensitive nature of customer data involved. According to the Federal Trade Commission, financial fraud accounted for over $3.3 billion in losses in 2021 by emphasizing the need for effective fraud detection solutions in this sector. The BFSI industry's reliance on advanced analytics and real-time monitoring is essential for safeguarding assets and maintaining consumer trust in an increasingly digital financial landscape.

The retail and e-commerce segment is estimated to achieve a significant CAGR of 22.3% during the forecast period in the North America fraud detection and prevention market. This rapid growth is driven by the exponential increase in online shopping, which has led to a corresponding rise in fraud incidents. According to the National Retail Federation, retail fraud losses reached $94.5 billion in 2021 with the urgent need for robust fraud prevention measures. The retailers are adopting advanced fraud detection technologies, such as machine learning and behavioral analytics is to protect against chargebacks and identity theft. This segment's growth is vital for ensuring secure transactions and enhancing customer confidence in online shopping environments.

REGIONAL ANALYSIS

The United States held the dominant share of the North America fraud detection and prevention market share in 2024 owing to the driven by the extensive digital economy and the high volume of financial transactions processed daily. According to the Federal Trade Commission, U.S. consumers lost over $5.8 billion to fraud in 2021 with the rising need for effective fraud detection solutions. The U.S. market's emphasis on advanced technologies, such as artificial intelligence and machine learning, which is essential for combating increasingly sophisticated fraud tactics by making it a pivotal player in the global landscape of fraud prevention.

Canada fraud detection and prevention market is growing at faster rate with an estimated CAGR of 18.4% from 2025 to 2033. This growth is fueled by the rising adoption of digital payment methods and the increasing incidence of cybercrime. According to the Canadian Anti-Fraud Centre, reported fraud losses in Canada reached over CAD 380 million in 2021 with the urgent need for enhanced fraud detection measures. The demand for effective fraud prevention technologies is expected to rise by ensuring the protection of consumer data and financial assets.

KEY MARKET PLAYERS

The major players in the North America fraud detection and prevention market include IBM Corporation, FICO, SAS Institute, NICE Systems, ACI Worldwide, BAE Systems, LexisNexis Risk Solutions, TransUnion, Oracle Corporation, and Experian.

TOP 3 PLAYERS IN THE MARKET

IBM Corporation

IBM Corporation is a prominent player in the fraud detection and prevention market, leveraging its advanced analytics and artificial intelligence capabilities to provide comprehensive solutions. IBM's Watson platform utilizes machine learning algorithms to analyze vast datasets, enabling organizations to detect fraudulent activities in real-time. The company’s focus on integrating AI with traditional fraud detection methods enhances predictive accuracy and reduces false positives. IBM's contributions to the global market are substantial, as its solutions are widely adopted across various sectors, including banking, insurance, and retail, helping organizations mitigate risks and protect sensitive information.

FICO

FICO is renowned for its expertise in predictive analytics and decision management, particularly within the financial services sector. The company’s FICO Falcon Fraud Manager is a leading solution that employs advanced machine learning techniques to monitor transactions in real-time, identifying patterns indicative of fraud. FICO's solutions are instrumental in reducing fraud losses and improving operational efficiency for financial institutions. With a significant market share in North America, FICO's contributions extend globally, as its technologies are utilized by banks and credit unions worldwide to enhance their fraud prevention strategies and maintain customer trust.

SAS Institute

SAS Institute is a leader in analytics, providing robust fraud detection solutions that empower organizations to combat fraud effectively. Their software utilizes advanced statistical techniques and machine learning to identify anomalies and suspicious behavior across various industries, including banking, insurance, and government. SAS's commitment to data-driven insights allows organizations to enhance their fraud prevention strategies significantly. The company’s global reach and tailored solutions have made it a key player in the North American market, contributing to the overall growth of the fraud detection and prevention landscape by helping businesses adapt to evolving fraud tactics and regulatory requirements.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Strategic Partnerships and Collaborations

Key players in the North America fraud detection and prevention market often engage in strategic partnerships and collaborations to enhance their capabilities and market reach. By partnering with technology providers, financial institutions, and regulatory bodies, these companies can leverage shared data and insights to develop more effective fraud prevention strategies. Such collaborations enable organizations to combine their strengths, resulting in innovative solutions that address the complex and evolving nature of fraud. For instance, partnerships with cybersecurity firms can enhance the security features of fraud detection systems, while collaborations with financial institutions can provide valuable insights into transaction patterns and customer behavior, ultimately leading to improved detection and prevention measures.

Expansion of Product Portfolios

To maintain a competitive edge, key players continuously innovate and expand their product portfolios to meet the diverse needs of their customers. This strategy involves developing specialized solutions tailored for various industries, such as banking, insurance, and e-commerce. By offering a wide range of products, companies can address specific fraud challenges faced by different sectors, thereby attracting a broader customer base. For example, a company may introduce a fraud detection solution specifically designed for online retailers, incorporating features that address the unique risks associated with e-commerce transactions. This focus on product diversification not only enhances customer satisfaction but also positions companies as leaders in the market.

Integration of Advanced Technologies

The integration of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), is a prevalent strategy among key players in the fraud detection and prevention market. These technologies enable organizations to analyze vast amounts of data in real-time, improving the accuracy and speed of fraud detection. AI and ML algorithms can identify patterns and anomalies that may indicate fraudulent activity, allowing businesses to respond swiftly to potential threats. Additionally, the incorporation of blockchain technology enhances security and transparency in transactions, making it more difficult for fraudsters to operate. By leveraging these advanced technologies, companies can significantly enhance their fraud prevention capabilities and stay ahead of emerging threats.

Mergers and Acquisitions

Mergers and acquisitions (M&A) are strategic moves employed by companies in the North America fraud detection and prevention market to strengthen their capabilities and expand their market presence. Through M&A, firms can acquire new technologies, talent, and customer bases, allowing them to enhance their product offerings and improve operational efficiencies. For instance, a company may acquire a startup specializing in machine learning algorithms to bolster its fraud detection capabilities. This strategy not only accelerates growth but also enables companies to quickly adapt to changing market dynamics and customer demands. By consolidating resources and expertise, organizations can position themselves as formidable competitors in the rapidly evolving fraud prevention landscape.

Focus on Regulatory Compliance

Adhering to stringent regulatory requirements is crucial for companies operating in the fraud detection and prevention market. Key players invest in solutions that ensure compliance with various laws and regulations while effectively managing fraud risks. This focus on regulatory compliance not only strengthens their market position but also builds trust with clients and stakeholders. By demonstrating a commitment to data protection and consumer privacy, companies can enhance their reputation and attract more customers. Additionally, compliance with regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) can serve as a competitive advantage, as organizations that prioritize compliance are often viewed as more reliable partners in security.

Customer Education and Support

Providing educational resources and support to clients is a vital strategy employed by key players in the North America fraud detection and prevention market. By helping customers understand fraud risks and prevention measures, companies position themselves as trusted partners in security. This approach not only enhances customer relationships and loyalty but also empowers clients to make informed decisions regarding their fraud prevention strategies. Companies may offer training sessions, webinars, and informative content to educate clients about the latest fraud trends and best practices. By fostering a culture of awareness and preparedness, organizations can strengthen their customer base and improve overall satisfaction, ultimately contributing to long-term success in the market.

COMPETITIVE LANDSCAPE

The North America fraud detection and prevention market is characterized by intense competition among a diverse array of players, ranging from established technology giants to specialized startups. Major companies such as IBM, FICO, and SAS Institute dominate the landscape, leveraging their advanced analytics, artificial intelligence, and machine learning capabilities to deliver comprehensive solutions. These key market players continuously innovate to enhance their offerings, focusing on real-time fraud detection and predictive analytics to address the evolving tactics employed by cybercriminals.

In addition to these established players, numerous smaller firms and startups are emerging, introducing niche solutions tailored to specific industries, such as retail, banking, and healthcare. This influx of new entrants fosters a dynamic environment where innovation is paramount, driving companies to differentiate themselves through unique features, customer service, and pricing strategies.

Moreover, the increasing regulatory scrutiny surrounding data protection and privacy is compelling organizations to invest in robust fraud prevention measures, further intensifying competition. As businesses seek to safeguard their assets and maintain consumer trust, the demand for effective fraud detection solutions continues to rise. Consequently, companies must remain agile and responsive to market trends, ensuring they can adapt to the rapidly changing landscape of fraud threats and customer expectations.

MARKET SEGMENTATION

This research report on the North America fraud detection and prevention market is segmented and sub-segmented into the following categories.

By Solution Type

- Fraud analytics solutions

- Authentication solutions

- Governance, Risk, and Compliance (GRC) solutions

By Application

- Banking, Financial Services, and Insurance (BFSI)

- Retail and e-commerce

- Government and Public sector

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What are the primary drivers for the growth of the fraud detection and prevention market in North America?

The primary drivers include the increasing number of fraudulent activities, stringent regulatory requirements, and the growing adoption of digital transformation initiatives by businesses across various sectors, such as banking, finance, and retail.

How does the regulatory environment in North America impact the fraud detection and prevention market?

The regulatory environment in North America, characterized by laws such as the Sarbanes-Oxley Act, Gramm-Leach-Bliley Act, and Dodd-Frank Act, imposes strict compliance requirements on organizations, compelling them to adopt robust fraud detection and prevention solutions.

What are the major challenges faced by the fraud detection and prevention market in North America?

Major challenges include the high cost of implementation, complexity of integration with existing systems, and the evolving nature of fraud techniques that require continuous innovation and adaptation.

What future trends are expected in the North America fraud detection and prevention market?

Future trends include increased adoption of blockchain technology for secure transactions, the use of advanced biometrics for identity verification, greater reliance on AI and machine learning for predictive analytics, and the development of more comprehensive and integrated fraud management platforms.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]