North America Frac Sand Market Size, Share, Trends & Growth Forecast Report By Type (White Sand, Brown Sand, Others), Application (Oil Exploitation, Natural Gas Exploration, Others), and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Frac Sand Market Size

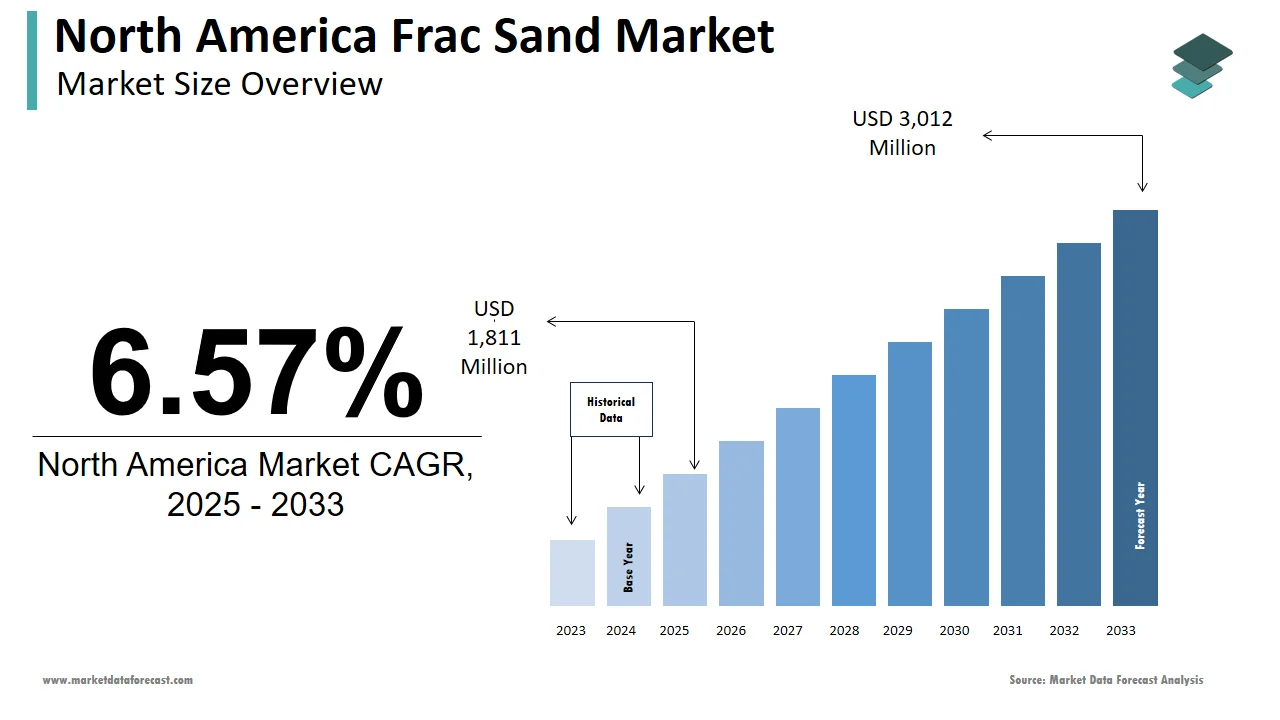

The North America frac sand market was valued at USD 1,699 million in 2024 and is anticipated to reach USD 1,811 million in 2025 from USD 3,012 million by 2033, growing at a CAGR of 6.57% during the forecast period from 2025 to 2033.

The North America frac sand market is driven by the increasing prominence of hydraulic fracturing for oil and natural gas extraction. According to the U.S. Energy Information Administration (EIA), shale gas production exceeded 80 billion cubic feet per day in 2022, with the demand for high-quality frac sand.

MARKET DRIVERS

Surging Demand for Shale Gas and Oil

The surging demand for shale gas and oil serves as a pivotal driver shaping the North America frac sand market. Hydraulic fracturing, which relies heavily on frac sand as a proppant, has become integral to unlocking unconventional reserves. According to the U.S. Energy Information Administration (EIA), shale gas production accounted for over 70% of total natural gas output in 2022. This growth is supported by technological advancements such as horizontal drilling and multi-stage fracturing, which require large quantities of high-quality frac sand.

Advancements in Proppant Technologies

Advancements in proppant technologies are another major driver fueling the North America frac sand market. Innovations in frac sand formulations, particularly white sand, have enhanced its performance in maintaining fracture conductivity during hydraulic fracturing. According to the Society of Petroleum Engineers, white sand offers superior permeability and crush resistance compared to brown sand by making it the preferred choice for high-pressure wells. Additionally, the development of resin-coated sands has expanded their applicability in deeper and more complex reservoirs. A report by the Independent Petroleum Association of America notes that resin-coated sands account for 15% of total proppant consumption in 2022 due to their growing popularity. Furthermore, the rise of precision fracking techniques has increased the demand for specialized frac sands tailored to specific geological conditions.

MARKET RESTRAINTS

Environmental Concerns and Regulatory Challenges

Environmental concerns and regulatory challenges pose significant restraints to the North America frac sand market. Hydraulic fracturing has faced increasing scrutiny due to its environmental impact, including water contamination and induced seismicity. Additionally, public opposition to fracking has led to bans in several states, such as New York and Maryland, reducing market opportunities. As per a study by the Natural Resources Defense Council, environmental compliance costs have increased by 20% for frac sand manufacturers by creating financial hurdles.

Volatility in Oil and Gas Prices

Volatility in oil and gas prices also acts as a restraint for the North America frac sand market. Fluctuations in global energy markets directly impact fracking activities, which are highly sensitive to price changes. According to the U.S. Energy Information Administration (EIA), crude oil prices dropped by 30% in 2020 due to the pandemic that is leading to a 15% decline in frac sand consumption. Similarly, geopolitical tensions and supply chain disruptions have exacerbated price volatility are creating uncertainty for manufacturers.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

The expansion into emerging markets presents a lucrative opportunity for the North America frac sand market. Trade agreements like the USMCA have created avenues for exports to countries such as Mexico, where unconventional oil and gas exploration is gaining momentum. Additionally, government initiatives to modernize Mexico’s energy infrastructure have opened doors for specialized proppants. The spending on advanced fracking technologies is increasing every year that may pose huge growth opportunities for the market in next coming years.

Adoption of Sustainable Practices

The adoption of sustainable practices offers significant opportunities for the North America frac sand market. Companies are increasingly focusing on eco-friendly solutions to address environmental concerns and comply with stringent regulations. For instance, the development of recycled proppants and biodegradable coatings aligns with global sustainability goals. According to the Environmental Protection Agency (EPA), sustainable proppants reduce water usage by up to 25% is making them an attractive option for environmentally conscious operators. Additionally, innovations in low-impact fracking techniques have broadened the appeal of frac sand among regulators and stakeholders. As per a report by the Sustainable Energy Coalition, 40% of fracking projects now incorporate green technologies is driving demand for sustainable frac sand solutions.

MARKET CHALLENGES

Intense Competition from Alternative Proppants

Intense competition from alternative proppants poses a significant challenge to the North America frac sand market. Ceramic and resin-coated proppants are gaining traction due to their superior performance in high-pressure and high-temperature wells. According to the Society of Petroleum Engineers, ceramic proppants offer 30% higher crush resistance compared to frac sand by making them an attractive substitute for deep reservoirs. This creates a significant barrier for frac sand manufacturers, particularly in premium applications. Additionally, misconceptions about the cost-effectiveness of alternative proppants hinder adoption.

Supply Chain Disruptions

Supply chain disruptions caused by logistical challenges and natural disasters also act as a challenge for the North America frac sand market. For instance, the COVID-19 pandemic disrupted global supply chains, leading to increased transportation costs for manufacturers. According to the International Energy Agency, supply chain bottlenecks reduced frac sand availability by 10% in 2022 thereby impacting fracking operations. Additionally, port closures and labor shortages further exacerbated the issue by creating logistical hurdles for companies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America. |

|

Market Leaders Profiled |

U.S. Silica Holdings, Inc., Hi-Crush Inc., Covia Holdings Corporation, Smart Sand, Inc., Badger Mining Corporation, Black Mountain Sand, Source Energy Services, Atlas Sand Company, LLC, Alpine Silica, LLC, Signal Peak Silica, LLC, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The white sand segment was the largest by occupying 60.5% of the North America frac sand market share in 2024. Its widespread adoption is attributed to its superior permeability and crush resistance is making it ideal for high-pressure wells. Industries such as shale gas and oil exploration rely heavily on white sand to maintain fracture conductivity during hydraulic fracturing. The U.S. Department of Energy emphasizes that 70% of fracking operations utilize white sand due to its ability to enhance production efficiency. Furthermore, advancements in mining technologies have enabled manufacturers to offer high-purity variants by aligning with regulatory requirements.

The resin-coated sand segment is likely to register a CAGR of 8.2% from 2025 to 2033. Its ability to withstand high temperatures and pressures makes it ideal for deep and complex reservoirs. The Society of Petroleum Engineers notes that resin-coated sand reduces proppant flowback by up to 40%, driving its adoption in premium applications. Additionally, its compatibility with advanced fracking techniques has expanded its applicability in unconventional reserves.

By Application Insights

The oil exploitation was the largest in the North America frac sand market by capturing 55.4% of the share in 2024 with the proliferation of shale oil reserves, which require hydraulic fracturing for extraction. The U.S. Energy Information Administration (EIA) reports that shale oil production exceeded 8 million barrels per day in 2022 with the need for efficient proppants. Additionally, advancements in horizontal drilling and multi-stage fracturing have further amplified frac sand usage in oil exploitation.

The natural gas exploration segment is likely to register a CAGR of 7.5% from 2025 to 2033. The rising demand for cleaner energy sources is propelling the segment’s growth, with natural gas serving as a key transition fuel. Additionally, government initiatives promoting sustainable energy have opened doors for frac sand in unconventional gas reserves.

COUNTRY LEVEL ANALYSIS

The United States was the largest contributor to the North America frac sand market, with an expected share of 85.4% in 2024 with its vast shale reserves in regions such as the Permian Basin, Eagle Ford, and Marcellus Shale. According to the U.S. Energy Information Administration (EIA), the country’s shale gas production exceeded 80 billion cubic feet per day in 2022, driving unprecedented demand for high-quality frac sand. Additionally, advancements in hydraulic fracturing technologies, such as horizontal drilling and multi-stage fracturing, have amplified the need for specialized proppants like white sand and resin-coated sands.

Canada was accounted in holding 12.3% of the North America frac sand market share in 2024 due to its growth trajectory is heavily influenced by unconventional oil and gas exploration in Alberta’s oil sands and British Columbia’s Montney Formation. The Canadian government’s commitment to reducing carbon emissions has significantly boosted demand for frac sand in cleaner energy projects. Additionally, Canada’s focus on sustainable mining practices has opened doors for innovations in eco-friendly proppants. Urban farming initiatives and government incentives for renewable energy projects have further propelled demand. These initiatives position Canada as a key player in shaping the regional market dynamics.

KEY MARKET PLAYERS

A few of the notable companies operating in the North America frac sand market profiled in this report are U.S. Silica Holdings, Inc., Hi-Crush Inc., Covia Holdings Corporation, Smart Sand, Inc., Badger Mining Corporation, Black Mountain Sand, Source Energy Services, Atlas Sand Company, LLC, Alpine Silica, LLC, Signal Peak Silica, LLC, and others.

LEADING PLAYERS IN THE MARKET

U.S. Silica Holdings

U.S. Silica Holdings stands as the leading player in the North America frac sand market. U.S. Silica caters to both large-scale operators and niche markets by offering solutions that align with stringent environmental regulations. Its commitment to sustainability is evident in its eco-friendly formulations, which comply with EPA standards.

Fairmount Santrol

Fairmount Santrol has carved a niche in the frac sand market. The company invests heavily in research and development to innovate products that meet evolving consumer demands. In 2023, Fairmount Santrol launched a resin-coated sand designed for deep reservoirs, targeting the growing demand for high-performance proppants. This aligns with global efforts to reduce environmental impact and promote green fracking practices. Fairmount Santrol’s global presence and diversified customer base enable it to capitalize on opportunities across various sectors, including oil exploitation and natural gas exploration.

Hi-Crush Inc.

Hi-Crush offers a wide range of frac sands, from white sand for high-pressure wells to specialized solutions for unconventional reserves. In 2023, the company expanded its manufacturing facility in Monterrey, Mexico, to cater to the growing demand in emerging markets. This strategic move amplifies its commitment to geographic expansion and market penetration.

TOP STRATEGIES USED BY KEY PLAYERS IN THE MARKET

Key players in the North America frac sand market employ a variety of strategies to maintain their competitive edge and drive growth. Mergers and acquisitions are a primary strategy, enabling companies to expand their product portfolios and strengthen their market presence. For instance, U.S. Silica Holdings’ acquisition of a regional frac sand supplier in 2022 bolstered its distribution network, enhancing its ability to serve industrial clients. Similarly, product innovation remains a cornerstone of growth, with companies investing heavily in research and development to introduce eco-friendly and high-performance solutions.

COMPETITION OVERVIEW IN THE MARKET

The North America frac sand market is characterized by intense competition. The market’s fragmented nature encourages innovation, as companies strive to differentiate themselves through product quality, performance, and sustainability. Regulatory compliance plays a critical role, with stringent environmental regulations driving the adoption of low-impact and eco-friendly proppants. Established players like U.S. Silica Holdings, Fairmount Santrol, and Hi-Crush Inc. dominate the market by leveraging their extensive resources, global reach, and technological expertise. However, smaller players focus on niche segments are offering specialized solutions tailored to specific industries or applications. The rise of e-commerce and digital marketing has further intensified competition by enabling smaller companies to reach a broader audience.

RECENT MARKET DEVELOPMENTS

- In April 2024, U.S. Silica Holdings acquired a regional frac sand supplier by enhancing its distribution network and strengthening its market presence in the Permian Basin.

- In June 2023, Fairmount Santrol launched a resin-coated sand designed for deep reservoirs by targeting the growing demand for high-performance proppants.

- In March 2023, Hi-Crush Inc. expanded its manufacturing facility in Monterrey, Mexico, to cater to the growing demand in emerging markets and enhance its geographic footprint.

- In January 2023, BASF partnered with a Canadian firm to develop sustainable proppants by focusing on reducing environmental impact and complying with regulatory standards.

- In October 2022, AkzoNobel introduced a biodegradable coating for frac sand by addressing the need for eco-friendly solutions in hydraulic fracturing operations.

MARKET SEGMENTATION

This research report on the North America frac sand market is segmented and sub-segmented into the following categories.

By Type

- White Sand

- Brown Sand

- Others

By Application

- Oil Exploitation

- Natural Gas Exploration

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What are the primary applications for frac sand in the North America Frac Sand Market?

Frac sand is mainly used in oil exploitation and natural gas exploration, essential for hydraulic fracturing to extract unconventional reserves.

2. Which type of frac sand is most used in the North America Frac Sand Market?

White sand is the most used type, favored for its superior permeability and crush resistance in high-pressure wells within the North America frac sand market.

3. Which country contributes the most to the North America Frac Sand Market?

The United States contributes the largest share due to its vast shale reserves and advanced hydraulic fracturing technologies in the North America frac sand market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]