North America Food Acidulants Market Size, Share, Trends & Growth Forecast Report By Product Type (Citric Acid, Lactic Acid, Acetic Acid), By Application, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2024 to 2033

North America Food Acidulants Market Size

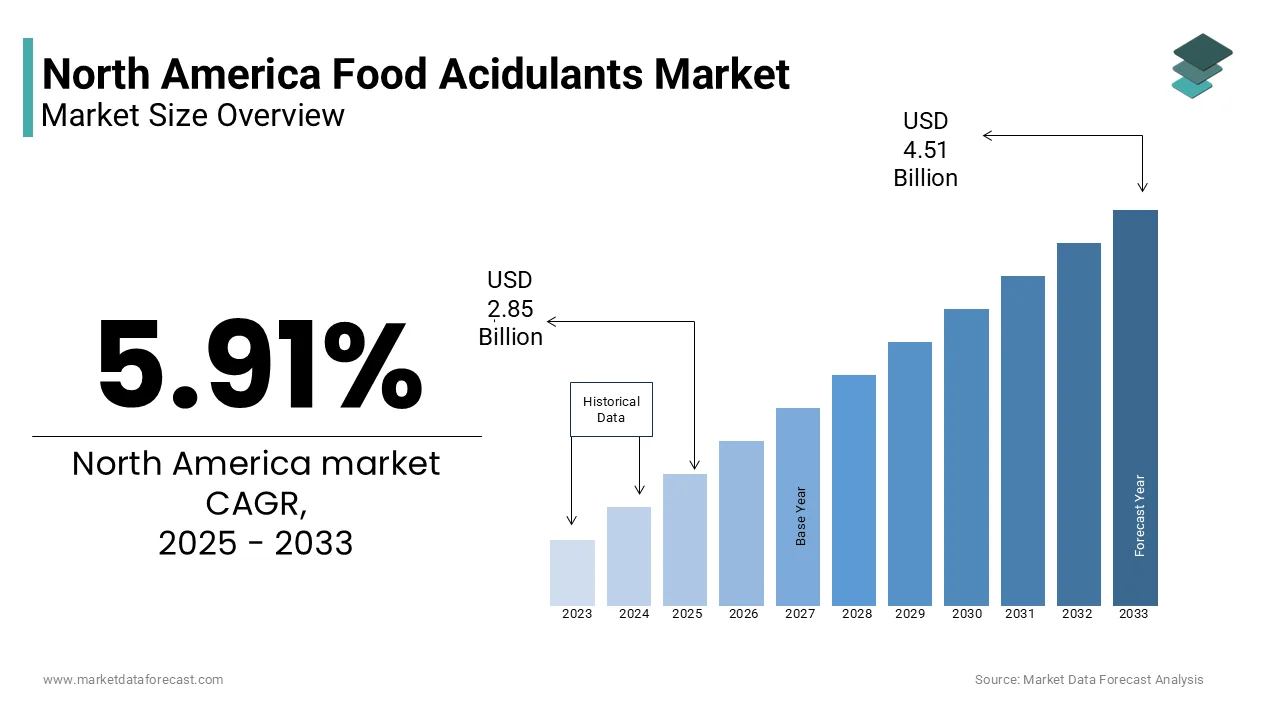

The Food Acidulants market size in North America was valued at USD 2.69 billion in 2024 and is predicted to be worth USD 4.51 billion by 2033 from USD 2.85 billion in 2025 and grow at a CAGR of 5.91% from 2025 to 2033.

MARKET DRIVERS

Increasing Demand for Processed Foods and Beverages

The surging consumption of processed foods and beverages serves as a primary driver for the North America food acidulants market. The heightened demand for convenience and shelf-stable products will escalate the growth of the market. Acidulants like citric acid and phosphoric acid are extensively used in carbonated beverages, juices, and canned goods to enhance flavor, preserve freshness, and regulate acidity levels. For instance, Coca-Cola’s reformulation of its beverages to include natural acidulants aligns with consumer preferences for clean-label products. Additionally, the rise of e-commerce platforms for grocery shopping has amplified the accessibility of processed foods, indirectly driving demand for acidulants.

Growing Emphasis on Clean-Label Ingredients

Consumer demand for clean-label ingredients represents another significant driver for the market. According to Nielsen, 70% of North American consumers prefer products labeled as "natural" or "organic," driving manufacturers to adopt acidulants derived from natural sources. Citric acid, derived from citrus fruits, is widely used in dairy and frozen products to replace synthetic preservatives by catering to the growing health-conscious demographic. Government incentives for sustainable farming practices further stimulate adoption. For example, California’s Proposition 65 mandates explicit labeling of hazardous substances by encouraging manufacturers to opt for naturally sourced acidulants.

MARKET RESTRAINTS

Fluctuating Prices of Raw Materials

One significant restraint facing the North America food acidulants market is the volatility in raw material prices, particularly citrus fruits and corn-based derivatives. These materials are sensitive to weather conditions and supply chain disruptions by causing price fluctuations that impact production costs. According to Plastics Today, the cost of citric acid surged by 22% in early 2023 due to limited availability caused by logistical bottlenecks. Such instability forces manufacturers to either absorb additional expenses or pass them on to consumers will hinder the growth of the market. Smaller players with limited financial resilience face greater difficulties navigating these uncertainties, intensifying competitive pressures.

Stringent Regulatory Frameworks

Stringent regulatory frameworks governing food additives present another hurdle for the food acidulants market. Regulatory bodies like the FDA mandate strict adherence to safety standards are compelling manufacturers to invest heavily in compliance measures. For example, California’s Proposition 65 requires explicit labeling of hazardous substances by adding complexity to product development. Non-compliance risks hefty fines and reputational damage. As per the Vinyl Institute, regulatory compliance costs account for approximately 15% of total production expenses.

MARKET OPPORTUNITIES

Expansion into Plant-Based and Alternative Protein Markets

A burgeoning opportunity lies in expanding food acidulant usage into plant-based and alternative protein markets within North America. Acidulants play a crucial role in enhancing the taste and texture of plant-based meat and dairy alternatives by making them indispensable for modern formulations. Similarly, rural areas in the U.S. and Canada are witnessing increased investments in sustainable agriculture, supported by federal funding programs aimed at diversifying food production.

Technological Advancements in Natural Acidulants

Technological advancements in natural acidulants represent another promising avenue for market growth. Innovations in fermentation techniques enable the development of next-generation acidulants derived from renewable resources by addressing unmet needs in specialized sectors. According to McKinsey & Company, companies adopting advanced manufacturing processes achieve up to a 30% reduction in operational costs while improving product quality. These innovations cater to niche applications, such as organic beverages and gluten-free baked goods by aligning with global sustainability trends. Additionally, digital tools like AI-driven predictive analytics optimize acidulant formulations, ensuring consistent performance.

MARKET CHALLENGES

Intense Competition from Alternative Preservatives

Intense competition from alternative preservatives poses a significant challenge for the food acidulants market. Traditional options like sodium benzoate and potassium sorbate remain popular due to their lower cost and familiarity among manufacturers. Similarly, advancements in bio-based alternatives, derived from renewable resources will threaten to disrupt the dominance of synthetic acidulants. Consumer skepticism regarding the long-term performance of newer formulations further complicates adoption. Smaller manufacturers face difficulties competing with established brands, particularly in price-sensitive markets. Differentiating products through superior performance and sustainability attributes remains critical for overcoming this challenge.

Economic Uncertainty and Supply Chain Disruptions

Economic uncertainty and supply chain disruptions hinder the growth of the food acidulants market, particularly during periods of inflation and geopolitical tensions. These delays disrupt supply chains and create inventory backlogs by impacting manufacturers’ profitability. Additionally, labor shortages exacerbate project timelines that further delays the material procurement. For instance, the Associated General Contractors of America reported a 15% shortfall in skilled labor by limiting the pace of infrastructure development. Navigating these economic headwinds requires strategic planning and collaboration with stakeholders to ensure timely execution of projects and sustained demand for acidulants.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.91% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Cargill Incorporated, Brenntag AG, Jungbunzlauer Suisse AG, Purac biochem BV, Archer-Daniels-Midland Company (ADM), Corbion, Tate & Lyle PLC, Bartek Ingredients, Inc., FBC Industries, and others |

SEGMENTAL ANALYSIS

By Type Insights

The citric acid dominated the North America food acidulants market and held 45.4% of share in 2024 owing to its versatility and widespread use in beverages, dairy products, and confectionery. Citric acid is favored for its ability to enhance flavor, preserve freshness, and regulate pH levels by making it indispensable for modern food formulations. Technological advancements have enabled the development of bio-based citric acid by appealing to eco-conscious consumers. For example, Cargill’s BioCit line offers enhanced stability and controlled release properties by appealing to manufacturers and consumers alike. Urbanization trends and government-funded agricultural projects further amplify demand will further boosts the growth of the segment.

The lactic acid segment is anticipated to register a CAGR of 8.5% from 2025 to 2033. This rapid growth is fueled by its exceptional ability to improve taste and texture in plant-based and fermented foods by aligning with sustainability goals and gaining traction among environmentally conscious consumers. Government incentives for green farming practices further stimulate adoption. For instance, the Canada Greener Homes Grant program promotes the use of sustainable materials, indirectly boosting lactic acid demand. Additionally, advancements in encapsulation technologies have improved stability and shelf life by addressing earlier concerns about limited durability.

By Application Insights

The beverages segment was accounted in holding 35.4% of the North America food acidulants market share in 2024 with the rapid adoption in carbonated drinks, juices, and energy beverages, where acidulants are critical for flavor enhancement and preservation. Citric acid is extensively used in soft drinks to provide a tangy flavor and extend shelf life. Urbanization trends and rising disposable incomes further amplify demand in metropolitan areas. Additionally, government initiatives promoting sustainable farming practices, such as tax credits for organic feed production, indirectly stimulate demand for advanced feed additives.

The plant-based segment is projected to witness a fastest CAGR of 9.2% in the next coming years. The growth of the segment is propelled by increasing investments in sustainable food production and the growing demand for high-quality plant-based alternatives. Acidulants, known for their superior stability and controlled release properties, are extensively used in plant-based meat and dairy substitutes to improve taste and texture. Technological advancements enabling eco-friendly formulations further enhance its appeal. Additionally, climate change concerns drive the adoption of resilient materials, particularly in coastal regions like Florida and Texas.

REGIONAL ANALYSIS

The United States dominated the North America food acidulants market with 76.1% of the share in 2024 with a robust food processing industry, driven by consumer demand for convenience foods, beverages, and plant-based alternatives. Key states like California, Texas, and Illinois serve as hubs for food innovation are leveraging advanced formulation technologies to meet evolving consumer preferences. Rising health-conscious trends have amplified the adoption of clean-label ingredients, with manufacturers prioritizing naturally derived acidulants over synthetic alternatives. Federal programs like the USDA’s Rural Development Program allocate significant funding for sustainable agriculture, indirectly stimulating demand for eco-friendly acidulants.

Canada was next in leading the North America food acidulants market share of 15.2% in 2024 driven by stringent food safety regulations and a growing emphasis on sustainability. Acidulants derived from natural sources, such as bio-based citric acid and lactic acid, gain traction in provinces like Ontario and British Columbia. Government-backed retrofitting schemes aimed at reducing carbon emissions further stimulate demand. For example, the Canada Greener Homes Grant program incentivizes the use of sustainable materials, indirectly boosting the adoption of natural acidulants. Additionally, the country’s cold climate necessitates durable and efficient solutions, making acidulants indispensable for preserving food quality in challenging environments. Strategic partnerships between local manufacturers and international players enhance product availability and affordability by ensuring sustained growth in the Canadian market.

KEY MARKET PLAYERS

Cargill Incorporated, Brenntag AG, Jungbunzlauer Suisse AG, Purac biochem BV, Archer-Daniels-Midland Company (ADM), Corbion, Tate & Lyle PLC, Bartek Ingredients, Inc., FBC Industries, and Hawkins Watts Limited are playing dominating role in North America food acidulants market.

The North America food acidulants market is characterized by intense competition, with leading players vying for market share through innovation, strategic alliances, and customer-centric services. The landscape is dominated by giants like Cargill Incorporated, Archer Daniels Midland (ADM), and DSM Nutritional Products, each employing unique strategies to differentiate themselves. Cargill’s emphasis on technological advancements and sustainability sets it apart, while ADM’s focus on specialized applications and customization resonates well with food manufacturers and processors. DSM’s commitment to customer-centric solutions and bio-based alternatives addresses niche market needs in plant-based and fermented food applications. Despite occasional price wars, value-added features such as enhanced stability, controlled release properties, and compatibility with clean-label trends mitigate margin pressures. Continuous investment in R&D ensures that companies stay ahead of evolving consumer preferences, particularly the growing demand for eco-friendly and high-performance acidulants. Smaller players face challenges competing with established brands but often carve out niches by focusing on specialized applications or localized markets.

TOP PLAYERS IN THE MARKET

Cargill Incorporated

Cargill Incorporated reigns supreme as the leading player in the North America food acidulants market. Renowned for its innovative BioCit line, Cargill leverages cutting-edge fermentation technologies to deliver high-performance solutions tailored to diverse applications. The company’s focus on sustainability is evident in its efforts to develop bio-based acidulants, appealing to environmentally conscious consumers. For instance, Cargill’s BioCit Max series, introduced in 2023, offers enhanced stability and controlled release properties, making it ideal for beverages, dairy products, and plant-based formulations. Strategic partnerships with food manufacturers and retailers enhance its reach across North America. Furthermore, Cargill’s commitment to R&D ensures continuous innovation, addressing evolving consumer needs and maintaining its dominant position in the competitive landscape.

Archer Daniels Midland (ADM)

Archer Daniels Midland (ADM) is known for its CitriStim and NutraSweet lines, ADM focuses on developing customized acidulants for specialized applications, including plant-based proteins and fermented foods. The company’s commitment to R&D ensures continuous innovation is addressing unmet needs in niche segments. For example, ADM’s encapsulated lactic acid is extensively used in plant-based meat alternatives to mimic the taste and texture of traditional meat, catering to the growing demand for premium vegan products. ADM’s global distribution network amplifies its market penetration. Additionally, the company’s sustainability-focused initiatives, such as reducing carbon emissions in production processes, resonate well with eco-conscious stakeholders. Strategic acquisitions and collaborations further strengthen its competitive edge by ensuring sustained growth in the North America market.

DSM Nutritional Products

DSM’s acquisition of Guardian Glass in 2022 expanded its portfolio of sustainable acidulants, reinforcing its competitive edge. The company’s focus on customer-centric solutions is evident in its tailored formulations for specific applications, such as encapsulated malic acid for sour candies and citric acid for carbonated beverages. Additionally, DSM’s commitment to sustainability aligns with global trends, as seen in its efforts to develop bio-based alternatives and reduce environmental impact.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the North America food acidulants market employ a variety of strategies to maintain their competitive edge and expand their market presence. Mergers and acquisitions remain a cornerstone strategy, enabling companies to broaden their product portfolios and enter new markets. For instance, DSM Nutritional Products’ acquisition of Guardian Glass in 2022 enhanced its capabilities in sustainable acidulants, addressing growing consumer demand for eco-friendly solutions. Product innovation is another critical tactic, with companies introducing next-generation formulations tailored to specific applications. Cargill’s launch of BioCit Max exemplifies this approach, offering superior performance attributes that cater to industries requiring enhanced flavor enhancement and preservation. Geographic expansion is equally vital, with manufacturers targeting underserved regions through strategic partnerships and distribution networks. Sustainability-focused initiatives also play a pivotal role, as seen in ADM’s efforts to develop energy-efficient formulations and reduce carbon emissions. Digital transformation further amplifies competitiveness, with companies leveraging AI-driven quality control systems and online platforms to streamline operations and engage customers. These multifaceted strategies ensure sustained growth and resilience amidst evolving market dynamics.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Cargill Incorporated launched BioCit Max, offering enhanced stability and controlled release properties for beverages and plant-based formulations. This product introduction expanded Cargill’s offerings and addressed consumer demands for superior acidulants.

- In June 2023, Archer Daniels Midland partnered with Habitat for Humanity, donating over 1 million square feet of feed additives for affordable housing projects. This initiative not only supported community development but also enhanced ADM’s brand visibility and reputation.

- In September 2023, DSM Nutritional Products acquired Guardian Glass, a leader in sustainable acidulants. This acquisition broadened DSM’s product range by enabling it to offer comprehensive eco-friendly solutions for modern food processing needs.

- In December 2023, IKO Industries introduced Dynasty coatings, featuring advanced UV protection and thermal insulation properties. This launch aligned with growing consumer demand for durable and energy-efficient ceramic coatings to reinforce IKO’s commitment to innovation.

- In February 2024, TAMKO Building Products implemented AI-driven quality control systems across its production facilities. This technological upgrade improved operational efficiency, reduced waste, and ensured consistent product quality, which is strengthening TAMKO’s competitive position in the market.

MARKET SEGMENTATION

This research report on the North America food acidulants market has been segmented and sub-segmented based on the following categories.

By Type

- Citric Acid

- Lactic Acid

- Acetic Acid

- Phosphoric Acid

- Malic Acid

By Application

- Beverages

- Bakery & Confectionery

- Dairy Products

- Meat & Poultry

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What are the major challenges facing the North America Food Acidulants Market?

Major challenges include volatility in raw material prices, stringent food safety regulations, and rising consumer scrutiny over synthetic ingredients, which may hinder widespread adoption.

2. What are the key opportunities in the North America Food Acidulants Market?

Opportunities are fueled by increasing demand for processed and convenience foods, growing usage of clean-label acidulants in beverages and bakery products, and rising health-conscious consumer trends favoring natural preservatives and flavor enhancers.

3. Who are the major players in the North America Food Acidulants Market?

Leading companies include Archer Daniels Midland (ADM), Cargill, Tate & Lyle, Corbion, and Jungbunzlauer, known for offering a broad portfolio of citric, lactic, and phosphoric acidulants across food and beverage applications.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]