North America Fluid Milk Market Research Report – Segmented By Type (Whole Milk, Skim Milk, Low-Fat Milk, Flavored Milk, Lactose-Free Milk, Organic Milk), Packaging Material, Distribution Channel, And Country (Us, Canada, And Rest Of North America) - Industry Analysis On Size, Share, Trends & Growth Forecast (2025 To 2033)

North America Fluid Milk Market Size

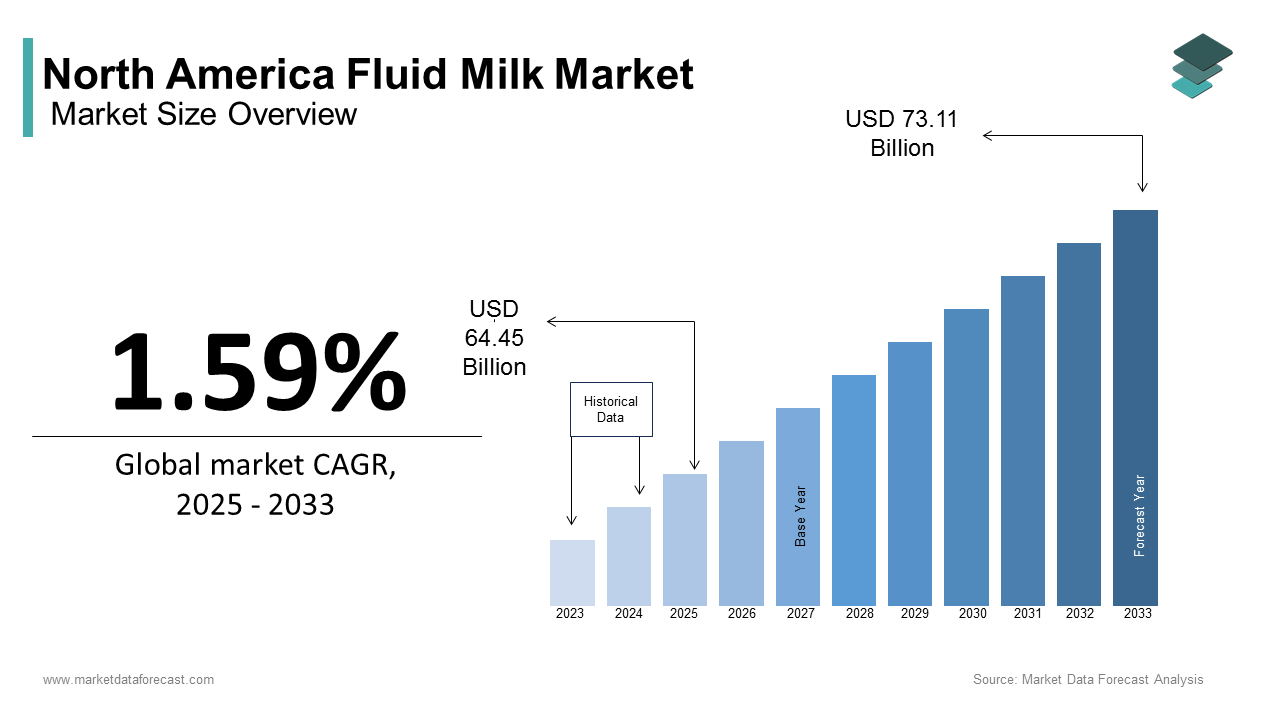

The North America fluid milk market size was valued at USD 63.44 billion in 2024 and is expected to reach USD 73.11 billion by 2033 from USD 64.45 billion in 2025. The market is projected to grow at a CAGR of 1.59%.

The North America fluid milk market covers the production, sale, and use of liquid milk products, such as whole milk, reduced-fat milk, low-fat milk, and skim milk. Fluid milk is a key item in many households and is used in many ways, like drinking, cooking, and baking. The market has seen steady growth as more consumers learn about the health benefits of milk, including its rich supply of calcium and vitamin D. This growth is also driven by the rising demand for organic and specialty milk products, along with more people choosing lactose-free options due to dietary needs. As health-aware consumers continue to include dairy in their diets, the North America fluid milk market is expected to keep growing, offering a variety of products to meet changing customer preferences.

MARKET DRIVERS

Rising Health Awareness and Nutritional Benefits

The growing focus on health among consumers is a key driver of the North America fluid milk market. As people pay more attention to what they eat and how it affects their health, more are looking for products that offer important nutrients. A survey by the International Dairy Foods Association found that 70% of consumers see milk as a valuable source of calcium and other key nutrients. Fluid milk is known for its strong nutritional benefits, providing calcium, protein, and vitamins like B12 and D. As health problems like osteoporosis and obesity become more common, more people are turning to nutrient-rich foods, which is helping to boost demand for fluid milk. Also, the trend toward clean label products, where shoppers want clear and simple ingredients, has increased interest in natural dairy options.

Growth of the Organic and Specialty Milk Segment

The rise of organic and specialty milk options is another major factor driving the North America fluid milk market. More people are choosing organic products because of their believed health advantages and eco-friendly farming methods, leading to higher demand for organic milk. The Organic Trade Association reports that U.S. organic milk sales hit $1.5 billion in 2020, a 10% jump from the year before. Organic milk is made without synthetic chemicals, attracting buyers who want pure and lightly processed choices. At the same time, the growing interest in specialty milk types, such as lactose-free, almond, and oat milk, has helped expand the fluid milk market. These products appeal to those with dietary needs or who prefer plant-based alternatives.

MARKET RESTRAINTS

Competition from Plant-Based Alternatives

A major challenge facing the North America fluid milk market is the growing presence of plant-based milk alternatives. The rise of vegan diets and greater awareness of lactose intolerance have boosted interest in non-dairy drinks, like almond, soy, oat, and coconut milk. A report from the Plant Based Foods Association shows that the U.S. plant-based milk market hit $2.5 billion in 2020, a 20% rise from the year before. This growing demand creates a hurdle for regular dairy milk makers, as many people choose non-dairy options for health or dietary reasons. In addition, plant-based brands often highlight eco-friendly practices and ethical sourcing, appealing to shoppers who care about the environment. To stay competitive, dairy producers need to set their products apart through superior quality, flavor, and nutrient content.

Price Volatility of Raw Materials

Another key challenge affecting the North America fluid milk market is the unstable cost of inputs, especially animal feed for dairy farms. The prices of key feed items, like corn and soybean meal, often change due to factors such as weather, harvest results, and international demand. The U.S. Department of Agriculture notes that feed expenses make up about 50% of dairy farmers’ total costs. These price swings can reduce profits for milk producers and may result in higher prices for shoppers. In addition, shifting input costs create uncertainty in the industry, making it harder for businesses to plan production and pricing strategies. To manage these risks, fluid milk companies need to build stronger supply chains and look for different sourcing methods.

MARKET OPPORTUNITIES

Expansion of E-commerce and Online Sales

The rise of online shopping and digital sales channels creates a strong opportunity for growth in the North America fluid milk market. The COVID-19 outbreak sped up the move toward buying groceries online, with more people now using websites and apps for food purchases. Milk suppliers can use these platforms to reach more customers and offer a wider selection, including organic and specialty dairy that may not be found in regular stores. Also, the growing popularity of home delivery and subscription boxes is boosting online demand for fluid milk.

Innovation in Product Offerings

The opportunity for innovation in product offerings represents a significant growth avenue for the North America fluid milk market. As buyer tastes shift, more people are looking for milk that meets specific wellness goals and special diets. New ideas like lactose-free varieties, milk boosted with extra nutrients, and fun flavoured options are becoming more popular. At the same time, the demand for simple, natural choices has grown, as shoppers want clear information about ingredients and how products are made. As companies focus on developing fresh and creative milk offerings, the North America market is set to grow further by appealing to more health-focused customers.

MARKET CHALLENGES

Environmental Sustainability Concerns

A significant challenge facing the North America fluid milk market is the growing concern over environmental sustainability and the ecological impact of dairy farming. The dairy sector faces growing criticism for its impact on the environment, including emissions, water use, and soil damage. Based on a study by the Food and Agriculture Organization states that dairy farming is responsible for about 4% of global greenhouse gas output. As people become more aware of ecological issues, fluid milk companies face growing expectations to follow eco-friendly methods and show care for the planet. Ignoring these concerns could hurt their public image and lead to losing customers to rivals who focus on sustainability. To tackle this issue, milk businesses need to support greener supply chains, improve farm practices, and clearly share their environmental efforts with buyers.

Regulatory Compliance and Quality Standards

Another serious challenge impacting the North America fluid milk market is the regulatory compliance and quality standards associated with dairy production. The fluid milk sector must follow strict rules set by groups like the Food and Drug Administration (FDA) and the U.S. Department of Agriculture (USDA). An FDA report highlights that meeting these safety guidelines can be difficult and expensive, especially for businesses making organic or specialty dairy items. The rising demand for clear labeling and honest ingredient sourcing adds further hurdles for brands trying to stand out in a busy market. Ignoring these rules could lead to heavy fines, harm to brand image, and loss of customer confidence. To overcome these obstacles, milk producers need to focus on following safety rules closely and strengthen their quality control efforts.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

1.59% |

|

Segments Covered |

By Type, Packaging Material, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

US, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Dairy Farmers of America, Nestlé S.A., Danone North America, Saputo Inc., Lactalis Group, Dean Foods, Agropur Dairy Cooperative, Prairie Farms Dairy, Borden Dairy Company, Organic Valley |

SEGMENTAL ANALYSIS

By Type Insights

The whole milk segment was the largest category by accounting for 40.7% of the total market share in 2024. This strong market position is linked to the popular choice of whole milk for its rich taste and smooth feel. A U.S. Department of Agriculture report shows that whole milk sales stayed steady, topping $7 billion in 2020. Many people view whole milk as a nourishing option, offering key nutrients like calcium and vitamin D. The increasing use of whole milk in recipes, from cooking to baking, also adds to its rising demand.

The fastest-growing segment in the North America fluid milk market is organic milk, projected to experience a CAGR of approximately 10.4%. This rise is linked to more shoppers choosing organic goods, largely due to increased focus on wellness and sustainability. Data from the Organic Trade Association states that organic milk sales in the U.S. hit $1.5 billion in 2020, marking a 10% jump from the year before. Free from artificial chemicals and fertilizers, organic milk attracts buyers looking for pure and lightly processed options. The surge in demand for transparent food labels also supports this growth trend.

By Packaging Material Insights

The plastic packaging segment dominated the category by capturing 60.9% of the total market share in 2024. This leading position is linked to the common use of plastic bottles for liquid dairy due to their light weight, strength, and affordability. A report by the Flexible Packaging Association reports that this market which includes plastic-based solutions is expected to expand at a 4% yearly and is fueled by rising interest in handy and travel-friendly packaging. Plastic options are preferred because they help shield products from spoilage and contamination while being easy to carry and store. The increasing habit of consuming dairy products while on the move also boosts the need for plastic-packed milk as busy people look for practical choices.

The fastest-growing segment is carton packaging and is predicted to see a CAGR of approximately 8.1%. This upward trend is fueled by rising interest in eco-friendly and recyclable packaging among modern consumers. Research by Smithers Pira stresses that the global carton trade is set to advance at a 4% yearly, as people increasingly choose packaging that is better for the planet. Carton options are especially popular with environmentally aware shoppers looking for cleaner, greener ways to buy dairy. Additionally, cartons help maintain the taste and freshness of milk, while being light, practical, and simple to carry, boosting their overall appeal.

By Distribution Channel Insights

The supermarkets and hypermarkets segment commanded the market by contributing 55.9% of the total market share in 2024 owing to the extensive reach and convenience offered by these retail formats, which provide consumers with a wide variety of fluid milk options under one roof. These often feature dedicated sections for dairy products, making it easier for consumers to find and purchase fluid milk. The growing trend of health-conscious shopping further propels the demand for fluid milk in these retail environments, as consumers increasingly seek nutritious options while grocery shopping. As the market continues to evolve, the supermarkets and hypermarkets segment is expected to maintain its leading position in the North America fluid milk market.

The online stores channel is witnessing swift expansion and is estimated to see a CAGR of 25.2% in the future because of the increasing consumer preference for online shopping, particularly in the wake of the COVID-19 pandemic, which has accelerated the shift towards e-commerce. These platforms offer consumers the convenience of purchasing fluid milk from the comfort of their homes, often with the added benefit of home delivery. Additionally, the rise of subscription services for dairy products is further driving the demand for online sales of fluid milk. As consumers increasingly seek convenient and flexible shopping options, the online stores channel is poised for significant growth in the North America fluid milk market.

COUNTRY ANALYSIS

The United States remained in a dominant position in the North America fluid milk market by accounting for 80.1% of the total market share in 2024. This rule can be attributed to the country's advanced dairy infrastructure and the presence of major dairy brands driving innovation in the fluid milk segment. According to the U.S. Department of Agriculture, fluid milk production in the United States reached over 200 billion pounds in 2020, providing a robust supply for the fluid milk market. The U.S. market is characterized by significant investments in dairy farming and processing, leading to the introduction of a wide variety of fluid milk options that cater to diverse consumer preferences. Additionally, the increasing focus on health and wellness among American consumers further propels the demand for fluid milk.

Canada is emerging as a significant player in the North America fluid milk market. This growth can be attributed to the increasing demand for fluid milk driven by the expansion of the dairy sector and the rising adoption of health-conscious products. As per a report by Statistics Canada, the Canadian fluid milk market is expected to grow by 5% annually is creating opportunities for fluid milk producers. The Canadian market is characterized by a strong emphasis on quality and sustainability, with consumers increasingly recognizing the importance of fluid milk in enhancing their nutrition. Additionally, government initiatives aimed at promoting local dairy production further support this trend.

The rest of North America is slowly emerging in the fluid milk market. This segment is witnessing growth driven by the increasing demand for fluid milk and the expansion of the dairy sector in the region. The market is described by a focus on affordability and accessibility, with organizations seeking cost-effective fluid milk solutions that enhance consumer health. Moreover, the rising awareness of the importance of nutrition and wellness is driving the adoption of fluid milk among Mexican consumers.

LEADING PLAYERS IN THE MARKET

Dean Foods

Dean Foods is a leading player in the North America fluid milk market, known for its extensive portfolio of dairy products, including a wide range of fluid milk options. The company operates numerous processing facilities across the United States and is committed to quality and sustainability in its production processes. Dean Foods' strong market presence and focus on innovation have positioned it as a dominant force in the fluid milk industry.

Dairy Farmers of America (DFA)

Dairy Farmers of America (DFA) is another major player in the North America fluid milk market, recognized for its cooperative model that supports dairy farmers across the United States. The organization produces a variety of fluid milk products and is dedicated to promoting sustainable dairy farming practices. DFA's emphasis on quality and community engagement has enabled it to capture a significant share of the market.

Lactalis Group

Lactalis Group is a prominent player in the North America fluid milk market, specializing in a diverse range of dairy products, including fluid milk, cheese, and yogurt. The company is known for its commitment to quality and innovation, offering a variety of fluid milk options that cater to consumer preferences. Lactalis Group's strong brand reputation and extensive distribution network have made it a trusted choice for consumers seeking high-quality dairy products.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Key players in the North America fluid milk market employ various strategies to strengthen their market position and enhance competitiveness. One prominent strategy is the focus on innovation and product development, enabling companies to introduce new fluid milk products that meet the evolving needs of consumers. For instance, Dean Foods continuously expands its product line to include lactose-free and organic milk options that align with market trends.

Additionally, strategic partnerships and collaborations play a crucial role in expanding market reach and enhancing product offerings. Dairy Farmers of America, for example, has formed alliances with various retailers to ensure a diverse range of high-quality fluid milk products for its customers, allowing the brand to differentiate itself in a competitive landscape.

Furthermore, companies are increasingly prioritizing sustainability and ethical sourcing in their production processes. Lactalis Group emphasizes its commitment to using responsibly sourced ingredients and environmentally friendly practices, which resonates with health-conscious consumers.

Moreover, many key players are actively pursuing marketing initiatives to raise awareness of their products and educate consumers about the benefits of fluid milk. By leveraging social media and influencer partnerships, these companies can effectively engage with their target audience and drive sales.

KEY MARKET PLAYERS AND COMPETITOR LANDSCAPE

Major Players of the North America fluid milk market include Dairy Farmers of America, Nestlé S.A., Danone North America, Saputo Inc., Lactalis Group, Dean Foods, Agropur Dairy Cooperative, Prairie Farms Dairy, Borden Dairy Company, and Organic Valley

The competition in the North America fluid milk market is characterized by a dynamic landscape where innovation, quality, and consumer engagement are paramount. Major players are continuously striving to differentiate themselves through unique product offerings and effective marketing strategies. The market is witnessing a surge in the adoption of fluid milk, driven by increasing consumer demand for nutritious and convenient dairy options. As organizations prioritize health and wellness, companies that provide high-quality, flavorful, and functional fluid milk products are gaining a competitive edge.

Furthermore, the presence of both established brands and emerging startups fosters a competitive environment that encourages rapid product development and innovation. The ongoing trend of health-conscious consumption is further intensifying competition, as consumers seek out new and exciting formulations.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Dean Foods announced the launch of a new line of lactose-free milk products aimed at expanding its offerings for consumers with dietary restrictions.

- In February 2024, Dairy Farmers of America introduced a new initiative to promote sustainable dairy farming practices among its member farmers.

- In March 2024, Lactalis Group expanded its distribution network to include more health food stores, increasing the availability of its organic fluid milk products.

- In April 2024, Organic Valley announced a partnership with a major grocery chain to enhance the visibility of its organic milk offerings.

- In May 2024, Horizon Organic launched a new marketing campaign focused on the benefits of organic milk for children's health.

- In June 2024, Fairlife introduced a new line of high-protein milk products, targeting fitness enthusiasts and health-conscious consumers.

- In July 2024, Silk announced a collaboration with a popular health influencer to promote its plant-based milk alternatives.

- In August 2024, Blue Diamond Growers launched a new almond milk product aimed at consumers seeking dairy-free options.

- In September 2024, Chobani expanded its product line to include a new range of flavored oat milks, catering to the growing demand for plant-based beverages.

- In October 2024, Stonyfield Organic announced a new initiative to support local dairy farmers and promote sustainable practices in its supply chain.

DETAILED SEGMENTATION OF NORTH AMERICA FLUID MILK MARKET INCLUDED IN THIS REPORT

This research report on the North America fluid milk market has been segmented and sub-segmented based on type, packaging material, distribution channel & region.

By Type

- Whole Milk

- Skim Milk

- Low-Fat Milk

- Flavored Milk

- Lactose-Free Milk

- Organic Milk

- Fortified Milk

By Packaging Material

- Plastic Bottles

- Cartons

- Glass Bottles

- Pouches

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail/E-Commerce

- Specialty Stores

- Direct-to-Consumer

By Region

- US

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. Which types of fluid milk are most popular in North America?

Whole milk, skim milk, low-fat milk (1% & 2%), flavored milk, lactose-free milk, and organic milk are among the most popular types.

2. Who are the key players in the North America fluid milk market?

Major players include Dairy Farmers of America, Nestlé S.A., Danone North America, Saputo Inc., Lactalis Group, Dean Foods, Agropur Dairy Cooperative, Prairie Farms Dairy, Borden Dairy Company, and Organic Valley.

3. What factors are driving the growth of the fluid milk market in North America?

Increasing demand for organic and lactose-free milk, rising consumer preference for fortified and functional dairy products, and the growth of e-commerce and direct-to-consumer distribution are key drivers.

4. How is the fluid milk market segmented by packaging material?

Fluid milk is packaged in plastic bottles (HDPE & PET), cartons (Tetra Pak, paperboard), glass bottles, and pouches (LDPE & flexible plastic).

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]