North America Fitness Equipment Market Size, Share, Trends & Growth Forecast Report By Type (Cardiovascular Training Equipment, Strength Training Equipment, and Other Equipment and Accessories), Price Range, Distribution Channel, End User, Country (The United States, Canada, and Rest of North America), Industry Analysis From 2024 to 2033

North America Fitness Equipment Market Size

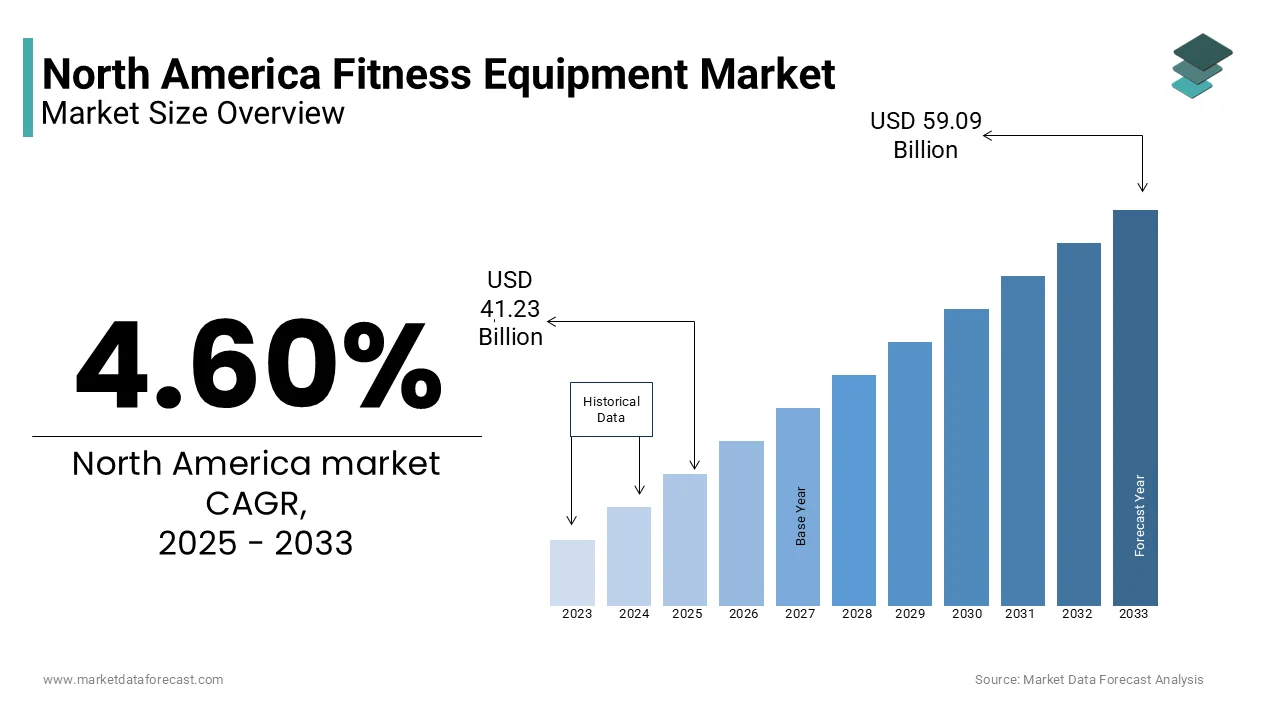

The North America fitness equipment market was worth USD 39.42 billion in 2024. The North America market is expected to reach USD 59.09 billion by 2033 from USD 41.23 billion in 2025, rising at a CAGR of 4.60% from 2025 to 2033.

The North America fitness equipment market includes various types of equipment, such as cardiovascular machines, strength training devices, and accessories, catering to both commercial and residential users. The surging awareness of health and fitness when coupled with an increasing emphasis on preventive healthcare has significantly contributed to the expansion of this market. This growth is driven by several factors, including the rising prevalence of obesity, an aging population seeking to maintain active lifestyles, and the proliferation of fitness centers and gyms. Also, the COVID-19 pandemic has accelerated the trend towards home fitness solutions, as consumers invest in personal equipment to support their health and wellness goals. As the fitness landscape continues to evolve, the North America fitness equipment market is expected to adapt, incorporating innovative technologies and sustainable practices to meet the changing demands of consumers.

MARKET DRIVERS

Increasing Health Awareness

A key driver of the North America fitness equipment market is the growing understanding of health and wellness among consumers. As lifestyle-related diseases, such as obesity and diabetes, become more prevalent, individuals are increasingly prioritizing physical fitness as a means of improving their overall health. According to the Centers for Disease Control and Prevention, more than 42% of adults in the United States were classified as obese in 2021, highlighting the urgent need for effective fitness solutions. This rising health consciousness has led to a surge in demand for fitness equipment, as consumers seek to incorporate regular exercise into their daily routines. Furthermore, the proliferation of fitness-related information through social media and digital platforms has empowered individuals to take charge of their health, driving interest in various forms of exercise, from strength training to cardiovascular workouts. As a result, the fitness equipment market is experiencing robust growth, with consumers increasingly investing in home gym setups and fitness accessories to support their health goals, as noted by the International Health, Racquet & Sportsclub Association.

Growth of the Home Fitness Trend

The COVID-19 pandemic has significantly accelerated the trend towards home fitness, serving as a major driver of the North America fitness equipment market. With gym closures and social distancing measures in place, many individuals turned to home workouts as a viable alternative to maintain their fitness routines. As per a survey, about 60% of U.S. consumers reported exercising at home during the pandemic, leading to a surge in demand for home fitness equipment. This shift has prompted consumers to invest in a variety of fitness products including resistance bands, dumbbells, stationary bikes, and treadmills to create their own workout spaces. The convenience and flexibility of home workouts have made them increasingly appealing, particularly for those with busy schedules or limited access to traditional gyms. Because the home fitness trend continues to gain traction, the demand for fitness equipment is expected to remain strong with consumers seeking innovative and space-efficient solutions to support their exercise routines, as spotlighted by the American Council on Exercise.

MARKET RESTRAINTS

High Cost of Equipment

The high cost associated with purchasing fitness equipment is one of the important factors impacting the North America fitness equipment market. While there is a growing demand for fitness solutions, the initial investment required for quality equipment can be a significant barrier for many consumers. The industry estimates that the average cost of a home gym setup can range from $1,000 to $5,000 is depending on the type and quality of equipment selected. This financial consideration can deter potential buyers, particularly those who may be uncertain about their long-term commitment to fitness. Besides, the economic impact of the COVID-19 pandemic has led to increased financial constraints for many households, further limiting discretionary spending on fitness equipment. As a result, consumers may opt for lower-cost alternatives or delay their purchases altogether, which can hinder market growth.

Competition from Alternative Fitness Solutions

The North America fitness equipment market faces significant competition from alternative fitness solutions, such as fitness apps, online workout programs, and boutique fitness studios. The rise of digital fitness platforms has transformed the way consumers engage with exercise, offering convenient and often more affordable options for staying active. A survey by McKinsey & Company found that around 70% of fitness enthusiasts in North America used online fitness platforms in 2022 is reflecting a strong shift towards digital fitness solutions and hybrid workout routines. This trend poses a challenge for traditional fitness equipment sales, as consumers may prioritize subscription-based services or digital solutions over investing in physical equipment. Furthermore, the proliferation of bodyweight training and minimal equipment workouts has further shifted consumer preferences, as individuals seek effective ways to exercise without the need for extensive equipment.

MARKET OPPORTUNITIES

Rising Popularity of Wearable Fitness Technology

The increasing popularity of wearable fitness technology presents a significant opportunity for the North America fitness equipment market. Wearable devices, such as fitness trackers and smartwatches, have gained widespread acceptance among consumers seeking to monitor their health and fitness levels. These devices not only track physical activity but also provide valuable insights into heart rate, sleep patterns, and overall wellness, encouraging users to engage in regular exercise. As consumers become more health-conscious and tech-savvy, the integration of wearable technology with fitness equipment is expected to enhance the user experience and drive demand for connected fitness solutions. Manufacturers that incorporate smart features into their equipment, such as compatibility with fitness apps and real-time data tracking, are likely to capture a larger share of the market is positioning themselves as leaders in the evolving fitness landscape, as noted by the Consumer Technology Association.

Expansion of Corporate Wellness Programs

The expansion of corporate wellness programs represents another major opportunity for the North America fitness equipment market. As organizations increasingly recognize the importance of employee health and well-being, many are investing in wellness initiatives that promote physical activity and healthy lifestyles. According to the Global Wellness Institute, the corporate wellness is projected to arrive at $66 billion by 2025 is backed by the growing emphasis on employee engagement and productivity. This pattern presents a significant opportunity for fitness equipment manufacturers to partner with businesses and provide tailored solutions for on-site fitness facilities or wellness programs. Additionally, the integration of fitness challenges and incentives within corporate wellness programs can further drive demand for fitness equipment, as employees seek to participate in activities that promote health and camaraderie. Companies prioritize employee well-being, the fitness equipment market is well-positioned to benefit from this trend, as stressed by the Society for Human Resource Management.

MARKET CHALLENGES

Supply Chain Disruptions

The North America fitness equipment market faces significant challenges from supply chain disruptions, particularly in the wake of the COVID-19 pandemic. The fitness equipment industry relies on a complex network of suppliers for components and materials, and the pandemic has exposed vulnerabilities in these supply chains. As per a survey conducted by the National Association of Manufacturers, nearly 80% of manufacturers reported supply chain disruptions due to the pandemic, leading to delays in production and project timelines. These disruptions can result in increased costs for fitness equipment manufacturers, as they may need to source materials from alternative suppliers or expedite shipping to meet project deadlines. Additionally, the ongoing global semiconductor shortage has further exacerbated supply chain challenges, impacting the availability of critical components for fitness devices. As companies navigate these disruptions, they may face difficulties in fulfilling orders and maintaining customer satisfaction, which can hinder growth and market expansion.

Intense Market Competition

The North America fitness equipment market is characterized by intense competition among established players and new entrants. The market is populated by a mix of global corporations and regional companies, each vying for market share in a competitive landscape. This competitive environment can lead to price wars which may erode profit margins and compel companies to invest heavily in marketing and innovation to differentiate their offerings. Also, the rapid pace of technological advancements necessitates continuous investment in research and development, further straining financial resources. Smaller companies may struggle to compete with larger firms that have greater access to capital and established brand recognition. So, the intense competition in the fitness equipment field can pose challenges for companies seeking to maintain profitability and market position, as spotlighted by the National Sporting Goods Association.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.60% |

|

Segments Covered |

By Type, Price Range, Distribution Channel, End User, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

BowFlex Inc. (U.S.), Peloton Interactive, Inc. (U.S.), Cybex International, Inc. (U.S.), Johnson Health Tech. Co., Ltd. (U.S.), ControllerTechnogym S.p.A. (Italy), Dyaco International Inc. (Taiwan), Decathlon SA (France), Precor Incorporated (U.S.), Hammer Sport AG (Germany), Tonal Systems, Inc. (U.S.), HOIST Fitness Systems, Inc. (U.S.), and NordicTrack (U.S.). |

SEGMENTAL ANALYSIS

By Type Insights

The cardio equipment segment remained the biggest contributor and posses a market share of 43.8% in 2024 because of the wide recognition or favour of cardiovascular exercises, which are essential for improving heart health and overall fitness. The Physical Activity Council reports that in 2022, nearly 60 million North Americans used cardio equipment regularly, reflecting the growing popularity of treadmills, stationary bikes, and ellipticals as part of home and commercial fitness routines. The growing awareness of the health benefits associated with cardiovascular workouts, coupled with the rise of home fitness trends, has led to a surge in demand for cardio equipment. Furthermore, the convenience and accessibility of cardio machines make them a preferred choice for consumers looking to incorporate regular exercise into their routines. The fitness landscape continues to evolve, so, the cardio equipment segment is well-positioned to maintain its leading position in the North American market, as showcased by the International Health, Racquet & Sportsclub Association.

The strength training equipment segment quickly moving ahead in this market, which is projected to grow at a CAGR of 6.9% during the forecast period. This progress can be credited to the increasing popularity of strength training among fitness enthusiasts and the rising awareness of its benefits for overall health and wellness. According to data from the Sports & Fitness Industry Association (SFIA), sales of strength training equipment in North America grew by 15% in 2022, driven by the surge in home gyms and increased focus on weight training among fitness enthusiasts. The accelerating pattern of functional fitness and bodyweight training has also contributed to the rising interest in strength training solutions. Consumers seek to enhance their strength and muscle tone, hence, the demand for innovative and versatile strength training equipment is anticipated to rise significantly, positioning this segment as a major propellent of market dynamics in North America.

By Application Insights

The commercial segment was the superior one in the North America fitness equipment market by capturing 60.2% of the total market share in 2024. This authority is mainly caused by the increasing construction of fitness centers, gyms, and health clubs, which require a wide range of fitness equipment to cater to diverse clientele. As per the International Health, Racquet & Sportsclub Association, the number of health clubs in the United States reached over 41,000 in 2022 is drawing attention on a robust growth trajectory. The demand for fitness equipment in commercial applications is further fueled by the need for compliance with industry standards and the growing emphasis on user experience in modern fitness facilities.

The residential category is expected to exhibit a noteworthy CAGR of 7.9% from 2025 to 2033 owing to the increasing demand for home fitness solutions and particularly in the wake of the COVID-19 pandemic, which prompted many individuals to invest in personal fitness equipment for home use. A survey conducted shows that approximately 60% of U.S. consumers reported exercising at home during the pandemic, leading to a surge in demand for home fitness products. The convenience and flexibility of home workouts have made them increasingly appealing, particularly for those with busy schedules or limited access to traditional gyms.

By Distribution Channel Insights

The online segment in 2024 captured the top position in the North America fitness equipment market by commanding a market share of 57.2%. This place in the market is basically propelled by the surging popularity of e-commerce and the convenience it offers consumers in purchasing fitness equipment. According to a report by the U.S. Department of Commerce, online fitness equipment sales in North America increased by 28% between 2020 and 2022, fueled by rising consumer preference for home fitness solutions and digital shopping platforms. The ability to compare prices, read reviews, and access a wider range of products has made online shopping an attractive option for consumers seeking fitness solutions. Additionally, the COVID-19 pandemic accelerated the trend towards online shopping, as many consumers turned to e-commerce for their fitness needs during lockdowns and gym closures.

The fastest rising distribution channel within the North America fitness equipment market is the retail category which is projected to grow at a CAGR of 5.3% from 2025 to 2033. This growth can be caused by the resurgence of brick-and-mortar stores as consumers seek to experience products firsthand before making a purchase. According to the Sports & Fitness Industry Association (SFIA), North American retail sales of home fitness equipment grew by 40% between 2019 and 2022, as consumers increasingly invested in personal wellness and at-home workout solutions. The ability to provide personalized customer service and expert advice in physical retail locations enhances the shopping experience for consumers, making it a preferred choice for many. The fitness equipment market continues to expand, so, the retail segment is well-positioned for growth, supported by the increasing demand for fitness solutions and the desire for in-person shopping experiences.

REGIONAL ANALYSIS

The United States fitness equipment market is highly mature, but still dynamic. It was the dominant player in the North America market by holding a substantial market share of 75.9% in 2024. The U.S. fitness industry exhibits its size and diversity, with significant investments in health clubs, gyms, and home fitness solutions. According to the International Health, Racquet & Sportsclub Association, the number of health clubs in the United States reached over 41,000 in 2022 is reflecting a robust growth trajectory. The demand for fitness equipment is driven by the increasing focus on health and wellness among the population, with a growing number of individuals seeking to improve their fitness levels and overall well-being. Additionally, the rise of digital fitness solutions and home workout trends has further stimulated the market, as consumers invest in personal fitness equipment to support their health goals. The U.S. market is also described by a high level of innovation, with manufacturers continuously introducing advanced fitness technologies and smart equipment to meet the evolving needs of consumers.

Canada became the second-largest market in the North America fitness equipment sector. It is progressing steadily through a healthy growth stage, reflecting its increasing national focus on health and wellness. The Canadian fitness industry has been experiencing steady growth, driven by increasing health awareness and a rising number of fitness facilities. According to Statistics Canada, the number of fitness and recreational sports centers in the country reached over 6,000 in 2022 is signifying a growing interest in health and wellness among Canadians. The demand for fitness equipment in Canada is influenced by the need for specialized machinery to meet the diverse requirements of fitness enthusiasts and commercial establishments. Furthermore, the increasing focus on preventive healthcare and the promotion of active lifestyles are prompting consumers to invest in fitness solutions.

The rest of North America is at an early yet promising stage of market development. The fitness industry in Mexico has been gaining momentum and is driven by government initiatives promoting health and wellness, as well as a growing middle class with increased disposable income. According to the Mexican National Institute of Statistics and Geography, the number of gyms and fitness centers in Mexico reached over 2,500 in 2022 is showing a growing demand for fitness solutions. As the fitness sector in Mexico and neighboring countries continues to expand, the demand for fitness equipment is expected to rise, providing opportunities for growth in the North American fitness equipment market. The increasing focus on health and wellness, coupled with urbanization and lifestyle changes, is likely to drive the adoption of fitness solutions in these regions, further enhancing the market's potential.

KEY MARKET PLAYERS

The major players in the North America fitness equipment market include BowFlex Inc. (U.S.), Peloton Interactive, Inc. (U.S.), Cybex International, Inc. (U.S.), Johnson Health Tech. Co., Ltd. (U.S.), ControllerTechnogym S.p.A. (Italy), Dyaco International Inc. (Taiwan), Decathlon SA (France), Precor Incorporated (U.S.), Hammer Sport AG (Germany), Tonal Systems, Inc. (U.S.), HOIST Fitness Systems, Inc. (U.S.), and NordicTrack (U.S.).

MARKET SEGMENTATION

This research report on the North America fitness equipment market is segmented and sub-segmented into the following categories.

By Type

- Cardiovascular Training Equipment

- Exercise Bikes

- AirBikes

- Stationary Cycles

- Elliptical Machines

- Treadmills

- Manual Treadmills

- Automatic Treadmills

- Rowers

- Treadclimbers

- Exercise Bikes

- Strength Training Equipment

- Free Weights

- Power Racks

- Dumbbells

- Other Equipment and Accessories

By Price Range

- Low Price Range

- Medium Price Range

- High Price Range

By Distribution Channel

- Online/E-commerce

- Retail

By End User

- Commercial

- Gyms and Fitness Clubs

- Hospitality and Leisure

- Corporate Gyms

- Educational Institutes

- Residential

- Apartment Gyms

- Home/Multi-family Residences

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What are the main factors driving the North America fitness equipment market?

The market is driven by increasing health awareness, rising obesity rates, growing home fitness trends, and technological advancements in fitness equipment.

How is technology impacting the fitness equipment market?

Smart fitness equipment with AI-powered training, virtual coaching, performance tracking, and interactive workouts is revolutionizing the industry.

Which age group is the largest consumer of fitness equipment?

Millennials and Gen Z are driving demand for connected fitness solutions, while older adults are investing in low-impact and rehabilitation equipment.

What is the future outlook for the North America fitness equipment market?

The market is expected to grow due to the increasing adoption of smart fitness devices, growing corporate wellness programs, and a focus on health and well-being.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]