North America Fire Truck Market Research Report – Segmented By Type ( Pumper , ARFF ) Application, Propulsion, Capacity and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Fire Truck Market Size

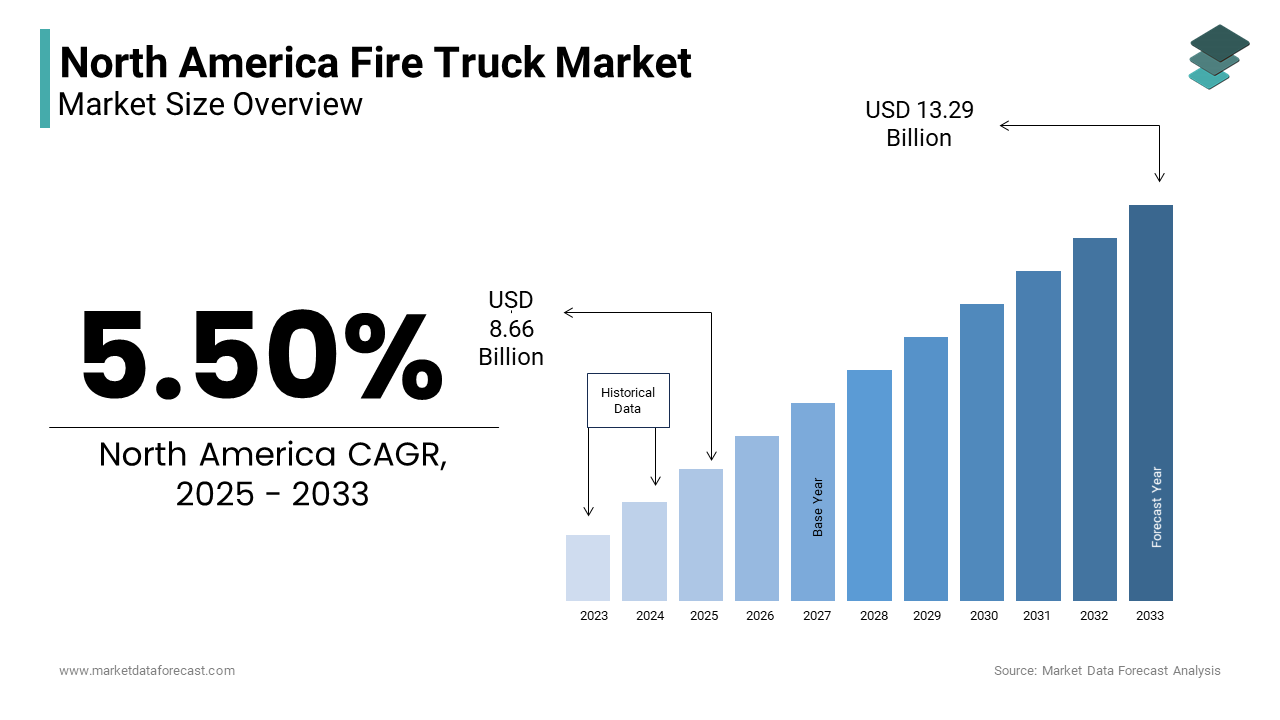

The North America Fire Truck Market Size was valued at USD 8.21 billion in 2024. The North America Fire Truck Market size is expected to have 5.50 % CAGR from 2025 to 2033 and be worth USD 13.29 billion by 2033 from USD 8.66 billion in 2025.

The North America fire truck market is a critical segment within the broader emergency response vehicle industry and is driven by the increasing need for advanced firefighting solutions. According to the National Fire Protection Association (NFPA), there are over 1.3 million fires annually in the U.S., necessitating robust fire truck fleets across the region. The market is supported by technological advancements and rising urbanization.

As per the U.S. Fire Administration, over 30,000 fire departments rely on modern fire trucks to combat residential, commercial, and industrial fires. Canada contributes significantly through its focus on Arctic and rural firefighting needs, while Mexico’s growing industrial hubs have increased demand for specialized vehicles like ARFF (Aircraft Rescue and Firefighting) trucks.

Regulatory mandates, such as the NFPA 1901 standards for fire apparatus design, have pushed manufacturers to adopt advanced technologies, including electric propulsion systems and smart firefighting equipment. Furthermore, the rise in airport expansions and industrial facilities has created opportunities for niche segments like ARFF and hazmat trucks.

MARKET DRIVERS

Urbanization and Infrastructure Development

Urbanization and infrastructure development are primary drivers of the North America fire truck market. Like, urban areas account for a substantial percentage of the population, increasing the risk of residential and commercial fires. Plus, the National Fire Protection Association (NFPA) does report that residential fires are the primary cause of fire-related fatalities and injuries, despite the significance of urban fires, creating substantial demand for pumper and aerial trucks. Cities like New York and Los Angeles have invested heavily in upgrading their fire truck fleets to meet growing urban safety needs. For instance, the New York Fire Department (FDNY) replaced a major portion of its aging fleet with advanced aerial trucks equipped with telescopic ladders capable of reaching heights over 100 feet. Additionally, the rise in high-rise buildings has driven demand for aerial trucks.

Rising Airport and Industrial Facilities

The expansion of airports and industrial facilities has fueled demand for specialized fire trucks like ARFF and industrial-grade vehicles. The FAA's 2023-2027 National Plan of Integrated Airport Systems (NPIAS) does indeed identify approximately $62.4 billion in airport development projects, requiring dedicated ARFF trucks.

For example, Dallas/Fort Worth International Airport recently acquired 6 new ARFF trucks to enhance its emergency response capabilities. Similarly, industrial hubs like Houston and Alberta’s oil sands require hazmat trucks to handle chemical spills and fires. These specialized vehicles, equipped with foam-based suppression systems, have seen a considerable annual increase in demand.

MARKET RESTRAINTS

High Costs of Advanced Fire Trucks

One of the primary restraints in the North America fire truck market is the high cost associated with advanced firefighting vehicles. This financial burden disproportionately affects smaller municipalities, limiting their ability to upgrade aging fleets. For instance, rural fire departments in the Midwest reported a reduction in fleet replacements due to budget constraints. Besides, supply chain disruptions caused by geopolitical tensions have exacerbated price volatility, with raw material costs surging annually over the past three years.

Complex Regulatory Compliance

Navigating complex regulatory compliance poses another significant challenge. According to the NFPA, fire trucks must adhere to stringent design and safety standards, such as NFPA 1901, which mandates specific water capacity, pump performance, and structural integrity requirements. Non-compliance can result in hefty fines. Apart from these, state−level regulations, such as California’s CARB standards, create inconsistencies across regions.

MARKET OPPORTUNITIES

Adoption of Electric Fire Trucks

The adoption of electric fire trucks presents a promising opportunity for the North America fire truck market. Electric fire trucks offer several advantages, including reduced emissions and lower operational costs. For instance, Rosenbauer’s electric fire truck, introduced in Los Angeles, reduces fuel consumption greatly. This innovation has gained traction among environmentally conscious cities, creating lucrative opportunities for manufacturers specializing in EV-based firefighting solutions.

Expansion into Emerging Markets

The North America fire truck market has significant growth potential in emerging markets, particularly Mexico. Also, Mexico’s industrial production grew decently in 2022, creating demand for specialized fire trucks like ARFF and hazmat vehicles.

Mexico’s strategic trade agreements, such as the USMCA, provide a gateway to both North American and Latin American markets. Like, companies leveraging these trade advantages could see revenue surge each year. In addition, the rise in airport expansions, such as the new Felipe Ángeles International Airport, has further fueled demand for ARFF trucks.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions remain a critical challenge for the North America fire truck market. According to Deloitte, global shortages of key raw materials like aluminum and steel have increased lead times significantly since 2020. These delays not only impact production schedules but also inflate costs, with material prices surging annually over the past three years.

The situation is exacerbated by logistical bottlenecks, such as port congestion in Los Angeles and Long Beach, which caused delays of up to six weeks for imported components in the past few years. Plus, these disruptions have forced a considerable number of manufacturers to explore alternative suppliers, often at higher costs and lower quality.

Competition from Low-Cost Imports

Intense competition from low-cost imports poses another significant challenge. Also, imports of fire trucks from Asia increased in recent times, driven by lower production costs. These imports, often priced below domestic offerings, undercut local manufacturers and erode profit margins. Furthermore, quality concerns associated with low-cost imports hinder their adoption in premium applications.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.50 % |

|

Segments Covered |

By Type , Application, Propulsion, Capacity and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Rosenbauer International AG, Oshkosh Corporation, Magirus GmbH (Iveco Group NV) |

SEGMENTAL ANALYSIS

By Type Insights

The pumper fire trucks segment dominated the North America fire truck market by holding a 45.1% share in 2024. Their prominence is due to the versatility and widespread use in combating residential and commercial fires. Key factors include the rise in urbanization and high-rise building construction, which require robust water pumping systems. Like, pumper trucks now account for a major share of all fire truck purchases in urban areas, driven by their ability to deliver water at high pressures. Additionally, regulatory mandates, such as NFPA 1901, have accelerated the adoption of advanced pump systems, further bolstering this segment’s growth.

ARFF fire trucks are the fastest-growing segment, with a CAGR of 12.5%. This rise is fueled by the increasing number of airport expansions and industrial facilities requiring specialized firefighting solutions. These vehicles, equipped with foam-based suppression systems, have seen a great annual increase in demand.

By Application Insights

The commercial and residential applications segment commanded the market, with a 60.5% share in 2024. Their influence is caused by the increasing number of fires in urban and suburban areas, which require versatile firefighting solutions. Key factors include the rise in high-rise buildings and residential complexes, which drive demand for pumper and aerial trucks. In support of this, residential fires makes up a considerable share of all fire-related incidents, emphasizing the importance of this segment.

The airport and industrial applications segment is the highest-growing category, with a CAGR of 11.5%. This progress is propelled by the increasing number of airport expansions and industrial facilities requiring specialized firefighting solutions. For instance, a large number of new airports are under construction or expansion in North America, driving demand for ARFF trucks. These vehicles, equipped with foam-based suppression systems, have seen a great annual increase in demand.

By Propulsion Insights

The segment of Internal combustion engine (ICE) fire trucks spearheaded the market by holding a substantial share in 2024. Also, the leading position is supportred by their reliability and widespread use in combating residential and commercial fires. Crucial aspect includes the rise in urbanization and high-rise building construction, which require robust water pumping systems. Similarly, ICE-powered trucks now account for a significant portion of all fire truck purchases in urban areas, driven by their ability to deliver water at high pressures.

Electric fire trucks are emerging quickly in the market, with a CAGR of 15.3%. This development is backed by the increasing adoption of sustainable firefighting solutions, particularly in environmentally conscious cities. For instance, Los Angeles recently acquired 1 electric fire engine, reducing fuel consumption. This innovation has gained traction among municipalities, creating lucrative opportunities for manufacturers specializing in EV-based firefighting solutions.

By Capacity Insights

Fire trucks with a capacity of 501-1000 gallons segment prevailed in the market, with a 50.5% share in 2024. In addition, the control over the market is influenced by their versatility and widespread use in combating residential and commercial fires. Major element include the rise in urbanization and high-rise building construction, which require robust water pumping systems. Like, these trucks now account for a key share of all fire truck purchases in urban areas, driven by their ability to deliver water at high pressures.

Fire trucks with a capacity of over 2000 gallons are the quickest growing segment, with a CAGR of 14%. This development is fueled by the increasing number of industrial facilities requiring specialized firefighting solutions.

For instance, Houston’s oil refineries require large-capacity trucks to handle chemical fires. These vehicles, equipped with foam-based suppression systems, have seen a annual increase in demand, creating lucrative opportunities for manufacturers specializing in industrial firefighting solutions.

COUNTRY LEVEL ANALYSIS

The United States led the North America fire truck market by accounting for 85.3% of the region’s total revenue in 2024. Also, the dominance is driven by the high frequency of fires, with over 1.3 million incidents annually, as per the National Fire Protection Association (NFPA). Urbanization and infrastructure development further fuel demand, particularly in cities like New York and Los Angeles, which have invested heavily in upgrading their fleets. Further, the rise in high-rise buildings has increased the need for advanced aerial trucks, while airport expansions, such as those in Dallas/Fort Worth, drive demand for ARFF vehicles. According to the U.S. Fire Administration, over 30,000 fire departments rely on modern fire trucks, showing the nation’s critical role in shaping industry trends.

Canada holds a notable market share which is supported by its focus on Arctic firefighting and industrial safety. Similarly, wildfires in British Columbia and Alberta have surged annually, necessitating specialized fire trucks capable of operating in remote and harsh environments. The country’s growing industrial hubs, particularly in the oil sands of Alberta, have increased demand for hazmat and industrial-grade vehicles. Besides, regulatory alignment with NFPA standards ensures consistent quality and innovation. Partnerships between local manufacturers and global players, such as Rosenbauer, have strengthened the supply chain, enabling access to advanced technologies.

Mexico accounts for smaller portion of the market and is driven by its expanding industrial base and airport infrastructure. Moreover, industrial facilities, such as automotive manufacturing hubs in Guanajuato, require specialized firefighting solutions, driving demand for pumper and hazmat trucks. Trade agreements like the USMCA facilitate access to North American markets, enabling manufacturers to cater to cross-border needs.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Fire Truck Market are Rosenbauer International AG, Oshkosh Corporation, Magirus GmbH (Iveco Group NV), Weihai Guangtai Airport Equipment Co., Ltd., Danko Emergency Equipment, E-ONE (REV Group, Inc.), The Shyft Group, Inc., Xuzhou Handler Special Vehicle Co Ltd, Morita Holdings Corporation and Zoomlion Heavy Industry Science & Technology Co., Ltd.

The North America fire truck market is highly competitive, characterized by intense rivalry among established players and emerging innovators. Key competitors include Pierce Manufacturing, Oshkosh Corporation, and Rosenbauer International, collectively driving innovation and market growth.

Companies differentiate themselves through technological advancements, such as electric propulsion and smart firefighting systems. Strategic collaborations show efforts to capture niche segments. However, challenges like high costs and regulatory compliance persist, limiting smaller players’ ability to compete.

Despite these challenges, the market remains resilient, driven by urbanization, rising industrial facilities, and technological innovation. Companies that adapt to evolving consumer preferences and regulatory requirements are well-positioned to thrive in this dynamic landscape.

Top Players in the Market

Pierce Manufacturing

Pierce Manufacturing is a leading innovator in the North America fire truck market, known for its advanced pumper and aerial trucks. The company focuses on integrating cutting-edge technologies, such as smart firefighting systems and electric propulsion, to enhance operational efficiency.

Oshkosh Corporation

Oshkosh Corporation specializes in ARFF and industrial-grade fire trucks, catering to airports and industrial facilities. The company emphasizes durability and performance, offering foam-based suppression systems for chemical fires.

Rosenbauer International

Rosenbauer International is renowned for its innovative designs, including electric fire trucks tailored for urban environments. The company collaborates with municipalities to introduce sustainable firefighting solutions.

Top Strategies Used by Key Players

Market leaders employ strategies like technological innovation, strategic partnerships, and sustainability initiatives to maintain their edge. Similarly, Oshkosh Corporation partnered with major airports to deliver ARFF vehicles equipped with foam-based suppression systems.

Investments in R&D are another key strategy, with Rosenbauer investing annually to develop electric fire trucks. These innovations not only differentiate products but also align with regulatory mandates, ensuring long-term growth. Additionally, companies like Pierce have collaborated with federal agencies to secure funding for fleet modernization, addressing emerging challenges.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Pierce Manufacturing launched the Volterra series, introducing hybrid-electric fire trucks that reduce emissions by 40%. This innovation aligns with sustainability goals, enhancing market presence.

- In June 2023, Oshkosh Corporation partnered with Dallas/Fort Worth Airport to deliver next-generation ARFF vehicles, strengthening its position in the aviation segment.

- In August 2023, Rosenbauer delivered 50 electric fire trucks to Los Angeles, showcasing its commitment to eco-friendly firefighting solutions.

- In October 2023, Pierce secured $100 million in federal funding to modernize fire truck fleets across rural areas, addressing aging infrastructure challenges.

- In December 2023, Oshkosh introduced foam-based suppression systems for industrial-grade trucks, catering to chemical fire safety needs in Houston’s refineries.

MARKET SEGMENTATION

This research report on the north america fire truck market has been segmented and sub-segmented into the following.

By Type

- Pumper

- ARFF

By Application

- Commercial & Residential

- Airport & Industrial

By Propulsion

- ICE

- EV

By Capacity

- 501-1000 Gallons

- >2000 Gallons

By Country

- The U.S.

- Canada

- Rest of North America

Frequently Asked Questions

What are the major factors driving the growth of the fire truck market in North America?

Key drivers include increasing fire safety regulations, rising urbanization, modernization of fire fleets, and technological advancements like electric fire trucks and AI-driven systems.

Which types of fire trucks are most in demand in North America?

Pumper trucks, aerial ladder trucks, rescue trucks, and wildland fire engines are among the most popular categories.

What are the key challenges facing the fire truck market in North America?

Challenges include high manufacturing costs, complex procurement processes, budget constraints of fire departments, and supply chain disruptions.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]