North America Feed Phosphate Market Size, Share, Growth, Trends, And Forecasts Segmented, By Type (Monocalcium Phosphate, Dicalcium Phosphate, Mono-Dicalcium Phosphate, Tricalcium Phosphate, Defluorinated Phosphate And Others), Livestock (Swine, Poultry, Cattle, Aquatic Animals, Others) And By Region Industry Analysis From (2025 to 2033).

North America Feed Phosphate Market Size

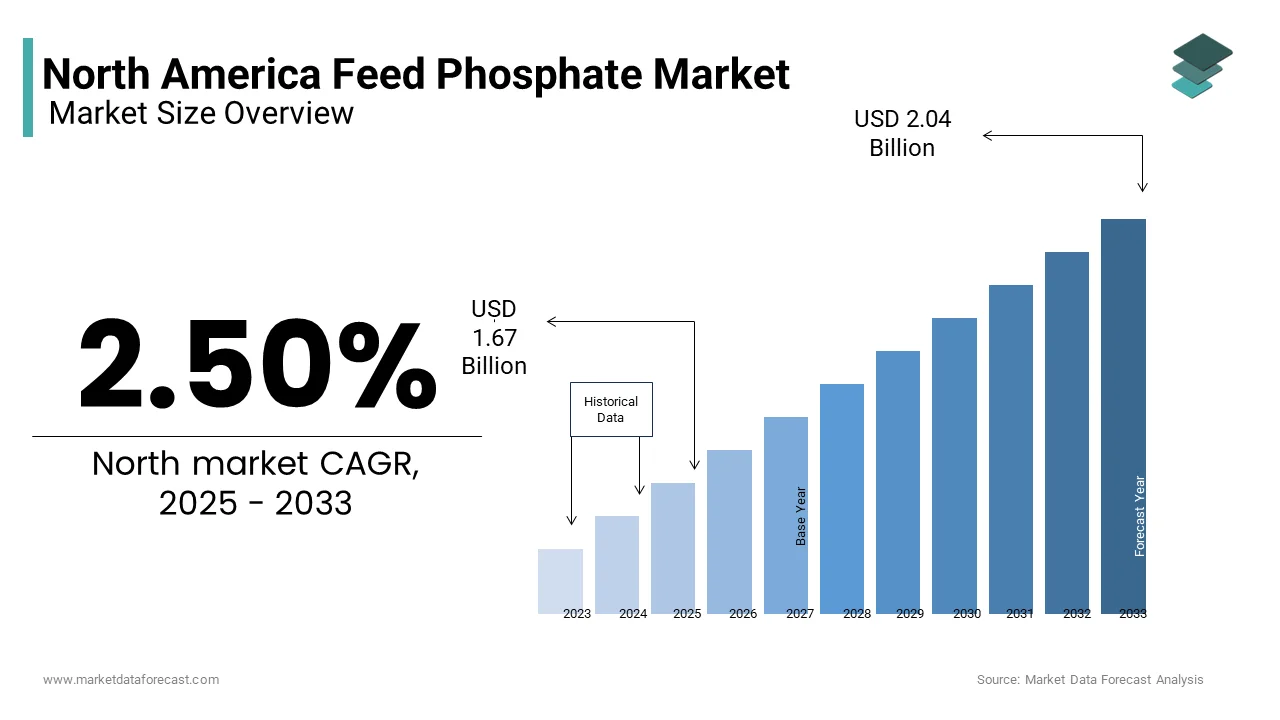

The North America feed phosphate market size was valued at USD 1.63 billion in 2024 and is anticipated to reach USD 1.67 billion in 2025 from USD 2.04 billion by 2033, growing at a CAGR of 2.50% during the forecast period from 2025 to 2033.

The growing demand for high-quality animal nutrition is ascribed to fuel the growth of the North America feed phosphate market. For instance, the U.S. Department of Agriculture (USDA) emphasizes that feed phosphates are essential for bone development and energy metabolism in livestock. Canada’s focus on sustainable farming practices has further propelled demand, with Additionally, the rise of aquaculture as a protein source has amplified the need for specialized feed phosphates.

MARKET DRIVERS

Growing Demand for High-Quality Animal Nutrition

The rising demand for high-quality animal nutrition is a pivotal driver shaping the North America feed phosphate market. As per the National Research Council, phosphorus is a critical nutrient for bone development, energy metabolism, and overall health in livestock and poultry. With consumers increasingly prioritizing protein-rich diets, farmers are adopting feed phosphates to enhance animal productivity and meet quality standards. Additionally, the rise of organic and antibiotic-free farming practices has further amplified the adoption of feed phosphates, which ensure optimal nutrient delivery without compromising animal health. According to the American Feed Industry Association, 60% of large-scale farms now incorporate feed phosphates into their livestock diets. This shift towards premium animal nutrition positions feed phosphates as a key growth driver in the market.

Expansion of Aquaculture and Poultry Industries

The expansion of the aquaculture and poultry industries serves as another major driver fueling the North America feed phosphate market. Feed phosphates play a crucial role in fish diets by ensuring skeletal development and metabolic efficiency. Similarly, the poultry industry, which contributes over USD 50 billion annually to the U.S. economy, relies heavily on feed phosphates to enhance egg production and meat quality. A report by the Poultry Science Association notes that monocalcium phosphates are widely used in poultry feed due to their high bioavailability. Furthermore, government initiatives promoting sustainable aquaculture have opened doors for specialized feed phosphates. These factors collectively position aquaculture and poultry as critical growth drivers for the market.

MARKET RESTRAINTS

Fluctuating Raw Material Prices

Fluctuations in raw material prices pose a significant challenge to the North America feed phosphate market. Key components like phosphoric acid and phosphate rock are subject to price volatility due to geopolitical tensions and supply chain disruptions. According to the U.S. Geological Survey, phosphate rock prices surged by 30% in 2022, increasing production costs for feed phosphate manufacturers. This volatility disrupts profit margins and complicates pricing strategies for companies. The rising input costs forced 25% of small-scale manufacturers to reduce production volumes. Additionally, environmental regulations limiting phosphate mining have further compounded the issue that is creating uncertainty in the market.

Stringent Environmental Regulations

Stringent environmental regulations also act as a restraint for the North America feed phosphate market. Governments across the region have imposed strict guidelines to minimize phosphate runoff and promote sustainable farming practices. The U.S. Environmental Protection Agency mandates that farmers adopt measures to reduce nutrient pollution, which increases compliance costs for feed phosphate manufacturers. According to a report by the Canadian Environmental Law Association, companies investing in eco-friendly formulations incur up to 20% higher operational expenses. Moreover, smaller players often lack the resources to adapt to these regulations, leading to reduced market participation. A study by the National Institute of Standards and Technology notes that 15% of regional manufacturers faced delays in product approvals due to non-compliance issues in 2022.

MARKET OPPORTUNITIES

Rising Focus on Sustainable Farming Practices

The rising focus on sustainable farming practices presents a lucrative opportunity for the North America feed phosphate market. Farmers are increasingly adopting feed phosphates to optimize nutrient utilization and reduce environmental impact. According to the USDA, feed phosphates reduce phosphorus excretion by up to 30%, aligning with regulatory requirements for nutrient management. Additionally, innovations in eco-friendly formulations, such as defluorinated phosphates, have broadened their appeal among environmentally conscious consumers.

Emerging Markets in Latin America

Emerging markets in Latin America offer untapped potential for the North America feed phosphate market. Trade agreements like the USMCA have created opportunities for exports to countries such as Mexico, where livestock production is rapidly expanding. These animals require precise nutrient management by making feed phosphates an attractive option for farmers. Additionally, government initiatives to promote modern farming practices have opened doors for specialized feed phosphates.

MARKET CHALLENGES

Competition from Alternative Feed Additives

Intense competition from alternative feed additives poses a significant challenge to the North America feed phosphate market. Products such as phytase enzymes and organic minerals are gaining traction due to their cost-effectiveness and perceived benefits. According to the American Society of Animal Science, phytase enzymes reduce phosphorus excretion by up to 40%, making them an attractive substitute for traditional feed phosphates. This creates a significant barrier for feed phosphate manufacturers, particularly among cost-sensitive farmers. Additionally, misconceptions about the complexity of feed phosphate application hinder adoption.

Supply Chain Disruptions

Supply chain disruptions caused by geopolitical tensions and natural disasters also act as a challenge for the North America feed phosphate market. For instance, the Russia-Ukraine conflict disrupted global phosphate supplies is leading to increased production costs for manufacturers. According to the International Fertilizer Association, supply chain bottlenecks reduced feed phosphate availability by 15% in 2022 by impacting livestock and poultry operations. Additionally, transportation delays and port closures further exacerbated the issue, creating logistical hurdles for companies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.5% |

|

Segments Covered |

By Type, Livestock, Form and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

USA, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

Mosiac (US), Nutrien Ltd (Canada), OCP (Morocco), Rotem (Turkey), Eurochem Group (Switzerland), Phosagro (Russia), Fosfitalia Group (Italy), Phosphea (France), YARA (Norway), and J. R. Simplot Company (US). |

SEGMENTAL ANALYSIS

By Type Insights

The monocalcium phosphate segment dominated the North America feed phosphate market with an estimated share of 40.1% in 2024 with its widespread adoption is attributed to its high bioavailability and effectiveness in enhancing animal productivity. Industries such as poultry and swine farming rely heavily on monocalcium phosphate to ensure optimal nutrient delivery. The USDA emphasizes that 70% of poultry feed incorporates monocalcium phosphate due to its ability to improve egg production and meat quality. Furthermore, advancements in formulation technologies have enabled manufacturers to offer eco-friendly variants by aligning with regulatory requirements.

The defluorinated phosphate is projected to witness a CAGR of 6.2% from 2025 to 2033. Its ability to reduce fluorine content while maintaining nutrient efficacy makes it ideal for ruminants and aquaculture. Additionally, its compatibility with sustainable farming practices has expanded its applicability in modern agriculture.

By Livestock Insights

The poultry segment was accounted in holding 35.4% of the North America feed phosphate market share in 2024 with the proliferation of poultry farming. Additionally, the rise of antibiotic-free farming practices has further amplified feed phosphate adoption in poultry diets. Data from the Poultry Science Association reveals that 60% of poultry farms utilize feed phosphates to enhance egg production and meat quality

The aquaculture segment is likely to register a CAGR of 7.5% from 2025 to 2033. The segment’s growth is fueled by the rise in global fish consumption, with aquaculture emerging as a vital protein source. Additionally, government initiatives promoting sustainable aquaculture have opened doors for feed phosphates in fish diets. Statistics Canada reports that aquaculture production increased by 10% in 2022, benefiting the feed phosphate market. Innovations in formulations tailored for aquatic species have broadened their appeal.

By Form Insights

The powder segment was the largest and held 60.1% of the North America feed phosphate market share in 2024 due to its ease of blending and uniform distribution in animal feed. Industries such as poultry and swine farming rely heavily on powdered feed phosphates to ensure consistent nutrient delivery. Furthermore, advancements in grinding technologies have enabled manufacturers to offer fine-particle powders, enhancing bioavailability.

The granule segment is anticipated to witness a CAGR of 5.7% during the forecast period. Its ability to reduce dust formation and improve handling efficiency makes it ideal for large-scale farming operations. The USDA notes that granular feed phosphates reduce dust-related respiratory issues in livestock by up to 40%. Additionally, their compatibility with automated feeding systems has expanded their applicability in modern farming practices.

COUNTRY ANALYSIS

Top Countries In The Market

The United States was the largest contributor in the North America feed phosphate market by holding 75.6% of share in 2024 due to its vast livestock sector, stringent environmental regulations, and a growing emphasis on high-quality animal nutrition. According to the U.S. Department of Agriculture (USDA), the livestock industry contributes over USD 200 billion annually to the economy, driving demand for advanced feed additives like phosphates. For instance, feed phosphates are widely adopted in poultry and swine farming due to their ability to enhance bone development and metabolic efficiency. Additionally, the rise of aquaculture as a sustainable protein source has amplified demand for specialized feed phosphates.

Canada ranks second in the North America feed phosphate market by holding 19.9% of the share in 2024. Its growth trajectory is heavily influenced by sustainable farming practices and the expansion of aquaculture and poultry industries. The Canadian government’s commitment to reducing nutrient pollution has significantly boosted demand for feed phosphates. According to the Canadian Environmental Law Association, defluorinated phosphates reduce fluorine toxicity by up to 50%, aligning with regulatory requirements. Additionally, Canada’s cold climate necessitates efficient nutrient delivery systems by making feed phosphates an ideal solution for ruminants and poultry.

KEY MARKET PLAYERS

Mosiac (US), Nutrien Ltd (Canada), OCP (Morocco), Rotem (Turkey), Eurochem Group (Switzerland), Phosagro (Russia), Fosfitalia Group (Italy), Phosphea (France), YARA (Norway), and J. R. Simplot Company (US). are the market players dominating the North America feed phosphate market.

Top Players In The Market

Nutrien Ltd.

Nutrien Ltd. stands as the leading player in the North America feed phosphate market. The company’s dominance stems from its extensive product portfolio, which includes innovative feed phosphate formulations tailored for diverse livestock needs. Nutrien caters to both large-scale farms and small-scale operations, offering solutions that align with stringent environmental regulations. Its commitment to sustainability is evident in its eco-friendly product lines, which comply with EPA standards.

Yara International

Yara International ranks second in the market with its cutting-edge technology and sustainability initiatives. The company invests heavily in research and development to innovate products that meet evolving consumer demands. In 2023, Yara launched a defluorinated feed phosphate designed for aquaculture, targeting the growing demand for sustainable aquafeed. This aligns with global efforts to reduce fluorine toxicity and promote green agriculture. Yara’s global presence and diversified customer base enable it to capitalize on opportunities across various sectors, including poultry, swine, and ruminants.

The Mosaic Company

The Mosaic company’s success is attributed to its strong brand recognition, extensive distribution network, and customer-centric approach. Mosaic offers a wide range of feed phosphates, from monocalcium formulations for poultry to specialized solutions for aquaculture. In 2023, the company expanded its manufacturing facility in Monterrey, Mexico, to cater to the growing demand in emerging markets.

Top Strategies Used By Key Players Market

Key players in the North America feed phosphate market employ a variety of strategies to maintain their competitive edge and drive growth. Mergers and acquisitions are a primary strategy by enabling companies to expand their product portfolios and strengthen their market presence. For instance, Nutrien Ltd.’s acquisition of Agrium in 2022 bolstered its feed phosphate segment by enhancing its ability to serve industrial clients. Similarly, product innovation remains a cornerstone of growth, with companies investing heavily in research and development to introduce eco-friendly and high-performance solutions. Yara International launched a defluorinated feed phosphate in 2023 by targeting the growing demand for sustainable products.

Competition Overview

The North America feed phosphate market is characterized by intense competition. The market’s fragmented nature encourages innovation, as companies strive to differentiate themselves through product quality, performance, and sustainability. Regulatory compliance plays a critical role, with stringent environmental regulations driving the adoption of low-fluorine and eco-friendly formulations. Established players like Nutrien Ltd., Yara International, and The Mosaic Company dominate the market, leveraging their extensive resources, global reach, and technological expertise. However, smaller players focus on niche segments, offering specialized solutions tailored to specific industries or applications. The rise of e-commerce and digital marketing has further intensified competition, enabling smaller companies to reach a broader audience.

RECENT HAPPENINGS IN THIS MARKET

- In April 2024, Nutrien Ltd. acquired Agrium, a leader in feed phosphates, to enhance its product portfolio and strengthen its position in the livestock segment.

- In June 2023, Yara International launched a defluorinated feed phosphate designed for aquaculture by targeting the growing demand for sustainable aquafeed.

- In March 2023, The Mosaic Company expanded its manufacturing facility in Monterrey, Mexico is to cater to the growing demand in emerging markets and enhance its geographic footprint.

- In January 2023, BASF partnered with a Canadian firm to develop granular feed phosphates, focusing on improving handling efficiency and reducing dust formation.

- In October 2022, AkzoNobel introduced a coated feed phosphate for poultry diets, addressing the need for enhanced bioavailability and reduced environmental impact.

MARKET SEGMENTATION

This research report on the North American feed phosphate market is segmented and sub-segmented into the following categories.

By Livestock

- Dicalcium Phosphate

- Monocalcium Phosphate

- Mono-Dicalcium Phosphate

- Defluorinated Phosphate

- Tricalcium Phosphate

- Others.

By Livestock Stock

- Poultry

- Swine

- Aquatic Animals

- Cattle

- Others

By Country

- The USA

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

Why is feed phosphate important in animal nutrition?

Feed phosphate provides essential phosphorus, which supports bone strength, growth, and metabolism in livestock, especially poultry, swine, and cattle.

What’s driving demand for feed phosphate in North America?

Rising demand for meat and dairy, intensive livestock farming, and the need for nutrient-rich feed are pushing the market forward.

Which animals benefit most from feed phosphate?

Poultry and swine benefit the most, as they require consistent phosphorus intake for rapid growth, reproduction, and strong skeletal development.

Are there any sustainability concerns in the market?

Yes. Overuse of phosphate can lead to environmental runoff. The market is gradually shifting toward balanced formulations and more efficient feed utilization.

What trends are shaping the future of feed phosphate?

Key trends include precision nutrition, improved feed formulations, and increased focus on bioavailability and digestive efficiency of phosphate sources.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]