North America Feed Palatability Enhancers And Modifiers Market Size, Share, Trends & Growth Forecast, Segmented By Type, Livestock, And By Country (The USA, Canada, Mexico and Rest of North America), Industry Analysis From 2025 to 2033

North America Feed Palatability Enhancers & Modifiers Market Size

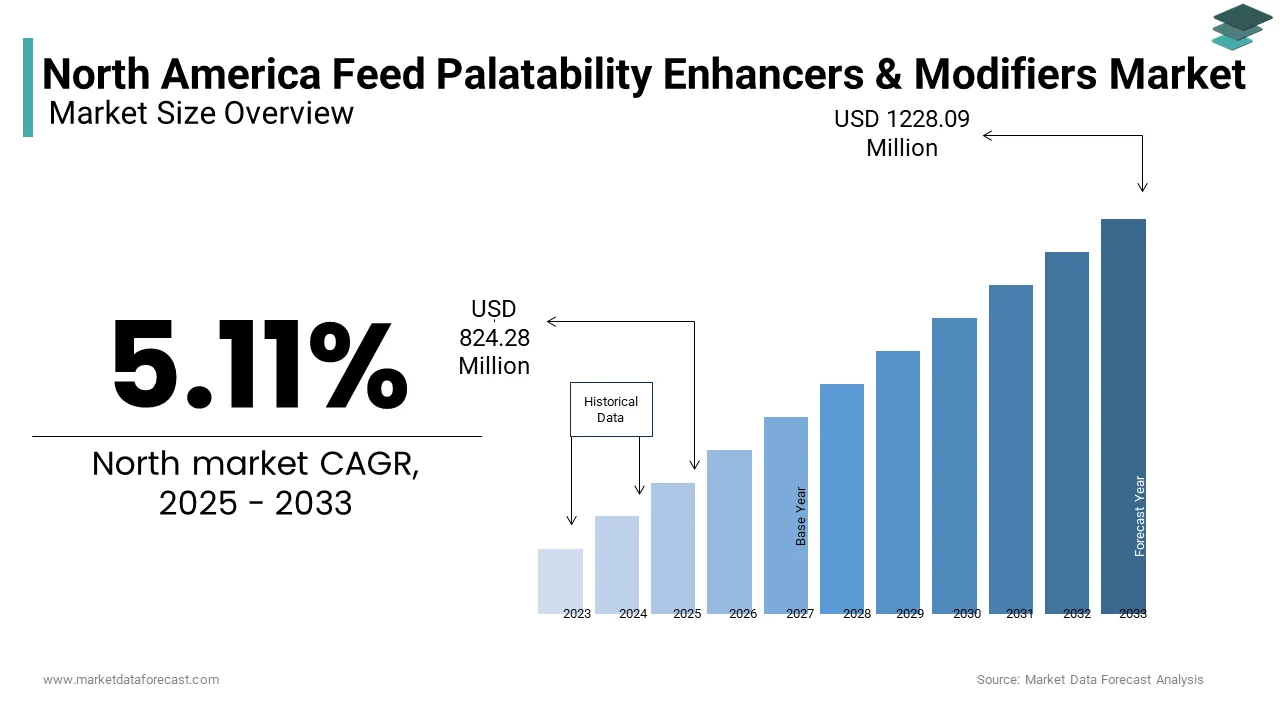

The North America feed palatability enhancers market size was valued at USD 784.21 million in 2024 and is anticipated to reach USD 824.28 million in 2025 from USD 1228.09 million by 2033, growing at a CAGR of 5.11% during the forecast period from 2025 to 2033.

The increasing livestock production and evolving consumer preferences for high-quality meat, dairy, and pet food are the major factors driving the growth of the North America feed palatability enhancers market. The rising demand for enhanced feed formulations that improve animal health and productivity is rising that is impacting the adoption of palatability enhancers to improve feed intake and animal performance. Rising awareness about the benefits of flavoring agents, sweeteners, and aroma enhancers further bolsters market growth. However, economic uncertainties, fluctuating raw material prices, and regulatory challenges pose hurdles by necessitating adaptive strategies from manufacturers.

MARKET DRIVERS

Increasing Demand for High-Quality Animal Products

The growing consumer preference for high-quality animal products serves as a primary driver for the North America feed palatability enhancers market. The livestock producers are increasingly adopting palatability enhancers to improve feed intake, which directly impacts animal growth and product quality. For instance, flavoring agents like garlic extracts and yeast derivatives are widely used in poultry and swine diets to enhance taste and encourage consistent feed consumption.

Advancements in Feed Formulation Technologies

Technological advancements in feed formulation technologies represent another significant driver for the market. Innovations in encapsulation techniques and microencapsulation enable the development of next-generation palatability enhancers that offer superior stability and controlled release properties. These innovations cater to niche applications, such as aquaculture and equine nutrition, which is addressing unmet needs in specialized sectors. For example, encapsulated sweeteners are extensively used in fish feed to improve palatability without compromising water quality. Additionally, digital tools like AI-driven predictive analytics optimize feed formulations, ensuring consistent performance. The manufacturers can differentiate themselves in a competitive landscape and capture premium segments by investing in R&D and leveraging cutting-edge technologies.

MARKET RESTRAINTS

Fluctuating Prices of Raw Materials

One significant restraint facing the North America feed palatability enhancers market is the volatility in raw material prices, particularly natural flavoring agents and synthetic sweeteners. These materials are sensitive to geopolitical tensions and supply chain disruptions by causing price fluctuations that impact production costs. Such instability forces manufacturers to either absorb additional expenses or pass them on to consumers are potentially dampening demand. Smaller players with limited financial resilience face greater difficulties navigating these uncertainties by intensifying competitive pressures.

Stringent Regulatory Frameworks

Stringent regulatory frameworks governing chemical usage and food safety present another hurdle for the feed palatability enhancers market. Regulatory bodies like the FDA mandate strict adherence to safety standards are compelling manufacturers to invest heavily in compliance measures. For example, California’s Proposition 65 requires explicit labeling of hazardous substances by adding complexity to product development. Non-compliance risks hefty fines and reputational damage. These financial burdens constrain innovation budgets and slow down market responsiveness for smaller firms lacking robust infrastructure. Balancing regulatory requirements with cost efficiency remains a persistent challenge for industry participants.

MARKET OPPORTUNITIES

Expansion into Emerging Aquaculture Markets

A burgeoning opportunity lies in expanding feed palatability enhancer usage into emerging aquaculture markets within North America in Mexico and underserved regions of the U.S. and Canada. Palatability enhancers play a crucial role in enabling cost-effective yet effective feeding strategies by making them indispensable for modern aquaculture operations. Similarly, rural areas in the U.S. and Canada are witnessing increased investments in aquaculture projects, supported by federal funding programs aimed at diversifying agricultural practices.

Growing Adoption In the Pet Food Industry

The pet food industry represents another promising avenue for market growth with the rising pet ownership and consumer willingness to spend on premium pet care products. Palatability enhancers are increasingly adopted to improve the taste and texture of pet food, catering to the growing demand for customized and high-quality formulations. For example, encapsulated flavors and aroma enhancers are extensively used in dry kibble to mimic the taste of fresh meat by enhancing palatability and consumer satisfaction.

MARKET CHALLENGES

Intense Competition from Alternative Additives

Intense competition from alternative feed additives poses a significant challenge for the feed palatability enhancers market. Traditional options like probiotics and enzymes remain popular due to their lower cost and familiarity among livestock producers. According to Floor Covering Weekly, traditional additives accounted for nearly 40% of total sales in 2023. Similarly, advancements in bio-based alternatives are derived from renewable resources, threaten to disrupt the dominance of synthetic palatability enhancers. Consumer skepticism regarding the long-term performance of newer formulations further complicates adoption. Smaller manufacturers face difficulties competing with established brands in price-sensitive markets. Differentiating products through superior performance and sustainability attributes remains critical for overcoming this challenge.

Economic Uncertainty and Supply Chain Disruptions

Economic uncertainty and supply chain disruptions hinder the growth of the feed palatability enhancers market, particularly during periods of inflation and geopolitical tensions. According to the National Bureau of Economic Research, agricultural project delays increased by 12% in 2023 due to rising financing costs and budget constraints. These delays disrupt supply chains and create inventory backlogs, which are impacting manufacturers’ profitability. Additionally, labor shortages exacerbate project timelines will further delays material procurement. Navigating these economic headwinds requires strategic planning and collaboration with stakeholders to ensure timely execution of projects and sustained demand for feed additives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.11% |

|

Segments Covered |

By Type, Livestock and Country |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country's Covered |

The United States, Canada, and the Rest of North America |

|

Market Leaders Profiled |

include Diana Group, Associated British Foods PLC, E. I. Dupont, Ensign-Bickford Industries Inc., Eli Lilly and Company, Kemin Europa, Ferrer, Kerry Group PLC, Kent Feeds Inc., Tanke International Group. |

SEGMENTAL ANALYSIS

By Type Insights

The sweeteners segment dominated the North America feed palatability enhancers market with 45.4% of share in 2024 due to the ability to improve feed intake and mask undesirable tastes by making them ideal for livestock and pet food applications. Encapsulated sweeteners are widely used in poultry and swine diets to enhance palatability and encourage consistent feed consumption. Technological advancements have enabled the development of customized formulations tailored to specific animal species. For example, Cargill’s SweetPro line offers enhanced stability and controlled release properties by appealing to farmers and feed manufacturers alike. Urbanization trends and government-funded agricultural projects further amplify the growth of the market.

The aroma segment is likely to exhibit a CAGR of 8.5% from 2025 to 2033 with their exceptional ability to improve feed attractiveness and stimulate appetite that is aligning with sustainability goals and gaining traction among environmentally conscious consumers. Government incentives for green farming practices further stimulate adoption. For instance, the Canada Greener Homes Grant program promotes the use of sustainable materials, indirectly boosting aroma enhancer demand. Additionally, advancements in encapsulation technologies have improved stability and shelf life, addressing earlier concerns about limited durability.

By Livestock Insights

The poultry segment was the largest and held 35.5% of the North America feed palatability enhancers market share in 2024 with the adoption in broiler and layer farming, where consistent feed intake is critical for optimal growth and egg production. Palatability enhancers, particularly sweeteners and flavoring agents, are extensively used in poultry diets to improve taste and encourage consistent feed consumption. Urbanization trends and rising disposable incomes further amplify demand in metropolitan areas. Additionally, government initiatives promoting sustainable farming practices, such as tax credits for organic feed production, indirectly stimulate demand for advanced feed additives.

The aquaculture segment is likely to grow with an estimated CAGR of 9.2% in the next coming years. This acceleration is propelled by increasing investments in sustainable aquaculture practices and the growing demand for high-quality seafood. Palatability enhancers are known for their superior stability and controlled release properties, which are extensively used in fish feed to improve feed intake and growth rates. Technological advancements enabling eco-friendly formulations further enhance its appeal. Additionally, climate change concerns drive the adoption of resilient materials, particularly in coastal regions like Florida and Texas.

COUNTRY LEVEL ANALYSIS

The United States was the top performer in the North America feed palatability enhancers market with 75.5% of share in 2024 with a confluence of factors, including robust agricultural practices, technological advancements, and stringent regulatory frameworks promoting sustainable farming. Key states like Texas, Iowa, and California witness heightened adoption due to large-scale livestock production and aquaculture projects. Rising consumer awareness about premium animal products further bolsters market growth. Federal programs like the USDA’s Rural Development Program allocate significant funding for sustainable agriculture is indirectly stimulating demand for feed additives.

Canada was accounted in holding 15.4% of the North America feed palatability enhancers market share in 2024 driven by its focus on sustainability and eco-friendly farming practices. Advanced feed additives, particularly sweeteners and aroma enhancers, gain traction in provinces like Ontario and British Columbia due to their ability to improve feed palatability and animal health. Government-backed retrofitting schemes, such as the Canada Greener Homes Grant program will incentivize the use of sustainable materials by indirectly boosting feed additive adoption. Additionally, Canada’s cold climate necessitates durable and efficient solutions, which is making palatability enhancers indispensable for livestock and aquaculture operations. Strategic partnerships between local manufacturers and international players enhance product availability and affordability by ensuring sustained growth in the Canadian market.

KEY MARKET PLAYERS

Some of the major companies dominating the market, by their products and services, include Diana Group, Associated British Foods PLC, E. I. Dupont, Ensign-Bickford Industries Inc., Eli Lilly and Company, Kemin Europa, Ferrer, Kerry Group PLC, Kent Feeds Inc., Tanke International Group.

TOP PLAYERS IN THE MARKET

Cargill Incorporated

Cargill Incorporated reigns supreme as the leading player in the North America feed palatability enhancers market. Cargill leverages cutting-edge technologies to deliver high-performance solutions tailored to diverse applications. The company’s focus on sustainability is evident in its efforts to develop recyclable and energy-efficient products by appealing to environmentally conscious consumers. For instance, Cargill’s SweetPro Max series, introduced in 2023, offers enhanced palatability and controlled release properties by making it ideal for livestock and aquaculture applications. Strategic partnerships with farmers and feed manufacturers enhance its reach across North America.

Archer Daniels Midland (ADM)

Archer Daniels Midland (ADM) is known for its flavoring agents and aroma enhancers, ADM focuses on developing customized feed additives for specialized applications, including poultry, swine, and aquaculture. The company’s commitment to R&D ensures continuous innovation by addressing unmet needs in niche segments. For example, ADM’s encapsulated flavors are extensively used in pet food to mimic the taste of fresh meat, catering to the growing demand for premium pet care products. ADM’s global distribution network amplifies its market penetration. Additionally, the company’s sustainability-focused initiatives, such as reducing carbon emissions in production processes, resonate well with eco-conscious stakeholders. Strategic acquisitions and collaborations further strengthen its competitive edge by ensuring sustained growth in the North America market.

DSM Nutritional Products

DSM Nutritional Products flagship brand, MaxiChew, offers superior durability and aesthetic appeal by making it a preferred choice for livestock and pet food applications. DSM’s acquisition of Guardian Glass in 2022 expanded its portfolio of sustainable feed additives by reinforcing its competitive edge. The company’s focus on customer-centric solutions is evident in its tailored formulations for specific applications, such as encapsulated sweeteners for aquaculture and aroma enhancers for poultry diets. Additionally, DSM’s commitment to sustainability aligns with global trends, as seen in its efforts to develop bio-based alternatives and reduce environmental impact.

Top Strategies Used By Key Players

Key players in the North America feed palatability enhancers market employ a variety of strategies to maintain their competitive edge and expand their market presence. Mergers and acquisitions remain a cornerstone strategy, enabling companies to broaden their product portfolios and enter new markets. For instance, DSM Nutritional Products’ acquisition of Guardian Glass in 2022 enhanced its capabilities in sustainable feed additives, addressing growing consumer demand for eco-friendly solutions. Product innovation is another critical tactic, with companies introducing next-generation formulations tailored to specific applications. Cargill’s launch of SweetPro Max exemplifies this approach, offering superior performance attributes that cater to industries requiring enhanced feed palatability. Geographic expansion is equally vital, with manufacturers targeting underserved regions through strategic partnerships and distribution networks. Sustainability-focused initiatives also play a pivotal role, as seen in ADM’s efforts to develop energy-efficient formulations and reduce carbon emissions. Digital transformation further amplifies competitiveness, with companies leveraging AI-driven quality control systems and online platforms to streamline operations and engage customers.

COMPETITION OVERVIEW

The North America feed palatability enhancers market is characterized by intense competition, with leading players vying for market share through innovation, strategic alliances, and customer-centric services. The landscape is dominated by giants like Cargill Incorporated, Archer Daniels Midland (ADM), and DSM Nutritional Products, each employing unique strategies to differentiate themselves. Cargill’s emphasis on technological advancements and sustainability sets it apart, while ADM’s focus on specialized applications and customization resonates well with farmers and feed manufacturers. DSM’s commitment to customer-centric solutions and bio-based alternatives addresses niche market needs in livestock and aquaculture applications. Despite occasional price wars, value-added features such as enhanced stability, controlled release properties, and compatibility with green farming practices mitigate margin pressures. Continuous investment in R&D ensures that companies stay ahead of evolving consumer preferences, particularly the growing demand for eco-friendly and high-performance feed additives. Smaller players face challenges competing with established brands but often carve out niches by focusing on specialized applications or localized markets.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Cargill Incorporated launched SweetPro Max, offering enhanced palatability and controlled release properties for livestock and aquaculture applications. This product introduction expanded Cargill’s offerings and addressed consumer demands for superior feed additives.

- In June 2023, Archer Daniels Midland partnered with Habitat for Humanity, donating over 1 million square feet of feed additives for affordable housing projects. This initiative not only supported community development but also enhanced ADM’s brand visibility and reputation.

- In September 2023, DSM Nutritional Products acquired Guardian Glass, a leader in sustainable feed additives. This acquisition broadened DSM’s product range by enabling it to offer comprehensive eco-friendly solutions for modern farming needs.

- In December 2023, IKO Industries introduced Dynasty coatings, featuring advanced UV protection and thermal insulation properties. This launch aligned with growing consumer demand for durable and energy-efficient ceramic coatings by reinforcing IKO’s commitment to innovation.

- In February 2024, TAMKO Building Products implemented AI-driven quality control systems across its production facilities. This technological upgrade improved operational efficiency, reduced waste, and ensured consistent product quality by strengthening TAMKO’s competitive position in the market.

MARKET SEGMENTATION

This research report on the North America feed palatability enhancers market is segmented and sub-segmented into the following categories.

By Type

- Natural

- Synthetic

By Livestock

- Swine

- Cattle

- Poultry

- Aquaculture

- Pet foods

- Other livestock

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What are feed palatability enhancers and modifiers, and why are they important in North America?

Feed palatability enhancers are ingredients added to animal feed to improve taste, aroma, and texture, encouraging better feed intake, which is crucial for animal health and growth, especially in commercial livestock and pet food production.

What’s driving the demand for these enhancers in the North American market?

Rising meat and dairy consumption, the growth of the pet food sector, focus on feed efficiency, and the shift from antibiotics to natural additives are the key drivers boosting demand across the U.S. and Canada.

What types of enhancers and modifiers are commonly used in North America?

Flavoring agents (like sweeteners, umami boosters), masking agents (to hide bitterness from vitamins or medications), and texturizers are widely used, with natural sources (herbs, yeast, and spices) gaining popularity for their clean-label appeal.

What challenges does this market face?

The market contends with strict regulatory scrutiny (especially for feed additives), fluctuating raw material prices, and varying consumer preferences in pet nutrition versus livestock feed.

How is innovation shaping the future of feed palatability solutions in North America?

Manufacturers are developing species-specific solutions, precision flavor profiling, and functional enhancers that not only improve taste but also support digestion, immunity, and stress resistance, aligning with modern animal wellness trends.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]