North America Facilities Management Market Size, Share, Trends & Growth Forecast Report By Service Type (Hard Services, Soft Services), Industry Vertical (Healthcare, Government, Education, Military & Defense, Real Estate), and Country (US, Canada, Mexico) Industry Analysis From 2025 to 2033.

North America Facilities Management Market Size

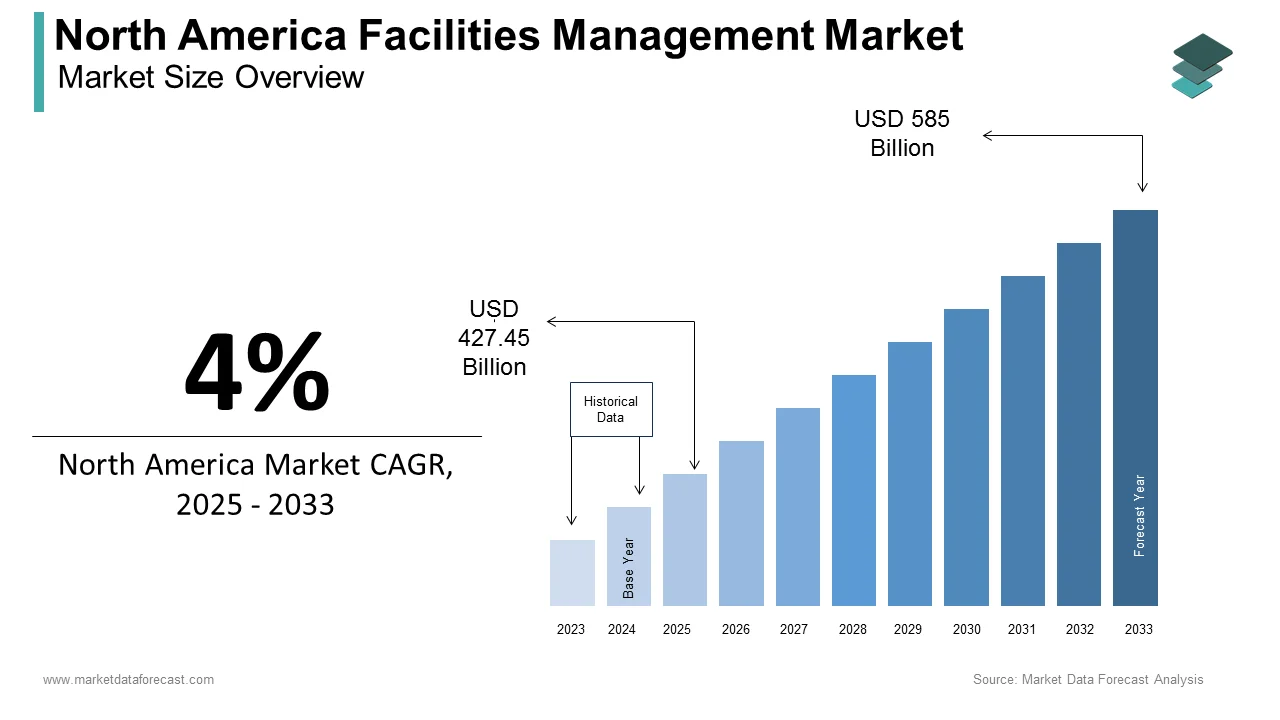

The facilities management market size in north america was valued at USD 411.01 billion in 2024. The North American market is estimated to be worth USD 585 billion by 2033 from USD 427.45 billion in 2025, growing at a CAGR of 4% from 2025 to 2033.

North American facilities management is an integration of various disciplines, including maintenance, operations, and project management, to ensure that facilities meet the needs of their occupants while adhering to regulatory standards. Facilities management is increasingly recognized as a strategic function that contributes to organizational performance, employee satisfaction, and sustainability initiatives.

In recent years, the importance of facilities management has been underscored by the growing emphasis on workplace wellness and environmental stewardship. For instance, a study by the Global Wellness Institute indicates that the wellness economy in North America is projected to reach $1.2 trillion by 2024 with the increasing focus on creating healthier work environments. Furthermore, according to the U.S. Green Building Council, buildings that prioritize sustainability can reduce energy consumption by up to 30%, thereby not only lowering operational costs but also enhancing the overall quality of life for occupants.

The market is also influenced by technological advancements, with the integration of smart building technologies and Internet of Things (IoT) solutions becoming more prevalent. A report from the International Facility Management Association reveals that 70% of facility managers are now utilizing technology to improve operational efficiency. The North American facilities management market is poised for significant growth and transformation as organizations continue to adapt to changing workforce dynamics and environmental challenges.

MARKET DRIVERS

Increasing Demand for Outsourced Facility Management Services

The North American facilities management market is significantly driven by the rising demand for outsourced facility management services. Organizations are increasingly recognizing the benefits of outsourcing these functions to enhance operational efficiency and allow them to concentrate on their core business activities. According to the U.S. Bureau of Labor Statistics, employment in the facilities management sector is projected to grow by 6% from 2020 to 2030 by indicating a robust need for skilled professionals in this field. This trend reflects a broader shift towards strategic partnerships, where companies leverage external expertise to optimize their facilities, reduce costs, and improve service delivery. The outsourcing of facility management services is becoming a prevalent strategy as businesses seek to streamline operations.

Emphasis on Sustainability and Energy Efficiency

Another major driver of the North American facilities management market is the increasing emphasis on sustainability and energy efficiency. The U.S. Department of Energy reports that energy-efficient buildings can achieve significant cost savings, with potential reductions in energy use ranging from 20% to 30%. This focus on sustainability is further amplified by the growing urbanization in North America, which necessitates effective management of facilities to accommodate rising populations and their associated needs. The organizations are now prioritizing green building practices and sustainable operations, not only to comply with regulatory requirements but also to enhance their corporate social responsibility profiles. The demand for facilities management services that prioritize energy efficiency and sustainability is expected to continue to rise.

MARKET RESTRAINTS

High Operational Costs

One of the significant restraints affecting the North American facilities management market is the high operational costs associated with maintaining and managing facilities. According to the U.S. General Services Administration, facility management costs can account for up to 30% of an organization’s total operating expenses. This financial burden can deter companies from investing in comprehensive facilities management solutions for small and medium-sized enterprises that may lack the necessary capital. Additionally, fluctuating costs of labor, materials, and compliance with regulatory standards can further exacerbate these expenses. The high operational costs present a considerable challenge that can limit market growth as organizations strive to balance cost management with the need for effective facilities management.

Workforce Shortages and Skill Gaps

Another critical restraint in the North American facilities management market is the ongoing workforce shortages and skill gaps within the market. The U.S. Bureau of Labor Statistics indicates that the facilities management sector is facing a significant talent shortage, with an estimated 1.5 million new jobs expected to be created by 2030. This shortage is compounded by an aging workforce, as many experienced professionals are retiring by leaving a gap in expertise. Furthermore, the rapid evolution of technology in facilities management necessitates a workforce that is not only skilled in traditional practices but also adept in modern technologies. The lack of adequately trained personnel can hinder the effectiveness of facilities management services by impacting the overall market growth.

MARKET OPPORTUNITIES

Integration of Smart Technologies

A significant opportunity in the North American facilities management market lies in the integration of smart technologies and automation. The adoption of Internet of Things (IoT) solutions and smart building systems can enhance operational efficiency and reduce costs. According to the U.S. Department of Energy, smart building technologies can lead to energy savings of up to 30% by optimizing energy use and improving system performance. The demand for facilities management services that incorporate these advanced technologies is expected to rise as organizations increasingly seek to leverage data analytics for better decision-making. This shift not only improves the sustainability of facilities but also enhances occupant comfort and productivity by creating a compelling case for investment in smart facilities management solutions.

Growing Focus on Health and Safety

The growing focus on health and safety in the workplace presents a substantial opportunity for the North American facilities management market. In the wake of the COVID-19 pandemic, organizations are prioritizing the implementation of health and safety protocols to ensure employee well-being. According to the Centers for Disease Control and Prevention (CDC), effective facility management practices can significantly reduce the risk of infectious disease transmission. The companies are increasingly investing in enhanced cleaning protocols, air quality management, and space reconfiguration to promote a safe working environment. This heightened awareness of health and safety not only drives demand for facilities management services but also encourages the adoption of innovative solutions that can address these critical concerns, thereby expanding market opportunities.

MARKET CHALLENGES

Regulatory Compliance and Standards

One of the major challenges facing the North American facilities management market is the complexity of regulatory compliance and standards. Facilities managers must navigate a myriad of federal, state, and local regulations, which can vary significantly across jurisdictions. The Occupational Safety and Health Administration (OSHA) enforces strict safety standards that facilities must adhere to, and non-compliance can result in substantial fines and legal repercussions. According to the National Safety Council, workplace injuries cost U.S. employers over $170 billion annually, underscoring the financial implications of regulatory failures. The evolving nature of regulations, particularly concerning environmental sustainability and health standards, adds further complexity by requiring facilities management professionals to stay informed and adaptable to maintain compliance and avoid penalties.

Cybersecurity Threats

Another significant challenge in the North American facilities management market is the increasing threat of cybersecurity breaches. As facilities become more reliant on digital technologies and IoT devices, they also become more vulnerable to cyberattacks. According to the Cybersecurity & Infrastructure Security Agency (CISA), critical infrastructure sectors, including facilities management, are prime targets for cybercriminals. In 2021, the FBI's Internet Crime Complaint Center received over 800,000 complaints of suspected cybercrime, with losses exceeding $6.9 billion. This growing threat necessitates that facilities management professionals invest in robust cybersecurity measures to protect sensitive data and operational systems. Failure to address these vulnerabilities can lead to significant financial losses, reputational damage, and operational disruptions by posing a considerable challenge for the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Service Type, Industry Vertical and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

The United States, Canada, and Rest of North America. |

|

Market Leader Profiled |

CBRE Group, Inc. (U.S.), Bouygues Energies & Services (Canada), Aramark (U.S.), Jones Lang LaSalle Incorporated (U.S.), Royalty General Construction (Canada), ABM Industries (U.S.), EMCOR Facilities Services (U.S.), GDI Integrated Facilities Services (Canada), Emeric Facility Services (U.S), SMI Facility Services (U.S.), Edon Properties Inc. (Canada), AHI Facility Services, Inc. (U.S.) MRI Software LLC (U.S.), Sodexo (France) |

SEGMENT ANALYSIS

By Service Type Insights

The hard services segment was the largest by capturing 60.3% of the North America facilities management market share. Hard services include essential maintenance functions such as HVAC, plumbing, electrical, and structural repairs. This segment is leading due to the critical nature of these services in ensuring operational efficiency and safety within facilities. According to the U.S. Energy Information Administration, buildings account for about 40% of total energy consumption in the United States with the importance of effective hard services in managing energy use and reducing operational costs.

The soft services segment is projected to grow at a CAGR of 8.5% from 2025 to 2033. Soft services are a range of non-core functions, including cleaning, security, landscaping, and waste management. This segment is expanding rapidly due to the increasing focus on workplace wellness and employee satisfaction. The Global Wellness Institute reports that companies investing in employee well-being can see a return of $3 for every $1 spent. The demand for soft services continues to rise as organizations prioritize creating healthier and more productive work environments is driving market growth.

By Industry Vertical Insights

The healthcare sector dominated the North America facilities management market by occupying 30.4% of share in 2024. This dominance is attributed to the critical need for maintaining safe, clean, and efficient healthcare environments. According to the Centers for Disease Control and Prevention (CDC), healthcare-associated infections affect 1 in 31 hospital patients on any given day by emphasizing the importance of effective facilities management in ensuring patient safety and compliance with health regulations. Additionally, the U.S. healthcare spending is projected to reach $6.2 trillion by 2028 that further boosts the vital role of facilities management in optimizing operational efficiency and patient care.

The education sector is swiftly emerging projected to grow at a compound annual growth rate (CAGR) of 9.2% from 2021 to 2028. This growth is driven by increasing investments in educational infrastructure and the rising demand for safe, conducive learning environments. The National Center for Education Statistics reports that public elementary and secondary school enrollment is expected to reach 50.1 million by 2029, necessitating enhanced facilities management to accommodate this growth. Furthermore, educational institutions are increasingly focusing on sustainability and energy efficiency, with the U.S. Green Building Council noting that green schools can reduce energy costs by 30% by making effective facilities management essential for meeting these goals.

REGIONAL ANALYSIS

United States facilities management market 80% of the total market share. This dominance is driven by the extensive infrastructure and diverse industries present in the country. According to the U.S. General Services Administration, the federal government alone manages over 370 million square feet of property, underscoring the critical need for effective facilities management. Additionally, the U.S. facilities management market is projected to reach $1.5 trillion by 2025, reflecting the increasing investments in technology and sustainability initiatives that enhance operational efficiency and workplace safety.

In Canada, the facilities management market is anticipated to grow steadily, with a projected CAGR of 6.5% from 2021 to 2028. The Canadian government is investing heavily in infrastructure development, with a commitment of CAD 180 billion over 12 years, which will enhance the demand for facilities management services. Additionally, the emphasis on sustainability and energy efficiency is gaining traction, as the Canadian government aims to reduce greenhouse gas emissions by 40-45% below 2005 levels by 2030, according to Environment and Climate Change Canada. This focus on sustainable practices will likely drive growth in both hard and soft services within the facilities management sector.

KEY MARKET PLAYERS

CBRE Group, Inc. (U.S.), Bouygues Energies & Services (Canada), Aramark (U.S.), Jones Lang LaSalle Incorporated (U.S.), Royalty General Construction (Canada), ABM Industries (U.S.), EMCOR Facilities Services (U.S.), GDI Integrated Facilities Services (Canada), Emeric Facility Services (U.S), SMI Facility Services (U.S.), Edon Properties Inc. (Canada), AHI Facility Services, Inc. (U.S.) MRI Software LLC (U.S.), Sodexo (France), and Others.

TOP LEADING PLAYERS IN THE MARKET

CBRE Group, Inc.

CBRE Group, Inc. is the largest commercial real estate services and investment firm globally, with a dominant presence in the North American facilities management market. The company offers an extensive range of services, including property management, project management, sustainability consulting, and integrated facilities management. CBRE leverages advanced technologies like IoT, AI, and data analytics to optimize facility operations, reduce energy consumption, and enhance workplace experiences, positioning itself as a leader in smart building solutions. It has committed to achieving net-zero carbon emissions across its managed properties by 2040, promoting green building certifications and renewable energy adoption. Operating in over 100 countries, CBRE manages more than 6.8 billion square feet of commercial space globally.

Jones Lang LaSalle Incorporated (JLL)

Jones Lang LaSalle Incorporated (JLL) is a leading player in the global facilities management market, offering end-to-end solutions such as property management, tenant representation, workplace strategy, and sustainability consulting. JLL integrates real estate, finance, and operational strategies to provide tailored facilities management services that maximize asset value and operational efficiency. The company has pledged to achieve net-zero carbon emissions from its operations and client-managed properties by 2040, actively promoting energy-efficient practices and renewable energy adoption. Through its subsidiary, JLL Technologies, it develops cutting-edge tools for predictive maintenance, space utilization, and energy management. With operations in over 80 countries and managing 5.7 billion square feet of real estate globally, JLL serves Fortune 500 companies, governments, and institutional investors, solidifying its position as a global leader.

Aramark

Aramark specializes in food services, facilities management, and uniform services, with a significant focus on maintaining workplaces, educational institutions, healthcare facilities, and sports venues. Its facilities management division provides diverse services, including cleaning, landscaping, security, and technical support, often bundled under single contracts to streamline operations. Aramark excels in niche markets such as healthcare and education, where it offers specialized FM solutions tailored to the unique needs of these industries. The company emphasizes employee well-being and engagement, enhancing service quality and client retention. With operations in 19 countries and serving over 2 billion customers annually, Aramark has demonstrated its capabilities in managing large-scale events like the Olympics and NFL games. Its commitment to sustainability, particularly in waste reduction and energy efficiency, further underscores its contributions to the global facilities management market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

-

Technology Integration and Digital Transformation

Key players in the North American facilities management market are heavily investing in technology to stay competitive and meet evolving client demands. Companies like CBRE and JLL are leveraging advanced technologies such as IoT, AI, and data analytics to optimize facility operations. These tools enable predictive maintenance, energy efficiency, and real-time monitoring of building systems, allowing for cost reductions and improved operational performance. For example, IoT sensors can detect equipment failures before they occur, minimizing downtime. Additionally, proprietary platforms developed by companies like JLL Technologies provide innovative solutions for space utilization, energy management, and workplace optimization. By embracing digital transformation, these players enhance their service offerings and position themselves as leaders in smart building solutions.

-

Sustainability and Green Initiatives

Sustainability has become a cornerstone strategy for facilities management companies aiming to strengthen their market position. CBRE and JLL have both committed to achieving net-zero carbon emissions across their managed properties by 2040, aligning with global environmental goals. These companies actively promote green building certifications such as LEED and WELL Building Standards to attract environmentally conscious clients. Energy efficiency programs, waste reduction initiatives, and renewable energy adoption are also central to their strategies. For instance, Aramark focuses on water conservation and sustainable practices in its operations, particularly in healthcare and education sectors. By prioritizing sustainability, these companies not only reduce their environmental impact but also appeal to clients seeking eco-friendly solutions.

-

Strategic Acquisitions and Partnerships

Strategic acquisitions and partnerships are critical for expanding service portfolios and entering new markets. Companies like CBRE and JLL frequently acquire smaller firms or niche players to bolster their capabilities. For example, CBRE has acquired several technology startups to enhance its digital offerings, while JLL has expanded its global footprint through acquisitions in Europe and Asia. Collaborations with tech firms are also common, enabling co-development of innovative FM solutions. Joint ventures with local firms help players enter emerging markets or industries, leveraging regional expertise. These strategies allow companies to diversify their services, increase market share, and remain competitive in a rapidly evolving market.

-

Focus on Integrated Facilities Management (IFM)

Integrated facilities management (IFM) is a key strategy used by companies to streamline operations and enhance efficiency. Players like CBRE, JLL, and Aramark offer bundled services that combine cleaning, security, HVAC maintenance, and other functions under a single contract. This approach simplifies operations for clients and reduces costs by eliminating the need to manage multiple vendors. Additionally, these companies tailor IFM solutions to specific industries, such as healthcare, education, and retail, addressing unique client needs. By providing comprehensive and customized services, they strengthen customer loyalty and differentiate themselves from competitors.

-

Expansion into Emerging Markets

Geographic expansion is a vital strategy for companies looking to diversify revenue streams and mitigate risks associated with reliance on a single market. While North America remains a core market, players like CBRE and JLL are aggressively expanding into emerging markets such as Asia-Pacific, Latin America, and Africa. These regions offer significant growth opportunities due to increasing urbanization and infrastructure development. To ensure seamless service delivery, companies standardize their operations across regions, enabling them to efficiently manage multinational clients’ facilities worldwide. This global presence not only boosts revenue but also enhances their reputation as international leaders in facilities management.

-

Emphasis on Employee Training and Engagement

Employee training and engagement are critical components of success in the facilities management market. Companies like Aramark place a strong emphasis on workforce development, ensuring employees are skilled in delivering high-quality services. Training programs focus on technical skills, safety protocols, and customer service excellence. Additionally, diversity and inclusion initiatives are prioritized by companies like CBRE and JLL, fostering innovation and improving organizational culture. By investing in their workforce, these companies enhance service quality, boost employee retention, and build stronger relationships with clients.

-

Client-Centric Approach

A client-centric approach is essential for maintaining long-term relationships and ensuring customer satisfaction. Key players invest in understanding client-specific requirements and designing tailored FM solutions. For example, Aramark provides specialized services for healthcare facilities, focusing on hygiene, infection control, and patient safety. Similarly, CBRE and JLL offer customized workplace experience solutions that enhance employee productivity and well-being. By securing long-term contracts and consistently delivering value-added services, these companies ensure stable revenue streams and strengthen their market position.

-

Innovation in Service Offerings

Innovation is at the heart of staying competitive in the facilities management market. Companies are constantly exploring new ways to enhance their service offerings. For instance, CBRE and JLL emphasize workplace experience management, offering services that improve employee productivity, well-being, and satisfaction. Remote monitoring and automation technologies are also being adopted to reduce reliance on manual labor and improve service reliability. By staying ahead of industry trends and continuously innovating, these players differentiate themselves and meet the growing demand for smarter, more efficient facilities management solutions.

-

Branding and Thought Leadership

Establishing a strong brand and thought leadership position is crucial for gaining trust and credibility in the market. Key players publish research reports, host webinars, and participate in industry conferences to showcase their expertise. For example, JLL’s annual Global Real Estate Transparency Index ensures its deep understanding of market trends. Corporate social responsibility (CSR) initiatives, such as community development and disaster relief efforts, further enhance their brand image.

-

Cost Optimization and Operational Efficiency

Cost optimization and operational efficiency are key strategies for maintaining profitability and competitiveness. Companies focus on streamlining internal processes and reducing overhead costs to offer competitive pricing without compromising service quality. Shared services models, where functions like procurement and HR are centralized, help achieve economies of scale. Lean operations, driven by automation and process improvements, further enhance efficiency. By optimizing costs and improving operational performance, these players ensure they remain attractive to budget-conscious clients while maintaining healthy profit margins.

COMPETITIVE LANDSCAPE

The North American facilities management (FM) market is characterized by intense competition, driven by the increasing demand for efficient, cost-effective, and sustainable solutions across industries such as commercial real estate, healthcare, education, and retail. Key players like CBRE Group, Inc., Jones Lang LaSalle (JLL), and Aramark dominate the landscape, leveraging their extensive service portfolios, technological innovations, and global reach to maintain their positions. These companies focus on integrated facilities management (IFM), offering bundled services such as cleaning, security, HVAC maintenance, and sustainability consulting to meet diverse client needs.

The competitive dynamics are further intensified by the growing adoption of smart technologies, including IoT, AI, and data analytics, which enable predictive maintenance, energy efficiency, and real-time monitoring. Sustainability has also emerged as a critical differentiator, with firms committing to net-zero carbon goals and promoting green building certifications like LEED and WELL. Strategic acquisitions, partnerships, and geographic expansion into emerging markets are additional strategies employed to strengthen market presence and diversify revenue streams.

Smaller niche players and regional firms add to the competitive intensity by offering specialized services tailored to specific sectors or geographies. However, the dominance of large players is reinforced by their ability to scale operations, invest in innovation, and deliver consistent quality globally. As clients increasingly prioritize customizable, technology-driven, and eco-friendly FM solutions, competition in the North American market is expected to remain fierce, driving continuous innovation and value creation across the industry.

RECENT MARKET DEVELOPMENTS

- In February 2024, CBRE Group, Inc. announced a definitive agreement to acquire J&J Worldwide Services, a leading provider of engineering services, base support operations, and facilities maintenance for the U.S. federal government. This acquisition aims to enhance CBRE's technical services capabilities and expand its government client base within Global Workplace Solutions.

- In May 2021, CBRE Group, Inc. was assigned the responsibility of selling the embassy headquarters of Britain and Northern Ireland in Mexico City. This move demonstrated CBRE's involvement in significant real estate transactions in North America.

- In May 2022, mCloud Technologies Corp., a provider of AI-powered asset management and ESG solutions, signed a three-year contract with a global wind power developer operating in Europe. This contract ascribes to mCloud's expansion into the renewable energy sector, relevant to facilities management.

- In April 2022,S. Central Command extended a five-year contract with SOS International, valued at USD 17.9 million, to continue managing and maintaining secure facilities at Al-Udeid Airbase in Doha, Qatar, and MacDill Air Force Base in Tampa, Florida. This extension underscored SOS International's role in critical facilities management.

MARKET SEGMENTATION

This north america facilities management market research report is segmented and sub-segmented into the following categories.

By Service Type

- Hard Services

- Soft Services

- Other Services

By Industry Vertical

- Healthcare

- Government

- Education

- Military & Defense

- Real Estate

- Others

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What is the market size of the North America facilities management market?

The North America facilities management market was valued at USD 411.01 billion in 2024 and is projected to reach USD 585 billion by 2033, growing at a CAGR of 4% from 2025 to 2033.

2. What factors are driving the growth of the North America facilities management market?

The North America facilities management market is driven by the increasing demand for outsourced facility management services, rising emphasis on sustainability and energy efficiency, and the integration of smart building technologies.

3. What are the key challenges in the North America facilities management market?

The North America facilities management market faces challenges such as high operational costs, workforce shortages, regulatory compliance complexities, and cybersecurity threats due to digital transformation.

4. How does sustainability impact the North America facilities management market?

Sustainability is a major factor in the North America facilities management market, with energy-efficient buildings reducing costs by up to 30%. Green building practices and smart technologies are increasingly adopted to enhance sustainability.

5. Which industries contribute the most to the North America facilities management market?

The North America facilities management market serves industries such as healthcare, government, education, military & defense, and real estate, with each sector demanding specialized facility management services.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]