North America Eyewear Market Size, Share, Trends & Growth Forecast Report By Product Type (Spectacles, Sunglasses, Contact Lenses), Sales Channel, End-User and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Eyewear Market Size

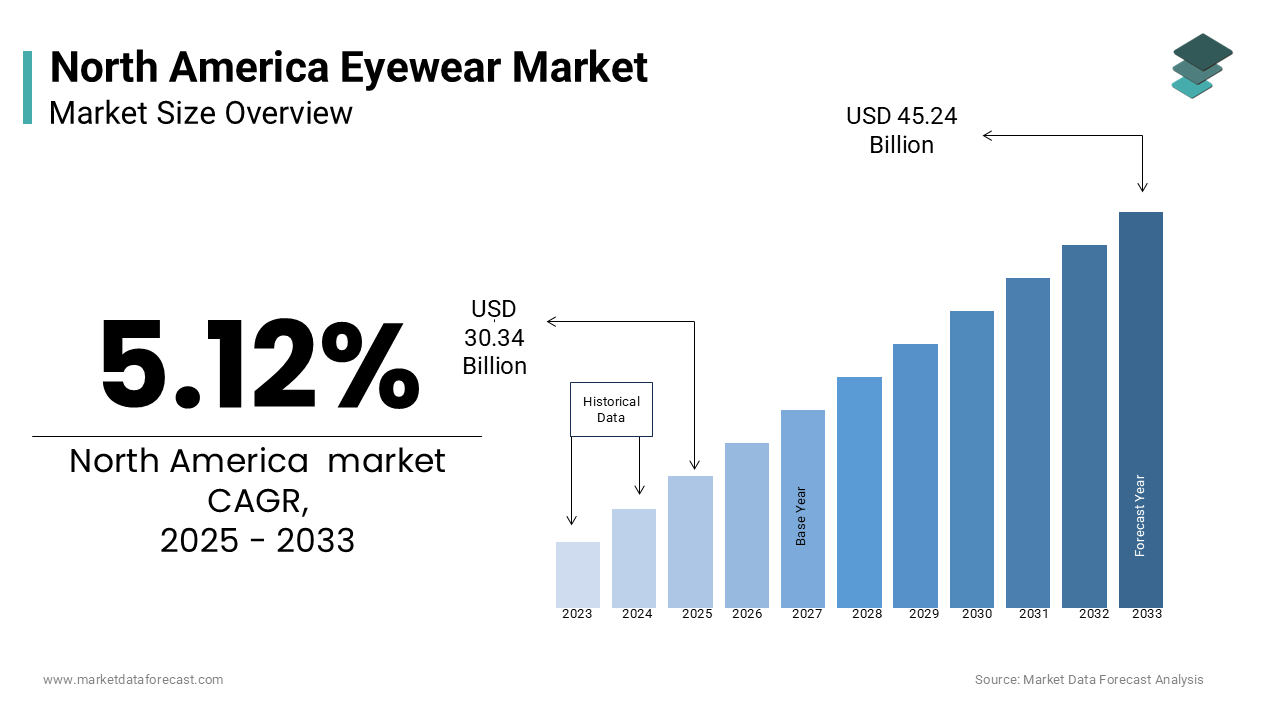

The North America eyewear market was worth USD 28.86 billion in 2024. The North American market is estimated to grow at a CAGR of 5.12% from 2025 to 2033 and be valued at USD 45.24 billion by the end of 2033 from USD 30.34 billion in 2025.

The North American eyewear market represents a dynamic and evolving segment within the broader consumer goods industry, encompassing prescription glasses, sunglasses, contact lenses, and related accessories. Eyewear in this region is not merely a functional necessity for vision correction but has also emerged as a significant fashion statement, reflecting personal style and cultural trends. The United States and Canada, as key contributors to this market that exhibit a high penetration of eyewear usage driven by increasing awareness of eye health, aging populations, and the growing prevalence of digital screen use. According to the Vision Council of America, nearly 75% of adults in the U.S. require some form of vision correction, underscoring the widespread reliance on eyewear products. Furthermore, the American Academy of Ophthalmology reports that over 40% of Americans experience symptoms of digital eye strain is fueling demand for specialized lenses designed to mitigate such issues.

In addition to functionality, the aesthetic appeal of eyewear continues to gain prominence, with consumers increasingly viewing glasses as an extension of their identity. A study by the National Institutes of Health shown that millennials and Gen Z are particularly inclined toward purchasing multiple pairs of eyewear to complement varying outfits and occasions. This shift in consumer behavior escalates the dual role of eyewear as both a medical device and a fashion accessory. Moreover, environmental concerns are shaping the market landscape, as evidenced by a report from the Environmental Protection Agency emphasizing the need for sustainable materials in eyewear production.

MARKET DRIVERS

Increasing Prevalence of Vision Disorders

The rising incidence of vision-related disorders is a significant driver propelling the North American eyewear market. According to the Centers for Disease Control and Prevention, approximately 11 million Americans aged 12 years and older require some form of vision correction is the widespread need for eyewear solutions. Additionally, the National Eye Institute reports that conditions such as myopia and hyperopia are becoming increasingly common, with myopia alone affecting nearly 42% of the U.S. population. Aging demographics further exacerbate this trend, as individuals over the age of 40 are more prone to presbyopia, a condition that affects near vision. The U.S. Census Bureau projects that by 2030, all baby boomers will be older than 65, significantly expanding the demographic reliant on corrective eyewear. This growing prevalence of vision impairments amplifies the necessity for accessible and innovative eyewear products tailored to diverse consumer needs.

Growing Awareness of Eye Health and Preventive Care

A heightened focus on eye health and preventive care is another pivotal factor driving the North American eyewear market. The American Optometric Association emphasizes that regular eye exams play a critical role in early detection and management of ocular conditions by encouraging consumers to invest in quality eyewear. Data from the National Institutes of Health reveals that nearly 61 million adults in the United States are at high risk for serious vision loss, yet only half of them have had a comprehensive eye exam in the past year. This gap in eye care utilization has spurred campaigns by government agencies and healthcare organizations to promote routine check-ups, indirectly boosting demand for prescription glasses and lenses. Furthermore, the rise in digital device usage has led to increased awareness of blue light exposure risks, prompting many consumers to seek protective eyewear.

MARKET RESTRAINTS

High Cost of Eyewear and Accessibility Challenges

The affordability and accessibility of eyewear remain significant restraints in the North American market for low-income populations. The U.S. Bureau of Labor Statistics reports that the average cost of prescription eyeglasses ranges from 150to350, while designer frames and specialized lenses can exceed $500. For many households, this represents a substantial financial burden, especially considering that the U.S. Census Bureau identifies approximately 11% of Americans living below the poverty line. Furthermore, the National Health Interview Survey indicates that nearly 8% of adults in the United States delayed or did not purchase needed eyewear due to cost concerns in recent years. Rural communities face additional challenges due to a shortage of eye care professionals in these areas that is limiting access to affordable vision care services.

Limited Insurance Coverage for Vision Care

Inadequate insurance coverage for vision care acts as another major restraint in the North American eyewear market. The Centers for Disease Control and Prevention notes that only about 34% of Americans have access to comprehensive vision insurance, leaving a significant portion of the population to bear out-of-pocket expenses for eyewear. The Kaiser Family Foundation further reveals that even among those with health insurance, vision benefits are often limited, covering only basic exams and offering minimal allowances for frames or lenses. This lack of robust coverage disproportionately affects children and elderly populations, who are more likely to require frequent updates to their prescriptions. According to the American Academy of Ophthalmology, untreated vision problems can lead to long-term health and economic consequences, including reduced productivity and increased healthcare costs.

MARKET OPPORTUNITIES

Expansion of Telehealth and Virtual Eye Care Services

The integration of telehealth into eye care presents a transformative opportunity for the North American eyewear market. According to the U.S. Department of Health and Human Services, telehealth adoption surged by over 63% during the pandemic, with virtual eye exams gaining traction as a convenient alternative to in-person visits. This shift is supported by the Centers for Disease Control and Prevention, which emphasizes the potential of telehealth to address barriers such as transportation and time constraints in underserved areas. Furthermore, the Federal Communications Commission reports that approximately 93% of Americans have access to high-speed internet, enabling widespread adoption of digital eye care platforms. These advancements allow eyewear retailers to offer personalized recommendations and streamline prescription updates that is by enhancing customer convenience. Companies can expand their reach among tech-savvy millennials and Gen Z consumers by fostering growth in online sales and subscription-based lens replacement programs.

Rising Demand for Sustainable and Eco-Friendly Eyewear

The growing consumer preference for sustainable products offers a significant opportunity for innovation in the North American eyewear market. The Environmental Protection Agency estimates that over 300 million pairs of glasses are discarded annually in the United States alone, contributing to landfill waste. In response, the National Institutes of Health advocates for the development of eco-friendly materials, such as biodegradable acetate and recycled plastics, to reduce environmental impact. A survey conducted by the Pew Research Center reveals that 72% of U.S. adults consider sustainability when making purchasing decisions, with younger generations driving this trend. Additionally, the U.S. Department of Commerce notes that the global green eyewear segment is projected to grow significantly as brands adopt transparent supply chains and carbon-neutral manufacturing practices.

MARKET CHALLENGES

Counterfeit Products and Intellectual Property Concerns

The proliferation of counterfeit eyewear poses a significant challenge to the North American market, undermining brand integrity and consumer trust. The U.S. Department of Commerce estimates that counterfeit goods account for approximately 2.5% of global trade, with eyewear being one of the most commonly replicated products. These unauthorized replicas often fail to meet safety and quality standards, posing risks to eye health. The Food and Drug Administration warns that counterfeit lenses and frames may contain harmful materials, such as unregulated coatings or low-grade plastics, which can cause skin irritation or vision impairment. Furthermore, the International Trade Commission reports that businesses in the United States lose billions annually due to intellectual property violations, stifling innovation and investment in authentic product development. This issue is exacerbated by the rise of e-commerce platforms, where counterfeit sellers exploit lax oversight is making it difficult for consumers to distinguish genuine products from fraudulent ones.

Regulatory Compliance and Manufacturing Complexity

Stringent regulatory requirements and the complexity of manufacturing processes present notable challenges for the North American eyewear market. The U.S. Food and Drug Administration mandates rigorous testing and certification for all corrective lenses and prescription eyewear, ensuring they meet optical and safety standards. According to the National Institute of Standards and Technology, compliance with these regulations often increases production costs and extends time-to-market for new innovations. Additionally, the Occupational Safety and Health Administration emphasizes the need for safe manufacturing practices, particularly in facilities producing plastic or metal frames, where workers are exposed to hazardous materials. According to the Environmental Protection Agency, manufacturers must also adhere to strict waste management protocols, further complicating operations. These regulatory burdens disproportionately affect smaller players, limiting their ability to compete with larger, well-established brands and stifling market dynamism.

SEGMENTAL ANALYSIS

By Product Type Insights

The spectacles segment dominated the North American eyewear market with significant share in 2024 owing to the widespread prevalence of vision correction needs, with the National Eye Institute estimating that over 150 million Americans require corrective lenses. The aging population further amplifies demand, as the U.S. Census Bureau projects a significant increase in individuals over 40, who are more prone to presbyopia. Spectacles remain indispensable due to their dual functionality by offering both vision correction and protection against digital eye strain. Their affordability compared to alternatives like contact lenses also contributes to their dominance by ensuring accessibility for diverse consumer groups.

The contact lenses segment is likely to grow with a CAGR of 7.2% during the forecast period. This rapid expansion is driven by advancements in lens technology, including daily disposables and extended-wear options, which cater to convenience and hygiene preferences. According to the American Optometric Association, nearly 45 million Americans use contact lenses, with younger demographics favoring them for aesthetic and active lifestyles. Additionally, the rise in myopia among children was reported by the National Institutes of Health, has spurred demand for pediatric contact lenses.

By Sales Channel Insights

The retail stores was the largest in holding the dominant share of the North American eyewear market in 2024. This segment's leadership stems from its ability to provide personalized customer experiences by allowing consumers to try on frames and receive expert advice from opticians. According to the National Retail Federation, physical stores remain a preferred choice for eyewear purchases due to the tactile nature of selecting glasses and lenses. Additionally, retail chains often partner with vision insurance providers by making them accessible and convenient for insured customers.

The online stores segment is likely to gain traction with a CAGR of 12.5% during the forecast period. This rapid expansion is fueled by increasing internet penetration, with the Federal Communications Commission reporting that over 93% of Americans have access to high-speed broadband. The convenience of browsing extensive collections, competitive pricing, and virtual try-on technologies has attracted tech-savvy consumers, particularly millennials and Gen Z. A study by the Pew Research Center reveals that 80% of U.S. adults shop online, with eyewear emerging as a popular category. The rise of subscription-based lens replacement services further accelerates this trend.

By End User Insights

The women segment dominated the North American eyewear market by accounting for 55.3% during the forecast period with the higher purchasing power and a greater emphasis on eyewear as both a functional necessity and a fashion accessory. According to the U.S. Census Bureau, women are more likely to prioritize health and wellness, including routine eye exams that is driving demand for prescription glasses and sunglasses. Additionally, women’s inclination toward owning multiple pairs for different occasions amplifies consumption. This segment's importance lies in its influence on design trends and premium product adoption by making it a key target for brands aiming to maximize profitability.

The children’s segment is anticipated to witness a CAGR of 7.8% during the forecast period. This growth is fueled by rising cases of myopia among children, with the National Eye Institute reporting a 66% increase in myopia prevalence over the past few decades. Prolonged screen time and limited outdoor activities are significant contributors, as noted by the American Academy of Pediatrics. Furthermore, increasing parental awareness about pediatric eye care drives demand for durable, stylish, and affordable eyewear for younger demographics. This segment’s rapid expansion escalates the need for innovative products tailored to children by ensuring early intervention and long-term vision health while presenting lucrative opportunities for manufacturers.

REGIONAL ANALYSIS

The United States dominated the North American eyewear market with 86.4% of the share in 2024 due to its large population, with over 330 million people, and a high prevalence of vision disorders, such as myopia and presbyopia, according to the Centers for Disease Control and Prevention. The presence of major eyewear brands and advanced healthcare infrastructure further solidifies its dominance. According to the National Institutes of Health, over 60% of Americans wear corrective lenses, creating a robust demand for both prescription and non-prescription eyewear. The U.S. market’s importance lies in its ability to set global trends, influence innovation, and serve as a hub for technological advancements in lens and frame design.

Canada is swiftly emerging with an estimated CAGR of 5.2% during the forecast period. This growth is fueled by an aging population, with the Canadian Census Bureau projecting that seniors will account for nearly 25% of the population by 2030 by increasing demand for corrective eyewear. Rising awareness about eye health, coupled with government initiatives promoting affordable vision care under the Canada Health Act, further accelerates adoption. The Public Health Agency of Canada emphasizes that digital screen usage among Canadians has surged by 40% in recent years by contributing to higher cases of digital eye strain.

KEY MARKET PLAYERS

Luxottica Group S.p.A., EssilorLuxottica, Johnson & Johnson Vision Care, Inc., The Cooper Companies Inc., Bausch Health Companies Inc., Safilo Group S.p.A., National Vision Holdings, Inc., Visionworks of America, Inc., Warby Parker, Zenni Optical, Marchon Eyewear Inc., Marcolin S.p.A., Carl Zeiss AG, and Ray-Ban are key market players in the North America eyewear market.

Top Key players in the market

Luxottica Group S.p.A.

Luxottica Group S.p.A. has long been a cornerstone of the North American eyewear market, renowned for its unparalleled portfolio of luxury and mainstream eyewear brands. As a pioneer in blending fashion with functionality, Luxottica owns iconic labels such as Ray-Ban, Oakley, and Persol, which have become synonymous with style and quality. The company’s vertical integration model, encompassing design, manufacturing, and retail, allows it to maintain strict control over product quality and pricing. Luxottica’s influence extends beyond North America, shaping global trends through collaborations with high-end fashion houses like Chanel and Prada.

EssilorLuxottica

EssilorLuxottica represents a powerhouse in the global eyewear market, born from the merger of two industry giants: Essilor, a leader in lens technology, and Luxottica, a trailblazer in frames and sunglasses. This synergy has created an unparalleled entity capable of addressing the entire spectrum of vision care needs. EssilorLuxottica’s contribution to the North American market is marked by its commitment to advancing optical technology, including progressive lenses and anti-glare coatings, while maintaining a strong presence in fashionable eyewear.

Johnson & Johnson Vision Care, Inc.

Johnson & Johnson Vision Care, Inc. stands out as a key contributor to the North American eyewear market, particularly in the contact lens segment. With its flagship brand Acuvue, the company has revolutionized the way consumers perceive vision correction, offering innovative solutions like daily disposable lenses and UV-blocking technologies. Johnson & Johnson’s emphasis on research and development has enabled it to address unmet needs, such as lenses designed for digital device users experiencing eye strain. Beyond its product innovations, the company plays a crucial role in promoting eye health awareness through educational campaigns and partnerships with healthcare professionals.

Top strategies used by the key players in the market:

Strategic Collaborations and Partnerships

Key players in the North American eyewear market have increasingly turned to strategic collaborations and partnerships to bolster their market presence. By teaming up with fashion designers, tech companies, and healthcare providers, eyewear manufacturers can tap into new consumer segments and enhance product innovation. For instance, partnerships with luxury fashion brands allow companies to create exclusive collections that appeal to style-conscious buyers, while alliances with technology firms enable the integration of smart features into lenses and frames. These collaborations not only expand the product portfolio but also reinforce brand credibility and customer loyalty.

Focus on Sustainability and Eco-Friendly Solutions

Sustainability has emerged as a cornerstone strategy for key players aiming to strengthen their position in the North American eyewear market. Companies are increasingly adopting eco-friendly materials, such as bio-acetate, recycled plastics, and sustainable metals, to address growing consumer demand for environmentally responsible products. Beyond material innovation, many brands are implementing recycling programs, encouraging customers to return old eyewear for proper disposal or repurposing. This focus on sustainability aligns with broader societal trends toward environmental consciousness and positions these companies as leaders in corporate social responsibility.

Investment in Digital Transformation and E-Commerce

Digital transformation has become a pivotal strategy for eyewear companies seeking to solidify their foothold in the competitive North American market. The rise of e-commerce platforms and virtual try-on technologies has enabled brands to reach a broader audience while offering personalized shopping experiences. Key players are investing heavily in user-friendly websites and mobile apps, allowing customers to browse, customize, and purchase eyewear from the comfort of their homes. Additionally, advancements in telehealth have facilitated virtual eye exams and remote prescription updates, streamlining the purchasing process. This shift toward digitalization not only enhances customer convenience but also strengthens the brand’s adaptability in an ever-evolving market landscape.

RECENT MARKET DEVELOPMENTS

- In September 2024, Marchon Eyewear Inc. partnered with Canada Goose through an exclusive global licensing agreement to design, produce, and distribute eyewear.

- In December 2024, Johnson & Johnson Vision Care appointed Shawn Millerick as President of Vision Care Americas. This leadership change aims to strengthen the company's strategic growth and market share in North America.

- In January 2025, Safilo Group reported a 2.3% decline in net sales for 2024, primarily due to challenges in the North American sunglasses and sports eyewear segments. This performance review may lead to strategic adjustments to regain market momentum.

- In February 2025, EssilorLuxottica announced a 6% revenue growth for 2024, with North America being a significant contributor. This growth reinforces the company’s dominant position in the region's eyewear market.

- In February 2025, Bausch + Lomb reported an increase in Vision Care segment revenue, reaching $2.739 billion for 2024, compared to $2.543 billion in 2023. This growth indicates an expanding market share in North America.

- In February 2025, National Vision Holdings reported a 3.9% increase in net revenue for Q4 2024, amounting to $437.3 million. This revenue boost escalates the company’s strengthening position.

- In February 2025, Warby Parker announced plans to open 45 new stores, including five shop-in-shops at select Target locations across multiple states. This expansion is expected to increase accessibility and enhance brand presence in North America.

- In March 2025, Zenni Optical received the Mobile & Social Optimization Award at the 2024 Brand Experience Awards by Retail Touchpoints. This recognition amplifies the company’s efforts to enhance customer engagement and experience in North America.

- In March 2025, Ray-Ban and Meta reported a 210% year-over-year surge in global smart glasses shipments, driven by their collaboration. This surge reflects a growing consumer adoption of smart eyewear in North America.

- In March 2025, Visionworks expanded its retail presence to 773 locations, adding 28 new stores, with a focus on California and Washington state. This expansion strengthens Visionworks’ footprint in the North American eyewear retail sector.

MARKET SEGMENTATION

This research report on the North American eyewear market is segmented and sub-segmented based on categories.

By Product Type

- Spectacles

- Sunglasses

- Contact Lenses

By Sales Channel

- Retail Stores

- Online Store

- Ophthalmic Clinics

By End User

- Men

- Women

- Children

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What are the latest trends in the North America eyewear market?

The rise of blue light-blocking glasses, smart eyewear (AR/VR glasses), sustainable and eco-friendly eyewear, and the growing adoption of direct-to-consumer (DTC) brands.

What is the future growth projection for the North America eyewear market?

The market is expected to grow at a CAGR of 4-6% in the coming years, driven by rising vision disorders, technological advancements, and increasing online sales.

What are the key factors driving the North America eyewear market?

Factors include increasing screen time, aging population, rising cases of myopia and presbyopia, growth in disposable income, and advancements in eyewear technology.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]