North America Enterprise Resource Planning (ERP) Market Size, Share, Trends & Growth Forecast Report By Deployment (On-Premises, Cloud, Hybrid), Type, Application, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2024 to 2033

North America Enterprise Resource Planning (ERP) Market Size

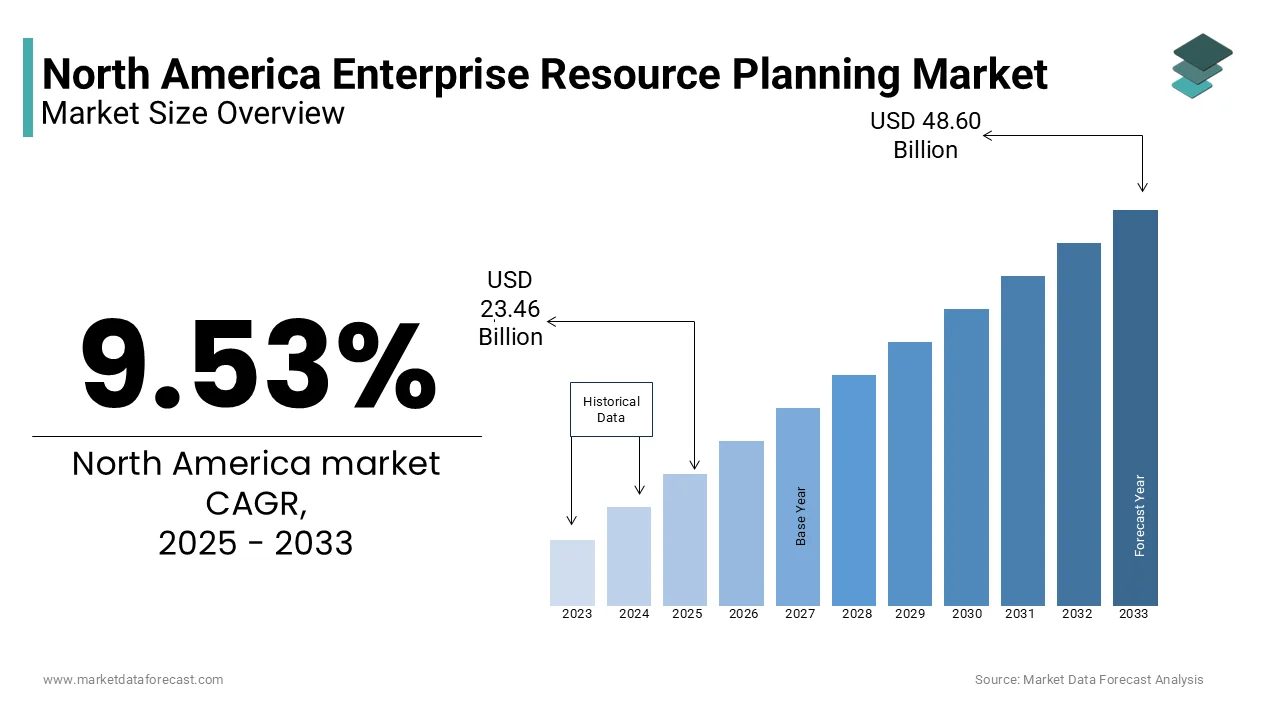

The North America Enterprise Resource Planning (ERP) market size was valued at USD 21.42 billion in 2024. The European market is estimated to be worth USD 48.60 billion by 2033 from USD 23.46 billion in 2025, growing at a CAGR of 9.53% from 2025 to 2033.

Enterprise resource planning (ERP) is a suite of integrated applications designed to manage and automate core business processes across various industries. ERP systems facilitate the flow of information between all business functions, providing a unified platform for data management, reporting, and decision-making. These systems typically include modules for finance, human resources, supply chain management, customer relationship management, and manufacturing, among others. The increasing complexity of business operations and the need for real-time data access have driven the adoption of ERP solutions among organizations of all sizes. This growth is fueled by the rising demand for cloud-based ERP solutions, which offer scalability, flexibility, and cost-effectiveness. As businesses continue to seek ways to enhance operational efficiency and improve decision-making, the ERP market in North America is poised for significant expansion, driven by technological advancements and evolving business needs.

MARKET DRIVERS

Increasing Demand for Cloud-Based Solutions

The growing demand for cloud-based ERP solutions is a significant driver of the North America Enterprise Resource Planning (ERP) market. As organizations increasingly migrate their operations to the cloud, they seek ERP systems that offer flexibility, scalability, and reduced IT overhead. According to a report by Gartner, the public cloud services trade around the world is expected to reach $397 billion by 2022, with cloud-based ERP solutions accounting for a substantial portion of this growth. The advantages of cloud ERP, such as lower upfront costs, automatic updates, and remote accessibility, make it an attractive option for businesses looking to streamline their operations. Also, the COVID-19 pandemic has accelerated the shift to remote work, further emphasizing the need for cloud-based solutions that enable collaboration and data access from anywhere. Since organizations prioritize digital transformation and seek to enhance operational efficiency, the demand for cloud-based ERP solutions is expected to continue driving growth in the North America ERP market.

Focus on Operational Efficiency and Cost Reduction

The increasing focus on operational efficiency and cost reduction is another key driver propelling the North America Enterprise Resource Planning (ERP) market. Organizations are continually seeking ways to optimize their processes, reduce waste, and improve productivity. As per a survey conducted by the Aberdeen Group, companies that implement ERP systems experience an average of 22% improvement in operational efficiency. ERP solutions provide organizations with real-time visibility into their operations, enabling them to identify bottlenecks, streamline workflows, and make data-driven decisions. Furthermore, the integration of various business functions within a single platform reduces the need for disparate systems, leading to lower operational costs and improved collaboration. Because businesses strive to remain competitive in an increasingly challenging economic environment, the emphasis on operational efficiency and cost reduction will continue to drive the adoption of ERP solutions in North America.

MARKET RESTRAINTS

High Implementation Costs

High implementation costs related to ERP systems is one of the primary restraints derailing the growth trajectory of the North America Enterprise Resource Planning (ERP) market. The initial investment required for software licenses, hardware, and consulting services can be substantial, often deterring organizations, particularly small and medium-sized enterprises (SMEs), from adopting ERP solutions. Based on a report by Panorama Consulting Solutions, the average cost of implementing an ERP system can range from $150,000 to $1 million is depending on the size and complexity of the organization. Additionally, the ongoing costs related to maintenance, upgrades, and training can further strain budgets. This financial barrier can lead to a slower rate of ERP adoption among SMEs, limiting their ability to compete effectively in the market.

Complexity of Implementation and Change Management

Another significant restraint impacting the North America Enterprise Resource Planning (ERP) market is the complexity of implementation and the challenges associated with change management. Implementing an ERP system often requires significant changes to existing business processes, which can lead to resistance from employees and disruptions to operations. A study by the Harvard Business Review states that approximately 70% of change initiatives fail due to employee resistance and lack of engagement. The difficulties of integrating ERP systems with existing software and data sources can also pose challenges, leading to extended implementation timelines and increased costs. Organizations must invest in comprehensive change management strategies, including training and communication, to ensure a smooth transition to the new system. Failure to address these challenges can result in suboptimal utilization of the ERP system and hinder the expected benefits.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies into ERP systems presents a significant opportunity for growth in the North America Enterprise Resource Planning (ERP) market. These advanced technologies can enhance the capabilities of ERP systems by enabling predictive analytics, automation of routine tasks, and improved decision-making. As stated by Deloitte, organizations that leverage AI in their ERP systems can achieve up to a 30% increase in productivity. AI-driven insights can help businesses optimize inventory management, forecast demand, and identify trends, leading to more informed strategic decisions. Besides, the automation of repetitive tasks, such as data entry and report generation, can free up valuable resources for higher-value activities. The companies increasingly seek to harness the power of AI and ML to drive efficiency and innovation, the integration of these technologies into ERP systems will be a key driver of growth in the North America market.

Growing Demand for Industry-Specific ERP Solutions

The risinhg demand for industry-specific ERP solutions represents another major opportunity for the North America Enterprise Resource Planning (ERP) market. As organizations seek to address unique challenges and requirements within their respective industries, there is an increasing need for tailored ERP solutions that cater to specific business processes. Industries such as manufacturing, healthcare, and retail are particularly poised for growth, as organizations in these sectors require specialized functionalities to manage their operations effectively. By offering industry-specific ERP solutions, vendors can differentiate themselves in a competitive market and capture a larger share of the growing demand. Since businesses continue to prioritize operational efficiency and seek solutions that align with their unique needs, the demand for industry-specific ERP systems is expected to drive significant growth in the North America ERP market.

MARKET CHALLENGES

Data Security and Privacy Concerns

A serious challenge encountered by the North America Enterprise Resource Planning (ERP) market is the growing concern over data security and privacy. As companies increasingly rely on ERP systems to manage sensitive business information, the risk of data breaches and cyberattacks becomes a pressing issue. As indicated in a report by the Cybersecurity Ventures, cybercrime is projected to cost the world $10.5 trillion annually by 2025 is showcasing the urgent need for robust security measures. Organizations must ensure that their ERP systems comply with data protection regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Failure to address these security concerns can result in severe financial penalties, reputational damage, and loss of customer trust. To mitigate these risks, organizations must invest in comprehensive security strategies, including encryption, access controls, and regular security audits.

Rapid Technological Changes

The rapid pace of technological changes in the enterprise resource planning landscape presents a challenge for organizations seeking to implement and maintain ERP systems. As new technologies emerge, organizations must continuously adapt their ERP solutions to remain competitive and meet evolving business needs. In line with a study by Forrester, 60% of organizations struggle to keep their ERP systems aligned with the latest technological advancements. This challenge can lead to increased complexity in managing ERP systems, as organizations may need to invest in regular updates, training, and integration with new technologies. Apart from these, the constant introduction of new features and functionalities can overwhelm users, leading to difficulties in adoption and utilization. To navigate this challenge, organizations must prioritize ongoing training and development for their employees, ensuring they are equipped with the skills and knowledge necessary to leverage the full potential of their ERP systems.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.53% |

|

Segments Covered |

By Deployment, Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and rest of North America |

|

Market Leaders Profiled |

SAP SE, Oracle Corporation, Microsoft Corporation, Workday, Inc., Plex Systems Inc. (Rockwell Automation Inc.)., and others. |

SEGMENTAL ANALYSIS

By Deployment Insights

The cloud-based ERP segment was the top performing category by possessing 55.8% of the total market share in 2024. This dominance can be attributed to the increasing demand for flexible, scalable, and cost-effective solutions that cloud-based ERP systems offer. Cloud-based ERP solutions enable businesses to access their systems from anywhere is offering remote work and collaboration. Also, the lower upfront costs associated with cloud deployments make them an attractive option for small and medium-sized enterprises (SMEs) looking to implement ERP systems without significant capital investment.

The fastest-growing segment in the North America Enterprise Resource Planning (ERP) market is the hybrid ERP segment which is projected to experience a CAGR of 25.2% owing to the increasing demand for solutions that combine the benefits of both cloud and on-premises deployments. Hybrid ERP solutions allow businesses to maintain critical data on-premises while leveraging cloud capabilities for scalability and accessibility. This approach enables organizations to address specific regulatory and security requirements while benefiting from the cost-effectiveness and agility of cloud solutions.

By Type Insights

The cloud ERP segment commanded the market by contributing 57.2% of the total market share in 2024. This control is supported by the surging demand for flexible, scalable, and cost-effective solutions that cloud-based ERP systems offer. According to a report by Gartner, the cloud ERP landscape worldwide is forecasted to expand at a pace of 22% in the future that is driven by the rising adoption of cloud technologies among organizations of all sizes. Cloud-based ERP solutions enable businesses to access their systems from anywhere is facilitating remote work and collaboration. Apart from these, the lower upfront costs associated with cloud deployments make them an attractive option for small and medium-sized enterprises (SMEs) looking to implement ERP systems without significant capital investment.

The mobile ERP segment quickly aroused and is estimated to experience a CAGR of approximately 31.5% over the forecast period. This sudden rise can be atached to the increasing reliance on mobile devices for business operations and the demand for real-time access to ERP systems. According to a report, the number of mobile device users in the United States is expected to reach 300 million by 2025 and is drawing attention to the growing importance of mobile accessibility in the workplace. Mobile ERP solutions enable employees to access critical business information and perform tasks on-the-go is enhancing productivity and decision-making.

By Application Insights

The manufacturing segment was the largest application area by accounting for 33.2% of the total market share in 2024. This prominence is backed by the critical need for manufacturers to streamline their operations, improve supply chain management, and enhance production efficiency. In accordance to a report by the National Association of Manufacturers, U.S. manufacturing output is projected to reach $2.5 trillion by 2025 is showcasing the importance of effective resource planning in this sector. ERP systems provide manufacturers with real-time visibility into their operations, enabling them to optimize production schedules, manage inventory levels, and ensure compliance with industry regulations. The ability to integrate various functions, such as procurement, production, and sales, within a single platform further enhances operational efficiency.

The retail segment is on the rise and is projected to register highest CAGR of 23.1% from 2025 to 2033. This development due to the increasing digitization of retail operations and the rising demand for integrated solutions that enhance customer experiences. ERP systems enable retailers to manage inventory, track sales, and analyze customer data in real-time by facilitating better decision-making and improved operational efficiency. Moreover, the integration of ERP with e-commerce platforms allows retailers to streamline their online operations and enhance their omnichannel strategies. Since the retail landscape continues to evolve, the demand for ERP solutions that cater to the unique challenges of the retail sector is expected to drive significant growth in this application segment.

REGIONAL ANALYSIS

The United States held the foremost position in the North America Enterprise Resource Planning (ERP) market and captured a market share of 73.7% in 2024. This control over the market is driven by widespread integration of cloud-based ERP solutions, a highly digitized business ecosystem, and strong demand from industries such as manufacturing, retail, and healthcare. Also, the country's advanced technological infrastructure and the presence of major technology companies propelling innovation in the ERP sector. According to the U.S. Bureau of Economic Analysis, the U.S. economy is projected to grow at a rate of 2.5% annually is further fueling the demand for ERP solutions across various industries. The U.S. market is marked by huge investments in research and development which is turning them to the introduction of innovative ERP systems that cater to the evolving needs of businesses. Furthermore, the growing adoption of cloud-based ERP solutions among U.S. organizations is propelling the demand for these systems.

Canada is advancing at the fastest pace in the North America Enterprise Resource Planning (ERP) market and is forecast to record a CAGR of 9.6% over the projected period. This growth is supported by the increasing demand for ERP solutions driven by the expansion of the technology sector and the rising adoption of cloud-based systems. As per the details shared by Statistics Canada, the Canadian technology sector is expected to grow by 5% annually is creating opportunities for ERP providers. The Canadian market is defined by a high priority given to quality and customer service, with organizations increasingly recognizing the importance of ERP systems in enhancing operational efficiency. Additionally, government initiatives aimed at promoting innovation and technology adoption further support this trend.

The rest of North America includes countries such as Mexico is progressing steadily in the enterprise resource planning market. This region is witnessing progress aided by the increasing demand for ERP solutions and the expansion of the technology sector in the region. The market is distinguished by a focus on affordability and accessibility, with organizations seeking cost-effective ERP solutions that enhance operational efficiency. Also, the rising awareness of the importance of quality assurance in ERP implementations is driving the adoption of reliable systems and vendors.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The major key players in North America Enterprise Resource Planning (ERP) market are SAP SE, Oracle Corporation, Microsoft Corporation, Workday, Inc., Plex Systems Inc. (Rockwell Automation Inc.), and others.

The competition in the North America Enterprise Resource Planning (ERP) market is characterized by a dynamic landscape where innovation, efficiency, and user experience are paramount. Major players are continuously striving to differentiate themselves through advanced technologies and comprehensive solutions. The market is witnessing a surge in the adoption of ERP systems, driven by increasing consumer demand for operational efficiency and integrated business processes. As organizations prioritize digital transformation and seek to enhance their software capabilities, companies that provide reliable, user-friendly platforms and robust functionalities are gaining a competitive edge.

Furthermore, the presence of both established players and emerging startups fosters a competitive environment that encourages rapid technological advancements. The ongoing digital transformation across various sectors is further intensifying competition, as organizations seek to optimize their operations through ERP solutions.

TOP PLAYERS IN THE MARKET

SAP

SAP is a leading player in the North America Enterprise Resource Planning (ERP) market, known for its comprehensive suite of ERP solutions that cater to various industries. The company's flagship product, SAP S/4HANA, offers advanced capabilities for finance, supply chain, and customer relationship management, enabling organizations to streamline their operations and enhance decision-making. SAP's commitment to innovation and customer-centric solutions has positioned it as a dominant force in the ERP market, with a significant share of the North American market.

Oracle

Oracle is another major player in the North America Enterprise Resource Planning (ERP) market, recognized for its cloud-based ERP solutions that provide organizations with the flexibility and scalability needed to adapt to changing business environments. The Oracle Cloud ERP platform offers a wide range of functionalities, including financial management, procurement, and project management, making it a popular choice among enterprises seeking comprehensive solutions. Oracle's focus on integrating advanced technologies, such as AI and machine learning, into its ERP offerings further enhances its competitive position in the market.

Microsoft

Microsoft is a prominent player in the North America Enterprise Resource Planning (ERP) market, primarily through its Dynamics 365 suite, which combines ERP and customer relationship management (CRM) capabilities. Dynamics 365 offers organizations a unified platform for managing their operations, sales, and customer service, enabling them to improve efficiency and drive growth. Microsoft's strong brand recognition and extensive ecosystem of products and services have contributed to its success in the ERP market, making it a preferred choice for businesses of all sizes.

STRATEGIES USED BY THE MARKET PLAYERS

Key players in the North America Enterprise Resource Planning (ERP) market employ various strategies to strengthen their market position and enhance competitiveness. One prominent strategy is the focus on innovation and research and development, enabling companies to introduce cutting-edge ERP solutions that meet the evolving needs of organizations. For instance, SAP continuously invests in enhancing its S/4HANA platform to incorporate advanced features and functionalities that align with industry trends.

Additionally, strategic partnerships and collaborations play a crucial role in expanding market reach and enhancing product offerings. Oracle, for example, has formed alliances with cloud service providers to integrate its ERP solutions into cloud environments, allowing organizations to leverage the benefits of cloud computing in their operations.

Furthermore, companies are increasingly prioritizing customer-centric approaches, offering tailored solutions and support services to address specific requirements of their clients. This focus on customer engagement not only fosters loyalty but also enhances the overall value proposition of their offerings.

Moreover, many key players are actively pursuing educational initiatives to empower organizations in their ERP implementations. Microsoft, for instance, provides extensive resources and training programs to help users navigate the complexities of its Dynamics 365 platform. By leveraging these strategies, companies in the North America Enterprise Resource Planning (ERP) market are positioning themselves to capitalize on emerging opportunities and navigate the challenges of a rapidly evolving industry landscape.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, SAP announced the launch of a new version of its S/4HANA platform, featuring enhanced AI capabilities to improve data analytics and decision-making processes for users.

- In February 2024, Oracle introduced new features in its Cloud ERP suite aimed at improving financial management and compliance for businesses in regulated industries.

- In March 2024, Microsoft Dynamics 365 expanded its integration capabilities with third-party applications, allowing users to streamline their workflows and enhance productivity.

- In April 2024, Infor, a subsidiary of Koch Industries, unveiled a new cloud-based ERP solution tailored specifically for the manufacturing sector, focusing on industry-specific functionalities.

- In May 2024, Workday announced a partnership with a leading analytics firm to enhance its ERP offerings with advanced data visualization and reporting tools.

- In June 2024, Epicor launched a new version of its ERP software designed for the retail sector, featuring improved inventory management and customer engagement tools.

- In July 2024, Sage introduced a new cloud-based ERP solution aimed at small and medium-sized enterprises, emphasizing affordability and ease of use.

- In August 2024, NetSuite announced enhancements to its ERP platform, including improved e-commerce integration and real-time inventory tracking capabilities.

- In September 2024, Acumatica expanded its ERP offerings to include advanced project management features, catering to the needs of construction and project-based businesses.

- In October 2024, Zoho Corporation launched a new suite of ERP applications designed for startups and small businesses, focusing on affordability and scalability.

MARKET SEGMENTATION

This research report on the North America Enterprise Resource Planning (ERP) market is segmented and sub-segmented into the following categories.

By Deployment

- On-Premise

- Cloud

- Hybrid

By Type

- Mobile

- Cloud

- Social

- Two-Tier

By Application

- Retail

- Manufacturing

- BFSI (Banking, Financial Services, and Insurance)

- Government

- Telecom

- Military and Defense

- Education & Research

- Transport & Logistics

- Other End-user Industries

By Country

- The United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the projected growth rate for the North America ERP market?

The market is expected to grow at a compound annual growth rate (CAGR) of 9.53% from 2025 to 2033.

2. What factors are driving the growth of the North America ERP market?

Key drivers include increasing demand for operational efficiency, digital transformation initiatives, and the adoption of cloud-based solutions across various industries.

3. Who are the major players in the North America ERP market?

Major companies in this market include SAP SE, Oracle Corporation, Microsoft Corporation, Workday, Inc., and Plex Systems Inc. (Rockwell Automation Inc.).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]