North America Elevator Market Size, Share, Trends & Growth Forecast Report By Type (Hydraulic, Traction), By Business (New Equipment, Maintenance, Modernization), By Application (Residential, Commercial), and Country (The United States, Canada, Mexico, Rest of North America) Industry Analysis From 2025 to 2033.

North America Elevator Market Size

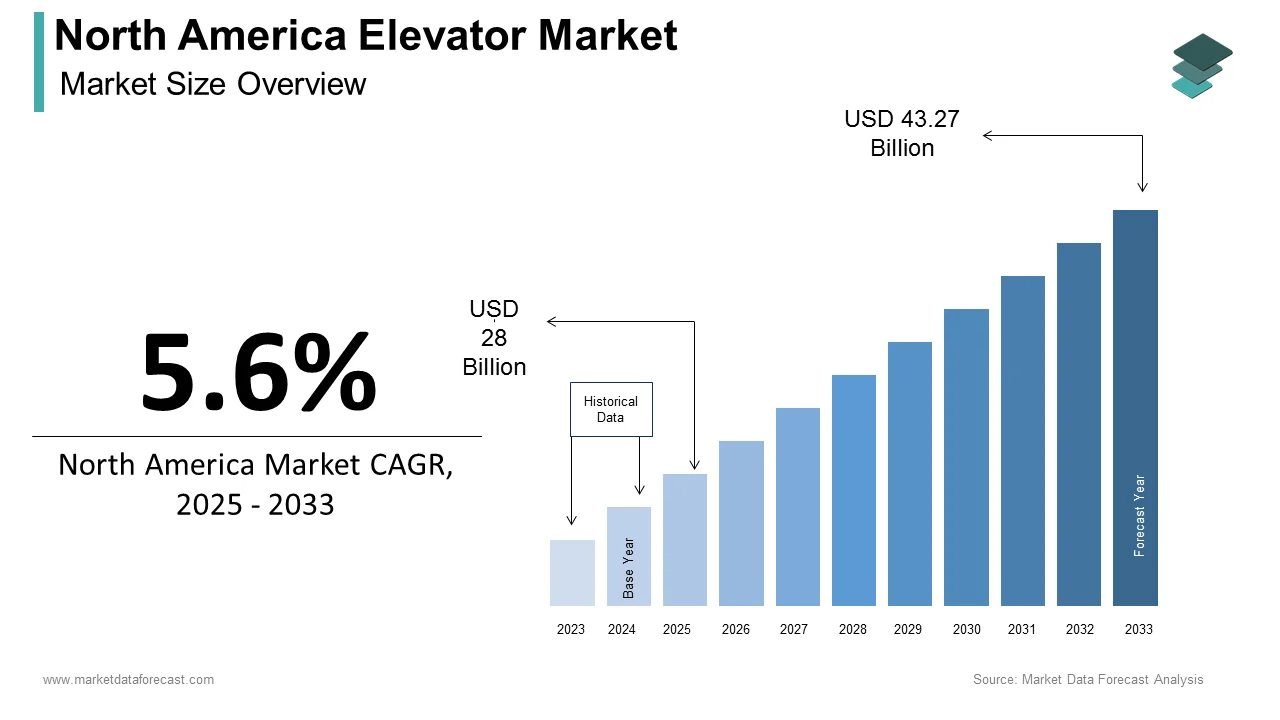

The elevator market size in North America was valued at USD 26.5 billion in 2024. The North American market is estimated to be worth USD 43.27 billion by 2033 from USD 28 billion in 2025, growing at a CAGR of 5.6% from 2025 to 2033.

The North America elevator market includes various types of elevators, such as hydraulic and traction systems, and serves multiple applications, including residential, commercial, and industrial sectors. The elevator market in North America has been experiencing steady growth, driven by urbanization, increasing construction activities, and the rising demand for modernized and efficient vertical transportation solutions. This growth is further supported by advancements in technology, such as smart elevators equipped with IoT capabilities, which enhance operational efficiency and user experience. As the construction industry continues to evolve, the elevator market is expected to adapt, incorporating innovative solutions that meet the changing demands of urban environments and contribute to the overall enhancement of building infrastructure.

MARKET DRIVERS

Urbanization and Infrastructure Development

Urbanization is a major driver of the North America elevator market as cities continue to expand and evolve. The increasing population density in urban areas necessitates the construction of high-rise buildings and multi-story structures, which in turn drives the demand for efficient vertical transportation systems. In line with the U.S. Census Bureau, over 80% of the U.S. population now resides in urban areas, a trend that is expected to continue. This demographic shift has led to a surge in construction activities, with the American Institute of Architects projecting a 5% increase in non-residential construction spending by 2025. As urban centers grow, the need for elevators becomes paramount to ensure accessibility and convenience for residents and businesses alike. Furthermore, the push for sustainable urban development has prompted the integration of energy-efficient elevator systems, which align with modern building codes and environmental standards. Since cities strive to accommodate their growing populations, the elevator market is poised for robust growth, driven by the demand for innovative and efficient vertical transportation solutions, as stressed by the National Association of Home Builders.

Technological Advancements

Technological advancements are revolutionizing the North America elevator market, significantly enhancing the efficiency, safety, and user experience of vertical transportation systems. The integration of smart technologies, such as IoT and artificial intelligence, is transforming traditional elevator systems into intelligent solutions that optimize performance and reduce operational costs. According to KONE, buildings equipped with smart elevator systems can improve passenger traffic efficiency by up to 25%, reducing wait and travel times in high-rise buildings. Such elevators can monitor usage patterns, predict maintenance needs, and provide real-time data to building managers and thereby improving operational efficiency and minimizing downtime. Besides, developments in energy-efficient technologies, such as regenerative drives and LED lighting, are contributing to the sustainability of elevator systems. As building owners and developers prioritize energy efficiency and user convenience, the demand for technologically advanced elevators is expected to rise, positioning the North America elevator market for continued growth and innovation, as noted by the International Energy Agency.

MARKET RESTRAINTS

High Installation and Maintenance Costs

High installation and maintenance costs associated with elevator systems is one of the primary restraints affecting the North America elevator market. The initial investment required for installing elevators and mainly in high-rise buildings, can be substantial, often ranging from $20,000 to $100,000 or more, depending on the type and specifications of the elevator. According to the Elevator World, the average cost of installing a commercial elevator can reach up to $50,000, which can deter some developers and building owners from incorporating elevators into their projects. Additionally, ongoing maintenance costs can further strain budgets, as regular inspections, repairs, and modernization efforts are essential to ensure safety and compliance with regulations. These financial considerations can lead to delays in project timelines or the decision to forgo elevator installation altogether, particularly in smaller residential or commercial developments. Consequently, the high costs associated with elevator systems can hinder market growth, as stakeholders weigh the benefits against the financial implications, as highlighted by the National Elevator Industry, Inc.

Regulatory Compliance and Safety Standards

The North America elevator market is also constrained by stringent regulatory compliance and safety standards that must be adhered to during the design, installation, and operation of elevator systems. Various codes and regulations such as the American Society of Mechanical Engineers (ASME) A17.1 Safety Code for Elevators and Escalators, impose rigorous requirements to ensure the safety and reliability of elevators. Compliance with these standards can be complex and costly, requiring manufacturers and installers to invest in specialized training, equipment, and processes. The National Elevator Industry, Inc. emphasizes that the costs associated with meeting regulatory requirements can account for up to 15% of the total project budget. In addition, the evolving nature of safety regulations can create challenges for elevator companies, as they must continuously adapt to new standards and ensure that their products remain compliant. This regulatory burden can deter smaller companies from entering the market or limit the ability of existing players to innovate and expand their offerings.

MARKET OPPORTUNITIES

Growing Demand for Green Building Solutions

The increasing emphasis on sustainability and green building practices presents a significant opportunity for the North America elevator market. As environmental concerns continue to rise, building owners and developers are increasingly seeking energy-efficient solutions that minimize their carbon footprints. According to McGraw Hill Construction, owners of green buildings report an average of 7% increase in building asset value compared to traditional buildings. These are equipped with energy-efficient technologies such as regenerative drives and LED lighting align with these sustainability goals and can significantly reduce energy consumption. Additionally, the integration of smart technologies allows for better monitoring and management of energy usage, further enhancing the sustainability of elevator systems. As regulatory frameworks increasingly favor green building initiatives, the demand for eco-friendly elevator solutions is expected to grow, providing rental companies with a unique opportunity to position themselves as leaders in the sustainable construction movement. This trend not only aligns with environmental objectives but also enhances the marketability of buildings, making them more attractive to tenants and investors, as emphasized by the World Green Building Council.

Expansion of Smart City Initiatives

The expansion of smart city initiatives across North America represents another major opportunity for the elevator market. As urban areas increasingly adopt smart technologies to improve infrastructure and enhance the quality of life for residents, the demand for advanced elevator systems that integrate seamlessly with these initiatives is expected to rise. The Smart Cities Council via its reports that investments in smart city projects are projected to reach $1 trillion globally by 2025, with a significant portion allocated to transportation and infrastructure improvements. Smart elevators that utilize IoT technology can provide real-time data on usage patterns, optimize traffic flow, and enhance user experience through features such as mobile app integration and predictive maintenance. As cities prioritize the development of smart infrastructure to accommodate growing populations and improve efficiency, the demand for innovative elevator solutions that align with these initiatives is anticipated to increase.

MARKET CHALLENGES

Intense Competition

The North America elevator market faces significant challenges from intense competition among established players and new entrants. The market is characterized by a mix of global corporations and regional companies, each vying for market share in a competitive landscape. According to the Bureau of Labor Statistics, about 58% of elevator installers and repairers in the U.S. were employed by building equipment contractors as of 2023, highlighting the industry's reliance on specialized trade services. This competitive environment can lead to price wars, which may erode profit margins and compel companies to invest heavily in marketing and innovation to differentiate their offerings. Additionally, the rapid pace of technological advancements necessitates continuous investment in research and development, further straining financial resources. Smaller companies may struggle to compete with larger firms that have greater access to capital and established brand recognition.

Supply Chain Disruptions

Supply chain disruptions represent a significant challenge for the North America elevator market, particularly in the wake of the COVID-19 pandemic. The elevator industry relies on a complex network of suppliers for components such as motors, control systems, and safety devices. A survey conducted by the National Association of Manufacturers states that nearly 80% of manufacturers reported supply chain disruptions due to the pandemic, leading to delays in production and project timelines. These disruptions can result in increased costs for elevator manufacturers because they may need to source materials from alternative suppliers or expedite shipping to meet project deadlines. Additionally, the ongoing global semiconductor shortage has further exacerbated supply chain challenges, impacting the availability of critical components for elevator systems. Companies are navigating these disruptions, so they may face difficulties in fulfilling orders and maintaining customer satisfaction, which can hinder growth and market expansion. The need for robust supply chain management strategies has become increasingly important for elevator companies to mitigate the impact of these challenges, as noted by the Equipment Leasing and Finance Association.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Business, Application and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America |

|

Market Leader Profiled |

TK Elevator, Schindler, KONE Corporation, Hitachi Ltd., HYUNDAIELEVATOR CO.,LTD., Mitsubishi Electric Corporation, Toshiba Group, FUJITEC CO., LTD., Aritco Lift AB; EMAK, Sigma Elevator Company, Schumacher Elevator Company, ESCON Elevators Pvt Limited, Electra Elevators,CANNY ELEVATOR CO, LTD., and Others. |

SEGMENTAL ANALYSIS

By Type Insights

The traction elevator segment emerged as the prime contributor to the North America elevator market by commanding a market share of 60.9% in 2024. This prominence is basically fuelled by the widespread use of traction elevators in high-rise buildings and commercial applications, where efficiency and speed are paramount. Traction elevators utilize a system of pulleys and cables, allowing for smoother and faster vertical transportation compared to hydraulic systems. The Elevator World reports that traction elevators are used in over 80% of mid- and high-rise buildings globally, thanks to their ability to handle higher travel speeds and greater load capacities compared to hydraulic systems. The surging pattern of vertical construction and particularly in metropolitan areas necessitates the installation of traction elevators to accommodate the needs of modern buildings. Additionally, advancements in technology, such as regenerative drives and smart controls, are enhancing the efficiency and sustainability of traction elevators, further solidifying their position as the preferred choice for developers and building owners, as highlighted by the American Society of Mechanical Engineers.

The hydraulic elevator category is on the rise and is expected to be the fastest growing segment in the global market by witnessing a CAGR of 5% during the forecast period. This sudden expansion can be credited to the amplified need for hydraulic elevators in low-rise buildings and residential applications, where space constraints and cost considerations play a significant role. These elevators are known for their simplicity and reliability, making them an attractive option for smaller buildings and homes. According to the Council on Tall Buildings and Urban Habitat (CTBUH), hydraulic elevators account for nearly 70% of elevator installations in low-rise buildings worldwide, due to their cost-effectiveness and suitability for buildings up to five stories. Also, the growing focus on accessibility and compliance with building codes is prompting developers to incorporate hydraulic elevators into their projects.

By Application Insights

The commercial segment stands out as the largest contributor and accounted for 55.5% of the total market share in 2024. This control is mainly backed by the increasing construction of commercial buildings such as office complexes shopping malls, and hotels, which require efficient vertical transportation systems to accommodate high foot traffic. According to the U.S. Census Bureau, non-residential construction spending in the United States reached approximately $800 billion in 2022 and is reflecting a robust growth trajectory. The demand for elevators in commercial applications is further fueled by the need for compliance with accessibility regulations and the growing emphasis on user experience in modern building design.

The fastest-growing application segment within the North America elevator market is the residential category, projected to grow at a CAGR of 6% from 2025 to 2033. This growth can be attributed to the increasing demand for residential elevators in multi-story homes and aging-in-place solutions, as homeowners seek to enhance accessibility and convenience. According to a report by Dodge Construction Network, U.S. residential construction starts reached $912 billion in 2023, reflecting steady demand for both single-family homes and multi-family projects, despite economic headwinds. The growing focus on accessibility features in residential properties is prompting homeowners to invest in elevators as a means of improving mobility and comfort. Besides, advancements in elevator technology, such as compact designs and energy-efficient systems, are making residential elevators more appealing to consumers.

REGIONAL ANALYSIS

The United States was the dominant player in the North America elevator market by holding a market share of 80.8% in 2024. It is mature but still shows consistent growth which is fuelled by both urban redevelopment and new high-rise construction. Cities like New York, Chicago, and Los Angeles continue to demand advanced elevator systems as they revitalize aging infrastructure and build new skyscrapers. The U.S. construction industry is defined by its size and diversity, with significant investments in residential, commercial, and infrastructure projects. According to the U.S. Census Bureau, construction spending in the United States reached approximately $1.6 trillion in 2022, reflecting a robust growth trajectory. The demand for elevators is driven by the need for efficient vertical transportation in high-rise buildings and commercial spaces. Also, the ongoing urbanization trend and the increasing focus on smart building technologies are expected to further stimulate the elevator market.

In Canada, the elevator market is shaped by the country’s steady urbanization and rising demand for sustainable buildings in cities like Toronto, Vancouver, and Calgary. The Canadian construction industry has been experiencing steady growth, driven by investments in residential and commercial projects, as well as infrastructure development. As per the Statistics Canada, construction spending in the country reached CAD 300 billion in 2022, with projections indicating continued growth in the coming years. The demand for elevators in Canada is influenced by the need for specialized machinery to meet the diverse requirements of construction projects. Further, the increasing focus on sustainability and green building practices is prompting construction firms to seek elevator solutions that align with their environmental goals.

In the Rest of North America, including Mexico and parts of the Caribbean, the elevator market is at an earlier stage of development but is catching up fast. Mexico, in particular, is seeing growing demand for elevator systems due to rapid urbanization in cities like Mexico City, Monterrey, and Guadalajara. The rise of middle-class housing projects, office buildings, and commercial spaces has expanded the customer base, which is increasingly open to adopting modern elevator technologies. In tourist-heavy regions across the Caribbean, resorts and hospitality developments are fueling further demand. The construction industry in Mexico has been gaining momentum, driven by government investments in infrastructure and housing projects. According to the Mexican National Institute of Statistics and Geography, construction spending in Mexico reached approximately MXN 1 trillion in 2022, reflecting a growing demand for elevator systems. The rental market in this region is characterized by a mix of local and international players, each vying for market share in a competitive landscape.

KEY MARKET PLAYERS

Some notable companies that dominate the North America elevator market profiled in this report are TK Elevator, Schindler, KONE Corporation, Hitachi Ltd., HYUNDAIELEVATOR CO.,LTD., Mitsubishi Electric Corporation, Toshiba Group, FUJITEC CO., LTD., Aritco Lift AB; EMAK, Sigma Elevator Company, Schumacher Elevator Company, ESCON Elevators Pvt Limited, Electra Elevators,CANNY ELEVATOR CO, LTD., and Others.

MARKET SEGMENTATION

This North America elevator market research report is segmented and sub-segmented into the following categories.

By Type

- Hydraulic

- Traction

- Machine Room-Less Traction

- Others

By Business

- New Equipment

- Maintenance

- Modernization

By Application

- Residential

- Commercial

- Industrial

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the projected growth of the North America Elevator Market?

The North America Elevator Market is expected to grow from USD 28 billion in 2025 to USD 43.27 billion by 2033, at a CAGR of 5.6%.

2. What factors are driving the North America Elevator Market?

Urbanization, increasing construction activities, and advancements in smart elevator technologies are major growth drivers.

3. What are the key challenges in the North America Elevator Market?

High installation and maintenance costs, along with strict regulatory compliance, pose significant challenges.

4. Which segments dominate the North America Elevator Market?

The market includes hydraulic and traction elevators, primarily used in residential, commercial, and industrial sectors.

5. How is technology shaping the North America Elevator Market?

IoT-enabled smart elevators optimize efficiency, reduce downtime, and improve passenger experience.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]