North America Electrical Testing Services Market Size, Share, Trends & Growth Forecast Report By Service Type (Transformer Testing, Thermographic Testing), End Use, And Country (US, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Electrical Testing Services Market Size

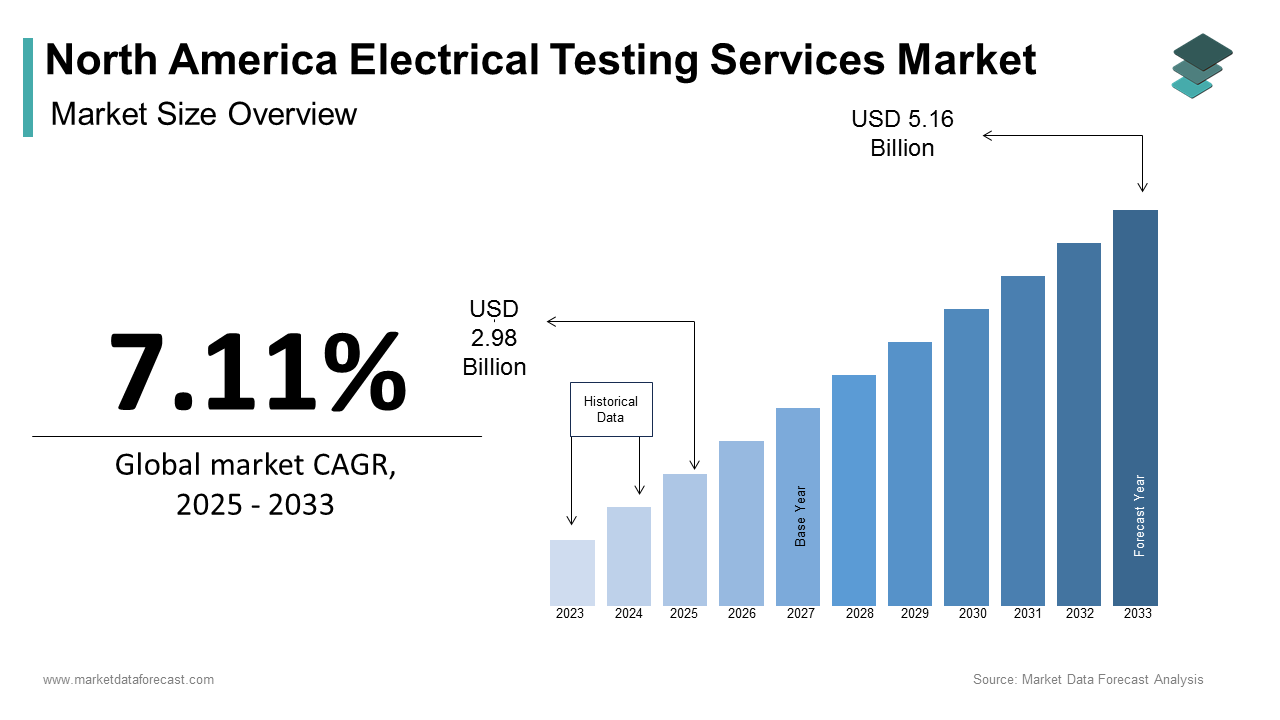

The North America electrical testing services market size was calculated to be USD 2.78 billion in 2024 and is anticipated to be worth USD 5.16 billion by 2033, from USD 2.98 billion in 2025, growing at a CAGR of 7.11% during the forecast period.

MARKET DRIVERS

Aging Electrical Infrastructure

A primary driver of the North America electrical testing services market is the aging electrical infrastructure across the region. According to the American Society of Civil Engineers (ASCE), much of the U.S. power grid was built over 50 years ago, with a significant portion of transformers and transmission lines operating beyond their intended lifespan. This aging infrastructure increases the risk of failures and outages, necessitating regular testing and maintenance to ensure reliability. For instance, in recent years, the Department of Energy reported that power outages caused by equipment failures significantly cost the U.S. economy. These factors collectively underscore the importance of electrical testing services in maintaining the integrity of the region’s power systems.

Rising Adoption of Renewable Energy

Another significant driver is the growing adoption of renewable energy sources, which require specialized testing services to integrate seamlessly into existing grids. Like, renewable energy accounted for a significant portion of total electricity generation in North America, with projections indicating a notable rise by 2030. Solar and wind farms, along with battery storage systems, introduce unique challenges, such as intermittent power supply and voltage fluctuations, necessitating advanced testing solutions. For example, in 2022, the U.S. Department of Energy invested $5 billion in renewable energy projects, many of which required comprehensive testing to ensure compatibility with the grid. Additionally, the rise of microgrids and distributed energy resources (DERs) has increased the demand for protection testing and fault detection services.

MARKET RESTRAINTS

High Costs of Advanced Testing Equipment

A significant restraint in the North America electrical testing services market is the high cost associated with advanced testing equipment and technologies. Cutting-edge tools such as thermal imaging cameras and circuit breaker analyzers often come with substantial price tags, making them inaccessible for smaller service providers. This financial barrier limits the ability of smaller players to compete with larger firms that can afford such investments. Besides, the ongoing economic uncertainties including inflationary pressures have exacerbated affordability issues. For instance, a survey revealed that a significant percentage of small businesses cited rising operational costs as a major challenge. While larger companies can absorb these costs, smaller entities often resort to outdated methods, potentially compromising accuracy and reliability. This affordability gap acts as a barrier to widespread adoption, thereby restraining market growth.

Stringent Regulatory Compliance Requirements

Further notable restraint is navigating the stringent regulatory compliance requirements imposed by governing bodies. The Federal Energy Regulatory Commission (FERC) and other agencies enforce rigorous standards for electrical testing, particularly in industries such as power generation and transmission. Similarly, compliance-related costs account for a key portion of the total operational expenses for electrical testing service providers. Achieving certifications such as NETA accreditation and adhering to National Electrical Code (NEC) guidelines require substantial investment in training, documentation, and quality control processes. Smaller players often struggle to meet these demands due to limited resources is creating a competitive disadvantage. Furthermore, frequent updates to regulations, such as those addressing cybersecurity risks in smart grids, add another layer of complexity. These regulatory hurdles pose a significant challenge to market participants striving to maintain compliance while ensuring profitability.

MARKET OPPORTUNITIES

Expansion into Smart Grid Technologies

The most promising opportunity in the North America electrical testing services market lies in expanding into smart grid technologies. The region is witnessing a rapid transformation of its electrical infrastructure, with smart grids becoming a cornerstone of modern energy systems. Apart from these, the integration of Internet of Things (IoT) devices and automation technologies has increased the demand for thermographic testing and protection testing services. Companies that align their expertise with these trends are well-positioned to capitalize on this burgeoning opportunity.

Growth of Data Centers and Commercial Establishments

A significant opportunity arises from the rapid expansion of data centers and commercial establishments across North America. Data centers require uninterrupted power supply and precise electrical systems, necessitating regular testing and maintenance to prevent downtime. For example, Amazon Web Services (AWS) invested $35 billion in expanding its data center infrastructure, creating a surge in demand for electrical testing services. Similarly, the commercial real estate sector is witnessing a boom, with a notable increase in commercial construction projects in the last few years. These developments have heightened the need for transformer testing, circuit breaker testing, and battery testing services.

MARKET CHALLENGES

Increasing Complexity of Electrical Systems

A significant challenge in the North America electrical testing services market is the increasing complexity of modern electrical systems, particularly with the integration of renewable energy sources and smart technologies. Also, the addition of distributed energy resources (DERs) and microgrids has created a fragmented and dynamic power landscape, complicating testing and maintenance processes. For instance, in 2022, California experienced multiple grid failures due to the integration of solar farms without adequate testing protocols, underscoring the risks of inadequate system assessments. Additionally, the rise of IoT-enabled devices and automation technologies has introduced new vulnerabilities, such as cybersecurity threats, requiring specialized testing solutions. Only a small number of utilities have implemented comprehensive cybersecurity measures, leaving systems exposed to potential breaches. These complexities not only increase operational costs but also raise the stakes for service providers tasked with ensuring system reliability and safety.

Limited Skilled Workforce Availability

Another pressing challenge is the shortage of skilled professionals capable of performing advanced electrical testing services. The industry requires technicians with expertise in areas such as thermographic testing, protection testing, and rotating equipment vibration analysis. Similarly, the demand for skilled electricians and technicians is expected to notably exceed supply, creating a significant talent gap. This shortage is exacerbated by the retirement of experienced workers and the lack of adequate training programs. Additionally, the rapid pace of technological advancements necessitates continuous upskilling, which many companies struggle to implement effectively. This workforce challenge poses a formidable obstacle to meeting the growing demand for electrical testing services.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.11% |

|

Segments Covered |

By Service Type, End Use, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, And Rest Of North America |

|

Market Leaders Profiled |

SGS SA, Bureau Veritas, Intertek Group plc, TÜV SÜD, Applus+, ALS Limited, Electrical Testing Services, Inc., American Electrical Testing Co. LLC, Doble Engineering Company, RESA Power |

SEGMENTAL ANALYSIS

By Service Type Insights

The segment of transformer testing dominated the North America electrical testing services market with 30.3% of the total share in 2024. This dominance is primarily driven by the critical role transformers play in power transmission and distribution systems. Also, transformers account for a notable portion of total grid infrastructure investments, exhibiting their importance. Regular testing is essential to identify issues such as oil degradation, insulation failure, and overheating, which can lead to costly outages. Additionally, the aging transformer fleet in North America, with a major share of operating beyond their intended lifespan, has further fueled demand. Federal mandates requiring periodic inspections and the adoption of predictive maintenance technologies have solidified the position of transformer testing as the largest segment in the market.

Thermographic testing is the fastest-growing service type in the North America electrical testing services market, with a projected CAGR of 7.5% from 2025 to 2033. This growth is fueled by the increasing adoption of infrared technology to detect electrical faults and inefficiencies. Additionally, the rise of predictive maintenance practices has accelerated demand, particularly in industries such as data centers and healthcare. Predictive maintenance can reduce downtime considerably and is making thermographic testing a key enabler of this transformation

By End Use Insights

The Power generation stations segment prevailed in the North America electrical testing services market with a 25.7% of the total share in 2024. This leading position is supported by the critical need to ensure the reliability and efficiency of power generation systems. Moreover, power generation makes up a notable share of total electricity-related investments, necessitating regular testing and maintenance. Additionally, the integration of renewable energy sources, such as wind and solar, has introduced new testing requirements, particularly for inverters and battery storage systems.

The data centers segment is moving ahead quickly and is expected to attain a CAGR of 9.2%. This progress is propelled by the increasing demand for cloud computing and digital services, which require uninterrupted power supply and precise electrical systems. Apart from these, the rise of edge computing and IoT applications has increased the complexity of electrical systems, requiring specialized testing solutions.

REGIONAL ANALYSIS

The United States was the leader in the North America electrical testing services market with 70.5% of the regional revenue share in 2024. This is attributed to the country’s extensive power generation and transmission infrastructure, coupled with significant investments in grid modernization and renewable energy integration. These factors collectively position the U.S. as the cornerstone of the North America electrical testing services market, with its influence extending globally through technological advancements and regulatory standards.

Canada plays a pivotal role in the North America electrical testing services market. It is driven by its focus on renewable energy projects and modernization of aging infrastructure. Also, the country invested majorly in renewable energy initiatives in recent years, creating a fertile environment for market expansion. The Canadian government’s commitment to reducing carbon emissions has accelerated the adoption of smart grid technologies, necessitating advanced testing solutions. Besides, Canada’s strong industrial base, including steel plants and refineries, contributes significantly to market growth. While Canada accounts for a smaller share of the regional market compared to the U.S., its rapid growth trajectory positions it as a key contributor to the North America electrical testing services market.

The Rest of North America, comprising Mexico and other regions and represents a nascent yet promising segment in the electrical testing services market. Also, the rise of commercial and industrial establishments in Mexico has heightened the need for electrical testing services. Like, commercial construction projects in Mexico grew notably in the past few years, creating demand for services such as battery testing and rotating equipment vibration analysis. These efforts have positioned the region as an emerging hub for electrical testing services, with significant potential for future growth.

LEADING PLAYERS IN THE NORTH AMERICA ELECTRICAL TESTING SERVICES MARKET

Intertek Group plc

A global leader in quality assurance. The company’s dominance is driven by its comprehensive service portfolio, which includes transformer testing, thermographic inspections, and predictive maintenance solutions. Also, the company’s strategic focus on innovation is evident in its recent launch of AI-driven predictive maintenance platforms, enabling customers to identify vulnerabilities and prevent failures proactively.

SGS SA

Headquartered in Switzerland, and is renowned for its high-quality testing and certification services. The company’s commitment to sustainability is reflected in its introduction of eco-friendly testing protocols, aligning with growing environmental concerns. SGS’s global campaign to promote its AI-driven testing solutions has resonated strongly with tech-savvy customers, reinforcing its brand image. Additionally, the company’s focus on precision and reliability ensures its services meet the stringent requirements of industries such as power generation and data centers.

UL Solutions

A U.S.-based company. Its expertise in standards development and compliance testing has made it a trusted partner for industries such as healthcare, hospitality, and commercial establishments. UL Solutions’ strategic collaborations with research institutions have enabled it to co-develop specialized testing methodologies, further enhancing its competitive edge. The company’s emphasis on affordability and accessibility has made it a preferred choice for smaller enterprises and academic institutions.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Innovation in Testing Technologies

Innovation remains a cornerstone of success in the electrical testing services market, with companies continuously launching advanced solutions to meet the evolving demands of customers. Similarly, these innovations not only differentiate services but also ensure compliance with increasingly stringent regulatory standards.

Strategic Partnerships

Collaborations with research institutions and industry players are another key strategy. Such partnerships allow companies to leverage external expertise and resources, accelerating service development and market penetration.

Geographic Expansion

Geographic expansion is critical for capturing untapped markets and diversifying revenue streams. Intertek Group plc has established a strong presence in emerging industrial hubs such as Texas and California, while SGS SA has expanded its distribution network in Canada and Mexico. These efforts ensure widespread availability of services and enable companies to cater to regional preferences.

Sustainability Initiatives

Sustainability has emerged as a key differentiator, with companies increasingly focusing on eco-friendly practices. SGS SA introduced eco-friendly testing protocols in 2022, addressing environmental concerns and appealing to environmentally conscious customers. Similarly, UL Solutions has explored the use of recyclable materials in its service processes, aligning with global trends toward greener practices.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Key Market Players of the North America electrical testing services market include SGS SA, Bureau Veritas, Intertek Group plc, TÜV SÜD, Applus+, ALS Limited, Electrical Testing Services, Inc., American Electrical Testing Co. LLC, Doble Engineering Company, RESA Power

The North America electrical testing services market is characterized by intense competition, with key players vying for market share through innovation, strategic initiatives, and customer-centric approaches. The market is highly fragmented, with global giants such as Intertek Group plc, SGS SA, and UL Solutions dominating alongside numerous regional players targeting niche segments.

Service Differentiation: Service differentiation is a key battleground, with companies focusing on developing advanced testing solutions tailored for specialized applications. For instance, SGS SA provides thermographic testing optimized for detecting inefficiencies in electrical systems. These innovations enable companies to cater to specific customer needs and command premium pricing.

Pricing Strategies: Pricing strategies vary significantly across the market, reflecting the diverse needs of end-users. Premium services target large utilities and industrial facilities that prioritize reliability and precision, while cost-effective solutions cater to smaller enterprises operating under tight budgets. This segmentation allows companies to maximize their reach while maintaining profitability.

Collaborations and Mergers: Collaborations and mergers are common strategies employed to enhance capabilities and expand market presence. For example, UL Solutions’ partnerships with research institutions have strengthened its R&D capabilities, enabling it to develop cutting-edge services.

Sustainability Initiatives: Sustainability has emerged as a critical factor influencing competition. Companies that adopt eco-friendly practices, such as introducing recyclable materials or energy-efficient testing protocols, gain a competitive edge by appealing to environmentally conscious customers.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Intertek Group plc launched an AI-driven predictive maintenance platform, enabling customers to identify vulnerabilities and prevent failures proactively. This launch underscores the company’s commitment to innovation and its focus on catering to the growing demand for advanced testing solutions.

- In June 2023, SGS SA introduced eco-friendly testing protocols, aligning with sustainability goals and addressing environmental concerns. This initiative reflects the company’s dedication to reducing its carbon footprint and appealing to environmentally conscious customers.

- In August 2022, UL Solutions partnered with a leading research institution to co-develop specialized testing methodologies for data centers, enabling it to tap into niche markets and expand its service offerings. This collaboration highlights UL’s strategic approach to leveraging external expertise and resources.

- In March 2022, Intertek acquired ALS Industrial Services for $1.5 billion, significantly expanding its reach in the industrial testing sector. This acquisition not only broadened Intertek’s customer base but also enhanced its ability to offer integrated solutions.

- In October 2021, SGS launched a global campaign to promote its AI-driven testing solutions, targeting tech-savvy customers and reinforcing its brand image. This campaign demonstrated the company’s proactive approach to innovation and its ability to differentiate itself in a competitive market.

MARKET SEGMENTATION

This research report on the North America electrical testing services market has been segmented and sub-segmented based on service type, end use and region.

By Service Type

- Transformer Testing

- Thermographic Testing

By End Use

- Power Generation Stations

- Data Centers

By Region

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. Who uses electrical testing services in North America?

Industries such as power generation and distribution, manufacturing, oil & gas, commercial construction, and data centers rely heavily on these services.

2. What is driving market growth in North America?

Key drivers include aging electrical infrastructure, stringent safety and regulatory requirements, increased demand for uninterrupted power, and the rise of automation.

3. Which testing methods are most widely used in this market?

Widely used methods include insulation resistance testing, high potential (HiPot) testing, power quality analysis, thermal imaging, and time domain reflectometry.

4. How is the market evolving with technology?

The market is shifting toward digital testing solutions, real-time monitoring, remote diagnostics, and the integration of AI for predictive maintenance.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]