North America Electric vehicles Market Size, Share, Trends & Growth Forecast Report Segmented By Product Type, Vehicle Type, And By Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America Electric vehicles Market Size

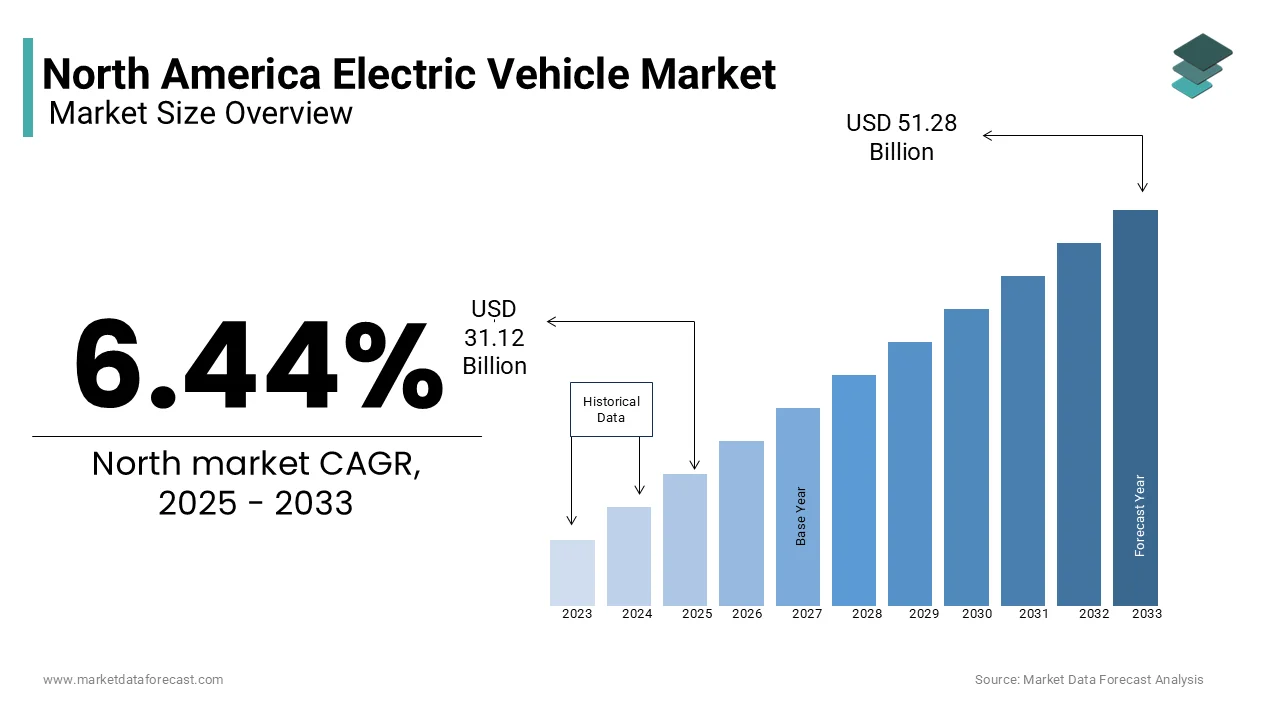

The North America electric vehicle market was valued at USD 29.24 billion in 2024 and is anticipated to reach USD 31.12 billion in 2025 from USD 51.28 billion by 2033, growing at a CAGR of 6.44% during the forecast period from 2025 to 2033.

Electric vehicles include various types of electric vehicles, including battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) that are designed to reduce reliance on fossil fuels and minimize greenhouse gas emissions. The North American electric vehicles market has gained significant traction due to a confluence of factors, including technological advancements, government incentives, and a growing consumer preference for sustainable transportation solutions. The growing availability of EV models, improvements in battery technology, and the expansion of charging infrastructure are also aiding the expansion of electric vehicles market in North America. As consumers become more environmentally conscious and seek alternatives to traditional internal combustion engine vehicles, the electric vehicle market is poised for substantial growth, reflecting a transformative shift in the automotive landscape.

MARKET DRIVERS

Government Incentives and Regulations in North America

Government incentives and regulations are driving the North America electric vehicles market. Various federal, state, and local governments have implemented policies aimed at promoting the adoption of electric vehicles, including tax credits, rebates, and grants for consumers purchasing EVs. For instance, the federal tax credit in the United States can provide up to $7,500 for eligible electric vehicle purchases, significantly reducing the overall cost for consumers. According to the U.S. Department of Energy, these incentives have contributed to a substantial increase in EV sales, with over 600,000 electric vehicles sold in 2021 alone, representing a 70% increase from the previous year. Additionally, stringent emissions regulations are compelling automakers to invest in electric vehicle technology to meet compliance standards. The California Air Resources Board has set ambitious targets for zero-emission vehicles, further encouraging manufacturers to expand their electric vehicle offerings. As governments continue to prioritize sustainability and environmental protection, the supportive regulatory framework is expected to propel the growth of the electric vehicle market in North America.

Advancements in Battery Technology

Advancements in battery technology are further propelling the growth of the North America electric vehicle market, enhancing the performance, range, and affordability of electric vehicles. The development of lithium-ion batteries has revolutionized the EV landscape, providing higher energy densities and longer lifespans compared to traditional battery technologies. According to a report by BloombergNEF, the cost of lithium-ion batteries has decreased by approximately 89% since 2010, making electric vehicles more economically viable for consumers. This reduction in battery costs has enabled manufacturers to produce a wider range of electric vehicles at competitive prices, thereby increasing consumer accessibility. Furthermore, innovations in battery management systems and fast-charging technologies are addressing range anxiety, a common concern among potential EV buyers. The introduction of ultra-fast charging stations, capable of charging an EV to 80% in under 30 minutes, is enhancing the convenience of electric vehicle ownership. As battery technology continues to evolve, the electric vehicle market is expected to experience accelerated growth, driven by improved performance and reduced costs.

MARKET RESTRAINTS

High Initial Purchase Costs

The high initial purchase costs associated with electric vehicles is one of the major restraints of the North America electric vehicle market. While the long-term savings on fuel and maintenance can offset these costs, the upfront investment remains a barrier for many consumers. The average price of a new electric vehicle in the United States was approximately $56,000 in 2022, according to Kelley Blue Book, which is significantly higher than the average price of a gasoline-powered vehicle. This price disparity can deter budget-conscious consumers from considering electric vehicles as a viable option. Additionally, the limited availability of affordable EV models further exacerbates this challenge, as many consumers are hesitant to invest in a technology that they perceive as expensive. Although government incentives can help mitigate these costs, the effectiveness of such programs varies by state and may not be sufficient to encourage widespread adoption. Addressing the issue of high initial purchase costs through the development of more affordable electric vehicle options will be crucial for expanding the consumer base and driving market growth.

Limited Charging Infrastructure

The limited availability of charging infrastructure is also hampering the growth of the North America electric vehicle market. Despite the increasing number of electric vehicles on the road, the charging network has not kept pace with demand, leading to concerns about range anxiety among potential buyers. According to the U.S. Department of Energy, there were approximately 100,000 public charging stations in the United States as of 2022, which is insufficient to support the growing EV population. This lack of charging infrastructure can deter consumers from making the switch to electric vehicles, particularly in rural areas where charging stations are scarce. Furthermore, the time required to charge an electric vehicle compared to refueling a gasoline vehicle can be a deterrent for consumers accustomed to the convenience of traditional fueling methods. To overcome this challenge, significant investments in charging infrastructure are necessary, including the expansion of fast-charging networks and the integration of charging stations into urban planning. As the charging infrastructure improves, consumer confidence in electric vehicles is likely to increase, facilitating market growth.

MARKET OPPORTUNITIES

Expansion of Charging Infrastructure

The expansion of charging infrastructure is a notable opportunity for the North America electric vehicle market. As governments and private companies invest in the development of charging networks, the accessibility and convenience of charging electric vehicles will improve, addressing one of the primary barriers to EV adoption. According to a report by the International Energy Agency, the number of public charging points in the United States is expected to increase to over 1 million by 2030, reflecting a commitment to supporting the growing electric vehicle market. This expansion will not only alleviate range anxiety for consumers but also encourage more individuals to consider electric vehicles as a viable alternative to traditional gasoline-powered cars. Additionally, the integration of charging stations into existing infrastructure, such as shopping centers, workplaces, and residential areas, will further enhance convenience for EV owners. As the charging infrastructure continues to develop, the electric vehicle market is poised for significant growth, driven by increased consumer confidence and accessibility.

Growing Consumer Awareness and Demand for Sustainability

The growing consumer awareness and demand for sustainability is another promising opportunity for the North America electric vehicle market. As environmental concerns become increasingly prominent, consumers are actively seeking eco-friendly transportation options that align with their values. According to a survey conducted by Deloitte, 70% of consumers in the U.S. expressed a willingness to pay more for sustainable products, including electric vehicles. This shift in consumer preferences is driving automakers to expand their electric vehicle offerings and invest in sustainable practices throughout their supply chains. Furthermore, the rise of corporate sustainability initiatives is encouraging businesses to adopt electric vehicles for their fleets, further boosting demand. As consumers become more informed about the environmental impact of their transportation choices, the electric vehicle market is well-positioned to capitalize on this trend, fostering growth and innovation in the industry.

MARKET CHALLENGES

Competition from Traditional Vehicles

The competition from traditional internal combustion engine vehicles is a major challenge to the North America electric vehicle market. Despite the growing popularity of electric vehicles, gasoline-powered cars still dominate the automotive landscape, accounting for approximately 95% of total vehicle sales in the United States as of 2022, according to the Automotive News Data Center. This entrenched market position presents a formidable barrier for electric vehicles, as consumers may be reluctant to switch to a new technology that they perceive as less familiar or convenient. Additionally, the extensive existing infrastructure for gasoline vehicles, including refueling stations and maintenance services, further reinforces consumer preferences for traditional vehicles. To overcome this challenge, electric vehicle manufacturers must effectively communicate the benefits of EVs, such as lower operating costs, environmental advantages, and advancements in technology. By addressing consumer concerns and highlighting the advantages of electric vehicles, the market can gradually shift towards greater acceptance and adoption.

Supply Chain Disruptions

Supply chain disruptions is another notable challenge for the North America electric vehicle market. The COVID-19 pandemic has exposed vulnerabilities in global supply chains, leading to shortages of critical components such as semiconductors and batteries. According to a report by the Automotive Industry Association, the semiconductor shortage alone resulted in the loss of over 1.3 million vehicle sales in North America in 2021. These disruptions have hindered production capabilities for electric vehicle manufacturers, delaying the rollout of new models and limiting the availability of existing ones. Furthermore, the reliance on global supply chains for battery materials, such as lithium and cobalt, raises concerns about sustainability and ethical sourcing. As the demand for electric vehicles continues to rise, addressing supply chain challenges will be crucial for ensuring the timely production and delivery of electric vehicles. Manufacturers must explore strategies to enhance supply chain resilience, including diversifying suppliers and investing in domestic production capabilities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

% |

|

Segments Covered |

By Vehicle Type, Distribution Channel, End-User and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

BYD Motors Inc., Daimler Truck AG, Ford Motor Company, General Motors, Lucid, MITSUBISHI MOTORS CORPORATION, Nissan Motor Co., Ltd., Tesla, TOYOTA MOTOR CORPORATION, Volkswagen Group |

SEGMENTAL ANALYSIS

By Product Insights

The battery electric vehicles (BEVs) segment accounted for 71.4% of the North American market share in 2024. The dominance of BEVs segment in North America can be attributed to the growing consumer preference for fully electric vehicles that operate solely on battery power, offering zero tailpipe emissions and lower operating costs compared to traditional vehicles. According to the Electric Drive Transportation Association, BEV sales in the United States reached over 400,000 units in 2021, reflecting a significant increase in consumer interest. The importance of BEVs is underscored by advancements in battery technology, which have improved range and charging times, making them more appealing to consumers. Additionally, the expansion of charging infrastructure and government incentives further support the growth of the BEV segment. As consumers increasingly prioritize sustainability and seek alternatives to fossil fuel-powered vehicles, the BEV segment is expected to maintain its leading position in the North American electric vehicle market.

The plug-in hybrid electric vehicles (PHEVs) segment is another promising segment and is estimated to register the fastest CAGR of 26.2% over the forecast period. The growth of the PHEVs segment in the North American market can be attributed to the unique advantages offered by PHEVs, which combine an internal combustion engine with an electric motor, allowing for greater flexibility in driving range and fuel efficiency. According to industry data, PHEV sales in the United States increased by over 50% in 2021, driven by consumer interest in vehicles that provide the benefits of both electric and gasoline power. The ability to charge the battery from an external source while also having the option to use gasoline makes PHEVs an attractive choice for consumers who may have concerns about range anxiety. As automakers continue to expand their PHEV offerings and improve battery technology, this segment is well-positioned for sustained growth, catering to a diverse range of consumer preferences and driving needs.

By Vehicle Type Insights

The passenger cars and light trucks (PCLT) segment occupied 76.7% of the North American market share in 2024. The dominating position of PCLT segment in the North American market is primarily driven by the increasing consumer demand for electric vehicles in the personal transportation sector, where convenience and efficiency are paramount. According to the Automotive News Data Center, sales of electric passenger cars and light trucks reached over 1 million units in 2021, reflecting a significant shift in consumer preferences towards electric mobility. The importance of the PCLT segment is underscored by the growing availability of diverse electric models, ranging from compact cars to SUVs and trucks, catering to various consumer needs and lifestyles. Additionally, the expansion of charging infrastructure and government incentives has further facilitated the adoption of electric vehicles in this segment. As consumers increasingly prioritize sustainability and seek alternatives to traditional gasoline-powered vehicles, the PCLT segment is expected to maintain its leading position in the North American electric vehicle market, driving overall growth and innovation in the industry.

The commercial vehicle segment is estimated to register the highest CAGR of 31.3% over the forecast period owing to the increasing demand for sustainable logistics and transportation solutions among businesses and municipalities. According to a report by the North American Council for Freight Efficiency, the adoption of electric commercial vehicles is expected to rise significantly as companies seek to reduce their carbon footprints and comply with stringent emissions regulations. The benefits of electric commercial vehicles, such as lower operating costs, reduced maintenance, and the potential for government incentives, are driving fleet operators to transition to electric options. Additionally, advancements in battery technology and charging infrastructure are enhancing the feasibility of electric commercial vehicles for various applications, including delivery services, public transportation, and utility operations. As the market for electric commercial vehicles continues to expand, it presents significant opportunities for manufacturers and stakeholders in the North American electric vehicle landscape.

COUNTRY ANALYSIS

The United States held the most dominating share of the North American market in 2024. The leading position of the U.S. in the North America is driven by a robust automotive industry, significant investments in electric vehicle technology, and a growing consumer base that increasingly prioritizes sustainability. According to the Electric Drive Transportation Association, the U.S. saw electric vehicle sales surpass 600,000 units in 2021, reflecting a 70% increase from the previous year. The federal government has implemented various incentives, such as tax credits and rebates, to encourage electric vehicle adoption, further bolstering the market. Additionally, the expansion of charging infrastructure and advancements in battery technology are enhancing the appeal of electric vehicles among consumers. As the U.S. continues to lead in electric vehicle innovation and adoption, it plays a pivotal role in shaping the future of the North American electric vehicle market.

Canada is likely to account for a notable share of the North American electric vehicle market over the forecast period. The Canadian electric vehicle market has experienced steady growth, driven by a strong commitment to sustainability and government initiatives aimed at reducing greenhouse gas emissions. According to the Canadian Electric Vehicle Association, electric vehicle sales in Canada surged by over 50% in 2021, reflecting a growing consumer preference for eco-friendly transportation options. The Canadian government has set ambitious targets for electric vehicle adoption, including a goal to have 100% of light-duty vehicle sales be zero-emission by 2035. Additionally, the expansion of charging infrastructure and incentives for electric vehicle purchases are further supporting market growth. As Canadians increasingly seek sustainable transportation solutions, the electric vehicle market is well-positioned for continued expansion, reflecting the nation's commitment to environmental stewardship.

Mexico is emerging as a growing player in the North America electric vehicle market. The increasing popularity of electric vehicles among Mexican consumers, coupled with government initiatives to promote sustainable transportation, has contributed to the market's expansion. According to the Mexican Association of Electric Vehicles, electric vehicle sales in Mexico have been on the rise, with a growing number of manufacturers entering the market. The Mexican government has implemented various policies to encourage electric vehicle adoption, including tax incentives and investments in charging infrastructure. Additionally, the country's diverse landscapes and favorable climate make it an attractive destination for electric vehicle enthusiasts. As the market continues to develop, Mexico presents significant opportunities for growth, particularly in the context of cross-border travel and the increasing interest in exploring sustainable transportation options.

KEY MARKET PLAYERS

BYD Motors Inc., Daimler Truck AG, Ford Motor Company, General Motors, Lucid, MITSUBISHI MOTORS CORPORATION, Nissan Motor Co., Ltd., Tesla, TOYOTA MOTOR CORPORATION, Volkswagen Group are the market players that are dominating the North America electric vehicle market.

MARKET SEGMENTATION

This research report on the North America electric vehicle market is segmented and sub-segmented into the following categories.

By Product

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

By Vehicle Type

- PCLT

- Passenger Cars

- Light Trucks

- Commercial Vehicle

By Country

- U.S.

- Canada

- Mexico

Frequently Asked Questions

What is driving the growth of the electric vehicle market in North America?

Government incentives, increasing fuel prices, advancements in battery technology, and growing consumer awareness of sustainability are key drivers.

Which types of electric vehicles are most popular in North America?

Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) dominate, with SUVs and trucks gaining significant traction.

What challenges does the North American EV market face?

High initial costs, limited charging infrastructure in rural areas, battery supply chain constraints, and consumer range anxiety are major hurdles.

Which companies are leading the EV market in North America?

Tesla, General Motors, Ford, Rivian, and Lucid Motors are key players, along with new entrants and global brands expanding their EV offerings.

How is the charging infrastructure evolving in North America?

Expansion of fast-charging networks by companies like Tesla Supercharger, Electrify America, and ChargePoint, along with government investments in EV infrastructure.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]