North America Electric Outboard Engines Market Size, Share, Trends & Growth Forecast Report By Power (Below 25 kW, 25 – 50 kW, 50 – 150 kW), Speed, Application, Distribution Channel and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Electric Outboard Engines Market Size

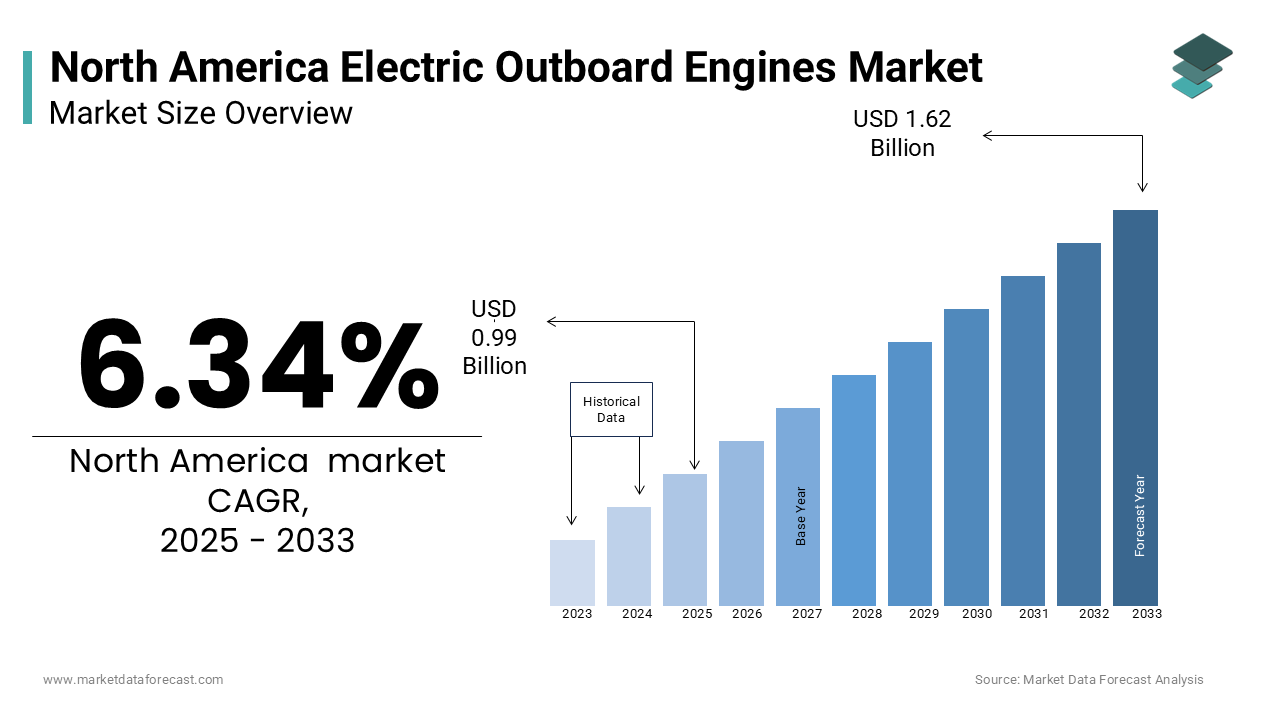

The North America electric outboard engines market was worth USD 0.93 billion in 2024. The North American market is estimated to grow at a CAGR of 6.34% from 2025 to 2033 and be valued at USD 1.62 billion by the end of 2033 from USD 0.99 billion in 2025.

Electric outboard engines utilize electric motors instead of traditional internal combustion engines and are gaining traction among recreational boaters and commercial operators alike. This shift is largely attributed to the growing emphasis on sustainability and the reduction of carbon emissions in marine activities. This growth is further fueled by innovations in battery technology, which enhance the efficiency and range of electric outboard motors, making them more appealing to consumers. The increasing availability of charging infrastructure and government incentives for electric vehicle adoption also play a crucial role in this market's expansion.

MARKET DRIVERS

The increasing demand for sustainable boating solutions is a primary driver of the North America electric outboard engines market. As environmental concerns escalate, consumers are gravitating towards eco-friendly alternatives that minimize their carbon footprint. The recreational boating sector, in particular, is witnessing a paradigm shift, with electric outboard engines being perceived as a viable solution to reduce emissions and noise pollution. According to the National Marine Manufacturers Association, nearly 70% of boaters express a preference for electric options, citing environmental benefits as a key factor in their purchasing decisions. Furthermore, the U.S. government has introduced various incentives to promote electric vehicle adoption, including tax credits and grants for electric marine technologies. This regulatory support not only encourages manufacturers to innovate but also enhances consumer confidence in electric outboard engines.

Technological advancements in battery efficiency and performance are significantly propelling the North America electric outboard engines market. Innovations in lithium-ion battery technology have led to substantial improvements in energy density, charging times, and overall lifespan, making electric outboard engines more competitive with traditional gasoline-powered alternatives. As per a report by BloombergNEF, the cost of lithium-ion batteries has decreased by nearly 89% since 2010 which has made electric propulsion systems more economically viable for manufacturers and consumers alike. This reduction in costs, combined with enhanced performance metrics, has resulted in a growing acceptance of electric outboard engines among both recreational and commercial users. Further, advancements in smart technology, such as integrated navigation systems and real-time performance monitoring, are further enhancing the user experience.

MARKET RESTRAINTS

The high initial cost of electric outboard engines remains a significant restraint in the North America market. While the long-term operational savings and environmental benefits are appealing, the upfront investment required for electric propulsion systems can deter potential buyers. As indicated by a study by the Electric Boat Association, electric outboard engines can cost up to 50% more than their gasoline counterparts, which poses a barrier for many consumers, particularly in the recreational boating segment. This price disparity is compounded by the relatively limited availability of affordable charging infrastructure, which can further discourage adoption. As a result, many consumers remain hesitant to transition from traditional outboard engines to electric alternatives, impacting overall market growth.

The limited range and performance capabilities of electric outboard engines compared to traditional gasoline engines present another significant restraint in the North America market. While advancements in battery technology have improved the efficiency and range of electric motors, many consumers still perceive electric outboards as inadequate for long-distance travel or high-performance applications. Based on the National Marine Manufacturers Association, around 40% of boaters express concerns about the range limitations of electric outboard engines, particularly for extended trips or commercial use. This perception is further exacerbated by the current state of charging infrastructure, which is not as widespread or accessible as traditional fuel stations. Consequently, the fear of running out of power during a boating excursion remains a significant barrier to adoption.

MARKET OPPORTUNITIES

The growing trend of eco-tourism and sustainable recreational activities presents a significant opportunity for the North America electric outboard engines market. As consumers increasingly seek environmentally friendly options for their leisure activities, electric outboard engines align perfectly with this demand. According to a report by the Adventure Travel Trade Association, eco-tourism is projected to grow at a notable pace in the coming years which is indicating a robust market for sustainable boating solutions. This trend is particularly pronounced among younger generations, who prioritize sustainability in their purchasing decisions. This shift not only opens new revenue streams for manufacturers but also fosters a broader acceptance of electric propulsion systems in the boating industry. The market is expected to capitalize on this opportunity, with electric outboard engines likely to become a preferred choice for eco-tourism operators and recreational boaters alike.

The increasing investment in charging infrastructure for electric vehicles, including marine applications, represents another promising opportunity for the North America electric outboard engines market. As governments and private entities recognize the importance of supporting electric mobility, significant resources are being allocated to expand charging networks. The U.S. Department of Energy states that the number of public charging stations for electric vehicles has increased by over 50% in the past two years, with similar growth anticipated for marine charging facilities. This expansion not only alleviates range anxiety among potential electric outboard engine users but also enhances the overall appeal of electric propulsion systems. Furthermore, partnerships between electric outboard manufacturers and charging infrastructure providers are likely to emerge, creating synergies that promote the adoption of electric outboard engines.

MARKET CHALLENGES

The challenge of consumer education and awareness regarding electric outboard engines poses a significant hurdle for market growth. Despite the environmental benefits and advancements in technology, many potential buyers remain uninformed about the advantages of electric propulsion systems. A survey conducted by the Marine Industry Association found that nearly 60% of boaters are unaware of the latest developments in electric outboard technology, which hampers their willingness to consider these options. This lack of awareness is particularly pronounced among traditional boaters who have long relied on gasoline engines.

The challenge of regulatory compliance and standardization in the electric outboard engines market is another significant barrier to growth. As the industry evolves, manufacturers must navigate a complex landscape of regulations and standards that vary by region and application. According to the National Marine Manufacturers Association, compliance with environmental regulations and safety standards can be particularly challenging for new entrants in the market. This complexity can lead to increased costs and delays in product development, hindering innovation and market entry. Additionally, the lack of standardized testing and certification processes for electric outboard engines can create confusion among consumers and manufacturers alike.

SEGMENTAL ANALYSIS

By Power Insights

The segment of engines with a power rating of below 25 kW was the largest in the North America electric outboard engines market by commanding a market share of 45.1% in 2024. This rule can be linked to the increasing popularity of small recreational boats and personal watercraft, which are often powered by lower-wattage electric outboard engines. As per the National Marine Manufacturers Association, the sales of small boats have surged by 30% over the past three years, with many consumers opting for electric options due to their environmental benefits and ease of use. The growing trend of eco-friendly boating is further driving the demand for lower-powered electric outboards, as they are ideal for short trips and leisurely outings. Additionally, advancements in battery technology have improved the performance and efficiency of these engines, making them more appealing to consumers.

The segment of electric outboard engines rated between 25 kW and 50 kW is emerging as the fastest-growing category, with a projected CAGR of 20.4% owing to the increasing demand for mid-sized boats that require more power for recreational and commercial applications. According to industry forecasts, the sales of mid-sized boats are expected to rise by 25% by 2028, driven by a growing interest in water sports and fishing activities. The enhanced performance capabilities of electric outboard engines in this power range, combined with advancements in battery technology, are making them an attractive option for consumers seeking a balance between power and sustainability. Furthermore, the expansion of charging infrastructure is alleviating concerns about range limitations, further fueling the growth of this segment.

By Speed Insights

The segment of engines with speeds below 5 mph gained the maximum portion under this category and held a market share of 40.6% in 2024. This segment's dominance can be associated with the increasing popularity of electric outboard engines for leisurely activities such as fishing and cruising in calm waters. As per the National Marine Manufacturers Association, closely 50% of boaters prefer low-speed options for recreational use, as they provide a quieter and more serene experience on the water. Apart from this, the lower energy consumption of these engines makes them an attractive choice for environmentally conscious consumers.

The segment of electric outboard engines with speeds above 15 mph is advancing quickly, with an estimated CAGR of 18.2% during the forecast period. This growth can be attributed to the increasing demand for high-performance electric outboard engines among recreational and commercial users. The ability of these engines to deliver impressive speeds while maintaining low emissions is appealing to consumers seeking both performance and sustainability. Furthermore, the growing interest in water sports and competitive boating is fueling the demand for high-speed electric outboard engines.

By Application Insights

The commercial application segment spearheaded the North America electric outboard engines market and contributed for 50.8% of the market share in 2024. This rise can be caused by the increasing adoption of electric outboard engines in various commercial sectors, including fishing, tourism, and transportation. As per the National Marine Manufacturers Association, the commercial boating sector is experiencing a shift towards sustainable practices, with many operators seeking to reduce their carbon footprint and operational costs. The lower maintenance requirements and fuel savings associated with electric outboard engines make them an attractive option for commercial operators.

Whereas, the recreational application segment is the questest-growing category, with a projected CAGR of 22.1% over the next five years. This growth can be supported by the increasing popularity of recreational boating activities, particularly among younger generations who prioritize sustainability. The industry forecasts indicate that the number of recreational boaters is expected to rise significantly, driven by a growing interest in outdoor activities and eco-tourism. The appeal of electric outboard engines for recreational use lies in their quiet operation, reduced emissions, and lower operating costs.

By Distribution Channel Insights

The direct sales channel remained the best performer in the North America electric outboard engines market by holding a market share of 64.7% in 2024. This influence can be due to the increasing trend of manufacturers selling directly to consumers, allowing for better pricing and customer engagement. The industry reports suggest that the direct sales have become a preferred method for many consumers, as it provides access to a wider range of products and personalized service. Additionally, manufacturers are leveraging online platforms to enhance their direct sales efforts, making it easier for consumers to research and purchase electric outboard engines.

The indirect sales channel is accelerating with a projected CAGR of 19% over the years. This expansion can be credited to the rising number of retail outlets and distributors specializing in electric outboard engines. The National Marine Manufacturers Association states that the expansion of retail networks is making electric outboard engines more accessible to consumers, particularly in regions with high boating activity. Additionally, partnerships between manufacturers and established retailers are enhancing the visibility of electric outboard engines in the market.

REGIONAL ANALYSIS

The United States electric outboard engines market was the largest in North America by accounting for approximately 75.6% of the regional share in 2024. The U.S. market is described by a strong demand for recreational boating and a growing emphasis on sustainability. The National Marine Manufacturers Association reveals that, the number of registered boats in the U.S. has reached over 12 million, with a significant portion of boaters expressing interest in electric propulsion systems. The U.S. government has also implemented various incentives to promote electric vehicle adoption, further driving the growth of electric outboard engines.

Canada is experiencing the swiftest expansion in the North America electric outboard engines market and is expected to register a CAGR of 7.1% during the forecast period. This is fueled by government-backed clean energy incentives and a growing preference for eco-friendly marine transport solutions, especially across its extensive network of lakes and waterways. The Canadian market is distinguished by a surgung interest in eco-friendly boating solutions, driven by increasing environmental awareness among consumers. Based on a report by the Canadian Marine Industry Association, the sales of electric outboard engines have surged by 30% in the past year, reflecting a shift towards sustainable practices in the boating sector. Additionally, the Canadian government has introduced various initiatives to support the adoption of electric vehicles, including grants and incentives for electric marine technologies.

The Rest of North America continues to progress steadily in the electric outboard engines market and is driven by increasing awareness of sustainable watercraft technologies and the modernization of local boating industries, particularly in smaller coastal and island economies. Since the market in this region is still developing, there is a growing interest in electric propulsion systems, particularly among environmentally conscious consumers. According to industry reports, the Mexican government has begun to explore initiatives to promote electric vehicles, including marine applications, which could pave the way for future growth in the electric outboard engines market. As awareness of the benefits of electric propulsion systems continues to rise, the rest of North America is expected to experience gradual growth, with electric outboard engines gaining traction among consumers. The potential for eco-tourism and sustainable boating practices in this region presents opportunities for manufacturers to expand their market presence.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The North America electric outboard engines market is characterized by the presence of several key players who are actively contributing to the growth and innovation within the sector. Leading manufacturers such as Torqeedo, Brunswick Corporation, and Yamaha Motor Co., Ltd. are at the forefront of this market, each playing a pivotal role in shaping the landscape of electric propulsion technology.

Torqeedo is a pioneer in electric marine propulsion, having established itself as a leader by offering a range of high-performance electric outboard engines that cater to both recreational and commercial applications. Their commitment to sustainability and innovation has positioned them as a preferred choice among environmentally conscious consumers. Torqeedo's products are known for their efficiency and advanced technology, making them a popular option for boaters looking to reduce their environmental impact.

Brunswick Corporation, a major player in the marine industry, has made significant investments in electric propulsion technology through its brands such as Mercury Marine. The company is focused on developing advanced electric outboard engines that meet the growing demand for sustainable boating solutions. Their strategic initiatives include partnerships with technology firms to enhance battery efficiency and performance, further solidifying their position in the market. Brunswick's extensive distribution network and brand recognition also contribute to its competitive advantage.

Yamaha Motor Co., Ltd. is another key player that has been actively expanding its electric outboard engine offerings. The company leverages its extensive experience in the marine sector to develop innovative electric propulsion systems that deliver high performance while minimizing environmental impact. Yamaha's commitment to research and development is driving advancements in electric outboard technology, making them a formidable competitor in the North American market. Their focus on quality and reliability has earned them a loyal customer base.

The competition in the North America electric outboard engines market is intensifying as more players enter the space and existing manufacturers expand their product offerings. With the growing emphasis on sustainability and environmental responsibility, companies are racing to innovate and capture market share. The competitive landscape is characterized by a mix of established marine industry giants and emerging startups, each vying for consumer attention through technological advancements and unique value propositions.

Established players like Torqeedo, Brunswick Corporation, and Yamaha Motor Co., Ltd. leverage their extensive experience and resources to develop high-performance electric outboard engines that meet the diverse needs of consumers. These companies are investing in R&D to enhance battery efficiency, motor performance, and overall product reliability, ensuring they remain competitive in a rapidly evolving market.

On the other hand, new entrants are bringing fresh ideas and innovative solutions to the market, often focusing on niche segments or specific consumer needs. This influx of competition is driving innovation and pushing established players to continuously improve their offerings. Additionally, the increasing availability of charging infrastructure and government incentives for electric vehicle adoption are further fueling competition, as more consumers become interested in electric outboard engines.

Major Strategies Used by Key Players in the North America Electric Outboard Engines Market

Key players in the North America electric outboard engines market are employing a variety of strategies to strengthen their positions and capitalize on the growing demand for electric propulsion systems. One prominent strategy is the focus on research and development (R&D) to enhance product performance and efficiency. Companies like Torqeedo and Brunswick Corporation are investing heavily in R&D to develop cutting-edge battery technologies and electric motor designs that improve the range and power of their outboard engines. This commitment to innovation not only helps them stay ahead of competitors but also addresses consumer concerns regarding performance limitations.

Another significant strategy is the establishment of strategic partnerships and collaborations. For instance, manufacturers are partnering with battery technology firms and charging infrastructure providers to create integrated solutions that enhance the overall user experience. These collaborations enable companies to leverage each other's expertise, resulting in more efficient and reliable electric outboard engines. Additionally, partnerships with marine tourism operators and eco-tourism businesses are helping manufacturers promote their products to environmentally conscious consumers, further expanding their market reach.

Furthermore, key players are actively engaging in marketing and educational campaigns to raise awareness about the benefits of electric outboard engines. By highlighting the environmental advantages, cost savings, and technological advancements associated with electric propulsion, companies aim to educate potential customers and encourage the adoption of electric outboard engines. This proactive approach not only fosters consumer confidence but also positions these manufacturers as leaders in the transition towards sustainable boating solutions.

RECENT MARKET DEVELOPMENTS

- In March 2023, Torqeedo announced the launch of its new high-efficiency electric outboard engine, the Travel 1103 C, designed for small boats and dinghies. This product aims to enhance the user experience with improved battery life and performance.

- In June 2023, Brunswick Corporation unveiled its latest electric outboard engine, the Avator 7.5e, which features advanced battery technology and a lightweight design, catering to the growing demand for sustainable boating solutions.

- In August 2023, Yamaha Motor Co., Ltd. expanded its electric outboard engine lineup by introducing the new F20DETL, which combines high performance with eco-friendly features, targeting both recreational and commercial markets.

- In October 2023, the Electric Boat Association launched a nationwide campaign to promote the benefits of electric outboard engines, aiming to raise awareness and encourage adoption among boaters across North America.

- In November 2023, a collaboration between Torqeedo and a leading battery manufacturer was announced, focusing on the development of next-generation battery systems to enhance the performance and range of electric outboard engines.

- In January 2024, Brunswick Corporation partnered with a major marine tourism operator to provide electric outboard engines for eco-friendly boat rentals, promoting sustainable practices in the recreational boating sector.

- In February 2024, Yamaha Motor Co., Ltd. participated in a marine industry trade show, showcasing its latest electric outboard technologies and engaging with potential customers to highlight the advantages of electric propulsion.

- In March 2024, Torqeedo launched an educational initiative aimed at informing consumers about the environmental benefits and cost savings associated with electric outboard engines, fostering greater acceptance in the market.

- In April 2024, Brunswick Corporation announced a strategic investment in a startup focused on electric marine technologies, aiming to accelerate innovation and expand its product offerings in the electric outboard segment.

- In May 2024, Yamaha Motor Co., Ltd. revealed plans to expand its distribution network for electric outboard engines, enhancing accessibility for consumers and increasing market penetration across North America.

MARKET SEGMENTATION

This research report on the North America electric outboard Engines Market is segmented and sub-segmented based on categories.

By Power

- Below 25 kW

- 25 – 50 kW

- 50 – 150 kW

By Speed (mph)

- Below 5 mph

- 5-10 mph

- 10-15 mph

- Above 15 mph

By Application

- Commercial

- Recreational

- Military

By Distribution channel

- Direct Sales

- Indirect Sales

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What are the challenges in the North America Electric Outboard Engines Market?

High initial costs, limited battery range, longer charging times, and infrastructure challenges for charging stations hinder widespread adoption.

What is the future outlook for the North America Electric Outboard Engines Market?

The market is expected to grow steadily due to technological advancements in batteries, increasing marine electrification, and rising eco-conscious consumers.

What factors are driving the growth of the North America Electric Outboard Engines Market?

Rising environmental concerns, government regulations on emissions, increasing adoption of sustainable marine solutions, and advancements in battery technology drive market growth.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]