North America Dough Conditioners Market Size, Share, Trends & Growth Forecast Report By Ingredient Type (Enzymes, Emulsifiers, Oxidizing Agents, Reducing Agents), Form and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Dough Conditioners Market Size

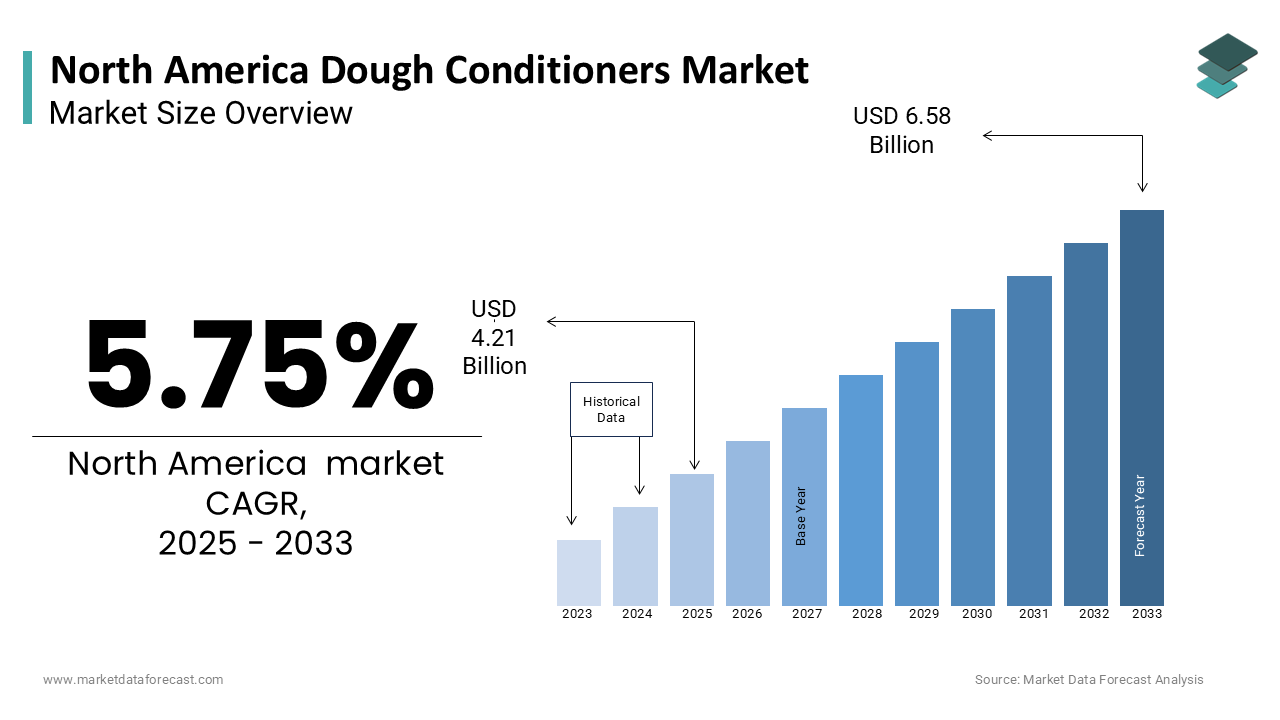

The North America dough conditioners market was worth USD 3.98 billion in 2024. The North American market is estimated to grow at a CAGR of 5.75% from 2025 to 2033 and be valued at USD 6.58 billion by the end of 2033 from USD 4.21 billion in 2025.

The North America dough conditioners market covers a diverse range of ingredients and additives that enhance the quality and performance of dough in various baked goods. These conditioners play a pivotal role in improving dough elasticity, stability, and shelf life, thereby meeting the evolving demands of both commercial and artisanal bakers. The market is characterized by a growing inclination towards convenience foods, as consumers increasingly seek ready-to-eat and easy-to-prepare options. This trend is further fueled by the rise of the food service industry, which relies heavily on high-quality dough products for pizzas, breads, and pastries. According to industry analyses, the North American dough conditioners market is projected to witness substantial growth, driven by innovations in formulation and an expanding consumer base that prioritizes quality and taste. The market's dynamics are influenced by factors such as the increasing prevalence of health-conscious eating habits, which has led to a demand for clean-label products devoid of artificial additives.

MARKET DRIVERS

Increasing Demand for Convenience Foods

The increasing demand for convenience foods is a significant driver of the North America dough conditioners market. As lifestyles become busier, consumers are gravitating towards ready-to-eat and easy-to-prepare food options. This shift is particularly evident in the food service sector, where establishments are seeking high-quality dough products that can be prepared quickly without compromising on taste or texture. According to market research, the convenience food segment is projected to grow continuously in the coming years as well and is showcasing the rising consumer preference for products that save time and effort in meal preparation. Dough conditioners play a crucial role in this context, as they enhance the quality and consistency of dough, making it easier for food manufacturers and restaurants to deliver superior baked goods.

Health and Wellness Trend

The health and wellness trend is another major driver influencing the North American dough conditioners market. As consumers become increasingly aware of the nutritional content of their food, there is a growing demand for clean-label products that are free from artificial additives and preservatives. This shift is prompting manufacturers to innovate and develop dough conditioners that align with health-conscious consumer preferences. As per a survey, about 70% of consumers are willing to pay a premium for products that are labeled as natural or organic. This trend is particularly pronounced among younger demographics, who prioritize transparency and ingredient integrity in their food choices. The market for organic and natural food products is expected to move ahead greatly and is indicating a significant opportunity for dough conditioner manufacturers to develop formulations that meet these evolving consumer demands.

MARKET RESTRAINTS

Volatility of Raw Material Prices

The volatility of raw material prices poses a significant restraint on the North American dough conditioners market. Fluctuations in the prices of key ingredients, such as wheat and other grains, can adversely affect production costs and profit margins for manufacturers. The U.S. Department of Agriculture suggests that wheat prices have experienced considerable volatility, with an increase of over 20% in the past year alone due to adverse weather conditions and supply chain disruptions. This unpredictability can lead to challenges in pricing strategies and inventory management for dough conditioner producers, ultimately impacting their competitiveness in the market. Additionally, the reliance on specific raw materials can create supply chain vulnerabilities, making it essential for manufacturers to adopt strategies that mitigate these risks.

Regulatory Challenges

Regulatory challenges also represent a significant restraint on the North America dough conditioners market. The food industry is subject to stringent regulations regarding ingredient safety, labeling, and health claims, which can complicate the development and marketing of dough conditioners. Compliance with the Food and Drug Administration (FDA) and other regulatory bodies requires manufacturers to invest time and resources in ensuring that their products meet established safety standards. The industry experts stress that the cost of compliance can account for up to 15% of total production expenses for food manufacturers. This financial burden can be particularly challenging for smaller companies that may lack the infrastructure to navigate complex regulatory landscapes. Furthermore, the increasing scrutiny on food additives and preservatives may lead to heightened consumer skepticism, prompting manufacturers to reformulate their products to align with clean-label trends.

MARKET OPPORTUNITIES

Rising Trend of Plant-Based Diets

The rising trend of plant-based diets presents a significant opportunity for the North America dough conditioners market. As more consumers adopt vegetarian and vegan lifestyles, there is an increasing demand for plant-based alternatives in various food categories, including baked goods. According to a report by the Plant Based Foods Association, the plant-based food trade in the United States reached $7 billion in sales in 2021 signifying a growth rate of 27% over the previous year. This surge in demand is prompting manufacturers to explore innovative formulations that incorporate plant-based ingredients into their dough conditioners. Furthermore, the integration of plant-based proteins and fibers into dough conditioners can enhance the nutritional profile of baked goods, appealing to health-conscious consumers.

Expansion of E-Commerce and Online Food Delivery Services

The expansion of e-commerce and online food delivery services represents another significant opportunity for the North America dough conditioners market. The COVID-19 pandemic has accelerated the shift towards online shopping and food delivery, with consumers increasingly turning to digital platforms for their grocery and meal needs. This shift presents a unique opportunity for dough conditioner manufacturers to enhance their visibility and accessibility through online channels. As the online food market continues to expand, the North America dough conditioners market can leverage this trend to drive growth and innovation in product offerings.

MARKET CHALLENGES

Maintaining Product Consistency and Quality

The challenge of maintaining product consistency and quality is a critical issue facing the North America dough conditioners market. As manufacturers strive to meet the diverse needs of consumers and food service operators, ensuring uniformity in product performance can be complex. Variability in raw materials, processing conditions, and storage can all impact the final quality of dough products. Around 30% of bakers report issues with dough consistency which can lead to product rejections and increased production costs. This challenge is particularly pronounced in large-scale operations, where maintaining quality across multiple batches is essential for customer satisfaction and brand reputation. To solve this issue, manufacturers must invest in advanced quality control measures and innovative formulation techniques that enhance the stability and performance of their dough conditioners.

Competitive Landscape

The competitive landscape of the North America dough conditioners market presents another significant challenge. With numerous players vying for market share, companies must differentiate their products and establish a strong brand presence to succeed. The market analysis reveal that the top five players in the dough conditioners market account for nearly 60% of the total market share is indicating a high level of concentration. This competitive pressure can lead to price wars and reduced profit margins, particularly for smaller manufacturers that may struggle to compete on price alone. Additionally, the rapid pace of innovation in the food industry necessitates continuous investment in research and development to stay ahead of emerging trends and consumer preferences. Companies that fail to adapt to changing market dynamics risk losing relevance and market share.

SEGMENTAL ANALYSIS

By Ingredient Type Insights

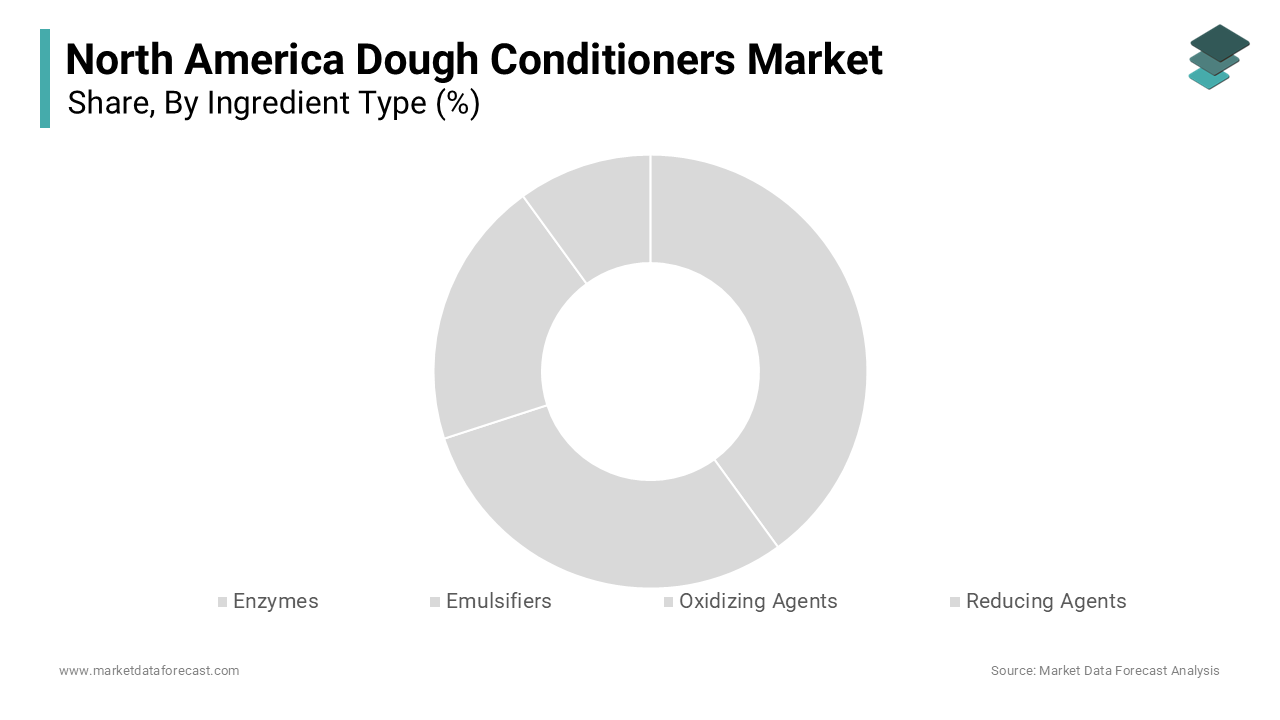

The enzymes segment depicted the majority share of the North America dough conditioners market and accounted for 45.6% of the total market value in 2024. This dominance can be attributed to the essential role that enzymes play in enhancing dough quality and performance. Enzymes such as amylases and proteases are crucial for improving dough elasticity, fermentation, and overall texture, making them indispensable in the baking process. The ability of enzymes to improve the nutritional profile of baked goods by enhancing digestibility and reducing the need for artificial additives further supports their popularity among manufacturers.

The emulsifiers segment is anticipated to be the fastest-growing category within the North America dough conditioners market, with a projected CAGR of 7.3% during the forecast period. This growth can be linked to the rising demand for emulsifiers that enhance dough stability and texture, particularly in the production of gluten-free and specialty baked goods. As more consumers seek alternatives to traditional wheat-based products, the need for effective emulsifiers that can mimic the properties of gluten is becoming increasingly important. Additionally, the versatility of emulsifiers in improving dough handling and extending shelf life further contributes to their rapid adoption in the baking industry.

By Form Insights

The liquid form segment of the North America dough conditioners market held the highest portion i.e. 55.8% of the total market value in 2024. This prominence can be associated with the ease of use and versatility that liquid dough conditioners offer to manufacturers. Liquid formulations allow for precise dosing and uniform distribution within the dough is ensuring consistent performance across batches. The convenience of liquid dough conditioners in commercial baking operations, where efficiency and consistency are paramount, further supports their leading position in the market.

The powder form segment is expected to be the Most rapidly advancing category within the North America dough conditioners market, with a calculated CAGR of 6.5% in the future. This development can be credited to the rising demand for powdered dough conditioners that offer extended shelf life and ease of storage. Powdered formulations are particularly appealing to manufacturers looking for cost-effective solutions that do not compromise on quality. According to market research, the demand for powdered baking ingredients is on the rise, driven by the increasing popularity of home baking and artisanal bread production. The ability of powdered dough conditioners to provide consistent results while allowing for flexibility in formulation further contributes to their rapid adoption in the market.

REGIONAL ANALYSIS

The United States remained the largest consumer and producer in the North America dough conditioners market and commanded 71.3% in 2024. The U.S. has a high density of industrial bakeries and a well-established convenience foods market, with heavy consumption of bread, buns, and processed bakery products. Additionally, the U.S. is home to several leading bakery ingredient companies, increasing demand for dough conditioners. According to the U.S. Bureau of Labor Statistics, the bakery industry in the United States is projected to grow at a rate of 3% annually, reflecting the increasing consumption of bread, pastries, and other baked products. The importance of the U.S. market lies in its diverse consumer base, which includes both health-conscious individuals seeking clean-label products and food service operators looking for high-quality dough solutions. This dual demand creates a favorable environment for dough conditioner manufacturers to innovate and expand their offerings, solidifying the United States' position as a key player in the North America dough conditioners market.

Canada maintains a steady progression in the North America dough conditioners market. It is largely supported by the growing preference for artisanal and organic bakery products. Consumer interest in healthier ingredients is influencing local bakeries and food manufacturers to adopt dough conditioners that comply with clean-label standards. Additionally, the country’s strong regulatory environment around food quality and safety ensures sustained demand for advanced baking solutions. This growth can be also be attributed to the increasing consumer interest in artisanal and specialty baked goods, as well as the rising trend of health-conscious eating. This wave is prompting manufacturers to innovate and develop dough conditioners that align with consumer preferences for clean-label products. The Canadian market is further benefiting from a growing foodservice sector, which is increasingly incorporating high-quality dough products into their offerings.

Mexico and the surrounding areas are showing accelerated momentum in this market and are expected to register the fastest expansion i.e. a CAGR of 6.1% in the future. Mexico’s bakery sector is rapidly modernizing, supported by urbanization and rising demand for packaged and shelf-stable baked goods. Also, traditional consumption of baked items like bolillos, conchas, and tortillas, coupled with industrialization of bakeries, is fueling the demand for dough conditioners. Moreover, foodservice and retail bakery chains are expanding in Mexico and other regions (such as the Caribbean and Central America), pushing the adoption of advanced bakery inputs. As per the Mexican National Institute of Statistics and Geography, the bakery industry is projected to expand at a considerable rate every years which is driven by the popularity of ready-to-eat products. As manufacturers adapt to these changing consumer preferences, the demand for dough conditioners that enhance product quality and shelf life is expected to increase.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The North America dough conditioners market is characterized by the presence of several key players that significantly contribute to its growth and development. Companies such as Archer Daniels Midland Company, DuPont de Nemours, Inc., and Corbion N.V. are among the leading players in this sector. Archer Daniels Midland Company, a global leader in food processing and agricultural services, has a strong portfolio of dough conditioners that cater to various baking applications. Their focus on innovation and sustainability has positioned them as a trusted supplier in the market. DuPont de Nemours, Inc., known for its extensive range of food ingredients, offers advanced dough conditioning solutions that enhance the quality and performance of baked goods. Their commitment to research and development enables them to stay ahead of emerging trends and consumer demands. Corbion N.V. specializes in biobased ingredients and has developed a range of dough conditioners that align with the growing demand for clean-label products. These companies, along with others in the market, are continuously investing in product innovation and strategic partnerships to strengthen their positions and meet the evolving needs of consumers and food manufacturers.

The competition in the North America dough conditioners market is intense, characterized by a mix of established players and emerging companies striving to capture market share. The presence of major corporations with extensive resources and established distribution networks creates a challenging environment for smaller manufacturers. These larger companies often leverage their economies of scale to offer competitive pricing, which can pressure smaller players to differentiate themselves through innovation and niche product offerings. Additionally, the rapid pace of technological advancements in food processing and ingredient formulation necessitates continuous investment in research and development, further intensifying competition.

Moreover, the increasing consumer demand for clean-label and health-oriented products is driving companies to innovate and reformulate their offerings. As a result, manufacturers are focusing on developing dough conditioners that align with current trends, such as plant-based ingredients and natural additives. This shift not only enhances product appeal but also fosters brand loyalty among health-conscious consumers. The competitive landscape is further complicated by the need for effective marketing strategies that communicate product benefits and build brand recognition.

Major Strategies Used by Key Players in the North America Dough Conditioners Market

Key players in the North America dough conditioners market are employing various strategies to enhance their competitive edge and strengthen their market positions. One prominent strategy is the focus on product innovation, where companies are investing in research and development to create advanced formulations that meet the changing preferences of consumers. For instance, many manufacturers are developing clean-label dough conditioners that utilize natural ingredients, catering to the growing demand for healthier and more transparent food options. Additionally, strategic partnerships and collaborations with food manufacturers and distributors are being leveraged to expand market reach and enhance product offerings. By aligning with key players in the food industry, dough conditioner manufacturers can gain access to new distribution channels and customer segments.

Another significant strategy is the emphasis on sustainability and environmental responsibility. Many companies are adopting sustainable sourcing practices and reducing their carbon footprint in production processes. This commitment to sustainability resonates with consumers who are increasingly concerned about the environmental impact of their food choices. Furthermore, companies are focusing on enhancing their supply chain efficiency to mitigate the risks associated with raw material price volatility and ensure consistent product availability.

RECENT MARKET DEVELOPMENTS

- In March 2023, Archer Daniels Midland Company launched a new line of clean-label dough conditioners aimed at meeting the growing consumer demand for natural ingredients. This initiative is expected to enhance their product portfolio and cater to health-conscious consumers.

- In January 2023, DuPont de Nemours, Inc. announced a strategic partnership with a leading bakery chain to develop innovative dough conditioning solutions tailored to their specific needs. This collaboration aims to improve product quality and consistency across the bakery's offerings.

- In February 2023, Corbion N.V. expanded its production capacity for dough conditioners in North America to meet the rising demand for high-quality baking ingredients. This expansion is anticipated to strengthen their market presence and enhance supply chain efficiency.

- In April 2023, Lesaffre announced the acquisition of a regional dough conditioner manufacturer to broaden its product range and enhance its distribution capabilities in the North American market.

- In May 2023, AB Mauri launched a new range of enzyme-based dough conditioners designed to improve the texture and shelf life of gluten-free baked goods, addressing the growing demand for specialty products.

- In June 2023, Puratos introduced a new line of organic dough conditioners that align with the clean-label trend, catering to consumers seeking natural and sustainable baking solutions.

- In July 2023, Bakels announced a partnership with a major foodservice provider to supply customized dough conditioning solutions, enhancing their reach in the foodservice sector.

- In August 2023, Cargill launched a new research initiative focused on developing innovative dough conditioners that utilize plant-based ingredients, reflecting the growing trend towards plant-based diets.

- In September 2023, Ingredion Incorporated expanded its portfolio of dough conditioners with the introduction of a new emulsifier that enhances dough stability and texture, targeting the growing demand for high-quality baked goods.

- In October 2023, Bunge Limited announced a strategic investment in a technology startup focused on developing sustainable dough conditioning solutions, positioning itself as a leader in innovation within the market.

MARKET SEGMENTATION

This research report on the North American dough conditioners market is segmented and sub-segmented based on categories.

By Ingredient Type

- Enzymes

- Amylases

- Xylanases

- Lipases

- Proteases

- Others

- Emulsifiers

- Mono-Glycerides

- Calcium Stearoyl Lactylate

- Sodium Stearoyl Lactylate

- Others

- Oxidizing Agents

- Azodicarbonamide

- Potassium Iodate

- Calcium Peroxide

- Potassium Bromate

- Others

- Reducing Agents

- L-Cysteine

- Glutathione

- Sodium Bisulphite

- Sodium Metabisulphite

- Others

- Others

By Form

- Powder

- Liquid

- Semi-Liquid

- Granular

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What are the challenges in the North America Dough Conditioners Market?

Regulatory restrictions on certain additives, growing consumer demand for clean-label products, and fluctuating raw material costs are major challenges.

What is the future outlook for the North America Dough Conditioners Market?

The market is expected to grow due to increasing adoption of clean-label and organic dough conditioners, along with innovations in enzyme-based solutions.

What factors are driving the growth of the North America Dough Conditioners Market?

Increasing demand for high-quality bakery products, advancements in food processing technology, and rising consumer preference for convenience foods are key growth drivers.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]