North America Digital Diabetes Management Market Size, Share, Trends & Growth Forecast Report By Product (Devices, Digital Diabetes Management Apps, Data Management Software and Platforms, Services), Device Type, End-User, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2024 to 2033

North America Digital Diabetes Management Market Size

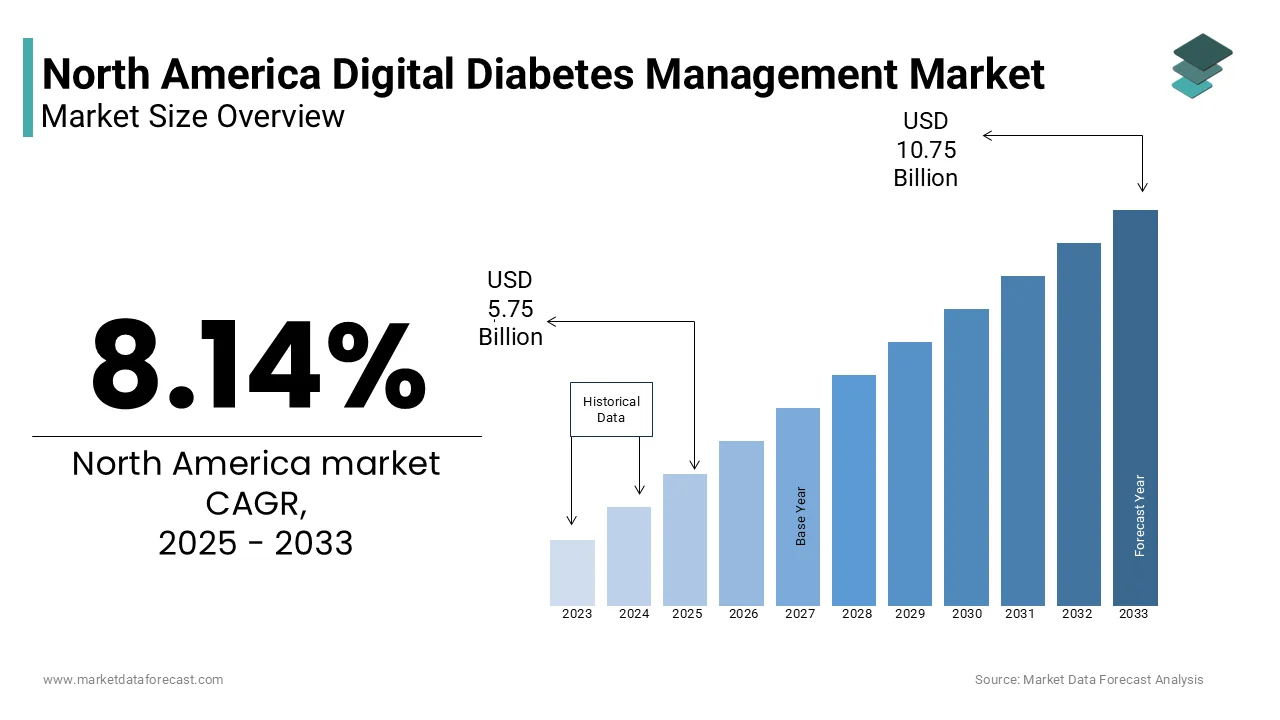

The Digital Diabetes Management market size in North America was valued at USD 5.32 billion in 2024 and is predicted to be worth USD 10.75 billion by 2033 from USD 5.75 billion in 2025 and grow at a CAGR of 8.14% from 2025 to 2033.

The North America digital diabetes management market is a rapidly evolving segment within the broader healthcare technology landscape, driven by the rising prevalence of diabetes and technological advancements. According to the Centers for Disease Control and Prevention (CDC), over 37 million Americans are diagnosed with diabetes representing approximately 11% of the population. This alarming statistic underscores the growing need for innovative solutions to manage the condition effectively. The region benefits from robust healthcare infrastructure, widespread adoption of smartphones, and increasing awareness of self-care technologies. Canada complements this growth with its universal healthcare system, which encourages the integration of digital tools into chronic disease management. Key players are leveraging artificial intelligence (AI) and cloud-based platforms to enhance data accessibility and decision-making. However, challenges such as high costs of devices and limited access in rural areas persist. As per a study published in the Journal of Medical Internet Research, nearly 25% of diabetic patients face barriers to adopting digital health tools due to affordability and lack of technical literacy. Despite these hurdles, the market remains buoyant, supported by government initiatives and patient-centric innovations.

MARKET DRIVERS

Rising Prevalence of Diabetes

The escalating prevalence of diabetes is a primary driver of the North America digital diabetes management market, creating an urgent demand for advanced monitoring and management solutions. As per the American Diabetes Association, the total economic burden of diabetes in the U.S. exceeds $327 billion annually, with medical expenditures for diabetic patients being 2.3 times higher than those without the condition. This financial strain has prompted stakeholders to adopt cost-effective digital tools that improve glycemic control and reduce complications. For instance, continuous glucose monitors (CGMs) and smart glucometers enable real-time tracking of blood sugar levels, empowering patients to make informed decisions. Additionally, the rise of type 2 diabetes among younger populations, attributed to sedentary lifestyles and obesity, further amplifies demand. As per a report by the National Institutes of Health, the incidence of type 2 diabetes in adolescents increased by 4.8% annually between 2002 and 2018. These trends highlight the critical role of digital diabetes management solutions in addressing unmet needs and improving patient outcomes.

Technological Advancements and Integration

Technological advancements and seamless integration with healthcare systems are pivotal drivers of the North America digital diabetes management market. Innovations such as AI-powered algorithms, wearable devices, and cloud-based platforms have revolutionized diabetes care. For example, Abbott’s FreeStyle Libre CGM system utilizes AI to provide predictive insights helping patients anticipate hyperglycemic or hypoglycemic events. Furthermore, interoperability standards, such as HL7 and FHIR, facilitate data sharing between devices and electronic health records (EHRs), enhancing care coordination. The proliferation of mobile apps, with over 1,000 diabetes-specific applications available on iOS and Android, further supports patient engagement. As per a survey by the Pew Research Center, 85% of Americans own smartphones, enabling widespread access to digital health tools. These advancements not only improve usability but also foster trust and adherence among patients.

MARKET RESTRAINTS

High Costs of Devices and Services

A crucial restraint impacting the North America digital diabetes management market is the high cost of devices and services, which limits accessibility for many patients. Advanced tools such as CGMs and insulin patch pumps often come with steep price tags, making them unaffordable for low- and middle-income households. Based on a report by the Kaiser Family Foundation, over 25% of diabetic patients in the U.S. struggle to afford their medications and devices. Insurance coverage for these technologies remains inconsistent, with many plans excluding newer innovations. For instance, as per the American Association of Clinical Endocrinologists, only 60% of private insurance plans cover CGMs, leaving patients to bear the full cost. While subsidies and assistance programs offer some relief, they are often insufficient to address the financial burden. Beyond this, the recurring costs of consumables, such as sensors and test strips, further exacerbate affordability concerns. Without effective measures to reduce costs, the market risks alienating a significant portion of its target audience.

Data Privacy and Security Concerns

Data privacy and security concerns pose another significant restraint for the North America digital diabetes management market. The collection and transmission of sensitive health information through connected devices and apps raise fears of unauthorized access and misuse. Patients are increasingly wary of sharing personal health data, particularly in light of high-profile cyberattacks on healthcare providers. A survey conducted by Deloitte revealed that 40% of consumers hesitate to use digital health tools due to privacy concerns. Regulatory frameworks, such as the Health Insurance Portability and Accountability Act (HIPAA), aim to safeguard patient information but are often perceived as inadequate in addressing emerging threats. To add to this, the lack of standardized encryption protocols across devices increases vulnerability. Balancing innovation with robust security measures remains a pressing challenge for industry stakeholders.

MARKET OPPORTUNITIES

Expansion of Telehealth Integration

The integration of telehealth platforms presents a significant opportunity for the North America digital diabetes management market enhancing accessibility and convenience for patients. Virtual consultations enable healthcare providers to monitor glycemic levels, adjust treatment plans, and offer personalized guidance remotely. According to the Center for Disease Control and Prevention, telehealth usage surged by 50% during the pandemic, with sustained growth expected in chronic disease management. Companies like Livongo and Teladoc have pioneered remote diabetes care programs, combining real-time data analytics with behavioral coaching to improve outcomes. Data from McKinsey & Company indicates that telehealth adoption among diabetic patients grew by 35% in 2023 reflecting shifting consumer preferences. By leveraging telemedicine, pharmaceutical companies can expand their reach, improve patient engagement, and foster loyalty. This trend aligns with the broader shift toward digital transformation, positioning telehealth as a key growth driver for the market.

Development of AI-Powered Predictive Tools

A fellow potential opportunity lies in the development of AI-powered predictive tools catering to the growing emphasis on proactive diabetes management. Machine learning algorithms analyze vast datasets to identify patterns and predict potential complications enabling early intervention. For instance, Medtronic’s Sugar.IQ app uses AI to provide actionable insights, helping patients optimize their insulin dosing and meal planning. Additionally, partnerships between tech giants and healthcare providers are accelerating the adoption of predictive analytics. For example, Google’s collaboration with Novo Nordisk focuses on developing AI-driven solutions for diabetes care. Government initiatives promoting precision medicine further bolster demand. By focusing on predictive tools, the market can address unmet needs while fostering long-term relationships with patients.

MARKET CHALLENGES

Limited Accessibility in Rural Areas

Limited accessibility to digital diabetes management tools in rural areas represents a formidable challenge for the North America market. Many patients in these regions lack access to reliable internet connectivity and advanced healthcare facilities, hindering the adoption of digital solutions. As indicated by the Federal Communications Commission (FCC), approximately 19 million Americans, predominantly in rural areas do not have access to broadband internet. This digital divide exacerbates disparities in diabetes care, as patients rely on traditional methods that may be less effective. A study by the Rural Health Information Hub sheds light on rural residents that are 17% more likely to develop diabetes compared to urban counterparts yet they receive fewer preventive services. Outreach programs and mobile clinics have emerged as potential solutions, but funding and logistical challenges hinder scalability. Bridging this accessibility gap is essential to ensuring equitable access to digital diabetes management tools and driving inclusive market growth.

Resistance to Behavioral Change

Resistance to behavioral change among patients poses another significant challenge for the North America digital diabetes management market. Despite the availability of advanced tools, many individuals struggle to adopt healthier lifestyles and adhere to treatment regimens. According to a study published in the Journal of Diabetes Science and Technology, over 50% of diabetic patients fail to consistently use their monitoring devices citing inconvenience or lack of motivation. Cultural perceptions and lifestyle habits further compound the issue, with many patients reluctant to embrace new technologies. For instance, older adults, who represent a significant portion of the diabetic population, often exhibit skepticism toward digital tools due to unfamiliarity. A survey by the National Council on Aging reveals that 60% of seniors prefer traditional methods of care over digital alternatives. Addressing this resistance requires comprehensive education campaigns and user-friendly designs that cater to diverse demographics. Without effective strategies to promote behavioral change, the market risks underutilization of its offerings.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.14% |

|

Segments Covered |

By Product, Device Type, End-User, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Abbott, PHC Holdings Corporation, WellDoc, Sanofi, Dexcom, Inc., DarioHealth Corp, Agamatrix, Glooko, Inc., GlucoMe, BD, Azumio, Diabnext, Voluntis, Smart Meter LLC, Medtronic, B. Braun Melsungen AG, F. Hoffmann-La Roche Ltd, Insulet Corporation, and others |

SEGMENTAL INSIGHTS

By Product Insights

The continuous glucose monitors (CGMs) dominated the North America digital diabetes management market by capturing 45.1% of the total share in 2024. This supremacy is credited to their ability to provide real-time, continuous monitoring of blood glucose levels enabling proactive management of diabetes. The segment's growth is fueled by the increasing prevalence of type 1 diabetes, which accounts for 5-10% of all cases, according to the Juvenile Diabetes Research Foundation. In support of this, advancements in sensor technology, such as extended wear durations and improved accuracy, enhance usability and patient satisfaction. The rise of reimbursement policies, with Medicare covering CGMs for eligible patients further propels adoption. Strategic partnerships between manufacturers and healthcare providers ensure seamless integration with existing systems. With CGMs becoming the gold standard for glucose monitoring, this segment remains a cornerstone of the market.

The smart glucometers represented the fastest-growing segment in the North America digital diabetes management market, with a projected CAGR of 18.5% through 2033. This progress is propelled by their affordability, ease of use, and compatibility with mobile apps, making them accessible to a broader audience. Smart glucometers connect wirelessly to smartphones enabling users to track trends, set reminders, and share data with healthcare providers. As per a report by the Pew Research Center, over 85% of Americans own smartphones, facilitating widespread adoption. Innovations such as cloud-based storage and AI-driven analytics enhance functionality, addressing unmet needs in personalized care. Beyond this, partnerships with insurance companies and employers have expanded access, particularly among low-income populations. With increasing emphasis on self-care and preventive measures, smart glucometers are poised to outpace other categories strengthening their status as a growth engine for the market.

The diabetes apps commanded the North America digital diabetes management market by holding a share of 50.5% in 2024. This visibility is attributed to their versatility and ability to address diverse patient needs, including glucose tracking, meal planning, and medication reminders. Over 1,000 diabetes-specific apps are available on iOS and Android, catering to various demographics. According to a survey by the American Diabetes Association, 70% of diabetic patients use mobile apps to manage their condition reflecting widespread adoption. The rise of gamification features such as rewards for adhering to treatment plans enhances engagement and adherence. In extension to this, partnerships with healthcare providers and insurers have expanded access particularly among underserved populations. Strategic collaborations with tech companies further enhance functionality, integrating AI and machine learning for predictive insights. With apps becoming an integral part of diabetes care, this segment continues to lead the market.

The software and platforms segment represented the swiftly advancing category, with a calculated CAGR of 20.3% in the coming years. This rise is linked to the increasing adoption of cloud-based solutions and AI-powered analytics, enabling seamless data sharing and decision-making. Platforms such as Glooko and One Drop aggregate data from multiple devices, providing a comprehensive view of patient health. Additionally, interoperability standards, such as HL7 and FHIR, facilitate integration with electronic health records (EHRs), enhancing care coordination. Government initiatives promoting digital health further support adoption, particularly among hospitals and clinics. With software and platforms transforming diabetes care, this segment is poised to emerge as a dominant force in the market.

By Device Type Insights

The handheld devices segment secured the top spot in the North America digital diabetes management market by capturing 60.8% of the overall share in 2024. This supremacy is stimulated by their portability and ease of use, making them suitable for both home and clinical settings. Traditional glucometers and insulin pens remain popular, particularly among older adults who prefer familiar tools. A survey by the National Council on Aging states that 65% of seniors rely on handheld devices for diabetes management. Also, advancements in sensor technology and connectivity have enhanced functionality, enabling seamless data sharing with mobile apps and EHRs. The affordability of handheld devices compared to wearables further bolsters demand. With handheld devices remaining the preferred choice for many patients, this segment continues to lead the market.

The wearable devices segment emphasizing the rapid increase and significance of the market, with an estimated CAGR of 22.7% through 2033. This growth is driven by their ability to provide continuous, real-time monitoring of vital parameters, such as glucose levels and physical activity. Devices such as CGMs and insulin patch pumps offer convenience and accuracy, appealing to tech-savvy patients. According to a report by the Pew Research Center, over 20% of Americans use wearable devices for health monitoring reflecting shifting consumer preferences. Innovations such as biocompatible materials and extended battery life enhance usability addressing unmet needs in chronic disease management. Moreover, partnerships with fitness trackers and smartwatches have expanded functionality enabling holistic health management. With wearables becoming increasingly integrated into daily life, this segment is set to outpace other categories reinforcing its status as a growth engine for the market.

By End-User Insights

The best performing segment of the North America digital diabetes management market is the self/home healthcare and commanded a substantial share in 2024. This recognition is propelled by the growing emphasis on patient empowerment and self-care, particularly among individuals managing chronic conditions. The rise of user-friendly devices and mobile apps has enabled patients to monitor their health independently, reducing reliance on clinical visits. As per a survey by the American Diabetes Association, 80% of diabetic patients prefer managing their condition at home citing convenience and cost-effectiveness. To add to this, the proliferation of telehealth platforms has enhanced accessibility enabling remote consultations and personalized guidance. Strategic partnerships between manufacturers and insurers have expanded access particularly among low-income populations. With self/home healthcare becoming the norm, this segment remains a cornerstone of the market.

Hospitals segment is experiencing exponential growth, with a projected CAGR of 19.8% in the coming years owing to the increasing adoption of digital tools for inpatient care and post-discharge monitoring. Hospitals leverage advanced platforms to streamline workflows, enhance patient outcomes, and reduce readmission rates. According to a report by the Agency for Healthcare Research and Quality, hospitals implementing digital diabetes management solutions have reduced readmissions by 25%. Additionally, the integration of AI-powered analytics enables predictive insights, facilitating early intervention and personalized care. Government initiatives promoting value-based care further support adoption, particularly among large healthcare systems. With hospitals embracing digital transformation, this segment is poised to emerge as a key growth driver for the market.

REGIONAL ANALYSIS

The U.S. stood as the largest contributor to the North America digital diabetes management market capturing 79.6% of the total market share in 2024. Its hegemony is supported by the country's robust healthcare infrastructure, high prevalence of diabetes, and significant investments in technological innovation. According to the CDC, over 37 million Americans are diagnosed with diabetes creating a substantial demand for advanced management solutions. The rise of telehealth platforms and wearable devices has further accelerated adoption, with companies like Abbott and Dexcom leading the charge. Government initiatives such as Medicare coverage for CGMs ensure widespread accessibility. Additionally, partnerships between tech giants and healthcare providers are driving digital transformation. With the U.S. at the forefront of innovation, this market remains a cornerstone of regional growth.

Canada’s digital diabetes ecosystem is smaller in scale but increasingly proactive in adoption. The country’s influence is because of its universal healthcare system, which promotes the integration of digital tools into chronic disease management. As per the Statistics Canada, over 3 million Canadians live with diabetes, underscoring the need for innovative solutions. The rise of AI-powered platforms and mobile apps has enhanced accessibility, particularly in remote areas. Government funding for research and development further bolsters innovation, with institutions like the Canadian Institutes of Health Research spearheading advancements. Collaborations between public and private sectors ensure equitable access reinforcing Canada’s significance in the regional market.

In the Rest of North America, including Mexico and select Caribbean nations, the digital diabetes market is on an accelerated growth track by posting a CAGR of 8.2% through 2023 which is the fastest in the region. Mexico’s digital diabetes management market benefits from its expanding middle class and rising awareness of chronic diseases. The Mexican Diabetes Federation states that over 12 million Mexicans are diagnosed with diabetes, creating opportunities for digital solutions. However, challenges such as limited access to advanced technologies and affordability issues persist. Government initiatives promoting health literacy and partnerships with international companies are driving growth. Innovations such as affordable devices and localized platforms further enhance accessibility. With increasing urbanization and economic development, Mexico’s market is set to gain momentum, contributing to regional growth.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Abbott, PHC Holdings Corporation, WellDoc, Sanofi, Dexcom, Inc., DarioHealth Corp, Agamatrix, Glooko, Inc., GlucoMe, BD, Azumio, Diabnext, Voluntis, Smart Meter LLC, Medtronic, B. Braun Melsungen AG, F. Hoffmann-La Roche Ltd, Insulet Corporation are playing dominating role in North America digital diabetes management market.

The North America digital diabetes management market is characterized by intense competition, driven by the presence of multinational corporations and regional players. Companies strive to differentiate themselves through innovation, cost efficiency, and patient-centric solutions. Strategic collaborations, such as joint ventures and licensing agreements, are common to leverage complementary strengths. The market’s fragmented nature necessitates continuous investments in R&D and process optimization. Regulatory compliance and shifting consumer demands further intensify competition, compelling players to adopt agile strategies.

TOP PLAYERS IN THE MARKET

Abbott Laboratories

Abbott Laboratories is a global leader in the digital diabetes management market, renowned for its innovative solutions and extensive product portfolio. Headquartered in Illinois, the company specializes in continuous glucose monitors (CGMs), such as the FreeStyle Libre system, which has transformed diabetes care. Abbott’s strengths lie in its cutting-edge R&D capabilities and commitment to affordability, exemplified by its efforts to reduce costs for patients. The company’s integration of AI-powered analytics enhances usability, ensuring proactive management of diabetes. Strategic partnerships with healthcare providers and insurers further enhance accessibility, solidifying its leadership position globally.

Dexcom Inc.

Dexcom Inc. is a dominant player in the North America digital diabetes management market, excelling in producing high-performance CGMs. Its market position is bolstered by strategic investments in wearable technology and cloud-based platforms. Dexcom’s collaborative approach with tech giants and researchers fosters innovation, enabling it to deliver tailored solutions that meet evolving market demands. The company’s emphasis on real-time data sharing aligns with global health trends, reinforcing its reputation as a trusted partner in diabetes care.

Medtronic plc

Medtronic plc is a key contributor to the North America digital diabetes management landscape, specializing in insulin pumps and CGMs. The company’s state-of-the-art manufacturing facilities and focus on operational excellence drive its success. Medtronic’s control in developing integrated platforms, such as the MiniMed system, aligns with patient-centric goals. Its strong distribution network and customer-centric strategies further enhance its market presence, positioning it as a vital player in the global healthcare technology industry.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the North America digital diabetes management market employ strategies such as mergers and acquisitions, R&D investments, and sustainability initiatives to strengthen their positions. Mergers and acquisitions enable companies to expand their product portfolios and geographic reach. For instance, Medtronic acquired Companion Medical to enhance its offerings in connected insulin delivery systems. R&D investments focus on developing innovative solutions, such as Abbott’s advancements in AI-powered analytics for predictive insights. Sustainability initiatives, including partnerships with non-profits, address regulatory requirements and consumer preferences. Collaborations with tech firms also drive digital transformation, optimizing supply chains and production processes.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Abbott launched the FreeStyle Libre 3 system, the world’s smallest CGM, enhancing patient convenience and accuracy.

- In June 2023, Dexcom partnered with Apple to integrate CGM data with the Apple Watch, improving accessibility and engagement.

- In March 2023, Medtronic introduced the MiniMed 780G system, featuring AI-driven automation for insulin delivery.

- In January 2023, Roche Diagnostics acquired mySugr, expanding its digital health platform for diabetes management.

- In November 2022, Insulet initiated a nationwide campaign to promote awareness of insulin patch pumps, distributing educational materials to over 5,000 clinics.

MARKET SEGMENTATION

This research report on the North America digital diabetes management market has been segmented and sub-segmented based on the following categories.

By Product

- Devices

- Smart Glucose Meters

- Continuous Glucose Monitoring (CGM) Systems

- Smart Insulin Pens

- Smart Insulin Pumps/Closed-loop Pumps & Smart Insulin Patches

- Application

- Diabetes & Blood Glucose Tracking Apps

- Obesity & Diet Management Apps

- Data Management Software & Platforms

- Services

By Device Type

- Handheld Devices

- Wearable Devices

By End-User

- Self/Home Healthcare

- Hospitals & Specialty Diabetes Clinics

- Academic & Research Institutes

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What is the projected size of the North America digital diabetes management market by 2033?

The market is expected to grow from USD 5.75 billion in 2025 to USD 10.75 billion by 2033, at a CAGR of 8.14%.

2. What factors are driving growth in the digital diabetes management market?

Key drivers include rising diabetes prevalence, technological advancements, adoption of telehealth solutions, and favorable reimbursement policies.

3. Who are the key players in the North America digital diabetes management market?

Major companies include Abbott Laboratories, Medtronic plc, Dexcom Inc., Roche Diabetes Care, and Insulet Corporation.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]