North America Diagnostic Imaging Market Research Report – Segmented By Type ( X-ray, Molecular Imaging ) Application ( Cardiology , Oncology ) End User ( Hospitals , Diagnostic Imaging Centers ) & Country (The U.S., Canada and Rest of North America) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

North America Diagnostic Imaging Market Size

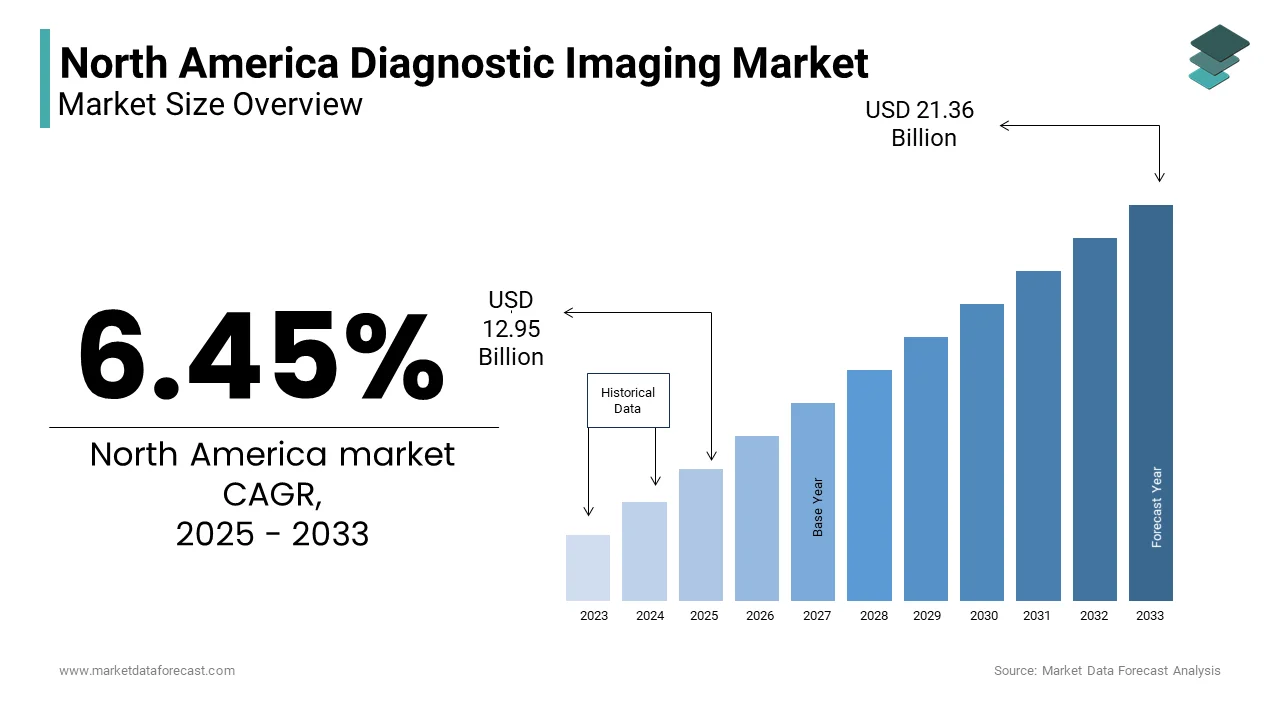

The North America Diagnostic Imaging Market was valued at USD 12.17 billion in 2024. The North America Diagnostic Imaging Market is expected to have a 6.45 % CAGR from 2024 to 2033 and be worth USD 21.36 billion by 2033 from USD 12.95 billion in 2025.

Diagnostic imaging is a cornerstone of modern healthcare, providing critical insights into the human body to diagnose and treat various conditions. Technologies like X-rays, MRIs, CT scans, ultrasounds, and nuclear imaging have become essential tools for detecting diseases such as cancer, heart conditions, and neurological disorders. The North America Diagnostic imaging market is thriving, fueled by an aging population, increasing rates of chronic illnesses, and rapid advancements in imaging technology. These innovations are transforming how healthcare providers approach patient care, making early detection and accurate diagnosis more accessible than ever.

The United States leads this market, thanks to its advanced healthcare system and widespread adoption of state-of-the-art imaging solutions. Meanwhile, Canada is also experiencing steady growth, supported by government efforts to improve access to diagnostic services. For example, the Canadian Institute for Health Information notes that reducing wait times for imaging procedures remains a priority. Beyond healthcare, other statistics highlight the region’s broader trends. The U.S. Bureau of Labor Statistics predicts that jobs in healthcare will grow by 13% from 2021 to 2031, outpacing all other sectors. Similarly, the National Science Foundation reports that the U.S. invests roughly $700 billion each year in research and development, much of which drives progress in Diagnostic technologies.

Artificial intelligence is now playing a transformative role in Diagnostic imaging, enhancing accuracy and efficiency. By combining AI with traditional imaging methods, healthcare providers can reduce errors and deliver faster results, benefiting patients across North America. This integration underscores the region’s commitment to innovation and improved healthcare outcomes.

MARKET DRIVERS

Aging Population Fuels Demand for Diagnostic Imaging

The growing number of older adults in North America is a key factor driving the Diagnostic imaging market. As people age, they are more likely to develop conditions like heart disease, cancer, and bone disorders, which require advanced diagnostic tools. The U.S. Census Bureau predicts that by 2040, there will be 80 million Americans aged 65 or older, up from 56 million in 2020. These individuals often rely on imaging technologies such as MRIs and CT scans to diagnose and manage their health issues. The National Council on Aging states that nearly 90% of seniors have at least one chronic condition showcasing the critical role of early detection through imaging. Programs like Medicare also make these services more accessible to older adults. With the aging population expected to grow significantly, the demand for Diagnostic imaging solutions is set to rise across the region.

Emphasis on Preventive Care Boosts Imaging Use

Preventive healthcare is becoming increasingly important in North America, boosting the use of Diagnostic imaging technologies. Early detection of diseases through imaging helps prevent complications and lowers treatment costs. According to the Milken Institute, chronic illnesses cost the U.S. economy over $1 trillion annually in lost productivity and healthcare expenses. To address this, employers and insurers are encouraging regular screenings, such as mammograms and cardiac imaging, to catch diseases early. The American Heart Association notes that detecting heart disease early through imaging can reduce mortality rates by up to 30%. Public health initiatives, including provisions in the Affordable Care Act, promote preventive services and increase awareness about their benefits. This shift toward prevention is a major factor driving the adoption of Diagnostic imaging technologies in the region.

MARKET RESTRAINTS

Radiation Risks Spark Patient Concerns

Concerns about radiation exposure from certain imaging tests, such as X-rays and CT scans, are limiting the growth of the Diagnostic imaging market. Repeated exposure to ionizing radiation can slightly increase the risk of cancer, leading some patients to avoid necessary procedures. The American Cancer Society estimates that about 2% of all cancers in the U.S. may be linked to radiation from diagnostic imaging. Despite advancements in reducing radiation doses, public fear persists. A University of Michigan survey found that nearly 60% of people worry about the potential risks of radiation from Diagnostic imaging. This apprehension is particularly strong among younger patients and parents of children, who may delay or skip imaging tests altogether. Addressing these concerns while ensuring safety remains a challenge for the industry.

Limited Availability of Radiologists Hinders Progress

A shortage of trained radiologists is creating challenges for the Diagnostic imaging market in North America. The rising number of imaging procedures has outpaced the availability of professionals qualified to interpret the results. The Association of American Diagnostic Colleges warns that there could be a shortfall of up to 42,000 radiologists by 2033, driven by an aging workforce and insufficient training programs. Rural areas are especially affected, as highlighted by the Rural Health Information Hub, which reports that many rural hospitals struggle to hire radiologists. This leads to longer wait times for patients needing imaging services. Additionally, the complexity of modern imaging technologies requires ongoing training, which many facilities cannot afford due to budget constraints. This shortage slows down the diagnostic process and limits the market's ability to meet growing demand.

MARKET OPPORTUNITIES

Growing Use of Hybrid Imaging Technologies

The increasing use of hybrid imaging systems, such as PET-CT and SPECT-CT, is opening new doors for the North America Diagnostic imaging market. These systems combine functional and anatomical imaging, offering a more detailed view of the body. In cancer care, these technologies are proving invaluable. For example, studies show that PET-CT scans can improve cancer detection rates by up to 30%. The National Cancer Institute emphasizes that precise diagnosis through hybrid imaging leads to better treatment outcomes. Hospitals and clinics are also investing in these advanced tools to meet patient demand for faster and more accurate diagnostics. As healthcare providers focus on personalized medicine, hybrid imaging is set to play a key role in shaping the future of diagnostics in the region.

Upgrading Healthcare Facilities Boosts Market Growth

Investments in modernizing healthcare infrastructure are creating significant opportunities for the Diagnostic imaging market in North America. Governments and private organizations are channeling funds to enhance facilities, especially in underserved areas. For instance, the U.S. government allocated $10 billion under the American Rescue Plan Act to upgrade rural healthcare systems, including diagnostic equipment. Deloitte reports that over 60% of healthcare providers plan to increase spending on imaging technologies by 2025. Similarly, Canada has committed CAD 2 billion to improve healthcare access nationwide. These efforts aim to address gaps in diagnostic services, particularly in remote regions. By replacing outdated systems with state-of-the-art imaging solutions, the market is poised to benefit from improved accessibility and higher demand for advanced diagnostics, driving growth across the region.

MARKET CHALLENGES

Bias in AI Raises Ethical Questions

A major challenge for the North America Diagnostic imaging market is the issue of bias in artificial intelligence algorithms used for image analysis. These algorithms are often trained on datasets that lack diversity, leading to disparities in diagnostic accuracy. A study in The Lancet Digital Health found that AI models were 10-15% less accurate when analyzing images from minority groups compared to majority populations. This bias can lead to incorrect diagnoses, particularly for marginalized communities. The Brookings Institution notes that addressing this problem requires retraining AI systems with more inclusive data, which is both costly and time-consuming. Additionally, regulatory bodies like the FDA are still working on guidelines to ensure fairness in AI tools. Until these challenges are resolved, ethical concerns could slow the adoption of AI-driven imaging technologies.

High Costs Limit Access to Advanced Imaging

Strict reimbursement policies for advanced imaging procedures are hindering the growth of the North America Diagnostic imaging market. Many insurance plans impose limits on coverage for high-cost imaging tests, making them unaffordable for some patients. The Kaiser Family Foundation states that nearly 28 million Americans remain uninsured, while insured individuals often face steep out-of-pocket costs. For example, a PET-CT scan can cost up to $5,000, but reimbursement is often partial or unavailable. This financial barrier discourages patients from seeking necessary diagnostic care, reducing the market’s reach. Smaller healthcare facilities also struggle to adopt advanced imaging technologies due to uncertain reimbursement rates. Without changes to expand coverage and lower costs, these policies will continue to restrict market growth and limit patient access.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.45 % |

|

Segments Covered |

By Type,Application, End User and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

GE Healthcare,Siemens Healthineers,Philips Healthcare,Canon Diagnostic Systems Corporation |

SEGMENTAL ANALYSIS

By Type Insights

In 2024, X-ray emerged as the leading segment in the North America Diagnostic imaging market by capturing 35.3% of the total share. Its popularity is linked to its cost-effectiveness, wide accessibility, and ability to diagnose a variety of conditions like fractures and pneumonia. According to the Centers for Disease Control and Prevention, over 80 million X-ray procedures were conducted in the U.S. that year, showcasing its widespread use. X-rays are often the first choice for initial diagnosis is making them essential in healthcare settings. Innovations such as digital X-ray systems also contributed to their dominance by reducing radiation exposure by up to 70% compared to older methods , as noted by the National Institutes of Health. These factors ensured X-rays remained the most utilized imaging technology.

Between 2025 and 2033, molecular imaging is projected to grow at the fastest pace, with a CAGR of 9.2%. This rapid growth will be fueled by increasing demand for early cancer detection and tailored treatment plans. The American Cancer Society predicts that over 2.1 million new cancer cases annually will require advanced imaging by 2030. Technologies like PET scans, a form of molecular imaging, are critical for identifying tumors in their early stages. Research from the National Cancer Institute shows that PET scans improve diagnostic accuracy by 20-30% compared to conventional methods. Additionally, advancements in AI and hybrid imaging systems are driving adoption. As healthcare shifts toward personalized medicine, molecular imaging’s ability to provide detailed insights into cellular activity will make it a cornerstone of modern diagnostics.

By Application Insights

In 2024, oncology emerged as the leading application segment in the North America Diagnostic imaging market, capturing 30% of the total share . This dominance was driven by the growing number of cancer cases and the vital role imaging plays in detecting and managing the disease. The American Cancer Society recorded over 2 million new cancer diagnoses in the U.S. that year, emphasizing the need for advanced imaging tools like MRI and PET-CT scans. Early detection through imaging has proven life-saving; for example, mammography has been linked to a 20-40% reduction in breast cancer deaths , according to the National Cancer Institute. These advancements highlight oncology’s critical importance in improving patient survival rates and treatment outcomes.

The cardiology is set to become the fastest-growing segment, with a CAGR of 8.5%. This rapid expansion will be fueled by the rising incidence of cardiovascular diseases (CVDs) and innovations in imaging technologies. The Centers for Disease Control and Prevention reports that heart disease remains a leading cause of death, claiming nearly 697,000 lives annually in the U.S. alone. An aging population, with the number of seniors expected to reach 80 million by 2040 , as per the U.S. Census Bureau, will further increase demand for cardiac imaging. Tools like echocardiography and AI-driven diagnostics are transforming how heart conditions are detected and managed. As healthcare shifts toward prevention, cardiology’s adoption of cutting-edge imaging solutions will play a key role in addressing this growing health challenge.

By End User Insights

The hospitals segment is the largest end-user segment in the North America Diagnostic imaging market by holding a 45.1% market share in 2024. This dominance was due to their role as primary healthcare providers, offering comprehensive diagnostic and treatment services under one roof. The Centers for Medicare & Medicaid Services reported that hospitals accounted for over 70% of all imaging procedures performed in the U.S. that year. Hospitals are equipped with advanced imaging systems like MRI and CT scanners, making them the go-to choice for complex cases. Also, the American Hospital Association highlighted that hospitals conducted nearly 130 million outpatient visits annually , many involving imaging diagnostics. This widespread use underscores their importance in delivering accessible and reliable imaging services.

The diagnostic imaging centers segment is expected to grow at the rapid pace, with a CAGR of 9.8%. This growth will be driven by their affordability, shorter wait times, and specialized focus on imaging services. The National Center for Health Statistics projects that outpatient imaging procedures will increase by 15% annually , as patients seek cost-effective alternatives to hospitals. Diagnostic imaging centers also benefit from advancements in AI and teleradiology is enabling faster and more accurate diagnoses. A study by Deloitte notes that these centers are increasingly adopting cloud-based solutions, improving accessibility in rural areas. As healthcare shifts toward outpatient care, diagnostic imaging centers will play a pivotal role in expanding access to advanced imaging technologies across North America.

Country Level Analysis

The United States held the largest share of the North America Diagnostic imaging market by contributing 85% in2024. This leadership stemmed from its robust healthcare system and widespread adoption of advanced imaging technologies. According to the Centers for Medicare & Medicaid Services, U.S. healthcare spending hit $4.7 trillion in 2024, with diagnostic imaging playing a critical role. The country’s dominance was further supported by the presence of global giants like GE Healthcare and Siemens Healthineers. Notably, the National Science Foundation reported that over 70% of AI-enabled imaging innovations originated in the U.S. showing its pivotal role in driving technological progress in the sector.

Looking ahead, Canada is expected to emerge as the fastest-growing market in North America, with a projected CAGR of 7.8% from 2025 to 2033. This growth will be driven by government efforts to reduce diagnostic wait times and improve healthcare access in rural areas. For example, the Canadian Institute for Health Information noted a 15% reduction in imaging wait times due to increased funding. Additionally, Canada’s aging population, which Statistics Canada estimates will account for 25% of the total population by 2030, will create higher demand for imaging services. Investments in teleradiology and AI-powered tools are also set to accelerate adoption, positioning Canada as a key player in enhancing diagnostic efficiency across the region.

Top 3 Players in the market

GE Healthcare

GE Healthcare is one of the prominent players in the North American Diagnostic imaging market. The company is well-known for its innovation in developing advanced imaging technologies such as magnetic resonance imaging (MRI), computed tomography (CT), and ultrasound systems. GE Healthcare’s contributions to the market include a broad portfolio of imaging equipment designed to improve patient outcomes, streamline clinical workflows, and enhance diagnostic accuracy. Their ongoing investment in research and development allows them to introduce cutting-edge solutions that address evolving healthcare needs. With a strong presence across North America, GE Healthcare plays a key role in providing hospitals, clinics, and imaging centers with high-quality imaging technologies.

Siemens Healthineers

Siemens Healthineers is another leading player in the North American Diagnostic imaging market. The company has a robust portfolio that spans imaging modalities such as MRI, CT, X-ray, and ultrasound. Siemens Healthineers is recognized for its focus on creating integrated solutions that enhance diagnostic processes, improve clinical outcomes, and optimize healthcare workflows. The company is committed to advancing Diagnostic imaging with artificial intelligence (AI) and digital transformation, helping healthcare providers make quicker and more accurate decisions. Siemens’ ongoing innovations, particularly in AI-powered imaging systems, position it as a major contributor to improving healthcare delivery in North America.

Philips Healthcare

Philips Healthcare is a key player in the North American Diagnostic imaging market, offering a diverse range of diagnostic imaging solutions, including MRI, CT, ultrasound, and X-ray equipment. The company is known for its emphasis on patient-centered care and its integration of advanced technologies to improve the quality of Diagnostic imaging. Philips Healthcare has made significant strides in incorporating AI, cloud computing, and real-time imaging analytics into its systems, enhancing diagnostic accuracy and operational efficiency. The company continues to focus on developing solutions that not only provide detailed imaging but also reduce radiation exposure, ensuring both safety and precision for patients in North America.

Top strategies used by the key market participants

Strategic Partnerships and Acquisitions

Many players in the North American Diagnostic imaging market strengthen their position through strategic partnerships and acquisitions. By collaborating with other healthcare companies, technology firms, or research institutions, companies can expand their capabilities and gain access to new technologies, markets, or expertise. Acquiring smaller, innovative firms also allows larger companies to quickly integrate new technologies into their product offerings, helping them maintain a competitive edge. These partnerships and acquisitions foster innovation, accelerate product development, and enable companies to provide more comprehensive solutions to healthcare providers across North America.

Customer-Centric Approach

A customer-centric strategy is central to many key players in the Diagnostic imaging market. Companies are increasingly focusing on understanding the specific needs of their customers, such as healthcare providers, hospitals, and diagnostic centers. By offering tailored solutions, excellent customer support, and extensive training, companies can enhance their relationships with clients and ensure better adoption of their products. This strategy also includes the creation of flexible financing options, customized service contracts, and support services that cater to the unique challenges faced by healthcare providers. A strong customer-centric approach helps companies build trust, improve loyalty, and secure long-term relationships with their customers.

Expanding Global Reach

Expanding their global reach is another important strategy for Diagnostic imaging companies in North America. While these companies have a strong presence in their domestic market, they are increasingly looking to expand into international markets to broaden their customer base and drive growth. By establishing a foothold in emerging markets or regions with growing healthcare needs, companies can diversify their revenue streams and mitigate risks associated with reliance on one region. This strategy often involves adapting products to local market needs, navigating regulatory environments, and establishing partnerships with local distributors or healthcare providers. Expanding globally enables companies to leverage new opportunities and strengthen their competitive position on the international stage.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Diagnostic Imaging Market are GE Healthcare,Siemens Healthineers,Philips Healthcare,Canon Diagnostic Systems Corporation,Fujifilm Holdings Corporation,Hitachi, Ltd.,Mindray Diagnostic International Limited,Samsung Medison Co., Ltd.,Hologic, Inc.

The North American Diagnostic imaging market is becoming more competitive due to the increasing focus on personalized healthcare and advancements in technology. While traditional imaging companies like GE Healthcare, Siemens, and Philips remain dominant, newer players, including tech startups, are entering the market by offering specialized solutions using AI and machine learning. These companies focus on improving diagnostic precision, streamlining workflows, and enabling faster decision-making, which makes them strong contenders in the market.

Another key competitive factor is the shift toward more affordable imaging solutions. As healthcare costs rise, hospitals and clinics are looking for ways to provide high-quality care without overspending. In response, some companies are developing cost-effective imaging technologies and offering flexible financing options to make their products more accessible. This creates a unique competitive edge for companies that can balance high performance with affordability.

Furthermore, as the market continues to embrace digital health, interoperability between imaging devices and electronic health records (EHRs) is gaining importance. Companies that can seamlessly integrate their imaging systems with other healthcare technologies will likely have a competitive advantage, offering greater convenience and improving patient outcomes. This trend is pushing the industry toward more collaborative and integrated approaches, creating new competitive dynamics.

RECENT HAPPENINGS IN THE MARKET

- In June 2024, Philips received FDA 510(k) clearance for the Zenition 90 Motorized Mobile C-arm. This device is expected to enhance the quality and efficiency of complex vascular procedures through its intuitive motorization and high-power capabilities, delivering state-of-the-art imaging for clinicians.

- In November 2024, Philips obtained FDA 510(k) clearance for its Radiology Operations Command Center (ROCC), enabling remote scanning and protocol management. This advancement allows radiologists to assist technologists in real-time, improving diagnostic quality and patient outcomes.

- In December 2024, Philips launched the CT 5300 system at the Radiological Society of North America (RSNA) annual meeting. The system, powered by in-house AI, is designed to optimize CT workflows, enhancing image quality and operational efficiency for healthcare providers.

- In December 2024, Siemens Healthineers expanded its photon-counting CT portfolio with the introduction of two new scanners in the Naeotom Alpha class. These scanners provide high image quality at low radiation doses, offering new opportunities in diagnostics and treatment pathways.

- In December 2024, Siemens Healthineers launched the Luminos Q.namix platform, a versatile solution for fluoroscopy and radiography. The platform is designed to improve workflow efficiency and flexibility with optimized AI-powered features and intuitive usability.

MARKET SEGMENTATION

This research report on the North America Diagnostic Imaging Market has been segmented and sub-segmented into the following categories.

By Type

- X-ray

- Molecular Imaging

By Application

- Cardiology

- Oncology

By End User

- Hospitals

- Diagnostic Imaging Centers

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What is the size of the North America Diagnostic Imaging Market?

The market size varies annually, but it is a multi-billion-dollar industry driven by rising healthcare demand and technological advancements.

Which country leads the North America Diagnostic Imaging Market?

The United States dominates due to higher healthcare expenditure, advanced technology adoption, and a large patient base. Canada follows as a significant market player.

How is AI impacting the diagnostic imaging industry?

AI helps in early disease detection, enhances image analysis accuracy, speeds up diagnosis, and reduces human errors in radiology.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]